IN THE HIGH COURT OF MALAYA AT KUALA LUMPUR

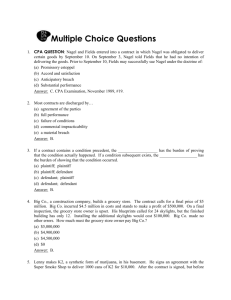

advertisement

IN THE HIGH COURT OF MALAYA AT KUALA LUMPUR (COMMERCIAL DIVISION) SUIT NO. D-22-2232-2008 BETWEEN CIMB BANK BERHAD (Company No : 13491-P) … PLAINTIFF AND 1. SPECTRUM CREST SDN BHD (No. Syarikat : 378310-X) … FIRST DEFENDANT 2. TANG YONG KIAT RICKIE (No. K/P Singapura : S1355983Z) … SECOND DEFENDANT GROUNDS OF DECISION 1 1. Enclosure (28) is the first defendant’s appeal against the decision of the Senior Assistant Registrar on 22.7.2010 dismissing the first defendant’s application to set aside the Judgment in Default of appearance (“JID”) entered against the first defendant on 5.3.2009. 2. The plaintiff claim for the outstanding sums pursuant to the Revolving Credit Facility of RM1,900,000.00 granted by the plaintiff to the first defendant together with the continuing interest of 8% per anum on RM1,665,648.23 from 5.3.2009 until full settlement. Issues 3. 4. The issues for determination by the court are as follows : (i) Whether the JID was regularly entered and ; (ii) Whether the defendant has merits in its defence The Court of Appeal in the case of Yap Ke Huat & Ors v Pembangunan Warisan Murni Sejahtera Sdn Bhd & Anor [2008] 4 CLJ 175 held as follows : 2 It is trite that when considering an application to set aside a judgment in default, the first task is to ascertain whether it is a regular or irregular judgment. If it is an irregular judgment, then the default judgment ought to be set aside ex debitio justitae. If it is regularly obtained, then the principle expounded in Evans v. Bartlam [1937] AC 473 applies - see the judgment of the Federal Court in Hasil Bumi Perumahan Sdn Bhd & 5 Ors v. United Malayan Banking Berhad [1994] 1 CLJ 328. This requires the defendant to show that he has a defence on merits. Delay in making such application is a factor to be considered by the court in deciding whether to grant or refuse the application - see Tuan Haji Ahmed Abdul Rahman v. Arab-Malaysian Finance Bhd [1996] 1 CLJ 241. Whether the JID was regularly entered 5. The defendant admitted that the address in the Writ of Summons was correct and was not disputed, but what was disputed was the service of the summon on the first defendant. In this regard, the first defendant contended that the AR card was not received by the officers of the first defendant or the company secretary of the first defendant. 6. On this issue, the court finds that the Writ of Summons had been served by way of A.R. registered post on the first defendant on 9.1.2009 at 3 its registered office at Box#269, Lot 4.88, 4th Floor, Wisma Central, Jalan Ampang, 50450 Kuala Lumpur, Wilayah Persekutuan. The first defendant’s company secretary, C & Y Management Service has acknowledged receipt of the Writ of Summons on 12.1.2009 by affixing its rubber stamp on the A.R. card. (See Exhibit “OML-1” of the Affidavit of Service affirmed by Oon Mei Ling on 11.2.2009 – letter dated 8.1.2009 from the plaintiff enclosing the Writ of Summons together with the proof of posting and copy of the A.R. card Exhibit “P-1” of Enclosure 16). 7. As regards service, under Order 10 Rule 1 of the Rules of the High Court 1980, the Writ of Summons may be served by way of A.R. registered post on the first defendant at its registered address. 8. The court accepts the plaintiff argument that the service of the Writ of Summons on the first defendant is good and effective because the first defendant’s company secretary had acknowledged receipt of the Writ of Summons by affixing its rubber stamp on the A.R. card. It is not necessary that the Writ of Summons must be served on a director of the first defendant as argued by the first defendant. In Pengkalan Concrete Sdn 4 Bhd v Chow Mooi & Anor [2003] 6 CLJ 326, Suriyadi Halim Omar J (now JCA) held that: “There is no indication under O. 10 r. 1(1) of the Rules of the High Court 1980 that the plaintiff must evidentially prove that the named person in the writ must be the very person who had “received it ie if it was sent by prepaid AR registered post.” 9. The principle in Pengkalan Concrete Sdn Bhd v Chow Mooi & Anor was approved and followed by the Court of Appeal in the case of Yap Ke Huat & Ors v Pembangunan Warisan Murni Sejahtera Sdn Bhd & Anor [2008] 4 CLJ 175. 10. In this present case, the first defendant has failed to enter appearance within twelve (12) days upon receipt of the Writ of Summons. As such, the plaintiff is entitled to enter JID on the first defendant on 5.3.2009. As such, the court finds that the said JID is a regular judgment. 11. Referring to the Federal Court decision in Hasil Bumi Perumahan Sdn Bhd & Ors v United Malayan Banking Corp Bhd [1994] 1 MLJ 312, the Court of Appeal in the case of Yap Ke Huat (supra) held as follows : 5 “When the judgment is a regular judgment, this defendant: must show to the court that he has a defence that has some merits of which the court should try. To use common and plain language, the applicant must show that his defence is not a sham defence but one that is prima facie, raising serious issues as a bona fide reasonable defence that ought to be tried because obviously if the defence is a sham defence, there is no defence and the application must fail - Jemuri Serjan CJ (Borneo) in Hasil Bumi Perumahan Sdn Bhd & 5 Ors v. United Malayan Banking Corp Bhd (supra).” 12. Based on the principle cited in Hasil Bumi Perumahan case, the next question to consider is whether the first defendant has a bona fidei reasonable defence. On this issue, the first defendant’s counsel submitted that the first defendant has defence on merits to the plaintiff’s claim based on the following : (i) Failure to sell the pledged shares of Jutajaya Berhad (“the jutajaya shares”) before the commencement of the suit. (ii) Failure to notify the first defendant of the disposal of the shares. 6 (iii) Failure to sell the Jutajaya shares at the best price at Kuala Lumpur Security Exchange (“KLSE”). (iv) Delay in selling the Jutajaya shares. (v) The plaintiff’s action is time-barred. (vi) No vesting order was served on the first defendant. (vii) Failure to provide an account of the upliftment of the pledged fixed deposit to the first defendant. Failure to sell the pledged shares of Jutajaya Berhad (“the Jutajaya shares”) before the commencement of the suit. 13. The first defendant contended that the plaintiff should dispose of the Jutajaya shares before the plaintiff could commence civil suit against the first defendant. 14. In this regard, the court finds that there is no provision in the Letter of Offer dated 15.1.1999 & 27.6.2000 and the Memorandum of Charge dated 15.1.1999 that the plaintiff must realize the security i.e. dispose of the 7 Jutajaya shares before the plaintiff could commence civil suit against the first defendant. As such, the plaintiff is at absolute liberty to commence either the civil or foreclosure proceedings against the first defendant to recover the outstanding sums under the Revolving Credit Facility. In the case of Chan Boi Loi v Public Bank Bhd & Another Application [2009] CLJ 81, Gopal Sri Ram delivering the judgment of the Federal Court held as follows : “A lender is entitled to pursue all remedies available against a borrower simultaneously, contemporaneously or successively to recover the money lent unless there is an agreement to the contrary. It is not an agreement by the instant respondent bank to postpone its right to bring an action in personam for the recovery of the whole sum lent (together with interest) until after the charged land has been sold. If the courts were to read such an agreement into the clauses in question it would amount to an unwarranted restriction on a lender's rights to seek the remedies open to it. The fallacy of the contrary argument is revealed by asking the question: what if the land can never be sold despite all attempts to do so? It would mean that the borrower would get away scot-free from making any payment because his answer to any action by the lender upon the covenant to pay would be that it is a condition precedent that the land be sold and a shortfall 8 produced before any suit may be instituted. The want of logic in that proposition is sufficient to demonstrate that it is not common sense and certainly not the common law.” Failure to notify the first defendant of the disposal of the shares 15. The first defendant alleged that the plaintiff had failed to notify the first defendant of the disposal of the shares. 16. Even though it is not mandatory for the plaintiff to give notice to inform the first defendant of the plaintiff’s intention to sell the Jutajaya shares, the court notes that the plaintiff had sent letters dated 27.9.2001 and 23.10.2001 to notify the first defendant that in the event the plaintiff failed to remit the sum of RM1,980,749.12 to the plaintiff within seven (7) days, the plaintiff would sell the Jutajaya shares without any reference to the first defendant. Thus, on this issue, the court finds that there is no merit in the first defendant argument. 9 Failure to sell the Jutajaya shares at the best price at Kuala Lumpur Security Exchange (“KLSE”) 17. The first defendant alleged that the plaintiff had failed to sell the shares at the best price in KLSE. 18. In this regard, the plaintiff submitted that it did not breach the duty to sell the pledged Jutajaya shares at the best price because the Jutajaya shares were sold at market price. 19. Further, the plaintiff argued that to determine whether the pledged shares were sold at the best price, the test is not whether the price was reasonable but whether the mortgage in exercise of the power of sale had taken reasonable efforts to obtain the best price that was available in the circumstances. 20. On this issue, counsel for the plaintiff referred to Lord Templeman decision in the Court of Appeal Hong Kong in the case of China & South Sea Bank Ltd v Tan Soon Gin, George [1990] 3 CLJ Rep 398 where the Court held as follows : 10 “If the creditor chose to exercise his power of sale over the mortgaged security he must sell for the current market value but the creditor must decide in his own interest if and when he should sell.” (pg 401 para e) 21. Similarly, in Beckkett Pte Ltd v Deutsche Bank AG and another and another appeal [2009] 3 SLR(R) 452, the Court of Appeal, Singapore held that: “It is settled law that a mortgagee, in exercising his power of sale, has a duty to act in good faith and also a duty to take reasonable care to obtain the true market value or the proper price of the mortgaged property at the date on which he decides to sell the property. In Good Property Land Development Pte Ltd v Société Général [1989] 1 SLR(R) 97 ("Good Property Land"), the High Court held (at [4]-[5]), following the decision of the English Court of Appeal in Cuckmere Brick Co Ltd v Mutual Finance Ltd [1971] Ch 949 ("Cuckmere"), which was approved by the Privy Council in Tse Kwong Lam v Wong Chit Sen [1983] 1 WLR 1349, that: As far as this court is concerned, the law is as stated in Cuckmere Brick Co Ltd v Mutual Finance Ltd [1971] Ch 949 where the Court of Appeal decided that a mortgagee had two duties: one to act in good faith and the other 'to take reasonable precautions to obtain ... the true market value of the 11 mortgaged property at the date on which he decides to sell it': per Salmon LJ at 966. ... These duties do not preclude the mortgagee from preferring his own interest to that of the mortgagor provided that he does not disregard the interests of the mortgagor. He is not a trustee of his power of sale vis-à-vis the mortgagor. Thus, the mortgagee is not required to wait for the most propitious market conditions to sell or to delay a sale in the hope of obtaining a better price. He is also not required to consult the mortgagor as to the time and manner of sale. He can sell by private treaty or public auction provided that he takes adequate steps to publicise the sale and bring it to the notice of a reasonable number of prospective buyers.” 22. Further, the court notes that the Letter of Offer (Exhibit P-4 of Enclosure 10) states that : “The Bank reserves the absolute discretion to dispose any of the shares pledged to cover the outstanding loans as and when it deems fit. A notice may be given to inform the Borrower/Pledgor of the Bank’s intention to do so. Notwithstanding such notice, the Bank further reserves the right not to dispose the shares for any reason whatsoever including that of price fluctuation. The Bank shall not be held liable for any losses suffered by the Borrower/Pledgor arising from such disposals or non-disposals thereof.” 12 23. Based on the authorities cited above, I am of the view that the plaintiff shall not be held liable for the losses suffered by the first defendant arising from the disposal or non-disposal of Jutaraya shares as the plaintiff had sold the shares at market price and the plaintiff has an absolute discretion to dispose any of the Jutaraya shares as and when it deems fit. Delay in selling the Jutajaya shares 24. The first defendant alleged that the plaintiff had delayed in disposing of the Jutajaya shares to reduce the first defendant’s indebtedness. It was also argued that the plaintiff should have sold the Jutajaya shares when there was a breach of the Letter of Offer and/or Memorandum of Charge and/or default in repayment of the Facility by the first defendant. 25. The court finds that the plaintiff has exercised the right of disposal in accordance with the Letter of Offer. There is no provision in the Letter of Offer that the plaintiff must dispose of all the Jutajaya shares immediately upon the default of payment by the first defendant. Indeed, as mentioned earlier, the plaintiff has absolute discretion to dispose any of the Jutajaya shares as and when it deems fit. 13 26. Based on the affidavit filed by the plaintiff, the plaintiff had disposed of 1,413,000 Jutajaya shares from October 2001 till 12.12.2002 to reduce the first defendant’s indebtedness. There was no further transaction of the Jutajaya shares since 12.12.2002 because the trading of the Jutajaya shares was suspended by the KLSE beginning 13.12.2002 and the Jutajaya shares were de-listed from the Official List of the KLSE on 16.3.2004. 27. From the facts above, in my judgment there is no delay on the part of the plaintiff in disposing of the Jutajaya shares. The plaintiff’s action is time-barred 28. In the present case, the plaintiff’s claim is for the shortfall after the sale of the Jutajaya shares charged to the plaintiff. According to section 6(5)(b) of the Limitation Act 1953, section 6 of the Limitation Act 1953 is not applicable in any action to recover money secured by any mortgage for charge on land or personal property. Therefore, the plaintiff’s claim is not subject to the limitation period of six (6) years in the section 6(1) of the Limitation Act 1953. 14 29. The applicable provision is section 21(1) of the Limitation Act 1953 which specifically refers to an action to recover moneys secured by a mortgage or charge on land or personal property which is an action in personam. Therefore, the plaintiff’s claim is subject to the limitation period of twelve (12) years from the date when the right to receive the money accrued. 30. In the case of Tan Kong Min v Malaysian Nasional Insurance Sdn Bhd [2005] 3 CLJ 825, the respondent granted the appellant a housing loan on 28.3.1984. By way of security, the appellant inter alia charged a piece of land in favour of the respondent. The appellant defaulted. The respondent foreclosed and the land was auctioned off on 16.3.1992. There was a shortfall of RM336,012.52 due and owing. The respondent demanded the shortfall together with the interest from the appellant by letter dated 18.8.1994 and 11.11.1994. The appellant failed to make payments and the respondent thus filed a suit on 17.1.1995. Alauddin Mohd Sheriff FCJ held that: “On the facts, s. 6 could not apply in view of the express exclusion of ‘any action to recover money secured by any mortgage of or charge on land’ in 15 s. 6(5)(b) of the Act. The action was thus not founded on a claim on contract under s. 6. The applicable provision was s. 21. Section 21(1) specifically refers to an action to recover moneys secured by a charge which is an action in personam, whereas s. 21(2) specifically refers to a foreclosure in respect of mortgaged personal property which is an action in rem. The limitation period was therefore 12 years from the date when the right to receive the money accrued or 12 years from the date on which the right to foreclose accrued, respectively. There was thus no need to answer question (2). (p 834 f-g). A cause of action normally accrues where there is in existence a person who can sue and another who can be sued and when all the facts have happened which are material to be proved to entitle the plaintiff to succeed. In the instant case, the point in time where all the material facts were said to be in existence to render the cause of action complete would be after the sale had been conducted and the differential amount remaining due to the respondent had been ascertained. On the facts, the earliest possible date the respondent could bring an action against the appellant under cl. 7 was on 16 March 1992 – the date the property was sold by auction. Since the respondent’s cause of action arose on 16 March 1992, its action against the appellant filed on 17 January 1995 was filed well within the time prescribed in s. 21(1) of the Act. Lim Kean v. Choo Koon [1970] 1 MLJ 158 (folld); Credit Corporation (M) Bhd v. Fong Tak Sin [1991] 1 MLJ 409 (folld). (p 836 c-f). 16 The limitation period only began to run from the expiry of the time specified for payment in the letter of 18 August 1994 ie, on 26 August 1994. The respondent’s action therefore was filed well within the limitation period allowed under s. 21(1) of the Act. (p 838 f-g).” 31. In the present case, upon disposal of the shares pledged as security and upliftment of the fixed deposit, there was still a shortfall of RM2,335,945.90 as at 26.7.2007 together with the continuing interest. The plaintiff had sent the letter dated 14.10.2008 to demand the shortfall from the first defendant within 14 days but the first defendant had failed to do so. The limitation period of 12 years only began to run from the expiry of the time specified in the said letter of demand i.e. 29.10.2008. Therefore, the plaintiff’s action was filed well within the limitation period allowed under section 21(1) of the Limitation Act 1953. No vesting order was served on the first defendant 32. The first defendant alleged that the plaintiff had failed to serve on the first defendant the vesting order to vest the businesses, accounts and assets from Ban Hin Lee Bank Berhad (“BHL”) to Southern Bank Berhad (“SBB”) and from SBB to Bumiputra-Commerce Bank Berhad (“BCBB”) and 17 also the Form 13 of the Companies Act 1965 as to change of name from BCBB to CIMB Bank Berhad (“CIMB”). 33. The court accepts the plaintiff argument that it has no contractual or legal obligation and duty to serve a copy of the vesting order and Form 13 as to the change of name of the plaintiff to the first defendant. As such, failure to do so would not affect the plaintiff’s right to proceed with legal action against the first defendant to recover the outstanding sums under the Revolving Credit Facility due and owing to the plaintiff. 34. Further, the first defendant is not prejudiced by the failure to serve the vesting order and Form 13 as to the change of name because the plaintiff has pleaded the relevant facts in the paragraph 3.1, 3.2 and 3.3 of the Statement of Claim. Indeed, the vesting order and Form 13 of the Company Act 1965 as to the change of name has been exhibited in Enclosure 16. 35. For the above reasons, I find that there is no merit in the first defendant defence. 18 Conclusion 36. There was a Certificate of Indebtedness to conclusively show the amount due and owing from the defendant to the plaintiff (RM1,665,648.23 as at 26.7.2007). (See Exhibit “P-11” of Enclosure 16 – Certificate of Indebtedness (RM1,665,648.23 as at 26.7.2007). 37. In the case of Cempaka Finance Bhd v Ho Lai Ying (trading as KH Trading) & Anor [2006] 2 MLJ 685, the Federal Court held that: “A Certificate of Indebtedness operates in the field of adjectival law. It excuses the plaintiff from adducing proof of debt. Such a certificate shifts the burden onto the defendant to disprove the amount claim.” 38. The onus therefore clearly falls on the defendants to adduce evidence to challenge the Certificate of Indebtedness relied upon by the plaintiff. In my view, the defendants have not discharged such onus. 39. For the above reasons, I find the said JID was regularly obtained and the first defendant does not have merits in its defence. 19 Thus the first defendant’s application in Enclosure (28) is dismissed with costs. Costs of RM4,500.00 to the plaintiff as agreed between the parties. (Hanipah binti Farikullah) Pesuruhjaya Kehakiman Dagang 7 KUALA LUMPUR Dated : 18.1.2011 20 Solicitor for the Plaintiff Tay Hong Huat Messrs Tay & Helen Wong Suite 703, Block F Phileo Damansara I No. 9, Jalan 16/11 46350 Petaling Jaya Selangor Darul Ehsan Solicitor for the Defendant Kuan Chee Foo Messrs R.M Abdullah, Kuan & Associates No. 22.1A, 22nd Floor Menara Haw Par Jalan Sultan Ismail 50250 Kuala Lumpur 21