Best Practices in CI

advertisement

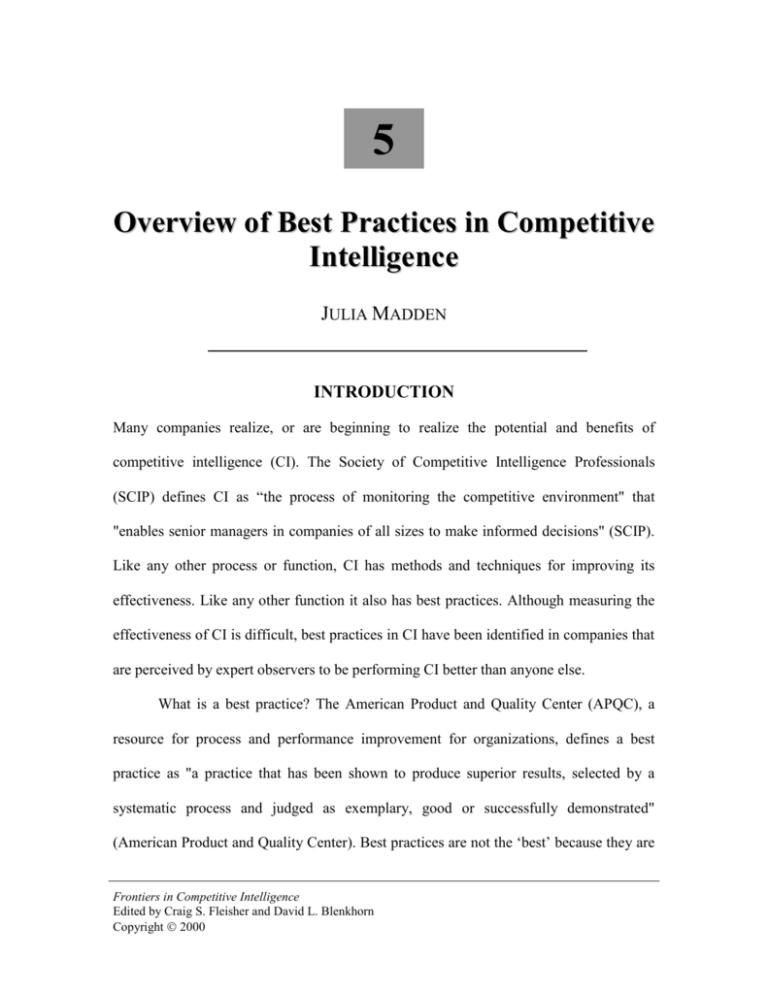

5 Overview of Best Practices in Competitive Intelligence JULIA MADDEN INTRODUCTION Many companies realize, or are beginning to realize the potential and benefits of competitive intelligence (CI). The Society of Competitive Intelligence Professionals (SCIP) defines CI as “the process of monitoring the competitive environment" that "enables senior managers in companies of all sizes to make informed decisions" (SCIP). Like any other process or function, CI has methods and techniques for improving its effectiveness. Like any other function it also has best practices. Although measuring the effectiveness of CI is difficult, best practices in CI have been identified in companies that are perceived by expert observers to be performing CI better than anyone else. What is a best practice? The American Product and Quality Center (APQC), a resource for process and performance improvement for organizations, defines a best practice as "a practice that has been shown to produce superior results, selected by a systematic process and judged as exemplary, good or successfully demonstrated" (American Product and Quality Center). Best practices are not the ‘best’ because they are Frontiers in Competitive Intelligence Edited by Craig S. Fleisher and David L. Blenkhorn Copyright 2000 92 Overview of Best Practices in Competitive Intelligence for everyone. They must be adapted to fit each specific organization. Several studies, models and speculative theories have evolved around best practices in CI, but a greater understanding of CI is still needed. By looking at several different studies, models and current best practices, several common or similar factors should appear to be crucial to effective CI regardless of the organization, size of organization or industry. Each organization should look at these similarities as the foundation on which to base its efforts in adapting CI practices. CURRENT BEST PRACTICES American Product and Quality Center (APQC) Consortium Study In 1996, International Benchmarking Clearinghouse (IBC), a service of APQC, performed a "best practices" business and competitive intelligence study across several industries (O’Dell, C. and C.J.Jr. Grayson, 1996). Twenty-two companies participated in the study of which seven were selected as best practice companies. The seven companies were used as benchmarks with which the other companies could compare themselves. From this study seven findings were identified as components to best practices in competitive intelligence. Companies considered having best practices in CI included Bell Atlantic, Eastman Kodak, Fidelity Investments, Ford Motor Company, Merck and Company, Pacific Enterprises and Xerox Corporation. The seven key findings from the study of these best practice companies are: Evolving, stable CI infrastructures: Best practice companies have CI mechanisms and structures in place that have evolved over time. The stability of these structures is usually held together by key people who have experience in their Frontiers in Competitive Intelligence 93 respective industries and the development of networks. Key people or champions ensure there is continuity and that the CI function is maintained. For example, in the APQC study, the Merck and Fidelity corporations were revealed to have personnel with long term experience and certain personality traits. Where champions are not available to drive CI, best practice organizations have developed policies, mission statements or other means of substituting these individuals and integrating CI into the organization. Best practice organizations also plan for the evolution of their CI to continually adjust to new trends and industry changes. Decentralized, coordinated networks: The study determined that decentralized networks have to develop for several reasons. They: Better address the company's diverse intelligence needs Capture the realization that all employees are not knowledgeable about every area of the business Allow for use of resources and personnel that exist throughout the company Various methods are used for forming networks. Some develop from grassroots while others are more formal. Kodak, for example, has a matrix of different groups performing CI in different areas such as manufacturing, competitors, and technology. When information is needed it can be drawn from any of these sources by either individuals or groups. Best practice companies developed their networks slowly. Because of the length of time required for effective CI 94 Overview of Best Practices in Competitive Intelligence functional development, companies starting CI and adapting best practices should focus on areas where there is the greatest competitive threat and build from there. Responsive information technology systems: For best practice companies information technology (IT) usually makes the transfer and sharing of information more effective and efficient. The platforms used in best practice companies provide databases that catalogue studies and other information already owned by the company, while easy to use discussion forums allow the organization to get rid of unwanted data and coordinate diverse information systems. Topics are added and taken out as necessary, which allows individuals to share their knowledge with others in the organization. IT helps organizations deal with information in a timely manner, and keep up with the changing competitive environment. It may be wise for companies to develop the CI program with existing IT first, and then determine what is needed to make the system better and more flexible to accommodate CI and information sharing across the company. Linkage between strategic and tactical intelligence: Tactical intelligence comes from the day-to-day operation of an organization. Operational level employees see trends, new technology, and have personal contact with suppliers and customers. Information gathered at this level of the operation must flow upward to be incorporated into the strategic level of the organization, and be examined for future strategic decisions. Strategic decisions must flow downward and have support at the tactical level. The two types of intelligence rely on each other and must be linked. Strategic intelligence looks at how the organization can change and respond to changes in the industry and environment. There should be a link Frontiers in Competitive Intelligence 95 between these two types of intelligence because they feed into and augment each other. Best practice companies realize the tradeoff between the two types of intelligence and work to keep them in balance. Often, strategic intelligence is overemphasized to the detriment of tactical intelligence or vice versa. Companies need to keep up with current strategy but allow for new information to affect future strategic direction. Customer feedback and implementation link: Best practice CI programs ensure that there is feedback and dialogue with the customer. The customer refers to the requester of information within the organization. Competitive intelligence requests must be well defined and re-defined until the request is actionable. For CI to be of value to the customer it must be in a form that can be used and ideally is measurable. For example, at Bell Atlantic the CI project is only considered complete when management uses the information. Feedback from the customer also allows CI to develop better services and products that are useful to the decision-maker. Measurement of CI is still very difficult; however with clearer defined deliverables, CI projects may be measured more effectively. Customer/CI feedback is two-way and hopefully nearly symmetric in volume. The customer should be able to determine what specifically they require of CI, and CI must be able to determine what it can provide in return. Hypothesis driven recommendations: Competitive intelligence programs (CIP) should add value to the company. They should generate a positive return on the resources invested in developing it. The information should be infused with some analytical insight or strategic direction to assist managers in making decisions. 96 Overview of Best Practices in Competitive Intelligence Analytical thinking is critical for best practice companies. From the APQC study very few of the studied companies could explain how they perform analytical thinking, but stated that it was important. In other words, analysis has the classic elements of tacit knowledge. Competitive intelligence products and services in an organization should answer questions or provide information to an executive that helps them make better decisions. Many best practice companies analyze their CI findings relevant to their current strategic position to determine if change is needed. Institutionalizing intelligence cultures: Best practice companies develop ways to make CI a part of everyone's job. The top managers need to be involved and drive the organization's culture to institutionalize CI into the company's culture. This process takes time and commitment on the part of senior managers, but is necessary for the continuous implementation of CI. This area is where the most resistance and difficulty of instituting CI is found. THE NEXT PHASE OF BEST PRACTICES UNDERSTANDING In 1997-98, a follow up study, Managing Competitive Intelligence Knowledge in a Global Economy (American Product and Quality Center, 1998), was conducted. Again the study used twenty-two companies with seven chosen as best practice partner companies with which to benchmark. From this second APQC study an enhanced model was developed to demonstrate the best practice CI process. Five Steps of the FIICH Model Focus: Develop a clear set of goals and objectives for CI knowledge activities. Frontiers in Competitive Intelligence 97 Implement: Create an organizational culture conducive to implementing actionable CI knowledge. Institutionalize: Incorporate CI knowledge management practices into the daily activities of managers. Change: Modify thought processes, behaviors, and performance in ways that help achieve organizational goals and objectives. Hone: Make the CI knowledge management process a dynamic, evolving activity with a bias toward continuous improvement. In this study, researchers were interested in what "attributes of CI were most valued by managers" (American Product and Quality Center, 1998). Different findings were determined for best practice companies under each step of the FIICH model’s framework. Focus of CI Efforts. Best practice CI organizations: Focus their CI efforts on decision-making areas that are critical to their business Have actively involved senior management in CI rather than just asking for moral support of CI Allow the critical intelligence needs (CIN) focus to drive the output of CI products and services Implementation of CI. Best practice CI organizations: Establish a systematic, documented process that clearly defines roles and responsibilities for those involved with CI 98 Overview of Best Practices in Competitive Intelligence Follow practices that include a sensible approach, built-in redundancies, future orientation, global perspective, integration of informal and formal networks, and a concern for ethics Institutionalize CI Knowledge. Best practice CI organizations: Spread CI by providing a variety of products, services and practices throughout the organization Change. Best practice CI organizations: Provide training in information technology (IT) and human networks Encourage managers to make more decisions using CI knowledge and embed CI processes in the organization culture Hone. Best practice CI organizations: Coordinate and strive for continuous improvement across diverse business units Measure, or attempt to measure, the economic impact of CI In a recent study in the United Kingdom, researchers found from their survey of firms and competitive intelligence professionals that there is a "scarcity of models of CI in action" and that “there is a problem of knowing what was needed for the CI unit." (Wright, Callow and Pickton, 1999). The FIICH model simplifies the approach to CI; however it does not express how to apply this knowledge to actual decisions. This model has been added as an item to the seven key findings of the 1996 APQC study (Wyckoff, 1999). However, tacking the model on to this list does little to provide a clearer understanding of best practices in CI and the adaptation of these best practices in organizations. The first study explains seven significant components to CI in best practice Frontiers in Competitive Intelligence 99 companies. In combining the seven components into the FIICH five-step model, a more detailed process identifies how each component fits into the process. The detailed combination may help organizations better determine how they can incorporate a best practice into their business (Figure 1). DIFFICULTIES IN IMPLEMENTING BEST PRACTICES FOR CI One difficulty with transferring best practices in CI is that the best practice for one company may not become a best practice in another company (if any of the seven elements described above are missing). There are several problems and difficulties in establishing and adapting best practices in CI to businesses. 100 Overview of Best Practices in Competitive Intelligence Figure 1:Combining the 1996 APQC Study (7 components that make a good competitive intelligence program) with the FIICH Model FOCUS Hypothesis development link to strategy. What do you want to know or learn? Customer feedback to clearly define CI deliverables HONE Customer feedback to CI Are the IT systems supportive? How can CI be improved? Adjust to new trends IMPLEMENTATION Place or empower champions throughout the organization to drive CI Use of IT system to make process efficient and effective. Support storage and transfer of information Create formal and informal networks CHANGE Champions have role to influence and incorporate change, but maintain stability Culture must evolve and change to accommodate CI Senior managers must demonstrate the value of CI and commitment to institutionalizing it INSTITUTIONALIZATION Incorporate CI into policy and mission Link tactical intelligence to strategic intelligence Make CI part of strategic decision making Decentralized networks sharing across business units Companies must recognize their limitations and be prepared for the length of time it takes to develop the necessary components for a successful CI program. Time is required for CI to become institutionalized and integrated into a company's culture to allow the processes and practices to be adopted and incorporated. For companies just getting into CI this time element may be discouraging and detrimental to the development Frontiers in Competitive Intelligence 101 of a CI program. If results from CI are not visible a CI program may lose its credibility before it has a chance to become established in a company. The lack of key people or champions to carry the momentum for a CI program may also be a difficulty. Best practice companies have large established networks with experienced CI champions. Companies new to CI may not have people with the necessary qualities to execute an effective CI program or carry the momentum. The difficulty of measuring the economic benefits of CI is another problem of transferring best practices in CI. How should a company determine which best practice will suit them if measurement of CI is illusive? To get CI started there must be some tangible results and definite benefits derived from the intelligence collected, or the CI program will lose credibility and acceptance in an organization. Well-defined CI needs, deliverables, and goals will help determine whether the CI product/service provided was actionable and/or useful in making a decision. Organizational structure and culture need to be arranged so that communication occurs across business units. If an organization is not already communicating crossfunctionally it will be more difficult to implement an effective CI program. It is much more difficult to identify and transfer tacit knowledge rather than explicit knowledge. Tacit knowledge, as defined here, tends to be the intuition and experience combination that leads to useful CI analysis. In best practice companies this tacit knowledge is there but how it is passed on and used is not clear (Prescott, Herring and Panfely, 1998). This element of a best practice is difficult to adapt, and must be discovered by each company individually. 102 Overview of Best Practices in Competitive Intelligence In the studies conducted it was evident that active involvement by senior management is a strong key to the success of a good CI program. Senior management must commit to, see the value of, and integrate CI into the company's decision-making process. OPPORTUNITIES AND BENEFITS Companies can learn a great deal from other companies with well-developed and defined CI programs. Organizations must remember that no individual best practice is suitable for everyone, and needs to be evaluated within the firm planning to implement it. From the APQC Best Practices White Paper Report (O’Dell, and Grayson, 1996) on identifying and transferring internal best practices, four expectations of networks should be addressed. These expectations can be applied to the transfer and adaptation of best CI practices. The really important and useful tacit information is passed on through human contact and face-to-face information sharing. Information technology systems can be used to assist in this information exchange. For example, the AMP Inc. database system identifies the source of information, name and brief description of the information entered, when it was entered, who entered it, and a person to contact for more information. This type of system points people in the right direction to obtain needed information. The IT in this case supports the various people talking to each other. A framework for classifying information should be established. A framework helps with the process of collecting, sharing and adapting CI best practices. Each Frontiers in Competitive Intelligence 103 company may have its own classification system that feeds into their specific structure or industry. Entering information into the system must be part of everyone's job, whether they work in CI or not, if CI is to be institutionalized throughout the organization. Anyone who enters information should be responsible for ensuring that the information is accurate and credible. Unchecked information can potentially lead to poor decision-making. Culture and behaviors can be difficult inhibitors or drivers of information sharing in a company. For example, at Chevron teams were formed to work on adopting best practices and benchmarking. The teams had a difficult time explaining to coworkers the time they were spending on these projects. Management had to communicate the investment of time that these teams were spending on information-sharing processes. Involvement of senior management and commitment assists with a company's overall adoption of CI and the sharing of information. SUMMARY Like any other functional adaptation of best practices, the adoption of CI best practices is tricky. No one best practice is suitable for every organization. Each practice must be modified and changed to suit an organization's industry, culture, and level of diversity. Several studies and models have been developed to determine some of the best practices in CI. The studies indicate that developing and institutionalizing good CI programs takes time and commitment to build into the organization. This time commitment, combined 104 Overview of Best Practices in Competitive Intelligence with weak measurement of the economic benefits of CI, makes it difficult to justify resource allocation to CI. However, best practice companies have demonstrated that CI programs produce actionable intelligence that leads to competitive advantage. Companies embarking on CI programs should realize that the long-term benefits of a good CI program can keep the company in tune with the competitive environment and changes that may affect business strategy. REFERENCES American Product and Quality Center (APQC), Consortium Report, (1998). Managing Competitive Intelligence Knowledge in a Global Economy. http://www.apcq.org/ American Product and Quality Center (APQC), APQC Benchmarking Terms http://www.apcq.org/free/terms O'Dell, C. and C.J.Jr. Grayson, (1996). Identifying and Transferring Internal Best Practices. American Product and Quality Center (APQC) Best Practices White Paper Report. http://www.store.apqc.org/cgi-bin/vsc.exe/Jacket/cmifwp.htm?E+BookStore Society of Competitive Intelligence Professionals (SCIP), What is CI? http://www.scip.org/ci/ Prescott, J., Herring, J., and P. Panfely (1998). "Leveraging Information for Action: A Look into the Competitive and Business Intelligence Consortium Benchmarking Study,” Competitive Intelligence Review, 9(1), 4-12. Frontiers in Competitive Intelligence 105 Wright, S., Callow, J., and D. Pickton (1999). Competitive Intelligence in Action. Competitive Marketing Practice Research Group, Leicester, UK: DeMontforte University. . Wyckoff, T. (1999). Benchmarking Competitive Intelligence. Washington, DC: Special Libraries Association.