FINANCIAL REVIEW BY MANAGEMENT

advertisement

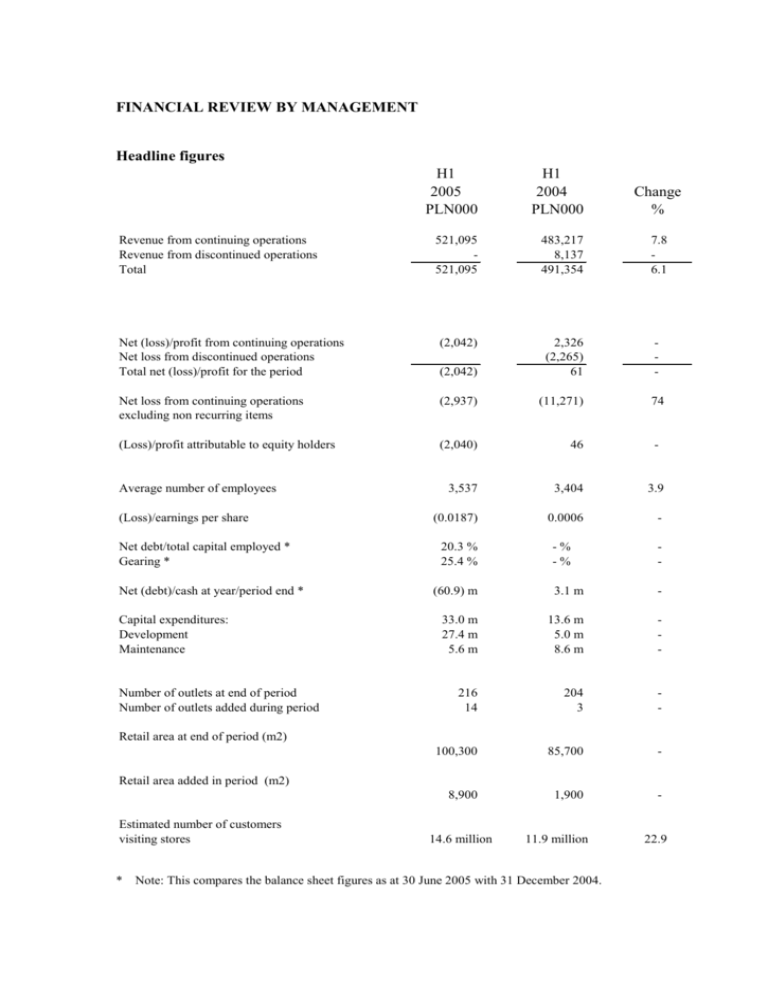

FINANCIAL REVIEW BY MANAGEMENT Headline figures H1 2005 PLN000 H1 2004 PLN000 521,095 521,095 483,217 8,137 491,354 7.8 6.1 Net (loss)/profit from continuing operations Net loss from discontinued operations Total net (loss)/profit for the period (2,042) (2,042) 2,326 (2,265) 61 - Net loss from continuing operations excluding non recurring items (2,937) (11,271) 74 (Loss)/profit attributable to equity holders (2,040) 46 3,537 3,404 3.9 (0.0187) 0.0006 - Revenue from continuing operations Revenue from discontinued operations Total Average number of employees (Loss)/earnings per share Net debt/total capital employed * Gearing * Net (debt)/cash at year/period end * Capital expenditures: Development Maintenance Number of outlets at end of period Number of outlets added during period 20.3 % 25.4 % Change % - -% -% - (60.9) m 3.1 m - 33.0 m 27.4 m 5.6 m 13.6 m 5.0 m 8.6 m - 216 14 204 3 - 100,300 85,700 - 8,900 1,900 - Retail area at end of period (m2) Retail area added in period (m2) Estimated number of customers visiting stores * 14.6 million 11.9 million Note: This compares the balance sheet figures as at 30 June 2005 with 31 December 2004. 22.9 FINANCIAL REVIEW BY MANAGEMENT 1. Economic environment & market trends 1.1 Consumer behaviour and spending patterns According to market estimates, GDP in Poland increased by an estimated 2.5 – 2.8 % during the second quarter of 2005 on a year on year basis compared with 2.1 % for the first quarter of 2005. According to GUS (the Central Statistical Office), retail sales fell by 1.9 % in the first half of 2005 (in fact, the sector to which the Group belongs, as recorded by GUS, saw a decrease of 15.4 %) compared with a significant increase in 2004. This has been blamed on weakening consumer demand this year when compared with the period last year when there was a significant increase in spending both before and after Poland joined the European Union in May 2004. The June 2005 economic outlook showed a decrease in the unemployment rate and an increase in average salary in Poland, which should establish a benign environment for the rest of the year. GUS and economic commentators believes GNP will pick up in the latter part of the year to 3.6 % per annum compared with 5.3 % experienced in 2004 with unemployment projected to decrease and continued growth in average salaries. 1.2 New commercial real estate developments It has been noted that Poland will see over the next few years the largest development of shopping malls in Europe. The Group believes it is well placed over the coming years to benefit from this trend. As announced at the beginning of the year, the Group is intending to open 40 to 50 new stores with a total new retail area of over 18,000 to 25,000 m2. There are a number of significant shopping malls which are envisaged to be opened in the latter part of this year, such as the Silesian Business Park in Katowice. The Group has noted some delays in projects and one major project, Lodz Manufaktura, has been deferred until next year. The Group is actively seeking credible replacements in specific locations to meet its objective of a value generating rollout of its stores in Poland. 1.3 The impact of foreign exchange rates on the business Around 35 % of the Group`s purchases of goods are foreign currency based with a significant proportion accounted for by EURO and US $ denominated purchases. A significant proportion of the Group`s building costs are also EURO denominated. The Group has taken steps to hedge its principal foreign exchange exposures during 2005. 2 2. Results for period – group level 2.1 Sales development Total sales, excluding the discontinued operation, increased in the first half of 2005 by 7.8 % compared with 2004. Overall, retail sales, increased by 7.9 % compared with 2004. The Group opened 14 new stores with new retail area of 8,900 m2. Our wholesale operations increased their sales by 10.4 % as compared with last year`s first half. 2.2 Gross margins development Group management monitor the gross margins earned by its various operating subsidiaries as a means of assessing their financial and operational performance. Gross margin is defined as income from sales less: the cost of purchasing goods and merchandise, as increased by applicable taxes and customs duty, franchise payments and royalties, bad stock, the change in provision for unsellable inventory as well as, in the case of language schools, the cost of teachers` salaries and school textbooks, and, in the case of the wholesale operations, the cost of transporting merchandise, and is then treated as a % of income from sales. Gross margins on continuing operations amounted to 40.1 % in the first half of 2005 (2004 – 37.7 %). The key factors which have influenced margin were: In part, the change in the average EURO exchange rate which was 4.08 in the first half of 2005 compared with 4.73 in the comparative period of 2004; thereby making imported goods cheaper. However, it should be noted that a significant proportion of our purchases are PLN based and an element of foreign purchases are made at fixed rates, due to hedging. Better markdown performance in the fashion business in the first half of 2005 when compared with the period in 2004 which led to a reduced markdown cost. The continuing shift in purchases from overseas where the Group, particularly in respect of Smyk and Galeria Centrum, has continued to increase its sourcing of goods from Turkey and China rather than Poland and other EU countries in order to benefit from the weakening US $ - the average US $ exchange rate was 3.18 in the first half of 2005 compared with 3.86 in the comparative period of 2004, as well as obtaining products at competitive prices. We envisage further shifts to sourcing from these regions and that this should result in a sustainable increase in the Group`s profitability. Better purchasing conditions due to our developing sales and by virtue of our significant market share in our segments. 2.3 Cost development The cost base of the Group has developed slower than our increased sales and our new store openings. Employee costs increased by 6.4 %, in part due to the existence of the holding company after 16 March 2004, but also new store openings during the first six months. Building costs have remained virtually unchanged, despite the new openings, due to the beneficial exchange rates noted above. 2.4 Net results for the first half of 2005 Typically, seasonal businesses, which account for a significant proportion of the Group`s business, will generate a loss in the first half of the year due to the following factors: Lower sales in the first half of the year than in the rest of the year. The higher proportion of markdown sales, which take place in January/February and June, which drive down gross margins. The Group`s net loss for the six months, after income tax, was PLN 2.0 million (2004 - PLN 61,000 (profit)). However, the 2004 result includes the loss of a discontinued operation of PLN 2.3 million - the Group decided to dispose of its photoprocessing chain in the Czech and Slovak Republics, E – Foto sro in September 2004). A key measure for the Group`s overall financial performance is the result from continuing operations. The net loss from continuing operations for the six months ended 30 June 2005 amounted to PLN 2.0 million compared with a profit of PLN 2.3 million for the comparative period in 2004. The net loss from continuing operations however includes non recurring items/exceptional gains, net of tax, in the first half of 2005 of PLN 0.9 million (2004 PLN 13.6 million), as noted below. Therefore, the net loss from continuing operations in the first half of 2005, excluding non recurring items and their related tax effect, amounted to PLN 2.9 million compared with the prior year first half loss of PLN 11.3 million - an improvement of PLN 8.4 million. Depreciation and amortisation increased in the six month period of 2005 compared with 2004 by PLN 2 million to PLN 15.3 million due to the new openings in the latter half of 2004 and new openings in 2005. Finance costs increased by PLN 2.2 million over the comparative period in 2004 to PLN 3.3 million due, in part, to the interest on the Medium Term Notes as well as the absence of significant foreign exchange gains in the period. The tax charge decreased by almost PLN 800,000 to PLN 2.5 million due to the lower tax rate, the absence of significant gains in the period and deferred tax movements. 4 Non recurring items Non recurring items in the six months ended 30 June 2005 and 2004 can be analysed as follows (in PLN million): 2005 2004 Sale of real estate to Dawtrade Sale of retail perfumery stores to Sephora Polska Compensation for Galeria Centrum Impairment of fixed assets Sale of minority shareholdings Total 0.2 1.0 2.6 1.0 (0.4) 0.1 0.9 10.0 13.6 Empik disposed of a number of its properties in March 2004 to Dawtrade Sp z o.o. The PLN 0.2 million item in the first quarter of 2005 reflects the revaluation gain on the receivable. The Sephora item represents the revaluation gain on the receivable. In 2004, Galeria Centrum received compensation of PLN 10 million and a PLN 2 million rent adjustment for the reduction in space in its Sawa store in Warsaw for several months beginning in June 2004 caused by refurbishment work. Management has estimated that the lost margin in the second half of 2004 caused by the disruption to the store amounted to between PLN 4.1 million and 6.1 million, and have assumed an average loss of margin of PLN 5.1 million. This, together with the provisions in fixed assets and inventory of PLN 0.9 million, resulted in a cost to Galeria Centrum of PLN 6 million, which was therefore compensated by the abovementioned PLN 12 million for the full year ended 31 December 2004. The PLN 10 million above reflects the sole financial impact in the first half of 2004. The impairment charge reflects the cost of outlets i.e. stores, closed by Empik and laboratories by Empik Foto. The Group achieved a small gain on the sale of certain minority interests belonging to the National Investment Fund. 3. Segment performance Fashion & Beauty The Fashion & Beauty segment`s sales increased by 4.1 % to PLN 220.5 million (2004 - PLN 211.8 million). Based on management`s information, Galeria Centrum`s sales in the first half of 2005 decreased by 2.8 % when compared with the first half of 2004. This was caused by the reduction in retail space of the Marszalkowska store which took place during 2004. The sales in stores, other than the main Marszalkowska store, increased by 4.8 %. Ultimate Fashion`s sales in the first half of 2005 increased by 19 % when compared with the first half of 2004. In the first half of 2005, the entity opened two stores in Krakow Kazimierz and Promenada which contributed over PLN 1 million of new sales from their opening. Young Fashion`s sales in the first half of 2005 increased by 12 % when compared with the first half of 2004. In the first half of 2005, the entity opened one store in Krakow Kazimierz which contributed over PLN 2.1 million of new sales from its opening. As at 30 June 2005, Galeria Centrum had 12 stores, Young Fashion had 8 stores and Ultimate Fashion had 27 stores. Optimum Distribution Poland`s sales in the first half of 2005 increased by 3.2 % with sales of both cosmetics and optics increasing by 11.7 % and 1.5 % respectively offsetting decreases in sales of sports clothing. Optimum Distribution Czech`s sales in the first half of 2005 decreased by 1.2 % in PLN terms while in Czech Krowns, sales increased by 5.8 % to Cz Kr 161.4 million. This was caused by the strengthening of the PLN over the period when compared with 2004. Sales of cosmetics (in Cz Kr) increased by 8.1 % while sales of optics increased by 2.7 %. The Company changed its wholesale distribution base in May with minimum disruption to its customer base and on going business. As noted earlier, this segment, more than the “Media & Entertainment” segment, typically generates losses in the first half of the year due to its greater exposure to the factors set out in section 2.4 above. In the first half of 2005, EBITDA for this segment amounted to PLN 6.1 million (2004 – PLN 3.3 million) and the loss from operations of this segment amounted to PLN 151,000 compared with a loss in the first half of 2004 of PLN 2.9 million. Of these amounts, Galeria Centrum`s EBITDA (negative) in the first half of 2005 amounted to PLN 5.5 million (2004 – PLN 2.6 million positive) and the net loss amounted to PLN 9.4 million (2004 – 1.3 million loss). The loss has arisen due to the decrease in sales in the period combined with the absence of one off items such as compensation for the Sawa store as noted earlier above. Excluding one off items, the net loss of Galeria Centrum amounted to PLN 9.4 million compared to PLN 11.3 million in 2004, which is an improvement of PLN 1.9 million. Media & Entertainment The Media & Entertainment segment’s sales in the first half of 2005 increased by 10.7 % to PLN 300.6 million (2004 - PLN 271.5 million). Based on management’s information, Empik`s total sales, including Empik Foto, increased by 7.2 %. Despite decreasing music sales, there were healthy increases in the sales of the other categories such as books and press. Empik opened six new stores during 2005 in Krakow Kazimierz, Warszawa Promenada, Poznan King Cross, Poznan Plaza, Bytom Plejada and Katowice Trzy Stawy which contributed PLN 5 million of new sales. 6 Sales at Empik language schools decreased by 11.3 % to PLN 23.2 million in the first half of 2005 due, in part, to the closure of two schools from June 2004, as well as reduced student numbers. Following a strategic review of the business and market, the Group decided to undertake an acquisition in this sector with a view to playing a leading role in the consolidation of this otherwise fragmented sector and to avail itself of multimedia learning products as well as direct selling skills to reinforce its market position. Details of the Group’s actions are set out later in this review. Smyk`s total sales increased by 22.3 % in the first half of 2005 to PLN 61.5 million (2004 – PLN 50.3 million). The overall performance was assisted by the strong sales contribution made by stores opened last year as well as the five new store openings during 2005. Smyk opened five new stores during 2005 in Krakow Kazimierz, Warszawa Promenada, Poznan King Cross, Poznan Plaza and Katowice Trzy Stawy which contributed PLN 4.5 million of new sales. As at 30 June 2005, Empik had 64 stores and 42 Foto outlets, and Smyk had 25 stores. In the first half of 2005, EBITDA for this segment amounted to PLN 14 million (2004 – PLN 17.2 million) and the profit from operations of this segment amounted to PLN 5 million compared with 2004 of PLN 10.1 million. The EBITDA and profit from last year included one off gains such as the sale of properties to Dawtrade, as noted above. 4. Loss per share The loss per share are based on the results recognized in the consolidated IFRS income statement. The loss per share has arisen as a result of the net loss in the first half when compared with last year. 5. Financial condition 5.1 Liquidity and capital resources The consolidated cash flow statement illustrates that there was a decrease in cash and cash equivalents in the six months ended 30 June 2005 of PLN 49.4 million (2004 – PLN 25.9 million - decrease). Net cash used in operating activities amounted to PLN 49.0 million (2004 – PLN 50.5 million) due mainly to payments to our suppliers in January following the busiest part of our year in November/December 2004. The slightly smaller usage in 2005 than in 2004 was due to the improvement in credit terms with suppliers The Group invested PLN 33.0 million in capital expenditures and other investing activities, of which more is noted below. The Group`s cash as at 30 June 2005 amounted to PLN 36.3 million (31 December 2004 – PLN 86.4 million). Following the disbursements to suppliers during the first month or so, as well as capital expenditures, the Group`s overall position, as expected given the nature of our business, is net debt of PLN 60.9 million (31 December 2004 – PLN 3.1 million – net cash), as set out below in PLN millions: 7 5.2 Asset and capital structure Equity and gearing The Group`s capital structure as at 30 June 2005 and 31 December 2004 is as follows: 2005 2004 36.3 86.4 (90.6) ( 6.6) (74.2) (9.1) (60.9) (239.8) (300.7) 25.4 % 20.3 % 3.1 (242.7) (239.6) -% -% Cash and cash equivalents Less: Non current borrowings Current borrowings Net cash/(debt) position Total equity Total capital employed Gearing Net debt/total capital employed As can be seen, the Group has a reasonable level of gearing and debt as at 30 June 2005 given it has settled, from its own cash, a significant amount of trade creditor balances arising from the 2004 year end which is the busiest part of the year for the Group, as well as the use of debt finance to fund the capital expenditure programme. This has led to the use of long term finance as opposed to current borrowings which reflect the projected timing of cash inflows from the new stores opened. Included in non current borrowings is the loan from ING Bank of PLN 40.4 million which is fully secured on the long term receivable in respect of Sephora (see note 17 of the 2004 year end consolidated financial information). Therefore, the actual debt position is PLN 40.4 million less than that stated. Profile of debt The profile of the Group`s debt finance is as follows: Current Bank loans payable within 1 year Finance leases payable within 1 year Other Non current Long term bank loan Finance leases payable over 1 year Medium Term Notes Other long term borrowings Total 2005 2004 94 6,551 6,645 136 7,572 1,361 9,069 40,401 22,315 25,000 2,866 90,582 40,790 30,323 3,100 74,213 97,227 83,282 As can be seen, the Group has increased its level of indebtedness as at the period end due to seeking Medium Term Notes to partly finance its capital expenditure programme. The Medium Term Notes (“MTNs”) are to be repaid in periods from two to four years. In addition, in the first half of 2005, the Group undertook repayments of finance lease principal and other loans of PLN 4.6 million but, in turn, obtained PLN 11 million, under finance leasing agreements arranged with landlords as part of the capital expenditure programme. As noted above, the actual level of borrowings is PLN 40.4 million less due to the ING bank loan being fully secured on an asset of the Group. It should be also noted that, on 29 April 2005, NFI EMF SA and its subsidiaries, Empik, LEM Sp z o.o, Polperfect Sp z o.o, Young Fashion Sp z o.o, Ultimate Fashion Sp z o.o, Galeria Centrum Sp z o.o. Optimum Distribution Sp z o.o. and Smyk Sp z o.o, signed an agreement with ABN Amro Bank to renew the PLN 39.1 million overdraft facility which it entered into on 26 May 2004 on the same terms and conditions as before. This facility is to provide the Group with temporary financing to overcome the usual peaks of trading such as payments to suppliers in the less busy parts of the year. 5.3 Capital expenditure The Group incurred capital expenditures on its segments of PLN 33 million in the first half of 2005 (in the first half of 2004 – PLN 13.6 million). Development expenditures amounted to PLN 27.4 million (2004 – PLN 5 million) of which PLN 14.3 million (2004 – PLN 1.1 million) was spent in the Fashion & Beauty segment and PLN 13.1 million was spent in the Media & Entertainment segment (2004 – PLN 3.9 million). In the “Fashion & Beauty” segment, in the first half of 2005, Ultimate Fashion opened two stores while Young Fashion opened one store. Total new retail area added in the six month period amounted to almost 2,000 m2 and total area in this segment amounted to over 45,000 m2 as at the period end (31 December 2004 – 43,000 m2). In the first half of 2005, both Empik and Smyk opened six and five new stores respectively with a total area of almost 7,000 m2. Total area in the segment amounted to over 55,000 m2 as at the period end (31 December 2004 – 49,000 m2). The Group incurred maintenance expenditures of PLN 5.6 million in the first half of 2005 (2004 – PLN 8.6 million) of which PLN 1.6 million was spent in the Fashion & Beauty segment, and PLN 4 million was spent in the Media & Entertainment segment. 6. Employees The average number of employees in the Group has increased to 3,537 in the first half of 2005 from 3,404 in the first half of 2004 due to new staff taken on for the new shops in both 2004 as well as in 2005, offsetting the reduction of 92 employees arising from the disposal of the E Foto sro operation in September 2004. 9 7. Outlook As noted in the year end review, over the coming year, the Group intends to open 40 to 50 new stores with a total new retail area of over 18,000 to 25,000 m2. To 30 June 2005, the Group has opened 14 new stores with a total new area of almost 9,000 m2. In July, the Group opened a further Smyk outlet in Zabrze with 700 m2 of new retail area. In the third quarter, it is further envisaged that further Empik, Smyk and Ultimate Fashion outlets will be opened in Sadyba Best Mall in Warsaw as well as in Wroclawek. On 5 July 2005, the Extraordinary Shareholders Meeting of NFI Empik Media & Fashion SA adopted a resolution on the purchase of up to 10 % (10,940,561) of its own shares for redemption. On 12 August 2005, based on the authorisation included in the above mentioned resolution of the Shareholders Meeting, the Management Board adopted its resolution setting out the purchase price per share for the public tender of PLN 5.92 per share and announced the public tender for the purchase of up to 10,940,561 of its own shares for the purpose of redemption. The subscription period commences on 22 August and will conclude on the 30 August. The purpose of the share redemption is to return windfall gains to shareholders, i.e. significant value one off gains, including the sale of a stake in Young Fashion Sp. z o.o. (“Young Fashion”)(see next paragraph), which are not needed to finance the business in view of existing finance available e.g. cash generated from operations and proceeds from MTNs. The share redemption is likely to have a beneficial impact going forward on the earnings per share – one of the measures identified by management for monitoring the enhancing of shareholder value. The redemption of the purchased own shares shall be carried out in accordance with the provisions of the “Code on commercial companies”. On 14 July 2005, NFI Empik Media & Fashion SA signed an Investment and Shareholders Agreement with Inditex SA (“Inditex”), the owner of the Zara brand, regarding the sale to Inditex of a stake in Young Fashion. On 10 August 2005, Inditex purchased 51 % of the shares from NFI Empik Media & Fashion SA in Young Fashion, the franchisee of the Zara brand in Poland. The price for the 51 % was determined by reference to the results of Young Fashion for the first half of 2005 and amounted to EURO 10,177,870. A further 29 % shares in Young Fashion can be acquired by Inditex not earlier than February 2008 for EURO 4,350,000 – in this respect NFI Empik Media & Fashion S.A made an offer to sell the 29% shareholding to Inditex. The remaining 20 % of the shares will be subject to a “put/call” mechanism which cannot be triggered by NFI Empik Media & Fashion SA earlier than April 2008 and by Inditex not earlier than 1 February 2011. In addition, NFI Empik Media & Fashion SA has established for the benefit of Inditex certain rights over the exercise of the 29 % shareholding in Young Fashion and, Inditex prepaid an amount of EURO 4,350,000 for the future purchase of said 29%. The transaction has led to the assets and liabilities of Young Fashion being disclosed in the balance sheet as at 30 June 2005 as “Non current assets classified as held for sale” and “Liabilities directly associated with non current assets classified as held for sale” – see note 9 of the IFRS Interim Condensed Consolidated Financial Information. The gain on the disposal will be reflected in the third quarter’s results. On 5 August 2005, NFI Empik Media & Fashion SA announced that its subsidiary, Empik Sp z o.o, (“Empik”), will contribute its 38 language schools to Learning Systems Poland Sp z o.o. (“LSP”), the operator of seven language schools trading under the name “The Orange School”, in return for 65 % of the shares in LSP. In addition, NFI Empik Media & Fashion SA acquired 36 shares in LSP from TCA Marketing Partners SL for PLN 3 million, to be paid upon the registration by the court of the contribution in kind by Empik as referred to above. The transaction requires the consent of the Office for Protection of Competition and Consumers (UOKiK). Under the Investment Agreement signed on 4 August 2005 between NFI Empik Media & Fashion SA Empik and the current shareholders of LSP, NFI Empik Media & Fashion SA (or Empik) shall have the right, or, under certain circumstances the obligation, to acquire the 34.36 % of the shares of LSP it does not hold, directly or through Empik, by the end of 2011 under an agreed formula, based on the results of LSP. As noted earlier, this transaction reinforces the Group’s position as one of the leading providers of educational services in Poland. 11

![Dr. Z's Math251 Handout #13.3 [Arc Length and Curvature] By](http://s3.studylib.net/store/data/008263836_1-3cdb80f6ec4c3c8afbcf7b46fe80eeff-300x300.png)