BUDGET PROJECT Mrs. Hillaby's Health Class Grade 9 The

advertisement

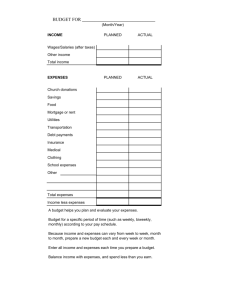

BUDGET PROJECT Mrs. Hillaby’s Health Class Grade 9 The objective of this project is to provide students with an understanding of the financial responsibilities and realities of independent adulthood. These are life skills that will allow you to plan and understand life’s responsibilities after high school. You have just graduated from high school and are moving out. Your parents have given you a gift of $2000 and said good luck! You will have to: 1. Find a job (commission sales job is not acceptable) 2. Rent an apartment (roommate to share expenses is okay) 3. Buy a car (you may not accept a car from relatives) You will have to develop a monthly budget. Based upon a monthly salary for the job selected, your will be totally responsible for all expenses from daily living needs such as laundry and food to larger fixed expenses such as, house bills, health and car insurance. It’s important that you get a realistic picture of how much something costs. Look at telephone bills, insurance bills, etc from home. This project is due BUDGET PROJECT Job: No kijiji ads please Place ad here Job description: Job security: Job benefits: Promotion potential: Hours per month times $ per hour TOTAL MONTHLY INCOME Gross monthly Salary Net Monthly Income $ $ $$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ BUDGET PROJECT LIVING ARRANGEMENTS No kijiji ads please Place ad for apartment or house here Are you sharing or not sharing living accommodations? If sharing, who are you sharing with? Security deposit required $ TOTAL MONTH EXPENSE Rent or mortgage $ If sharing, your share of the rent of mortgage $ BUDGET PROJECT AUTOMOBILE No kijiji ads please Place ad for car here COSTS Purchase Price $ Minus Down payment $ Equals Financed Amount $ Financed amount divided by ____ months equals $ * Insurance $ Monthly maintenance amount $ (Step 1: determine yearly maintenance expenses: oil changes, tire rotation, balancing, alignment and tune-up. Step 2: divide this number by 12) TOTAL MONTHLY EXPENSES Car payment Gas expense $ litres per month x $1.05 $ Insurance per month $ Maintenance expenses $ BUDGET PROJECT HOME FURNISHINGS Bedroom: bed, chest of drawers and lamp No kijiji ads please Place ads for bedroom here Bedroom furniture total: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ Living room: sofa, coffee table, television, entertainment unit and lamp No kijiji ads please Place ads for Living room here Living room furniture total: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ Kitchen: microwave, plates, silverware, glassware, pots and pans No kijiji ads please Place ads for kitchen here Kitchen furniture total: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ BUDGET PROJECT EXPENSE SHEET ONE TIME EXPENSES: Security Deposit (Accommodations) $ Auto: Down payment or total cost paid (Auto sheet) $ Furniture (Home Furnishings total / number of roommates) $ TOTAL – one-time expenses $ MONTHLY FIXED EXPENSES: Rent or mortgage payment (accommodations) $ Loan payments (automobile sheet) $ Insurance: car (automobile sheet) $ * Insurance: Dental $ * Insurance: Medical $ TOTAL – fixed expenses $ MONTHLY VARIABLE EXPENSES: Groceries $ Utilities: gas and electricity $ Utilities: Water, Garbage, Recycle (Aquatera) $ Telephone $ Laundry $ Clothes $ Body Care (gym, activities etc) $ Car: Gas (from automobile sheet) $ Car: maintenance (from automobile sheet) $ Entertainment $ Netflix, Telus TV etc $ TOTAL – variable expenses $ TOTAL MONTHLY FIXED AND VARIABLE EXPENSES $ BUDGET PROJECT BALANCE SHEET Gift from parents $ Minus one-time expenses $ Emergency Savings fund $ Net income $ Less total monthly expenses $ Equals Savings $ I will change my spending by ………………… 2,000.00 BUDGET PROJECT DREAM JOB MONTHLY BUDGET A few assumptions must be made for you to complete this worksheet: 1) you have completed your education/ training and are starting out in the world and 2) you may live anywhere in the Canada to complete this portion of the project. Next, you will need to find the entry-level salary for your dream job. You must include proof for dollar amounts you write down. Name and explain your dream job. In your description of this job, discuss any training, and /or schooling required for this position. Also include why you would like to make this profession your life’s work. BUDGET PROJECT $$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ EMPLOYMENT Job: No kijiji ads please Place ad here Job description: Job security: Job benefits: Promotion potential: TOTAL MONTHLY INCOME Gross monthly Salary Taxes or deductions Net Monthly Income $ $ $ $$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ BUDGET PROJECT LIVING ARRANGEMENTS No kijiji ads please Place ad for apartment or house here Are you sharing or not sharing living accommodations? If sharing, who are you sharing with? Security deposit required (25% of gross) TOTAL MONTH EXPENSE Rent or mortgage $ If sharing, your share of the rent of mortgage $ BUDGET PROJECT NEW AUTOMOBILE No kijiji ads please Place ad for car here COSTS Purchase Price $ Minus Down payment $ Equals Financed Amount $ Financed amount divided by ____ months equals $ Insurance $ Monthly maintenance amount $ (Step 1: determine yearly maintenance expenses: oil changes, tire rotation, balancing, alignment and tune-up. Step 2: divide this number by 12) TOTAL MONTHLY EXPENSES Car payment Gas expense $ litres per month x $1.04 $ Insurance per month $ Maintenance expenses $ BUDGET PROJECT MONTHLY BUDGET: Annual salary (Employment sheet) $ Monthly salary after taxes $_________________ Income $ Property $ Rent/ mortgage per month (Living Arrangements sheet) $ Utilities Electricity and Gas $ Water, Garbage, Recycle (Aquatera) $ Groceries $ Clothing $ Phone $ TV $ Insurance: Car $ House $ Life $ Health $ New Automobile (Automobile Sheet) $ Monthly Payments $ Gas $ Maintenance $ Entertainment $ Savings $ Credit Card/ Student Loan debt $ Total Monthly budget $ BUDGET PROJECT DREAM JOB REFLECTION How do you suspect your life would differ from your first job to your dream job? Please explain, using specific evidence, why your life would be better, worse or stay the same in each scenario