Solutions

advertisement

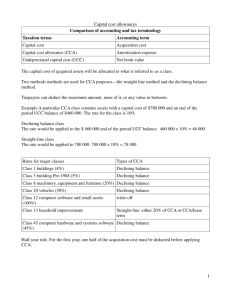

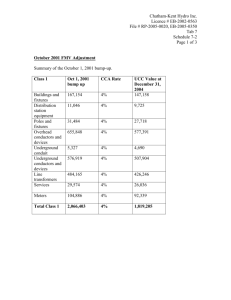

AFM 361 Spring 2008 Final Solution Question 1: 55 marks, = 1.2 mark, max 53 (A) Calculation of taxable income (max 21 ) 105,000 Net income Add: 19,500 10,000 Tax expense Charitable contribution Depreciation Golf membership Taxes on U.S. dividends Less: CCA on furniture and fixture 60,000 x 20% CCA on leasehold improvements 144,000 ÷ (10 + 5 ) CECA (48,500 + ¾ x 40,000 ) x 7% no half year rule Division B income Division C Deductions: Charitable contributions lesser of (a) contribution, 10,000 (b) 75% of 229,905 172,429 Canadian dividends Net capital loss not deducted 120,000 2,000 500 ( 12,000) ( 9,600) ( 5,495) 229,905 ( 10,000) ( 2,000) 217,905 (B) Calculation of tax payable (max 32 ) Tax 217,905 x 38% Abatement (Schedule 1) Tax reduction 8.5% x 217,905 Non-business foreign tax credit (Schedule 2) Business foreign tax credit (Schedule 3) 82,804 ( 17,705) ( 18,522) ( 500) ( 7,000) 39,077 Schedule 1 (abatement) Revenues Salaries Canada 600 + 300 75% 120+ 30 + 112.5 87.5% U.S. 300 37.5 1,200 300.0 Abatement: 81.25% x 10% x 217,905 = 17,705 Schedule 2 (Non business FTC) Avg. 81.25% 500 Lesser of (a) tax paid (b) for. non-bus. inc. x tax otherwise payable1 Div. B inc – dividend dedn – NCL 3,000 229,905 – 2,000 x (82,804 – 17705 – 18522 )= 613 Schedule 3 (Business FTC) Least of (a) tax paid 7,000 (b) for. bus. inc. x tax2 Div. B inc – dividend dedn – NCL 35,000 x (82,804– 18522 )= 229,905 – 2,000 9,872 (c) tax (*) w/o abatement – non-bus. FTC = 82,804– 18522 – 500 63,782 Question 2: 55 marks, = 1.2 mark, max 59 (A) Calculation of losses (max 20 ) Non-capital 42,000 Prior year – non-capital – net capital Current year – a.c.l. Property: dividend Div C ded’n interest Net capital Expiring 11,000 11,000 10,000 10,000 ( 1,500) 1,500 2,500 2,500 2,500 Business: operations inventory CCA on cl 43 27,000 500 3,000 30,500 73,500 23,000 23,500 Elect on land for t.c.g. of 23,500; deemed PoD of 100,000 + 2 * 23,500 = 149,000 Net capital losses used up, therefore $0 Non-capital losses: Beginning balance New: business loss property loss Dividends deduction Net capital loss claimed 3(c) income 25,500 – 10,000 30,500 1,000 1,500 13,000 ( 15,500) 42,000 30,500 72,500 Verify that loss can be used: continue business with reasonable expectation of profit (B) Asset values (max 8 ) Assets after acquisition Inventory Equipment – CC UCC Building – CC UCC Land – ACB 100,000 + 2 * 23,500 1,500 30,000 15,000 250,000 235,200 149,000 (C) Calculation of taxable income (max 31 ) 174,000 31,000 120,000 2,000 15,000 ( 34,200) ( 9,600) ( 9,600) ( 4,500) ( 5,110) Net income Add: Tax expense Depreciation Golf membership Loss on sale Less: Terminal loss on the building (Sch. 1) CCA on furniture and fixture (60,000 – 12,000) x 20% CCA on leasehold improvements 144,000 ÷ (10 + 5 ) CCA on equipment 15,000 x 30% CECA (78,500 – 5,495) x 7% Division B income Division C Deductions: Non capital losses (assume businesses are similar) Schedule 1 (subsection 13(21.1) PoD on building: Lesser of (i) FMV land and building minus lesser of (A) ACB land (B) FMV land (ii) greater of (A) FMV building (B) lesser of CC UCC 278,990 ( 72,500) 196,490 350,000 149,000 150,000 250,000 235,200 149,000 201,000 200,000 235,200 Therefore, PoD on building is 201,000, leading to a terminal loss of 235,200 – 201,000 = 34,200 Therefore, PoD on land is 350,000 – 201,000 = 149,000 leading to an allowable capital loss of (149,000 – 149,000 ) / 2 = 0. 235,200 Question 3: 40 marks, = 1.2 mark, max 38 Division B income before the following SR&ED: last year’s ITC new computer used computer new furniture salaries operating costs CCA: building 1.5M x 6% x ½ CECA: 209,250 x 7% inclusion * Non-capital loss carry-forward Taxable income Tax @ 38% Abatement @10% Tax reduction @8.5% (technically 7% in 2007) ITC max: 20% x (300 + 100 + 200 + 30) = 126,000 limited to tax payable max: 20% x (50 + 20 + 450 + 100) carryforward: 126,000 – 111,553 2007 1,200,000 ( ( ( ( ( ( ( ( 2008 1,500,000 111,553 300,000) ( 50,000) 50,000) 100,000) ( 20,000) 200,000) ( 450,000) 30,000) ( 100,000) 45,000) ( 87,300) 14,648) 125,148 10,000) 450,352 1,029,401 171,134 ( 45,035) ( 38,280) 111,553 ( 111,553) 0 * Lesser of (a) negative amount: opening balance 209,250 2007 CECA ( 14,648) 2008 disposal ¾ x 500,000 ( 375,000) 180,398 (b) total CECA 350,000 + 14,648 + 15,750 380,398 less previous recaptured ( 350,000) 30,398 Plus: 2/3 x (180,398 – 30,398 ) 391,172 ( 102,940) ( 87,499) 200,733 ( 124,000) ( 14,447) 62,286 30,398 100,000 130,398