Travel and Tourism – SINGAPORE MARKET

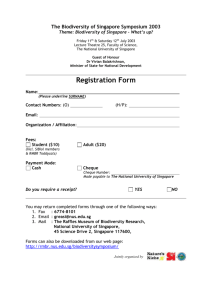

advertisement

Travel and Tourism – SINGAPORE MARKET

1. EXECUTIVE SUMMARY

The travel and tourism industry in 2005 witnessed an increase in both arrivals and departures.

The total number of arrivals increased by 7%, while departures grew by 14%. The growth

achieved by arrivals and departures is primarily due to the buoyant economy of the country and

increased travel confidence.

The Singapore Tourism Board (STB); the key tourism agency in Singapore, took several

initiatives in 2005. Some of the initiatives taken by STB included its vision for making

Singapore a powerful tourism hub for attracting visitors, businesses and talents from across the

world by 2015. The efforts made in this direction included 'Make It Singapore plus' Campaign to

attract MICE events, participation in 2005 World Exposition which was held in Japan, and

opening of Singapore Education Services Centre. STB also upgraded its online services and

made it interactive and user friendly.

Travel accommodation grew by 10% in current value terms in 2005, to reach a total of S$1

billion. The growth is largely attributed to the increase in tourist arrivals especially from

countries such as Indonesia, India, China and Thailand, as travellers regained confidence in

travelling.

Transportation in 2005 was impacted by the proliferation of low cost carriers. The budget

airlines contributed significantly to the increase in tourist arrivals in Singapore, by increasing

their operations and connecting several countries with Singapore.

The up and coming low cost carrier market in Singapore witnessed the merger of two budget

airlines in July 2005. Qantas Airways-supported Jetstar Asia and Singapore-based Valuair

merged their businesses and formed a single corporate entity. Under the deal worth S$60 million,

Qantas will have 44.5% stake in Jetstar Asia. The merger is likely to provide a platform for

growth in the Asian markets, particularly in China, for Qantas. The two airlines will have a

combined fleet of eight aircraft.

Car rental in 2005 witnessed growth of 5% in current value terms over the previous year. The

factors which impacted car rental positively were the increase in tourist traffic, and the growing

number of business meetings and conventions held in Singapore.

Travel retail in 2005 grew steadily at 12% and is S$3 billion in value terms as compared to 2004.

This is as a result of a better performing economy and increase in travel confidence. The rise of

the low cost carriers and lowering of package deals by travel agencies also encouraged more

people to travel, as travelling is becoming more affordable.

Gathered by: Department of Tourism ASEAN

Page 1

Travel and Tourism – SINGAPORE MARKET

2. OPERATING ENVIRONMENT

2.1 Macroeconomic Parameters

GDP and tourism

Singapore's total GDP grew by 7% in 2005, a stable rise, although a slow-down on the 8%

growth seen in 2004. Growth remains heavily dependent on certain key exports, and on

economic developments in the region. Tourism was among the leading areas which contributed

to Singapore's economy in a significant manner. The tourism industry in 2005 witnessed an

increase in overseas arrivals, which led to higher retail sales as well as improved hotel revenue

and occupancy rates.

The government also made ambitious plans to further propel tourism and tourism-related

services in Singapore. One such plan includes two proposed casino resorts. The casino resorts

are likely to boost the economic growth of the country and indirectly create jobs.

Disposable income

Buoyant economic growth experienced in 2005 boosted the per capita income of the local people

in Singapore, which in turn led to higher disposable income, boosting tourism spending on

outbound travel as well as domestic travel amongst Singaporeans.

Consumer expenditure on leisure

The positive economic scenario and increase in disposable income in 2005 led to increased

spending on leisure. The spending on outbound travel, domestic tourism and shopping

constitute an important part of consumer spending on leisure. Among the above three, outbound

travel showed the maximum increase in 2005.

Table 1 Operating Environment Parameters 2000-2005

S$ bn

2000 2001 2002 2003 2004

2005

Annual disposable income 82.5 87.4 91.3 99.1 105.2 109.1

159.8 153.4 158.4 161.5 181.7 194.4

Total GDP

9.0

8.1

8.0

8.1

8.8

9.2

Leisure and recreation

Source: Euromonitor International from national statistical offices

2.2 Political and Legislative Environment

Long-term initiatives by Singapore Tourism Board (STB)

Tourism is one of the key industries in Singapore, and forms an important part of the economy.

Singapore Tourism Board (STB), which is the main economic development agency for tourism

Gathered by: Department of Tourism ASEAN

Page 2

Travel and Tourism – SINGAPORE MARKET

in Singapore, aims to develop and enhance tourism in the coming years. Some of the initiatives

taken by STB include its vision for making Singapore a powerful tourism hub for attracting

visitors, businesses and talents from across the world by 2015

STB identified three key areas of focus for achieving this goal; enhancing Singapore’s position

as the leading convention & exhibition city in Asia; providing high end quality services such as

healthcare and education services; and improving Singapore’s image as a leading Asian leisure

destination.

Government Tourism Development Fund to boost infrastructure

The government’s contribution in this direction includes a S$2 billion Tourism Development

Fund (TDF). This fund will be directed to developing critical infrastructure pertaining to tourism,

anchoring mega events pertaining to leisure as well as the business world, and improving the

potential of travel channel partners. The fund will also be used for developing strategic tourism

products. Another key effort made by the Government in an attempt to rejuvenate tourism, was

the lifting of the ban on casinos. The major step taken, pertaining to the development of

integrated resorts with casinos is expected to enhance the volume of tourist arrivals as well as

increase the yield per tourist.

In addition to the goals set for 2015, STB made web-based developments in 2005 in order to

attract the growing internet savvy population. These developments included re-launching

Singapore's destination website; www.visitsingapore.com. The new portal is available in a

variety of languages including English, Simplified Chinese, Traditional Chinese, Thai,

Vietnamese, Bahasa, Japanese, Korean, Russian, Arabic, French and German. The new website

is easy to navigate and showcases all the prime attractions of Singapore. The interactive nature of

the website allows customisation as per the requirements of the traveller.

Singapore Airlines; the local airline of the country, also took several initiatives in 2005 to

promote tourism in Singapore. Some of these steps included signing a Memorandum of

Understanding (MoU) with the Queensland Government. Another MoU was signed with South

Australian Tourism Commission. The main purpose of these agreements was to jointly boost

tourist arrivals with Singapore airlines as the preferred airline.

STB opens Indian branch office

In 2005, STB opened its New Delhi Regional Office. The office will primarily conduct

marketing campaigns so as to attract Indian tourists to Singapore. STB also made special efforts

for transit passengers. This included the launch of Phase Two of the Transit Programme. Phase

Two includes free bus shuttle services from the airport to Suntec City/Little India/Parkway

Parade with return transfer to the airport, Tourist Day Pass for transit visitors preferring to travel

and venture through Singapore on their own, food and beverages/shower facility vouchers for

use at the airport upon return after transit experience, free city tour in Chinese and taxi tourist

guide.

Gathered by: Department of Tourism ASEAN

Page 3

Travel and Tourism – SINGAPORE MARKET

2.3 Terrorism and Security

Like other countries across the region, Singapore has been characterised by increased insecurity

amongst the population, due to increased threats surrounding terrorism and attacks.

Singapore’s more significant attacks have included the 1965 bomb explosion at the central

location, Orchard Road, which killed two Chinese and one Malay, and injured 33 people. In

January 1974, members of the Japanese Red Army (JRA) bombed petroleum tanks at Pulau

Bukom, and in 1991, terrorists hijacked a Singapore Airlines shuttle flight SQ117 from Subang

International Airport (Kuala Lumpur) with 129 passengers onboard. In 1985, the government

uncovered planned activities of a local terrorist network, the Liberation Tiger of Tamil Ealam

(LTTE), headed by Sri Lankans in Singapore, deporting members of the network back to their

country of origin.

Stepping up security

Following the 9/11 US attacks in 2001, and the Bali bombings, the threat of terrorist attacks in

Singapore is thought to be relatively high compared to other countries, due to the strong

Western presence in the country, and large-scale business interests in Singapore. In response to

this, the government has continued to be proactive in counteracting terrorism threats, and since

the 9/11 US attacks in 2001, has stepped up its security measures significantly.

In December 2001, 15 people involved in terrorist-related activities were arrested, and several

major plots, including plans to carry out attacks on Singapore’s MRT public transport system,

were uncovered. In 2005, measures were taken to increase security further, with initiatives such

as the encouragement of people to own an emergency “Ready Bag” (bags containing items and

equipment to help people in an emergency), as well as the tracking of users of prepaid mobile

phone cards to prevent their abuse by terror groups. Together with Malaysia and Indonesia, the

“Eyes in the Sky” campaign was launched as a security measure for waterways. Furthermore, in

2006, the government plans to stage “Exercise NorthStar 2006”, which will simulate a terror

attack in Singapore to test the response of the different agencies and the public in such a

scenario.

Enhancing the sharing of intelligence

Singapore has also readily shared relevant intelligence with foreign security agencies. This has

led to the arrest of several Jemaah Islamiyah (JI) members in the region spread over several

countries. Singapore participates actively in many international and regional security forums,

sharing its experiences in counter-terrorism and hosting training courses for regional countries.

Tackling terrorism on the ideological and social fronts

Ministers in Singapore have met up with Muslim and non-Muslim community leaders to discuss

the terrorism issue openly and rationally. The local Muslim community has also developed and

Gathered by: Department of Tourism ASEAN

Page 4

Travel and Tourism – SINGAPORE MARKET

implemented self regulatory measures to prevent radical and extremist groups from subverting

and misleading Singapore Muslims.

Enhancing Protective and Preventive Measures

Enhancing home front security

In the area of maritime and port security, since 1 July 2004, Singapore has complied fully with

security measures adopted by the International Maritime Organisation (or IMO). Singapore also

tightened security screening of incoming cargo and travellers, deploying radiographic scanners in

doing so.

Singapore is also moving towards greater use of biometrics for immigration clearance. In

December 2005, new passports formats were introduced with enhanced security features and

higher technology identification software.

2.4 Sustainable Tourism

At the national level, the Singapore Tourism Board (STB) is responsible for sustainable

tourism. Other agencies responsible for the planning and management of sustainable resources

in Singapore include the Urban Redevelopment Board (URA), National Parks Board (NParks),

and the National Heritage Board (NHB).

Eco-tourism continues to be promoted as part of its other activities, although this area remains a

small part of many areas of promotion, rather than a key focus area of expansion. Compared to

its neighbouring countries, Singapore’s nature reserves are more limited, and as such, ecotourism is considered a relatively higher risk area of investment, and visitors continue to

perceive Singapore as a city destination.

Nevertheless, Singapore continues to promote itself as a country offering something for

everyone, and there are a wide range of nature zones and parks designated as eco-sites. Such

major areas include: forested areas, such as the Bukit Timah Nature Reserve and Central

Catchment Nature Reserve, Bukit Batok, Labrador Park and Singapore Botanic Gardens.

Singapore’s marshes and mangrove swamps are found at the Pasir Ris Park, Marina South fresh

water marsh, Sungei Mandai, Kranji Reservoir, Sungei Buloh, Khatib Bongsu and the Western

Catchment Area.

Singapore’s ridges and hillocks include Kent Ridge Park, Mount Faber and Telok Blangah Hill

Park. Its offshore islands also attract a high degree of tourism, including at islands such as Pulau

Ubin, Pulau Semakau, Sentosa and Pulau Tekong.

2.5 Positive Growth Factors

The tourism industry in 2005 witnessed an increase in tourist arrivals, departures and domestic

tourists. One of the key events which gave a major boost to tourism in Singapore was the

proliferation of low cost carriers. The budget carriers opened the travel market for tourists who

Gathered by: Department of Tourism ASEAN

Page 5

Travel and Tourism – SINGAPORE MARKET

could not afford the airfares of traditional airlines. Besides this, the low cost carriers added new

destinations, which led to an influx of tourist traffic to these new destinations. The new

destinations added by the budget airlines in 2005 were mainly the second tier cities in the

countries, which are located at short haul distance. For example, Valuair added Surabaya in

Indonesia, and Tiger Airways added Darwin in Australia.

Another prime factor which contributed to the positive growth was the improved economic

scenario of Singapore and led to increase i

n both arrivals and departures. The positive economic growth, which led to increase tourism

spending, propelled the outbound travel. In terms of inbound travel, the growing economy

enhanced the brand image of the country and improved travel confidence among the incoming

tourists.

In addition to the above factors, STB played a major role in enhancing Singapore’s image as an

attractive tourist destination. STB launched 'Make It Singapore plus' campaign, to attract MICE

events. This campaign was an extension of 'Make It Singapore' campaign which was launched

on November 2003. The ‘Make It Singapore’ campaign attracted about 40 major events in 2004.

Some of these events included the Global Brand Forum, Nortel Networks sales and training rally,

the Amway India incentive group, the Asia Pacific low cost airline symposium, the International

Conference on Materials for Advanced Technologies (ICMAT) and the International Conference

on Advanced Materials (ICAM).

The new 'Make It Singapore plus' campaign, offered additional benefits such as better event

management in the form of value-adds. Some of these value added services included

videography services, team-building activities for corporate meetings and incentive groups and

publicity support.

The overseas effort made by Singapore Tourism Board included taking part in 2005 World

Exposition (World Expo), which was held in Japan, and showcased many unique aspects of

Singapore. Pertaining to high-end services; STB opened Singapore Education Services Centre

in 2005, with the aim to provide information on various education options, registration

procedures and processes.

Summary 1 Positive Growth Factors

Growth of low-cost carriers with additional regional routes

Improved economic climate increased propensity to to travel

Improved travel confidence

Strong branding and marketing efforts by STB

Source: Company websites, company annual reports, trade interviews, Euromonitor

International

Gathered by: Department of Tourism ASEAN

Page 6

Travel and Tourism – SINGAPORE MARKET

2.6 Negative Growth Factors

The natural calamities and terrorist activities in the Asia Pacific region indirectly affected

tourist traffic

While the tourism industry remained buoyant in 2005, some external as well as internal factors

slowed growth. Some of these factors included the threat of security and terrorism in the Asia

Pacific region. One such event was the Bali bombing, which led to many cancellations of

Singapore-Bali travel packages. The region also suffered from several natural calamities such

as the tsunami at the end of 2004 and bird flu in 2005. Though Singapore remained safe from

such incidents, the tourism market was indirectly affected for travel packages, which included

Singapore as one of the destinations.

In addition to this, Singapore is facing competition from several upcoming destinations such as

Dubai. The new convention centre and hotels being built in Dubai to attract MICE events to the

city are likely to take away a certain percentage of MICE related business from Singapore.

Besides this, neighbouring countries such as Malaysia are also upgrading themselves and

enhancing their image as shopping destinations. Thus the cheaper shopping alternative in

Malaysia and other neighbouring countries have impacted on the shopping tourism in

Singapore.

Tourism in Singapore was also negatively affected by the fuel price surcharge. The

transportation sector; especially the airlines, had to adjust their fuel surcharge for tickets. The

surcharge, which translated into higher pricing for travellers, also negatively impacted tourist

arrivals.

Summary 2 Negative Growth Factors

Terrorism in the region

Natural disaster in nearby destinations

Diseases such as bird flu, dengue fever

Competition from other regional destinations

Price surge on transport

Gathered by: Department of Tourism ASEAN

Page 7

Travel and Tourism – SINGAPORE MARKET

3. COMPETITIVE ENVIRONMENT

3.1 Recent Mergers and Acquisitions

The mergers and acquisitions that took place in 2005 were as follows:

Raffles Holding and Colony Capital

Raffles Holdings sold its hotel business, including Singapore's 118-year-old Raffles Hotel,

to a US private-equity investor Colony Capital. Raffles Holdings is expected to gain $605

million and will retain its 45% share in Tincel Properties, which has a $700 million stake in

Raffles City, the complex houses Swissôtel and Stamford hotels, Raffles City Shopping

Centre, Tower Blocks and Convention Centre. Raffles Holdings will also have an option to

buy Raffles Hotel at market value after 82 years. Colony Capital plans to maintain all

operations under the current brands and will focus on opportunities to grow the franchise,

especially in Asia.

Jetstar Asia and Valuair

The up and coming low cost carrier market in Singapore witnessed merger of two budget

airlines in July 2005. Qantas Airways-supported Jetstar Asia and Singapore-based Valuair

merged their businesses and formed a single corporate entity. Under the deal worth S$60

million, Qantas will have 44.5% stake at Jetstar Asia. The merger is likely to provide a

platform for growth in the Asian markets, particularly in China.

Summary 3 Major Mergers and Acquisitions 2001-2005

Operator

Date

M&A details

Colony Capital

September

2005

Jetstar July 2005

Acquisition of Raffles hotel by Colony Capital

Merger of Valuair and Jetstar Asia to form

Valuair and

Orange Star

Asia

Source: Company websites, company annual reports, trade interviews

3.2 Key Strategic Alliances

Singapore Airlines and the Queensland Government

Singapore Airlines and the Queensland Government signed a Memorandum of

Understanding (MoU) to boost visitor arrivals into the Australian State of Queensland. The

MoU is effective from 1st April 2005 and is valid for three years. The main aim of the

alliance is to make co-ordinated efforts to promote Queensland as an attractive destination,

Gathered by: Department of Tourism ASEAN

Page 8

Travel and Tourism – SINGAPORE MARKET

and Singapore Airlines as the preferred airline. Some of the efforts made in this direction

include jointly-funded marketing campaigns in key markets, conducting familiarisation

trips to important tourism sights in Queensland for the consumer as well as trade media

from key markets, and holding joint road shows.

Singapore Airlines and South Australian Tourism Commission

Singapore Airlines signed a MoU with South Australian Tourism Commission, to jointly

promote tourism and boost visitor numbers to South Australia. Both Singapore Airlines

and South Australian Tourism Commission will commit about S$171,000 each per annum

to fund the proposed joint marketing activities in mutually agreed markets. Both the

parties have the option to renew MoU after a year.

Singapore Airlines and Air New Zealand

Singapore Airlines and Air New Zealand expanded their code share agreement. This

expanded agreement gives Singapore Airlines an option to sell dual Australia and New

Zealand destinations on Air New Zealand’s Sydney-Auckland services, and allow

passengers on its daily flights to Auckland to connect on Air New Zealand AucklandRotorua service. Customers of Air New Zealand can also enjoy more choice of flights on

Singapore Airlines services between Singapore and Dubai, Frankfurt and Rome.

Zuji and Mondial Assistance

Zuji has partnered with the travel insurance and assistance provider, Mondial Assistance to

introduce a range of travel insurance options that can be purchased online by Zuji customers

across the region.

Hilton International has made a global agreement with Expedia that allows Hilton International,

to add over 400 of its properties to Expedia’s preferred hotel programme. As part of the

agreement, Hilton International is implementing a direct connection with Expedia. Built on the

Open Travel Alliance standard, Expedia’s direct connect technology will assist Hilton in cost

reduction as well as increase the efficiency in managing inventory.

Summary 4 Key Strategic Alliances 2001-2005

Alliance companies

Year Sectors

Jet Airways and Qantas

2005 Transportation

Singapore Airlines and the 2005 Transportation

Queensland Government

Singapore Airlines and 2005 Transportation

South Australian Tourism

Gathered by: Department of Tourism ASEAN

Details of alliance

Promotion for frequent flyer

members

MoU for marketing campaign in

target segment countries

MoU for joint marketing campaign

in target segment countries

Page 9

Travel and Tourism – SINGAPORE MARKET

Commission

Singapore Airlines and Air 2005 Transportation

New Zealand

Zuji

and

Mondial 2005 Travel Retail

Assistance

Hilton International and 2005 Accommodation

Expedia

Expansion of code share agreement

Introduction of range of travel

insurance options

Agreement aimed at assisting

Hilton in cost reduction, as well as

increasing the efficiency in

managing inventory.

Signing of a Memorandum of

Understanding (MOU) on a

tourism cooperation framework

Formation of budget airline Tiger

Airways

Singapore Tourism Board 2004 General tourism

(STB)

and

Suzhou

Municipal Government

Singapore

Airlines, 2004 Air transportation

Temasek Holdings, Indigo

Partners

and

Irelandia

Investments Ltd

Valuair

and

Abacus 2004 Air Transportation Joining the Abacus ticketing and

International

reservation network

Singapore Tourism Board 2003 Tourist Attraction Construction of Singapore Flyer

and Melchers Group

Industry

Source: Company websites, company annual reports, trade interviews

3.3 Leading Company Profile: The Hertz Corp

Company background

Hertz Rent-a-car operates a car and equipment rental business, and until September 2005, was a

wholly-owned subsidiary of Ford Motor Co. In September 2005, Ford Motor Co sold Hertz

rental car unit to a private equity firm composed of Clayton Dubilier & Rice, Carlyle and Merrill

Lynch Global Private Equity for US$15 billion.

The core business of Hertz in Singapore is vehicle rental and leasing. It currently lags in fourth

place in the Singapore car rental sector, with 4% of total value sales as of 2005. The company

has two outlets in the country; one at Changi Airport and the other in the centre of town on

Scotts Road. It maintains a young fleet of cars and in line with the rest of the company,

focuses on providing quality services. It is also one of the few car rental operators with a

presence at the international airport. As such, the company’s prime target segment is

business travellers.

Summary 5 Hertz Rent-a-car: Company Factfile 2005

Company name and status:

Hertz Asia Pacific Pte Ltd

Parent company:

Country of origin:

Travel and tourism sectors:

The Hertz Corp

US

Car rental

Gathered by: Department of Tourism ASEAN

Page 10

Travel and Tourism – SINGAPORE MARKET

Major travel and tourism brands: Hertz

Source: Company research, Euromonitor International

Recent news

In an attempt to maintain competitiveness in the car rental sector, Hertz took several

initiatives over the review period, mainly in the form of alliances with other businesses, and

using synergies to boost usage of their respective products and services. One of its most

recent initiatives in 2005 was its partnership with low cost carrier Tiger Airways, whereby

it offered car rental services to Tiger Airways passengers at discounted rates. Under the

partnership with Hertz, Tiger Airways customers were offered special offers for car rentals

in Thailand, Hong Kong and the Philippines. In Thailand and Hong Kong, customers were

given one-day free rental and a 15% discount, while in the Philippines Hertz gave 20%

discount. Other alliances include agreements with several credit card companies, including

Singapore’s People’s Association passion card, where cardholders can obtain a 15%

discount when booking through this card.

3.4 Leading Company Profile: Millennium & Copthorne Hotels Plc

Company background

Millennium & Copthorne Hotels Plc is the international hotel arm of the Hong Leong

Group, Singapore. As of December 31, 2004, Millennium & Copthorne owned and

operated 89 hotels in 15 countries. The Company has two brands, Millennium Hotels and

Copthorne Hotels. The Millennium Hotels are four-star deluxe properties situated in

premier business locations around the world, while the Copthorne hotels are four-star

properties situated at regional business centres or resort locations in the United Kingdom,

France, Germany, New Zealand, Malaysia and Singapore.

In Singapore, Millennium & Copthorne International Limited is one of the leading players

in the hotel industry. The company operates the Grand Copthorne Waterfront Hotel, M

Hotel, Copthorne Orchid Hotel, Copthorne King’s Hotel and the Orchard Hotel in

Singapore. The company is focused on providing superior quality service in terms of

accommodation to its customers. The prime target segment for the group of hotels under

Millennium and Copthorne are business travellers and high spending leisure tourists. All

Millennium & Copthorne hotels have fully equipped business centres and a full range of inroom business facilities.

Summary 6 Milenium & Copthorne: Company Factfile 2005

Company name and Millennium & Copthorne International Limited

status:

Gathered by: Department of Tourism ASEAN

Page 11

Travel and Tourism – SINGAPORE MARKET

Millennium & Copthorne Hotels Plc

Parent company:

United Kingdom

Country of origin:

Travel and tourism Travel Accommodation

sectors:

Major travel and Grand Copthorne Waterfront Hotel, M Hotel, Copthorne Orchid

Hotel, Copthorne King’s Hotel and the Orchard Hotel

tourism brands:

Source: Company research, Euromonitor International

Recent news

Millennium & Copthorne Hotels took several initiatives in 2005 to attract incoming

tourists, especially for growing markets such as India. The company linked up with

Singapore Airlines and Singapore Tourism Board with an offer for incoming tourists from

India. The offer included special return Economy Class fares on Singapore Airlines from

all cities it operates from in India, a special hotel offer for a minimum of two nights from

Millennium Copthorne Hotels, and discount booklets worth S$250 from the Singapore

Tourism Board. The promotion was valid from July 1 to September 30, 2005. Millennium

& Copthorne International Limited also partnered with American Express to provide

special conference and room packages in Singapore, exclusively for American Express card

members.

The other promotional activities conducted by Millennium & Copthorne hotel in 2005

included special pricing for Singapore Airline passengers for the room tariff and additional

services such as free breakfast, late check out and 500 KrisFlyer miles per stay for

KrisFlyer members. The company also conducted a marketing programme for the month

of December, which offered prizes such as a holiday for two to Los Angeles, iPod Nanos,

weekend stays at its hotels, StarHub mobile subscription plans and a-la-carte dining card

memberships for staying or dining at the hotels.

The company made special efforts to enhance its online services by appointing VRX

Studios Inc. as its online content provider. VRX’s hotel programme will help Millennium &

Copthorne manage the integrity and presentation of its brand across all the online

distribution channels of the company.

Summary 7 Millennium & Copthorne: Summary of Key Events 2000-2005

2001

Millennium & Copthorne Hotels and

Maritim Hotels of Germany form global

strategic marketing alliance, which

allows guests a choice of 128 hotels in

Europe, the US and Asia.

The company also selects IDeaS Inc, provider 2002

of revenue management solutions, for their

Asian Properties. The Orchard Hotel is the

first site to install the e-yield Revenue

Gathered by: Department of Tourism ASEAN

Page 12

Travel and Tourism – SINGAPORE MARKET

Management Solution.

M Hotel Singapore re-opens after renovation 2003

Waterfront conference centre is launched at 2004

Grand Copthorne Waterfront Hotel

Copthorne King’s Hotel completed a $15 2005

million refurbishment project, making it a

four-star business hotel with better, modern

facilities.

Source: Company websites, press releases, annual reports, Euromonitor International

Financial summary

Millennium and Copthorne hotels in Singapore generated revenue worth S$114 million in

2005. Revenue has grown consistently since 2000, with 2003 being an exception. The

outbreak of SARS in 2003, which led to a significant decline in tourist arrivals, severely

impacted the overall hotel sector in Singapore. Hence Millennium and Copthorne hotel

sales dropped in 2003. The company witnessed revenue growth in 2004 and 2005 as a result

of increases in tourist arrivals and special promotions offered by the company.

Summary 8 Millennium & Copthorne: Operational Indicators 2005

Financial year end:

December

S$114 million

Travel and tourism sales 2005

11%

% change over 2004

S$13 million

Net earnings 2005

7%

% change over 2004

266

Number of employees

Source: Company websites, press releases, annual reports, Euromonitor International

3.5 Leading Company Profile: Orange Star

Company background

Valuair; the first low-cost airline to begin operations in Singapore in 2004, merged with

Australia’s Jetstar Asia in 2005, to form a single corporate entity called Orange Star.

Orange Star is the first major consolidation of Southeast Asia's low-cost airline industry.

Under the deal, which is worth S$60 million, Qantas ownership reduced from 49.9% to

44.5% of Jetstar Asia. Other shareholders include Temasek Holdings, Tony Chew with

22% in Jetstar Asia and FF Wong with 10% in Jetstar Asia, Singapore Exchange-listed

Asiatravel.com and Hong Kong-listed, Malaysian tycoon Lim Goh Tong owned Star

Cruises.

Prior to the merger, Valuair offered flights between its base in Singapore to Bangkok,

Hong Kong, Jakarta, Perth, Chengdu, and Xiamen. The airline recently dropped services

to the Chinese cities of Chengdu and Xiamen and the West Australian city of Perth. It also

Gathered by: Department of Tourism ASEAN

Page 13

Travel and Tourism – SINGAPORE MARKET

scrapped services to Bangkok and Hong Kong. Valuair has now become a dedicated

Singapore-Indonesia carrier. Hence Valuair will fly to Jakarta and Surabaya. On the other

hand, Jetstar Asia offers flights to Bangkok, Hong Kong, Kolkata, Manila, Taipei, Phuket,

Yangon, Phnom Penh and Siem Reap,

The main strategy of the newly merged company is to synergise on the strength and reach

of both the partners. Though currently both the partners are making losses, the merger is

expected to turn the new corporate entity to a profitable venture.

Summary 9 Orange Star: Factfile 2005

Company name and status:

Orange Star

Orange Star

Parent company:

Country of origin:

Singapore

Transportation

Travel and tourism sectors:

Major travel and tourism brands: Valuair, Jetstar

Source: Company research, Euromonitor International

Recent news

Jetstar Asia tied up with technology and distribution solutions provider, Amadeus for

distribution of its flight and fare information to travel agents in Asia-Pacific. This arrangement

will help enhance the reach of Jetstar Asia

The marketing campaign by Jetstar Asia included lower fares to its nine destinations to mark its

first year of operations. The airline sold one-way tickets for as low as S$18, for flights to

Bangkok. The promotional tickets are valid for travel between January 2 and June 30, 2006

Jetstar Asia launched flights to Bangalore, Yangon and to two Cambodian destinations, Phnom

Penh and Siem Reap

Summary 10 Orange Star: Summary of Key Events 2000-2005

2004

Both Valuair and Jetstar were founded in 2004

The merged company, Orange Star was founded

July 2005

Jetstar Asia begins flights to Kolkata

August 2005

September 2005 Valuair announces new flights twice daily from Singapore to Jakarta

Valuair announced a new flight from Singapore to Surabaya

October 2005

Jetstar Asia starts four-times weekly flight service to Phuket

October 2005

Source: Company websites, press releases, annual reports, Euromonitor International

3.6 Leading Company Profile: Raffles Hotels and Resorts Ltd

Company background and travel accommodation operations

Raffles Hotels and Resorts Ltd was established in 1989 to oversee the restoration and reopening of the world-famous Raffles Hotel in Singapore. Since its establishment, it has built

Gathered by: Department of Tourism ASEAN

Page 14

Travel and Tourism – SINGAPORE MARKET

up a portfolio of luxury hotels, and has continued to grow steadily through alliances and

agreements with other premium hotel operators worldwide to restore older historic hotels

and relaunch them with a luxury, yet traditional style. As of 2006, the company has 9

luxury hotels in operation, as well as a further 5 which are under development and due to

open over the next year or two.

Its first step of its international expansion was in 1994, when it took over and restored 2

hotels in Cambodia - Hotel Le Royal in Phnom Penh and Grand Hotel d'Angkor in Siem

Reap, which opened for business in 1997.

The company continued to buy up and restore further properties across the globe,

penetrating the European market in 1997 with the purchase of Brown's Hotel in London

and Hotel Vier Jahreszeiten in Hamburg.

In 1995, Raffles Hotels and Resorts became a subsidiary of Raffles Holdings Ltd, a

consortium created to cover a wide range of business interests domestically and

internationally in the travel accommodation sector. Raffles Holdings also controlled

Swissôtel Hotels & Resorts Ltd under its hotel arm, and under its award-winning concepts

and innovative management, both hotel groups extended their global reach and established

their name as a respected player in the niche luxury hotels market.

In October 2000, Raffles Hotels and Resorts tapped into North America by acquiring

L'Ermitage Beverly Hills. In the same year, it opened new spas under its brand Amrita and

several hotel locations, including at its flagship Raffles City in Singapore, as well as Hotel

Vier Jahreszeiten in Hamburg and Grand Hotel d'Angkor and Hotel Le Royal, both in

Cambodia.

In addition to Amrita spa, Raffles has also developed approximately 50 food and beverage

concepts to add to its portfolio, including the Equinox, Jaan, Doc Cheng and THOS SB

Raffles brands.

After a change in the top management in 2003, Raffles Holdings restructured its

organisation and expanded its hotels portfolio further by initiating management contracts

with little or no equity participation. In 2003, The group also received various awards and

accolades for its excellence in its hotel operations, top-notch products and services, and

innovative human resource management. Raffles was named one of The Strongest

Singapore Brands by International Enterprise Singapore for successfully crossing borders

and gaining brand recognition worldwide.

In June 2003, Raffles Holdings divested Raffles Brown's Hotel in London for S$161 million

with a divestment gain of S$38 million. In December 2003, the Group took over the

remaining 43% of its shareholdings to effect a full acquisition in The Raffles Hotel. Total

ownership would allow the Group greater flexibility in the financial and operational

management of Raffles Hotel.

In July 2005, Raffles Holdings Ltd sold off Raffles Hotels and Resorts Ltd and Swissôtel

Gathered by: Department of Tourism ASEAN

Page 15

Travel and Tourism – SINGAPORE MARKET

Hotels & Resorts Ltd for S$1.72 billion to Colony Capital LLC, a US real estate company

which owns stakes in several other key properties, including Resorts Atlantic City, Accor,

and Costa Smeralda. The purchase of Raffles Hotel by Colony Capital was part of its

expansion into property holdings worldwide, especially across Europe and Asia.

Summary 11 Raffles Hotels and Resorts Ltd: Key Facts

Company name and status:

Raffles Hotels and Resorts Ltd

Colony Capital LLC

Parent company:

Travel & tourism industry involvement: Travel accommodation

Raffles

Major travel & tourism brands:

Source: Company research, Euromonitor International

Recent news

In August 2004, the company made its mark on the lucrative Indian market by forming a

strategic marketing alliance with Taj Hotels Resorts and Palaces, a subsidiary of India’s

number one hotel player, Indian Hotels Co Ltd. The alliance is will involve the

development of several cross-marketing programmes for Raffles Hotels and Resortst and

Taj Luxury Hotels, the brand hotels of both companies in the upper-end segment.

In the same year, the company signed an agreement with Hong Kong company, Veritas

Ltd, to manage Raffles Taimana Resort Tahaa, a 65-villa luxury resort in French

Polynesia.

In 2005, the company expanded its global reach further, through new agreements in

Beijing and Dubai. Raffles Beijing was reopened in May 2006, and Raffles Dubai, a 240room luxury hotel in Dubai shopping destination, Wafi City is due to open in 2007.

Summary 12 Raffles Holdings: Summary of Key Events 2000-2005

2000 Opening of Amrita Spas. Acquisition of L'Ermitage Beverly Hills

Raffles International, former management arm of Raffles Hotels and Resorts, takes

over the management of Raffles the Plaza and Swissôtel the Stamford, Singapore

2003 Raffles named one of “The Strongest Singapore Brands” by International Enterprise

Singapore

2004 Enters Indian market through alliance with luxury hotel group, Taj Hotels Resorts and

Palaces

2004 Signs agreement to manage Raffles Taimana Resort Tahaa in French Polynesia

2005 Raffles Holdings sells hotel business, of which Raffles Hotels and Resorts Ltd is a

subsidiary, to Colony Capital for US$1.45 billion

Source: Company websites, press releases, annual reports, Euromonitor International

2002

3.7 Leading Company Profile: Singapore Airlines Ltd (SIA)

Gathered by: Department of Tourism ASEAN

Page 16

Travel and Tourism – SINGAPORE MARKET

Company background

Singapore Airlines Ltd (SIA) began in 1972 and is Singapore's national carrier and leading

airline in the country. In 2005, the company commanded a value share of 35% in the

Singaporean air industry. SIA's route network spans 90 destinations in 40 countries, and

its fleet of 89 passenger aircraft is among the youngest and most modern in the world. SIA

has principal activities in air transportation for passenger and cargo services. Other main

activities include engineering services, airport terminal services, training of pilots, tour

wholesaling and other related activities. Singapore Airlines Ltd has five subsidiaries: Silk

Air, Tradewinds Tours & Travel, SIA Engineering Company, SATS and SIA Cargo. Silk

Air is a regional airline based in Singapore which operates routes to 25 destinations in

Asia, with a focus on leisure tourism. Tradewinds Tours & Travel offers a wide range of

tours and travel packages to SIA's worldwide destinations and Silk Air's regional

destinations. Tradewinds operates tours and provides a travel agency for both inbound and

outbound travel. The SIA Engineering Company is based near Singapore Changi Airport

and provides engineering services and maintenance solutions to 80 international carriers.

SATS; SIA's ground-handling company, provides a wide range of services including

catering, passenger, baggage, cargo and ramp handling, aircraft interior cleaning and

aircraft security.

Singapore Airlines is also the largest founding share holder (49%) of the new budget

airline Tiger Airways, which is based at Changi Airport. Established in December 2003, the

budget airline started operating in September 2004 and now serves four city destinations in

Asia with a fleet of two Airbus A320 aircraft.

Singapore Airlines has been a member of Star Alliance since 2000 and has an equity

partnership in Virgin Atlantic, the holding company for Virgin Atlantic Airways, Virgin

Holidays, Virgin Sun, Virgin's cargo operation and Virgin Aviation Services.

Summary 13 Singapore Airlines Ltd: Company Factfile 2005

Company name and Singapore Airlines Ltd

status:

Singapore Airlines Ltd

Parent company:

Country of origin

Singapore

Travel and Tourism Air

sectors:

Major

travel

and Singapore Airlines, Silk Air, Tradewinds Tours & Travel, SIA

Engineering Company, SATS and SIA Cargo

tourism brands:

Source: Company websites, press releases, annual reports, Euromonitor International

Recent news

In 1999, Singapore Airlines signed a Memorandum of Understanding to acquire 49% of

Virgin Atlantic, the holding company for Virgin Atlantic Airways, Virgin Holidays, Virgin

Sun, Virgin's cargo operation and Virgin Aviation Services. The transaction was completed

Gathered by: Department of Tourism ASEAN

Page 17

Travel and Tourism – SINGAPORE MARKET

in 2000. The aim of the partnership was to enable the airlines to implement a wide range of

customer benefits as a result of the wider network, including code-sharing, enhancement of

their frequent flyer programmes, and shared access to passenger lounges and airport

facilities. The two carriers have, however, retained their distinctive identities and continue

to develop their own products.

In April 2000, SIA joined the Star Alliance network as the eleventh member, putting it into

a position to provide customers with enhanced benefits, such as easier access to a global

network, more travel options, and convenient connections.

In 2002, SIA increased operations to Brisbane, Australia to meet the rise in demand of

services between Singapore and Australia. Under this arrangement, a total of 70 weekly

flights were scheduled between Singapore and various destinations in Australia. Besides

these destinations, SIA also recognised Shanghai's potential to bring in a greater number of

passengers; being China's leading commercial centre. In 2002, SIA operated an extra daily

flight service between Singapore and Shanghai in response to the growing demand for both

business and leisure travel to and from Shanghai.

In 2003, SARS struck and had such crippling consequences that SIA had to take drastic

cost-cutting measures in order to reduce losses, including retrenchment of staff, wage cuts

and mandatory leave-taking. Capacity was also reduced by 32%. At the peak of the crisis,

SIA was losing S$5-6 million a day, and thus ended its first quarter with a loss of S$312

million. Nevertheless, the company was able to climb out of the danger zone to post

recovery from the losses incurred in the first half of the financial year 2003. The airline

continued its recovery with profitable third and fourth quarters, resulting in a year end

profit attributable to shareholders of S$849 million. SIA continued its steady growth to

post an operating profit of S$307million for the first quarter of the financial year

2004/2005.

In 2004, Singapore Airlines launched the world's longest non-stop flight from Singapore to

Los Angeles and New York. The non-stop flights take 16 hours-18 hours. These routes are

operated by the airline's newly-acquired A345Leadership aircrafts and provide passengers

with a premium economy class, a new class that offers better in-flight entertainment

systems and longer legroom for the same price.

SIA was abuzz with activities in 2004 to forge new ties and partnerships with other global

carriers. In the first half of the financial year, Singapore Airlines agreed to increase codeshare flights with Air Canada, Virgin Atlantic and Lufthansa. In the same period, SIA also

signed agreements to launch code-share services with British Midland, ANA and Austrian

Airlines. SIA also continued to add destinations to its network in 2004, such as Shenzhen in

China and Amritsar in India.

In January the same year, Singapore Airlines' Boarding Pass Privileges programme was

launched offering customers a range of new privileges and benefits at local and

international retailers, resorts, hotels, restaurants and cultural events. The carrier's awardwinning in-flight entertainment system, KrisWorld, was also improved, with over 400

Gathered by: Department of Tourism ASEAN

Page 18

Travel and Tourism – SINGAPORE MARKET

entertainment choices available by mid-2004. The expansion in the entertainment choices

include 60 blockbuster movies, over 90 TV hits, 196 CDs, 12 audio channels, 33 Nintendo®,

20 PC and three multi-player games. This extensive selection is available on most B747-400

and B777 aircraft, and all A345LeaderShip aircraft.

In 2005, the company sought to boost its coverage of Eastern European markets, and

embarked on this through establishing a code-share agreement with LOT Polish Airlines.

Through this, customers would have access to a wider choice of flights across Eastern

Europe, and travellers from that region would be able to take advantage of Singapore

Airline’s existing routes across Asia Pacific.

In 2006, Singapore Airlines extended its destination coverage to Moscow, Russia, with the

launch of three flights weekly. Russia is the airline’s first Eastern European destination

and with the addition of Russia as a destination, Singapore Airlines now boasts 74

scheduled flights a week to 10 cities in Europe: Moscow, Amsterdam, Athens, Copenhagen,

Frankfurt, London, Manchester, Paris, Rome and Zurich.

Summary 14 Singapore Airlines Ltd: Summary of Key Events 1999-2006

1999 Singapore Airlines signed a memorandum of understanding to acquire 9% of

Virgin Atlantic

Joined Star Alliance as its 11th member

SIA Cargo formed as an independently managed subsidiary of Singapore Airlines

Increases flights services to meet demand

SARS leads to capacity reduction, retrenchments, wage cuts

Introduced longest non-stop long haul flights in the world from Singapore and Los

Angeles and New York

2005 Begins code-sharing agreement with LOT Polish Airlines

2006 Introduced thrice-weekly flights to Russia

Source: Corporate websites, Press releases, Annual reports, Euromonitor International

2000

2001

2002

2003

2004

Financial summary

During the first quarter of 2003, Singapore Airlines Group saw a massive quarterly loss of

S$312 million, largely attributable to the Iraq war and the outbreak of SARS. However the

business climate proved to be stronger after SARS and careful cost-cutting measures

managed to bring the company back to profitably. The overall revenue received by the

group fell 7% in the financial year 2003/2004 at S$9,762 million. Overall operating profit

also reduced to S$680 million, which corresponded to a drop of 5% as compared to the

previous year. Profit before taxation was S$821 million, down 16% from the previous year.

The S$156 million decrease was due mainly to lower operating profit, share of profits of

associated companies and surplus on disposal of aircraft (including spares and spare

engines), and retrenchment and early retirement expenses (included under exceptional

items). Profit attributable to shareholders fell by 20% to S$849 million.

Gathered by: Department of Tourism ASEAN

Page 19

Travel and Tourism – SINGAPORE MARKET

Summary 15 Singapore Airlines Ltd: Operational Indicators 2005

Financial year end:

March

Travel and tourism sales 2005

% change over 2004

Net earnings 2005

% change over 2004

Number of employees

Source: Trade press (including Travel Daily

research, Euromonitor International

S$12,013 million

23%

S$1,309 million

205%

28,554

News, The Straits Times, Travelmole), company

3.8 Leading Company Profile: Zuji Travel Pte Ltd

Company background

Zuji Travel Pte Ltd was established in 2002, and until 2006, was owned by Abacus

International and AGC Holdings, a consortium of 15 airlines in the region, including

Australian carrier, Qantas. In February 2006, it was acquired by US online travel agency,

Travelocity, as part of the company’s move to strengthen its global presence.

Zuji is among the first few travel agents which solely provide online services in Asia. Since

2002, it has grown to become the leading online travel agent in Singapore. In addition to its

website in Singapore, it also has operations in Australia, Hong Kong, Korea, New Zealand,

and Taiwan. The main strategy of Zuji is to provide exhaustive travel options at attractive

prices to a relatively young, affluent and tech-savvy segment of customers. In particular, it

continues to target couples, single professional women and fresh graduates. The company’s

efforts to attract this target segment include specially tailored packages, such as romance

themes for couples and deluxe backpacking tours for younger travellers, which cost 3040% lower than usual packages.

Zuji offers a range of products, which include airlines, hotels, car rentals and package

tours. The airline sales accounted for maximum sales for Zuji’s overall revenue in 2005. In

addition to offering traditional airline fares, Zuji also linked up with low cost carriers.

Zuji’s efforts in this direction included a package offered in the last quarter of 2004. This

package included return Tiger Airways flights on the Singapore-Bangkok route, with onenight hotel accommodation in Bangkok, at a price of S$49. In 2005, Zuji teamed up with

Cathay Pacific Airways, to promote travel from Singapore to Sri Lanka. The airfare

started from $299 and was valid for trips in the month of May.

Gathered by: Department of Tourism ASEAN

Page 20

Travel and Tourism – SINGAPORE MARKET

The second leading travel segment for Zuji in terms of value sales are hotels. Zuji offered

specially discounted rates for several hotel accommodations in 2005. Zuji has also migrated

its hotel booking engine to the Travelocity Merchant Hotel platform to promote hotel sales.

Zuji also introduced about 300 international cruise packages, and new lifestyle-tailored

themed package vacations, as part of its 2006 holiday collection. These cruise packages,

which are valid in 2006, are available on SilverSea cruise line.

Summary 16 Zuji: Company Factfile 2005

Company name and status:

Zuji Enterprises

Travelocity

Parent company:

Country of origin:

Singapore

Travel Retail

Travel and tourism sectors:

Major travel and tourism brands: Zuji, Priceline

Source: Trade press (including Travel Daily News, The Straits Times, Travelmole), company

research, Euromonitor International

Recent news

As part of its growth strategy, Zuji continually teams up with players in the travel and

tourism industry to offer promotions to consumers. The most recent alliances include its

teaming up with Asia Miles; Asia's leading travel reward programme, to allow travellers a

chance to win 1,000,000 Asia Miles if they purchase flight, accommodation and/or car

rentals through Zuji’s website. In March 2005, Zuji formed a partnership with major

travel guide company, Lonely Planet, whereby Lonely Planet appointed Zuji to power the

flight and hotel search, booking and payment functionality for Asia/Pacific on the site

Lonelyplanet.com. Such alliances have helped Zuji offer competitive deals to consumers

and build its share in the travel agency market.

Summary 17 Zuji: Summary of Key Events 2000-2005

2002 Zuji was launched in Singapore and Hong Kong

2003

2004

2004

2005

Zuji was launched in Taiwan, teamed up with Abacus International to create a new

hotel booking solution

Zuji made alliance with MSN, AsiaOne (the Internet arm of Singapore Press

Holdings)

Zuji teams up with Asia Miles for promotional online offer

Zuji partnership with Lonely Planet

Source: Trade press (including Travel Daily News, The Straits Times, Travelmolee to fuel

price surge

Gathered by: Department of Tourism ASEAN

Page 21

Travel and Tourism – SINGAPORE MARKET

4. DEMAND FACTORS

4.1 Leave Entitlement

According to the Employment Act of Singapore, all employees are entitled to paid holidays

on days specified in the Schedule of the Holidays during their employment term. In

addition, employees are also entitled to a minimum of seven days paid leave with respect to

their first 12 months of continuous service with the same employer and provided that the

employee has served for a period of no less than three months. Thereafter, employees will

be entitled to an additional one-day’s annual leave for every subsequent year during the

tenure of employment and this is subjected to a maximum of 14 days. On top of that,

employees are also allowed to accept payment in lieu of their annual leave.

As of 2005, Singapore has 11 national holidays falling on working days. For national

holidays which fall on a weekend, the next working day becomes the public holiday. The

following is a list of national holidays in Singapore for 2005:

1 January – New Year’s Day

10 January – Hari Raya Haji

29 January – Chinese New Year

30 January – Chinese New Year

14 April – Good Friday

29 April – Nature Day

1 May – Labour Day

12 May – Vesak Day

9 August – National Day

21 October – Deepavali

24 October – Hari Raya Puasa

25 December – Christmas Day

31 December – Hari Raya Haji

Employees in Singapore usually schedule their leave around these national holidays in

order to maximise vacation time. There are two periods when longer holidays can be taken.

The first is over the Chinese New Year, and the other is the Deepavali and Hari Raya

Puasa holidays.

Table 2 Leave Entitlement: Volume 2005

Number of days

2005

Total holidays

Gathered by: Department of Tourism ASEAN

25.0

Page 22

Travel and Tourism – SINGAPORE MARKET

14.0

-Paid holiday

8.0

-Public holidays on working days

-Public holidays not on working days 3.0

Source: Ministry of Manpower, Euromonitor International estimates

4.2 Holiday Demographic Trends

Holiday takers

Increase in holiday taking boosted by low cost carriers

Outbound travel among Singaporeans in 2005 witnessed positive growth over the previous

years. One of the main factors which contributed to increase in holiday takers in Singapore

was the rise of low cost carriers, which made travelling more affordable. The increase in

number of destinations covered by low cost carriers ensured outgoing tourist traffic to

these destinations as well. In addition to this, several travel agents as well as the National

Association of Travel Agents, Singapore (NATAS) offered special promotions, which

encouraged holiday-taking and boosted outbound travel.

The other factors which impacted outbound travel included the strong economic

performance of the country in 2005, positive economic growth of the country, which led to

higher disposable income and enhanced tourism spending as well, in turn encouraging

outbound travel by the local people.

Besides the above factors, holiday taking was also impacted by the long weekends, as a

result of official holidays falling on Fridays and Mondays. The departures increased

significantly on these long weekends to nearby destinations such as Malaysia and Thailand.

Male vs Female

Female travellers accounted for 56% of the total outbound tourist traffic in 2005. While

travelling to foreign countries is popular among both males and females in Singapore,

females have surpassed males in outbound travel. Over the review period, there was a

consistent increase in the number of highly educated, independent, single, working women

with relatively higher spending power, and hence tended to take holidays more frequently

than their male counterparts.

The relatively high disposable income of female travellers led to increases in high-end

travel packages such as spa holidays. Another popular activity among female travellers in

2005 was shopping tourism. These shopping trips were primarily taken to destinations such

as Thailand, Indonesia and Hong Kong.

Female travellers also spend relatively higher than their male counterparts on

accommodation and transportation in the destination countries, as security and safety is of

prime concern.

Gathered by: Department of Tourism ASEAN

Page 23

Travel and Tourism – SINGAPORE MARKET

Age

Travellers in the age group 25 to 34 were the most travelled group, and accounted for 43%

of the total outbound travel in 2005. This group comprises of mainly young working adults;

of couples or DINK (double-income no kids). The destinations favoured by this group

include spa holidays, weekend getaways and leisure trips in nearby destinations such as

Thailand, Malaysia, Indonesia and Hong Kong, as well as adventure holidays in parts of

Australia and South Africa.

Travellers in the age group 35 to 49, which accounted for 26% of the total outbound travel,

were the second most travelled group in 2005. This group is also the major contributor to

the travel retail business in Singapore as they are the largest consumer for packaged

holidays. This group is comprised mainly professionals of a higher income group, families

and business travellers.

There was an increase in the number of travellers belonging to age group15 to 24 in 2005.

This was due to the rise of low cost carriers in the region, which makes travelling more

affordable. This group primarily consist of students or young working adults. This is also a

group which favours free and easy packages, as they offer more flexibility and are not tied

to a fixed travel arrangement.

Travellers in the age group 50 to 64 were mainly retirees. This group tends to prefer

package tours to destinations that offer sightseeing and cultural trips. Some of their

preferred destinations include China, Europe, Australia and New Zealand.

Consumer segmentation

Malaysia was the most popular destination for outbound travel in 2005

Prime destinations for outbound travel in 2005 included Malaysia, Indonesia, Thailand,

Hong Kong, China, Australia, South Korea, Taiwan, Japan and Philippines. Malaysia

remained the most popular destination, witnessing buoyant growth of 15% in terms of

tourist departures from Singapore. The proximity to Malaysia and presence of several

natural attractions such as beaches, mountains contributed to its popularity among

Singaporeans, especially for short weekend trips. Besides, Malaysia is also an important

shopping destination.

Japan was also amongst the fastest-growing markets for outbound travel amongst

Singaporeans, up by 15% on the previous year. Japan’s rich culture, as well as unique

offerings such as capsule hotels, helped increase tourist traffic from Singapore. The higher

spending power of Singaporeans, as a result of positive economic growth of the country,

contributed to outbound travel to expensive tourist destinations such as Japan.

Some of the markets with high growth potential in terms of tourist arrivals are India,

China and Malaysia. The tourists from these countries primarily visit Singapore for leisure

activities such as shopping, sight seeing etc.

Gathered by: Department of Tourism ASEAN

Page 24

Travel and Tourism – SINGAPORE MARKET

Corporate travel grew as a result of buoyant business environment

Outbound travel in 2005 was primarily taken for purpose of leisure, business and visiting

friends/relatives. The departures taken for business purposes amounted to three million

people. The business trips made in 2005 registered growth of 12% over the previous year.

The buoyant business environment witnessed by the country gave a major boost to business

travel. One of the trends expected regarding business travel in the coming years, is the shift

from travel with traditional airlines by some of the corporate travellers to low cost carriers.

Leisure activities continued to dominate the outbound tourist traffic

Leisure activities continued to dominate outbound tourist traffic. In 2005, the total number

of departures grew to 10 million for leisure purpose. Some of the popular destinations for

shopping include Hong Kong and Malaysia. The prime activities taken at these destinations

are relaxing and shopping.

Special Interest holidays such as spa holidays and golf holidays on the rise

One of the types of holiday which has become very popular in recent years is the spa

holiday to destinations such as Indonesia and India. Spa holidays are relatively more

expensive and are favoured by female travellers. Another type of holiday, which is gaining

popularity, is golf holidays. Though there only small segment of tourists opting for this type

of holiday, these tourists are high spenders and take these holidays for two to three days.

Short haul holidays registered maximum growth

Holidays taken for short haul as well as long haul destinations in 2005 registered growth

over 2004. Holidays taken for duration of up to three days, witnessed the highest growth of

10% over last year. These short duration holidays were primarily taken over long

weekends and during official holidays such as Chinese New Year and Deepavali. The main

destinations for these holidays were Malaysia and Thailand.

In 2005, long haul holidays; that is, holidays taken for more than a week, grew by 6% over

2004. The popular destinations for long haul were Australia, China and Japan. The long

haul holidays were preferred for destinations, which are large in size and hence cannot be

covered in a time span of less than a week.

Popularity of package holidays was on the rise in 2005

Package holidays continued to be the most popular type of holiday, taken for outbound

travel in 2005. These types of holidays were usually taken to destinations such as China,

which is a large country and hence is inconvenient and more expensive to visit without a

package tour. Package tours were also preferred for visiting countries with language

barriers.

Free and easy holidays, on the other hand, are more favoured in case of repeat visits. The

Gathered by: Department of Tourism ASEAN

Page 25

Travel and Tourism – SINGAPORE MARKET

familiarity with countries already visited helped visitors travel at their own convenience.

Free and easy are popular among young people as well, who prefer the convenience of

travelling on their own.

Table 3 Holiday Demographic Trends 2000-2005

% number of people 2000 2001 2002 2003 2004 2005

91.0 89.0 90.0 85.0 89.0 93.0

Holiday takers

11.0 10.0 15.0 11.0 7.0

Non-holiday takers 9.0

Source: Singapore Department of Statistics, Euromonitor International estimates

Note: Holiday takers as % of total population

Table 4 Holiday Takers by Sex 2000-2005

% number of people 2000 2001 2002 2003 2004 2005

49.1 48.0 46.0 46.0 45.0 44.0

Male

50.9 52.0 54.0 54.0 55.0 56.0

Female

Source: Singapore Department of Statistics, Euromonitor International estimatesNote: Sex

of national tourists (domestic and outbound)

Table 5 Holiday Takers by Age 2000-2005

% number of people 2000 2001 2002 2003 2004 2005

0-14

2.0

2.0

2.0

15-24

14.0 16.0 18.5

25-34

37.0 39.0 40.5

35-49

42.0 38.0 34.0

50-64

3.0

3.0

3.0

Over 65

2.0

2.0

2.0

Source: Singapore Department of Statistics,

national tourists (domestic and outbound)

1.0

2.0

18.9 17.5

41.5 41.6

34.6 34.4

2.5

3.0

1.5

1.5

Euromonitor

2.0

18.0

41.5

36.0

3.0

1.5

International estimatesNote: Age of

4.3 Holiday Length of Trip and Seasonality

Length of trip

Trips taken by Singaporeans increased from 8,265,800 in 2004 to 8,855,300 in 2005. The

growth in the number of leisure as well as business trips accounted for the increase in the

number of trips in 2005.

Trips taken for over seven days witnessed a growth of 6% in 2005 as compared to the

previous year. The growth was attributed to the increase in leisure trips to further

destinations such as China, Europe, Australia, New Zealand and America, which usually

require longer durations of stay.

Gathered by: Department of Tourism ASEAN

Page 26

Travel and Tourism – SINGAPORE MARKET

Trips ranging from four to seven days witnessed a growth of 8% over 2004. The increase

was driven by the demand for shopping trips to destinations such as Hong Kong, Taiwan

and South Korea.

Trips taken between one to three days had the largest growth of 10% over 2004. The

growth was primarily driven by the increase in low cost carriers in the region, which

encouraged more outbound travel to nearby destinations such as Indonesia, Malaysia and

Thailand.

Seasonality

The highest incidence of holiday taking by Singaporeans was in December, accounting for

12% of the total trips taken in 2005, the period of school holidays and year end holiday

season. The month of June, which is also a period of month-long school holidays, had the

second highest incidence of holiday taking at 10%. These two periods are popular periods

for travel as parents can plan for family trips, and employees can clear their annual leave

during year-end. The NATAS fairs which were organised during March and September

each year also pushed the demand for outbound travel, giving travellers ample time to plan

for their trips in the later months of the year.

Table 6 Length of Trip 2000-2005

1999

2000

2001

2002

2003

2004

2005

Over 7 days

3,309.3 3,635.0 3,766.0 3,954.3 3,756.6 4,515.2 4,786.1

4-7 days

3,151.0 3,573.0 3,382.0 3,517.3 2,462.1 2,824.8 3,050.8

0-3 days

948.0

1,066.0 917.0

962.9

770.3

925.8

1,018.4

Length of Trip 7,408.3 8,274.0 8,065.0 8,434.5 6,989.0 8,265.8 8,855.3

Source: Singapore Department of Statistics, Euromonitor International estimatesNote:

Includes outbound and domestic trips

5. TOURISM PARAMETERS

5.1 Balance of Tourism Payments

Singapore saw a net balance of tourism payments of S$4 billion in 2005, a decline from

S$4.2 billion in 2004. Although total tourism receipts increased by 6% in 2005, the high

growth rate of 15% in outgoing tourist expenditure over the previous year led to a slight

decline in the balance of tourism payments.

This was due to an increase in outbound travel in 2005 as a result of a better-performing

Gathered by: Department of Tourism ASEAN

Page 27

Travel and Tourism – SINGAPORE MARKET

local economy and greater consumer confidence amongst Singaporeans. Shopping trips

abroad to Thailand and weekend short-haul trips also helped spur outgoing tourist

expenditure compared to the previous year.

Table 8 Balance of Tourism Payments: Value 2000-2005

Receipts

Expenditure

Balance

S$ million

10,080.8

7,052.0

3,028.8

2000

9,121.9

6,546.0

2,575.9

2001

8,831.2

6,040.0

2,791.2

2002

6,937.3

5,134.0

1,803.3

2003

9,799.6

5,647.4

4,152.2

2004

10,400.0

6,483.2

3,916.8

2005

Source: Annual Report of Tourism Statistics, Euromonitor International estimates

5.2 Incoming: Arrivals and Receipts

Arrivals

Arrivals to Singapore in 2005 grew by 7% compared to the previous year, and this

represented total of nine million visitors. The main drivers of growth in arrivals were the

competitive airfares offered by both budget and full-fledged airlines operating in the

region, as well as the increase in travel confidence among regional and international

travellers.

The Singapore Tourism Board has set ambitious targets for 2015 to reach 17 million in

arrivals and S$30 billion in tourism receipts in 2015. To meet this target, the three key

areas of focus identified by STB are to strengthen Singapore’s position as a Leading

Convention & Exhibition City in Asia with a strong and dynamic business environment; to

develop Singapore as a leading Asian leisure destination by providing an enriching

experience that is Uniquely Singapore; and to establish Singapore as the Services Centre of

Asia – a place where visitors come to enjoy high-end quality services such as healthcare

and education services.

In line with its branding strategy to position Singapore as a unique business and leisure

destination, key brand programs were rolled out through broadcast and print media as

well as the STB’s “Uniquely Singapore” website: http://www.visitsingapore.com. The

brand message was delivered through a series of creative print and TV advertisements that

depicted the uniqueness of Singapore through its ways of life, landscapes and trademarks.

To complement the branding campaign, other promotions include the ‘My Uniquely

Singapore Passport 2005’ which offers both tourists and locals discounts on admission to

visitor attractions.

STB will also continue to attract key events that will drive international visitor traffic and

help position Singapore as the top-of-mind destination for key customer segments. These

Gathered by: Department of Tourism ASEAN

Page 28

Travel and Tourism – SINGAPORE MARKET

key events include the Indian International Film Academy Awards, ITMA Asia – The 2nd

Asian International Exhibition of Textile Machinery and the 117th International Olympics

Committee Session in 2005, and the Annual Meetings of the International Monetary Fund

and the World Bank Group in 2006.

Incoming receipts

Incoming receipts in 2005 amounted to S$10 billion, an increase of 6% in current value

terms over 2004. The growth is attributed to the growth in tourist arrivals in 2005.

Expenditure per arrival

Expenditure per arrival declined slightly in 2005 compared to the previous year. The main

reason underpinning the decline is the changing profile of incoming tourists, as visitors

from Indonesia, China and India, who spend less per visit are becoming more prominent

amongst the mix of travellers to Singapore. Total incoming tourism receipts therefore

registered a slight downturn following two years of consecutive growth, as countries with

more spending power began to increase in number alongside visitors from more developed

countries such as Japan, UK and USA.

Table 9 Arrivals: 2000-2005

% growth

'000 people

7,691.2 2000

7,518.0 -2.3

2001

7,566.2 0.6

2002

6,127.0 -19.0

2003

8,328.1 35.9

2004

8,867.5 6.5

2005

Source: Annual Report of Tourism Statistics, Singapore Tourism Board, Euromonitor International

Table 10 Incoming Tourist Receipts: 20002005

Current

Constant

S$ million

10,080.8

2000

9,121.9

2001

8,831.2

2002

6,937.3

2003

9,799.6

2004

10,400.0

2005

Source: Annual Report of

International

10,080.8

9,031.8

8,778.4

6,861.0

9,533.5

9,977.8

Tourism Statistics, Singapore Tourism Board, Euromonitor

Table 11 Incoming Tourist Receipts % Growth: 2000-2005

Gathered by: Department of Tourism ASEAN

Page 29

Travel and Tourism – SINGAPORE MARKET

% growth

Current

Constant

5.4

3.9

2000

-9.5

-10.4

2001

-3.2

-2.8

2002

-21.4

-21.8

2003

41.3

39.0

2004

6.1

4.7

2005

Source: Annual Report of Tourism Statistics, Singapore Tourism Board, Euromonitor

International

Table 12 Expenditure per Arrival: 2000-2005

S$

1,310.7

2000

1,213.3

2001

1,167.2

2002

1,132.3

2003

1,176.7

2004