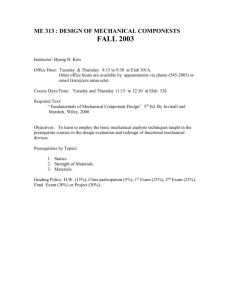

Business Management 418: Personal Financial

advertisement

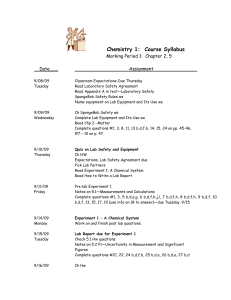

BM 418 Financial Planning Class Schedule and Objectives Financial Planning Business Management 418 Sections 1 and 2 Winter Semester 2012 Please read chapters before class on the specified day, and understand the review notes and case studies from each chapter after class. Quizzes are on Blackboard and are to be completed before coming to class on the day specified. Please be aware that during the semester current matters and specific opportunities may justify changes in the schedule, which will be announced in class. Class summaries will generally be available on the website after 8 a.m. the day after class. Read and Hand In before Class Class: Date / Topic Topic I. Personal Financial Management in Perspective Day 1 Thursday, January 5 Chapter 1 Introduction: Another Perspective on Wealth Objectives: 1. Understand the requirements of this course and fill out the Individual Education Plan 2. Understand another perspective on wealth 3. Understand the key principles of personal finance Topic II. Managing Your Money: Becoming Wise Financial Stewards Day 2 Tuesday, January 10 Personal Goals and Your Financial Plan Chapter 2 Objectives: 1. Understand the role of personal financial planning in achieving your goals 2. Understand the requirements for your Personal Financial Plan 3. Think through your personal goals: What do you want out of life? Items to Hand in: Individual Education Plan (from syllabus back) Day 3 Thursday, January 12 Budgeting and Personal Financial Statements Chapter 3 Objectives: 1. Develop and implement a budget for the rest of the semester 2. Calculate your net worth or wealth using a balance sheet, and financial ratios 3. Develop a personal income statement and use it to analyze your spending 4. Introduce financial software: Quicken 2010 Day 4 Tuesday, January 17 Time Value of Money and Debt Reduction Strategies, Quiz #1 Chapter 8 Objectives: 1. Understand the importance compound interest and time. Pass an assessment test. 2. Understand what our leaders have said regarding debt 3. Understand the debt cycle, and why people go into debt 4. Understand how to develop and use debt reduction strategies Items to Hand in: Quiz #1 Please bring your financial calculators to class from this day forward Page 1 of 10 BM 418 Financial Planning Class Schedule and Objectives Day 5 Thursday, January 19 Tax Planning Chapter 4 Objectives: 1. Understand what our leaders have said regarding taxes 2. Understand the importance of tax planning and how it helps attain your goals 3. Understand major tax strategies to help you lower your taxes (legally and honestly) 4. Understand the major tax features of our tax system Day 6 Tuesday, January 24 Cash Management Chapter 5 Objectives: 1. Understand the importance of cash management and how it can help you achieve your goals 2. Understand the different types of cash alternatives and how to compare them 3. Understand the different types of financial institutions 4. Understand that while technology can help, unless you plan and spend at least 1-2 hours a week following your finances, you will not be able to keep up with your personal financial goals Items to Hand in: I. Binder, Tabs, and Table of Contents (Roadmap) Day 7 Thursday, January 26 The Automobile Decision Objectives: 1. Understand how a car fits into your financial plan 2. Understand how to buy or lease a new vehicle 3. Understand the lease versus buy decision 4. Understand how to buy a used car Chapter 16 Day 8 Tuesday, January 31 Credit Reports, Credit Scores, and Credit Cards, Quiz #2 Chapter 6 Objectives: 1. Understand the correct uses of credit cards and how they can help (or hinder) you attain your financial goals 2. Understand credit evaluation, credit reports, and your credit score 3. Know how credit cards work and the costs involved 4. Know how to manage your credit cards and open credit Items to Hand in: Quiz #2, V. Tax Planning, VI. Cash Management Day 9 Thursday, February 2 Consumer and Mortgage Loans Chapter 7 Objectives: 1. Understand how consumer loans can keep you from your goals 2. Understand the types of consumer loans, their characteristics, and how to calculate their costs 3. Understand the types of mortgage loans, their characteristics, and how to calculate their costs 4. Know the least expensive types of loans and how to reduce the cost of consumer and mortgage loans Day 10 Tuesday, February 7 The Housing Decision I: Basics Objectives: : Chapter 15 Page 2 of 10 BM 418 Financial Planning Class Schedule and Objectives 1. Understand how a house fits into your personal financial plan 2. Understand the advantages and disadvantages of renting, buying, building, and renovating 3. Know the process on buying a home 4. Know how to compare different types of loans with different fees using the effective interest rate 5. Understand my recommendations in obtaining a home Items to Hand in: VII. Credit Cards, VIII. Credit Report and Credit Score, IX. Student/Consumer Loans and Debt Reduction. Please indicate on your Credit Report and Credit Score pages the name of the credit report and credit score provider. For security reasons, do not include the actual credit report and credit score printouts in your PFP. Day 11 Thursday, February 9 The Housing Decision II: Wrap Up and Additional Q & A Objectives: 1. Review the process on buying a home and other key questions 2. Answer additional questions on the housing decision Topic III. Protecting Yourself through Insurance: Using Wisdom Day 12 Tuesday, February 14 Insurance 1: Basics, Quiz #3 Objectives: 1. Understand what our leaders have said regarding insurance 2. Understand the importance of insurance 3. Understand the key principles of insurance Insurance 2: Life Insurance Objectives: 1. Understand the five key questions about life insurance 2. Understand the different types of life insurance 3. Understand the steps to buying life insurance Items to Hand in: Quiz #3 Chapter 11 Chapter 12 Guest Speaker: Tyler Vongsawad, Insurance Agent and Friend Day 13 Thursday, February 16 Insurance 3: Health Insurance Chapter 13 Objectives: 1. Understand how health insurance relates to your personal financial plan 2. Understand basic health insurance coverage and provisions 3. Understand how to control health care costs Insurance 4: Auto, Home & Liability Insurance Objectives: Page 3 of 10 Chapter 14 BM 418 Financial Planning Class Schedule and Objectives 1. Understand how homeowners, liability, and auto insurance fit into your personal financial plan 2. Understand the key areas of Auto Insurance 3. Understand the key areas of Homeowners Insurance 4. Understand the key areas of Liability Insurance Topic IV. Investing: Taking the Long-term View Day 14 Thursday, February 23 Investments 1: Before you Invest Objectives: 1. Know what to do before you invest 2. Understand the ten principles of successful investing 3. Understand asset classes 4. Review the risk and return history of the major asset classes Investments 4: Bond Basics Objectives: 1. Understand risk and return for bonds 2. Understand bond terminology and the major types of bonds 3. Understand how bonds are valued 4. Understand the costs of investing in bonds 5. Understand investing in other asset classes Items to Hand in: 1st Hour Service Teaching, Budget #1 Chapter 17 Chapter 20 Day 15 Tuesday, February 28 Investments 2: Your Investment Plan Chapter 18 Objectives: 1. Understand the Importance of Financial Goals and How to Set Them 2. Understand the Importance of your Personal Investment Plan and How to Prepare It 3. Consider Index funds as useful financial assets 4. Beware of “Get Rich Quick” schemes Investments 3: Securities Market Basics Objectives: 1. Understand the different types of securities markets 2. Understand the basics of brokers and investment advisors 3. Understand how to buy and sell securities 4. Know how to choose a broker or investment advisor Day 16 Thursday, March 1 Investments 5: Stock Basics, Quiz #4 Objectives: 1. Understand how stocks are valued 2. Understand strategies for investing in stocks 3. Understand preferred stock and how it is valued 4. Understand the costs of investing in stocks Investments 7: Building Your Portfolio Objectives: 1. Understand the factors controlling investment returns 2. Understand the priority of money Page 4 of 10 Chapter 19 Chapter 21 Chapter 23 BM 418 Financial Planning Class Schedule and Objectives 3. Understand how to build a successful investment portfolio 4. Understand the process of investing Items to Hand in: Quiz #4 Day 17 Tuesday, March 6 Investments 6: Mutual Fund Basics Chapter 22 Objectives: 1. Understand the advantages and disadvantages of Mutual Fund investing 2. Understand the major types of mutual funds 3. Understand how to calculate mutual fund returns 4. Understand the process of how to buy or sell a mutual fund 5. Understand the costs of investing in mutual funds Investments 8: Picking Financial Assets Chapter 24 Objectives: 1. Understand why you should wait to picking stocks (until your assets have grown) 2. Understand where to find important information on mutual funds and stocks 3. Understand what makes a good mutual fund 4. Understand index funds and ETFs Please bring your laptop to class Day 18 Thursday, March 8 Investments 9: Performance Reporting and Rebalancing Objectives: 1. Understand the uses and types of benchmarks 2. Understand the importance of portfolio management and reporting 3. Understand portfolio rebalancing 4. Understand how to perform attribution analysis Chapter 25 Investments 10: Behavioral Finance 1. Understand behavioral finance 2. Understand why we should learn behavioral finance 3. Understand other alternatives to traditional finance 4. Understand how behavioral finance can help us become better investors Items to hand in: X. Insurance Day 19 Friday, March 9 Investments 11: Investments Wrap Up and Q & A Objectives: 1. Answer any remaining questions regarding Investments Guest Speaker: Fred Hockenjos, Portfolio Manager and Friend Topic V. Planning for Retirement: Prepare Now Day 20 Tuesday, March 13 Retirement Planning 1: Basics, Quiz #5 Chapter 26 Objectives: 1. Understand how retirement planning impact your personal financial plan 2. Understand the principles, stages, and steps in retirement planning 3. Understand the different retirement planning vehicles Page 5 of 10 BM 418 Financial Planning Class Schedule and Objectives 4. Understand key payout options and caveats available at retirement 5. Understand how to monitor your retirement planning progress Items to Hand in: Quiz #5 Day 21 Thursday, March 15 Retirement Planning 3: Employer Qualified Plans Objectives: 1. Understand Employer Qualified Retirement Plans 2. Understand Defined Benefit Plans 3. Understand Defined Contribution Plans Chapter 28 Retirement Planning 4: Individual and Small Business Plans Chapter 29 Objectives: 1. Understand the difference between the traditional and Roth IRA 2. Know when a conversion to a Roth makes sense 3. Understand individual retirement accounts (IRAs) 4. Understand retirement plans (QRPs) for the self-employed and small businesses Day 22 Tuesday, March 20 Retirement Planning 2: Understanding Social Security Objectives: 1. Understand Social Security in a Historical Context 2. Understand how Social Security Works 3. Understand the key questions relating to Social Security 4. Understand the likely future of Social Security Chapter 27 Retirement Planning 5: Wrap Up and Additional Q & A Objectives: 1. Understand current events and their impact on family finances 2. Answer any remaining questions on Retirement Items to Hand In: XII. Investment Planning, Budget #2, 2nd Hour of Service Teaching Day 23 Thursday, March 22 Estate Planning 1: Estate Taxes and Trusts Chapter 30 Objectives: 1. Understand the importance of Estate Planning and the Estate Planning Process 2. Understand how trusts can be used to your advantage in Estate Planning 3. Understand the importance of wills and probate planning Estate Planning 2: Probate Planning and Wills Objectives: 1. Understand the importance of a will 2. Write a holographic will that is valid in Utah Guest Speaker: Kurt Johnson, Estate Planning Lawyer Topic VI. Relationships and Money Day 24 Tuesday, March 27 Family 1: Relationships and Money, Quiz #6 Objectives: Page 6 of 10 Chapter 31 BM 418 Financial Planning Class Schedule and Objectives 1. Understand the key principles of money and marriage 2. Understand why money may be an issue in relationships 3. Understand a few recommendations for money and marriage Items to Hand In: Quiz #6 Day 25 Thursday, March 29 Family 2: Teaching Children Financial Responsibility Chapter 32 Objectives: 1. Understand the importance of teaching your children about personal finance 2. Understand some thoughts on how do you teach children financial responsibility 3. Understand some thoughts on when to teach children financial responsibility Family 3: Financing Education and Missions Chapter 33 Objectives: 1. Understand the importance of how education relates to your financial goals 2. Understand the Priority of Money for financing school 3. Understand how to reduce the Cost of Education 4. Understand how to prepare for and finance your children’s education and missions Day 26 Tuesday, April 3 Careers in Financial Planning Objectives: 1. Understand careers in financial planning Items to Hand in: None Guest Speaker: Jason Payne, Personal Financial Planner and Friend Topic VII. On Giving and Deciding Day 27 Thursday, April 5 Conclusions 1: Learning to Give Objectives: 1. Understand the myths of giving 2. Understand what the scriptures say about money and giving 3. Understand why we should give 4. Understand how to give now 5. Understand the basics of wise giving Items to check: Last day for any changes to Blackboard Items to Hand in: Chapter 34 Your completed Personal Financial Plan (including all sections previously handed in and graded). This includes the final sections: II. Goals, III. Personal Financial Statements, IV. Final Month’s Budget, XI. Money and Relationships, XIII. Retirement Planning, XIV. Estate Planning, and XV. Wills. Also hand in all remaining Service Teaching and Items to Share in the Other Items tab of your PFP. This is the last day to hand in any assignments. Day 28 Tuesday, April 10 Conclusions 2: Decide to Decide: Final Review Day, Quiz #7 Objectives: 1. Understand your future starts today Page 7 of 10 Chapter 35 BM 418 Financial Planning Class Schedule and Objectives 2. Understand the key decisions to be truly successful in life—Decide to decide 3. Understand my final thoughts on personal finance—what wise stewards know 4. Learn about additional resources on personal finance 5. Review problems to prepare for the final exam Items to complete: Please note that half of Quiz #7 is the final class review from the BYU Route Y website. Please check the box that allows the instructor to see who has completed the class review assignment. Prepare for the Final Exam Final Exam: Comprehensive Final Exam Section 1: Monday, April 16 11:00 a.m. to 2:00 p.m. BM418 Class Schedule 2012 Fall 2012-01-03 BS.doc Page 8 of 10 BM 418 Financial Planning Class Schedule and Objectives BM418 Financial Planning Class at a Glance Day: 1 Date: Thursday, January 5 Read After/Before Class Chapter 1 2 Tuesday, January 10 Chapter 2 3 Thursday, January 12 Chapter 3 4 Tuesday, January 17 Chapter 8 5 6 7 8 Thursday, January 19 Tuesday, January 24 Thursday, January 26 Tuesday, January 31 Chapter 4 Chapter 5 Chapter 16 Chapter 6 9 10 Thursday, February 2 Tuesday, February 7 Chapter 7 Chapter 15 11 12 13 14 Thursday, February 9 Tuesday, February 14 Thursday, February 16 Thursday, February 23 Chapters 11, 12 Chapters 13, 14 Chapters 17, 20 15 Tuesday, February 28 Chapters 18, 19 16 17 18 19 20 21 22 Thursday, March 1 Tuesday, March 6 Thursday, March 8 Friday, March 9 Tuesday, March 13 Thursday, March 15 Tuesday, March 20 Chapters 21, 23 Chapters 22, 24 Chapter 25 Chapters 26 Chapters 28, 29 Chapter 27 6, 25 28 23 24 25 26 27 Thursday, March 22 Tuesday, March 27 Thursday, March 29 Tuesday, April 3 Thursday, April 5 Chapter 30 Chapter 31 Chapters 32, 33 1E, 14 21 6, 25 28 Tuesday, April 10 Chapter 35 Chapter 34 Page 9 of 10 Teachin g Tools Required Items to Hand In: 1, 1A, 1G 2A, 2B Individual Education Plan 1C, 4, 30A-D, 31 3, 9, 12, 18, 20 1D, 8 26 22 1B, 18, 24 9, 24 11, 19 1F, 29 Quiz #1 I. Binder and Tabs Quiz #2, V. Tax Planning, VI. Cash Management VII. Credit Cards, VIII. Credit Report and Credit Score, IX. Student /Consumer Loans and Debt Reduction Quiz #3 16, 10, Budget #1, 1st Service Teaching 23, 27 5A, 5B, 15 13, 32 Quiz #4 7 17, 23 X. Insurance Quiz #5 XII. Investment Planning, Budget #2, 2nd Service Teaching Quiz #6 Completed PFP with all sections including II. Goals, III. Financial Statements, IV. Budget, XI. Money and Relationships, XIII. Retirement Planning, XIV. Estate Planning, and XV. Wills; Remaining Service Teaching; last day to change blackboard grades Quiz #7 BM 418 Financial Planning Class Schedule and Objectives Spouse/Family/Friends Reading Schedule Winter Semester 2012 We have prepared a non-credit course that goes along with this class to encourage spouses to be able to better participate and contribute to the family financial decision-making process. Following are the online chapters from the Personal Finance website at http://personalfinance.byu.edu that correspond to the in-class discussions. Student Reads: Day: Date: Spouse/Friend Reads: 1 Thursday, January 5 Chapter 1 Another Perspective on Wealth 2 Tuesday, January 10 Chapter 2 Setting Personal Goals 3 Thursday, January 12 Chapter 3 Budgeting and Personal Financial Statements 4 Tuesday, January 17 Chapters 8,9 Time Value of Money 1-2, Understanding Debt 5 Thursday, January 19 Chapter 4 Tax Planning 6 Tuesday, January 24 Chapter 5 Cash Management 7 Thursday, January 26 Chapter 16 The Auto Decision 8 Tuesday, January 31 Chapter 6 Understanding Credit 9 Thursday, February 2 Chapter 7 Consumer and Mortgage Loans 10 Tuesday, February 7 Chapter 15 The Home Decision 11 Thursday, February 9 12 Tuesday, February 14 Chapter 11, 12 Insurance Basics Life Insurance 13 Thursday, February 16 Chapter 13, 14 Health Insurance, Auto, Home Liability Insurance 14 Thursday, February 23 Chapter 17, 20 Before you Invest Bond Basics 15 Tuesday, February 28 Chapter 18, 19 Your Investment Plan, Securities Market Basics 16 Thursday, March 1 Chapter 21, 23 Stock Basics, Building your Portfolio 17 Tuesday, March 6 Chapter 22, 24 Mutual Fund Basics, Picking Financial Assets 18 Thursday, March 8 Chapter 25 Performance Reporting and Rebalancing 19 Friday, March 9 20 Tuesday, March 13 Chapter 26 Retirement Planning Basics, 21 Thursday, March 15 Chapter 28, 29 Qualified Plans, Individual and Small Business Plans 22 Tuesday, March 20 Chapter 27 Social Security 23 Thursday, March 22 Chapter 30 Estate Planning: Basics 24 Tuesday, March 27 Chapter 31 Relationships and Money 25 Thursday, March 29 Chapter 32, 33 Teaching Children, Financing Education and Missions 26 Tuesday, April 3 27 Thursday, April 5 Chapter 34 Conclusions 1: Learning to Give 28 Tuesday, April 10 Chapter 35 Conclusions 2: Decide to Decide Page 10 of 10