Workbook

for

Bills & Collections

Version 1.0

© 2001 by i-flex solutions limited

All rights reserved. No part of this work may be reproduced, stored in a retrieval

system, adopted or transmitted in any form or by any means, electronic,

mechanical, photographic, graphic, optic recording or otherwise, translated in any

language or computer language, without the prior written permission of i-flex

solutions limited (i-flex).

Due care has been taken to make this workbook as accurate as possible. However,

i-flex makes no representation or warranties with respect to the contents hereof

and shall not be responsible for any loss or damage caused to the user by the

direct or indirect use of this workbook. Furthermore, i-flex reserves the right to

alter, modify or otherwise change in any manner the content hereof, without

obligation of i-flex to notify any person of such revision or changes.

All company and product names are trademarks of the respective companies with

which they are associated.

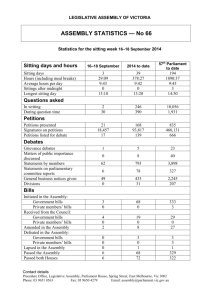

Document Control

File Name

Creation Date: 10th May 2001

Review Date: March 15th 2002

Last Saved On: 09th Sept.2002

Workbook-Bills and Collections

By : Umesh Aurora/ Rajesh kumar

Rajesh Ganesan / Ravi Handigol

Group: FC-COL Banking Products Group

Workbook – Bills for Collection

3

Table of Contents

Bills for Collections

Sight or Usance Bills: Import or Export Bills: LC Bill or Non LC Bill:

DA Bills or DP Bills: Usance D/P Bills

Various options in Bills How to handle Bills Collection in FLEXCUBE?

Module Overview: Module Static Maintenance: Product Maintenance

Product Branch and currency restrictions

Product Customer and account class restrictions

Product Tax details

Product Interest and Charges Details

Role to Head Mapping

Event accounting entry definition

Contract Input

Advices, Instructions and FFT’s

Exception Tracers Details for the bill

Discrepancies

SWIFT advices under Bills Module

Others

Flow Chart for BC Product Maintenance & Contract Input

Discount accruals in an LC

i-flex solutions ltd.

3

4

5

5

6

6

7

9

9

10

13

14

14

14

14

15

15

15

19

19

19

20

22

23

25

Workbook – Bills and Collection

3

Bills for Collections

Bill of exchange is a financial instrument defined in the Bill of Exchange Act of

UK and Negotiable Instruments Act of India . It is used in business to settle

money transactions. It is defined as “ An instrument in writing containing an

unconditional order signed by the maker directing a certain person to pay a certain

sum of money only to or to the order of a certain person.”

The parties in a bill of exchange are..

Drawer :

Drawee :

the payment

Payee :

One who is the maker of instrument

One on whom the bill is drawn and is expected to make

The beneficiary who is to receive the payment

Typically Exporter / Seller draws the Bill on the Importer / Buyer asking him to

make the payment to the Payee, normally a banker. Seller hands over such a bill

to his banker with a request to receive the money on the bill from the buyer on

his behalf and thereafter credit his account. This process is called collection.

In a trade transaction following documents are generally used.

1. A document for settling money transaction Eg. Bill of Exchange

2. A document signifying transport and possession of goods

Eg. Bill of lading, Airway bill, Motor Transport Receipt etc

3. A document giving description and ownership of goods Eg. Invoice

4. A document covering the risk of tranport of goods from seller to buyer

Eg. Insurance policy

_______________________________________________________________________________

i-flex solutions ltd.

Workbook – Bills and Collection

There are different ways in which bills can be categorized.

Usance or Sight Bill,

Import or Export Bill,

LC Bill or Non LC Bill,

DA or DP Bill

Sight or Usance Bills: If bills of exchange are drawn at sight by the exporter, they have to be paid by the

importer or by the importer’s bank (drawee) immediately on receipt of

documents. In other words, it is payable upon demand to the payeeexporter/exporter’s bank . On the other hand usance bills have a specific tenor like

30 days, 90 days. If the usance type bill of exchange is drawn by the exporter ,

the bill has to be paid by the importer or by the importer’s bank (drawee) on the

date of maturity.

Acceptance of Usance Bills:

Under usance bills, once the documents have been checked and found to contain

no discrepancies, the drawee/issuing bank gives an undertaking to pay the bill on

the date specified on the bill.. This in banking parlance is called acceptance.

_______________________________________________________________________________

i-flex solutions ltd.

4

Workbook – Bills and Collection

Import or Export Bills: Import Bills

These are bills handled by the importer’s bank. The importer’s bank would

receive from the exporter’s bank B/E drawn by the exporter. On receipt of these

bills, the importer’s bank could perform one or more of the following operations:

Collection,

Payment,

Acceptance

These bills can be drawn under LC or not drawn under LC

Export Bills

These are bills handled by the exporter’s bank. The exporter draws the bill of

exchange (which could be under LC or not under LC) and submits the necessary

documents of title to goods ( bill of lading, invoice, insurance etc) to his bank.

The exporter’s bank would perform one of the following operations on the bill

Discount the bill and send it on collection

Send the bill directly for collection

Negotiate the bill (if the bill is under LC) and send for collection

Purchase the bill (if it is a sight bill) and send it for collection.

In all cases the bill has to be sent to the importer’s bank for collecting the money

and cannot be retained by the exporter’s bank.

LC Bill or Non LC Bill:

Bills under Documentary Credits, are known as LC Bills

Collection bills, are also known as Non-LC Bills

Collections bills are cheaper and simpler for the importer than Documentary

Credits: this is because the collecting bank does not have any financial interest or

commitment, so there are fewer formalities and lesser charges/fees.

An importer will need to have import facilities from his bank if he wants to open

Documentary Credits - he does not need any if he imports on a collection basis.

Because of the different requirements of buyers and sellers, there are many

alternative ways of handling trade transactions.

_______________________________________________________________________________

i-flex solutions ltd.

5

Workbook – Bills and Collection

DA Bills or DP Bills: Documents against Payment (D/P)

This is sometimes referred to as delivery against cash. In effect D/P means

payable at sight (on demand). The collecting bank hands over the shipping

documents only when the importer has paid the bill. The drawee is usually

expected to pay within 3 working days of presentation.

Documents against Acceptance (D/A)

This means that the exporter is allowing credit terms to the importer: the period of

credit is the term of the bill, also known as “usance”. The importer/drawee is

required to ACCEPT the Bill i.e. to make a signed promise to pay the bill on a set

date in the future.

When he signs the bill in acceptance, he can take the documents and clear his

goods. The payment date is calculated from the term of the bill - the term is

usually a multiple of 30 i.e. 30 days, 60 days, 90 days, 120 days etc. and starts

either from sight or from the date of shipment, or from acceptance as stated on

the bill of exchange.

BUT REMEMBER a usance/term bill does not necessarily mean that documents

can be given against acceptance. ie on D/A basis.

Usance D/P Bills

A Usance D/P Bill is an arrangement where the buyer accepts the bill payable at a

specified future date but does not receive the documents until he has actually paid

for them. The reason is that airmailed documents may arrive much earlier than the

goods shipped by sea.

The buyer is not obliged to pay the bill before its due date, but he may want to do

so if the ship arrives before that date. This mode of payment is less in practice but

offers one more settlement possibility.

Remember that these are still D/P terms so there is no extra risk to the exporter or

his bank.

_______________________________________________________________________________

i-flex solutions ltd.

6

Workbook – Bills and Collection

As an alternative the covering schedule may simply allow acceptance or payment

to be deferred awaiting arrival of the carrying vessel.

If there are problems regarding storage of goods under a Usance D/P bill, the

collecting bank should notify the remitting bank without delay for instructions.

It should be noted however that the collecting bank does not have to do

everything the remitting bank’s schedule says.

Various options in Bills The various operations that are possible in bills are.

Collection

Export Bills for collection: In this case the exporter’s bank sends the bills to the

importers bank for collection of money from the importer. If the bill is a sight bill,

the importer/importer’s bank should pay upon seeing the bill. In case of usance

bill sent for collection, the importer’s bank presents the bill to the importer for

acceptance.

Import Bills for collection: In this case, the importer receives the bills (could be

under LC or not under LC) and makes the payment to the exporter’s bank through

his bank either on sight or an maturity date depending on the payment terms.

Discount

In case of a usance bill, the exporter will get his payment only on the due date of

the bill, which takes 90 or more days depending on the tenor. But if the exporter

wants money immediately, the bank deducts interest upfront and pays the

remaining amount to the exporter. Normally, the term “discount” is associated

with usance bills.

Purchase

Purchasing of a bill is done by the exporter’s bank if the exporter wants payment

of a sight bill immediately. Normally purchase is associated with sight bills that

are not under LC.

Negotiation

The term negotiation refers to any of the following operations on export bills that

are drawn under LC:

_______________________________________________________________________________

i-flex solutions ltd.

7

Workbook – Bills and Collection

8

Purchase of a sight bill under LC

Discount of a usance bill under LC

Acceptance

If the bill drawn by the exporter is a usance bill, the exporter’s bank will first send

the same to the importer’s bank for acceptance by the importer.

Importer’s bank presents the bills to the importer. The importer has to accept the

bill and the importer’s bank will forward the accepted bill to the exporter’s bank.

Thus the operation of acceptance is initiated at the exporter’s bank and completed

at the importer’s bank.

Advance

If the importer does not have sufficient funds to pay the bill, the bank can provide

a loan to the importer. This can be for a sight bill or for a usance bill. Usually, the

usance bill is first accepted and then on due date the bank can provide an advance.

Thus the operation of an advance is applicable only for incoming or import bills

(sight or usance).

_______________________________________________________________________________

i-flex solutions ltd.

Workbook – Bills and Collection

How to handle Bills Collection in FLEXCUBE?

Module Overview: The Bills and Collections (BC) module supports the processing of all types of

bills, both domestic and international and handles the necessary activities during

the entire lifecycle of a bill once it is booked.

The Bills and Collections module supports the processing of all types of

international and domestic bills like:

Incoming Bills under LCs

Incoming Bills not under LCs

Outgoing Bills under LCs

Outgoing Bills not under LCs

Incoming Collections

Outgoing Collections

Usance or Sight Bills

Documentary or Clean Bills

In an effort to provide quick turn around time in processing bills, you can create

products, templates or even copy the details of an existing bill on to a new one

and modify it to suit your requirements. This renders the input of the details of a

bill faster and easier. The BC module actively interacts with the LC module of

FLEXCUBE. This enables easy retrieval of information for bills drawn under an

LC that was issued at your bank. Most of the details maintained for the LC will be

defaulted to the bill when you indicate the reference number of the LC involved in

the bill. This eliminates the need to enter the details of the LC all over again.

All types of bills are classified to fall under two categories. They are:

Import Bills

Export Bills

All types of incoming bills (international and domestic) handled by your bank are

termed ‘Import’ bills. Similarly, all outgoing bills (international and domestic)

handled by your bank are termed ‘Export’ bills.

_______________________________________________________________________________

i-flex solutions ltd.

9

Workbook – Bills and Collection

The following operations can be performed on bills (international and domestic):

Incoming

Advance

Payment

Acceptance

Collection

Discounting

Outgoing

Payment

Acceptance

Collection

Purchase

Negotiation

Discounting

The system allows you to effect a change of operation for the following operation

types:

Acceptance to Advance (automatic facility provided)

Acceptance to Discount

Collection to Purchase

This module also supports automated follow-up and tracer facility for payments

and acceptance. Tracers can be automatically generated at the frequency that you

indicate until a discrepancy/payment/acceptance is resolved.

Depending on the processing requirements of your bank, you can define and store

the standard documents, clauses, and instructions and free format texts. These

details can be incorporated and printed onto the output document of the bill by

just entering the relevant code. This eliminates entering the details of standard

components of a bill each time you need to use them.

Module Static Maintenance: All Modules of FLEXCUBE utilize the Core static maintenance of Customer, GL,

Accounts, and Currency etc. The core maintenance is required to be completed

_______________________________________________________________________________

i-flex solutions ltd.

10

Workbook – Bills and Collection

before starting the module level maintenance. For starting operations in

FLEXCUBEe there is a list of module specific maintenance, which is required to

be completed prior to starting the Product definition.

The Bills module requires certain basic information to be set up before becoming

fully operational. You can maintain details for the following:

Clause details

Document details

Goods

Instruction codes

Free Format Texts

Discrepancy Codes and

Parameters for your branch

10.201 Maintaining clauses: A clause is a statement that can accompany a document that is sent under a bill.

Instead of specifying the details of a clause each time you need to use it, you can

maintain a list of the standard clauses, which can accompany (can be part of) the

documents sent under a bill, in the Clause Maintenance screen. The key things to

be maintained here are:

i.

ii.

User defined unique Clause Code

Indicating the clause type – which will determine the type of

document that it accompanies. The nature of the clauses that you define

can fall within the following categories:

Transport

Insurance

Invoice

Others

iii.

Clause Description contains the Contents of the Clause, which will be

printed on the documents that are required for the bill.

_______________________________________________________________________________

i-flex solutions ltd.

11

Workbook – Bills and Collection

Maintaining documents: There are certain standard documents that are required under a documentary bill.

This can be maintained in the Bills - Document Master Maintenance screen. The

advantage of maintaining document details is that, at the time of creating a

product or at the time of entering the details of a bill, you need to just specify the

code assigned to the document. The key things to be maintained here are:

Unique user-defined document code

Selecting the type of the document – transport, insurance, invoice or others

Short description of the document

Specifying the contents of the document with the clause codes

Maintaining goods: There are certain standard goods or commodities that are transacted under bills.

Instead of specifying details of the merchandise each time they are traded, you

can maintain the details of the standard goods in the Goods Maintenance screen.

The things to be maintained here are:

Unique user-defined commodity code

Description of the commodity

Maintaining Instruction Codes: You can register the standard set of instructions or statements that are applicable

to the bills that you issue and maintain their details in the Instruction Code

Maintenance screen. These standard instructions can be made to appear in the

correspondence and messages sent to the parties involved in a bill.

Unique user-defined instruction code

Description of the instruction

Maintaining Free Format Texts (FFTs): Free Format Texts (FFT’s) may be a set of instructions or statements that are

applicable to the bills that you process. There are certain standard free format

texts that should appear in the correspondence and messages sent to the parties

involved in the bill and these can be maintained in the FFT Maintenance screen.

The fields here are:

_______________________________________________________________________________

i-flex solutions ltd.

12

Workbook – Bills and Collection

Unique user-defined instruction code

Description of the FFT

Maintaining Discrepancy Codes: You can maintain the standard discrepancy codes that are applicable to the bills

you process in the Discrepancy Code Maintenance screen. The key fields are:

Unique user-defined discrepancy code

Description of the discrepancy

Maintaining Branch Parameters: This is done in BC Branch Parameters available under Bank/Branch Parameters in

the Main Menu. This setup helps in the auto-processing of contracts by the

system. The parameters that are required here are “Accrual Level” whether it need

to be at product level or at the contract level and whether the batch processing

needs to be “Till next working day”

Product Maintenance

A Product in simple terms is a category or type of Bill. The main objective of

creating a product is to construct a broad framework within which you can define

specific Bills. This helps to minimize your inputs at the contract level and ensures

uniformity.

Main Details

Product Code

Product Description, Slogan, Start & End Date

Specifying the Product Group

Product Type – Import & Export

Tenor – Sight & Usance

Under LC

Document – Clean & Documentary

Operations

Indicating whether change of operations is allowed – Acceptance to

Discount, Acceptance to Advance, Collection to Purchase

Product Preferences

The re-key requirement fields

_______________________________________________________________________________

i-flex solutions ltd.

13

Workbook – Bills and Collection

Limits monitoring Details

Tenor limit specification

Exchange Rate Variance specification and type of Rate Code to be used

(mid-rate or buy/sell rate)

Interest and charges components and accrual details

Pay Due advice details And

Past Due Reckoning

Product MIS details

The transaction related MIS details could be captured. The multiple MIS codes

can be captured as a MIS group and the group can be defaulted at the product

definition level.

Product Branch and currency restrictions

This will apply restrictions to the contracts done under the product with respect to

the branches in which the products can be used and also the currencies in which

the deals can be entered using this product.

Product Customer and account class restrictions

Deals with Restricted customers cannot be done under this product.

Product Tax details

The taxes applicable are maintained as tax schemes. The relevant tax schemes are

defaulted here for the respective components. This is allowed only if the allow tax

check box in the product preferences is checked.

Product Interest and Charges Details

The interest related details are to be maintained here. The name of the

component, the rule to be applied, the event at which the interest is to be applied,

the type of interest – whether it is fixed, floating or special, the different rates for

specific currencies etc. are defined.

The charges that are to be collected are maintained as charge classes. The relevant

charge classes are defaulted here.

_______________________________________________________________________________

i-flex solutions ltd.

14

Workbook – Bills and Collection

Role to Head Mapping

The mapping of the ‘accounting roles’ to the desired GLs is defined here.

Alternatively these can be maintained as a class and the class can be defaulted

here.

Event accounting entry definition

The accounting entries and advices as applicable for each event in the life of the

deal are defined here. Alternatively these can be maintained as a class and the

class can be defaulted here.

Documents, Instructions & Free Format Text

Here codes for document and instructions and free formats can be attached to

the product so that they are picked up for all contracts under that product.

These FFTs and Instructions can appear along with the advices that are

generated during the lifecycle of the Bills linked to this product.

Tracers

Tracers are reminders that can be sent to the various parties involved in a bill.

In this screen you can specify your preferences for the tracers that should be

generated for the various exceptions that occur in the life cycle of a bill.

Reserve Exception, Acceptance Exception, Payment Exception, Charges

Exception.

Status Control

A bill that is yet to reach a repayment date or on which repayments are being

made will be considered as having an ‘Active’ status. When a repayment

against the bill is not made on the due date, you may want to do an aging

analysis for the bill. You can do an aging analysis by changing the status of a

bill on which payment is defaulted (such as NAB, PDO)

Contract Input

A Contract is an instruction wherein a customer (drawer) approaches your bank to

purchase, negotiate, discount or send for collection, a financial instrument called a

bill. The contracts are input using the different products that have been created to

incorporate different kinds of bills.

A Bills Contract would therefore require information on:

Who is the Drawer of the bill?

_______________________________________________________________________________

i-flex solutions ltd.

15

Workbook – Bills and Collection

Who is the Drawee of the bill?

Is the bill drawn under an LC?

Is it a Sight or Usance bill?

The operation that is being performed on the bill.

The amount for which the bill is drawn and the currency in which it is

expressed.

Details of the parties involved in the bill.

Details of the collecting bank (for export bill) or the remitting bank (for

import bills).

Details of the merchandise that was traded.

The documents that should accompany the bill.

Specifications for the transportation of the consignment.

By default a bill inherits all attributes of the product to which it is associated. This

means that you will not have to define these general attributes, each time you

input a bill involving a product.

The details captured in the bills contract screen are: -

Contract Main Screen

Specifying the operation you are performing on the bill. Advance, Payment,

Discounting, Collection, Acceptance for Incoming Bills and Negotiation,

Payment, Collection, Discounting, Acceptance, Purchase in case of Outgoing

Bills.

Specifying References for the Bill. If the bill is under Collection, the

reference number assigned to the collection can be specified. If the bill is

under an LC, then the requirements to be specified are – the customer in

whose name the LC was drawn, the date on which LC was issued and the

reference number of the LC. If the bill is under an LC issued by some other

bank, then the charges of the other bank can also be specified.

Specifying the terms of the Bill. The amount and currency in which the bill is

drawn.

Tenor details for the bill. The value date, tenor of the bill, Base date, Transit

days, maturity date (=Base date + tenor + transit Days), Liquidation Date and

Transaction date.

Specifying Counter party details. The Drawer in case of export Bill, and the

drawee in case of Import bills.

_______________________________________________________________________________

i-flex solutions ltd.

16

Workbook – Bills and Collection

Specifying Batch Processing preferences. The mode of liquidation whether

auto or manual, whether status change is auto or manual, whether bill will be

made available for rediscounting and whether there will be auto-change from

acceptance to advance.

Specifying the Interest Computation dates – The period of interest

computation, the Grace days to penalty.

The cash collateral details.

_______________________________________________________________________________

i-flex solutions ltd.

17

Workbook – Bills and Collection

18

Parties

The party type of the customer.

The CIF ID assigned to the party.

The country to which the party belongs.

The party’s mail address.

The language in which tracers and messages should be sent to the party.

The media through which all tracers and advices should be routed.

The following table contains a list of party types that can be involved in all

types of bills:

Party Type

Party Description

DRAWER

DRAWEE

ISSUING BANK

NEG BANK 1

NEG BANK 2

BENEFICIARY

ACCOUNTEE

CASE NEED

GURANTOR

ACCEPTING BANK

DISCNTING BANK

REMITTING BANK

COLLECTING

BANK

REIMBURSING

BANK

CONFIRMING

BANK

Drawer

Drawee

Issuing Bank

Negotiating Bank 1

Negotiating Bank 2

Beneficiary

Accountee

Case Need

Guarantor

Accepting Bank

Discounting Bank

Remitting Bank

Collecting Bank

Reimbursing Bank

Confirming Bank

_______________________________________________________________________________

i-flex solutions ltd.

Workbook – Bills and Collection

Goods, Shipment and Document Details

Specifying details of the document applicable to a bill.

Specifying the clauses for the documents

Specifying shipping details – transshipment details, latest date of shipment,

the carrier of goods, location and destination of goods shipped.

Indicating the goods details

Advices, Instructions and FFT’s

Priority, Medium of advice and whether messages should be suppressed.

Specifying instructions and Free format texts for a bill

Exception Tracers Details for the bill

Payment exception or Acceptance Exception are the two types generated in

FLEXCUBE.

Specifying whether tracer is required for the bill

Specifying the number of tracers to be generated, the frequency, and the

receiver of the tracers

Discrepancies

Specifying the discrepancies that occurred in the bill

Specifying if a reserve tracer should be generated

Specifying the number of tracers that should be generated, the frequency and

the receiver of the tracers.

_______________________________________________________________________________

i-flex solutions ltd.

19

Workbook – Bills and Collection

SWIFT advices under Bills Module

Note: There is no SWIFT equivalent to Remittance letter, which is the covering letter

for the documents being sent by Remitting Bank to Collecting Bank (by mail)

i.

MT410 Acknowledgement

This is the SWIFT message in acknowledgement for receipt of remittance

letter and documents. It is sent by Collecting bank (the receiver of the

remittance letter) to Remitting Bank (the sender).

In FC this gets generated when an Incoming contract(collection, discount

etc.) is created.

ii.

MT400 Advice of payment.

This is the payment (transfer) message sent by the Collecting bank to the

remitting bank towards settlement of the Dues under the Bill (partial of final).

The collecting bank sends this message after it has collected the dues from

the Drawee (or Drawee bank) or made other arrangements (such as discount,

advance etc.). The message is usually a substitute to MT100, Mt200. Thus if

MT400 is sent then MT200 should not be sent (this will then become a

double payment)

In FC this gets generated when ever an incoming Collection or acceptance is

liquidated (through liquidation option icon). The payment date in the

exceptions tab is automatically populated. A separate version and event is

created for history.

iii.

MT 430 Amendment of Instruction

This is sent by remitting bank to collecting bank intimating the amendments to

the remittance instruction sent earlier (through remittance letter). Thus though,

the remittance letter is sent by mail (as it accompanies documents), amendment to

it is done through this message. The Collecting bank may send MT410 towards

acknowledgement.

In FC this gets generated when ever an outgoing Collection or discount is

amended

iv.

MT420 Tracers

_______________________________________________________________________________

i-flex solutions ltd.

20

Workbook – Bills and Collection

These are periodic ‘reminder’ or ‘queries’ sent by remitting bank to the

collecting bank seeking information on the status of acceptance or payment of the

bill as the case may be.

In FC this gets generated through an EOD batch function at predefined

frequency. It is generated for “outgoing/ export” bills (collection / discount /

negotiation) when set-up as required in the tracer maintenance tab.. It gets

stopped when the tracer generation is flagged as “not required” in the respective

Bill contract.

Tracers can be generated under the following cases (for outgoing/export) bills

1. Payment Exception – to enquire the payment status for a sight bill

2. Acceptance exception - to enquire the acceptance status for a usance bill

3. Reserve Exception – sent by negotiating bank (for bills under LC), if

discrepancies are noted and negotiation is done under reserve (right of

recourse). The tracers are for reminding resolution of the discrepancies and

get stopped when the respective discrepancy is marked as resolved.

v.

MT422 Advice of Fate

This is sent by the Collecting bank to the remitting bank as a reply to the tracers

(MT420).

In FC this is generated as a (one time advice- when ever required) when Advice

of Fate (in the exception tab) is chosen for an Incoming/Import bill

(Collection/discount). The advice of fate can be for payment (DP) or Acceptance

(DA). It is possible to attach “reasons” as clauses to the advice using the Free

format clause code feature of FC.

vi.

MT416 Advice of non-payment or Acceptance

This an advice sent by the collecting bank to the remitting bank, stating that the

Drawee has refused payment (of sight bill or matured usance bill) or acceptance

(of a usance Bill). The bills and documents are usually returned back to the

remitting bank separately.

In FC this is generated as a (one time advice) when (the respective import bill

contract is unlocked and ) non-payment Msg date or Non- Acceptance Message

date is input (in the exception screen tab) . A separate event and version is

triggered which keeps history of this event

vii.

MT412 Advice of acceptance

_______________________________________________________________________________

i-flex solutions ltd.

21

Workbook – Bills and Collection

This is sent by the collecting bank to the remitting bank advising the fact that the

usance bill is accepted by the Drawee. Payment (on the maturity date) follows

this activity.

In FC this is generated as a (one time advice) when (the respective import bill

contract is unlocked and ) Acceptance Msg date is input (in the exception screen

tab) for a collection Bill. A separate version and event is created for history. For

“acceptance” operation where the bank also accepts the bill this is directly

triggered.

Others

Apart from these details there is a set of other details, which can be entered, in the

different buttons available in the contract main screen. These include the

Settlement details, Interest and charge details, MIS details, TAX details, Contract

Linkages; User defined fields, FX linkages, Invoice Details.

Forfeiting of Bills

By specifying the invoice details. The identification number of invoice,

the date on which it was raised and the amount that was raised.

Specifying the margin details – margin can be percentage of bill amount

or flat amount.

Liquidating the margin

Linking contracts to Accounts and deposits

Specifying the type of linkage – account or deposit

Specifying the details of linkage, the currency, exchange rate, linked

amount

_______________________________________________________________________________

i-flex solutions ltd.

22

Workbook – Bills and Collection

23

Flow Chart for BC Product Maintenance &

Contract Input

WORKFLOW FOR BILLS AND COLLECTIONS MODULE

PRE REQUISITES

CORE MAINTENANCE

DOCUMENT

MAINTENANCE

GOODS/COMMODITIES

CODES

STATIC MAINTENANCE

INSTRUCTION CODES

CLAUSES

MAINTENA

NCE

FREE FORMAT

MAINTENANCE

BC BRANCH PARAMETERS

PRODUCT MAINTENANCE

BC PRODUCT MASTER MAINTENANCE

CHARGES DEFINITION

TYPE - Import or export

TAX DEFINITION

UNDER LC?

TENOR - Sight or Usance

INTEREST DEFINITION

ACCOUNTING ROLES

MIS DEFINITION

Clean or Documentary

PREFERENCES

OPERATIONS

BRANCH/CURRENCY RESTRICTIONS

CUSTOMER RESTRICTIONS

TRACERS

DOCUMENTS, INSTRUCTIONS & FFT

STATUS CONTROL

USER DEFINED FIELDS

_______________________________________________________________________________

i-flex solutions ltd.

Workbook – Bills and Collection

24

WORKFLOW FOR CONTRACT

INPUT

PRE REQUISITES

BC PRODUCT MAINTENANCE

BILLS CONTRACT SCREEN

CONTRACT INPUT

STAGE

OPERATION

MAIN

SCREEN

PARTIES &

LIMITS

DOCUMENTS

/SHIPPING

DETAILS

CONTRAC

T OR FX

LINKAGES

BILL ATTACHED TO LC. AND THE CHANGES

IT UNDERGOES AS LC AVAILMENT, ETC.

EXCEPTIONS

DISCREPANCIES

ADVICES/

FFTs

CHANGES IN CHARGES/TAX/ MIS/SETTLEMENT

DEFAULTS PICKED UP FROM PRODUCT

SAVE THE CONTRACT OR

PUT ON HOLD

DELETE THE

CONTRACT

AUTHORIZE

Life Cycle Events

AMEND

CONTRACT

LIQUIDATE

GENERATE

MESSAGES

REVERSAL

COLLECTION

TO PURCHASE

OPERATION CHANGES

_______________________________________________________________________________

i-flex solutions ltd.

ACCEPTANCE

TO DISCOUNT

ACCEPTANCE

TO ADVANCE

Workbook – Bills and Collection

Banks can finance EXPORTERS by:

PRE-SHIPMENT FINANCE for specific requirements e.g. Packing

Credits, Manufacturing Loans, usually relating to a single order or

shipment. These are loans granted to the exporter to enable him to

purchase raw materials to manufacture the goods.

POST SHIPMENT FINANCE - The Bank may be prepared to

PURCHASE or DISCOUNT bills of exchange after shipment but before

payment by the importer. This means making an advance to the exporter

against the security of the bills representing the goods shipped, pending

payment by the importer.

Running an OVERDRAFT to cover expenses of any kind.

Banks can finance IMPORTERS by:

IMPORT LOANS for specific shipments known as either LOANS

AGAINST IMPORTS (LAI) or CLEAN IMPORT LOANS (CIL).

Running an OVERDRAFT

In case of import bills, liquidation would mean payment of money to the

exporter’s bank on the due date of payment.

Discount accruals in an LC

When an export bill is discounted or negotiated, the discount income is taken

upfront. Discount accruals is a process by which the discount earned is

progressively amortized till the maturity date so that a true picture of income for

the period can be obtained. Accruals can be daily, monthly, quarterly, half-yearly

or annual.

_______________________________________________________________________________

i-flex solutions ltd.

25