FY09-CON-002-04

advertisement

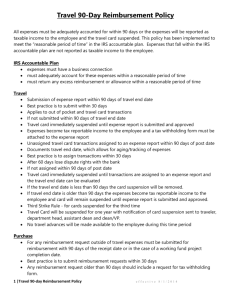

Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html Issuing Office: Controller’s Office Policy Number: FY09-CON-002-04 Policy Name: Employee Travel Policy & Procedures Original Date Issued: December 5, 2008 Revision #: 04 Date last Revised: December 2011 Purpose of Policy To support employee travel while on official UMass Boston business with procedures that ensure travel reimbursements are processed according to the Travel Policy set forth by the President’s Office and the Board of Trustees (T92-031, Appendix B) and within the procurement guidelines established by the UMass Boston Office of Contracts and Compliance. This policy also provides standards and guidelines for the effective utilization of the University’s Employee Expense Reimbursement System. Applicable to: This policy pertains to all employee travel expenditures by University of Massachusetts Boston employees on official UMass Boston business, regardless of source of funds. Travel expenses for non-university employees, such as consultants, speakers, lecturers, visiting professors, candidates for positions, and students are reimbursed in accordance with contract for services and vendor payment procedures. Definitions: Departmental Account Signatory - The individual(s) who have primary authority for financial approval for their respective departments and accounts. This signature must be documented in the Signature Authorization log located in the Controller’s Office. Additional signatory approvals may be required by internal control procedures such as the Principal Investigator for a grant or project. Chart String / Chartfield – A combination of numbers and/or characters that represent a University Fund-Department-Program for accounting purposes. Department Head – The person who has operational and fiscal responsibility for a department or higher organizational level. Domestic travel - Travel within the United States and its Territories (Guam, Puerto Rico and the US Virgin Islands). Expense Preparer – An employee who has been trained and approved to enter travel and employee expense reimbursements online in the PeopleSoft Expense Module on behalf of a department’s employees. Administration & Finance Controller’s Office Page 1 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html Foreign or international travel - Travel outside the United States and its Territories (Guam, Puerto Rico, and the US Virgin Islands). Official Travel – Official travel is defined as movement on official UMass Boston business of the University from one's home or normal place of employment to another destination, and return from there either to one's normal place of employment or to one's home. Commuting between one's home and regular place of employment is not official travel (see procedures for expenses eligible for reimbursement). Official UMass Boston Business - Actions that are necessary, appropriate, and reasonable to meet the programmatic requirements of the University of Massachusetts Boston. ORSP – Office of Research and Sponsored Programs. ORSP provides a secondary level of approval for external grants and sponsored programs. Out-of-Pocket Expenses – Amounts paid or committed by the traveler from personal funds. Per Diem – A daily allowance; usually for meals and incidentals, while traveling on UMass Boston business (see Domestic and International Travel sections). Incidental expenses - Fees and tips given to porters, baggage carriers, bellhops, hotel maids, stewards or stewardesses and others on ships, and hotel servants; transportation between places of lodging or business and places where meals are taken. (Internal Revenue Bulletin: 2011-42). Speed Type – A six digit number that is used in the University Finance System which represents the funding source for expenses, i.e.; a Chart String or Chartfield representing a combination of fund-department-program. Travel Expenses - All travel expenditures regardless of the source of funds related to UMass Boston business. Policy: The University Of Massachusetts Board Of Trustees, Policy Doc. T92-031, “assigns to the Chancellor of each campus general responsibility for the approval and control of travel by employees, and the establishment of written procedures.” To ensure appropriate approvals and management of employee travel, all travel expenses must be pre-approved and for official UMass Boston business only. Employee travel expenses may be paid via reimbursement (corporate travel card or out of pocket expense), travel advance or directly prepaid to the vendor by the University. Administration & Finance Controller’s Office Page 2 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html Responsibility of the Traveler A traveler on official UMass Boston business has the responsibility to act prudently and to incur expenses that are ordinary, appropriate and reasonable. Travel arrangements should be made using the most cost-effective means available to meet the programmatic requirements of the travel purpose. All travel must be by a usually traveled route. When a person travels by an indirect route for his or her convenience, any extra costs shall be borne by the traveler and reimbursement for expenses shall be based only upon such charges that would have been incurred by a usually traveled route. Commuting between an employee’s home and permanent work location is not a reimbursable expense Mileage is measured from the employee’s home to the destination and return or from the employee’s primary work location to the destination and return, whichever is less. Original receipts must be submitted for all individual expenditures exceeding $25. If expenses were ordered online using an Internet vendor, a printed copy of the charge and associated proof of payment reference by the traveler (e.g.; credit card receipt) must be submitted. Expenses associated with UMass Boston sponsored group travel may be reimbursed to a single employee upon submission of an approved Expense Reimbursement. Refer to the procedure section titled Group Travel for instructions for submitting group travel expenses. The traveler is responsible for prompt submission of travel expenses and accounting for advances received. Upon completion of the travel, the completed travel reimbursement request must be submitted to the Controller’s Office within ten (10) business days. For recurring travel, employees must submit travel reimbursements at least monthly. Employee travel reimbursements not submitted within 120 days of the completion of the travel will be considered taxable income and will be included in the employee’s W-2 taxable earnings in accordance with the IRS regulation pertaining to accountable reimbursement plans. Travelers must return any cash advance issued by the University in excess of substantiated expenses. An employee who has not settled a travel advance within thirty (30) days of completion of the travel will have the amount of the travel advance withheld from his or her wages. Corporate VISA® Travel Card - A Corporate VISA® Travel Card may be provided to employees who travel frequently on University business as an optional method of payment for reimbursable expenses. Cardholders are reimbursed by the University for authorized and approved expenses upon submission of an expense report. Cardholders are responsible for paying all charges made to their cards and for paying their cards on time. Travelers utilizing the University Corporate VISA travel cards are expected to maintain their accounts in good Administration & Finance Controller’s Office Page 3 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html standing to maintain the favorable terms and conditions provided by the Corporate VISA card. Use of the Corporate VISA® Travel Card is strictly for University travel and business expenses only. Personal charges may not be made on the Corporate VISA® Travel Card. The VISA® monthly statement is sent directly to the cardholder and is due and payable in full each month. The University receives information on delinquent accounts. Massachusetts sales tax will not be reimbursed to employees. Prepaying travel expenses and using a UMass Boston corporate VISA travel card should be used when practical in order to avoid sales tax. Responsibility of the Department Authority and responsibility for approval of travel by employees rests with the supervisor or account signatory of the account to which the expense is to be charged, usually the department head or Principal Investigator for sponsored projects. Intentional falsification of expense report documents and/or fraudulent submissions by the traveler will be referred to Human Resources for possible disciplinary action. Federal and Sponsor Funded Travel For travel charged to a sponsored project or grant, the Principal Investigator (PI) must ensure that, in addition to campus guidelines, all grantor and funding agency restrictions are followed. A traveler must receive approval from the department head and the Principal Investigator prior to traveling and again for reimbursement. Federal regulations prohibit the charging of business class or first class air travel to federally sponsored projects. o Federally sponsored trips should utilize U.S. flag carriers at the lowest available rates. o Sponsored project travel must adhere to this policy unless the sponsor imposes greater restrictions. For the complete federal travel regulations please refer to OMB Circular A-21. ORSP The Office of Research and Sponsored Programs provides a secondary level of approval for financial commitments and expenditures related to travel authorizations and travel reimbursement requests when the travel pertains to external grant and sponsored program funds. Controller’s Office Responsibility of Controller’s Office is to provide the final approval of financial commitments and expenditures related to travel advances, travel authorizations and travel reimbursement requests. Administration & Finance Controller’s Office Page 4 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html The Controller’s Office provides pre-audit and post-audit review of travel documents to prevent material erroneous reporting and expenditures. Procedure: 1.0 2.0 TRAVEL AUTHORIZATION (INCLUDING PRE-TRAVEL EXPENSES) 1.1 Pre-Approval - Travel must be authorized and approved by the traveler's supervisor and the Account Signatory (if different from the traveler’s supervisor) prior to the expenditure or commitment of travel funds except in the case of emergencies. 1.2 Encumber Pre-Travel Expenses – Pre-travel expenses may be encumbered for budget and grant reporting purposes. This optional accounting control is enabled when the traveler enters his or her Travel Authorization in the University Expense Module system. The completed Travel Authorization should be maintained by the Account Signatory until the travel is completed. The Travel Authorization form should be provided to the Expense Preparer along with the traveler’s expense reimbursement request and receipts upon completion of the travel. 1.3 Budget Check - The Account Signatory is responsible for ensuring adequate funds are available and that the travel is for an official UMass Boston business purpose. 1.4 Grants & Sponsored Programs Travel - When travel pertains to a grant or other restricted use program or fund, the Account Signatory is responsible for obtaining approval from the grant’s Principal Investigator and ORSP. 1.5 International Travel - University employees must receive their dean’s or vice chancellor’s approval prior to traveling internationally to ensure compliance with federal Export Control requirements. 1.6 Emergency Travel – Pre-travel authorization may not be practical when travel is necessary due to an emergency or unusual circumstance. The traveler’s supervisor should document the need and approval for the travel as emergency travel or similar explanation why the travel was not pre-approved. PREPAID TRAVEL 2.1 General - UMass Boston recommends that travelers prepay travel expenses through the Controller’s Office when required by a vendor (e.g. hotel deposit, airfare) or if prepayment results in material cost savings to the University. Prepaying a travel expense not only reduces the financial burden for the traveler to expend personal funds, it avoids Massachusetts sales tax charges and ensures that correct accounting and budget validations have been made before the travel commences, thus expediting the traveler’s reimbursement for out-of-pocket expenditures. The traveler should take into consideration any penalties associated with changing or canceling a prepaid reservation. Prepaid travel expenses are paid directly by the University and should not be included in the traveler’s reimbursement request. Administration & Finance Controller’s Office Page 5 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html 2.2 Conference Registration – A conference registration and related conference fees may be prepaid directly to the conference when the traveler submits a Prepaid Travel / Travel Authorization Request form along with the completed conference registration form to the Controller’s Office at least three (3) weeks prior to the payment due date. Conference fees may also be prepaid using the UMB Procard. 2.3 Travel Agency Reservations – Airfare, hotel and automobile reservations may be booked through the UMass Boston preferred travel agencies that accept direct billing from UMass Boston. The traveler must first obtain approval from his or her supervisor and account signatory, and then submit the approved Prepaid Travel / Travel Authorization Request form to the Controller’s Office. The Controller’s Office will issue a Business Travel (BT) reference number that participating travel agencies will use as their authorization from UMass Boston to reserve and subsequently invoice UMass Boston for the employee’s travel. 3.0 TRAVEL CASH ADVANCE 3.1 Cash Advance Request Form – The traveler must submit an approved Cash Advance Request to the Controller’s Office in order to receive cash in advance of the authorized travel. 3.2 Travel Authorization Form – An approved Travel Authorization Form must accompany all Cash Advance Requests. This ensures that sufficient budget funds are available and encumbered for the travel. 3.3 Minimum Request - Travel cash advances may only be made when anticipated CASH requirements exceed $100. 3.4 Maximum Request - The limit for a travel cash advance is $2,000. 3.5 3 Week Advance Notice - A travel cash advance must be submitted to the Controller’s Office 3 weeks prior to the start of the travel date in order for a check to be issued or payroll deposit to be made. 3.6 Standard Payment Method – The traveler advance will be included in the employee’s pay check / direct deposit pay advice. 3.7 Emergency Check - In extraordinary instances, a travel cash advance may be requested to be disbursed by the Bursar's Office in the form of a check payable to the traveler. Such requests must be approved, in writing, by the Department Head and the Controller. All advances must be picked up in-person by the traveler at the Bursar’s Office. 3.8 Settlement of Cash Advance – The cash advance must be settled not more than 30 days after the completion of the travel. Settlement must be done in the form of applying actual travel expenses against the amount of the travel advance with the balance being returned to the University if the travel advance amount exceeds the total travel expenditures. Administration & Finance Controller’s Office Page 6 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html Payroll Deduction – A travel cash advance balance that has not been settled 30 days after completion of the travel will be deducted from the employee’s pay in accordance with the signed Travel Advance Agreement. 3.9 4.0 EXPENSE REIMBURSEMENT 4.1 Expense Reimbursement Options through the Expense Module All employee travel reimbursements are entered in the University’s online Expense Reimbursement System (Expense Module). 4.1.1 Online Travel Reimbursement Request - Employees, or Authorized Expense Preparers entering on behalf of an employee, may submit travel expenses online. The Expense Module is accessed through the PeopleSoft Finance System. The employee or Authorized Expense Preparer must have PeopleSoft Finance Security Access and have completed the Expense Module User Training in order to create an online travel reimbursement. Upon submission of the expenses online, the traveler/expense preparer prints the completed expense report and attaches all required receipts. The traveler must sign and date the expense report form and submit the signed expense report and receipts for the Account Signatory’s approval. 4.1.2 Manual Travel Reimbursement Request - If the employee-traveler does not have access to the Expense Module and cannot utilize the services of an approved Expense Preparer, a completed travel reimbursement form must be submitted to the Controller’s Office for processing. The Manual Travel Reimbursement Form can be downloaded from http://www.umb.edu/administration_finance/controller/forms/ 4.2 Original Receipts - Original receipts are required for individual expenses exceeding $25, however all expenses are required to be detailed and itemized on the Travel Reimbursement form. 4.3 International Travel – Travel reimbursement must be submitted in U.S. Dollars with an explanation and translation of any international receipts and their conversions. The Traveler must use currency rates that were in effect when the travel took place. Therefore, currency receipts should be saved and used for converting international currencies back to U.S. Dollars on the Travel Reimbursement form. 4.4 Group Travel Expenses associated with University sponsored group travel may be reimbursed to a single individual upon submission of an Expense Reimbursement which details the expenses paid to, or on behalf of, the individuals who traveled with the group. Administration & Finance Controller’s Office Page 7 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html The reimbursement request must include a list of the names of each traveler in the group along with a description of the business purpose which must be prepared and submitted with the travel reimbursement. Each traveler must certify, by signature or initials next to his or her name, that they incurred and received the benefit of the expenses being claimed for reimbursement. Allowable group travel expenses are the same as for individual travelers. 4.5 Student Travel Student-employee A student who is also an employee of the University and is travelling on official University business is subject to the University of Massachusetts Boston travel policy and reimbursement rules. Travel expenses are reimbursed upon submission of a completed and approved UMass Boston Travel Expense form. Student Who Is Not a UMass Boston Employee A student who is not a UMass Boston employee must submit travel expenses for reimbursement on a UMass Boston Disbursement Voucher. Travel expenses are reimbursed in accordance with the student’s contract or grant requirements. Only expenses supported by original receipts will be reimbursed. . Reimbursement may not exceed the amounts allowed in the University travel policy. 5.0 ALLOWABLE EXPENSES 5.1 Air / Train / Bus Travel shall be at the most economical class as approved by the supervisor. The employee and supervisor shall make every effort to plan trips with sufficient lead-time to take advantage of discount fares. Any charges in excess of the most economical class shall not be reimbursed or if paid by the University must be refunded to the University. All unused tickets must be attached to the reimbursement form along with an explanation. Refunds on tickets must be repaid to the University. Lost or stolen airline tickets are not a reimbursable expense. Lost Baggage Accident and baggage insurance is provided at no charge by the University’s corporate VISA card if travel services are purchased with the Corporate VISA card. (Refer to Travel Insurance) Federal Tax Federal tax on airfare is allowable and reimbursable. Upgrades Upgrading the class of airfare tickets is usually not an allowable expense reimbursement and therefore not permitted unless the traveler pays the Administration & Finance Controller’s Office Page 8 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html incremental difference. Free upgrades are permitted but must be noted as such on the travel expense voucher. Frequent Flyer Programs The University will not reimburse for tickets purchased with frequent flyer miles. Frequent flyer mileage programs should not influence the traveler’s flight selection or routing. The Controller’s office should be contacted prior to finalizing plans regarding the use of private or chartered aircraft. (Refer to Travel Insurance). 5.2 Vehicles 5.2.1 Mileage Reimbursement for Private Vehicle Whenever the use of a privately owned vehicle is shown to be more economical or advantageous for official business, the University will reimburse travelers on a mileage basis at the UMass Boston Current Approved Mileage Rate. The current rate may be found at http://www.umb.edu/administration_finance/controller/memo/ Internet mapping services (e.g.:GoogleMaps or MapQuest) may be used to calculate the shortest distance. Mileage is measured from the employee’s home to the destination and return or from the employee’s primary work location to the destination and return, whichever is less. The University does not provide insurance coverage for employees operating a privately owned vehicle. The owner/driver is solely responsible for automobile insurance coverage. The owner/driver will be responsible for any damage caused to third party property and any damage to the employee’s own vehicle, regardless of fault. 5.2.2 Rental Vehicles The use of vehicles rented from automobile rental agencies and commercial dealers is allowed when it is economically more advantageous than using a personal vehicle or if the traveler does not have access to a personal vehicle. The reimbursement shall be for the most economical rate available for a standard class automobile. Acceptable charges include: the rental charge, gasoline, mileage charges and drop off charge if necessary to the performance of official UMass Boston business. car rental insurance Administration & Finance Controller’s Office Page 9 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html The University Treasurer's Office provides information and guidance about the University's auto insurance programs for auto rentals for University business travel. Insurance is purchased for the University by the Treasurers Office. Insurance coverage and guidelines are subject to change. Refer to http://www.massachusetts.edu/treasurer/rented%20vehicles.html for the most current information or contact Matthew Wamback at (774) 455-7588, mwamback@umassp.edu if you have any questions. Guidelines for Purchasing Insurance: 1) University Corporate VISA Card – Decline Coverage1 Full value, primary coverage is provided at no charge for most rental cars when the entire rental transaction is made with the University’s corporate VISA card. 1 Purchase the physical damage insurance if renting a van that carries more than eight, certain types of trucks and off-road usage. 2) Purchase Order - Collision Damage Waiver (CDW) or a Loss Damage Waiver (LDW) should be purchased from the rental company when using a purchase order as coverage is no longer provided by the University. - Liability Insurance should be purchased from the rental company, if renting a vehicle outside the State of Massachusetts or for use outside Massachusetts. Note: If renting the vehicle in Massachusetts and you will only be driving the vehicle in the State of Massachusetts, decline the Liability Insurance offered by the rental company. 3) Personal Credit Card - Collision Damage Waiver (CDW) or a Loss Damage Waiver The traveler should determine if his/her personal credit card provides automatic coverage for CDW. If not, the University strongly recommends purchasing the car rental company’s CDW. It is a reimbursable expense. - Liability Insurance should be purchased from the rental company, if renting a vehicle outside the State of Massachusetts or for use outside Massachusetts. 4) Include "University of Massachusetts" next to your name on rental application when purchasing optional insurance. Administration & Finance Controller’s Office Page 10 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html 5.2.3 University-Owned Vehicle Expenses related to the business use of a University-owned vehicle will be reimbursed for amounts actually paid by the traveler with proof of payment. These expenses are typically fuel, oil, parking, tolls and emergency repairs. Expense items which are less than $25 do not require a paid receipt. 5.3 Lodging Travelers are expected to incur the least expense to the University when booking lodging at a single occupancy rate. The traveler should check with the UMass Boston preferred travel agencies(link) as they may have preferred rates that are not available to the public when reserving a room directly with the hotel. The following lodging-related expenses are allowable: Reasonable tips for luggage assistance and housekeeping Internet charges Taxes Valet charges if mandatory to stay at the hotel Business calls. Indicate on the hotel bill to whom the call was placed and the business purpose Charges caused by failure to cancel a guaranteed reservation are not reimbursable. 5.4 Foreign (International) Travel-Related Expenses International travel is defined as travel outside the United States and its territories and possessions (Guam, Puerto Rico, and the U.S. Virgin Islands). University employees must receive their dean’s or vice chancellor’s approval prior to traveling internationally. 5.4.1 Passports and VISAs Passport and VISA expenses are reimbursable provided they were obtained to travel on University business. 5.4.2 Immunization Immunization expenses, when required for foreign travel, are reimbursable. 5.4.3 Converting International Currencies Travel expense vouchers must be submitted in U.S. Dollars with an explanation and translation of any international receipts and their conversions. o Travelers must use the currency rates that were in effect when the travel took place. Therefore, currency receipts should be saved and used for converting international currencies back to U.S. dollars on the travel expense voucher form. Administration & Finance Controller’s Office Page 11 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html o Use of the University Corporate VISA card or personal credit card eliminates the need to calculate international currency conversions and usually reflects favorable exchange rates. To convert international currency the following calculation is used: 5.5 - International Amount X Exchange Rate = U.S. Dollars - U.S. Dollars / Exchange Rate = International Amount - Rates may be obtained from the Treasurer’s Office, (508) 856-4700 - O and A Currency Converter web site: http://www.oanda.com/ Per Diem A traveler may be reimbursed at a daily rate (per diem) to cover the cost of meals and international lodging while traveling in lieu of submitting paid expense receipts. A traveler may use the per diem rates or choose to request reimbursement for actual expenses. Employees traveling on University business are eligible for reimbursement for their personal meal expenses. Employees may choose to submit receipts for their actual meal expenses or they may opt to use the Per Diem rate; they cannot combine both methods on the same trip. Actual meal expenses will be reimbursed only up to the maximum amount of the Per Diem Rate. The two methods cannot be combined for the same travel period. Domestic travel has one per diem for meals and incidentals. International travel has two per diems, one for meals and one for meals and lodging combined. In accordance with BOT Policy T92-031 (Appendix C)] related to Business Expenses, an employee is allowed to claim a business meal expense (assuming all requirements are met) and can claim the daily meal per diem on the same trip. The traveler would simply reduce the daily per diem for the meal that was claimed on the business meal expense in accordance with the Travel Policy. 5.5.1 Meal Per Diem Full Per-Diem (Domestic and International) Domestic Travel Meals) Per Diem Rates– The University’s per diem for employees is forty-six dollars ($46) per day for most US destinations. One half the per diem rate is allowed when travel status is at least 12 consecutive hours but less than 24 hours. The per diem rate is seventy-one dollars ($71) for “high cost” localities. Administration & Finance Controller’s Office Page 12 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html The per-diem allowance will not be granted to travelers that are provided meals as part of their official university business. The value of any meals provided while on travel status should be subtracted from per diem according to the following schedule: Most U.S. High Cost Cities Cities Breakfast $ 7.00 $12.00 Lunch $11.00 $18.00 Dinner $23.00 $36.00 Incidentals $ 5.00 $ 5.00 Full Per Diem $46.00 $71.00 Domestic per diem rates include meals and incidental expenses. Refer to Incidental Expenses Definition on page 2. Partial Day Per-Diem with Overnight Travel (Domestic and International) One half the per diem rate is allowed as follows: Overnight Travel Begins Before 12:00 Noon After 12:00 Noon Traveler Returns Before 12:00 Noon After 12:00 Noon Allowable Per-Diem Full Daily Rate ½ Daily Rate Allowable Per-Diem ½ Daily Rate Full Daily Rate 5.5.3 International Travel Per Diem International travelers may use the U.S. Department of Defense Foreign Per Diem rates which can be found at http://www.defensetravel.dod.mil/site/perdiemCalc.cfm. International per diem rates can be used to obtain reimbursement for authorized travel outside the United States, Canada and Mexico. The U.S. Department of Defense Foreign Per Diem rate is broken down into food, incidentals, and lodging so the applicable categories can be applied. The federal per diem local meals rate is applicable to international travel and may be used in all cases of international travel unless the traveler chooses to request reimbursement for actual expenses. In this case, receipts may be submitted with a travel expense voucher but cannot exceed the per diem rate. The value of any meals provided to the employee while on international travel status should be subtracted from the daily meal per diem rate. Administration & Finance Controller’s Office Page 13 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html 5.6 Trip Cancellation Penalties imposed as a result of canceling a ticket or fees assessed for reissuing a non-refundable ticket may be reimbursed to the traveler if extenuating circumstances are documented in writing and approved by the account signatory If it is necessary to cancel a trip the traveler should ask the issuing agency or airline about the terms and conditions that apply for future trips. Personal use of any portion of a University purchased/reimbursed ticket is not allowed. 5.7 Other Reimbursable Expenses Only actual and necessary expenses essential to the performance of official UMass Boston duties and in accordance with established University Board of Trustees and UMass Boston policies and procedures will be reimbursed. Expenses in excess of $25 per item must be supported by paid invoices or sales receipts however all expenses are required to be reported on the expense reimbursement. Examples of other reimbursable expenses are: 6.0 Convention or conference registration fees (When meals or lodging are included in the registration fee, the traveler may not also request reimbursement for the same meal). Meals (cannot be reimbursed if electing per diem on the same trip) Taxi, commercial bus & public transportation Bridge, road and tunnel tolls, ferries Storage or parking fees Communication expense (telephone, Internet, faxes, etc. for business purposes) Other Business Related expenses purchased while on travel status to meet an immediate business need APPROVAL OPTIONS (see Attachment 1 for Approval Flow Chart) 6.1 Online Approval (Expense Module) Traveler Travelers who enter travel in the Expense Module (or have entered on their behalf by an Authorized Expense preparer) must have their travel form approved online. Upon completion of the online entry of expense data the traveler must print, sign and date the PeopleSoft “Printable View” version of the travel form. The Traveler’s dated signature attests that the amounts as itemized were incurred by him or her as necessary expenses in the performance of his or her official UMass Boston duties. Departmental Account Signatory Approver (Expense Manager) Administration & Finance Controller’s Office Page 14 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html The Departmental Account Signatory approver must verify the following: that the travel is compliant with the UMass Boston travel policy, the Traveler has signed (not a copy or stamp) and dated the “Printable View” document, original receipts, or a Missing Original Receipt Affidavit if the receipts were lost or otherwise unattainable, that support the travel expenses are attached, that a Principal Investigator, whose name is listed in the Comment section of the Travel Expense Report, has signed and dated the Travel Expense Report on the line for Principal Investigator or Other Approval. This requirement only applies when a Project ID is entered on the Travel Expense Report. After verifying the above requirements, the Account Signatory must approve the travel form online and forward the original, signed and dated travel form to the Controller’s Office. ORSP Approver (Supplemental Approver) If the travel expenses are being charged to a grant or other sponsored program, the travel form must be approved by ORSP. After the travel form is approved online by the Departmental Account Signatory, the travel form will automatically be forwarded to ORSP for approval. The Departmental Account Signatory’s approval indicates that an authorized PI as indicated in the Comment section of the Travel Expense Report has signed and dated the Travel Expense Report. ORSP will verify: the correct Chartfield was entered, the grant or sponsored program includes a budget line item for travel expenses, that the PI as indicated in the Comment section of the Travel Expense report is an authorized PI for the grant or project. Controller’s Office Pre-Audit – The Controller’s office reviews all expense reimbursement forms for signatures, dates and original receipts. If the documentation looks complete, the Controller’s Office approves the expense reimbursement request online. Once the Controller’s Office approves the expense reimbursement, the payment will be processed through the biweekly payroll system. Post-Audit - A random sample of paid expense reimbursements are routinely checked for travel policy compliance. If an error is found, the employee will be Administration & Finance Controller’s Office Page 15 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html reimbursed if the error is in the employee’s favor. If the employee is deemed to owe the University, he or she will be contacted by the Controller’s Office and asked to repay the amount reimbursed in error. Expenses Not Approved If an approver is rejecting the travel form online, the approver will select the PeopleSoft Finance Expense Module “Send Back” option and provide an explanation for returning the travel in the Comments section of the travel form. Departmental Account Signatory - If the Departmental Account Signatory electronically “Sends Back” the travel form, the online document will be automatically sent back to the Traveler or Authorized Expense Preparer for corrective action. The Departmental Account Signatory must return the original, signed and dated travel form to the Traveler. ORSP – If ORSP electronically “Sends Back” the travel form, no further action is required by ORSP. The travel form will be electronically returned to the Account Signatory for corrective action. Note: Signed and dated document may be at the Controller’s Office and must be retrieved by the Traveler if modifications are necessary. Controller’s Office – The Controller’s Office will electronically “Send Back” a travel form only when the original, signed and dated travel form is not received or it has obvious errors or omissions (e.g.; no receipts, no dated signatures). The Controller’s Office will also return the original travel form to the Traveler for corrective action. 6.2 Manual Approval If expense reports, travel authorizations and travel cash advances are not prepared online by the traveler or an Authorized Expense Preparer, the traveler must submit completed travel forms with original signature and date, along with required receipts to the Departmental Account Signatory. Approval Workflow Departmental Account Signatory A Departmental Account Signatory approver must verify the following: that the travel is compliant with the UMass Boston travel policy, the Traveler has signed (not a copy or stamp) and dated the “Printable View” document, original receipts, or a Missing Original Receipt Affidavit if the receipts were lost or otherwise unattainable, that support the travel expenses are attached, Administration & Finance Controller’s Office Page 16 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html that a Principal Investigator, whose name is listed in the Comment section of the Travel Expense Report, has signed and dated the Travel Expense Report on the line for Principal Investigator or Other Approval. This requirement only applies when a Project ID is entered on the Travel Expense Report. If the submitted expenses are appropriate, the Departmental Account Signatory must sign and date the travel form and forward the original and signed and dated travel form to the Controller’s Office. Initial Approval by Controller’s Office The Controller’s Office processes travel forms online acting on behalf of the Traveler and Departmental Account Signatory who have submitted travel forms manually. Office of Research & Sponsored Programs (ORSP) ORSP will verify: the correct Chartfield was entered, the grant or sponsored program includes a budget line item for travel expenses, that the PI as indicated in the Comment section of the Travel Expense report is an authorized PI for the grant or project. The Departmental Account Signatory’s approval indicates that an authorized PI as indicated in the Comment section of the Travel Expense Report has signed and dated the Travel Expense Report. If ORSP approves the travel form, the ORSP representative will approve the expense report online in the PeopleSoft Finance Expense Module. Final Approval by Controller’s Office Pre-Audit – The Controller’s office reviews all expense reimbursement forms for dated signatures and original receipts. If the documentation looks complete, the Controller’s Office approves the expense reimbursement request online. Once the Controller’s Office approves the expense reimbursement, the payment will be processed through the biweekly payroll system. Post-Audit - A random sample of paid expense reimbursements are routinely checked for travel policy compliance. If an error is found, the employee will be reimbursed if the error is in the employee’s favor. If the employee is deemed Administration & Finance Controller’s Office Page 17 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html to owe the University, he or she will be contacted by the Controller’s Office and asked to repay the amount reimbursed in error. Expenses Not Approved If at any point in the approval process the Account Signatory determines that the expense reimbursement is not correct or allowed, the Account Signatory must return the travel form and any accompanying receipts to the traveler with an explanation why the travel form is being returned. If the Controller’s Office or ORSP rejects the travel form, the approver will also need to go online and select the PeopleSoft Finance Expense Module “Send Back” option and provide an explanation for returning it in the Comments section of the travel form. The Controller’s Office will return the original travel form to the Traveler for corrective action. Oversight Department & Internal Control: Controller’s Office Responsible Party within Department: Associate Controller for Fiscal Operations Monitoring: The Controller’s Office retains the responsibility for maintaining and updating all UMass Boston travel procedures, documentation and travel forms. The goal of the Controller’s Office is to process employee reimbursements within 5 business days. The payment will be added to the employee’s pay in the next available pay cycle. Post-Audit Review - Travelers are liable for overpayments that may be discovered in post-audit review. Discovery of fraudulent practice by travelers while on authorized University business is cause for dismissal as well as other consequences that may be determined in accordance with the Board of Trustees Policy Authority: Travel Policy, University of Massachusetts Board of Trustees, Doc. T92-031 Appendix B Policy for Management of University Funds, University of Massachusetts Board of Trustees, Doc. T92-031 Business Expense Policy, University of Massachusetts Board of Trustees, Doc. T92-031 Appendix C Internal Control Plan, University of Massachusetts Boston IRS Standard Mileage Rates Administration & Finance Controller’s Office Page 18 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html Related Documents: CON-02 Travel Expense Report CON-03 Travel Authorization & Cash Advance CON-04 Business Entertainment Expense Authorization Form CON-08 Missing Receipt Affidavit Related Links: PeopleSoft Finance Application, University of Massachusetts Per Diem, Travel and Transportation Allowance for International Travel, Department of Defense Change in Mileage Reimbursement Rate – Effective July1, 2011 2012 Mileage Reimbursement Rate 2011 Mileage Reimbursement Rate 2010 Mileage Reimbursement Rate Immunization Requirements - Centers for Disease Control and Prevention (CDC) OANDA.com Currency Conversion Administration & Finance Controller’s Office Page 19 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100 Administration & Finance Policy & Procedure http://www.umb.edu/administration_finance/controller/policies_controller.html Attachment 1 EXPENSE REIMBURSEMENT APPROVAL WORKFLOW (APPROVAL PROCESS) Submitting and Approving an Expense Report / Reimbursement Online Employee / Expense Preparer ORSP Add/Edit/Update Expense Report (online) FS_EX_Entry role (PROJ_SUPP role NO Automatic Routing to ORSP Print Expense Report Approve ? YES YES Expense Report Grant or Project ? Controller’s Office NO PREPAY_AUDITOR role Employee signs and dates report submits to Supervisor (& PI if Grant) for approval Supervisor, PI (if applicable) signs and NO dates, submits to Departmental Account NO Approve ? Dept. Account Signatory Submit for Approval (online) YES EXPENSE_MANAGER role YES Approve ? Employee Paycheck / Direct Deposit Payment NO Send Back for revision Legend: FS_EX_Entry EXPENSE_MANAGER = = PROJ_SUPP = PREPAY_AUDITOR = Employee who enters Expense Reports (only) The Departmental Account Signatory who approves online Expense Reports, Travel Authorizations, Cash Advances An employee in ORSP that approves Expense Reports, Travel Authorizations, Cash Advances for expenses related to grants and sponsored projects. An employee in the Controller’s Office Administration & Finance Controller’s Office Page 20 of 20 University of Massachusetts Boston Administration and Finance 100 Morrissey Blvd Boston, Massachusetts 02125 (617) 287-5100