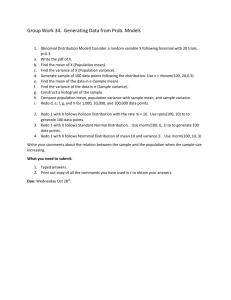

FBM IV

advertisement

STUDY MATERIAL SUBJECT CLASS SEMESTER UNIT HANDLED BY : FOOD AND BEVERAGE MANAGEMENT : III YEAR : VI : IV : RAJESH PANDIAN.T.R SYLLABUS Elements of cost: Cost defined, basic concepts of profit, control aspect, pricing aspects; cost dynamics; Fixed and variable costs- Break even charts- Turn over and unit costs. Variance analysis:- standard costs- standard costing- cost variancesMaterial variances-Over head variances- Labor variances- Fixed overhead variances- Sales variance. COST: Cost is the expenditure enquired in various operational activities, in order to manufacture or purchase and sell goods and services. ELEMENTS OF COST The cost of operating a catering unit or department is usually analyzed under three headings of 1. Material cost: Cost of food and Beverage consumed and the cost of additional items such as tobacco. (note; the cost of any food and beverage provided to staff in the form of meals is deducted from the material costs and added to labor cost). The food cost is then calculate by the formula Opening stock+ cost of purchases-closing stock-cost of staff meals = material cost 2. Labor cost: Wages and salaries paid to all employees plus any employer, contribution to government taxes, bonus, staff meals, pension fund etc 3. Over head cost: All costs other than material and labor cost, foe eg. Rent, rates, insurance, depreciation, repairs, printing and stationary, china and glassware, capital equipment. COST DEFINED; As most catering operations are subject to changes in the volume of business done, it is normal practice to express the elements of cost and net profit as a percentage of sales. A change in the volume of sales has an affect on the cost structure and on the net profit. Materials—30% Labor--- 30% Overheads---20% Net profit -20% Total cost - 80% Sales - 100% PROFIT: The term profit is defined as the excess of revenue/ income over expenditure/ cost incurred to conduct the economic activity. Nature of profit: Profit is the reward to the entrepreneur, for the entrepreneurial functions. In the words of” Drucker” “The surplus of current income over past cost is profit. It is measured by comparing the present income with the past average profits over a period. From the point of view of industry economy, profit is represented by the difference between current cost and current production and it is a sort of a premium for the future cost of staying in business and these profits differs from the return of other factors in three important respects; A) Profit is a residual income and not contractual or certain income as in the case of other factors. B) There are much grater fluctuations in profits than in the rewards of the other factors. C) Profits may be negative, where as rent, wages and interest must always be positive. Basic concept of profit; A) B) C) D) E) Profit is residue. Hence, it is exact forecast is not possible. Profit can be negative also. All business does not have equal opportunity for profits. Uncertainty of profit affects its magnitude year to year. Profit is an end product of dynamic economy. CONTROL; The managerial function of controlling is the measurement and correction of performance in order to make sure that enterprise objectives and the plans devised to attain them are being accomplished. Controlling is the function of every manager from president to supervisor. For making profits all people, top to bottom , must strive and control the costs. Although, the scope of control varies among managers, those at all level have responsibility for the execution of plans and control is therefore an essential managerial function at every level. The basic control process involves three steps. 1. Establishing standards 2. Measuring performance against these standards 3. Correcting variations from standards and plans PRICING ASPECTS; Price is the amount of money that has to be paid for a commodity or service. In legal terms, the price is the consideration for the title in a product or a commodity in exchange. In other words, the price is the quantity of money that has to be exchanged for one unit of a good or service. As a matter of fact, it is not easy to define price is in real life situation. When price is quoted, it is related to some assortment of goods and services. So price is what is charged for goods and services obtained. Any business transaction in our modern economy can be thorough of as an exchange of money the money being the price for something. An important objective of food & beverage control is to provide a sound basis for menu pricing including quotations for special functions. It is therefore, important to determine food menu and beverage list prices in the light of accurate food and beverage costs and other main establishments costs, as well as general market considerations, such as the average customer spending power, the prices charged by the competitors and the prices that the market will accept. COST DYNAMICS: Cost groups: It is necessary to examine costs not only by fixed cost, labor cost & over head cost but also by their behavior in relation to changes in the volume of sales. Costs may be identified by four kinds. FIXED COSTS; These are the costs which remain fixed irrespective of the volume of sales. Ex; rent, rates, insurance, etc... SEMI FIXED COST: These are costs which move in sympathy with but not in direct proportion to the volume of sales. For E.g. fuel cost, telephone, laundry etc.. VARIABLE COSTS; These are costs which vary in proportion to the volume of sales for ex. F&B TOTAL COSTS; This is the sum of the fixed costs, semi fixed costs & variable costs involved. BREAK EVEN ANALYSIS; It is very common for food & beverage management to be face with problems concerning the level of food & beverage cost that can be afforded, the prices that need to be set for F&B, the level of profit required at departmental & unit level & the no. of customers required to cover specific costs or to make a certain level of profit. B.E.A enables the relationship between fixed, semi fixed & variable cost at specific volumes of business to be conveniently represented on a graph. This enables the BEP to be identified & the level of net profit. The term BEP may be defined as that volume of business at which the total costs are equal to the sales and where neither profit nor loss is made. The technique is based on the assumption that the selling price remains constant irrespective of the volume of business: that certain unit costs remains the same over the sales range of the charted period; that only one product ( E.g. a meal) is being made or sold; that the product mix remains constant in cost price, Volume, labor & machinery productivity is constant. Nearly every action or planned decision in a business will affect the costs, prices to be charged the volume of business of the profit. Profit depends o the balance of the selling prices, the mix of products, and the volume of sale. The BE technique discloses the interplay of all these factors in a way which aids F&B in selecting the best course of action now & in the future. Pricing is a multi dimensional problem, which depends not only on the cost structure of a business & its specific profit objectives but also on the level of activity of the competition & the current business economic climate. B.E. FORMULA; Although a BE chart shows diagrammatically the varying levels of profit or loss from volume of sales, the level of accuracy f the information may at times be in doubt owing the scale of the graph& the skill of the person drawing it. A precise BEP may be calculated using the formula. BE = C ---------------------- =Units of out put at the BEP S-V Where C- The total capacity cost’, i.e.,, the costs of establishing the particular production capacity for an establishment. (For e.g., this would include rent, rates, insurance, salaries, building and machinery depreciation.) S- Sales price per unit V- Variable cost per unit. VARIANCE ANALYSIS. Standard cost: Standard costs are scientifically predetermined cost of manufacturing a single unit or a number of units of a product, or of rendering services during specified future periods. The main purpose of standard cost is to provide a base for control i.e., to fix desired targets in various areas, Thus standard costs are planned cost of a product or service under current and anticipated operating conditions. Standard assist the management in measuring performance and in ensuring efficiency in operations. Standards are laid down on the basis of past experience and records, current business trends and future forecast. Standards serve as a device, a yardstick, to measure the actual performance against the planned, that is, budgeted performances, and there by measure the deviation of actual performance form the standard performance. It enables the management to take corrective actions wherever necessary. STANDARD COSTING; Standard costing is used to as certain the efficiency and effectiveness of performance based on certain realizable measures of performances, known as standards, normally expressed in terms of percentages or in any other convenient means of measuring performances and comparisons. The purpose of standard costing is to reveal the difference between actual cost and standard cost. CIMA defines standard costing as “ a control technique, which compares standard costs and revenues with actual results to obtain variances which at used to stimulate improved performance”. ADVANTAGES OF STANDARD COSTING 1. It helps locate the causes of wastages and losses and eliminate them. 2. It helps activate and channelize human energy towards greater operational efficiency. 3. It nullifies the effects of Constants fluctuations in order to maintain standard prices and rates. 4. It helps objective judgment of people. 5. It focuses management attention only to those factors, which relates to deviation between standard and actual costs, thereby saving management time, energy and material. 6. It helps management in strategic planning for efficient operations. 7. It reduces administrative expenditure and costing and cost control procedures by introduction of simplified methods, systems and procedures of work. 8. It ensures continuity of cost reduction in operations 9. It helps in analyzing performance and interpreting information to enable the management to take appropriate decisions. VARIANCE: Variance is the difference between budgeted and the actual level of activity. It refers to the deviation of actual cost from standard cost. It reveals the extent to which the standards have been observed in the performance of activities and in achieving desired results, thereby enabling the management to take corrective measures wherever necessary. Variance help locate high cost areas, which may be so due to factors beyond the control of the management or due to inability of the authority to prevent rise in costs. Variance analysis in respect of each element of cost helps identify efficient and non efficient, productive areas, so as to detect the causes and factors responsible for the same and effect measures to improve the operational performance. Variance analysis means the analysis of performance. Variances can be classified into two categories as: 1. Cost variance 2. Sales Variance. COST VARIANCE It is the difference between what should have been the cost. i.e., standard cost and what has been the cost, i.e. actual cost. If the actual cost is lesser than the standard cost, the variance is termed as ‘favorable’. If, however, the actual cost I more than the standard cost, the variance is termed as ‘adverse’ or ‘un favorable’. Cost variance can be broadly classified in to the following. 1. Direct material cost variance. Material price variances Material usage variances a) material yield variance b) material mix variance 2. Direct labor cost variance Labor rate (wages) variances Labor efficiency( Time) variance 3 Over head cost variance Fixed overhead variance Variable overhead variance DIRECT MATERIAL COST VARIANCE This variance arises either on account to change in price or change in quantity or both and is calculated as under Direct material cost variance = Standard cost- Actual cost Standard cost = Standard price × Standard quantity for actual output Actual cost = Actual price × Actual quantity A). MATERIAL PRICE VRIANCES It is that portion of material cost variance which arises due to difference between the standard price specified and actual price paid. It reflects the price paid on the units purchased. If the actual price is more than standard price, the variance would be adverse and in case the standard price is more than the actual price, it would result in a favorable variance. It is calculated as under, Material price Variance = Actual quantity× (Standard price- Actual price) B). Material usage variance/ material volume variances It is that portion of material cost variances which arises due to difference between standard quantity of materials specified and actual quantity used. If the actual quantity used is more than standard quantity, the variance would be adverse and in case the standard quantity is more than the actual quantity used, it would result in a favorable variance. 1. Material Usage Variance = Standard rate × (standard quantity actual quantity Material yield variance: It is that portion of material usage variance which arises due to differences between actual yield obtained and standard yield specified. It enables effective control over usage f material. A lower actual yield is unfavorable and indicates inefficiency. It may be caused by defective operating methods, purchase and use of substandard quality of materials or improper handling and storing of material. It is calculated as under. II Material mix variance: It is that portion of the material usage variance, which is due to difference between the standard composition of mixing different type of materials and the actual composition. This variance arises a due to a change in the ration of actual material mix from the standard ratio of actual material mix from the standard ratio of material mix, and is calculated as under Revised std mix = Total actual quantity × std quantity of a material -----------------------------------------------------------Total std quantity Material mix variance = std cost of revised std mix – Std cost of actual mix DIRECT LABOUR COST VARIANCE; It reveals the difference between the standard direct wages fixed for the desired activity and the actual direct wages paid. The cost of labor depends upon two factors; wages rate and number oh hours worked. The labor variance is worked out as under Direct Labor Variance = Standard cost – Actual cost Standard cost= Standard rate × standard time for actual out put Actual cost = Actual rate × Actual time Labor Rate (wages) variance. LABOR RATE (WAGES VARIANCE) This variance is that part of the labor cost variance. This occurs due to difference between the actual rate paid and standard rate of pay fixed. If the actual rate is higher than the standard rate, the variance should be adverse and in case the standard rate is more than the actual rate, it would result in a favorable variance. It is calculated as under; Labor rate (wages) Variance: This variance is that part of the labor cost variance. This occurs due to difference between the actual rate paid and the standard rate of pay fixed. If the actual rate is higher than the standard rate, the variance should be adverse and in case the standard rate is more than the actual rate, if would result in a favorable variance. It is calculated as under: Labor rate variance = Actual time× (Standard rate- Actual rate) Labor efficiency (Time) Variance: It is the part of the labor cost variance , which occurs due to difference between the standard labor hours specified for the activity achieved and the actual labor hours spent for the activity, and is worked out as under: Labor efficiency variance = Standard rate × (standard time – actual time) Over head cost variance It is the difference between the standard / budgeted overheads for actual output and actual overhead. It is the total of both fixed and variable overhead variance, and is worked as under; Overhead cost variance = standard cost – actual cost Overhead cost variance = fixed overhead variance + variable overhead variance. Standard overhead cost = standard rate × actual output This variance can be divided into (a) fixed overhead variance (b) variable overhead variance. Fixed overhead variance It is the difference between standard fixed overhead for actual output and actual fixed overheads incurred, and are calculated as under; Fixed over head = standard fixed overhead – Actual fixed overhead Std fixed overhead = std fixed rate × Actual output Variance overhead variance It is the difference between standard variable overheads for actual output and actual variable overheads incurred, and are calculated as under: Variable overhead variance = standard variable overhead – Actual variable overhead Standard variable overhead = std variable rate × actual output. Sales Variance: It is the difference between that should have been the sales, i.e. budgeted sales. And what have been the sales. i.e., actual sales. If the amount of actual sales is more than the budgeted sales, the variance is said to be ‘favorable’. If, however, the amount of actual sales is less than the budgeted sales; the variance is said to be ‘adverse’ or ‘unfavorable’. Sales variances can be broadly classified into the following: I. sales price variance II. sales volume variances I. Sales price variance This is the difference between the budgeted selling price for actual; quantity and the actual selling price, and is calculated as under: Sales price variance = Actual quantity sold × (Actual price – Std price) II. Sales volume variance This variance represents the difference between the budgeted quantity and actual quantity of goods sold, and is calculated as under: Sales volume variance = Std price × (actual volume – Budgeted volume) Suggested Questions: 1. Define cost? 2. Define profit? 3. Define pricing? 4. Classification of sales variances? 5. Classification of cost variances? 6. Explain elements of cost? 7. Basic concept of profit? 8. Explain BE formula? 9. Explain cost groups? 10. Explain variances?