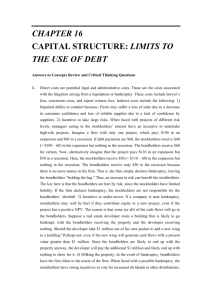

Corporate Finance

advertisement

.- Corporate finance PROF. ALESSANDRO PENATI COURSE AIMS The objective of the course is to understand and explain corporate financial policies. The best way to illustrate corporate finance is to list a few practical questions that the course will try to answer: what determines the value of a corporation? What is the value of flexibility in an investment project? How corporations decide their level of indebtedness? Is there an optimal debt policy? Why does a company go public? Or decide to merge with another? Or raise capital? Or pay dividends? Can a corporation measure its exposure to financial risk? Can we assess the probability of corporate default? What corporations do to emerge from bankruptcy, or to avert it? For each topic examined, the course will provide a theoretical framework for analyzing it, will review the empirical evidence, and will discuss a few case studies. The course is useful for those interested in dealing with corporate securities, working for the banks, asset managers, consultants, private equity, as well as corporations. Active participation is encouraged and highly desirable, albeit not compulsory. COURSE CONTENT Prerequisites A good understanding of the following concepts is required for the course: – accounting principles, including the consolidated balance sheet and the cash flow statement; some familiarity with Ias rules is desirable but not required; – multiperiod capital budgeting and discounted cash flow analysis (working knowledge); – capital asset pricing model (working knowledge); – term structure of interest rates: estimation, discounting, zero coupons, forward rates (working knowledge); – derivatives pricing: forwards, swaps, options (Black-Scholes, binomial) (working knowledge); – basic knowledge of risk aversion, decision under uncertainty, adverse selection and moral hazard; – linear regression model; rudimentary knowledge of time series analysis and panel date is desirable but not required. 1. Valuation – Multiperiod capital budgeting and the value drivers; assessing the value of growth; growth and the return on invested capital; – different ways of assessing the cost of capital; risky debt and the cost of capital; – value and corporate tax policies; – value and highly leverage transactions; value and corporate diversification; – corporate performance analysis; – real options: measuring the value of flexibility in capital budgeting; types of real options; valuing simple and compound options. 2. Corporate financial structure: debt – Determining the cost of corporate debt; the equilibrium Merton model; empirical models for pricing corporate debt; corporate debt and the swap market; – the determinants of rating; rating and the cost of debt; rating and corporate financial policies; – leverage buyouts and other highly leverage transactions; – bankruptcy costs and the traditional theory of the capital structure; – asymmetric informations and alternative theories of the capital structure; – the economic theory of bankruptcy; the cost of default; corporate reorganization and bankruptcy procedures; debt for equity swaps; leasing. 3. Corporate financial structure: equity – Dividend policy: determinants and the theory of optimal dividend policy; taxes and dividends; – dividends and the value of corporations (announcements, signaling, reputation); corporate equity repurchases; – seasoned equity offering; underpricing; delevering; warrants and convertibles; – initial public offerings (Ipos): underpricing; performance analysis; the mechanisms for pricing Ipos; – initial public offerings: why corporations go public; – mergers and acquisitions; takeovers; carve outs and spin offs. 4. Risk management: an introduction to financial engineering – A general framework for devising and managing corporate financial risk; an overview of the risk management process; – measuring and managing interest rate risk; – measuring and managing forex and commodity risk; – hybrid securities; puttable, callable, extendable debt, debt plus swap, debt plus option, indexed debt; – equity based derivatives for corporate financial policies; – credit default swaps and the cost of corporate debt. READING LIST There is no textbook for the course, but a reading list of articles that will be made available on the course web site on Blackboard. Class notes, teaching material and further references will be also available on Blackboard. TEACHING METHOD Class lectures (50 hours) and classroom review of empirical works (10 hours) . ASSESSMENT METHOD Option (a). For those attending regularly, the final grade is based on 3 take-home case studies or problem sets assigned during the course (70% of the grade) plus a final term paper, consisting of a small empirical work on a subject matter freely chosen by the students (30% of the grade). Option (a) is an option, not a requirement; but can be exercised only on the first useful exam date in June. Option (b). A written exam with three questions (90 minutes). This exam format is valid on all exam dates. NOTES Prof. Alessandro Penati meets students on Tuesday from 10,30 to 12,30 (via Necchi 5, room C-10) or by appointment alessandro.penati@unicatt.it.