Smartie Task and Stock

advertisement

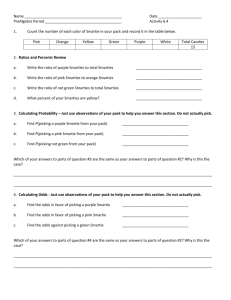

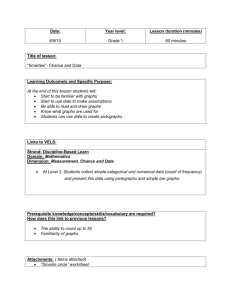

Stock Concepts Task 1 You may open your box of Smarties now, but don’t eat them yet! a. Assume that all your Smarties are very rare and you can sell them for $500 each. Complete the table below showing how much revenue you will make if you sell the following quantities. Quantity sold Revenue earned 1 Smartie 3 Smarties 7 Smarties The full box b. Explain the relationship between the quantity sold and the revenue earned. c. Each Smartie that you have available for sale was purchased at a cost price of $300. Complete the table below showing the cost of sales for the following quantities sold. Quantity sold Cost of sales 1 Smartie 3 Smarties 7 Smarties The full box d. Explain the relationship between the cost of sales and the quantity sold. e. Define the term cost of sales. f. When selling stock it is important to sell it for more than we paid for it. Define the term gross profit. g. Complete the table below showing the gross profit earned when the following quantities have been sold. (Continue to assume that we sell them for $500 each and that they cost $300 each.) Quantity sold Gross profit 1 Smartie 3 Smarties 7 Smarties The full box The revenue earned from the sale of Smarties must be considered in relation to the cost of sales in order to determine gross profit. h. The cost of sales is only one expense that a business has to pay. Using the expenses shown below, complete the following Income Statement, assuming that you sell all your Smarties. MS ROSSER’S SMARTIE SHOP Income Statement for the month ended 30 September 2015 Revenue Less Gross profit Less Expenses Rent $400 Wages 250 Office Expenses 180 Advertising 1 200 Delivery Expenses 95 Net _______ $ i. With reference to one qualitative characteristic, justify the inclusion of the delivery expenses in the Income Statement. Task 2 In the competitive world market, demand for Smarties varies a lot. Customer demands for different colours vary according to the fashions and trends of the season. You have set the following prices for the coming months. a. Complete the following table, showing the gross profit per item for each colour sold. Colour Cost price Selling price Brown $150 $250 Green $200 $300 Yellow $250 $350 Orange $300 $400 Purple $400 $600 Pink $450 $750 Blue $600 $900 Red $1 000 $1 400 Gross profit per Smartie b. Using your packet of Smarties, calculate the following items, assuming that all your Smarties are sold. Working space Answer Revenue earned Cost of sales Gross profit c. Complete the Income Statement below using the information you calculated in Question 2b. _________________________ SMARTIE SHOP Income Statement for the month ended 30 September 2010 Revenue Less Gross profit Less Expenses Wages $500 Security Expense 400 Office Expenses 560 Advertising 450 Vehicle Expenses 100 Net _______ $ ‘Cooking the Books’ Paige Turner owns a specialist bookshop in Mountain Gate called ‘Cooking the Books’. Paige purchases a range of cookbooks from Roland Butta, a small publisher of cookbooks in country Victoria. On 31 January 2016 Paige had a number of different books in stock but in February she decided to monitor the progress of her favorite volume: Fry Me to the Moon. At 31 January 2016 she had $2 200 of stock of this book in her shop. Transactions involving the book Fry Me to the Moon for February 2016 were as follows: Feb. 1 Purchased 100 copies at $10 each, plus GST of $1 per copy, on account (Invoice 124) 3 Sold 15 copies to Wangaratta TAFE for $330 (GST included) (Invoice S17) 8 Weekly cash sales totalled 320 copies at $20 per copy (plus GST) CRR 10 Purchased 80 new books at $12.10 each, including $1.10 GST. (Invoice 129) 11 Sold 35 books at $21 per copy, plus GST of $2.10 per copy, to Endeavour Hills College. (Receipt 615) 15 Weekly sales of 24 books for $504 plus GST of $50.40. CRR 15 Paige took a book home for her sister’s birthday. (Memo 7) 17 Paige purchased 150 books for $12 each, plus GST. (Invoice 136) 18 The publisher, Roland Butta, advised Paige that due to spiralling costs the latest books would be $15 each, but as she is a loyal customer she could have 75 books for $13 plus GST if she ordered immediately. Paige took advantage of this offer. (Invoice 139) 21 Paige increased the sale price to $24.75, including GST. She sold 100 copies to the South Australian Education Department. (Invoice S40) 23 Paige made a donation of five copies of the book as raffle prizes for a local netball club fundraiser. The netball club informed its patrons that the books were valued at $30 each. (Memo 10) 25 Weekly sales were 117 units. Revenue for these sales was $2 632.50. CRR 28 Purchased 200 copies for $15 each plus GST for cash. (Cheque 995) 29 The Perth Institute of Gastronomy received a quote from Paige offering books at $19.95 each, including GST. A minimum order quantity of 80 is required. 29 A physical stocktake revealed that there were 261 books in stock. (Memo 12) REQUIRED 1 Enter the transactions for the book Fry Me to the Moon onto the stock card. 2 Calculate the cost of sales for this book for February 2016 3 Explain why the figure calculated in Question 2 may not necessarily be the Cost of Sales figure reported in the Income Statement for February 2016 4 Explain what is meant by the term ‘perpetual inventory system’. 5 List three reasons that may have accounted for the stock loss identified by the physical stocktake. 6 Explain why credit purchases on 1 February and 10 February 2016 did not have consecutive invoice numbers. 7 With reference to an accounting principle, explain your treatment of the transaction in Memo 7 on 15 February 2016 8 Paige Turner feels that the cost price of her stock of books should really be at least 10% more than it actually is in order to reflect the high-quality paper used. With reference to a qualitative characteristic and an accounting principle, explain why she should not amend the cost price of the books. Question 1 Stock Item: Fry Me to the Moon Cost Method: Stock Code: CB 0001 Supplier: IN Date Feb. 1 Details Balance Qty Unit cost __________ Roland Butta OUT Value Qty Unit cost BALANCE Value Qty 275 Unit cost Value 8 2 200 Question 2 Calculation Cost of Sales $___________ Question 3 Explanation Question 4 Explanation Question 5 Reason 1 Reason 2 Reason 3 Question 6 Explanation Question 7 Explanation Question 8 Qualitative characteristic Explanation Accounting principle Explanation