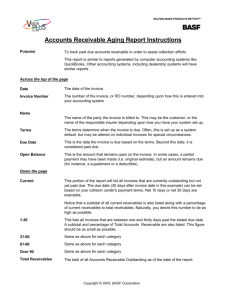

Chapter Four - Accounts Receivable

advertisement