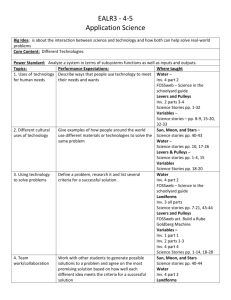

Sample of ExecPlan Graphs

advertisement

This sample illustrates some of the graphs that ExecPlan generates. These graphs can automatically be inserted into the ExecPlan Text and Snapshot Reports or saved in JPEG or WMF files for insertion into an MS Word, Excel, or PowerPoint presentation. Any of the graphs illustrated here can be easily changed to 2D/3D, line, area, tape, bar, stacked or unstacked, etc. And each of these graphs can be generated for any scenario, i.e. at client's death, disability, at spouse's death, etc. If we do not have a graph here that you want, call us and we can create a custom graph for you from any of the listed values at the end of this sample. SAMPLE GRAPHICS SAWHNEY SYSTEMS 777 Alexander Rd Princeton, NJ 08540 (800) 850-8444 www.execplan.com The Following page lists the items ExecPlan tracks year by year that can be used to create a graphical illustration 0 "State Tax" 1 "Case Title/Heading" 2 "Common Last Name" 3 "Name-Client" 4 "Name-Spouse" 5 "Street Address" 6 "City State Zip" 7 "Telephone #" 8 "Planning Firm" 9 "Firm Address" 10 "Planning Date" 11 "Case Assumptions" 12 "Foot Notes" 13 "Tax Filing Status" 14 "Total Dependents" 15 "Specific Percentage" 16 "Inflation Rate (%)" 17 "Annual Fed Tx Pmt%" 18 "Anul State Tx Pmt%" 19 "State Tax Code" 20 "State Tax Formula" 21 "Local Tax Formula" 22 "Past Inc Tax Due" 23 "Specific Text file" 24 "Long Rng Plan Info" 25 "Idle Cash on Hand" 26 "Saving/NOW Acts" 27 "Cert of Deposits" 28 "Money Market Fund" 29 "Treasury Bills" 30 "U S Govt Bonds" 31 "Corporate Bonds" 32 "Municipal Bonds" 33 "Stock/Securities" 34 "Notes Receivable" 35 "Specific Bond" 36 "Mutual Funds" 37 "Business/Ptshp" 38 "Closely Held Corp" 39 "S Corporation" 40 "Trade/Bus Invstmt" 41 "Simple Investment" 42 "Net Lease Invstmt" 43 "Lmtd Prtnrshp Inv" 44 "Unit Investment" 45 "Residence" 46 "Vehicle" 47 "Furniture/Fixture" 48 "Gems & Jewelry" 49 "Art & Antique" 50 "Life Ins Cash Val" 51 "Personal Property" 52 "Other Pers Assets" 53 "Ind Ret Plan-IRA" 54 "Keogh Plans" 55 "Company Ret Plan" 56 "Othr Retrmnt Plan" 57 "Deferred Comp" 58 "Profit Sharing" 59 "Stk Optn-Nonqual" 60 "Stk Options-ISOS" 61 "Stk Options-SARs" 62 "Emp Stk Prch Plans" 63 "Annuities" 64 "Home Mortgage" 65 "Amortzd Pers Debt" 66 "Other Prsnl Debt" 67 "Inv Notes Payable" 68 "Simple Inv Debt" 69 "Inv Note/Unit" 70 "Liabilities" 71 "Life Insurance" 72 "Disability Ins" 73 "Med/Long-Term Care" 74 "Property/Liability" 75 "Home Insurance" 76 "Compensation-Cl" 77 "Business Inc-Cl" 78 "Compensation-Cl" 79 "Payout Def Comp-C" 80 "Pension/IRA Inc-C" 81 "Business Inc-Cl" 82 "Lump-Sum Dist-Cl" 83 "Compensation-Sp" 84 "Business Inc-Sp" 85 "Compensation-Sp" 86 "Payout Def Comp-S" 87 "Pension/IRA Inc-S" 88 "Business Inc-Sp" 89 "Lump-Sum Dist-Sp" 90 "Taxable Int-Cash" 91 "Fed Txfree Int-Ca" 92 "State Txfre Int-C" 93 "Qual Dividends-C" 94 "Nonql Dividends-C" 95 "Txble Int-Noncash" 96 "Fed Taxfree Int-N" 97 "State Txfre Int-N" 98 "Qual Dividends-N" 99 "Nonql Dividends-N" 100 "State Tax Refund" 101 "Rents/Royalties" 102 "Lmtd Ptnr Inc-N" 103 "Net Inv Inc-Ncsh" 104 "Other Income-Csh" 105 "Other Inc-Noncsh" 106 "Soc Security Inc" 107 "OASDI-Exmpt WgC" 108 "OASDI-Exmpt WgS" 109 "Short Trm Gn/Loss" 110 "Long Term Gn/Loss" 111 "LTCG Princpl Res" 112 "Mid Term Gn/Loss" 113 "MT Cap Gn AdjAMT" 114 "ST Cap Gn AdjAMT" 115 "LT Cap Gn AdjAMT" 116 "Small Business Gain" 117 "Emp Bus ExpenseC" 118 "Ret Plan Contrb-C" 119 "Other AGI Deduction" 120 "Emp Bus ExpenseS" 121 "Ret Plan Contrb-S" 122 "Alimony Paid" 123 "Moving Exp" 124 "Interest Penalty" 125 "Five Yr Cap Gn/Loss" 126 "Med Ins Premium" 127 "Medicine & drugs" 128 "Other Medical" 129 "State & local Tax" 130 "Real Estate Tax" 131 "Sales Tax" 132 "Other Taxes" 133 "Home Mortg Int" 134 "Pers Int Exp" 135 "Cash Inv Int" 136 "Charity Contrb50%" 137 "Charity Contrb30%" 138 "Charity Contrb50%" 139 "Charity Contrb30%" 140 "Charity Contrb20%" 141 "Casualty Loss" 142 "Misc Ded-2% Limit" 143 "Noncash Inv Int" 144 "Other Deductions" 145 "Misc Ded-2% Limit" 146 "Other Deductions" 147 "1250 Capital Gain" 148 "Sales Proceeds" 149 "Withdrawls Made" 150 "Cash Received" 151 "Debt Recovered" 152 "Tax Free Interest" 153 "Social Security" 154 "Untxd Ret Plan W/d" 155 "Cash Borrowed" 156 "Purchases Made" 157 "Cash Deposits" 158 "Cash Contributed" 159 "Employee Contribs" 160 "Principal Pmt" 161 "Nondeductible Pmt" 162 "Child Education" 163 "Food" 164 "Clothing" 165 "Entertainment" 166 "Vacations" 167 "Gifts/Celebrations" 168 "Transportation" 169 "Insurance Premium" 170 "Rent" 171 "Repair/Maintenance" 172 "Utility/Phone" 173 "Household Frnshg" 174 "Other Supplies" 175 "Other Living Exp" 176 "Special Acquisitions" 177 "5yr Cap Gn AdjAMT" 178 "Tax-Free Income" 179 "1250 Cap Gn AdjAMT" 180 "Average Idle Cash" 181 "Overall Investmnt" 182 "Specific Invstmnt" 183 "Debt Liquidation" 184 "Z" 185 "Cash Management Sls" 186 "Soc Sec Information" 187 "Each Child's Info" 188 "Tax-Free Int NonC" 189 "Education Plan" 190 "Distributions" 191 "Txbl E'er Contribs" 192 "Ded E'ee Contribs" 193 "Lump Sum Distrib" 194 "Loan Repayment" 195 "Inv Income Electn" 196 "Estate Deductions" 197 "State Estate Tax" 198 "Estate Adjustmts" 199 "Estate Alteration" 200 "Date" 201 "Taxed Portion" 202 "Cash Expenses" 203 "Ret Plan Rollovers" 204 "NonCash Investment" 205 "Ret Plan Excise Tx" 206 "Addt'l Inc Tax" 207 "Recap of ITC" 208 "Other Taxes" 209 "Credit Carryovers" 210 "Elderly Credit" 211 "Foreign Tx Credit" 212 "Business Credit" 213 "Hope Scholarship Cr" 214 "Child Care" 215 "Ernd Inc Crd Ovrde" 216 "NonRefundable Crs" 217 "Refundable Credits" 218 "Base Adj A M T" 219 "Foreign Tax Credit" 220 "Inv Exp Tax Prefs" 221 "Other Tax Prefs" 222 "Exclusion Tax Pref" 223 "Inv Int Sch E" 224 "Lifetime Learn Cr" 225 "Carryover Sch E" 226 "Carryover Sch A" 227 "Cost/Basis" 228 "SBC Gain Distrib" 229 "Small Business Gain" 230 "Acccrued Interest" 231 "Tax Rate Overrides" 232 "Inv Int Exp AdjAMT" 233 "Max Inc Fr OASDI Tx" 234 "Max Inc Fr Medicare" 235 "Medicare Hosp Rate" 236 "Soc Sec Tax Rate" 237 "Self Emp Tax Rate" 238 "Depreciation" 239 "Misc Plan'g Info" 240 "Recommendations" 241 "Base X Adjustment" 242 "Base Y&Z Adjstmnt" 243 "Z" 244 "Z" 245 "Z" 246 "Z" 247 "Z" 248 "Z" 249 "Z" 250 "Z" 251 "Z" 252 "Z" 253 "Z" 254 "Cash Contribution" 255 "Cash Distribution" 256 "Add'l Tax Prefs" 257 "AMT C/O & LTCG/Ls" 258 "Simple Liabilities" 259 "Inv Int (noncash)" 260 "Expense (noncash)" 261 "Gross Profit" 262 "Cash Expenses" 263 "All Tax-Free Divs" 264 "Personnel Cost" 265 "Ordinary Income" 266 "Wages to Client" 267 "Actuarial Value" 268 "Depreciation" 269 "Misc Noncash Exp" 270 "Cash Retain/Dist" 271 "Liabilities" 272 "Taxes Paid/Owed" 273 "Ordinary Income" 274 "Tax-Deferred Grwth" 275 "Inv Int (noncash)" 276 "Employer Contribs" 277 "Passive Loss C/O" 278 "Psv Loss C/OAMT" 279 "Annuity Withdrawal" 280 "Growth in Mkt Value" 281 "Cap GainLumpsum" 282 "Business Credits" 283 "Business Credits" 284 "State Ord Inc Elmt" 285 "Activation Code" 286 "Max $ to Invest" 287 "Max % to Invest" 288 "Sales" 289 "Withdrawals" 290 "Shares Purchased" 291 "Shares Sold" 292 "Qualfd Dividends" 293 "Ord Inc Element" 294 "Ordinary Dividends" 295 "Cash Contribution" 296 "Cash Distribution" 297 "Tax Prefs -Direct" 298 "AMT C/O & LTCG/Ls" 299 "State Cap Gn Elmnt" 300 "Characteristics" 301 "Idle Cash on Hand" 302 "Saving/Now Acts" 303 "Cert of Deposits" 304 "Money Market Fund" 305 "Treasury Bills" 306 "U S Govt Bonds" 307 "Corporate Bonds" 308 "Municipal Bonds" 309 "Stock/Securities" 310 "Notes Receivable" 311 "Specific Bond" 312 "Mutual Funds" 313 "Business/Ptshp" 314 "Closely Held Corp" 315 "S Corporation" 316 "Trade/Bus Invstmt" 317 "Simple Investment" 318 "Net Lease Invstmt" 319 "Lmtd Prtnrshp Inv" 320 "Unit Investment" 321 "Residence" 322 "Vehicle" 323 "Furniture/Fixture" 324 "Gems & Jewelry" 325 "Art & Antique" 326 "Life Ins Cash Val" 327 "Personal Property" 328 "Other Pers Assets" 329 "Ind Ret Plan(IRA)" 330 "Keogh Plans" 331 "Company Ret Plan" 332 "Othr Retrmnt Plan" 333 "Deferred Comp" 334 "Profit Sharing" 335 "Stk Optn-Nonqual" 336 "Stock Option-ISOS" 337 "Stock OptionSARs" 338 "Emp Stk Prch Plan" 339 "Annuities" 340 "Home Mortgage" 341 "Amortzd Pers Debt" 342 "Other Pers Debt" 343 "Amortzd Inv Debt" 344 "Other Inv Debt" 345 "Amortzd Pers Debt" 346 "Scratch Set" 347 "Bonds Sold" 348 "Annuity Termination" 349 "Fed Tax-Free Divs" 350 "Liabilities" 351 "Characteristics" 352 "State Tax-Free Divs" 353 "Tax Information" 354 "Capital Gain Distrib" 355 "Undistrib Cap Gain" 356 "Shares Sold" 357 "Purch Price Override" 358 "Sales Charges" 359 "Special Calculations" 360 "Int Inc Override" 361 "Liquid Assets" 362 "Nonliquid Assets" 363 "Total Assets" 364 "Total Liabilities" 365 "Net Worth" 366 "Earned Income" 367 " Dividend Exclsn" 368 "Taxable Int+div" 369 "Adj Gross Income" 370 "Investment Income" 371 "Capital Gain Ded" 372 "S T Loss Carryover" 373 "L T Loss Carryover" 374 "Net Capital Gain" 375 "Gross Deductions" 376 "Standard Deduction" 377 "Allowed Deductions" 378 "Pers Exemptions" 379 "Taxable Income" 380 "Roth IRA Mod AGI" 381 "Cash Income" 382 "Interest Income" 383 "Dividends Rcvd" 384 "Personal Earnings" 385 "State Tax Refund" 386 "Total Cash Inflow" 387 "Tot Cash Available" 388 "Nondeductible" 389 "Tax Deductible" 390 "Taxes Paid" 391 "Past State Tx Pd" 392 "Ord Inc--Lump Sum" 393 "Stk Optn Exercisd" 394 "Past Fed Tax Pd" 395 "Fed Tax Refund" 396 "Tot Cash Outflow" 397 "Cash Balance" 398 "Medical" 399 "Charitable 50%" 400 "Charitable 30%" 401 "Charitable 20%" 402 "Casualty Loss" 403 "Contrib Dsalwd50%" 404 "Contrib Dsalwd30%" 405 "Cap Gns--Lump Sum" 406 "Inv Int Disalowd" 407 "Interest+Dividends" 408 "Assets Sold" 409 "Cash Borrowed" 410 "Cash Invested" 411 "Debt Liquidated" 412 "Fed Tax Paid" 413 "State Tax Paid" 414 "Local Tax Paid" 415 "Fed Tax Due" 416 "State Tax Due" 417 "Local Tax Due" 418 "St Loss Disallowed" 419 "Lt Loss Disallowed" 420 "Regular Tax" 421 "Income Averaging" 422 "Net Regular Tax" 423 "Gross Alt Min Tx" 424 "Gross Fed Inc Tax" 425 "Self Employmt Tax" 426 "Lump-Sum Dist Tax" 427 "Alt Minimum Tax" 428 "Past ITC Carryovr" 429 "ITC Disallowed" 430 "Other Fed Taxes" 431 "Fed Income Tax" 432 "NT Passive Income" 433 "Net Psv Inc-AMT" 434 "Fed Tax BracketOrd Inc" 435 "Top Rate Appl'd to" 436 "$ to Next Bracket" 437 "Next Bracket" 438 "Previous Bracket" 439 "$ to Prev Bracket" 440 "Contrib Dsalwd20%" 441 "Personal Interest" 442 "Disallowd Pers Int" 443 "FICA/Soc Sec Tax" 444 "State Tax 1" 445 "State Tax 2" 446 "State Tax 3" 447 "State Tax 4" 448 "State Tax 5" 449 "State Tax 6" 450 "State Tax 7" 451 "State Tax 8" 452 "State Tax 9" 453 "State Tax 10" 454 "State Tax 11" 455 "State Tax 12" 456 "Tot State/Local Tx" 457 "State Inc Tax" 458 "Local Inc Tax" 459 "Total Inc Tax" 460 "Gross Real Inc" 461 "Net Real Income" 462 "Cur Real Inc =" 463 "Purch Power Drop" 464 "At Infltn Rate of" 465 "Norml Cash Inflow" 466 "Norml Cash Outflw" 467 "Tot Cash Availble" 468 "Cap Loss Disallwd" 469 "Inv Int Disalwd E" 470 "Inv Int Disalwd A" 471 "Indexing Factor" 472 "Disallowed Misc Ded" 473 "Medical Disallowed" 474 "Contributions" 475 "Charity Disallowd" 476 "Interest Exp Ded" 477 "Casualty Disalwd" 478 "Misc Expense Ded" 479 "S.E. Tax Dedctn" 480 "AMT Exemptions" 481 "Tot Tax Prefs" 482 "AMT Taxable Inc" 483 "Tax Deductions" 484 "Alt Min Tx Credit" 485 "Total Asset Value" 486 "Liabilities" 487 "Cash Contributed" 488 "Cash Received" 489 "Ordinary Income" 490 "Lt Capital Gain" 491 "Depreciation" 492 "Invstmt Interest" 493 "Other Expenses" 494 "Alt Min Tax Adjs" 495 "Inv Tax Credit" 496 "Investment Income" 497 "Fed Tx Refund Due" 498 "Overpaid State Tx" 499 "Overpaid Local Tx" 500 "Txbl Social Sec" 501 "Total Asset Value" 502 "Liabilities" 503 "Cash Contributed" 504 "Cash Received" 505 "Hsg Credit C/over" 506 "Spouse Earnd Inc" 507 "Qual Dividends" 508 "Interest Expense" 509 "Short Term Gain" 510 "Long Term Gain" 511 "Ordinary Income" 512 "Tax Preferences" 513 "Capital Gain Pref" 514 "Other Qual Int" 515 "Earned Inc Credit" 516 "Max Tax on Cap Gn" 517 "Othr Bus Crd C/O" 518 "Othr Bus Crd Dsalwd" 519 "Allowed FTC (AMT)" 520 "Credit Carryback" 521 "State Tax 13" 522 "State Tax 14" 523 "State Tax 15" 524 "State Tax 16" 525 "State Tax 17" 526 "State Tax 18" 527 "State Tax 19" 528 "State Tax 20" 529 "State Tax 21" 530 "State Tax 22" 531 "State Tax 23" 532 "State Tax 24" 533 "State Tax 25" 534 "State Tax 26" 535 "State Tax 27" 536 "State Tax 28" 537 "State Tax 29" 538 "State Tax 30" 539 "Net Inv Income" 540 "Net Inv Inc-AMT" 541 "Total Inv Int" 542 "Psv Ls Ald-Rental" 543 "Psv Ls Ald-Phs-In" 544 "Psv Ls Ald--MT Rnt" 545 "Psv Ls Phs-in RdcIIE" 546 "Rntl Credt C/over" 547 "Psv Credit C/over" 548 "Hsg Credit C/over" 549 "Inv Int Exp Sch E" 550 "Inv Int C/O-AMT" 551 "Cap Gain at 20%" 552 "Ret Plan Excise Tx" 553 "Psv Ls Ald-Sales" 554 "Psv Ls Ald-MT Sls" 555 "Reductn for High Inc" 556 "AMT Credit C/Over" 557 "Capital GainsAMT" 558 "ST Cap Ls C/OAMT" 559 "LT Cap Ls C/OAMT" 560 "Fed Tax Less FTC" 561 "Adjusted AMTI" 562 "Administrative Exp" 563 "Individual Debts Pd" 564 "Bequests to Others" 565 "Social Security Inc" 566 "Estate/Death Taxes" 567 "Discr Spending" 568 "AMTI Bfr Excl" 569 "Federal Tax Due" 570 "Fed Tax Due 2 Years" 571 "Fed Tax Due 3 Years" 572 "LTCG treated as Ord" 573 "LTCG Txd at Max Rt" 574 "MT Cap Ls C/OAMT" 575 "ST Loss Carryover" 576 "LT Loss Carryover" 577 "MT Loss Carryover" 578 "5YR Loss Carryover" 579 "5YR Cap Ls C/OAMT" 580 "Ed Loan Ded Int" 581 "Hope Scholarship Cr" 582 "Lifetime Learn Cr" 583 "Child Tax Credit" 584 "MA LT Cap Loss C/O" 585 "MA ST Cap Loss C/O" 586 "Fed Capital Gain Rate" 587 "Fed Effective Tax Rate" 588 "Cl SS Max Benefit" 589 "SP SS Max Benefit" 590 "L/T Care PremiumCL" 591 "L/T Care PremiumSP" 592 "Ded L/T Care PremCL" 593 "Ded L/T Care PremSP" 594 "L/T Care ExpenseCL" 595 "L/T Care ExpenseSP" 596 "L/T Care BenefitCL" 597 "L/T Care BenefitSP" 598 "L/T Care Cumm Effect-CL" 599 "L/T Care Cumm Effect-SP" 600 "Z"