GRADE 11 WEEK 23 - Lesson 1 of 16 LESSON 73

advertisement

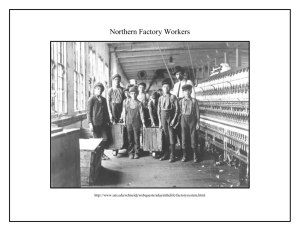

GRADE 11 WEEK 23 - Lesson 1 of 16 LESSON 73 MANUFACTURING REVISION GRADE 10 - WORKSHEET 1 In grade 10 and 11 we have learnt about service and trading concerns. In these types of businesses the goods that are sold were bought from a supplier and then re-sold. We will now learn about manufacturing businesses. The manufacturing concern will first manufacture (make) the goods from raw materials and then sell them to their customers. Making or manufacturing goods will involve a process. Manufacturing is a process of taking raw materials and make it into completed products. These completed products are called finished goods. Some processes are very simple. An example is making “ice lollies” which involves filling plastic bags with flavoured water, sealing the plastic bag and then freezing them. The lollies that we buy are the finished goods On the other hand the manufacturing process may be very complicated. An example is manufacturing a motor car. Look inside the engine compartment of a motor to see how many parts will have to be put together before the motor car is complete. Aim of a manufacturing concern In all cases the aim of manufacturing goods is to be able to sell the goods at a profit. In order to be able to make a profit we must sell the goods for more than it cost to make. It is, therefore, very important to be able to calculate the total cost to manufacture the goods so that we can accurately calculate the selling price. 73 Accounting Grade 11 - CAPS 1 REVISION GRADE 10 - WORKSHEET 2 PRODUCTION COSTS: DIRECT & INDIRECT COSTS Let us make a table What do we need to make a table? wood steel nails / screws varnish glue water and electricity workers who make the tables supervisors security to protect the factory cleaners and cleaning material insurance for the factory rent for the factory machinery Let us name the resources that were used to make a table wood steel nails / screws varnish glue workers who make the tables supervisors security to protect the factory cleaners cleaning material insurance for factory rent for factory electricity for factory Direct raw materials Indirect raw materials Direct labour Indirect labour Overhead costs depreciation on factory machinery = overhead costs Machinery = fixed assets 73 Accounting Grade 11 - CAPS 2 Let us revise these concepts. Direct Raw material costs The material that goes into the production of the finished goods and can be directly identified with the final product, e.g. wood is the raw material to make a table. It is material that I can touch and see and feel. Indirect material costs This is an insignificant part of the finished product, e.g. the nails, varnish and glue are indirect material costs. Direct labour costs This is the amount paid to workers who actually make the product (directly involved in making the product) Indirect labour costs This is the amount paid to workers in the factory who are not directly involved with the making of the product. Factory overhead costs (indirect costs) These are indirect costs. These are the expenses to run the factory, but none of them are directly involved with the making of the product. Indirect labour and indirect materials are treated as part of manufacturing overheads The word used to describe a single product made in the factory Unit BASELINE ACTIVITY 1 LABOUR COSTS REQUIRED The following table shows the people who are working in the factory that produces tables. Classify the costs by making a tick in the appropriate columns. Direct labour costs Work done by person Factory worker making the tables Cleaner Security guard Foreman Person looking after the stock 73 Accounting Grade 11 - CAPS 3 Indirect labour costs BASELINE ACTIVITY 2 DIRECT / INDIRECT COSTS REQUIRED Make a cross to indicate which items can be regarded as Direct costs / Indirect costs Direct Indirect Cost item costs costs Rent of factory Wages of cleaners Wages of employees using tools working on the product. Insurance of the equipment in the factory plant. Maintenance of the factory buildings. Cost of raw materials included in the finished products. Depreciation on factory equipment. Consumables issued to the factory BASELINE ACTIVITY 3 PRODUCTION COSTS REQUIRED Identify whether the following production costs are Direct Material Cost, Direct Labour Costs or Factory Overhead costs. Tick the correct column. Description of costs Fabric used to make jackets Cleaning materials Salary of the Security guard Wood used to make a chair Wages of workers who assemble (put together) a motor car. Zips sewn into a pair of trousers Rent of the factory premises Salary of the factory supervisor Pension fund contributions for the factory workers. Wages paid to workers who sew a garment. Insurance premiums for the factory. 73 Accounting Grade 11 - CAPS Direct Material costs 4 Direct Labour Costs Factory Overhead Costs ANSWERS 73 BASELINE ACTIVITY 1 LABOUR COSTS Direct labour costs X Work done by person Factory worker making the tables Cleaner Security guard Foreman Person looking after the stock Indirect labour costs X X X X BASELINE ACTIVITY 2 DIRECT / INDIRECT COSTS Cost item Direct costs Rent of factory Wages of cleaners Wages of employees using tools working on the product. Insurance of the equipment in the factory plant. Maintenance of the factory buildings. Cost of raw materials included in the finished products. Depreciation on factory equipment. Consumables issued to the factory 73 Accounting Grade 11 - CAPS 5 Indirect costs x x x x x x x x BASELINE ACTIVITY 3 PRODUCTION COSTS Description of costs Fabric used to make jackets Cleaning materials Salary of the Security guard Wood used to make a chair Wages of workers who assemble (put together) a motor car. Zips sewn into a pair of trousers Rent of the factory premises (plant) Salary of the factory supervisor Pension fund contributions for the factory workers. Wages paid to workers who sew a garment. Insurance premiums for the factory. 73 Accounting Grade 11 - CAPS Direct Material costs Direct Labour Costs Factory Overhead Costs 6 CHALKBOARD SUMMARY / TRANSPARENCY Factory floor where the products are produced LABOUR COSTS Direct labour The person making the product Indirect labour (not directly involved in the making of the product) (cleaner) (foreman) 73 Accounting Grade 11 - CAPS (security) 7