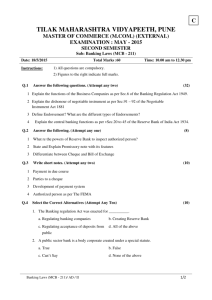

the banking regulation act, 1949

advertisement