Consumer Choice and Demand

advertisement

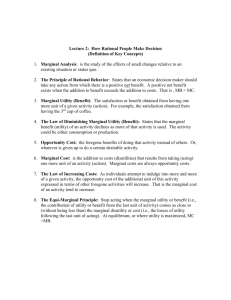

Consumer Choice and Demand CHAPTER OUTLINE Chapter 11 I. Calculate and graph a budget line that shows the limits to a person’s consumption possibilities. A. The Budget Line B. A Changes in the Budget C. Changes in Prices 1. A Fall in the Price of Water 2. A Rise in the Price of Water D. Prices and the Slope of the Budget Line 2. Explain marginal utility theory and use it to derive a consumer’s demand curve. A. Utility 1. Temperature: An Analogy B. Total Utility C. Marginal Utility D. Maximizing Total Utility 1. Allocate the Available Budget 2. Equalize the Marginal Utility Per Dollar Spent E. Finding An Individual Demand Curve F. The Power of Marginal Analysis G. Units of Utility 3. Use marginal utility theory to explain the paradox of value: Why water is vital but cheap while diamonds are relatively useless but expensive. A. Consumer Efficiency B. The Paradox of Value 1. Consumer Surplus 268 Part 4 . A CLOSER LOOK AT DECISION MAKERS What’s New in this Edition? Chapter 11 uses a see-saw analogy to give a more intuitive explanation of why equalizing the marginal utility per dollar maximizes total utility. The material that related elasticity to marginal utility is deleted. Where We Are In this chapter, we uncover the consumer’s behavior that leads to a downward-sloping demand curve. The consumer maximizes utility by allocating his or her entire budget while equating the marginal utility per dollar spent across all goods. As a result, the demand curve reflects choices a consumer is willing to make that maximize his or her utility. The chapter concludes by investigating the paradox of value. Where We’ve Been The first three sections of the book focused heavily on demand and supply. The demand and supply model was developed and then extended to discuss efficiency, externalities, public goods, common resources, and government policies such as price ceilings, price floors, and taxes. Where We’re Going After this chapter, the focus turns to exploring the supply curve in greater detail. Chapter 12 looks at a firm’s production choices and its total product function. After examining the firm’s production, we examine its costs and its cost curves in the short run and in the long run. IN THE CLASSROOM Class Time Needed You can complete this chapter in two to two and a half class sessions, depending the mathematical level of your class. An estimate of the time per checkpoint is: 11.1 Consumption Possibilities—25 to 35 minutes 11.2 Marginal Utility Theory—50 to 80 minutes 11.3 Efficiency, Price, and Value—15 to 20 minutes Chapter 11 . Consumer Choice and Demand 269 CHAPTER LECTURE 11.1 Consumption Possibilities The Budget Line Households have limited budgets, which means they must choose between affordable combinations of goods and services. A budget line, illustrated in the figure, shows the limits to a household’s consumption choices. The household can buy any combination of sodas and movies that lies on or within the budget line. A Change in the Budget When the person’s budget changes, the budget line shifts and its slope does not change. If the budget increases, the budget line shifts outward; if the budget decreases, the budget line shifts inward. A Change in Prices When the price of the good measured along the horizontal axis (movies) changes, the budget line rotates around the vertical intercept. If the price of the good falls, the budget line rotates outward and becomes steeper; if the price of the good rises, the budget line rotates inward and becomes steeper. When the price of the good measured along the vertical axis (sodas) changes, the budget line rotates around the horizontal intercept. If the price of the good falls, the budget line rotates outward and becomes less steep; if the price of the good rises, the budget line rotates inward and becomes less steep. A relative price is the price of one good divided by the price of another good. The magnitude of the slope of the budget line is the relative price of the good on the horizontal axis in terms of the good on the vertical axis, or in the diagram, the relative price of a movie in terms of sodas. A relative price is an opportunity cost, so the relative price of a movie in terms of sodas gives the opportunity cost of a movie in terms of sodas forgone Part 4 . A CLOSER LOOK AT DECISION MAKERS 270 11.2 Marginal Utility Theory Utility The benefit or satisfaction that a person gets from the consumption of a good or service is called utility. Total utility is the total benefit that a person gets Quantity Total Marginal from the consumption of goods and services. As of movies utility utility more of a good or service is consumed, total utility 0 0 increases. Marginal utility is the change in total utili24 ty that results from a one-unit increase in the quanti1 24 ty of a good consumed. Diminishing marginal utili20 ty is the principle that as more of a good or service is 2 44 consumed, its marginal utility decreases. 16 The table to the right has the total utility and mar3 60 ginal utility from an individual’s consumption of 12 movies in a week. 4 72 Maximizing Total Utility A consumer’s choices influence the total level of his or her utility by because the choice determines the combination of goods that are consumed. Some combinations will generate more utility than others. The key assumption of marginal utility theory is that the household consumes the combination that maximizes its utility. The utility-maximizing rule has two steps: Allocate the entire available budget Make the marginal utility per dollar equal for all goods. The marginal utility per dollar is the marginal utility from a good relative to the price paid for the good, which is the marginal utility from a good divided by its price. This rule maximizes utility because anytime the marginal utility per dollar spent on one good exceeds that of another good, the consumer can increase his or her total utility by spending a dollar less on the good with the lower marginal utility per dollar spent and spending the dollar on the good with the higher marginal utility per dollar spent. The table to the right has the marginal utiliQuantity Marginal Quantity Marginal ty schedules that are computed from the toof movutility of books utility tal utility schedules in the table above. The ies price of a movie is $8, the price of a paper 1 24 1 20 2 20 2 10 back book is $4, and the consumer has $24 3 18 3 8 to allocate between movies and books. To 4 8 4 6 maximize utility, the individual buys 2 5 4 5 4 movies and 2 books because that combina6 2 6 2 tion of movies and books spends all the available income and sets the marginal utility per dollar spent of movies equal to that of books. (Both equal 2.50.). Chapter 11 . Consumer Choice and Demand 271 To show that maximizing total utility requires equalizing the marginal utility per dollar spent on each good, work with the case when they are not equal. Suppose the marginal utility per dollar spent on a movie is 20 and the marginal utility per dollar spent on a soda is 10. Ask “If you gained an additional dollar, what would you spend it on and how much would your total utility increase?” The students will spend it on movies and their total utility will rise by 20. Now ask “If you lost a dollar, what you cut back on and how much would your total utility decrease?” The students will cut back on sodas and their total utility will fall by 10. Now tell them that they can gain a dollar by cutting back a dollar on sodas. Ask them the net change in their total utility, which is +10. The point to make is that anytime the marginal utility per dollar spent on one good differs from that of another good, the students can rearrange their consumption by cutting back on the good with the low marginal utility per dollar spent and spending the dollar on the good with the high marginal utility per dollar spent and increase their total utility. Finding an Individual Demand Curve If the price of a good falls and other things remain the same, the marginal utility per dollar spent on that good rises. As a result, the consumer increases his or her purchases of that good in order to maximize utility. (As more of the good is purchased, its marginal utility decreases; as less of other goods are purchased, their marginal utilities increase. Eventually the consumer reaches a new equilibrium at which the marginal utility per dollar spent on all the goods are equal.) When the price of a good falls, the consumer substitutes the now lower priced good for the other good. So, when the price of a good falls, the consumer increases the quantity demanded, which is the law of demand. When the price of a good rises, the consumer substitutes away from the now higher priced good for the other good. So, when the price of a good rises, the consumer decreases the quantity demanded, which is the law of demand. 11.3 Efficiency, Price, and Value Consumer Efficiency The demand curve is a consumer’s marginal benefit curve. Because the demand curve is derived by maximizing utility, marginal benefit is the maximum price a consumer is willing to pay for an extra unit of a good or service when utility is maximized. Paradox of Value The paradox of value is that water, which is essential to life, costs little, but diamonds, which are useless in comparison to water, are expensive. The resolution to this paradox comes from distinguishing total utility and marginal utility. The total utility from water is much more than from diamonds. But we have so much water that its marginal utility is small. And we have so few diamonds that their marginal utility is high. When a household maximizes its utility, it makes the marginal utility per dollar spent equal for all goods. Because diamonds have a high marginal utility, they have a high price. Because water has a low marginal utility, it has a low price. The consumer surplus from water exceeds the consumer surplus from diamonds. 272 Part 4 . A CLOSER LOOK AT DECISION MAKERS Lecture Launchers 1. Use the paradox of value to start your lecture. Ask students how much they are willing to pay for a gallon of water. Of course, they’ll answer a relatively low amount. Then ask them how much they would be willing to pay for a diamond. Most students will answer hundreds or thousands of dollars. Then ask them “Why?” Remind them that water is essential for life and that it makes no sense to be willing to spend so little for such a valuable item. Spark some more discussion by asking them their willingness to pay for water versus their willingness to pay for diamonds if they were lost in the desert. When you finish the day’s lecture, ask students if they can explain the paradox. Reassure them this topic is difficult to understand. In fact, so difficult that until the concepts of utility and marginal utility were discovered in the 1800s, the paradox could not be explained. 2. A major component of consumer demand is preferences, which vary between consumers. A good starting place might be to have the students name some things they had bought recently and explain why they did so. Then find someone else who would not have made the same purchase, and explain why. Often we see that someone else has bought something we regard as silly or useless, and mentally question it thinking “isn’t it strange what some people would rather have than money.” That the item was purchased at all is evidence that at least at the time of purchase, the good or service was more desirable than money 3. Once you have introduced the idea of marginal utility, ask your students why a vending machine, which requires payment for each snack purchased, is used to sell snacks while a newspaper can be sold out of a box that allows anyone to take more than one paper. If students fail to respond using marginal utility analysis, prompt them by asking, “If snacks were sold using a newspaper style box, would some people take more than they paid for?” Then ask, “Why don’t people take more than one paper?” See if the students can discover diminishing marginal utility on their own. If not, explain why different sales techniques are used: Because the marginal utility of a paper diminishes so rapidly, there is little concern that people take more than one. When you have formally taught diminishing marginal utility, tie your lecture back into this example. Land Mines 1. Students are introduced to another curve in this chapter, the budget line. Remind them that this line is not a demand curve nor a production possibilities frontier. Point out the differences: A demand curve is graphed in price/quantity space and shows how the quantity demanded of a product depends on its price; a budget line is graphed in good A/good B space and Chapter 11 . Consumer Choice and Demand shows combinations that can be afforded; and although a PPF is also graphed in good A/good B space, it applies to a nation as whole and shows what can be produced. However, the budget line is similar to the PPF because both show limits. 2. To help students remember how the budget line shifts when the prices of goods change, suggest they should assume they spend ALL of their income on either good. For example, suppose apples are on the x-axis, and oranges are on the y-axis. Ask students, “What happens if the price of apples increases?” Tell them to assume that they hate apples and regardless of the price of apples, they spend their entire budget on oranges. Because the price of oranges doesn’t change, ask how the change in the price of apples impacts the number of oranges they can buy. Point out the y-intercept and stress the fact that this is the consumption point at which all their budget is spent on oranges. Make it clear that this point does not change when the price of apples rises. Then turn to the x-axis and tell students that they now buy only apples and no oranges. Discuss with them that the x-intercept shows the maximum number of apples they can buy when they spend all their budget on apples. While pointing out the x-intercept, ask students what happens to the number of apples they can buy when the price of apples rises. When they answer “fewer apples,” move your finger leftward along the x-axis and make a mark. Then draw the new budget line: the yintercept does not change while the x-intercept rotates inward, making the budget line steeper. The point of this exercise is to focus on the intercepts and not the slope. For many students, this is an easier method of determining the change in the budget line. To complete the exercise, let the price of oranges fall and go through the same mechanics. 3. Students often struggle with the concept of marginality. A brief and very sloppy use of Betham’s utility calculus might solve the problem while getting the basic concept across. One sweater gives me 25 utils of bliss, while the second is worth only 23 utils, and so on, until a point come when one more sweater will provoke negative utility as not only have I run out of room in my closet but I’ve just been buried in a wooly avalanche! 4. When you use the marginal utility per dollar approach to explain utility maximization, you should be prepared for students’ questioning the reality of the idea that they actually equate marginal utility per dollar before making a consumption decision. Some will say, “I’ve never calculated the marginal utility of any item I’ve ever purchased. This material doesn’t make any sense.” You should agree with your students that people don’t calculate and compare marginal utilities and prices but point out to them that the goal is to predict choices, not to describe the thought processes that make them. Indeed, one of the challenges in teaching the marginal utility theory 273 274 Part 4 . A CLOSER LOOK AT DECISION MAKERS is getting the students to appreciate the fundamental role of a model of choice. Gary Becker had a pertinent story you can use: Orel Hershiser [substitute a current pitcher] is a top baseball player. He effectively knows all the laws of motion, of eye and hand coordination, about the speed of the bat and ball, and so on. He’s in fact solving a complicated physics problem when he steps up to pitch, but obviously he doesn’t have to know physics to do that. Likewise, when people solve economic problems rationally they’re really not thinking that well, I have this budget and I read this textbook and I look at my marginal utility. They don’t do that, but it doesn’t mean they’re not being rational any more than Orel Hershiser is Albert Einstein. 5. Students usually grasp the consumer must assess the marginal utility lost against the marginal utility gained as one good is substituted for another. Yet, students usually haven’t thought about how much of one good is available from forgoing some quantity of the other good. Point out that this is not known until the relative prices of the two goods are known, which is why the marginal utility is weighted by its price. Chapter 11 . Consumer Choice and Demand ANSWERS TO CHECKPOINT EXERCISES CHECKPOINT 11.1 Consumption Possibilities 1a. The affordable combinations of burgers and salad, all of which spend the $36 in Jenny’s budget, are: 0 burgers and 18 salads 2 burgers and 15 salads 4 burgers and 12 salads 6 burgers and 9 salads 8 burgersand 6 salads 10 burgers and 3 salads 12 burgers and 0 salads 1b. Figure 11.1 shows Jenny’s budget line. 1c. If the price of a burger falls, the budget line rotates outward and becomes flatter. The vertical intercept stays the same (18 salads) and the horizontal intercept increases. If Jenny’s burger and salad budget decreases, the budget line shifts inward and its slope does not change. 1d. The relative price of a salad is the opportunity cost of a salad—the number of burgers that Jenny must forgo to get 1 salad. The relative price of a salad equals the price of a salad divided by the price of a burger, which is $2 a salad $3 a burger = 2/3 of a burger for a salad. If the price of a burger falls to $1.50, the relative price of a salad increases to $2 a salad $1.50 a burger, which is 1 1/3 of a burger per salad. CHECKPOINT 11.2 Marginal Utility Theory 1a. The total utility of the third dish of pasta is 168 units of utility and the total utility of the second dish of pasta is 120 units of utility. The change in total utility equals the marginal utility, so the marginal utility is (168 units of utility) (120 units of utility) = 48 units of utility. 1b. The marginal utility per dollar spent on pasta when Wanda has 3 dishes of pasta a week is 48 units of utility $4 = 12 units of utility per dollar spent on the 3rd dish of pasta. 1c. The total utility of the fourth can of juice is 60 units of utility and the total utility of the third can of juice is 54 units of utility. The change in total utili- 275 276 Part 4 . A CLOSER LOOK AT DECISION MAKERS ty equals the marginal utility, so the marginal utility is (60 units of utility) (54 units of utility) = 6 units of utility. 1d. The total utility of the second can of juice is 40 units of utility and the total utility of the first can of juice is 22 units of utility. The change in total utility equals the marginal utility, so the marginal utility is (40 units of utility) (22 units of utility) = 18 units of utility. So, the marginal utility per dollar spent on the second can of juice a week is 18 units of utility $1 = 18 units of utility per dollar spent on the second can of juice. 1e. Wanda is not maximizing her utility. She is not allocating all of her budget because she is spending only $10. And the marginal utility per dollar spent on juice is 18 units of utility per dollar spent, which does not equal the marginal utility per dollar spent on pasta, which is 14 units of utility per dollar spent. To maximize her utility, Wanda should buy 1 more can of juice. If she buys 1 more can of juice, she consumes 3 cans of juice and 2 dishes of pasta. This combination allocates all of her budget and sets the marginal utility per dollar spent on juice equal to the marginal utility per dollar spent on pasta, which is 14 units of utility per dollar spent. CHECKPOINT 11.3 Efficiency, Price, and Value 1. On the margin, the economics book is more valuable. The marginal utility from the economics book exceeds the marginal utility from another gallon of water. But, the total utility from the economics book is much less than the total utility from water. Even an economist can live without an economics book but not even an economist can live without water! Chapter 11 . Consumer Choice and Demand 277 ANSWERS TO CHAPTER CHECKPOINT EXERCISES 1a. The table shows Amy’s consumption possibilities. Coffee (cups per week) 6 5 4 3 2 1 0 Soda (cans per week) 0 2 4 6 8 10 12 1b. Figure 11.2 shows Amy’s consumption possibilities, which are her budget line. 1c. Amy can afford to buy 7 cans of soda and 2 cups of coffee. 1d. Amy cannot afford to buy 7 cups of coffee and 2 cans of soda. 1e. The relative price of a cup of coffee is the number of cans of soda that Amy must forgo to get 1 cup of coffee. The relative price of a cup of coffee equals the price of a cup of coffee divided by the price of a can of soda, which is $2 a cup of coffee $1 per a of soda = 2 cans of soda per cup of coffee. 1f. The relative price of a can of soda is the number of cups of coffee that Amy must forgo to get 1 can of soda. The relative price of a can of soda equals the price of a can of soda divided by the price of a cup of coffee, which is $1 a can of soda $2 a cup of coffee = 1/2 of a cup of coffee per can of soda. 2a. The table shows Amy’s new consumption possibilities. Coffee (cups per week) 4 3 2 1 0 Soda (cans per week) 0 3 6 9 12 278 2b. 2c. 2d. 2e. 3a. 3b. 3c. Part 4 . A CLOSER LOOK AT DECISION MAKERS Figure 11.3 shows Amy’s old budget line, which is her old consumption possibilities, and her new budget line, which is her new consumption possibilities. If Amy buys 6 cans of soda, she can buy 2 cups of coffee. The relative price of a cup of coffee is the number of cans of soda that Amy must forgo to get 1 cup of coffee. The relative price of a cup of coffee equals the price of a cup of coffee divided by the price of a can of soda, which is $3 a cup of coffee $1 a can of soda = 3 cans of soda per cup of coffee. The relative price of a cup of coffee has increased The relative price of a can of soda has decreased. The relative price of a can of soda is the number of cups of coffee that Amy must forgo to get 1 can of soda. The relative price of a can of soda equals the price of a can of soda divided by the price of a cup of coffee, which is $1 a can of soda $3 a cup of coffee = 1/3 of a cup of coffee per can of soda. The table shows the missing numOrange juice bers. The missing number are under(cartons Total utility lined. per day) The number of cartons of orange 0 0 juice Ben buys depends on his budg1 7 et, the price of orange juice, the prices of the other goods and services Ben 2 12 buys, and Ben’s marginal utility from 3 15 these other goods and services. Ben will buy the quantity of orange juice 4 17 that sets the marginal utility per dollar spent from orange juice equal to 5 18 the marginal utility per dollar spent from the other goods and services. So Ben buys the quantity of orange juice such that the marginal utility per dollar spent from the last carton of orange juice equals the marginal utility per dollar spent from the other goods and services Ben buys. Ben would buy no orange juice if the marginal utility per dollar spent from the first carton of orange juice is less than the marginal utility per dollar from the other goods and services Ben buys. Marginal utility 7 5 3 2 1 Chapter 11 . Consumer Choice and Demand 3d. 3e. 4a. 4b. 4c. The principle of diminishing marginal utility applies to Ben’s consumption of orange juice because as the quantity of orange juice Ben consumes increases, his marginal utility from orange juice diminishes. Ben will have more cartons of orange juice at the “all-you-can-eat” breakfast than if he had to pay for each carton individually. At the “all-youcan-eat” breakfast the price of an individual carton of orange juice is zero. So Ben will maximize his utility by drinking orange juice until its marginal utility is zero. The figures are above. Look at Figure 11.5 on page 275 in the text and Figure 11.5 above. The graphs show that the marginal utility from gum decreases more rapidly than does the marginal utility from bottled water. If Tina is maximizing her utility, the marginal utility per dollar spent on gum equals the marginal utility per spent on bottled water. The marginal utility from the fourth pack of gum is 6, so the marginal utility per dollar spent on gum is 6 25¢, which is 24. The marginal utility from the fourth bottle of water is 6, so the marginal utility per dollar spent on bottled water is 6 50¢, which is 12. The marginal utility per dollar spent on gum does not equal the marginal utility per dollar spent on bottled water, so Tina is not maximizing her utility. The marginal utility per dollar spent on gum exceeds the marginal utility per dollar spent on bottled water, so Tina can increase her total utility by consuming more gum and less bottled water. In this case, the utility Tina gains when she spends another dollar on gum exceeds the utility she loses when she spends a dollar less on water. 279 280 Part 4 . A CLOSER LOOK AT DECISION MAKERS 5. If Tina’s budget increases, she’ll consume more water and gum because they are both normal goods. Between the two, she will consume relatively more water because its marginal utility does not decrease as rapidly as gum’s marginal utility. 6. If Tina’s budget increases and the price of bottled water rises, Tina consumes more gum. The impact on Tina’s consumption of water is ambiguous. The increase in the budget implies more bottled water will be consumed, but this increase can be offset by the increase in the price of bottled water. 7a. The total utility from consuming 3 cakes and 2 dishes of pasta is 61 units of utility. The marginal utility from the third cake is 7 units of utility. The marginal utility per dollar spent on the third cake is (7 $4), which is 1 3/4 units of utility per dollar spent. The marginal utility from the second dish of pasta is 16 units of utility. The marginal utility per dollar spent on the second dish of pasta is (16 $8), which is 2 units of utility per dollar spent. Martha is maximizing her utility because she is allocating her entire budget and the marginal utility per dollar spent on cake (2 units of utility per dollar spent) equals the marginal utility per dollar spent on pasta (2 units of utility per dollar spent). 7b. 7c. 7d. 7e. 7f. 8a. 8b. 8c. 8d. If the price of a dish of pasta falls to $4, Martha buys 2 cakes and 4 dishes of pasta. This combination maximizes Martha’s utility because it allocates her entire income and equates her marginal utility per dollar spent for both goods. When the price of a dish of pasta is $8 (and the price of a cake is $4), Martha buys 2 dishes of pasta. So, one point is a price of $8 for a dish of pasta and a quantity of 2 dishes. When the price of a dish of pasta is $4 (and the price of a cake is $4), Martha buys 4 dishes of pasta. So, another point is a price of $4 for a dish of pasta and a quantity of 4 dishes. Martha’s demand for pasta is unit elastic over the price range between $8 and $4 because her total expenditure on pasta does not change when the price falls. When the price of a cake is $4, the price of a dish of pasta is $8, and Martha has $40 to spend, she will buy 4 cakes and 3 dishes of pasta. This combination maximizes Martha’s utility because it allocates (spends) her entire budget and equates the marginal utility per dollar spent on cake to the marginal utility per dollar spent on pasta, with both equal to 1 1/2 units of utility per dollar. Chapter 11 . Consumer Choice and Demand 9a. The relative price of a movie ticket is the number of pizzas that Tim must forgo to buy 1 movie ticket. The relative price of a movie ticket equals the price of a movie ticket divided by the price of a pizza, which is $8 a movie ticket $4 a pizza = 2 pizzas per movie ticket. 9bi. Tim’s consumption possibilities increase because his budget line rotates outward. 9bii. Tim changes his purchases to equate the marginal utility per dollar spent on each good. 9biii. Most likely, Tim will increase the quantity of pizza he consumes. 10a. 10b. 11a. 11b. 11c. Because the price of a sandwich is 2 1/2 times greater than the price of a coffee and Josie is maximizing utility, the marginal utility from the last sandwich must be 2 1/2 times greater than the marginal utility from the last coffee. When the marginal utility of the sandwich is 2 1/2 times larger than the marginal utility of the coffee, Josie is equating the marginal utility per dollar spent for coffee and sandwiches. Josie’s allocation is efficient because she maximizes her utility. By maximizing her utility, she is making the best use of her scarce resources, that is, her income. Adrienne gets greater marginal utility from her apartment. The price of her apartment is 2 times greater than the price of the horse stable, so for Adrienne to maximize her utility, her marginal utility from her apartment must be 2 times her marginal utility from the horse. Adrienne thinks so highly of her horse stable, she receives greater total utility from her horse. As is the case for the water and diamond paradox of value, Adrienne receives greater total utility from the less expensive good. 281 282 Part 4 . A CLOSER LOOK AT DECISION MAKERS Critical Thinking 12a. 12b. 12c. 12d. 13a. 13b. 13c. Students who buy a meal plan do so because they plan to eat most of their meals on campus, where the plan covers them. Students who do not buy a meal plan, plan to eat most of their meals where the plan does not cover them. Both types of student buy their meals such that their marginal utility per dollar spent on meals equals the marginal utility per dollar spent on other goods and services. The student without the meal plan pays more for lunch. So this student’s marginal utility is higher than the student’s marginal utility who has the meal plan. To make the marginal utility per dollar spent equal for all goods, the student without the meal plan buys fewer lunches. The student who does not have a meal plan pays more for each lunch as it is consumed. Because the price of a lunch is higher for someone without a meal plan, the marginal utility for each lunch is higher for someone without a meal plan. The higher price of a lunch with an unchanged price for a meal plan increases the number of people who buy meal plans. The price of a lunch increases for those people who do not buy meal plans. For these students, the higher price of a lunch decreases the marginal utility per dollar spent on lunches. To maximize their utility, because the marginal utility per dollar spent on lunch is less, students without a meal plan buy fewer lunches. Students with a meal plan do not change their demand. When the ticket price of riding public transportation is zero, the marginal utility per dollar spent riding public transportation increases. So, to maximize their utility, more people ride public transportation. Even with a ticket price of zero, riding public transportation was not “free” because public transportation is generally less convenient than private transportation. So the opportunity cost of riding public transportation is not zero. This opportunity cost must be added to the ticket price of riding public transportation to get the total price of riding public transportation. So, even when the ticket price is zero, the marginal utility per dollar spent of riding public transportation was still to low to entice some people to ride. The free-ride day showed some people that the opportunity cost of riding public transportation is less than they thought. So these people realize that the price of riding public transportation, which includes the ticket price as well as the other opportunity costs, is less than they believed. As a result, some of these people will continue to ride public transportation even after the ticket price is no longer zero. So marginal utility theory predicts that there is a small increase in the demand for public transportation after the free-ride day. Chapter 11 . Consumer Choice and Demand 14. The marginal utility of additional food decreases rapidly as more food is consumed. However, the marginal utility of additional automobiles (more precisely, the attributes of an automobile such as horsepower, comfort, safety, and so forth) decreases slowly as more attributes are consumed. When people’s incomes increase, they buy more of all normal goods. For food, only a little additional food need be consumed until the marginal utility per dollar spent on food equals the marginal utility per dollar spent on other goods and services. But for automobiles, significantly more attributes of automobiles must be consumed to drive the marginal utility per dollar spent on an automobile to equality with the marginal utility per dollar spent on other goods and services. 283 284 Part 4 . A CLOSER LOOK AT DECISION MAKERS Web Exercises 15a. 15b. 15c. 16a. 16b. 16c. 17. There are a variety of ticket options. In general, the consumer wants to spend the minimum amount for a ride because that increases the consumer’s consumption possibilities. So, for instance, a one-way fare token is the least expensive if the consumer takes only a few rides a month and fewer than 3 rides on any given day. This pass makes the consumer’s rides as inexpensive as possible and so makes the consumer’s consumption possibilities as large as possible. But, if the consumer takes 3 or more rides a day for 5 or more days a week, a weekly pass minimizes the cost of a ride and maximizes the consumption possibilities. Similarly, a monthly pass is best if the consumer rides more frequently. The person wants to maximize his or her consumption possibilities by paying the least per ride. The decision whether to buy a day pass or a pass for a longer period of time depends on how many days the person rides. If the person rides for 5 or more days per week, a weekly pass has a lower per-ride price than a day pass, so the marginal utility per dollar spent on rides is greater buying a weekly pass. If the price of a single trip fell and the price of a day pass increased, the number of riders would decrease. After a person has purchased a day pass, all rides that day have a price of zero. So the person takes a ride even if the marginal utility from the ride is low because the price of the additional ride is zero. Lowering the price of a single trip and raising the price of a day price makes people less likely to buy a day pass and so decreases the number of riders. The students’ answers depend on their preferences and so probably are different for each student. The students buy the quantity of goods for which the marginal utility per dollar spent is equal for all goods. Because the prices are same for each student, differences in what they buy are the result of differences in the marginal utility among the students. If the voucher had doubled to $1,000 and the prices also had doubled, there would be no difference in what the students purchased. The budget line is unaffected if both the budget and prices change by the same proportion, so the students’ consumption possibilities do not change. The marginal utilities also do not change, so the students’ purchases do not change. It is likely that the student would buy the iPod from the store with the lowest price, though the student might be willing to pay a bit more to buy from a “name brand” store. By purchasing from the lowest priced store, the student is maximizing his or her utility because this procedure max- Chapter 11 . Consumer Choice and Demand 285 imizes the student’s consumption possibilities, that is, makes the budget line lie as far to the right as possible. ADDITIONAL EXERCISES FOR ASSIGNMENT Questions CHECKPOINT 11.1 Consumption Possibilities 1. Martha's cake and pasta budget is $24 a week. The price of a cake is $4, and the price of a dish of pasta is $6. 1a. List the combinations of cake and pasta that are on Martha’s budget line. 1b. Draw a graph of Martha's budget line with pasta plotted on the x-axis. 1c. If the price of a dish of pasta is halved, what is the change in the relative price of a cake? Explain your answer. 1d. Describe how Martha's budget line in (b) changes if the following events occur one at a time and other things remain the same: The price of a dish of pasta falls. The price of a cake falls. Martha's cake and pasta budget decreases. 2. The price of a bag of popcorn is $2, the price of a can of soda is $1, and Bobby’s budget for popcorn and soda is $10. 2a. List the affordable combinations of cans of soda and bags of popcorn that are on Bobby’s budget line. 2b. What is the relative price of a bag of popcorn? 2c. Suppose Bobby’s budget increases to $12 but the prices of a bag of popcorn and a can of soda do not change. What happens to the relative price of a bag of popcorn? CHECKPOINT 11.2 Marginal Utility Theory 3. The table shows Wendy's total utility Tacos from tacos and movies. The price of a Quantity Total (per week) utility taco is $2, the price of a movie is $8, and 0 0 Wendy has $22 a week to spend on 1 11 tacos and movies. 2 20 3a. Calculate Wendy's marginal utility from 3 27 the third movie in the week. 4 30 3b. Calculate the marginal utility per dollar 5 31 6 31 spent on movies when Wendy sees 3 movies a week. 3c. Calculate Wendy's marginal utility from the fourth taco in the week. Movies Quantity Total (per week) utility 0 0 1 32 2 60 3 84 4 104 5 120 6 132 286 Part 4 . A CLOSER LOOK AT DECISION MAKERS 3d. Calculate the marginal utility per dollar spent on tacos when Wendy buys 4 tacos a week. 3e. If Wendy sees 2 movies and buys 2 tacos a week, is she maximizing total utility? Explain your answer. If Wendy is not maximizing total utility, explain how she would adjust her consumption choice to do so. 4. The table has Bobby’s total utility from popcorn and soda. Assume the price of a bag of popcorn is $2, the price of a can of soda is $1, and Bobby’s budget is $10. What is the Bobby’s utility maximizing combination of cans of soda and bags of popcorn ? Popcorn Bags Total (per week) utility 0 0 1 40 2 60 3 70 4 75 5 77 Soda Cans Total (per week) utility 0 0 1 30 2 50 3 65 4 70 5 73 Answers CHECKPOINT 11.1 Consumption Possibilities 1a. The combinations of cake and pasta that are on Martha’s budget line are: 0 cake and 4 dishes of pastas 3 cakes and 2 dishes of pastas 6 cakes and 0 dishes of pasta 1b. Figure 11.6 shows Martha’s budget line. 1c. The relative price of a cake is the number of dishes of pasta that Martha must forgo to get 1 cake. The relative price of a cake equals the price of a cake divided by the price of a dish of pasta. At the initial prices, the relative price is $4 a cake $6 a dish of pasta, which is 2/3 of a dish of pasta per cake. When the price of a dish of pasta falls to $3, the relative price of a cake is $4 a cake $3 a dish of pasta, which is 1 1/3 of a dish of pasta per cake. Then fall in the price of a dish of pasta raises the relative price of a cake. 1d. If the price of a dish of pasta falls, the budget line rotates outward and becomes flatter. The vertical intercept stays the same, while the horizontal intercept increases. If the price of a cake falls, the budget line rotates outward and becomes steeper. The horizontal intercept stays the same, while the vertical intercept increases. Chapter 11 . Consumer Choice and Demand If Martha’s budget decreases, the new budget line shifts inward and is parallel to the old budget line. 2a. The affordable combinations are 0 bags of popcorn and 10 cans of soda; 1 bag of popcorn and 8 cans of soda; 2 bags of popcorns and 6 cans of soda; 3 bags of popcorns and 4 cans of soda; 4 bags of popcorns and 2 cans of soda; and 5 bags of popcorns and 0 cans of soda. 2b. The relative price of a bag of popcorn is the number of cans of soda that Bobby must forgo to get 1 bag of popcorn. The relative price of a bag of popcorn equals the price of a bag of popcorn divided by the price of a can of soda, which is $2 a bag of popcorn $1 a can of soda = 2 cans of soda per bag of popcorn. 2c. Because neither the price of a bag of popcorn nor a can of soda changes, the relative price of a bag of popcorn does not change. A change in a person’s budget does not change relative prices. CHECKPOINT 11.2 Marginal Utility Theory 3a. The total utility of 3 movies is 84 units of utility and the total utility of the 2 movies is 60 units of utility. The change in total utility, which equals the marginal utility, is (84 units of utility) (60 units of utility equals 24 units of utility. 3b. The marginal utility per dollar spent on movies when Wendy sees 3 movies is 24 $8 = 3 units of utility per dollar spent. 3c. The total utility of the 4 tacos is 30 units of utility and the total utility of the 3 tacos is 27 units of utility. The marginal utility of the 4th taco equals (30 units of utility) (27 units of utility), which is 3 units of utility. 3d. The marginal utility per dollar spent on the 4th taco is 3 units of utility $2 a taco, which is 1 1/2 units of utility per dollar spent. 3e. Wendy is not maximizing her utility. She is not allocating all of her budget because she is spending only $20. And the marginal utility per dollar spent on tacos is 4 1/2 units of utility per dollar spent, which does not equal the marginal utility per dollar spent on movies, which is 3 1/2 units of utility per dollar spent. To maximize her utility, Wendy should buy 1 more taco. If she buys 1 more taco, she will consume 3 tacos and 2 movies. This combination allocates all of her income and sets the marginal utility per dollar spent on tacos equal to that of movies, with both equal to 3 1/2 units of utility per dollar spent. 4. To maximize his utility, Bobby buys 4 cans of soda and 3 bags of popcorns. This combination allocates the entire budget and equates the marginal utility per dollar spent on cans of soda and bags of popcorn, with each equal to 5 units of utility per dollar spent. 287 288 Part 4 . A CLOSER LOOK AT DECISION MAKERS USING EYE ON THE U.S. ECONOMY Relative Prices on the Move The article provides data on relative prices. Use the data to show students that, contrary to what they might have predicted, the relative prices of many of the goods they buy have changed, with some falling and others rising. You can present the material by listing a number of the items on the board or overhead and then poll students what they think has happened to the relative price. They will probably find it surprising to see the relative prices of oranges and beef have risen while the relative prices of orange juice and coffee have fallen. Rational Choices in Beverage Markets The article and data provide a good example of reallocating budgets after the prices of goods have changed. The story provides a good explanation of what happens to demand for a good when its price changes as people attempt to equate marginal utility per dollar spent. Ask your students why they think these changes occurred. In other words, did the changes occur because people’s tastes changed or because other factors, such as supply, changed? You also can tell your students that nowadays more people are drinking “new age,” fruit-based beverages, such as Sobe. Ask your students how people’s decisions to drink Sobe is reflected in their marginal utility for new-age beverages. To personalize this last example, you can ask your class how many of them drink Sobe (or other trendy beverages, such as the many energy drinks now available). Ask the students who volunteer that they drink these beverages what this decision means about their marginal utility from these drinks? USING EYE ON THE PAST Jeremy Bentham, William Stanley Jevons, and the Birth of Utility The story provides background material to use for the lecture launchers. You can remind students that these ideas are “discoveries” in terms of economics and they allow economists to explain or better understand concepts such as the demand curve and the paradox of value.