How to Use This Guide - Learn Accounting Free

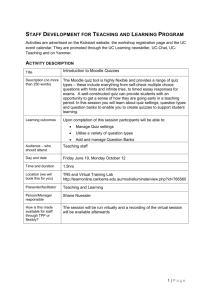

advertisement