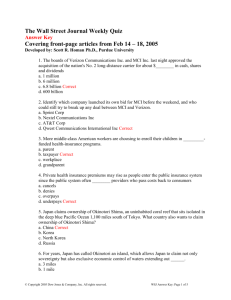

The Wall Street Journal Education Program

Weekly Review & Quiz

Covering front-page articles from Feb 3-9, 2007

Professor Guide with Summaries Spring 2007 Issue #1

Developed by: Scott R. Homan Ph.D., Purdue University

Questions 1 – 12 from The First Section, Section A

In Billboard War, Digital Signs Spark a Truce

By SARAH MCBRIDE

February 3, 2007; Page A1

http://online.wsj.com/article/SB117046875975697053.html

CLEVELAND -- For years, Clear Channel Communications Inc., a giant of the U.S.

billboard business, often won the right to put up big signs by dragging cities and

community groups into court. But in Cleveland, one of those court fights allowed Clear

Channel to soup up its signs and win over residents at the same time.

The reason: In a settlement, Clear Channel won permission to put up lucrative new digital

billboards along highways in return for taking down some old-fashioned inner-city

billboards. The new signs flash a sequence of ads from seven different companies,

multiplying Clear Channel's revenue. All over the country, billboard companies are

racing to transform venerable road signs into these high-tech moneymakers. As they do,

they are changing the dynamics of civic battles that date back more than a century.

"It's actually a huge change," says Mark Mays, chief executive of Clear Channel, the No.

1 player by revenue. It has 75,000 billboards in the U.S. "Historically, we've had an

adversarial relationship with them," says Mr. Mays.

After decades of slow gains, outdoor advertising is now the fastest-growing ad category

after the Internet. In the age of digital-video recorders, which allow viewers to skip

television ads, advertisers are turning back to old-fashioned billboards, which still have a

captive audience. Outdoor ads brought in an estimated $6.9 billion in the U.S. last year,

up 9% over the year before. In late 2005, Clear Channel took public a 10% stake in its

outdoor unit, in part because the unit's growth rate was far outpacing its parent's radio

business. (The parent is currently lobbying shareholders to agree to a plan to take the

company private.)

Today some 500 of the nation's billboards are digital, a figure expected to grow by

several hundred a year over the next few years, according to the Outdoor Advertising

Association of America Inc. The $500,000 cost of installing an electronic billboard is

more than outweighed by the ability to sell one space to multiple advertisers at the same

time. In some communities, they are also sparking a new round of criticism because they

can distract highway drivers.

Companies and communities have sparred over the size, shape and amount of outdoor

advertisements in U.S. cities since at least the early 1900s, when municipalities began

legislating against them.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 1 of 29

Those fights were just the warm up for legal battles in the 1950s, when interstate

highways began to crisscross the country, followed closely by signs for Burma Shave,

cigarettes and more. While some today remember these vintage placards as quaint bits of

Americana, at the time they irritated many drivers who were fed up with advertising's

encroachment on the countryside. In the 1960s, some local activists took to cutting down

boards in the middle of the night.

Eventually, Lady Bird Johnson spearheaded a campaign to reduce the number of

billboards on U.S. highways. The Highway Beautification Act was signed into law in

1965, calling for a reduction in the number of billboards. But funds to pay owners to take

down rural boards soon ran out.

The law still exists, but is replete with exceptions that have resulted in an estimated

500,000 billboards lining America's highways, according to the anti-billboard advocacy

group Scenic America. That's a 50% jump compared with the 326,000 highway ads that

were around in 1975, a few years after the Highway Beautification Act went into effect.

The industry disputes these figures and says the total number of billboards, including

highways and cities, is 450,000.

One recent challenge for anti-billboard forces has been the shift in billboard ownership

from a hodgepodge of regional players into a handful of media titans, including Clear

Channel. With deep pockets and teams of lawyers, the companies frequently haul

communities into court, citing First Amendment protections of free speech. Often, the

municipality backs down.

One of Cleveland's longtime billboard foes is community activist Tony Brancatelli, 49.

He has worked most of his life to clean up his working-class neighborhood of Slavic

Village, plagued by boarded-up buildings and suburban flight. One big goal: tearing

down the billboards littering Broadway, a major local artery.

For years, he tried to help property owners find a way to nullify their billboard contracts,

which sometimes had decades-long terms. That often meant sparring with executives

working for billboard concern Eller Media. The contracts usually held. When Clear

Channel acquired Eller in 1997, Mr. Brancatelli feared the acquisition would only make

his adversaries more formidable.

Two years later, in February 1999, the company took the city of Cleveland to court twice.

First it challenged a city ordinance banning alcohol advertising, and then it accused

Cleveland of unfairly targeting its billboards in a city inspection that cited hundreds of

boards for code violations.

The city lost the first case. A settlement in the second case, among other things, created

legislation allowing digital boards. Like traditional boards, each new digital board had to

first be approved by city government.

Mr. Brancatelli's worst tussle with Clear Channel came in 2001. He says he and his

lawyer repeatedly asked Clear Channel to take down a billboard that was blocking

construction of a Boys & Girls Club. Under the original contract, the billboard could be

removed if construction was planned on the land where it stood. Mr. Brancatelli says

company representatives spent months dithering and kept demanding a new location to

put up a new board, even though the contract made no provision for a replacement.

Clear Channel says Slavic Village misinterpreted the contract.

Fed up, Mr. Brancatelli headed to the billboard, grabbed a saw and attacked, say people

familiar with the matter. With construction equipment idling just feet away, Mr.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 2 of 29

Brancatelli sawed at the metal pins holding the board in place until it collapsed, these

people say. "I will never admit to taking down a billboard," Mr. Brancatelli now says. "I

will admit to evicting them off our real estate."

Clear Channel says it has worked with Mr. Brancatelli in the past, donating billboard

space over the years to Slavic Village as well as other Cleveland groups.

1. Outdoor ads brought in an estimated _______ in the U.S. last year, up 9% over the

year before.

a. $4.9 billion

b. $5.9 million

c. $6.9 billion Correct

d. $7.9 million

2. The __________ was signed into law in 1965, calling for a reduction in the number of

billboards.

a. Outdoor Advertising Act

b. Highway Beautification Act Correct

c. Billboard Reduction Act

d. Highway Billboard Act

Tired of Laughter, Beijing Gets Rid Of Bad Translations

By MEI FONG

February 5, 2007; Page A1

http://online.wsj.com/article/SB117063961235897853.html

BEIJING -- For years, foreigners in China have delighted in the loopy English

translations that appear on the nation's signs. They range from the offensive ("Deformed

Man," outside toilets for the handicapped) to the sublime (on park lawns, "Show Mercy

to the Slender Grass").

Last week, Beijing city officials unveiled a plan to stop the laughter. With hordes of

foreign visitors expected in town for the 2008 Summer Olympics, Beijing wants to

cleanse its signs of translation nonsense. For the next eight months, 10 teams of linguistic

monitors will patrol the city's parks, museums, subway stations and other public places

searching for gaffes to fix.

Already, fans of the genre are mourning the end of an era, and some Web sites dedicated

to it have seen traffic spike. The bewildering signs were "one of the great things we want

to show people visiting us," says financial-services consultant Josh Kurtzig, a

Washington native who lives in Beijing. Correcting them is "really taking away one of

the joys of China."

Stuck in Beijing traffic recently, Mr. Kurtzig noticed workers replacing one of the

classics: "Dongda Hospital for Anus and Intestine Disease Beijing." The new sign:

"Hospital of Proctology." He grabbed his BlackBerry and emailed the news to friends

around the globe. Their reactions, he says, were swift, and mostly unfavorable.

"Nooooooooooo," read an email from one friend.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 3 of 29

Not many locals share this sense of loss. "We cannot leave [these signs] up just for the

amusement of foreigners," says Olive Wang, marketing manager for a major sportswear

company.

Many in China regard the Olympics as the nation's coming-out party -- a milestone in its

ascent as a global power. Anticipation of the Games is fueling a surge of national pride,

and has sparked campaigns to make people smile more and embrace better etiquette.

The sign initiative is the latest part of a campaign to improve English translations in

public, including on restaurant menus. The group behind the effort, called the Beijing

Speaks Foreign Languages Program, is headed by Chen Lin, an elderly language

professor who acts as its language police chief.

"We want everything to be correct. Grammar, words, culture, everything," says Prof.

Chen, whose formal English enunciation would befit a Shakespearean actor. "Beijing will

have thousands of visitors coming," he says as he flips through pictures of poorly

translated signs on his dictionary-covered desk. "We don't want anyone laughing at us."

The sign police will conduct spot checks "to see if the signs are right," says Beijing Vice

Mayor Ji Lin.

China hardly has a monopoly on poor translation. In the U.S., the popularity of Chineselanguage tattoos during the past decade has left lots of hipster skin marked with

nonsensical character combinations.

In anticipation of the Games, Prof. Chen set up his group in 2002 with backing from the

Ministry of Foreign Affairs. The group's efforts, he says, will pick up over the next 1½

years and will likely involve thousands of city employees and volunteers.

Already, the city has replaced 6,300 road signs that carried bewildering admonitions such

as: "To take notice of safe: The slippery are very crafty." (Translation: Be careful,

slippery.) Replacing signs will cost the city a substantial amount of money, although it

isn't clear how much. Some of the faulty ones, Prof. Chen notes, are decades old and are

carved in marble.

The son of a government official and a teacher, Prof. Chen got hooked on English in high

school by reading simplified versions of Shakespeare. His interest made him a target

during the decade-long Cultural Revolution that began in 1966, when associations with

the West were a liability. He was sent off to do hard labor in the countryside.

In 1978, as China began embracing a policy of economic reform and openness, Prof.

Chen hosted the country's first television program teaching English. He became a minor

celebrity. "Everywhere I went, even in winter, I had to wear sunglasses," he recalls.

Through the 1980s and 1990s, the popularity of the English language grew faster than the

nation's proficiency in it. English words were used on billboards and on clothing to

denote exoticism and sophistication -- but the words often made no sense. Prof. Chen

says that municipal departments sometimes would leave it to employees with only

rudimentary English skills and a dictionary to handle translations of public signs. At

some of Beijing's most famous historic attractions, tourists were left puzzling over

incomprehensible signs.

Prof. Chen's Beijing Speaks committee set up a Web site to solicit volunteer translators,

part of a parallel effort to provide standardized translations for Chinese menus. In a little

over two months, it drew more than 7,000 responses. "People really want to get

involved," he says.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 4 of 29

These days, Prof. Chen regularly cruises the city looking for faulty signs, often in the

company of David Tool, a retired U.S. Army colonel and longtime resident of China.

Sometimes, a Beijing television crew accompanies them, documenting the results. (Two

programs on the topic have already aired.)

Some of the many Westerners living in Beijing view the disappearance of China's lost-intranslation signs as part of a broader modernization drive that is causing Beijing to lose

some of its character. Other foreigners lament the loss of a source of amusement.

Tourists and expatriates have been posting photographs of what has come to be known as

"Chinglish" on Internet sites such as chinglish.de. Beijing's sign-improvement efforts

appear to be boosting contributions and visitors to the sites.

In recent months, for example, the number of daily visitors to the Chinglish page of

software engineer Everett Griffith's Web site, pocopico.com -- it includes a photo of a

restroom sign that reads "Genitl Emen" -- has jumped by 25% to 500, he says.

Some foreigners question whether Beijing authorities should devote such effort to

changing signs, given other pre-Olympic concerns such as traffic and pollution woes.

Says longtime resident Jeremy Goldkorn, a South African: "Frankly, I prefer clean toilets

to correct English."

3. The Chinese government has made an effort to make sure signs are

a. amusing to tourists

b. translated into approximate English

c. incomprehensible

d. translated into comprehensible and correct English Correct

4. The effort to make changes to signs is motivated by

a. the preparation for the 2008 Olympics Correct

b. wanting to appear unsophisticated

c. a new form of language called “Chinglish”

d. public employees learning English

Corruption Crackdown Targets Shanghai Inc.

By JAMES T. AREDDY

February 6, 2007; Page A1

http://online.wsj.com/article/SB117072475510299033.html

SHANGHAI -- With its gleaming towers and explosive growth, this city has helped

inspire dreams of a China century. Governed for four years by a British-educated

architect named Chen Liangyu, Shanghai exuded a can-do attitude that welcomed foreign

investment and showcased China's emergence on the world stage.

But underneath the boom and glitter, Communist Party leaders in Beijing say, lay a

secret: massive corruption.

Last fall, the party fired Mr. Chen, alleging mismanagement and theft at a city pension

fund, influence peddling and other misdeeds. It detained him at an undisclosed location.

There, he has made no public comment.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 5 of 29

The fall of Mr. Chen, who not only ran the city but sat in China's ruling Politburo, was

China's biggest political shakeup in a generation. But more than the ouster of one official,

it amounted to an indictment of the business model known as Shanghai Inc.

Key to that model, according to company and government statements: Giant construction

projects got funded from public coffers; choice assets moved out of state hands in

elaborate transactions; and plum contracts went to the well-connected.

The crackdown is a reminder that China's system leaves great power in the hands of local

Communist leaders, whose decisions can ripple unchecked through the economy. Now

that the party has stepped in to take its Shanghai leader out of action, approval for the

flashy big development projects for which Shanghai is famed has slowed to a crawl.

The party, which says its biggest threat is corruption within its ranks, has sent

investigators sniffing for official graft in other Chinese cities as well. The Chinese have a

saying: Kill a chicken to scare the monkeys. Mr. Chen's ouster is a reminder to local

leaders, as well as to foreign investors, that roaring Shanghai-style growth is no longer

Beijing's priority. If officials elsewhere take Mr. Chen's fate as a warning, one result

could be to tap the brakes on China's booming economy. That would bolster a goal of

moderation that Beijing has so far pursued to limited success by jawboning and curbing

bank lending.

Mr. Chen's post as party secretary for Shanghai gave him vast power: control over 45%

of the city's industry, from manufacturers to banks and property developers. The portfolio

reflects the Communist Party's core position in Chinese business. A party-appointed

secretary sits at the helm of many business groups in the country, including some joint

ventures with foreigners.

In Shanghai, party officials all answered to Mr. Chen. After his September ouster, dozens

fell along with him, from a pension-system chief to a mutual-fund executive to Mr.

Chen's son and brother-in-law. The detentions have placed power in the hands of officials

who are extra-careful in granting licenses and making other approvals needed to do

business in Shanghai, say investors.

A subway expansion under way has been called into doubt, as has privatization of a water

utility. Museum projects, including a Shanghai branch of France's Centre Georges

Pompidou, are held up, as is approval for a Saks Inc. store on the classy waterfront

district known as the Bund. The city has put on ice a campaign to lure a Walt Disney Co.

theme park and a plan for the world's tallest Ferris wheel, officials say. Saks says it has

pushed back the planned opening of its store to 2009 from 2008, while Disney says its

China strategy is broader than a Shanghai theme park.

The 60-year-old Mr. Chen was fond of tennis, and a few years ago, Shanghai spent $300

million to build an arena to host the Tennis Masters Cup. Future tournaments are

uncertain without their No. 1 fan: Mr. Chen.

Shanghai still has plenty of sizzle. For 2006, it reported its 15th straight year of doubledigit economic growth, 12%. But expansion in fixed-asset investment such as property

development, while still robust at 11%, was far below the rate of two years ago.

And there are some signs the city is losing its legendary magnetism. The government

recently gave permission to the northern city of Tianjin to adopt looser foreign-exchange

regulations, not to the traditional banking center of Shanghai. Some foreign developers

say it makes sense now to seek opportunities in other Chinese cities rather than Shanghai.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 6 of 29

The scandal is a reminder of the role corruption long played in Shanghai's history.

Though the city was famed early last century as the East's richest banking center, and

opulent Art Deco buildings sprang up on the Bund, government-tolerated opium and

prostitution rings also earned the city the label Whore of the Orient. Its very name came

to stand for trickery, as in getting "shanghaied" into working on a ship. The Communist

Party was founded in Shanghai and rose partly on a wave of resentment against the

corruption of the ruling Nationalists.

Decades later, the city was identified with Mao's Cultural Revolution and then the

policies of "capitalist roader" Deng Xiaoping. Mr. Chen arrived in Shanghai as its

transformation to a futuristic city was beginning. After studying architecture at an army

institute, he joined the Communist Party in 1980. It put him in charge of Shanghai

Electric Group Co., a massive machinery maker sometimes called China's General

Electric. Later, his party jobs included overseeing sports programs, old cadres' retirement

and transforming the historic Bund district.

5. The crackdown in Shanghai is a reminder that China's system leaves great power in the

hands of__________, whose decisions can ripple unchecked through the economy

a. local governments

b. local Communist leaders Correct

c. business leaders

d. foreign developers

6. The Chinese have a saying: Kill a _____ to scare the monkeys.

a. chicken Correct

b. pig

c. cow

d. dream

Jobs's New Tune Raises Pressure On Music Firms

By NICK WINGFIELD and ETHAN SMITH

February 7, 2007; Page A1

http://online.wsj.com/article/SB117079215903499929.html

A movement to pressure the music industry to drop its primary weapon against online

piracy has gained a high-profile convert: Steve Jobs, the man who helped build the

market for selling music via the Internet.

In an 1,800-word online essay, Apple Inc.'s chief executive said the world's major music

companies should consider allowing Apple and others to sell songs unfettered by

anticopying software that prevents them from being shared or played however a

consumer chooses.

Mr. Jobs contends that the recording industry isn't solving piracy with the technology,

and could spur the market further if music lovers could buy music online without the

restrictions. Many consumers resent the curbs on how they can listen to what they buy

from online stores. Songs from one company's catalog, for example, won't work on

another company's player -- a gridlock that has frustrated some consumers. Getting rid of

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 7 of 29

the antipiracy software could make downloaded music as widely compatible with digital

players in the market as compact discs are with CD players.

While Mr. Jobs is positioning his proposal as a consumer-friendly step, it isn't clear

whether the biggest music companies -- Warner Music Group Corp., EMI Group PLC,

Vivendi SA's Universal Music Group, and Sony BMG, the joint venture of Sony Corp.

and Bertelsmann AG -- will embrace his recommendation. Allowing online music sales

without anticopying software would amount to a radical about-face for the recording

industry, which several years ago viewed the technology as a remedy to rampant online

piracy through file-sharing networks like the original Napster and Kazaa. Music

heavyweights have long required Apple and others to use the technology -- known as

digital-rights management, or DRM, software -- if they wish to sell their songs online.

Nor is it clear whether such a shift would deliver a further blow or a potential boon to the

music industry, which has endured a spiral of declining sales and rising piracy since the

advent of Internet-enabled copying and transmission of music. According to the

Recording Industry Association of America, the value of recorded music shipped to U.S.

retailers plunged 16% from a $14.5 billion peak in 1999 to $12.2 billion at the end of

2005 -- a slide the industry blames in part on online piracy. Record companies decided

that one way to keep this from worsening was to let legitimate companies sell music in a

format whose distribution could be more tightly controlled.

Apple quickly took the lead several years ago by selling music through its iTunes Store

for 99 cents a song. The digital music files are essentially padlocked by a layer of

software that makes them playable only on iPods and on computers using iTunes

software. Other companies use competing copy-protection software, though, limiting

users of digital-music players to purchasing songs online through compatible song

catalogs.

Yet for all the limits such software places on copying music, Mr. Jobs said, the

technology doesn't effectively deter piracy because more than 90% of music world-wide

is purchased on CDs -- which don't contain antipiracy software and are therefore easily

copied to a computer and then traded online.

In his essay, posted yesterday on Apple's Web site, Mr. Jobs suggests the music industry

might see better growth by abandoning its protective approach. "If such requirements

were removed, the music industry might experience an influx of new companies willing

to invest in innovative new stores and players," he wrote. "This can only be seen as a

positive by the music companies."

Sales of digital downloads have continued to rise, but at a slower rate than in previous

years. That, combined with an accelerating downturn in CD sales, has meant the music

companies have been harder pressed than ever to find new sales wherever they can. Some

executives in the technology and music industries have argued that sales of digital music

are being held back by the lack of compatibility between hardware devices and music

services. These people believe the market could grow more strongly if iTunes

competitors can sell music that can be played on iPods.

7. In an 1,800 word online essay, the chief executive of Apple said the world's major

music companies should consider allowing Apple and others to sell songs _____.

a. for less than 1 dollar

b. to China

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 8 of 29

c. on 2 inch CD’s

d. unfettered by anticopying software Correct

8. Music heavyweights have long required Apple and others to use the technology known

as ____ if they wish to sell their songs online.

a. ADM

b. MRD

c. DRM Correct

d. MDD

Behind Antismoking Policy, Influence of Drug Industry

By KEVIN HELLIKER

February 8, 2007 11:21 p.m.; Page A1

http://online.wsj.com/article/SB117088041013301313.html

Michael Fiore is in charge of revising federal guidelines on how to get smokers to quit.

He also runs an academic research center funded in part by drug companies that make

quit-smoking aids, and he personally has received tens of thousands of dollars in

speaking and consulting fees from those companies.

Conflict of interest? No, says Dr. Fiore, who has consistently declared that doctors ought

to use stop-smoking medicine. He says his opinion -- reflected in current federal

guidelines -- is based on scientific evidence from hundreds of studies.

Now debate is growing about that evidence, and about who should be entrusted to

interpret it. Some public-health officials say industry-funded doctors are ignoring other

studies that suggest cold turkey is just as effective or even superior to nicotine patches

and other pharmaceuticals over the long run, not to mention cheaper.

At stake is one of the most important issues in the nation's public-health policy.

Cigarettes kill an estimated 440,000 Americans a year. Helping America's 45 million

smokers kick the addiction could save untold numbers of people.

The Public Health Service, part of the Department of Health and Human Services, issued

guidelines in 2000 calling for smokers to use nicotine patches, gums and other

pharmaceutical aids to quit, with a few exceptions such as pregnant women. Dr. Fiore, a

University of Wisconsin professor of medicine, headed the 18-member panel that created

those guidelines. He and at least eight others on it had ties to the makers of stop-smoking

products.

Those opposed to urging medication on most quitters note that cold turkey is the method

used by the vast majority of former smokers. They fear the federal government's

campaign could discourage potential quitters who don't want to spend money on quitting

aids or don't like the idea of treating their nicotine addiction with more nicotine.

"To imply that medications are the only way is inappropriate," says Lois Biener, a senior

research fellow at the University of Massachusetts at Boston who has surveyed former

smokers in her state. "Most people don't want them. Most of the people who do quit

successfully do so without them."

Guidelines Revision

The panel is now working on a revision of the guidelines, scheduled for completion early

next year. Dr. Fiore, an internist, is again chairman. He says this time only seven of 26

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 9 of 29

members have industry ties. Karen Migdail, a spokeswoman for the revision effort, says

it involves so many voices that "it's hard for one perspective to have an influence on the

process." She says Dr. Fiore is "one of the leading experts" in smoking cessation and

well-suited to the job.

Dr. Fiore says his panel will give a fair hearing to all points of view on smoking

cessation. He says the process is sufficiently collaborative to prevent bias, his or anyone

else's, from creeping into the final product. He notes that many of the studies questioning

the effectiveness of stop-smoking medication arose after the publication of the 2000

guidelines. The panel will scrutinize them closely before reaching any conclusions, he

says.

David Blumenthal, director of the Institute for Health Policy at Massachusetts General

Hospital, questions the government's choice of Dr. Fiore. "The chairman of the

committee should be unquestionably impartial," says Dr. Blumenthal, who has published

extensively on conflicts of interest.

Pharmaceutical companies make several products to help smokers quit. Some give a

nicotine fix without a cigarette, such as GlaxoSmithKline PLC's Nicorette gum and

nicotine-laced Commit lozenges. Nicotine, the addictive agent in cigarettes, is considered

benign relative to the carcinogens in cigarettes. Bupropion, an antidepressant, and Pfizer

Inc.'s Chantix -- both pills available only by prescription -- aim to reduce cravings

without using nicotine.

9. The Public Health Service, part of the Department of Health and Human Services,

issued guidelines in 2000 calling for smokers to use ________ to help stop smoking.

a. pharmaceutical aids

b. nicotine gums

c. nicotine patches

d. All of the above Correct

10. The position of Dr. Fiore is somewhat in question because

a. he strongly believes “cold turkey” is the only way to quit

b. he is still a smoker himself

c. he runs an academic research center funded in part by drug companies that make quitsmoking aids Correct

d. Both a and b

Big Dealer to Detroit: Fix How You Make Cars

By NEAL E. BOUDETTE

February 9, 2007; Page A1

http://online.wsj.com/article/SB117098933533703281.html

Michael J. Jackson, chief executive of the U.S.'s largest chain of auto dealers, wants

Detroit to change how it makes cars -- and he may have the clout to succeed.

At one AutoNation Inc. location in Delray Beach, Fla., scores of "orphan" vehicles have

been sitting on the lot for months. One hulking silver Dodge Ram pickup has languished

unsold for 237 days, an eternity by automotive standards. The problem? Chrysler

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 10 of 29

equipped the truck with a V6 engine instead of the V8 requested by most buyers of big

trucks.

Parked nearby is a red Jeep Grand Cherokee with four-wheel drive, a feature popular in

snowy climes but not sunny Florida. One Chrysler Sebring convertible is so loaded with

options that its sticker price is $32,000 -- nearly as much as a BMW 3 Series.

"No customer would have asked for these vehicles that way, and they never should have

been built that way," says Mr. Jackson. "This has to change."

One of the toughest problems facing the ailing U.S. car industry stems from Detroit's

century-old business model, which dates to Henry Ford's mass production of millions of

largely identical Model T's. Rather than build cars to suit customer tastes, U.S. auto

makers churn out what makes sense for their plants, and then use incentives and rebates

to lure buyers. The thirst for revenue to pay for mounting health-care and pension costs

has further encouraged companies to keep plants running regardless of demand.

In years past, it was dealers who suffered as this excess inventory -- in the form of unsold

cars -- sat idly on their lots. But the rise of powerful national dealership chains,

exemplified by Mr. Jackson's AutoNation, has changed the equation. He's pushed Detroit

to cut production more than it wants and has cut orders when it hasn't responded. Last

year, when DaimlerChrysler AG's Chrysler Group pressured dealers to take thousands

of unwanted cars, AutoNation and other chains led a revolt that forced the car maker to

backtrack.

At the Detroit auto show last month , Mr. Jackson had private meetings with the chiefs of

General Motors Corp., Ford Motor Co. and Chrysler -- a dance card few in the industry

could match -- and offered to help. Last year, AutoNation began sifting through its trove

of data to identify the best-selling configurations of every vehicle on the market. He

wants GM, Ford and Chrysler to join the effort and use the information to produce

vehicles customers actually want.

11. Rather than build to suit customer tastes, US auto makers churn out ____, and then

use incentives and rebates to lure buyers.

a. expensive cars with few options

b. expensive trucks with lots of options

c. expensive SUVs with few options

d. what makes sense for their plants Correct

12. Due to _____ companies often feel the need to keep plants running regardless of

demand.

a. global competition

b. union contracts

c. mounting health-care and pension costs Correct

d. seasonal changes in consumer tastes

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 11 of 29

Questions 13 – 17 from Marketplace

Manager Shortage Spurs Small Firms To Grow Their Own

By ERIN WHITE

February 5, 2007; Page B1

http://online.wsj.com/article/SB117063558473797776.html

MARSHALL, Minn. -- Kristy Griffin was a manager in a Kansas frozen-pizza factory

when her bosses decided she was destined for greatness.

In 2002, executives at Schwan Food Co., maker of Mrs. Smith's pies and Red Baron

frozen pizzas, invited Ms. Griffin to join an intensive development program for "highpotential" managers. Since then, she's earned her M.B.A., moved her family twice, helped

engineer an acquisition, and taken posts in marketing and research, in which she'd had no

prior experience.

Schwan is one of many U.S. companies paying more attention to grooming their next

generation of leaders. Selected employees typically enter multi-year programs involving

management classes, coaching sessions and so-called stretch assignments that throw them

into big, unfamiliar challenges.

Such programs are old hat at corporate giants such as General Electric Co., PepsiCo Inc.,

and Bank of America Corp. Now, smaller companies, like closely held Schwan, with

annual sales of about $3.5 billion, are also adopting or expanding such programs in the

face of a shortage of seasoned managers.

Management consultants cite several reasons. The tight labor market puts a premium on

retaining top talent and raises the cost of outside hires. And leaner corporate structures

make it harder for managers to naturally hone their skills through incremental steps up

the ladder; companies must instead formally teach them. Demographics play a role, too:

The looming retirement of baby boomers is forcing companies to think about

replacements.

"There's a huge shortage of leaders," says Ravin Jesuthasan, a managing principal at

Towers Perrin, the consulting firm. For smaller companies in a fierce competitive

landscape, "growth rates and expectations for growth have ratcheted up, requiring you to

be much more diligent and proactive and structured in how you manage the flow of

talent." Mr. Jesuthasan says that he has seen smaller companies in the energy, software,

pharmaceutical and consumer-products industries begin or expand programs to identify

and develop strong managers.

13. Smaller companies have adopted intensive management training programs because

a. retiring baby boomers need to be replaced

b. it helps retain their top talent

c. it is difficult to hone skills in a lean corporate structure

d. all of the above Correct

Kodak's Strategy For First Printer -- Cheaper Cartridges

By WILLIAM M. BULKELEY

February 6, 2007; Page B1

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 12 of 29

http://online.wsj.com/article/SB117073503026399219.html

In a move that could shake up the $45 billion-a-year ink oligopoly, Eastman Kodak Co.

unveiled its long-awaited inkjet printer, with ink cartridges priced far less than its

competitors.

Printer makers, led by Hewlett-Packard Co., have long used the razor-and-blade pricing

model, in which the hardware is sold for little or no profit. They derive most of their

profits from ink, which is priced at more per ounce than perfume or caviar. Indeed,

annual sales of inkjet printers and multifunction devices world-wide are less than onequarter the annual sales of consumable ink and paper.

Kodak, which is led by several veterans of H-P's printer group, plans to modify that

model by making more money from hardware and accepting lower profits from the ink. It

says it will use a combination of new technology and alternative pricing to slash ink

prices by about 50% per page. On Tuesday, it unveiled new inkjet-based multifunction

devices that print, scan and copy documents, Web pages and photos. The printers,

primarily intended for home rather than business use, will be priced at $150 to $300,

depending on whether they have color displays and slots for camera memory cards.

Analysts said the prices are each about $50 more than comparable multifunction devices

now on the market.

Each of the Kodak printers will use a $10 black-ink cartridge and a $15 color-ink

cartridge -- about half the prevailing ink prices. Kodak says consumers who buy highvolume paper packages will be able to print 4-inch-by-6-inch snapshots for as little as 10

cents apiece -- compared with 29 cents on typical home printers and well under common

retail-store prices of 19 cents each.

Some industry watchers who have been briefed on the products think Kodak's strategy

spells trouble for inkjet-printer makers, especially second-tier vendors like Epson, a unit

of Seiko Epson Corp., and Lexmark International Inc. "This will be the year the razorand-blade model breaks," says Charles LeCompte, president of Lyra Research, a Newton,

Mass., market-research firm. He says Kodak's low-price strategy for ink is "such a

dramatic message that someone will have to respond." The success of cartridge-refill

companies, which cater to customers seeking cheaper ink rather than original cartridges

and have grabbed about 30% of the world-wide ink market, shows that consumers are

likely to welcome Kodak's approach, he says.

"This is going to change the industry," predicts Kodak's Philip J. Faraci, head of its

digital imaging consumer group. Mr. Faraci, who was once senior vice president for

inkjet systems at H-P, says: "For people who print a lot, we're offering a really great

solution." Mr. Faraci says Kodak expects the lower price ink to be especially appealing to

the top 20% of people who print at home and buy more than the average customer's 4.6

cartridges per year.

14. Printer makers, led by Hewlett-Packard Co., have long used the razor-and-blade

pricing model in which

a. the ink is sold for little or no profit

b. the hardware is sold for little or no profit Correct

c. the paper is sold for little or no profit

d. the blade is sold for little or no profit

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 13 of 29

Internet Technology Tests AT&T's Bid For TV Subscribers

By PETER GRANT

February 7, 2007; Page B1

http://online.wsj.com/article/SB117080773641100240.html

AT&T's big bet on using Internet technology to vault ahead of rival cable operators in the

television-distribution business is beginning to look more like a long shot.

The telecom giant says it has rolled out its so-called U-verse service in 11 cities. But

that's four fewer than promised, and the technology seems to remain mostly in the trial

phase. AT&T executives acknowledge they aren't fully marketing U-verse because the

service can't yet handle a surge of customers. AT&T counted just 3,000 customers at the

end of the fourth quarter, unchanged from three months earlier.

Meanwhile, AT&T executives last month admitted for the first time that there were

problems with the software for U-verse provided by Microsoft, its primary vendor on the

project. That's a concern not just for AT&T, but for telecom companies world-wide that

bought Microsoft technology to run TV services using Internet protocol, or IP, to transmit

signals.

It isn't clear how serious the problems are because AT&T and Microsoft executives won't

discuss them. An AT&T spokesman attempted to play down the situation, calling it "a

little fine tuning." A Microsoft spokesman said the technology was "on track."

But the delays plaguing U-verse have fed criticism that AT&T and Microsoft

overreached, trying to get more out of Internet technology than it's capable of delivering

at this time. The skeptics include vendors, former employees and competitors.

Surprisingly, one of the challenges they believe has tripped up AT&T is something the

earliest TV sets could do easily: switch channels instantaneously.

If AT&T did overreach, it was out of necessity. The company faces pressure to get into

the TV business from cable companies that are luring away tens of thousands of

customers with their "triple play" offers of phone, TV and high-speed Internet services.

AT&T wants to sell similar packages without investing billions of dollars in fiber-optic

cables to customers' homes, like Verizon Communications is doing.

Internet technology is an intriguing alternative. It doesn't require as much bandwidth as

cable because it doesn't deliver all broadcast channels to the TV set at once. Rather, it

sends them one at a time, similar to the way Web pages are sent to computers. That

means the signals technically could be sent along existing copper wires to customers'

homes.

15. AT&T's U-verse service provides _______ in 11 cities.

a. discounted cell phones

b. free cell phones

c. satellite radio

d. television Correct

The Magic Kingdom Looks to Hit the Road

By MERISSA MARR

February 8, 2007; Page B1

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 14 of 29

http://online.wsj.com/article/SB117090283470501808.html

Ever since Walt Disney opened Disneyland in 1955, Walt Disney Co. has rarely strayed

from his original vision of what a theme park should be. But at a top-secret development

unit these days, the company is plotting a new spurt of theme park expansion that goes

well beyond its traditional model of luring people to Disney resorts in Florida or

California.

Disney is hatching plans to take its theme-park experience to the masses, rather than the

other way around. Instead of building more big parks, the company is sketching out a

string of niche resorts and attractions around the world. That could include such things as

stand-alone, Disney themed hotels in cities and beach resorts, Disney branded retail and

dining districts, and smaller, more specialized parks.

In the near term, the company is using the Disney name to expand in other areas of the

travel business. For example, it is ramping up an operation called "Adventures by

Disney," in which travelers pay for guided Disney tours to popular destinations including

Italy and Ireland. The company also plans to build its presence in time-share vacation

homes in places like the Caribbean. And it is bulking up its popular cruise line, with more

Disney ships in the cards.

"Instead of saying where will the next Disneyland be, we need to think more in terms of

where around the world we can deliver an immersive experience appropriate to the size

of the market," says Jay Rasulo, chairman of Disney's theme park and resorts business.

"Not every market can support a full-on Disney location."

The expansion comes after a long stretch of rebuilding in the wake of 9/11. Only recently

has Disney's theme park business returned to the 20% margins seen before 2001. After

the success of last year's global campaign pegged to the 50th anniversary of Disneyland,

a big question has been what the theme parks will do next.

Mr. Rasulo says his strategy is aimed at tapping into a burst of growth in the travel

market, particularly in the Asia-Pacific region. Branching outside of Walt Disney's theme

park vision isn't without risk. Disney has tried it before and in some cases, failed. It

closed an indoor, interactive theme park project called Disney Quest in 2001 that drew

sparse crowds in Chicago. Its children's play center, Club Disney, shuttered two years

earlier after failing to sustain an initial burst of interest.

Mr. Rasulo, who took over as head of the parks in 2002, says his division learned an

important lesson from those ventures: they made the mistake of trying something that

didn't already have an established consumption pattern.

As Disney began thinking about a new strategy, it conducted research on why people go

to Disney's parks. Among the conclusions: people wanted to experience Disney in places

other than the parks.

Disney set to work sketching out some ideas. One concept is to create stand-alone

versions of the Downtown Disney dining and shopping districts or resorts like the

BoardWalk at Walt Disney World, which includes a hotel, clubs, arcades and other

entertainment. An alternative is building a resort around an attraction like an indoor

water-park or a theme like pirates or princesses. Another approach is building a family

version of a casino, without the gambling.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 15 of 29

A big focus will be Asia. Japan, for instance, has an insatiable appetite for everything

Disney but already has two parks. While a third park in another part of the country is

unlikely, adding a boutique attraction could theoretically be possible.

One issue is how to avoid cannibalizing existing parks with such attractions. Disney says

the goal is to give guests in new markets a taste of Disney with the hope of driving them

to the bigger parks. With guests at the domestic parks visiting on average every four

years, the thinking is that the smaller attractions will also serve existing guests between

visits.

Another challenge is tailoring the niche attractions to local markets while keeping the

Disney brand intact, something that has proved challenging with Hong Kong Disneyland.

Mr. Rasulo says there are no firm plans for any projects yet, with such ideas still in the

conceptual or "blue sky" stage.

More concrete are plans for the cruise lines. Mr. Rasulo says that business could double

in the next few years, with a "few more cruise ships." Disney has been waiting for better

contract terms and prices before going ahead with more ships, although it is likely to

approve some soon. Disney Cruise Line now accounts for between 5% and 8% of the

division's $10 billion annual revenue.

After quietly experimenting in the guided-tour business, "Adventures by Disney" is

meanwhile rolling out 12 itineraries in North/Central America and Europe, with two

guides leading groups of up to 40 people.

"It's not Mickey Mouse goes to the mountains," says Ed Baklor, who heads the

Adventures business. "Instead we're telling a local story with local characters." The

"Spirit of America" tour of Philadelphia, Washington, D.C., and Williamsburg, Va., for

instance, includes meetings with local characters like Benjamin Franklin. The trips also

try to entertain both adults and kids: On the Tuscany trip, adults go on a wine tasting

while kids do a gelato tasting.

The "Adventures" project raises a question: if the tours don't feature Mickey Mouse, why

will families want to go on them? Scott Lerman, CEO of brand consultancy Lucid Brands

says a big part of what guests expect from Disney is "fantasy," rather than "authenticity"

and "reality." Disney says it believes its selling point is offering a family vacation with

the safety and quality of the Disney brand as well as Disney-quality guides. They argue

the story doesn't need to be Disney to be "immersive."

Mr. Baklor notes that each trip includes some Disney "magic." One of example of that is

on the London/Paris trip, which includes VIP tickets to Disney's "Mary Poppins" stage

show and a backstage tour afterward.

Disney's time-share business, Disney Vacation Club, is also plotting new locations.

Outside of Florida, the company may consider locations such as California, Mexico and

the Caribbean, says Mr. Rasulo. It could take several years for such new ventures to

really move the needle, however.

Disney will work its traditional theme parks harder. It has a second, full-scale park in

China in its sights. That won't happen before 2012, though. Recent changes in local

government have slowed discussions in Shanghai, and Mr. Rasulo says they are "waiting

to re-engage when a new government is appointed."

16. Disney plans on expanding in the following ways

a. adding ships to the cruise line

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 16 of 29

b. create stand-alone versions of the Downtown Disney dining and shopping districts

c. "Adventures by Disney" in which travelers pay for guided Disney tours to popular

destinations

d. All of the above Correct

Spit's Out, Polish In As Beijing Primps For the Olympics

By MEI FONG

February 9, 2007; Page B1

http://online.wsj.com/article/SB117097099735302784.html

BEIJING -- China wants to lower great expectorations before the Olympics.

On the streets of the country's capital, spitting -- often complete with loud throat-clearing,

gurgling and an arc of phlegm -- is a frequent occurrence. The deeply ingrained habit is

found among young and old and crosses class lines.

Now Chinese officials are mounting a renewed campaign to abolish this custom and other

less-than-appealing practices -- including cutting in line and littering -- all to get the city

camera-ready for the 2008 Games.

This week, Beijing city authorities announced they will step up efforts to fine spitters as

much as 50 yuan, or $6.45, when they are caught doing the act in public -- a hefty sum by

Beijing standards and equivalent to a day's wages for many laborers. Laws against

spitting have existed for years, but haven't been strictly enforced.

At the same time, municipal authorities also announced Queuing Day. On the 11th of

each month, city residents will be encouraged to stand in line at subway stops, post

offices and various other public places. (The 11th was chosen because the two "1"s look

like they are standing neatly in line.)

Until relatively recently, China's history of scarce resources discouraged people from

waiting their turn in line. Crowds fighting to get onto buses and subways are a common

sight, as are drivers abruptly cutting into different lanes.

Many Chinese people are afraid of fighting back against line-jumpers. "You never know

when that person might be some important official," says Beijing resident Jason Chang, a

20-something teacher and Beijing resident. "Fighting for your rights -- it's still new in

China."

For decades, public etiquette campaigns have periodically surfaced, sometimes spurred

by concerns about health dangers of practices such as spitting. However, this latest push

reflects Beijing's high hopes for the Olympics Games next year -- widely seen as China's

coming-out party -- and its fear that rude habits could mar its chance to prove it is a

world-class city.

These initiatives are "an urgent demand to build a more civilized city, and to improve

people's behavior," says Zhang Huiguang, director of the Capital Ethic Development

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 17 of 29

Committee, an etiquette group in the Beijing government that is focused on readying the

city for the Olympics. Ms. Zhang, who has been dubbed Beijing's "Miss Manners" by

local media, came to the group in 2002 from her previous post as vice director of the

Chinese government's "Anti-Obscenity and Anti-Illegal Acts Department."

To raise Olympic spirits, the etiquette committee has created a slogan: "I participate, I'm

devoted, and I will be happy!" Activities will include poetry competitions and the

selection of goodwill ambassadors who will be lauded as "Top 10 Stars with high social

morality."

The anti-spitting initiative targets a long-held habit in Beijing. The city's dry desert air

and high levels of pollution can cause a rapid buildup of stringy phlegm, which is almost

as swiftly deposited on sidewalks, drains and just about anywhere.

That's partly because traditional Chinese medical philosophy -- centered on ideas of

balancing "hot" and "cool" elements in the body -- encourages expectoration as a healthy

habit, as it theoretically removes a "hot" element from the body. Even the etiquette police

don't go as far as recommending people swallow, not spit. Instead, they recommend

discreet deposits on tissues or scraps of paper -- rather than on the ground or someone's

shoe.

17. On the streets of China _______ is a frequent occurrence.

a. nudity

b. selling hot dogs

c. cursing out loud

d. spitting Correct

Questions 18 – 23 from Money & Investing

Despite Recent Oil-Price Rally, Stock Investors Hold On

By PETER A. MCKAY

February 3, 2007; Page B1

http://online.wsj.com/article/SB117046081888596783.html

If stock investors could spare a blanket, they might want to throw it on crude-oil prices,

which are rising again. For now, they seem to be using their blankets to keep warm.

After a selloff in crude to begin 2007, colder weather throughout much of the U.S. has

sent the commodity surging anew, up nearly 17% from its mid-January lows.

But while higher oil prices usually hurt stocks because of the impact of energy costs on

businesses and consumers, this oil rally hasn't sent investors into a panic. Even after a

small decline Friday, the Dow Jones Industrial Average is up 1.5% for the year after

closing at a record Thursday.

Investors figure at less than $60 a barrel, off 23% from the midsummer high, oil prices

aren't so bad. Still, they are paying attention to oil again, wary that if crude's rise

continues, it could eventually hurt corporate profits.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 18 of 29

"More than anything else, the effect of the oil price is very psychological," for both

investors and consumers, says analyst Fadel Gheit, of brokerage firm Oppenheimer &

Co. He says a return to retail gasoline prices over $3 a gallon could set off more

conservation by consumers and possibly a stock selloff. For now, that scenario doesn't

seem much of a risk.

After a rally in oil prices Friday, prices at the service station could be on the way up.

Forecasts for cold weather and buying by traders who often like to guard against adverse

news over the weekend sent crude prices up $1.72, or 3%, to $59.02 a barrel -- the

highest finish so far this year. That trimmed oil futures' decline for 2007 to 3.3%.

The rally helped push the Dow lower Friday, though it had its best week in more than two

months. The average fell 20.19 points Friday, or 0.2%, to 12653.49, up 1.3% for the

week. Higher energy prices generally concern investors because they believe that when

consumers spend more at the pump, it leaves fewer dollars to spend on other products and

services.

Other stock indicators rose Friday. The Standard & Poor's 500-stock index edged up

0.2%, or 2.45 points, to 1448.39, a six-year high and up 2.1% on the year. It rose 1.8%

for the week. The Nasdaq Composite Index gained 0.3%, or 7.50 points, to 2475.88, up

1.7% for the week and 2.5% on the year.

Stocks were also held in check by the Labor Department's release of weaker-thanexpected weekly employment data. Other economic signals were more upbeat. Measures

of both consumer confidence and factory orders were up for December.

"The economy is stronger than most people think," says strategist James Paulsen of Wells

Capital Management. "I don't think oil is down from [its summer highs] near $80 because

the economy has slowed. If anything, it's accelerated."

18. _____throughout much of the US has sent crude-oil prices surging anew, up nearly

17% from its mid-January lows.

a. Strong SUV sales

b. Strong auto sales

c. Colder weather Correct

d. Extensive winter vacation travel

Living High on the Hog

By KAREN RICHARDSON

February 5, 2007; Page C1

http://online.wsj.com/article/SB117063639186397804.html

Riders of Harley-Davidson Inc. motorcycles tend to be a loyal bunch, with many sporting

matching Harley-logo tattoos and traveling for days to attend far-flung bike rallies

sponsored by the company.

The 103-year-old Milwaukee company's management team, however, has shown less

fidelity, judging by its recent history of selling shares. Together with a slowdown in

Harley's U.S. motorcycle sales and its aging leather-clad customer base, the trend of

insider-selling may be a reason to gear down expectations for the company's high-octane

stock price.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 19 of 29

An American icon and one of the world's most recognizable brands, Harley has seen its

earnings and shares climb steadily since the company went public in 1986. Despite a

walkout by union members at its largest manufacturing plant, in 4 p.m. trading Friday on

the New York Stock Exchange, Harley shares closed at $70.10, up $1.34, or 1.95%.

While that is below its record close of $75.87 in November, the stock, which trades under

the symbol HOG, is up 129% over the past five years, leaving the S&P 500 choking on

its exhaust fumes. Harley has a market value of more than $18 billion.

That is rich for Wall Street. "We would become more aggressive with the stock in the

mid-$60s," says Craig Kennison, a research analyst at Robert W. Baird & Co. Like 18 of

the 20 analysts who cover Harley, he has a hold rating on the stock. One analyst has a sell

and another has a strong sell. Mr. Kennison says he doesn't own any Harley shares, nor

does his employer.

Apparently, the share price also is rich for Harley's management. As the stock rocketed to

dizzying levels in October and November, seven executives -- including Chairman

Jeffrey Bleustein, Chief Executive James Ziemer, the general counsel and the chief

accountant -- sold a record number of shares, which represented the highest amount of

insider selling in dollar value in Harley's history.

In several days over those two months, Harley insiders sold 1,517,760 shares valued at

$101.3 million. On the same day or a few days earlier, those insiders exercised options to

buy 1,402,266 shares at prices that valued their purchases at $55.4 million. That means

the insiders made net profit of $45.9 million, or a gain of 83%.

Harley's Mr. Ziemer said that "half the sales were for a retired CEO," referring to

Chairman Bleustein, whose deadline to cash in his shares was approaching. Mr. Bleustein

on two days sold 960,000 shares valued at $62.3 million.

As for the other sales, which in total exceeded the amount of stock bought through

options, Harley spokesman Robert Klein said they were prompted by "financial planning

and other reasons." Mr. Ziemer, who owns three Harley bikes, sold $7.7 million in shares

in 2006. He continues to directly or indirectly own at least 285,000 shares.

Still, the cluster of sales around the stock's record share price raises some eyebrows.

"When you have consensus-selling, it's definitely more telling of how investors should

play the market than when just a few insiders sell," says Jaseem Hasib, a senior research

analyst in New York at Thomson Financial.

The recent insider selloff is the latest in an interesting trend, says Mr. Hasib. During three

periods in 2001 and 2004, insider sales at Harley occurred after run-ups in share price,

and preceded periods of either flat performance or a fall in share price.

For example, in April 2004, four insiders sold $25.6 million in shares; the stock had risen

about 18% from the start of the year through the end of April and was up more than 50%

over the previous 13 months. In July, six insiders sold $55.4 million in shares.

19. In October and November, seven executives of Harley Davidson ___.

a. retired

b. toured China for new plant locations

c. purchased a record number of stock shares

d. sold a record number of stock shares Correct

Help Wanted: Bank Officials To Watch Cash

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 20 of 29

By CLINT RILEY

February 6, 2007; Page C1

http://online.wsj.com/article/SB117071792938998839.html

Years ago, as U.S. Army Sgt. Jon Elvin scoured the Arizona desert for signs of narcotics

traffickers, one of the last places he expected to end up was working at a bank in

Pennsylvania.

While his closely cropped haircut and gait give away his military background, the Army

reservist has spent many of his waking hours since early 2004 making sure crooks, shady

businessmen and terrorists aren't moving tainted money through PNC Financial Services

Group Inc.

Mr. Elvin is a vice president at PNC, overseeing the Pittsburgh-based bank's anti-moneylaundering efforts. Using instinct, sophisticated global databases and social-networking

software, he and his team can tell if a would-be checking-account holder is the family

member of a corrupt dictator or a suspected terrorist on an international watch list.

The 39-year-old Mr. Elvin is among the financial-services industry's growing army of

front-line soldiers during a time when bad guys move money in ever-changing ways and

regulators are passing out multimillion-dollar fines to financial institutions that fail to

keep diligent watch.

His talents and those of other analytical types like him are in great demand at banks and

other financial institutions, many of which now consider not having a strong compliance

operation a threat to their bottom lines and reputations.

20. Mr. Elvin is a vice president at PNC, overseeing the Pittsburgh based bank's ______

efforts.

a. anti terrorism

b. anti counterfeit laundering

c. anti money laundering Correct

d. takeover

Time to Fret Over Slowdown In Earnings?

By JUSTIN LAHART

February 7, 2007; Page C1

http://online.wsj.com/article/SB117080711634800217.html

It's been a long time since American businesses failed to produce a quarter of doubledigit earnings growth. The fourth quarter is shaping up to be a close call.

Combining results from companies that have already reported with analyst estimates for

companies that haven't, Thomson Financial estimates earnings per share for companies in

the S&P 500 were 10.4% higher in the fourth quarter than a year earlier. Reuters

Estimates puts that number at 9.9% and says it could exceed 10% once all the results are

in. Standard & Poor's number is 9.8%.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 21 of 29

The three firms have slightly different views about what qualifies as earnings. Each uses

a different version of "pro forma earnings," which exclude certain expenses that are

counted under generally accepted accounting principles.

Thomson depends on the consensus of analysts. Reuters asks analysts to provide

estimates that count employee stock options as an expense, though for some companies -including tech heavyweights Cisco, Google and Oracle -- the majority of analysts won't

give in. S&P uses its own analyst estimates, allowing it to uniformly include option

expenses. S&P is also more stringent about excluding "nonrecurring charges," such as

CEO retirement packages.

Now analysts are moving the chains, and looking for earnings to fall short in the first

quarter. Thomson, which put the biggest smiley face on the fourth quarter, will probably

put the biggest frowny face on the first quarter. Thomson analyst John Butters says

current estimates put first quarter earnings growth at just 4.9%, versus Reuters's 8.2% and

S&P's 7.3%. Thomson's numbers might be lower in part because some analysts are only

now starting to provide it with numbers accounting for options expenses.

Arguably, that means that the earnings slowdown won't be as severe as Thomson's

figures suggest. But Wall Street leans toward the Thomson numbers, so let the fretting

begin.

Last year, credit-ratings firm Moody's Corp. looked like it was on the ropes. Its Moody's

Investors Service unit rates the publicly traded debt of companies, municipalities and just

about anyone else who wants to borrow. The housing market was slowing, and one of its

main business lines, ratings of residential mortgage-backed securities, seemed certain to

slow.

Now, Moody's stock is testing its highs. Shares of Moody's hit a record of $73.29 in April

2006, dropped by almost a third to below $50 by midsummer and have climbed back to

$72.61.

Investors got the housing slowdown right, but underestimated the surging appetite for

debt among corporations, which borrowed record sums in the second half of last year.

A lot of the debt companies took out was repackaged into derivatives that also required

credit ratings, making the corporate borrowing boom "doubly-nice" for Moody's, noted

Bear Stearns analyst Michael Meltz in a recent report.

Today, Moody's reports fourth-quarter results. Analysts expect it to chalk up 15% to 20%

growth in revenues and earnings, excluding one-time gains. But beware. Just like the debt

it rates, Moody's is at an uncomfortable point in the credit cycle. After so many good

years, one has to wonder how much longer it will last.

21. Combining results from companies that have already reported with analyst estimates

for companies that haven't, Thomson Financial estimates earnings per share for

companies in the S&P 500 were ______ in the fourth quarter than a year earlier.

a. 9.9% lower

b. 9.9% higher

c. 10.4% lower

d. 10.4% higher Correct

Here's a Tip: Ignore Advice On Sector Moves

By JUSTIN LAHART

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 22 of 29

February 8, 2007; Page C1

http://online.wsj.com/article/SB117089774768301697.html

The next time you hear advice from an investment expert about a hot sector, the best

strategy might be to ignore it.

Analysts and fund companies like to advise investors to "overweight tech" or

"underweight energy." In plain English, that means they are saying to put extra cash into

technology shares or less of it into energy stocks. And over the years, they have come up

with a well-worn set of terms and guidelines. If the economy is heading for a rough

patch, for instance, it is time to buy "defensive" stocks; if it is pulling itself out of the

doldrums, it is time to buy "early cyclicals." The problem with well-worn ideas in

financial markets is they tend to stop working, and that might be happening with sector

pickers now. Lately, the difference between the best- and worst-performing sectors hasn't

been nearly as stark as it used to be, said Julius Baer Investment Management portfolio

manager Brett Gallagher.

The difference in annual returns between the top and bottom sectors in MSCI Barra's

world stock-market index has averaged a little more than 30 percentage points over the

past three years. Over the five-year period that ended in 2002, that average was about 60

percentage points. While tech's boom and bust was a big part of that, Mr. Gallagher said

the annual-return difference between the second-best- and second-worst-performing

sectors similarly narrowed.

22. The next time you hear advice from an investment expert about a hot sector, the best

strategy might be _______.

a. to ignore it Correct

b. to overweight it

c. to underweight it

d. to fund it

Cox's 'Independent' Day

By KARA SCANNELL and TOM LAURICELLA

February 9, 2007; Page C1

http://online.wsj.com/article/SB117098971972203291.html

Though the Securities and Exchange Commission remains undecided over whether to

require mutual-fund boards to be led by independent directors, the agency's chairman is

committed to finding a compromise rule to accomplish the goal, people familiar with the

matter said.

The SEC first proposed and passed the independent-chairman rule in 2004, but a federal

appeals court sent it back for reconsideration. The industry had expected SEC Chairman

Christopher Cox -- who took over in the fall of 2005 -- to let the issue die.

But people familiar with his thinking said he wants to strengthen independent fund

directors' role and believes the commission should stand its ground by passing a version

of the rule, given that it had voted for a previous iteration, albeit 3-2.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 23 of 29

The issue will test Mr. Cox's consensus-building skills. Appointed by President Bush, the

former Republican congressman has managed to corral the panel's two Democrats and

two Republicans into unanimous votes for other rules.

The rule passed by the SEC in 2005 under then-Chairman William Donaldson required

the chairman of each fund board and 75% of its members be independent, up from a

majority. Two Democratic commissioners and Mr. Donaldson, a Republican, voted for it.

The remaining two commissioners, both Republican, opposed it.

The challenge for Mr. Cox will be appeasing the old rule's opposing factions. The two

commissioners who voted on that rule and remain in office are steadfast: Republican Paul

Atkins opposes it and Democrat Roel Campos favors it. The two other commissioners -Republican Kathy Casey and Democrat Annette Nazareth -- haven't publicly stated

positions.

Observers expect the SEC to keep the 75% requirement. Opposition to that rule is more

muted because the majority of the fund industry has moved in that direction. About 80%

of fund companies that responded to a 2005 Investment Company Institute survey said

they met the 75% standard.

Bridging the divide over the independent-chairman requirement will be trickier, even

though more boards have independent leadership now, either voluntarily or forced by

regulatory settlements stemming from fund-industry abuses that helped prompt the SEC

rule. The ICI survey found that 52% of the boards had an independent chairman, a

percentage industry experts said likely is higher today.

Instead of requiring independent chairmen, the SEC could force fund boards to designate

a lead independent director and give that person substantive responsibilities, such as the

power to set agenda items for board meetings.

"That would address some of the reasons why the SEC thought an independent chair

would be of use," said Julie Allecta, a mutual-fund industry attorney.

Philip Khinda, also an industry attorney, said another possible compromise would require

prominent disclosure of whether funds have independent chairmen. That would

encourage funds to move in that direction, lest competitors seem more reform-minded to

potential investors.

"The SEC [could] say that they haven't imposed a standard but still have done something

that will affect behavior," Mr. Khinda says.

The original rule was crafted in the wake of revelations that some large mutual-fund

companies had allowed big investors to profit from trading strategies that violated their

fund rules and sometimes securities laws, to the detriment of other investors.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 24 of 29

23. The SEC first proposed and passed the ________ in 2004, but a federal appeals court

sent it back for reconsideration.

a. dependent chairman rule

b. independent chairman rule Correct

c. independent observer law

d. dependent observer law

Questions 24 – 26 from Personal Journal, Section D

How Plans to Expand Health Coverage Could Affect Insured

By LAURA MECKLER

February 6, 2007; Page D1

http://online.wsj.com/article/SB117072547140699043.html

New prescriptions to help the uninsured are proliferating by the day, but some of the

proposals would have a big impact on another group -- people who already have health

insurance.

Yesterday, Democratic presidential hopeful John Edwards became the latest entrant in the

health-overhaul derby, announcing that he would raise taxes to expand coverage. (See

related story.1) His plan, like those of many states working to expand coverage, would

require employers to "play or pay" -- meaning cover their workers or pay a new tax. He

would also require most Americans to have insurance, helping middle-and lower-income

people by offering tax credits. Both the uninsured and those who already have insurance

through work would have the option to get coverage through new public pools called

Health Markets.

The states have a better chance of quick action, with Democrats and Republicans working

to find consensus. In Massachusetts, a plan has already been passed and is being

implemented.

Here's a look at how the plans work, and some potential winners and losers:

PRESIDENT BUSH'S PLAN: Under the Bush plan, employer-provided health insurance,

now excluded from workers' taxable income, would be subject to income and payroll tax.

As a tradeoff, all taxpayers with insurance would get a standard deduction of $15,000 for

a family and $7,500 for an individual.

Among the winners would be those whose coverage costs less than $15,000 a year -- or

about 80% of workers who have job-based insurance, the White House says. For

example, a worker with a family policy costing him and his employer $10,000 a year

would still be able to take the full deduction of $15,000. Losers would include people

with family policies worth more than $15,000, including executives with generous

benefits and some union workers who have traded wage increase for better health

coverage. They would be taxed on the amount that exceeds the deduction.