Alex Smith is a management consultant with the firm Alliance

advertisement

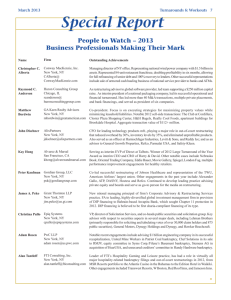

Alex G. Smith Alliance Management Mr. Smith joined Alliance Management in 2003 and has completed consulting engagements in multiple industries, including: healthcare, information technology, business services, transportation, diversified manufacturing, distribution & wholesale, agriculture and retail. Prior to Alliance Management, Mr. Smith served in various capacities including financial management, business and market development, and strategic planning in the medical, software, and internet technology industries. During his career, Mr. Smith has also performed interim CFO duties for start-up technology companies and step-out/break-out business ventures in large corporations. While assisting these companies in their efforts to raise funds (series A and B), Mr. Smith also helped to establish capital structures, corporate governance and relationships with secured and unsecured creditors. During 2006, Mr. Smith performed the following roles in the Retail Sector: Restructuring and Financial Advisor to Bachrach Clothing, Inc., an equitysponsored, U.S. based retailer of men’s clothing. He assisted the Company through a successful Chapter 11 Bankruptcy Filing in the Northern District of Illinois. The Company was sold through the Chapter 11 363 sale process. The company continues to operate multi store locations throughout the United States. Financial Advisor to a Retail Asset Based Lending Syndicate, with a $55 million credit facility to a distressed multi store merchandising operation located in the Midwest. While the loan was severely impaired the Company was successfully sold and the lending syndicate was repaid in full. Financial Advisor to a California based jewelry store chain. Following a business assessment and complete financial review, the Company was able to obtain a waiver of default and revised loan covenants from its senior lender. Mr. Smith currently serves on the Board of Directors of the Colorado Chapter of the Turnaround Management Association. He holds a Bachelor of Science degree in International Business and a minor in Spanish from Trinity University in San Antonio, Texas and an M.B.A., with honors, from the University of Chicago Graduate School of Business. James H. Cullen Alliance Management Mr. Cullen has a 20 year track record as serving as a CRO, CEO, CFO and Restructuring Adviser to companies and financial institutions undergoing transition and reorganization. He also worked in corporate finance and investment banking for a number of financial institutions and served as a manger of a $200 million portfolio of distressed debt and equity investments. His experience includes managing, operating and refinancing distressed corporations through crisis situations, litigation, financial restructuring, debt placements and equity financings in the US, Europe, Asia and Australia. During 2006, Mr. Cullen held the following roles in the Retail Sector: Chief Restructuring Officer and Investment Banker to Overland Trading, a national shoe retailer, and led the Company through a successful Chapter 11 Bankruptcy filing in the District of Missouri. The Company was ultimately sold through the 363 sale process to a California public company, Big Dog Holdings. The majority of stores continue to operate throughout the US. Chief Restructuring Adviser and Investment Banker to Bachrach Clothing, Inc., an equity-sponsored, U.S. based retailer of men’s clothing. He led the Company through a successful Chapter 11 Bankruptcy Filing in the Northern District of Illinois. The Company was sold through the Chapter 11 363 sale process. The company continues to operate multi store locations throughout the US. Chief Financial Advisor to a Retail Asset Based Lending Syndicate, with a $55 million credit facility to a distressed multi store merchandising operation located in the Midwest. While the loan was severely impaired the Company was successfully sold and the lending syndicate was repaid in full. A native of Ireland, Mr. Cullen graduated in Finance, with Honors from Trinity College Dublin, Ireland. Mr. Cullen is member of the Upper Midwest Chapter of the Turnaround Management Association and has served on the Board of several companies on behalf of financial institutions. Peter J. Roberts Shaw Gussis Fishman Glantz Wolfson & Towbin LLC Pete Roberts is a Member of the Chicago law firm of Shaw Gussis Fishman Glantz Wolfson & Towbin LLC. He concentrates his practice in bankruptcy, reorganization and creditors’ rights. In over sixteen years of practice, Mr. Roberts has represented and advised debtors, trustees, financial institutions, trade creditors, landlords, equipment lessors, and creditors’ committees in a variety of insolvency contexts and in virtually all aspects of bankruptcy. Illustrating his experience, Mr. Roberts represented Bachrach Clothing, Inc., a national clothing retailer, in its recently filed chapter 11 bankruptcy and the subsequent going concern auction sale of its assets; and he also recently represented a publicly traded jewelry retailer in an out-of-court workout of trade debt exceeding $40 million. Mr. Roberts also represented ABC-NACO Inc., a publicly traded Chicago-based railroad parts manufacturer, in the chapter 11 auction sale of its assets and the subsequent wind down of its affairs, and he represented Florsheim Group Inc., a national shoe retailer, in its chapter 11 case and related disputes with landlords and attorneys general over subsequent store closing sales. Mr. Roberts was also part of the appellate team representing Capital Factors, Inc. in the affirmance of its successful challenge to the payment of critical vendors in the Kmart bankruptcy. Mr. Roberts is a graduate of the Duke University School of Law, receiving his J.D. degree in 1990. He is also a cum laude graduate of Boston College, receiving his A.B. in history in 1987. Mr. Roberts is a member of the Turnaround Management Association, the American Bankruptcy Institute and the Lawyers Club of Chicago. He can be reached by phone at (312) 276-1322 or by e-mail at proberts@shawgussis.com. Cathy Hershcopf, Partner Cooley Godward Kronish LLP Cathy Hershcopf is a partner in the Firm's Bankruptcy and Restructuring practice. She joined Kronish Lieb Weiner & Hellman LLP in 1998, which was merged into Cooley Godward Kronish LLP in 2006. She is resident in the New York office. Cathy Hershcopf concentrates on debtor and creditor’s rights in Chapter 11 bankruptcy proceedings and out of court restructurings and workouts, with a focus on representing buyers and sellers of real estate, inventory, intellectual property and other assets in distressed situations, debtors in technology industries, and committees of unsecured creditors in retail cases nationwide. During the past several years, Ms. Hershcopf has represented official committees of unsecured creditors in some of the most significant retail Chapter 11 bankruptcy proceedings throughout the country. Highlights of Ms. Herschopf’s creditor committee representations include: Montgomery Ward — Ms. Hershcopf coordinated the sale of more than $500 million of real estate through a designation rights agreement with Kimco Realty, led a campaign to negatively solicit a liquidation plan proposed by GE Capital, and assisted in settling the Committee’s lawsuit against GE Capital for more than $80 million, which achieved a distribution to unsecured creditors in excess of 600% of the projected liquidation value of the largest retail liquidation in the country. Footstar, Inc. — Ms. Hershcopf assisted in the sale of the retail business to Foot Locker for $225 million, setting the stage for a successful reorganization which will pay unsecured creditors 100% of their claims, plus interest. Bob’s Stores — Ms. Hershcopf assisted in creating a three-day competitive auction for substantially all of the retailer’s assets resulting in a distribution to unsecured creditors in excess of 90% on their claims. New Weathervane — Ms. Hershcopf found a buyer to purchase substantially all of the noninventory assets of this New England retailer to a Canadian purchaser despite going out of business sales, thus obtaining a distribution and other benefits for unsecured creditors in a case where secured creditors were not paid in full. Archibald Candy Corporation — Ms. Hershcopf assisted in the sale of the Fanny May and Fanny Farmer assets in the U.S. and Laura Second assets in Canada, successfully litigated the estate’s right to retain $2.1 million of lease proceeds and negotiated a distribution for unsecured creditors in a case where secured creditors were not paid in full. Ms. Hershcopf also represented the creditors committees in retail Chapter 11 bankruptcy proceedings of Crowley Milner, Filene’s Basement, Lamont’s Apparel, Liberty House, Loehmann’s, Richman Gordman Stores, Stage Stores, Steinbach’s, Bedford Fair, C&R Clothiers, Casual Male, Christophers, Clothestime, Kuppenheimers, Moe Ginsburg, Today’s Man, Levitz, Cornell Trading, Bachrach, Nortstrom, Copelands, Athlete’s Foot, Herman’s Sporting Goods, Jumbo Sports, Just for Feet, Pic N’ Pay, The Walking Company and Sweet Factory. Highlights of Ms. Hershcopf’s recent employee committee representations include: United Airlines ESOP Committee — Ms. Hershcopf represented the ESOP Committee and its members in all matters relating to UAL Chapter 11 case, including successfully convincing the Bankruptcy Court to stay a class action lawsuit brought against the ESOP Committee in District Court and ultimately obtaining releases on behalf of the ESOP Committee and its past and current members. Enron Employee Related Issues Committee — Ms. Hershcopf assisted in obtaining a $28.8 million severance package for 4,500 employees terminated by Enron one day after the bankruptcy was filed. Highlights of Ms. Hershcopf’s recent debtor representations include: Metromedia Fiber Network, Inc., et al. — Ms. Hershcopf assisted the telecommunications and fiber network debtor in the sale of several stand alone businesses and excess real estate to fund the successful reorganization of the company and assist in restructuring approximately $5 billion in debt. Interliant, Inc., et al. — Ms. Hershcopf led this Internet service provider with revenues of approximately $160 million in the successful sale of its businesses as going concerns. Highlights of Ms. Hershcopf’s recent real estate restructuring representations include: Saint Vincent’s Hospital – Ms. Hershcopf is the tort committee’s representative on a joint committee to redevelop the Greenwich Village campus. Highlights of Ms. Hershcopf’s recent structured finance representations include: Carribean Property Group — Ms. Hershcopf issued the non consolidation opinions in connection with Carribean Property Group’s refinancing of the Ritz Carlton and Radisson hotels in Puerto Rico. Ms. Hershcopf received her J.D., summa cum laude, in 1985 from New York Law School, where she was a member of the Law Review, and graduated in 1975, summa cum laude, from University of Massachusetts, where she was Commonwealth Scholar, with a B.A. degree. Ms. Hershcopf regularly addresses creditor groups, real estate professionals, distressed debt conferences and other groups regarding creditors’ rights and bankruptcy and real estate matters. Ms. Hershcopf is an active member of the International Council of Shopping Centers and participates in annual sessions with attorneys from around the country regarding shopping center leasing and landlord and tenant issues related to retail bankruptcies. Most recently, she spoke at the ICSC Law Conference on the effect that changes in the bankruptcy law will have on retail cases. Mark P. Naughton Great American Group Vice President, General Counsel Years of Experience: Over 17 years representing debtors, trustees, secured creditors, creditors’ committees, and unsecured creditors in bankruptcies, workouts, and related litigation. Responsibilities: Represented nationally recognized companies in the liquidation and/or purchase of inventory and the disposition of leases in bankruptcy cases. Other Accomplishments: Prior to joining Great American Group, Mark was a Partner at Piper Rudnick, where he focused on retail bankruptcies, single asset bankruptcies, adversary proceedings in bankruptcy court, out of court workouts, and sales of troubled companies. Education: Marquette University, Bachelor of Arts Northwestern University, Juris Doctorate