ECO1 REV4 - Samar Reine

advertisement

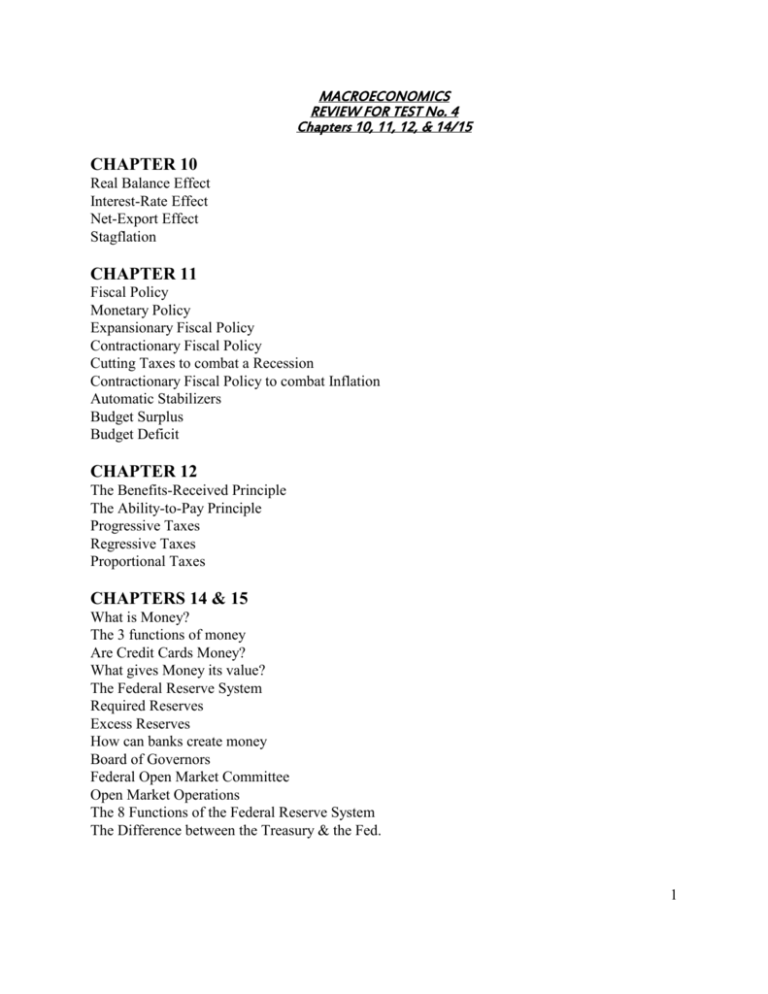

MACROECONOMICS REVIEW FOR TEST No. 4 Chapters 10, 11, 12, & 14/15 CHAPTER 10 Real Balance Effect Interest-Rate Effect Net-Export Effect Stagflation CHAPTER 11 Fiscal Policy Monetary Policy Expansionary Fiscal Policy Contractionary Fiscal Policy Cutting Taxes to combat a Recession Contractionary Fiscal Policy to combat Inflation Automatic Stabilizers Budget Surplus Budget Deficit CHAPTER 12 The Benefits-Received Principle The Ability-to-Pay Principle Progressive Taxes Regressive Taxes Proportional Taxes CHAPTERS 14 & 15 What is Money? The 3 functions of money Are Credit Cards Money? What gives Money its value? The Federal Reserve System Required Reserves Excess Reserves How can banks create money Board of Governors Federal Open Market Committee Open Market Operations The 8 Functions of the Federal Reserve System The Difference between the Treasury & the Fed. 1 Practice Questions 1. Keynes advises that the government should incur a budget deficit during __________________ only. 2. Student Pell grants are an example of supply-side fiscal policy. If not, then give an example ____________________________________________________________________________ 3. What do we call transfer payments and progressive taxes? Remember they are incorporated into the system. 4. Who mints the coins? 5. What does an increase in the price level do to net exports? 6. When the taxes levied increase with income we call that ___________________ taxes. 7. Expansionary discretionary F. P. does this: (circle all that apply) a. Increase AD b. Increase the RGDP c. Increase inflation d. decrease inflation 8. How independent is the Federal Reserves really? 9. What makes up stagflation exactly? 10. During a recession taxes are usually reduced in order to increase disposable income, Aggregate Demand, Aggregate Supply and RGDP. 11. Transfer payments are part of automatic fiscal policy because they adjust government spending automatically whenever there is a change in the unemployment rate. 12. An open market sale ___________________ the money supply. 13. The value of money is measured by how much it buys in goods and services. 14. How is the Federal Reserves different from the Treasury? 15. Why is fiscal policy aimed at AD? 16. What happens to disposable income and government spending when enacting contractionary discretionary Fiscal Policy? 2 17. Why does the government collect taxes? 18. Ability-to-pay principle is a _________ that is only applicable to _________ goods, like _____________________________________________________________________ 19. The real balance effect is about the changes that occur in the RDGP based on the inverse relationship of the price level on real consumption. 20. Banks create money via checkable deposits. How? 21. Credit cards are money. 22. What is stagflation? 23. The treasury is responsible for the government’s accounting, while the Fed’s sole purpose is to ensure proper rates of exchange and enough quantity of money in circulation. 24. If required reserves were 5% and we needed to shrink the money supply by $50 billion (50,000,000,000) then the Fed. would have to remove this much from circulation: 25. Benefits-received principle is a ________ that is only applicable to __________ goods, like ___________________________________________________________________ 26. What do classical economists say about AS, how do they explain equilibrium in the long run, and what are the assumptions they use? 27. What are the 4 ways that the Fed. increases M3? (The opposite is true when reducing it.) 3 28. Make sure that you know all the functions of money and all the functions of the federal reserves. 29. What other forms of currencies have there been throughout history? 30. How do disposable income, MPC, M and RGDP relate? 31. Explain what Keynes says about AS curve, what his assumptions are, and what role autonomous spending plays in his argument. Check out the additional links I left for you on my website regarding Test 4. 4