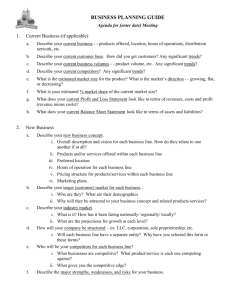

Pricing Info from Market-Oriented Pricing

advertisement

Pricing Info from Market-Oriented Pricing: Strategies for Management, Michael Morris and Gene Morris Examples of Pricing Objectives: target return on investment target market share maximize long-run profit maximize short-run profit sales growth stabilize the market convey a particular image desensitize customers to price be the price leader discourage entry by new competitors speed exit of marginal firms avoid government investigation and control maintain loyalty and sales support of middlemen avoid excessive demands from suppliers be regarded as fair by customers create interest and excitement for the item use price of one product to sell other products in line discourage others from lowering prices recover investment in product development quickly encourage quick payment of accounts receivable generate volume as to drive down costs Types of Pricing Strategies Cost Based: mark-up pricing – variable and fixed costs per unit are estimated, and a standard mark-up is added. The mark-up is frequently either a percentage of sales or of costs. target return pricing – variable and fixed costs per unit are estimated. A rate of return is then taken times the amount of capital invested in the product, and the result is divided by estimated sales. The resulting return per unit is added to unit costs to arrive at a price. Market-based: floor pricing – charging a price that just covers costs. Usually in order to maintain a presence in the market given the competitive environment. penetration pricing – charging a price that is low relative to a) the average price of major competitors and b) what customers are accustomed to paying parity pricing (going rate) – charging a price that is roughly equivalent to the average price charged by the major competition. premium pricing (skimming) – the price charged is intended to be high relative to a) the average price of major competitors and b) what customers are accustomed to paying price leadership – usually involves a leading firm in the industry making fairly conservative price moves, which are subsequently followed by other firms in the industry. This limits price wars and leads to fairly stable market shares. stay out pricing – the firm prices lower than demand conditions require, so as to discourage market entry by new competitors. bundle pricing – a set of products or services are combined and a lower single price is charged for the bundle than would be the case if each item were sold separately. value-based pricing (differentials) – different prices are set for different market segments based on the value each segment receives from the product or service. cross-benefit pricing – prices are set at or below costs for one product in a product line, but relatively high for another item in the line which serves as a direct complement (e.g. certain brands of cameras and film). SPMI Page 1 of 2 Factors Favoring Penetration Pricing possibility of significant cost reductions with volume production sizeable segments which highly elastic demand low barriers to competitive entry low customer switching costs ability to use price to convey bargain image ability to use low price of one product to sell other products in the line Factors Favoring Parity Pricing will entrenched competition or presence of a price leader desire to be regarded as “fair” by distributors and customers moderate barriers to competitive entry need exists to stabilize the market product or service does not lend itself to non-price differentiation no differences in cost structures among the various competitors Factors Favoring Permium Pricing no cost savings from increased production volume sizeable segments with highly inelastic demand high barriers to competitive entry high customer switching costs ability to use price to convey unique quality benefits or exclusivity clear-cut cost advantage which competitors cannot duplicate Key Managerial Questions to be Addressed in Developing a Pricing Structure Should a standard list price be charged for the product or service? Should frequent or large customers be charged the same base price? Can and should separate prices be charged for different aspects of the product or service? How should the time of purchase affect the price charged to a customer? To what extent should the price charged be varied to reflect the cost of doing business with a particular customer? Should customers who value the product more be charged a higher price than other customers? What is the nature of any discounts to be offered the buyer? When and where should title be taken by the buyer? Is it realistic to offer a dual-rate structure, where the same customer has a choice between two pricing options for the same product or service? Should the price structure involve a rental or leasing option? Ten Major Questions to Address Regarding Competitors before Making Pricing Decisions How do the market objectives of our leading competitors differ from our own objectives? Are there meaningful differences between the pricing strategies of leading competitors and our own strategy? Which target markets are receiving priority from our competitors? Are these the same as ours? What existing commitments do competitors have to production schedules for various products, to customer groups, to distributors, or to suppliers? How much unused production capacity do competitors have? Do competitors differ significantly in terms of their financial solvency? What are the differences in the production costs and overhead positions of our leading competitors? How quickly can competitors react to any pricing moves on our part, given their organizational structure, current product offerings, and their production techniques? Are there differences in the depth and breadth of competitors product lines compared to our own? Are their prices for any one item less flexible because of overall product line considerations? What situational factors exist for competitors which have implications for their pricing behavior (e.g. seasonality in a particular market, excess or obsolete inventory)? SPMI Page 2 of 2