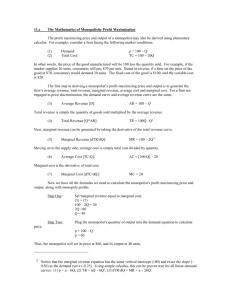

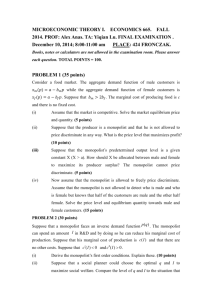

EC 203

advertisement

EC 203.01

PS: CH 24

FALL 2006

1. A monopolist with constant marginal costs faces a demand curve with a constant elasticity of

demand and does not practice price discrimination. If the government imposes a tax of 1YTL per

unit of goods sold by the monopolist, the monopolist will increase his price by more than 1YTL

per unit.

TRUE

2. A monopolist faces the inverse demand function described by p = 23 – 5q, where q is output.

The monopolist has no fixed cost and his marginal cost is $6 at all levels of output. Which of the

following expresses the monopolist’s profits as a function of his output?

a. 23 – 5q – 6 b. 17q – 5q2

c. 23 – 10q

d. 23q – 5q2 – 6 e. None of the above. C

3. The demand for a monopolist’s output is

, where p is its price. It has constant

marginal costs equal to 5YTL per unit. What price will it charge to maximize its profits?

a. 33YTL

b. 12 YTL

c. 26 YTL

d. 17 YTL

e. 5 YTL

D

4. A monopolist receives a subsidy from the government for every unit of output that is

consumed. He has constant marginal costs and the subsidy that he gets per unit of output is

greater than his marginal cost of production. But to get the subsidy on a unit of output, somebody

has to consume it.

a.

He will pay consumers to consume his product.

b.

If he sells at a positive price, demand must be inelastic at that price.

c.

He will sell at a price where demand is elastic.

d.

He will give the good away.

e.

None of the above.

B

5. A firm has invented a new beverage called Slops. It doesn’t taste very good, but it gives people

a craving for Lawrence Welk’s music and Professor Johnson’s jokes. Some people are willing to

pay money for this effect, so the demand for Slops is given by the equation q = 14 – p. Slops can

be made at zero marginal cost from old-fashioned macroeconomics books dissolved in bathwater.

But before any Slops can be produced, the firm must undertake a fixed cost of $54. Since the

inventor has a patent on Slops, it can be a monopolist in this new industry.

a. The firm will produce 7 units of Slops.

b. A Pareto improvement could be achieved by having the government pay the firm a subsidy of

$59 and insisting that the firm offer Slops at zero price.

c. From the point of view of social efficiency, it is best that no Slops be produced.

d. The firm will produce 14 units of Slops.

e. None of the above. B

6. A monopolist faces the demand function Q =

. If she charges a price of p, her

marginal revenue will be

a.

+ 3. b. 2p + 1.50.

c.

–

. d. –2(p + 3)–3. e. (p + B)–2.

C

1

7. The Fabulous 50s Decor Company is the only producer of pink flamingo lawn statues. While

business is not as good as it used to be, in recent times the annual demand has been Q = 400 – 6P.

Flamingo lawn statues are handcrafted by artisans using the process Q = min{L,

} where L is

hours of labor and P is pounds of pink plastic. PL = 15 and PP = 3. What would be the profitmaximizing output and price?

a. Q = 179 and P = 36.83.

b. Q = 192.25 and P = 34.63.

c. Q = 199.42 and P = 33.43.

d. Q = 101 and P = 49.83.

e. Q = 202 and P = 33. D

8. A basketball teams attendance depends on the number of games it wins per season and on the

price of its tickets. The demand function it faces is Q = N(20 – p), where Q is the number of

tickets (in hundred thousands) sold per year, p is the price per ticket, and N is the fraction of its

games that the team wins. The team can increase the number of games it wins by hiring better

players. If the team spends C million dollars on players, it will win 0.7 –

of its games. Over

the relevant range, the marginal cost of selling an extra ticket is zero.

a. Write an expression for the firms profits as a function of ticket price and expenditure on

players.

b. Find the ticket price that maximizes revenue.

c. Find the profit-maximizing expenditure on players and the profit–maximizing fraction of

games to win.

a. (0.7–

)(20 – p)p – C.

b. p = 10.

c. C = 10. The team will win 60% of its games.

2