038 - CCS Final Report - Spidi - Indian Institute of Management

advertisement

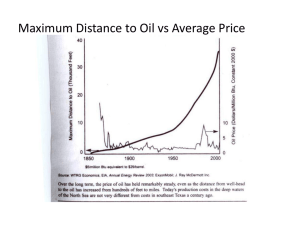

A report on Effect of Crude Oil Prices on Growth of South East Asian Economies Submitted to Prof Shyamal Roy On 28th August 2007 In Partial Fulfillment of the Requirements for the Course Contemporary Concerns Study By Abhipsita Singh Gautam Patil 0611213 0611230 Indian Institute of Management, Bangalore TABLE OF CONTENTS Sl. Particulars Pg No. 1 Introduction 3 2 Energy intensity as criterion 5 3 Methodologies used 8 4 Sectoral Breakdown of GDP 10 5 Causality tests 12 6 Inferences 14 7 Appendix 18 References 2 Introduction The South East Asian economies are now classified as a part of the emerging markets and have been registering impressive growth rates since 2000. Some of these economies are predominantly manufacturing oriented and thus energy prices play a critical role in the sustenance of their growth rates. Growth of SE Asian Economies since 2000 12 yoy growth 10 8 Hong Kong 6 Malaysia 4 Philllipines Singapore 2 Thailand 0 -2 2000 2001 2002 2003 2004 2005 2006 South Korea -4 year Figure 1: Growth trend of major economies in SE Asia With Indonesia also turning into a net importer of oil in 2002, a common concern across these economies is the resource dependence shown by them for the energy sources. Though the consumption pattern varies across different countries, the economies considered for the study are net oil importers. This may intuitively suggest that the growth in the region is susceptible to the changes in the energy prices. This is the starting point of our analysis of the economies that we study. Though the oil demand was sluggish until 2002 due to the Asian Economic crisis and the burst of the IT bubble, it has been growing steadily since then. At these high consumption levels, these countries have a much higher exposure to oil price volatility through factors like inflation and income transfer to oil-producing countries. All these have an adverse impact on the real growth rate of these economies. 3 Figure 2: Increase in Asian oil imports The objective of this project is to determine if there is a link between growth and energy prices in these economies. Because of the volatility in energy prices and the growth trend shown by the South East Asian economies, the inferences given by the project will provide a broad framework to show how the energy prices can play a role in making investment decisions in the economies that are studied. While there are many factors beyond supply-demand like geo-political situations and market sentiment that influence oil prices; the focus of this project will mainly be on the quantifiable data with due attention to the other factors. The scope of the project will be limited to identifying the effect of various energy prices scenarios on the growth; however no attempt will be made at predicting energy prices. 4 Criterion of Energy Intensity The countries under study in this project are South Korea, Indonesia, Malaysia, Singapore and Hong Kong. Many factors like availability of statistics on economy, quality of information, periodicity of reporting of information, size of the economy, dominance in the region and sectoral diversity within the economy have affected the choice of these countries. It can be noted that no single country has a demand large enough to individually affect energy prices and thus is effectively a price taker. Also, oil prices are taken as a proxy for energy prices for multiple reasons, namely: a) Non availability of data on gas consumption and prices in some countries b) Oil consumption in value terms is currently much higher than gas consumption c) Other sources like coal, methane etc have been ignored for simplicity d) Restriction on substitutability due to technological issues As stated before there are other factors which contribute to oil price volatility as shown in the figure below and no attempt is made to account for these factors. Energy Intensity Energy intensities are valuable indicators in describing the energy consumed in entire production chains and provide insight into an economy's total energy use. Changes in energy consumption reflect the combined effects of changes in energy intensities in various sectors and changes in the volume and structure of demand. Energy needed per unit of production (referred to as energy 5 intensity or specific energy consumption) shows the sensitivity of an economy to changes in energy prices. It is useful as criteria for comparison because it is not biased by the absolute value of the GDP. Figure3: Energy Intensity for East and South Asian nations Note: Nepal and Sri Lanka measured on the secondary axis Source: Data from EIA website www.eia.doe.gov/emeu/international/energyconsumption.html The SE Asian region constitutes economies with distinctly different energy intensities. The variation in energy intensity values can be due to several reasons: Different levels of energy efficiency in the various economies: For instance, the high values of energy intensities in Nepal, Pakistan with a modest growth rate compared to other economies in the region may reflect inefficient use of energy (which in turn may be due to poor public transport or lack of investment in newer technologies). The varying nature of the different economies: While the economies dominated by the service industry usually have low energy requirements, the ones which are manufacturing intensive would have higher energy consumption. As a result, the energy intensity is likely to be much more in the case of the latter. In order to conduct the study, countries with energy intensity values in different ranges have been selected (highlighted in Figure 4). However, all the four economies have comparable growth rates. This will help in analyzing if there is a conclusively similar dependence of growth on energy prices for countries with energy intensities in the same range. Also, the selected economies differ in their composition and this will help determining if there are some factors other than energy consumption per unit of GDP that can influence the dependence of GDP on energy prices. 6 Country 2003 2000 1990 Hong Kong 91.4 89 92.4 Bangladesh 97.9 98.1 102.1 Sri Lanka 120.8 115.1 136.8 Philippines 127.4 139 110.4 India 189.5 208.1 250.2 Thailand 199.1 193.3 176.3 Singapore 213.8 233.2 297.1 Viet Nam 227.3 236.7 303.2 China 231.3 243.1 504.5 Pakistan 236.1 240.5 257.6 Korea, Rep 238.2 251 220.7 Indonesia 239.3 233.6 241.5 Nepal 248.1 252.6 293.7 Malaysia 257.5 237.8 229.1 Figure 4: Ton Equivalent of Oil (ToE) per $ million of GDP 7 Methodologies Employed Initially, a simple linear correlation measure between quarterly GDP and crude oil prices was taken in order to get the expected negative relationship. This approach did not give the expected result because: 1. Since both nominal GDP and crude oil prices showed an increasing trend, the resulting correlation measure would be negative. 2. In some countries, as the retail fuel prices administered, the effect of crude oil prices is not direct. 3. Seasonality of data also posed a problem. For instance, South Korea’s utility consumption peaks in December due to the extreme cold. An increase in crude oil price in this period would only reduce the peak consumption but the consumption would nonetheless increase over the previous quarter. 4. Even a QoQ % change of GDP and crude oil prices linear correlation measure did not help because the effect of price change was not direct (due to price administration, taxation, refinement to other petroleum products) and linear. To overcome these problems, two alternative approaches were considered. 1. An increase in crude oil prices causes inflation (consumption does not reduce much due to inelasticity of oil consumption to price in the short term) which is like an additional tax burden on the consumer and it also reduces the real GDP growth. Thus, assuming a scenario of flat crude oil prices, it is possible to negate this effect of inflation and account for the ‘lost’ GDP growth. Due to problems related to data availability and many simplifying assumptions, this approach was not taken up further. 2. Since price administration distorted the effect of crude oil prices on the economy, using retail fuel prices instead will result in a more ‘transparent’ relationship. Since retail fuel prices were step-wise in nature, these could be interpolated and then used. The problem with this approach however is that crude oil is further refined into different products like gasoline, kerosene, naphtha, propane etc. Getting data for the required period and periodicity on the consumption of these products for most of the countries was a problem. Sectoral Breakdown of GDP As the consolidated GDP data did not produce any conclusive results and lack of availability of data was a problem, broad sectors of these economies were then studied. This approach was used because 8 the consumption of crude oil was distinctly different across each sector and in addition, the contribution of a particular sector to the GDP varied in % terms across each country. Thus, the impact of crude oil price changes would also be different on the growth of each of these countries. The sectors were chosen so as to envelop all the activities which can contribute to a nation’s GDP. 100% 90% Others 80% Agriculture & Mining 70% services 60% real estate 50% retail 40% finance 30% utilities 20% transport 10% manufacturing 0% S. Korea Indonesia M alaysia Hong Kong Singapore Figure5: The industry wise composition of the economies under consideration Source: Bloomberg As can be seen from Figure 5, the contribution of a sector to the GDP varies across the countries. The intensity of crude oil consumption varies across each of these sectors. Manufacturing, transport and utilities (water, electricity and gas) are traditionally seen as the sectors which are energy intensive and thus may show a higher sensitivity to crude oil prices. On the other hand, sectors like services, retail and finance may not be directly affected by changes in crude oil prices. Crude oil prices can affect GDP growth via two ‘routes’, as listed below: 1. An increase in prices results in reduced consumption and thus production of goods or transportation may be directly hit. Thus, affecting GDP growth. 2. Similarly, an increase in prices increases inflation. A sharp increase causes the inflation to increase above acceptable levels which may induce central banks to use macroeconomic policies like interest rate hikes which may reduce GDP growth rates. This is a more indirect transmission mechanism and is not fully considered in this study. Causality Tests The sectoral GDP data of each country was obtained and a correlation measure was taken between % QoQ changes of this data and crude oil prices. Some sectors did show markedly better 9 correlations while others showed very low correlation and did not yield any conclusive results. Since correlation does not imply causality, it was decided to test the causality between the GDP of various sectors and the crude oil prices using the Granger Causality Test. Granger Causality is useful for determining if one time series can be used to forecast another however, it places a prerequisite of stationarity (a stochastic process whose probability distribution at a fixed time or position is same at all times and positions) on the time series. The Unit Root Test (Dickey Fuller test, in particular, is used) is used to determine the lag and difference for which a particular time series becomes stationary. The next step is to perform a Cointegration test on pairs of these time series at the lag at which they become stationary and by making certain assumptions about the nature of relationship (for instance, presence of linear deterministic trend and intercept). The purpose of the Cointegration test is to check if a linear combination of two or more non-stationary time series is possible and this is followed by the Granger Causality test. The Granger Causality test determines is used on pairs of time series and checks the presence and direction of causality between them. The results from the causality tests between the sectoral GDP data and the crude oil prices are provided in Appendix A for further perusal, however the important results are as tabulated below. Sector Manufacturing Transport Utilities Construction Services Real Estate Wholesale/Retail Trade Finance Agriculture Mining Indonesia X X N.A. N.A. X N.A. N.A. X X N.A. X Malaysia X N.A. N.A. N.A. X N.A. N.A. N.A. N.A. X √ [√ - Causality, X – No causality, N.A. – Not Applicable] 10 Singapore √ N.A. X X X X N.A. N.A. N.A. N.A. N.A. South Korea √ X X √ X √ X N.A. X N.A. N.A. Inferences Hong Kong: Outlook on growth of the economy and energy demand: Service dominated economy: Almost 60% of the GDP is contributed by financial and other services e.g. the traditional financial, logistics, property, tourism and producer services, growth is supported by more knowledge-based and services industries such as fitness and beauty, theme park, business consulting, and the environmental industry. 11 The absence of domestic energy sources has made Hong Kong, China a net importer for oil (mainly from Singapore) and natural gas (from China). By 2030, the share of GDP in the services sector is expected to reach more than 95 percent. Final Energy Demand by various sectors : Outlook Over the outlook period, final energy demand is projected to grow at 3.2 percent per year, slower than the 5.3 percent annual growth rate in the past two decades. In 2030, the transport sector will maintain the largest share at 61 percent, followed by commercial (21 percent), residential (9 percent), and industry (9 percent). Results derived from the causality tests: Due to lack of availability of sectoral GDP on Hong Kong, only a qualitative analysis was performed on the data. Hong Kong’s GDP has demonstrated steady growth since 2002 and has been able to keep inflation at very low levels of about 1%. This can be attributed to low cost imports from mainland China. The services industry in Hong Kong accounts for about 60% of the GDP with the rest coming from transportation, wholesale & retail etc. Empirical evidence suggests that the services industry is quite resilient to oil price changes in the short run (however, an oil price shock like the one in the 1970’s may still have dire consequences). Transportation is another major contributor since the port services at Hong Kong and its international airport (with the largest passenger handling capacity in Asia) provide a hub for the region and also an entrance in the Pearl Delta river region of mainland China. The GDP contribution resulting from wholesale and retail will only be affected to the extent of inflation due to increase in price of imports. 12 Figure 7: Final Energy Demand Projections in Hong Kong From the figure above, it is clear that the transportation sector will become the major consumer of energy while its contribution to GDP will still be lower than that of the services sector. Consequences for investment decisions: From the analysis above, it can be stated that the Hong Kong economy is very resilient to crude oil price changes mainly due to the services industry. A cause of concern maybe the utilities and the transport sector which will be huge consumers of energy in future. This dependence is now being reduced by switching to nuclear and gas based electricity generation of electricity but the transport sector still remains vulnerable. Indonesia: Outlook on growth of the economy and energy demand: Indonesia is endowed with indigenous energy resources such as natural gas, coal and oil, and is self sufficient in terms of energy supply except oil. Indonesia has been a net oil importer since 2002.48 Oil production decreased from 70.6 Mtoe in 2000 to 54.6 Mtoe in 2004 due to depleting reserves and lack of investment for exploration and development. GDP is projected to grow at 4.6 percent per year, from US$790 billion in 2002 to US$2,795 billion in 2030. The growth in GDP will be largely attributed to the services sector and will account for about 57 percent of the incremental GDP growth. 13 Indonesia’s urbanisation level is projected to increase from a low of 44 percent in 2002 to 68 percent in 2030. Over the outlook period, it is estimated that about 18 cities will have population between 1 and 5 million. Growth of urban population will lead to higher demand for oil in transport, and electricity in the residential and commercial sectors. Final Energy Demand Outlook: Indonesia’s final energy demand is projected to grow at 2.9 percent per year, reaching 247 Mtoe in 2030, more than double that of 2002 at 112 Mtoe. Results derived from the causality tests: The causality tests indicate lack of any kind of causality between the crude oil prices and sectoral GDP contributions. Following reasons can be attributed to this result: Indonesia become a net energy importer only in late 2002, thus its economy was insulated from world wide crude oil price fluctuations Indonesia has provided high subsidies on the refined petroleum products and though subsidies on gasoline and diesel were only recently abolished, rest of the subsidies still continues. These subsidies distort the effect of energy prices on the economy by influencing consumption and transferring the resulting burden to other sectors. Effect on Investment: This economy however enjoys the benefits of diversification, since no sector contributes to more than 15% of the GDP and each of these sectors are quite different from the other, for instance, agriculture, mining, trade, manufacturing, finance and services. The energy consumption trend is skewed towards the private consumers currently but, as shown in the figure below, the industrial consumption might outpace it in future. Thus, this economy faces no immediate threat of an oil price increase to its growth prospects. 14 . South Korea: Outlook on growth of the economy and energy demand : With very limited indigenous energy resources,Korea relies heavily on imports of oil, natural gas and coal. Net imports have more than doubled from 72 Mtoe in 1990 to 190 Mtoe in 2005. In 2005, Korea was the world’s fourth-largest importer of oil and the second-largest importer of both coal and liquefied natural gas (LNG). Korea’s GDP is projected to grow at an annual rate of 3.6 percent over the outlook period – a slower rate than the past two decades at 7.0 percent per year. Final energy demand is projected to grow at 2.3 percent per year, much slower compared with the annual growth in the previous two decades of 7.5 percent. 15 Korea’s primary energy consumption grew at an average annual rate of 3.2 percent between 2002 and 2005, much slower than that of the last decade at 6.9 percent per year. The sluggish growth in energy consumption is due mainly to the economy’s rather slow GDP growth at around 3.9 percent per year over the same period, dampened further by energy efficiency improvements in the industry and transport sectors. The shift from energy-intensive industry to non-energy intensive industry will result in the lower projected growth for industrial energy demand. Over the past two decades, the value added of energy intensive manufacturing sector has grown more than ten-fold, due to the production capacity expansion in industries such as steel, cement, shipbuilding62 and petrochemicals. By contrast, future growth of industrial value-added is expected to be led by non energy- intensive industries such as IT, electronics, machinery and services sector.63 The impact of the changes in the economy’s industrial structure will result in significant improvements in energy intensity, from 273 toe per US$ million in 2002 to 164 toe per US$ million in 2030. Over the past two decades, income growth, improvements in living standards, expansion of residential suburbs and development of vehicle manufacturing industries have all contributed to a thirty-fold increase in the stock of vehicles, which have in turn resulted in a ten-fold increase in gasoline and diesel consumption.65 Managing road transport congestion66, and air pollution67 caused by passenger vehicles and freight trucks continues to be a significant challenge for the economy. Results derived from the causality tests: 16 The manufacturing sector of South Korea constitutes energy intensive sectors like the cement and steel industry and thus displays heavy dependence on crude oil. The construction sector of South Korea also displays a dependence on crude oil prices mainly due to use of heavy fuel and other petroleum products in this industry. The utilities sector is unaffected due to reliance on nuclear and gas based electricity generation. Effect on Investment: Given the contribution of the manufacturing and the construction sector to GDP and its heavy reliance on crude oil (97% of its requirements are imported), its economy is highly susceptible to crude oil price changes. Thus, its GDP growth and growth prospects may suffer adversely. Appendix Indonesia 1) Unit root test Null Hypothesis: D(MANUFACTURING) has a unit root 17 Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=7) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -4.726191 0.0008 Test critical values: 1% level -3.689194 5% level -2.971853 10% level -2.625121 Null Hypothesis: D(MINING) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=7) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -4.068785 0.0040 Test critical values: 1% level -3.689194 5% level -2.971853 10% level -2.625121 Null Hypothesis: D(AGRICULTURE) has a unit root Exogenous: Constant Lag Length: 6 (Automatic based on SIC, MAXLAG=7) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -3.169047 0.0359 Test critical values: 1% level -3.769597 5% level -3.004861 10% level -2.642242 Null Hypothesis: D(SERVICES) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=7) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -4.122305 0.0035 Test critical values: 1% level -3.689194 5% level -2.971853 10% level -2.625121 18 Null Hypothesis: D(TRADE) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=7) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -4.866217 0.0005 Test critical values: 1% level -3.689194 5% level -2.971853 10% level -2.625121 Null Hypothesis: D(TRANSPORT) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=7) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -5.057363 0.0003 Test critical values: 1% level -3.689194 5% level -2.971853 10% level -2.625121 Null Hypothesis: D(CONSTRUCTION) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=7) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -4.678305 0.0009 Test critical values: 1% level -3.689194 5% level -2.971853 10% level -2.625121 2) Pair wise co-integration test Date: 08/28/07 Time: 03:07 Sample (adjusted): 4 30 Included observations: 27 after adjustments Trend assumption: Linear deterministic trend Series: AGRICULTURE CRUDE Lags interval (in first differences): 1 to 2 Unrestricted Cointegration Rank Test (Trace) 19 Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None 0.122347 7.034413 15.49471 0.5736 At most 1 0.121931 3.510805 3.841466 0.0610 Trace test indicates no cointegration at the 0.05 level * denotes rejection of the hypothesis at the 0.05 level Mining Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.368494 17.63621 12.32090 0.0059 At most 1 * 0.156518 4.766063 4.129906 0.0345 Trace test indicates 2 cointegrating eqn(s) at the 0.05 level Transport Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.387401 16.40579 12.32090 0.0098 At most 1 0.091423 2.684532 4.129906 0.1198 Trace test indicates 1 cointegrating eqn(s) at the 0.05 level Manufacturing Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.316579 17.72792 15.49471 0.0227 At most 1 * 0.279977 8.211799 3.841466 0.0042 Trace test indicates 2 cointegrating eqn(s) at the 0.05 level Series: SERVICES CRUDE Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized No. of CE(s) Eigenvalue Trace 0.05 Statistic Critical Value 20 Prob.** None * 0.342942 15.73600 12.32090 0.0129 At most 1 0.132393 3.976466 4.129906 0.0547 Trace test indicates 1 cointegrating eqn(s) at the 0.05 level Series: TRADE CRUDE Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.319442 12.70887 12.32090 0.0430 At most 1 0.066716 1.933274 4.129906 0.1936 Trace test indicates 1 cointegrating eqn(s) at the 0.05 level 3) Granger’s causality test CRUDE does not Granger Cause SERVICES 28 SERVICES does not Granger Cause CRUDE TRANSPORT does not Granger Cause TRADE 28 TRADE does not Granger Cause TRANSPORT CRUDE does not Granger Cause TRADE 28 TRADE does not Granger Cause CRUDE CRUDE does not Granger Cause TRANSPORT 28 TRANSPORT does not Granger Cause CRUDE CRUDE does not Granger Cause MINING 28 MINING does not Granger Cause CRUDE CRUDE does not Granger Cause MANUFACTURING 28 MANUFACTURING does not Granger Cause CRUDE CRUDE does not Granger Cause FINANCE 28 FINANCE does not Granger Cause CRUDE Malaysia 21 1.34197 0.28104 0.79565 0.46332 0.11923 0.88815 0.23873 0.78956 0.67066 0.52109 0.77440 0.47263 0.46688 0.63277 1.40781 0.26499 0.22813 0.79780 9.32106 0.00108 1.03000 0.37290 0.19614 0.82326 0.55879 0.57947 0.57043 0.57308 1) Unit root test of sectoral data Null Hypothesis: D(AGRICULTURE) has a unit root Exogenous: Constant Lag Length: 1 (Automatic based on SIC, MAXLAG=10) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -7.174750 0.0000 Test critical values: 1% level -3.552666 5% level -2.914517 10% level -2.595033 Null Hypothesis: D(MANUFACTURING) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=10) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -6.361328 0.0000 Test critical values: 1% level -3.550396 5% level -2.913549 10% level -2.594521 Null Hypothesis: D(MINING) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=10) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -6.940643 0.0000 Test critical values: 1% level -3.550396 5% level -2.913549 10% level -2.594521 Null Hypothesis: D(SERVICES) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=10) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -6.480503 0.0000 Test critical values: 1% level -3.550396 5% level -2.913549 22 10% level 2) -2.594521 Pair wise co-integration test on sectoral data Trend assumption: Linear deterministic trend Series: AGRICULTURE CRUDE Lags interval (in first differences): 1 to 2 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.236232 21.32435 15.49471 0.0059 At most 1 * 0.105330 6.232824 3.841466 0.0125 Trace test indicates 2 cointegrating eqn(s) at the 0.05 level Trend assumption: No deterministic trend Series: MANUFACTURING CRUDE Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.167446 15.37736 12.32090 0.0149 At most 1 * 0.082883 4.931668 4.129906 0.0313 Trace test indicates 2 cointegrating eqn(s) at the 0.05 level Trend assumption: No deterministic trend Series: MINING CRUDE Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.237236 20.43028 12.32090 0.0018 At most 1 * 0.083891 4.994321 4.129906 0.0302 Trace test indicates 2 cointegrating eqn(s) at the 0.05 level 23 Trend assumption: No deterministic trend Series: SERVICES CRUDE Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.191425 14.97906 12.32090 0.0175 At most 1 0.049064 2.867561 4.129906 0.1069 Trace test indicates 1 cointegrating eqn(s) at the 0.05 level 3) Pair wise Granger Causality test Lags: 2 Null Hypothesis: CRUDE does not Granger Cause AGRICULTURE Obs F-Statistic Probability 57 0.73640 0.48376 0.62067 0.54152 3.40376 0.07043 0.92637 0.34002 0.40358 0.52788 1.45835 0.23236 0.15057 0.69949 1.08069 0.30309 AGRICULTURE does not Granger Cause CRUDE CRUDE does not Granger Cause MINING 58 MINING does not Granger Cause CRUDE CRUDE does not Granger Cause SERVICES 58 SERVICES does not Granger Cause CRUDE CRUDE does not Granger Cause MANUFACTURING 58 MANUFACTURING does not Granger Cause CRUDE Singapore 4) Unit root test of sectoral data Null Hypothesis: D(MANUFACTURING) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=10) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -8.375142 0.0000 Test critical values: -3.574446 1% level 24 5% level -2.923780 10% level -2.599925 Null Hypothesis: D(UTILITIES) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=10) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -6.964056 0.0000 Test critical values: 1% level -3.574446 5% level -2.923780 10% level -2.599925 Null Hypothesis: D(CONSTRUCTION,2) has a unit root Exogenous: Constant Lag Length: 2 (Automatic based on SIC, MAXLAG=10) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -12.13684 0.0000 Test critical values: 1% level -3.584743 5% level -2.928142 10% level -2.602225 Null Hypothesis: D(SERVICES) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=10) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -5.984815 0.0000 Test critical values: 1% level -3.574446 5% level -2.923780 10% level -2.599925 5) Pair wise co-integration test on sectoral data Date: 08/27/07 Time: 23:31 Sample (adjusted): 3 50 Included observations: 48 after adjustments Trend assumption: No deterministic trend 25 Series: MANUFACTURING CRUDE Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None 0.178500 12.20750 12.32090 0.0522 At most 1 0.056067 2.769594 4.129906 0.1136 Trace test indicates no cointegration at the 0.05 level * denotes rejection of the hypothesis at the 0.05 level Date: 08/27/07 Time: 23:37 Sample (adjusted): 3 50 Included observations: 48 after adjustments Trend assumption: No deterministic trend Series: CRUDE CONSTRUCTION Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.232708 13.18817 12.32090 0.0357 At most 1 0.009818 0.473569 4.129906 0.5546 Trace test indicates 1 cointegrating eqn(s) at the 0.05 level * denotes rejection of the hypothesis at the 0.05 level **MacKinnon-Haug-Michelis (1999) p-values Date: 08/27/07 Time: 23:39 Sample (adjusted): 3 50 Included observations: 48 after adjustments Trend assumption: No deterministic trend Series: UTILITIES CRUDE Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None 0.198420 12.18736 12.32090 0.0526 At most 1 0.032202 1.571142 4.129906 0.2465 26 Trace test indicates no cointegration at the 0.05 level * denotes rejection of the hypothesis at the 0.05 level Date: 08/27/07 Time: 23:39 Sample (adjusted): 3 50 Included observations: 48 after adjustments Trend assumption: No deterministic trend Series: SERVICES CRUDE Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.250064 17.19974 12.32090 0.0071 At most 1 0.068129 3.386898 4.129906 0.0779 Trace test indicates 1 cointegrating eqn(s) at the 0.05 level * denotes rejection of the hypothesis at the 0.05 level 6) Pair wise Granger Causality test Pairwise Granger Causality Tests Date: 08/27/07 Time: 23:42 Sample: 1 50 Lags: 2 Null Hypothesis: Obs F-Statistic Probability 48 8.09506 0.00104 0.92001 0.40621 7.41912 0.00171 2.89227 0.06630 6.32121 0.00392 3.33917 0.04487 3.40879 0.04225 5.44058 0.00783 0.06162 0.94032 0.63214 0.53632 0.10740 0.89841 CONSTRUCTION does not Granger Cause MANUFACTURING MANUFACTURING does not Granger Cause CONSTRUCTION UTILITIES does not Granger Cause MANUFACTURING 48 MANUFACTURING does not Granger Cause UTILITIES SERVICES does not Granger Cause MANUFACTURING 48 MANUFACTURING does not Granger Cause SERVICES CRUDE does not Granger Cause MANUFACTURING 48 MANUFACTURING does not Granger Cause CRUDE UTILITIES does not Granger Cause CONSTRUCTION 48 CONSTRUCTION does not Granger Cause UTILITIES SERVICES does not Granger Cause CONSTRUCTION 48 27 CONSTRUCTION does not Granger Cause SERVICES CRUDE does not Granger Cause CONSTRUCTION 48 CONSTRUCTION does not Granger Cause CRUDE SERVICES does not Granger Cause UTILITIES 48 UTILITIES does not Granger Cause SERVICES CRUDE does not Granger Cause UTILITIES 48 UTILITIES does not Granger Cause CRUDE CRUDE does not Granger Cause SERVICES 48 SERVICES does not Granger Cause CRUDE 7.18219 0.00204 1.85479 0.16879 0.94965 0.39484 3.44895 0.04081 2.04288 0.14205 0.10472 0.90080 0.64033 0.53207 0.97588 0.38505 2.92850 0.06422 South Korea 4) Unit root test Null Hypothesis: D(MANUFACTURING) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=8) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -10.66307 0.0000 Test critical values: 1% level -3.661661 5% level -2.960411 10% level -2.619160 Null Hypothesis: D(UTILITIES) has a unit root Exogenous: Constant Lag Length: 2 (Automatic based on SIC, MAXLAG=8) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -4.550401 0.0011 Test critical values: 1% level -3.679322 5% level -2.967767 10% level -2.622989 Null Hypothesis: D(CONSTRUCTION) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=8) 28 t-Statistic Prob.* Augmented Dickey-Fuller test statistic -12.50798 0.0000 Test critical values: 1% level -3.661661 5% level -2.960411 10% level -2.619160 Null Hypothesis: D(RETAIL) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=8) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -10.27515 0.0000 Test critical values: 1% level -3.661661 5% level -2.960411 10% level -2.619160 Null Hypothesis: D(TRANSPORT) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=8) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -6.129146 0.0000 Test critical values: 1% level -3.661661 5% level -2.960411 10% level -2.619160 Null Hypothesis: D(FINANCE) has a unit root Exogenous: Constant Lag Length: 0 (Automatic based on SIC, MAXLAG=8) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -5.822840 0.0000 Test critical values: 1% level -3.661661 5% level -2.960411 10% level -2.619160 Null Hypothesis: D(REAL_ESTATE) has a unit root Exogenous: Constant 29 Lag Length: 0 (Automatic based on SIC, MAXLAG=8) t-Statistic Prob.* Augmented Dickey-Fuller test statistic -9.399434 0.0000 Test critical values: 1% level -3.661661 5% level -2.960411 10% level -2.619160 5) Pair wise co-integration test Trend assumption: No deterministic trend Series: MANUFACTURING CRUDE Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.314337 13.61583 12.32090 0.0302 At most 1 0.059978 1.917403 4.129906 0.1956 Trace test indicates 1 cointegrating eqn(s) at the 0.05 level Trend assumption: No deterministic trend Series: CONSTRUCTION CRUDE Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.206677 12.85461 12.32090 0.0407 At most 1 * 0.167349 5.677359 4.129906 0.0204 Trace test indicates 2 cointegrating eqn(s) at the 0.05 level Trend assumption: No deterministic trend Series: FINANCE CRUDE Lags interval (in first differences): 1 to 2 Unrestricted Cointegration Rank Test (Trace) 30 Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None 0.293300 11.86581 12.32090 0.0595 At most 1 0.047226 1.451341 4.129906 0.2675 Trace test indicates no cointegration at the 0.05 level Trend assumption: No deterministic trend Series: REAL_ESTATE CRUDE Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.371048 16.08816 12.32090 0.0112 At most 1 0.053773 1.713448 4.129906 0.2239 Trace test indicates 1 cointegrating eqn(s) at the 0.05 level Trend assumption: No deterministic trend Series: RETAIL CRUDE Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.330243 13.46185 12.32090 0.0321 At most 1 0.032862 1.035823 4.129906 0.3587 Trace test indicates 1 cointegrating eqn(s) at the 0.05 level Trend assumption: No deterministic trend Series: TRANSPORT CRUDE Lags interval (in first differences): 1 to 2 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.366224 14.83410 12.32090 0.0186 31 At most 1 0.037682 1.152313 4.129906 0.3298 Trace test indicates 1 cointegrating eqn(s) at the 0.05 level Trend assumption: No deterministic trend Series: UTILITIES CRUDE Lags interval (in first differences): 1 to 1 Unrestricted Cointegration Rank Test (Trace) Hypothesized Trace 0.05 No. of CE(s) Eigenvalue Statistic Critical Value Prob.** None * 0.306489 12.62047 12.32090 0.0445 At most 1 0.040289 1.274815 4.129906 0.3023 Trace test indicates 1 cointegrating eqn(s) at the 0.05 level 6) Granger’s causality test CRUDE does not Granger Cause CONSTRUCTION 31 CONSTRUCTION does not Granger Cause CRUDE CRUDE does not Granger Cause FINANCE 31 FINANCE does not Granger Cause CRUDE CRUDE does not Granger Cause MANUFACTURING 31 MANUFACTURING does not Granger Cause CRUDE CRUDE does not Granger Cause REAL_ESTATE 31 REAL_ESTATE does not Granger Cause CRUDE CRUDE does not Granger Cause RETAIL 31 RETAIL does not Granger Cause CRUDE CRUDE does not Granger Cause TRANSPORT 31 TRANSPORT does not Granger Cause CRUDE CRUDE does not Granger Cause UTILITIES 31 32 3.10390 0.06182 1.99727 0.15599 1.52389 0.23669 1.87607 0.17335 3.85640 0.03414 4.27942 0.02474 4.33125 0.02379 3.55255 0.04325 0.31304 0.73394 6.24001 0.00612 1.52707 0.23602 0.48821 0.61924 0.10391 0.90168 UTILITIES does not Granger Cause CRUDE 0.68398 0.51346 References 1.APEC Energy Demand and Supply Outlook 2006, Asia Pacific Energy Research Centre, Institute of Energy Economics, Japan 2.Energy Demands and Sustaining Growth in South East Asia 2006 , Pragya Jaswal and Mitali Das Gupta , Institute of Development Studies 3. Developing Asia and the Pacific: Performance and prospects , Asia Development Outlook 2007 33 4. Bloomberg database 34 Criterion of Energy Intensity The countries under study in this project are South Korea, Indonesia, Malaysia, Singapore and Hong Kong. Many factors like availability of statistics on economy, quality of information, periodicity of reporting of information, size of the economy, dominance in the region and sectoral diversity within the economy have affected the choice of these countries. It can be noted that no single country has a demand large enough to individually affect energy prices and thus is effectively a price taker. Also, oil prices are taken as a proxy for energy prices for multiple reasons, namely: a) Non availability of data on gas consumption and prices in some countries b) Oil consumption in value terms is currently much higher than gas consumption c) Other sources like coal, methane etc have been ignored for simplicity d) Restriction on substitutability due to technological issues As stated before there are other factors which contribute to oil price volatility as shown in the figure below and no attempt is made to account for these factors. Energy Intensity 35 Energy intensities are valuable indicators in describing the energy consumed in entire production chains and provide insight into an economy's total energy use. Changes in energy consumption reflect the combined effects of changes in energy intensities in various sectors and changes in the volume and structure of demand. Energy needed per unit of production (referred to as energy intensity or specific energy consumption) shows the sensitivity of an economy to changes in energy prices. It is useful as criteria for comparison because it is not biased by the absolute value of the GDP. Figure3: Energy Intensity for East and South Asian nations Note: Nepal and Sri Lanka measured on the secondary axis Source: Data from EIA website www.eia.doe.gov/emeu/international/energyconsumption.html The SE Asian region constitutes economies with distinctly different energy intensities. The variation in energy intensity values can be due to several reasons: Different levels of energy efficiency in the various economies: For instance, the high values of energy intensities in Nepal, Pakistan with a modest growth rate compared to other economies in the region may reflect inefficient use of energy (which in turn may be due to poor public transport or lack of investment in newer technologies). The varying nature of the different economies: While the economies dominated by the service industry usually have low energy requirements, the ones which are manufacturing intensive would have higher energy consumption. As a result, the energy intensity is likely to be much more in the case of the latter. In order to conduct the study, countries with energy intensity values in different ranges have been selected (highlighted in Figure 4). However, all the four economies have comparable growth rates. 36 This will help in analyzing if there is a conclusively similar dependence of growth on energy prices for countries with energy intensities in the same range. Also, the selected economies differ in their composition and this will help determining if there are some factors other than energy consumption per unit of GDP that can influence the dependence of GDP on energy prices. Country 2003 2000 1990 Hong Kong 91.4 89 92.4 Bangladesh 97.9 98.1 102.1 Sri Lanka 120.8 115.1 136.8 Philippines 127.4 139 110.4 India 189.5 208.1 250.2 Thailand 199.1 193.3 176.3 Singapore 213.8 233.2 297.1 Viet Nam 227.3 236.7 303.2 China 231.3 243.1 504.5 Pakistan 236.1 240.5 257.6 Korea, Rep 238.2 251 220.7 Indonesia 239.3 233.6 241.5 Nepal 248.1 252.6 293.7 Malaysia 257.5 237.8 229.1 Figure 4: Ton Equivalent of Oil (ToE) per $ million of GDP 37 Causality Tests The sectoral GDP data of each country was obtained and a correlation measure was taken between % QoQ changes of this data and crude oil prices. Some sectors did show markedly better correlations while others showed very low correlation and did not yield any conclusive results. Since correlation does not imply causality, it was decided to test the causality between the GDP of various sectors and the crude oil prices using the Granger Causality Test. Granger Causality is useful for determining if one time series can be used to forecast another however, it places a prerequisite of stationarity (a stochastic process whose probability distribution at a fixed time or position is same at all times and positions) on the time series. The Unit Root Test (Dickey Fuller test, in particular, is used) is used to determine the lag and difference for which a particular time series becomes stationary. The next step is to perform a Cointegration test on pairs of these time series at the lag at which they become stationary and by making certain assumptions about the nature of relationship (for instance, presence of linear deterministic trend and intercept). The purpose of the Cointegration test is to check if a linear combination of two or more non-stationary time series is possible and this is followed by the Granger Causality test. The Granger Causality test determines is used on pairs of time series and checks the presence and direction of causality between them. The results from the causality tests between the sectoral GDP data and the crude oil prices are provided in Appendix A for further perusal, however the important results are as tabulated below. Sector Manufacturing Transport Utilities Construction Services Real Estate Wholesale/Retail Trade Finance Agriculture Mining Indonesia X X N.A. N.A. X N.A. N.A. X X N.A. X Malaysia X N.A. N.A. N.A. X N.A. N.A. N.A. N.A. X √ [√ - Causality, X – No causality, N.A. – Not Applicable] Valuation of Nantucket Nectars 38 Singapore √ N.A. X X X X N.A. N.A. N.A. N.A. N.A. South Korea √ X X √ X √ X N.A. X N.A. N.A. The following methods were considered for valuation of Nantucket Nectars: Sales multiple EBITDA multiple EBIT multiple P/E multiple method APV method Sales multiple based valuations are typically used for internet firms or service industry based firms which have very few tangible assets. In addition, a sales multiple based valuation does not take into account the profitability of the business and could thus give favorable valuations even for a loss making firm but with high revenues. EBIT multiple should not be used because the value of this multiple is affected by accounting practices which may vary considerably across firms. Thus, it doesn’t fully reflect a given firm’s performance. The EBITDA multiple is a better option as it captures operational efficiency more accurately. The thumb rule is that as the base of the multiple goes lower it becomes more susceptible to manipulation and thus may give ‘spurious’ valuations. A price earning multiple is used mostly to estimate the performance of companies whose shares are traded in public and therefore reflect market expectation to a credible extent. Nantucket Nectars being a privately held firm should not be valued using this method. The multiples method has some drawbacks compared to APV method. Though the multiples method is simple and much easier to implement than the APV method, it’s useful only if the firm being valuated does not operate in a niche with characteristics completely different from those of its industry. The drawback of the APV method however is that it gives vastly different valuations for changes in the value of r and g assumed (especially for new enterprises since terminal value forms a large proportion of the valuation). In addition, the choice of the discount rates used for tax shields from interest and operating losses carried forward can change valuations. 39 Based on the arguments presented above, the valuations of the firms using the APV method and the EBITDA method have been presented in the annexure for further perusal. Apart from the base case valuation as provided in the case, two more scenarios corresponding to a 10% to 20% reduction in COGS (Cost of Goods Sold) have also been considered1. This is to accommodate the cases in which NN founders benefit from the favorable cost structure of the acquirer. Recommendations 1 Harvard Business School Case Study, ‘Nantucket Nectars’, Valuation Analysis, Para 2, Pg. 10 40 The final recommendations to the founders of Nantucket Nectars (NN) on each of the following issues: Mode of exit: As can be seen from Table 1, the alternative of trade sale seems most preferable in order to satisfy the stakeholders. The concerns of the employees regarding further growth and culture fit can be alleviated if care is taken to find an acquirer to fulfill these needs of the employees. Thus, trade sale is the recommended mode of exit. Acquirer: Among the potential bidders provided in the case2 the analysis as presented in Table 2 presents Seagram and Ocean Spray as two strong contenders. Ocean Spray additionally provides the advantage of culture fit thereby alleviating the issue encountered above and it may also bid aggressively in order to prevent NN from exploiting its loss of Pepsi distribution. Thus, Ocean Spray should be considered as the potential acquirer. Valuation: An EBITDA multiple based valuation is recommended and the founders should expect the acquirers to demand a discount rate upwards of 18% (to compensate them for the market risks associated with a relatively new firm like NN). In addition, as NN will benefit from the favorable cost structure of Ocean Spray an optimistic estimate of 10% reduction in COGS may be made. Thus, final negotiation of valuations should be expected in the $70 million to $105 million bracket. Structuring: As neither Michael Egan nor the founders have stated strong preferences for any particular mode of trade sale, the structuring related issues can be resolved only through negotiations. Annexure Exhibit 1 (in 000s) Cash Flow Forecasts 2 Harvard Business School Case Study, ‘Nantucket Nectars’, Exhibit 9 41 Base Case Total Revenues EBITA Income Taxes (benefit) on Unlevered Income Unlevered Net Income (EBIAT) Depreciation Working Capital Requirements Capex Free Operating Cash Flow Tax Rate Tax loss Shield EBIT Interest Taxable income Loss available for carry forward Loss set off Tax Tax Shield Notes payable interest Subordinated Debt Interest Income Notes payable shield Subordinated Debt Shield Interest Income Shield Total Tax Shield 1995 1996 1997 1998 1999 2000 2001 2002 15335 -45 -18 -27 29493 722 286 436 50026 2025 802 1223 69717 4279 1695 2584 93700 6964 2758 4206 122981 10633 4211 6422 148499 14698 5820 8878 174635 19192 7600 11592 137 -185 -295 -370 247 -3232 -315 -2864 209 -1484 -350 -402 331 -1137 -488 1290 495 -1365 -656 2680 710 -2658 -861 3613 763 -2283 -1039 6319 947 -2401 -1222 8916 39.60% 39.60% 39.60% 39.60% 39.60% 39.60% 39.60% 39.60% -45.00 139.00 -184.00 2252.00 0.00 0.00 722.00 301.00 421.00 2025.00 405.00 1620.00 4279.00 432.00 3847.00 6964.00 340.00 6624.00 10633.00 182.00 10451.00 14698.00 -74.00 14772.00 19192.00 -469.00 19661.00 -2436.00 421.00 166.72 -2015.00 1620.00 641.52 -395.00 395.00 156.42 3452.00 0.00 0.00 10451.00 0.00 0.00 14772.00 0.00 0.00 19661.00 0.00 0.00 337.00 102.00 34.00 323.00 204.00 95.00 323.00 204.00 187.00 323.00 204.00 345.00 323.00 204.00 601.00 323.00 204.00 996.00 1504.80 897.60 704.11 1698.29 Base Case: Discount rate 12% 14% 16% 18% Terminal Growth rate 4% 6% 8% $71,698 $92,778 $134,938 $54,177 $65,754 $85,048 $42,708 $49,783 $60,396 $34,680 $39,320 $45,815 Tax Shield $1,698 $1,698 $1,698 $1,698 Tax Loss $697 $683 $669 $656 4% $74,094 $56,558 $45,076 $37,034 Total 6% $95,174 $68,135 $52,151 $41,674 8% $137,334 $87,430 $62,763 $48,169 4% $170,465 $131,293 $105,531 $87,403 Total 6% $217,060 $156,882 $121,170 $97,658 8% $310,250 $199,531 $144,628 $112,016 10% COGS reduction: Discount rate 12% 14% 16% 18% Terminal Growth rate 4% 6% 8% $168,767 $215,362 $308,552 $129,594 $155,184 $197,832 $103,833 $119,471 $142,930 $85,705 $95,960 $110,318 Tax Shield $1,698 $1,698 $1,698 $1,698 42 Tax Loss $0 $0 $0 $0 20% COGS reduction: Discount rate 12% 14% 16% 18% Terminal Growth rate 4% 6% 8% $188,956 $240,858 $344,663 $145,280 $173,784 $221,290 $116,546 $133,966 $160,096 $96,317 $107,741 $123,733 Tax Shield $1,698 $1,698 $1,698 $1,698 Tax Loss $0 $0 $0 $0 4% $190,654 $146,978 $118,244 $98,015 Total 6% $242,556 $175,482 $135,664 $109,439 8% $346,361 $222,989 $161,794 $125,432 Exhibit 2 (in 000,000s) EBITDA Multiples $95 10.825 10% COGS Reduction $136 14% $83 $124 $175 16% $76 $114 $160 18% $70 $105 $148 Disc Rate 12% Base Case 20% COGS Reduction $191 Comparable: Includes the firms Celestial Seasonings, Ben & Jerry’s, Boston Beer and Weider Nutrition (2001 figures for Nantucket Nectars were used) 43