1.3 - Business Life Cycle

advertisement

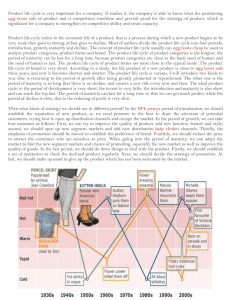

Business Studies Topic 1: Preliminary Course Nature of Business Section 1.3: Business Life Cycle Section Overview: 1.3.1 Phases of the cycle – establishment – growth – maturity – post-maturity 1.3.2 Challenges presented at each stage of business life cycle 1.3.3 Voluntary and involuntary cessation 1 Section 1.3 Business Life Cycle 1.3.1 Phases of the Cycle Establishment, Growth, Maturity, Post-Maturity Once they are established, businesses often go through different phases over the course of their existence. This is known as the life cycle of the business. The figure below depicts the four distinct stages in the life cycle of a business – establishment, growth, maturity and post-maturity. The Life Cycle of a Business Each phase has its own characteristics, challenges and opportunities that distinguish it from other phases and which need to be addressed by businesses before they can advance into the next phase of the life cycle. Businesses can also move through the life cycle at different rates; some move to maturity very quickly, only to fail abruptly. Other businesses may take a number of years to move through the growth stage. 2 Section 1.3 Stage 1: Business Life Cycle Establishment The establishment phase is where the business entrepreneurial idea is created. This phase is full of expectation, creativity, enthusiasm, and stress. The owner/manager must make many decisions about their new venture such as: What is the most appropriate legal structure for the business? Who is going to provide the finance? Where is the right location for the business? What government regulations must be adhered to? What type of staff will the business employ? These are only a few of the decisions that must be made during the establishment phase. Stage 2: Growth Once a business has survived its establishment stage, it moves on to a period of rapid growth. Several features characterise this stage: Customer awareness of the business and what it offers increases. Business OPERATIONS generally improve resulting in cost savings. Increased sales may also result in ECONOMIES OF SCALE. DISTRIBUTION CHANNELS & MARKETING are often refined. The business benefits from better management having learnt from earlier mistakes. It becomes easier to obtain finance. Staff levels increase allowing for specialisation for some individuals. There are several ways a business may expand and grow. For example: Merging (MERGER) with another business. (i.e. Colonial State Bank) Taking over (TAKEOVER) another business. (i.e. Burns Philp) Selling retail FRANCHISES (i.e. McDonald’s, L.J. Hooker, 7-11) Extending the sales territory by setting up new BRANCHes. Overhauling the business structure. (RESTRUCTURING) 3 Section 1.3 Business Life Cycle Diversifying the product range. (i.e. Mercedes Benz, Coles Myer) Moving up or down the production chain. (VERTICAL INTEGRATION) As mentioned, DIVERSIFICATION is another avenue for business growth, where a business moves from its initial prime function into unrelated markets. Rip Curl is a good example of a business moving away from its prime function and reaping the benefits of diversifying into other areas. Consider Activity 2: Stage 3: The Business Brief 1.3 Maturity A business enters the third stage in its life cycle when the rapid growth phase levels off. At this point the business has reached maturity, and it is unlikely to achieve substantial further growth unless internal or external conditions change significantly. Factors that contribute to a business maturing include: The owner may be content with the size of the business. The owner may not wish to take the risks that he/she used to. The management may have run out of ideas. The overall growth in demand may have slowed with the emergence of numerous competitors. Because it is now harder for the business to increase its sales or prices, the firm tends to focus on reducing its production costs. This may involve changes to management, reducing staffing levels, using different equipment, or scaling back on expenses such as marketing. Stage 4: Post-Maturity After maturity, the business can head in one of three different directions: 1) Steady State This is where sales levels are maintained and the business remains profitable without any significant changes to the overall business strategy. 4 Section 1.3 Business Life Cycle 2) Renewal This is where the business takes off and expands again. This expansion might be fuelled by the introduction of new products, a takeover or merger, or expansion into new markets (such as new markets for the products overseas). 3) Decline/Cessation Here, the business may lose its competitive advantage or its product may become obsolete. Profits may decline steadily, finally reaching a point where the business is no longer viable. Consider the Case Study: Business Life Cycle – Poppy Industries 1.3.2 Challenges Presented at Each Stage of the Business Cycle Stage 1: Establishment The challenges facing the entrepreneur at this stage are: High costs associated with the setup of the business. Difficulties in obtaining the necessary funds for the business. Slow growth in sales putting pressure on cash flow. Difficulties in attracting staff with appropriate skills. High costs associated with the promotion of the business. If the business can conquer these challenges it will experience growth, move into the second phase of the business cycle and be confronted with a whole new set of decisions to be made. Stage 2: Growth The challenges for business operators during the growth phase include: Ensuring the quality of service or production is maintained as output grows. Developing appropriate accounting and financial information systems which provide management with detail about the business. 5 Section 1.3 Business Life Cycle Managing the cash flow and being aware of the financial requirements involved in expanding the business. Sustaining growth and not letting the successes of the business create a sense of self-satisfaction or laziness. Redefining the role of management so that the manager’s workload is not overwhelming. Recruiting new employees and delegating responsibility. Stage 3: Maturity The challenges for business operators during the maturity phase include: Stage 4: Staying responsive to changes in consumer demands. Identifying opportunities for innovation in products and services. Rationalising business operations and minimizing costs. Sustaining the motivation of management and staff and avoiding laziness and complacency. Post-Maturity Understanding the changing tastes and needs of the customer base. Shifting into new or related markets where there are greater growth opportunities. Orienting the management and staff towards change. Consider the Case Study: Business Life Cycle – Graphic Preprint 1.3.3 Voluntary and Involuntary Cessation There are two main reasons why businesses cease trading. 1) Because the owners wish to get out, whether it be for retirement or so that they can redeploy their investment funds elsewhere. This is known as voluntary cessation. 2) Because the business may have been forced to close its doors because of its inability to pay its debts. This is known as involuntary cessation. Voluntary cessation is not considered to be business failure, whereas involuntary cessation is. 6 Section 1.3 Business Life Cycle Close to 30 000 small businesses fail in Australia each year, that is about 100 every working day. Businesses fail for many reasons. They can fail because of external or internal factors or because the owner decides to voluntarily become insolvent. External Factors for Business Failure Government policies Unexpected competition Natural disasters Even though external factors are considered to be beyond the control of business, careful planning can minimise their impact. Internal Factors for Business Failure Lack of management knowledge and skills Inadequate planning Lack of adequate cash flow and finance Incorrect location Unable to service excessive debt Death or illness of a key individual What are the procedures for cessation? The procedures that businesses must follow in order to cease to exist, voluntarily or involuntarily, depend on the legal structure of the business. Structure 1: Sole Trader A sole trader ceases to exist when the owner dies, when the sole trader voluntarily decides to cease the operations in a solvent state by paying all debts, or when a court declares the business bankrupt. BANKRUPTCY occurs when those who have lent money to the business go to court to seek recovery of loans which have not been repaid. At this point, courts appoint a trustee who assesses the financial position of the owner and the business. The trustee has complete control over the finances of the company and may require the owner to sell all their assets in order to repay the creditors. The trustee will endeavor to pay all the debts of the firm. 7 Section 1.3 Business Life Cycle Structure 2: Partnership Partners may decide to end the partnership because they may have had a disagreement, or because they no longer need the stress. To end the partnership, they will follow the details of the partnership agreement. If the partners do not have an agreement, they must follow the Partnership Act. A partnership can also be dissolved by an order of the court if it is not paying its debts, if one of the partners dies, if one or more of the partners have been involved in fraud, and if any of the partners becomes bankrupt. Structure 3: Company The winding up of a company is the most complex. that a company comes to an end. There are three ways 1) By Administration Here an administrator attempts to trade the business out of financial difficulty. If unsuccessful, the business is wound up. 2) Through Liquidation Here a liquidator is appointed with the specific task of converting all the company’s assets into cash, so as to pay down its debts. 3) By Receivership Here a person is appointed under a debenture deed to manage the company until the debt is paid. The business may survive or end. The main difference between the closure of a business operated by an individual or partnership and the closure of a company is that when companies cease trading, creditors can not gain access to the personal assets of the owner of the company. The Process of Winding Up a Business Involuntary Wind-Up Voluntary Wind-Up The courts make an order to wind up the company Liquidator is appointed by the court Directors write a solvency declaration Shareholders pass a resolution Liquidator is appointed by the shareholders Liquidator converts all of the company’s assets into cash. Creditors are paid in order of priority. 8 Section 1.3 Business Life Cycle DEFINITIONS: Bankruptcy Where an individual has insufficient funds to pay debts. This may happen to sole traders and partners whose businesses become insolvent. Branch A division of a business which is expanding into new locations. Distribution Channels The means by which the product or service is transferred to the marketplace. Diversification The development or acquisition by a business of product lines that are not related to its prime function or core business. Economies of Scale Savings that are made by a business when increased productive capacity allows units of production to be produced at a lower cost. Franchise The provision of a licence by the owner of a successful business to others to produce that good or service. Horizontal Integration The process by which a business acquires or develops businesses which have the same core business of producing similar products. Insolvency The situation where a business has insufficient funds to pay its debts. Marketing A system of business activities designed to plan, price, promote and distribute goods, services and ideas in order to satisfy the wants and needs of the customer. Merger Two or more enterprises combine to form a new business. Operations The process of planning and controlling all of the activities necessary for production. Restructuring Completely overhauling the business, staff and procedures; often selling off non-core assets. Takeover The situation where one business purchases another business. Vertical Integration The situation in which a business acquires or develops a business which either produces inputs for the original business or which purchases the original business’ output. 9 Section 1.3 Business Life Cycle HOMEWORK ACTIVITIES: Activity 1: Computer Room View the website: Task: http://www.arnotts.com.au This site has a history section for the company. Open the site and prepare a time line for Arnott’s establishment, growth and maturity. Activity 2: Complete Business Brief 1.3 on P.22 of Heinemann Text. Activity 3: Complete the following questions: (1) (2) (3) (4) (5) Using a diagram, define each of the stages of the business cycle. Explain why the plateau effect happens in the maturity stage. What is meant by involuntary cessation? What are the main reasons for business failure? Explain the difference between insolvency and bankruptcy. Activity 4: Case Study: Business Life Cycle – Poppy Industries Activity 5: Case Study: Business Life Cycle – Graphic Preprint Activity 6: For each of the businesses described below, identify the phase of the life cycle, give reasons for your answer and give an example of a challenge to be faced at this stage of the life cycle. Business One is an internet service provider. It has been in business for four years. Last year its turnover was $100 000. This year, its turnover is forecast to be $1.4 million. Phase: Reason: Challenge: ……………………………………………. …………………………………………………………………………... …………………………………………………………………………... …………………………………………………………………………... 10 Section 1.3 Business Life Cycle Business Two is a plant nursery in the outer suburbs of Sydney. It is run by two brothers who inherited the 30 year old business from their father 10 years ago. Since taking over, they have successfully diversified into landscape supplies and garden accessories. They have increasing turnover and have purchased additional land for extra display space. Phase: Reason: Challenge: ……………………………………………. …………………………………………………………………………... …………………………………………………………………………... …………………………………………………………………………... Business Three is a tutoring service run by 3 university students who did the HSC last year. They plan to provide maths and science tutoring to local students once they have raised the money to rent and fit out some premises. Phase: Reason: Challenge: Activity 7: ……………………………………………. …………………………………………………………………………... …………………………………………………………………………... …………………………………………………………………………... Vocabulary Exercise and Chapter Review There are distinct __________ of the business life cycle: _______________, growth, ____________ and ________ ____________. In this last stage, a business can remain in a __________ _________ or it can ___________ and eventually cease, or it may ______________. In the establishment stage, a major problem is ________ ________. A business will have _________ costs which have to be paid, regardless of how much is sold. These costs include ________ and the connection costs of _____________ and _______________. Businesses also have to pay ____________ costs which vary according to how much is sold. These costs include _________, ________ and __________. Businesses may have allowed customers __credit__ on their purchases and may not receive that __income__ for a __month__ or more. About __________ businesses fail in Australia each year (or about _______ every working day). The main reasons for failure are poor ____________ and inexperienced and untrained ______________. planning, establishment, cash flow, 30 000, 100, stages, fixed, variable, management, rent, labour, decline, rejuvenate, maturity, electricity, power, income, month, steady state, post maturity, telephone, fuel, credit 11