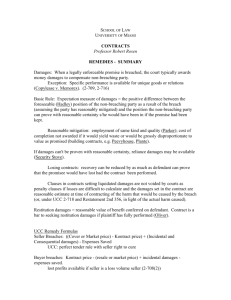

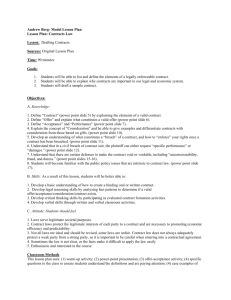

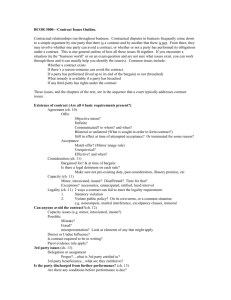

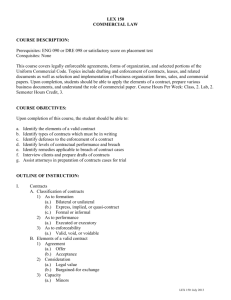

Contracts II Outline

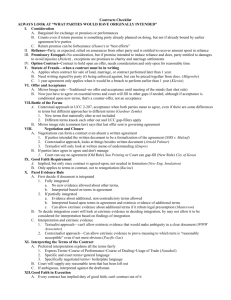

advertisement