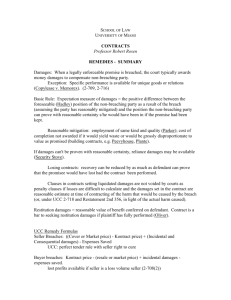

Anonymously contributed contracts outline

advertisement