Assignment #10 - gozips.uakron.edu

advertisement

106747392

Foundations of Economic Analysis

Homework #4

Stratton

Name _________________________

Objective: to provide practice and assessment of your understanding of short run and long run

costs. Your ability to demonstrate understanding, insight and/or the ability to use the material is

the primary purpose of the assessment. Thus full credit will only be earned if you follow the

directions carefully and provide the explanation, description, and thought process as directed.

(Hint: you may want to work out your answers on another sheet of paper and transfer your work

to this one to avoid submitting a messy worksheet.) {See HW04_SRCost and Doc4 for graphs}

Instructions: For each term, write a short definition in your own words in the space provided or

attach additional sheets if necessary. Each numbered question is worth 2 points – total 56

points.

Definitions:

1.

Economic profit – The difference between total revenue (sales receipts) and total costs

(opportunity costs, including explicit and implicit costs).

2.

The short run – A period of time short enough that the amount of at least one input used

in production is fixed. A time period short enough that the amount of at least one input

used in production cannot be changed.

3.

Marginal cost – The additional expense (cost) incurred to produce one additional unit of

output. Measured as TC / Qx

4.

Average fixed cost (AFC) – Average fixed cost is the average per unit of output expense

of the fixed factors of production. It is calculated as total fixed cost divided by the

quantity produced. TFC / Qx

5.

Marginal product (MP) – Is the additional output produced when one additional unit of a

variable input is used. Thus if labor is the variable input, MP of labor is the additional

output gained by using one additional unit of labor. The MP function shows the MP of

labor at every level of labor usage.

6.

Implicit cost – An opportunity cost of using a resource, but which is not explicitly paid. It

is often the sacrificed value of using the resource in the next best activity. For example,

the implicit cost of living in your own home is the rent you could receive if you were to

rent it to someone else.

7.

Economies of scale – The reduction of ATC as the scale of production increases.

Sometime measured as cost-output elasticity [percentage change in TC / percentage

change in output].

8.

Capital intensive production – A production process that uses a high percentage of capital

relative to other inputs.

1 of 10

3/6/2016

106747392

9.

Foundations of Economic Analysis

Stratton

Minimum efficient scale (MES) – The lowest level of output (smallest production scale)

at which LRAC reaches its minimum. The minimum scale of production at which

economies of scale are exhausted.

10. Best practices (Economic efficiency) – Production techniques that creates the highest

levels of productivity. This is NOT just physical productivity, since there may be several

options that provide high physical productivity, but also includes using inputs to

minimize opportunity cost. This depends on the relative costs and relative productivity of

the inputs.

Instructions: Answer the questions in the space provided or attach additional sheets if necessary

Problems

Scenario 1:

Below is a hypothetical short run production function for an automobile plant.

Where output is measured in units per hour and labor is measured in worker hours.

Qx = 10L + 5L2 – 0.4L3

Average

Product

AP

Marginal

Product

MP(point)

Marginal

Product

Capital

K

Labor

L

Total

Product

TP

20

0

0.00

20

1

14.60

14.60

18.80

14.60

20

2

36.80

18.40

25.20

22.20

20

3

64.20

21.40

29.20

27.40

20

4

94.40

23.60

30.80

30.20

20

5

125.00

25.00

30.00

30.60

20

6

153.60

25.60

26.80

28.60

20

7

177.80

25.40

21.20

24.20

20

8

195.20

24.40

13.20

17.40

20

9

203.40

22.60

2.80

8.20

20

10

200.00

20.00

-10.00

-3.40

20

11

182.60

16.60

-25.20

-17.40

MP(arc)

11. Fill-in the table above. Graph the total, average and marginal product functions on the

graphs provided. Be sure to label your graphs clearly. (15)

12. At what level of labor usage do diminishing returns first begin?

With the fifth unit of labor – MP declines from 30.80 to 30.00 (point).

With the sixth unit of labor – MP declines from 30.60 to 28.60 (arc).

2 of 10

3/6/2016

106747392

Foundations of Economic Analysis

Stratton

13. What is the closest whole unit of labor usage at which AP is maximized? At this level of

labor usage is AP increasing or decreasing? Explain using the relationship between MP

and AP.

AP is maximized at about the sixth unit of labor – AP is 25.60 (point) [28.60 (arc)] at the sixth

unit. However, since MP is still above AP, we know that AP is still increasing and the true max is

above 6 units of labor.

Total Product

Total Product Function

250.00

200.00

150.00

TP

100.00

50.00

0.00

0

2

4

6

3 of 10

8

10

12

3/6/2016

106747392

Foundations of Economic Analysis

Stratton

Average and Marginal Product Functions

Average and Marginal Product Functions

35.00

30.00

25.00

20.00

15.00

AP

10.00

MP

5.00

0.00

-5.00 0

2

4

6

8

10

12

-10.00

-15.00

4 of 10

3/6/2016

106747392

Foundations of Economic Analysis

Stratton

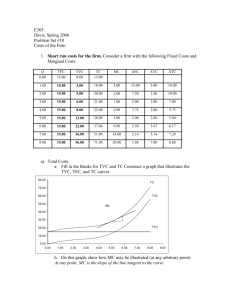

Scenario 2:

Below is a hypothetical short run cost functions for the automobile plant. Where

output is measured in units per hour and labor is measured in worker hours.

The price of capital is $100 per unit; the cost of labor is $75 per unit.

TP

0

15

37

64

94

125

154

178

195

203

TFC

$2,000

$2,000

$2,000

$2,000

$2,000

$2,000

$2,000

$2,000

$2,000

$2,000

TVC

$0

$75

$150

$225

$300

$375

$450

$525

$600

$675

TC

$2,000

$2,075

$2,150

$2,225

$2,300

$2,375

$2,450

$2,525

$2,600

$2,675

AFC

$133

$54

$31

$21

$16

$13

$11

$10

$10

AVC

$5

$4

$4

$3

$3

$3

$3

$3

$3

ATC

MC

$138

$58

$35

$24

$19

$16

$14

$13

$13

$5

$3

$3

$2

$2

$3

$3

$4

$9

The above table is the result of using the printed, rounded numbers in this table and ignoring any

underlying structure. The following table is the result of using the underlying equation structure

and rounding at the end of the process.

TP

0

15

37

64

94

125

154

178

195

203

TFC

$2,000

$2,000

$2,000

$2,000

$2,000

$2,000

$2,000

$2,000

$2,000

$2,000

TVC

$0

$75

$150

$225

$300

$375

$450

$525

$600

$675

TC

$2,000

$2,075

$2,150

$2,225

$2,300

$2,375

$2,450

$2,525

$2,600

$2,675

AFC

$137

$54

$31

$21

$16

$13

$11

$10

$10

AVC

$5

$4

$4

$3

$3

$3

$3

$3

$3

ATC

MC

$142

$58

$35

$24

$19

$16

$14

$13

$13

$4

$3

$3

$2

$3

$3

$4

$6

$27

14. Fill-in the table above. Round all entries to the nearest whole dollar. (50)

15. Graph the total cost functions on the graph provided. Be sure to label your graphs clearly.

Graph the average cost and marginal cost functions on the graph provided. Be sure to

label your graphs clearly.

16. Between what levels of output is AVC minimized? Explain using the relationship

between MC and AVC.

AVC is at its minimum between 154 and 178 units of output. At 154, MC < AVC, so AVC is still

declining. At 178, MC > AVC, so AVC is increasing.

17. At what level of output is AFC minimized?

AFC is always declining, thus there is no level of output at which it is minimized. AFC = FC/Q.

Since FC is constant, AFC declines as Q increases. However, since the production function being

used (as in scenario 1) has negative MP beyond 9 units of labor (203 units of output) AFC is

minimized at that output level (203).

5 of 10

3/6/2016

106747392

Foundations of Economic Analysis

Stratton

Total cost functions

Total Cost Functions

$3,000

$2,500

$2,000

TC

$1,500

TFC

TVC

$1,000

$500

$0

0

50

100

150

200

250

Average and Marginal cost functions

Average and Marginal Cost Functions

$160.00

$140.00

$120.00

ATC

$100.00

AVC

$80.00

AFC

$60.00

MC

$40.00

$20.00

$0.00

0

50

100

150

6 of 10

200

250

3/6/2016

106747392

Foundations of Economic Analysis

Stratton

Scenario 3:

John is currently employed as a systems analysis at a salary of $85,000 per year.

However, he is dissatisfied and has decided to quit his job and start his own ice cream stand. To

do so he will use $50,000 of his savings (he is currently getting 5%) and barrow $100,000 from

the bank at an interest rate of 8%. With these funds he will be able to purchase the ice cream

making equipment he needs. His other average weekly expenses are listed below:

Rent:

$100

Wages:

$600 (96 hours times $5.15 plus 20% for taxes)

Utilities:

$150

Materials:

$400

Answer and explain the questions below using the information above.

18. What are John’s annual explicit costs? Explain.

Explicit costs are “out-of-pocket” costs. Thus these are often called accounting costs and

include payments to the factors of production.

Rent:

$ 5,200 => [$100 per week times 52 weeks]

Wages:

$31,200 => [$600 per week times 52 weeks]

Utilities:

$ 7,800 => [$150 per week times 52 weeks]

Materials:

$20,800 => [$400 per week times 52 weeks]

Interest on loan: $ 8,000 => [(0.08*100,000)]

Total:

$73,000 per year.

19. What are John’s annual implicit costs? Explain.

Implicit costs are forgone opportunities costs. Thus in this situation these include forgone

salary and interest.

Sacrificed wages:

$85,000

Forgone interest on savings:

$ 2,500 => [(0.05*50,000)]

Total:

$87,500 per year.

20. How much revenue must John generate annually to breakeven? Explain.

To breakeven John must be just as well of as before, thus he must earn revenue sufficient

to cover total cost (explicit plus explicit costs).

Explicit costs:

$73,000 per year.

Implicit costs:

$87,500 per year.

Total costs:

$160,500 per year.

Breakeven Revenue

$160,500

(32,100 servings at $5 per serving; a little over

100 servings per day)

7 of 10

3/6/2016

106747392

Scenario 4:

Foundations of Economic Analysis

Stratton

Answer the following questions using the graph below.

21. What is VC at output level Q3? Explain. FC cost is incurred even if output is zero. Thus

FC = OA at all output levels, including Q3. At Q3 TC = OD; since TC = FC + VC, VC =

TC – FC. Thus, at Q3 VC = TC – FC = OD – OA = AD.

22. At what output level is ATC at its minimum? Explain. ATC reaches its minimum when

output is at Q3. This is the output level at which a line from the origin is just tangent to

the TC curve. ATC is represented by slope of the line from origin to TC curve. The slope

of this line reaches its minimum at its tangent point (at Q3).

23. How would the TC change if the wage paid to labor increased? Explain in words and

draw it on the graph. An increase in wages increases variable costs but not fixed costs.

Thus the VC increases at each output level and TC will rotate counter clockwise around

point A. TC4

TC4

TC

T

C

TC5

D

D

C

C

B

B

A

A

O

O

Q1

Q2

8 of 10

Q3

Q

Q

Q

1

2

3

3/6/2016

106747392

Foundations of Economic Analysis

Stratton

Scenario 5:

Below is a hypothetical production function for the production of woven baskets.

Where output is measured in units per hour and labor is measured in worker hours.

Labor

20

15

10

5

0

K

0

5

10

15

20

TP

80

100

80

60

40

TC1

$2000

$2000

$2000

$2000

$2000

AC1

$25.00

$20.00

$25.00

$33.33

$50.00

TC2

$2000

$3000

$4000

$5000

$6000

AC2

$25.00

$30.00

$50.00

$83.33

$150.00

TC3

$4000

$3250

$2500

$1750

$1000

AC3

$50.00

$32.50

$31.25

$29.17

$25.00

24. What combination of labor and capital is the most productive (is output maximized)? The

maximum physical output is reached using 15 units of labor and 5 units of capital.

25. If the price of capital is $300 per unit; the cost of labor is $100 per unit, what is the cost

per unit minimizing combination of labor and capital? Minimum AC is at 20 units of

labor and 0 units of capital.

Scenario 6:

For each industry characterized below, describe a representative LRAC and

industry demand for the industry. Be sure to discuss how the prevailing MES and LRAC in the

industry relative to the industry demand curve are consistent with the description. Then sketch a

representative LRAC and industry demand for the industry.

26. The industry is characterized by very few large firms. Assume there are n firms; the MES

will occur about output level 1/n. The LRAC will have a relatively steep gradient.

27. The industry is characterized by many small to medium firms, but no large firms. The

MES will occur at a relatively small percentage of the industry demand and relatively flat

LRAC, allowing many firms to survive. The LRAC will tend to be relatively flat after

reaching the MES, but will tend to increase rapidly at some point well before the industry

demand is met, ensuring there will be no large firms.

28. The industry is characterized by many small firms, but no medium or large firms. The

MES will occur at a relatively small percentage of the industry demand, ensuring many

firms will be needed to meet demand. The LRAC will tend to have a relatively steep

gradient, ensuring firms of similar size.

9 of 10

3/6/2016

106747392

Foundations of Economic Analysis

Cost in dollars

Stratton

Market demand

26

28

27

Output

10 of 10

3/6/2016