Cost Analysis

advertisement

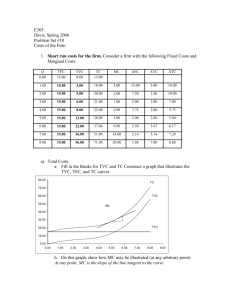

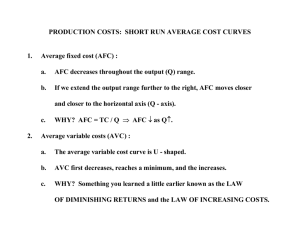

Topic 5 – Cost Analysis / Cost Functions Outline: I) II) III) IV) Motivation Short-Run Costs Long-Run Costs An Application I) Motivation / Introduction - In analyzing the efficiency implications of various market structures or polices, it is common to model the firm as choosing a level of output to maximize profits. - By deriving the firm’s cost functions, we can sidestep the firm’s input decisions and consider the firm’s choice of output directly. - This is because the tangency points between isoquants and isocost lines tell us the total cost of producing a given level of output in the least cost manner. - Thus, the firm’s cost functions subsume the input selection decision. - Can categorize costs in the following ways: - Total, Average, Marginal - Fixed vs. Variable - We will look at the various combinations and their relationships to one another in both the short run and the long run. II) Short-Run Costs (most of this should be review) A) Total Costs - Recall that in our two input world, total cost (TC) is given by TC = wL + rK - Since some inputs are fixed in the short run (e.g. K), there are two types of short-run costs. (1) Fixed Costs, FC: Do not vary with output. These are the costs of the fixed inputs. Example: FC = rK0 when capital is fixed at K0 in the short run. (2) Variable costs, VC(Q) : Vary with output. These are the costs of the variable inputs. Example: VC(Q) = wL Note: VC(Q) is written as a function of Q since varying L will change Q. Short-Run (Total) Cost Function – Defines the minimum cost of producing each level of output when variable inputs are used in the cost-minimizing way. Note: Embeds the optimal input choices we studied in the last section. To begin, recall that: Short Run TC = wL + rK0 Example: Suppose capital costs $1000 per unit and labor costs $400 per unit. Derive the costs associated with the production technology shown in the table below. Fixed Variable Input Input (Capital) (Labor) 2 0 2 1 2 2 2 3 2 4 2 5 2 6 2 7 2 8 2 9 2 10 2 11 Output 0 76 248 492 748 1100 1416 1708 1952 2124 2200 2156 FC VC(Q) TC(Q) K0 * 1000 L * 400 FC + VC(Q) $2000 $2000 $2000 $2000 $2000 $2000 $2000 $2000 $2000 $2000 $2000 $2000 $0 $400 $800 $1200 $1600 $2000 $2400 $2800 $3200 $3600 $4000 $4400 $2000 $2400 $2800 $3200 $3600 $4000 $4400 $4800 $5200 $5600 $6000 $6400 We can also illustrate these relationships graphically (see diagram). B) Average Costs Average Fixed Costs, AFC – Fixed costs divided by the number of units of output. AFC FC Q - AFC declines with output - Captures the fact that as output increases, “overhead” expenses are spread over larger values of Q. Average Variable Costs, AVC – Variable costs divided by the number of units of output. AVC VC (Q) Q - Generally declines with output initially, then levels off, then rises since AVC VC (Q) wL w w Q Q Q AP L L Average Total Costs, ATC – Total costs divided by the number of units of output. ATC TC(Q) Q - Generally declines with output initially, then levels off, then rises (for same reason as AVC). Example: Derive average costs for previous example. Output 0 76 248 492 748 1100 1416 1708 1952 2124 2200 FC VC(Q) K0 * 1000 L * 400 $2000 $2000 $2000 $2000 $2000 $2000 $2000 $2000 $2000 $2000 $2000 $0 $400 $800 $1200 $1600 $2000 $2400 $2800 $3200 $3600 $4000 AFC AVC $26.32 $8.06 $4.07 $2.55 $1.82 $1.41 $1.17 $1.02 $0.94 $0.91 $5.26 $3.23 $2.44 $2.04 $1.82 $1.69 $1.64 $1.64 $1.69 $1.82 C) Marginal Costs Marginal Cost, MC – The cost of producing an additional unit of output. MC TC (Q) Q - Generally declines with output initially, then levels off, then rises since TC (Q) VC FC VC wL wL w w MC Q Q Q Q Q Q MP L L Applications: 1) Why do some, but not all, companies move manufacturing plants to counties with lower labor costs? 2) Why does the cost of a college education continue to rise faster than the cost of most manufactured goods? Numerical Example: Derive marginal costs for previous example. Output Q TC TC 0 76 248 492 748 1100 1416 1708 1952 2124 2200 76 172 244 292 316 316 292 244 172 76 $2000 $2400 $2800 $3200 $3600 $4000 $4400 $4800 $5200 $5600 $6000 400 400 400 400 400 400 400 400 400 400 MC = TC/Q 5.26 2.33 1.64 1.37 1.27 1.27 1.37 1.64 2.33 5.26 Relationships Among Short-Run Cost Curves - See diagram (i) The marginal cost curve intersects the ATC and AVC cost curves at their minimum points. - For the same reason that MP intersects AP at it’s maximum. - GPA example. (ii) The spread between ATC and AVC decreases as output increases. - This is due to the fact that AFC declines with output and ATC – AVC = AFC. Mathematical Example Consider the cubic cost function: TC(Q) 100 aQ bQ2 cQ3 Problem: Calculate TFC, TVC(Q), AFC, and AVC(Q). Note: Calculation of MC(Q) requires the use of calculus. TFC 100 TVC (Q) aQ bQ2 cQ3 100 AFC Q AVC(Q) a bQ cQ2 Note: For those of you know calculus, MC(Q) is simply the derivative of TC(Q). III) Long Run Costs (most of this should be review) - All inputs can be varied (no fixed costs). A) Total Costs - Long run total cost curve is derived from the isoquant / isocost diagram via the output expansion path. Output Expansion Path – The set of cost-minimizing input bundles at fixed input prices. Given by the locus of tangencies between isoquants and isocosts at different output levels. - See diagram. - Can use the output expansion path to create a table relating output and total cost. - This allows you to graph the long run total cost curve. - Output expansion path provides the link between the cost curve, written as a function of output, and the firm’s cost-minimizing input choices. B) Average and Marginal Costs - These are defined analogously to their short run counterparts, except that there are no fixed costs, so AVC = ATC - Specifically, ATC MC TC wL rK Q Q TC wL rK Q Q Returns to Scale and Long Run Cost Curves - First note that if we double K and L, TC exactly doubles, since TC (2K, 2L) = r(2K) + w(2L) =2 [rK + wL] =2 TC (K, L) a) Increasing Returns to Scale – Output more than doubles and total cost exactly doubles, so TC(Q) is a concave function (see diagram) This implies that AC TC Q is declining and that MC is below AC (see diagram). b) Constant Returns to Scale – Output exactly doubles and total cost exactly doubles, so TC(Q) is a linear function (see diagram). This implies that AC TC Q is constant and MC = AC (see diagram). c) Decreasing Returns to Scale – Output less than doubles and total cost exactly doubles, so TC(Q) is a convex function (see diagram). This implies that AC TC Q is increasing and that MC is above AC (see diagram). Typical Case: Increasing returns at low levels of output, followed by constant returns, followed by decreasing returns. U-shaped average cost curve IV) Application: Emergency Room Costs - Many health policy-makers (e.g. those who administer the Medicaid program) and hospital administrators believe that health care costs can be reduced by cutting down on unnecessary ER visits. - These beliefs have lead to attempts to reduce “nonurgent” ER visits. Question: How large are the cost savings from reduced ER visits likely to be? Answer: Much smaller than is commonly believed. Reason: The perceived costs of ER visits and hospitalizations are typically based on average cost calculations. These include fixed costs (e.g. costs of buildings, equipment, and salaried staff) that will not go away if fewer patients are served. Example: How much cost savings could be achieved by eliminating all “non-urgent” ER visits? - Williams (see handout) estimates the average cost of non-urgent ER visits to be $69 per visit. - Actual cost savings depend on marginal costs (i.e., how much will total costs fall if we reduce output?) - Williams estimates the marginal cost of non-urgent ER visits to be $24 per visit. - Thus, MC is only 39% of AC, so the true cost savings will be only 39% of the projected cost savings.