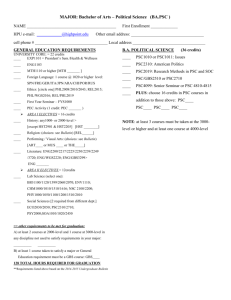

Tabular analysis of the Public Sector Entity

advertisement

Corporate Governance in Public Sector Companies Prepared by: Noman Hameed Introduction: The importance of good Corporate Governance has been recognized and is on the agenda of law makers in Pakistan over the last decade. The Securities and Exchange Commission of Pakistan (SECP) formulated the Code of Corporate Governance (CCG) in 2002 which was based on OECD’s principles of corporate governance and requirements of the local environment. In April 2012 SECP issued a revised Code which is applicable to all listed companies, in both the private and public sectors. During recent times there were several misappropriations highlighted in Government owned unlisted corporations including National Logistics Corporation, Pakistan Steels, Distribution and Generation Companies of Wapda as well as other Public Sector Enterprises. The scrutiny of these issues highlighted that there were some major Governance issues in the Public Sector and the provisions available in company law or any other law in force for the time being were not enough to cope with these kinds of matters. Securities and exchange commission therefore realized that they need to develop some Corporate Governance regulations specifically for the Public Sector. SECP along with help of other Professional Bodies has developed a Code of Corporate Governance for Public Sector Companies. The main focus of the Code is to bring transparency and accountability in the governance of the Public sector in Pakistan. ACCA Pakistan was a key stakeholder during the process of drafting a Code for Public Sector through its recommendations in order to bring the Public Sector of Pakistan in line with the global environment. ACCA has played a key role in the thought leadership on governance conducting several debates over the emerging best practices in corporate governance in Pakistan. In keeping with this commitment the Subcommittee for the Public Sector (of the Members Network Panel of ACCA Pakistan) has prepared an analysis on the “Implications of Code of Corporate Governance for Public Sector Companies (2013) issued by the Securities and Exchange Commission of Pakistan”. It attempts to discuss the major requirements of the Code with an emphasis on the practical implications of these requirements. Where applicable, interrelationship of the requirements with other company law provisions (as applicable in Pakistan) has also been highlighted. I would like to thank Ms. Gillian Fawcett, Head of Public Sector, ACCA for her valuable feedback on this topic. I would also like to appreciate Ms. Nida Naeem, Chairman Public Sector committee, Pakistan for her continuous effort and support. The Detailed analysis is given as under: Sr No Issue Provision 1 Applicability The rules are applicable to all the All the provisions of these public sector companies. rules have been made applicable from 7th June th Rules have issued on 8 March 2013. 2013 and shall come into force after 90 days of their issuance. In the case of listed Public Sector Companies, where there is any inconsistency with the Code of Corporate Governance for listed companies 2012, the provisions of CCG 2012 for listed companies shall prevail. Section 1 2 Definition of Public "Public Sector Company" means a Sector Company. company, whether public or private, which is directly or Section 2(g) indirectly controlled, beneficially owned or not less than fifty percent of the voting securities or voting power of which are held by the Government or any instrumentality or agency of the Government or a statutory body, or in respect of which the Government or any instrumentality or agency of the Government or a statutory body, has otherwise power to elect, nominate or appoint majority of its directors, and includes a public sector association not for profit, licensed under section 42 of the Ordinance. Implication A very comprehensive definition which includes public sector companies, their subsidiaries, subsubsidiaries and also companies registered under Section 42(not for profit companies) of companies’ ordinance 1984. Bringing Section 42 companies under the ambit of these regulations is a very positive step because nowadays most of the newly formed Government companies are registered under Section 42. Some important authorities like OGRA, WAPDA, NADRA and PTA are still outside the ambit of these rules as these rules are only applicable to companies. Government must take some steps to bring these authorities under some kind of Corporate Governance rules. 3 Composition Board Section 3 mandatory of The Board shall consist of atleast The requirement to have at 40% independent directors. least 40% independent Casual vacancy to be filled in 90 director is introduced. days. Within 2 years of this A person cannot be on the Board of notification every PSC more than 5 Public Sector needs to fulfil 40% independent companies and listed companies mandatory director’s requirement and simuntaneously. majority independent directors by the next 2 years. A comprehensive criteria “FIT and Proper” is given in the annexure to SRO which the entails the requirement for appointment as Director in PSC. 4 Chairman and CEO Section 5 The Chairman and Chief executive This requirement would should be separate persons. help to improve transparency, achieve an appropriate balance of increasing Chairman should be selected by power, accountability, and BOD from independent directors. improving the Board's capacity for exercising independent judgment. Currently chairman of PSC are appointed by Government directly and a post facto approval is taken from the BOD. This is in conflict of this rule. BOD shall after applying FIT and proper criteria forward 3 names of person for the position of CEO to the Government.This would bring transparency if applied in true spirit. 5 Meeting of BOD Section 6 BOD meeting to be held atleast The requirement has been once in each quarter. introduced to improve BOD oversight of Companies Operations. Previously there was no such requirement other than the one available in CCG for listed companies. 6 Performance evaluation of BOD. Section 8 Performance evaluation of BOD A very good step to and senior Management on annual improve transparency and basis. accountability.It is suggested that the mechanism followed along with evaluation reports for BOD should be available on companies website for general public. An annual evaluation of board members can be considered good practice. This reminds members of their responsibilities to take an active part and utilise their skills for the benefit of an organisation. Also, it is ultimately a check on performance. 7 Monthly,Quarterly and Annual Accounts Section 10 8 Board Committees Section 12 Every Public Sector Company shall, within one month of the close of first, second and third quarter of its year of account, prepare a profit and loss account for, and balancesheet as at the end of, that quarter, whether audited or otherwise, for the Board's approval. A new requirement for preparation of quarterly and monthly accounts has been introduced. Annual report needs to be published on companies website for general public. Every PSC shall have following PSC’s are required to have committees: all these committee which would be chaired by non Audit Committee executive directors. Risk Management Committee HR Committee Procurement Committee Nomination Committee Majority Members of these committees are required to be independent directors. Chairman and Chief executive cannot be members of Audit Committee. Sec21(2) of CCG for PSC. Exception: For PSC whose total assets are less than 5 billion there is no compulsion of having risk management Comittees. Note: Minutes of the meetings of BOD and these committees are also required to be published on company’s website by Public Accounts Committees. However the companies are not following this directive taking the plea of “breach of confidentiality”. CFO,CIA and Every PSC should have a separate Many of Government Company Secretary. CFO,CIA and CS. companies do not have separate persons working Section 13 on these positions. Exception: Where the company secretary is not separately appointed, the role of company secretary may be combined with chief financial officer or any other member of senior management. 9 CFO Qualification Section 14(1) No person shall be appointed as the No exception has been chief financial officer of a Public provided in this clause Sector Company unless he is,therefore all the persons working on these positions (a) a member of a recognized body that do not have the of professional accountants with required qualifications and atleast five years relevant experience (where experience, in case of Public Sector applicable) would have to Companies having total assets of be removed from this five billion rupees or more; or position. (b) a person holding a master degree in finance from a university recognized by the Higher Education The Guidelines which Commission with at least ten years defines a professional relevant experience, in case of other body (Criteria/Guidelines Public Sector Companies. for recognition of bodies of professional accountants and corporate/chartered secretaries for the purpose of prescribed qualification of CFO and Company Secretary Dated 29th April 2004)should be read in conjunction with this requirement of the Code. Gillian Fawcett, Head of Public Sector ACCA said “I strongly believe that a CFO should hold a professional accounting qualification as a minimum and there should be no other options. Experience alone doesn't make up for the technical skills required to support successful financial management. I also think that degree courses that have a finance element are not a substitute for a professional accountancy qualification. There is also the ethical dimension to consider i.e. professional accountants are bound by a strong ethical code the same does not apply to non-accountants”. Practically there would be many difficulties in applying this regulation because majority of small Government companies have people working on these positions who do not fulfill this criteria. Fit and proper criteria given in the annexure to CCG for PSC is applicable for this position. 10 Company Secretary No person shall be appointed as the Qualification company secretary of a Public Sector Company unless he is a,— Sec 14(4) (a) member of a recognized body of professional accountants; or No exception has been provided in this clause therefore all the persons working on these positions that do not have the required qualifications and (where (h) member of a recognized body experience of corporate or chartered applicable) would have to be removed from this secretaries; or position. (c) person holding a master degree in business administration or Practically there would be difficulties in commerce or being a law graduate many from a university recognized by the applying this regulation Higher Education Commission with because majority of small companies at least five years relevant Government have people working on experience. these positions who do not fulfill this criteria. Fit and proper criteria given in the annexure to CCG for PSC is applicable for this position. 11 Directors Report Directors Report shall be prepared The material issues which Section 17 and presented to the shareholders need to be incorporated in annually. this report are more or less the same as are required in CCG for listed companies 2012 and also Section 236 of companies ordinance 1984. Section 19(4) of CCG for PSC requires criteria of directors remuneration to be disclosed in annual report. 12 Chief Internal No person shall be appointed as the Auditor Qualification Chief Internal Auditor of a Public Sector Company unless he has five Section 22(2) years of relevant audit experience and is a,— Every PSC has to have a internal audit department and a separate person acting as Chief Internal Auditor. Persons not fulfilling both (a) member of a recognized body of the criteria i.e. experience professional accountants; or and qualification stand removed immediately. (b) certified internal auditor; or (c) certified fraud examiner; or (d) certified auditor; or internal control (e) person holding a master degree in finance from a university recognized by the Higher Education Commission: I strongly believe that a CIA should hold a professional qualification as a minimum and there should be no other options. Experience alone doesn't make up for the technical skills required to support successful internal audit management. I also think that degree courses that have a audit element are not a substitute for a professional accountancy qualification. There is also the ethical dimension to consider i.e. professional accountants are bound by a strong ethical code the same does not apply to non-accountants. Exception to rule: Provided that individuals serving as Head of Internal Audit of a public company for the last five years at the time of coming into effect of this Code shall be exempted from the above. 13 14 External Rotation Auditors Every Public Sector Company in the financial sector shall change its external auditors every five years. Section 23(6) Financial sector, for this purpose, means banks, non-banking finance companies, mutual funds, modarabas, takaful companies and insurance companies. Every Public Sector Company other than those in the financial sector shall, at a minimum, rotate the engagement partner after every five years. Management Letter Rotation of audit firm and audit partner(where applicable) has been introduced to ensure transparency in the audits of PSC’s. Previously these rules these regulations were only for listed companies. Practically it would create difficulty for small companies as many of these were conducting their external audits through single partner audit firms. Every Public Sector Company shall Previously there was no require external auditors to furnish such requirement for a management letter to its Board external auditors to not later than thirty days from the provide a ML. date of audit report. 23(8) 15 Fit and Criteria 16 Compliance Statement Proper Sec 24 A detailed criteria has been provided as an annexure to CCG for PSC. Previously some information has been provided in companies ordinance Section 187 for ineligibilities of directors. Every Public Sector Company shall Compliance statement publish and circulate a statement needs to be reviewed by along with its annual report to set the external auditor. out the status of its compliance with these rules, and shall also file with Format of this statement the Commission and the registrar has not been provided in concerned such statement along the rules. with its annual report. Sample statement has been provided in CCG for listed companies and same may be used here after some amendments. Abbreviations Used: CCG: Code of corporate governance PSC: Public sector company PSE: Public sector entity. SRO: Statutory Regulatory Order.