Philippines: Minimum Wage Rates CAR & NCR (2012)

advertisement

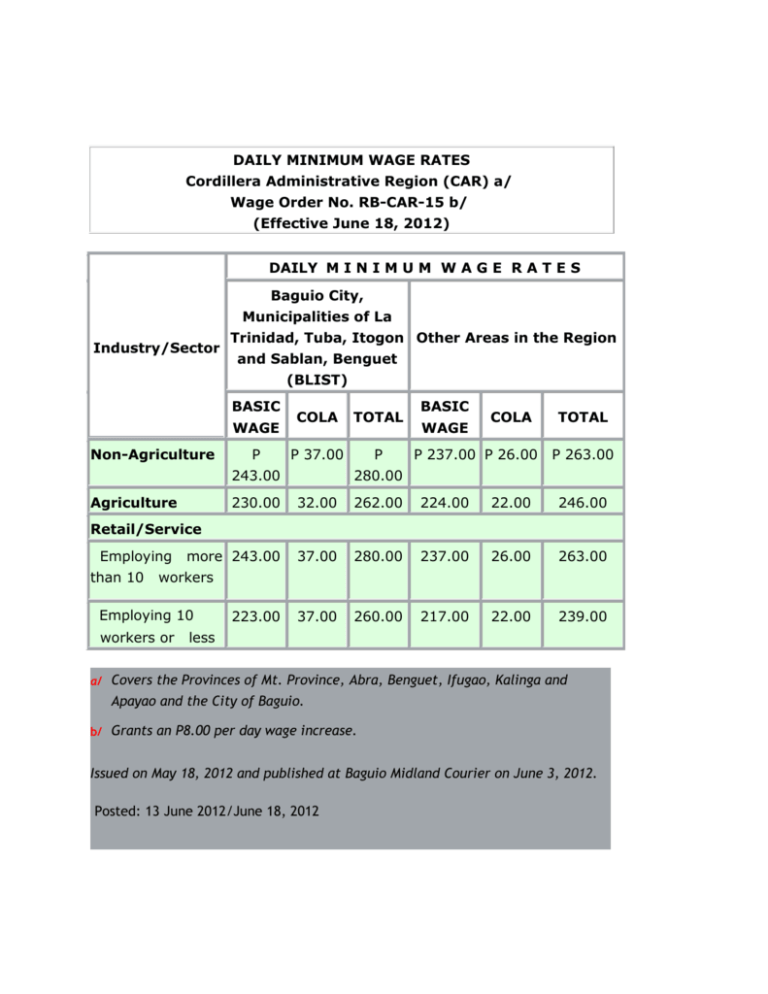

DAILY MINIMUM WAGE RATES Cordillera Administrative Region (CAR) a/ Wage Order No. RB-CAR-15 b/ (Effective June 18, 2012) DAILY M I N I M U M W A G E R A T E S Baguio City, Municipalities of La Industry/Sector Trinidad, Tuba, Itogon Other Areas in the Region and Sablan, Benguet (BLIST) BASIC WAGE Non-Agriculture P COLA TOTAL P 37.00 P 243.00 Agriculture BASIC WAGE COLA P 237.00 P 26.00 TOTAL P 263.00 280.00 230.00 32.00 262.00 224.00 22.00 246.00 more 243.00 37.00 280.00 237.00 26.00 263.00 37.00 260.00 217.00 22.00 239.00 Retail/Service Employing than 10 workers Employing 10 workers or 223.00 less a/ Covers the Provinces of Mt. Province, Abra, Benguet, Ifugao, Kalinga and Apayao and the City of Baguio. b/ Grants an P8.00 per day wage increase. Issued on May 18, 2012 and published at Baguio Midland Courier on June 3, 2012. Posted: 13 June 2012/June 18, 2012 DAILY MINIMUM WAGE RATES National Capital Region (NCR) a/ Per Wage Order No. NCR-17 b/ Effective: 3 June 2012 Upon Effectivity: Sector/Industry Non-Agriculture Agriculture (Plantation and Non Plantation) Private Hospitals with bed capacity of 100 or less Retail/Service Establishments employing 15 workers or less Manufacturing Establishments regularly employing less than 10 worker Basic Wage After COLA Integration COLA New Minimum Wage Rates P 426.00 P 20.00 P 446.00 P 389.00 P 20.00 P 409.00 P 389.00 P20.00 P 409.00 P 389.00 P20.00 P 409.00 P 389.00 P 20.00 P 409.00 Effective 01 November 2012: Sector/Industry Non-Agriculture Agriculture (Plantation and Non Plantation) Private Hospitals with bed capacity of 100 or less Retail/Service Establishments employing 15 workers or less Manufacturing Establishments regularly employing less than 10 workers a/ Covers Basic Wage COLA New After COLA Effective Minimum COLA Effective 1 Wage Integration 3 June November Rates 2012 2012 P 426.00 P 20.00 P 10.00 P 456.00 P 389.00 P 20.00 P10.00 P 419.00 P 389.00 P20.00 P10.00 P 419.00 P 389.00 P20.00 P10.00 P 419.00 P 389.00 P 20.00 P 10.00 P 419.00 the Cities of Caloocan, Las Pinas, Makati, Malabon, Mandaluyong, Manila, Marikina, Muntinlupa, Paranaque, Pasay, Pasig, Quezon, San Juan, Taguig, and Valenzuela and Municipalities of Navotas and Pateros. b/ Grants the following to all minimum wage workers in the private sector in the region: a. Integration of P22.00 COLA under W.O. No. RB-NCR-16 into the basic wage. b. P30.00 COLA per day to be given into two (2) tranches: > P20.00/day upon effectivity of this Wage Order > P10.00/day effective November 1, 2012 W.O. issued 17 May 2012, published at Philippine Daily Inquirer on 19 May 2012. Basis. All employees required to work beyond eight hours in one workday is entitled to overtime pay. The basis of overtime pay is found in Article 87 of the Labor Code. Article 87. Overtime work. Work may be performed beyond eight hours a day provided that theemployee is paid for the overtime work an additional compensation equivalent to his regular wage plus at least twenty-five percent thereof. Work performed beyond eight hours on a holiday or rest day shall be paid an additional compensation equivalent to the rate for the first eight hours on a holiday or rest day plus at least 30 percent thereof. Terminology. Overtime Pay. Overtime pay is the additional compensation payable to employee for services or work rendered beyond the normal eight hours of work. It is computed by multiplying the overtime rate with the number of hours in excess of the regular eight hours of work. Overtime Work. Any work performed beyond the normal 8 hours of work in one workday is considered as overtime work. Workday. A workday is the consecutive 24-hour period which commences from the time the employee starts to work and ends at the same time the following day. To illustrate, if the employee regularly works from 8AM to 4PM, his regular workday is the 24-hour period from 8AM to 8AM of the following day. Workdays do not necessarily corresponds to calendar days. Overtime Pay Rates. Overtime pay rates depend upon the day the work is performed, whether it is ordinary working day, special day, holiday or rest day. For ordinary working day, an additional compensation equivalent to his regular hourly rate plus at least 25% thereof. For holiday, special day and rest day, an additional compensation equivalent to the rate for the first eight hours on a holiday or rest day plus at least 30% thereof. Computation of Overtime Pay Assuming that the mininum wage rate is P250, how much is the overtime rate per hour? On ordinary day On an ordinary day, the overtime rate per hour is determined as follows: First, compute the hourly rate of the employee: Regular hourly rate = Minumum wage rate ÷ 8 hours = P250 ÷ 8 hours = P31.25 per hour Now to determine overtime rate per hour: Overtime rate = Regular hourly rate + 25% of Regular hourly rate Overtime rate = P31.25 + (25% of P31.25) = P31.25 x 1.25 = P39.06 per hour On rest day and special day Compute the hour rate of the employee on a rest day or special day: Hourly rate = 130% of Regular hourly rate = P31.25 x 1.30 = P40.625 per hour (Note: The hourly rate on rest day and special day is 130% of the regular rate.) To determine overtime rate per hour: Overtime rate = Hourly rate on rest day + 30% Hourly rate on rest day = P40.625 + (30% of P40.625) = P40.625 x 1.30 = P52.81 per hour On rest day which falls on a special day Compute the hourly rate of the employee on a rest day which falls on a special day: Hourly rate = 150% of Regular hourly rate = P31.25 x 1.50 = P46.875 per hour To determine overtime rate per hour: Overtime rate = Hourly rate + 30% of Hourly rate = P46.875 + (30% of P46.875) = P46.875 x 1.30 = P60.94 per hour On a regular holiday Compute the hourly rate on regular holiday: Hourly rate = 200% of Regular hourly rate = P31.25 x 2 = P62.5 per hour To determine overtime rate per hour: Overtime rate = Hourly rate + 30% of Hourly rate = P62.50 + (30% of P62.50) = P62.50 x 1.30 = P81.25 per hour On a rest day which falls on a regular holiday Compute the hourly rate: Hourly rate = 260% of Regular hourly rate = P31.25 x 2.60 = P81.25 per hour To determine overtime rate per hour: Overtime rate = Hourly rate + 30% of Hourly rate = P81.25 + (30% of P81.25) = P81.25 x 1.30 = P105.625 per hour Computation of wages The Department of Labor and Employment (DOLE) has set out the following rules in computing overtime pay, pay for work done on holidays, premium on nightshift and 13th month pay: Computing Overtime: On Ordinary Days Plus 25% of the hourly rate multiplied by the number of hours. On a rest day, special day or regular holiday Plus 30% of the hourly rate on said days multiplied by the number of hours. Computing pay for work done on: A special day (130% x basic pay) A special day, which is also a scheduled rest day (150% x basic pay) A regular holiday (200% x basic pay) A regular holiday, which is also a scheduled rest day (260% x basic pay) Computing Night Shift Premium Where Night Shift is a Regular Work: On Ordinary day (110% x basic hourly rate) On a rest day, special day, regular holiday (110% of regular hourly rate for a rest day, special day, regular holiday) The Labor Code provides that every employee is entitled to a night shift differential or night shift pay of not less than ten percent (10%) of his regular wage for each hour of work performed between 10 p.m. and 6 a.m. night shift differential pay also known as Night Shift Pay to compensate them for the hazards and inconvenience of working at odd hours when the body is normally asleep. If overtime work or work in excess of eight (8) hours falls within the night shift period, premiums for overtime work should first be integrated into the regular hourly rate of the employee before computing night shift pay. Computing Overtime on Night Shift: On ordinary day (110% x overtime hourly rate) On rest day, special day or regular holiday (110% x overtime hourly rate for rest days, special days, regular holidays) Computing 13th Month Pay: Total basic salary earned for the year exclusive of allowances, overtime, holiday, and night shift differential pay divided by 12 months = 13th month pay. Sample computation of Overtime Pay per Hour Let us assume a regular daily wage rate of Php 404.00, what is the overtime rate per hour? On Ordinary days: First, let’s compute for the hourly wage rate as follows: Regular hourly rate = Daily wage rate / 8 hours = P404/8 = P50.5 per hour Then, let’s compute for the overtime rate per hour as follows: Overtime rate = hourly rate + 25% of hourly rate = P50.5 + (.25 x 50.5) =P50.5 + 12.65 =P63.125 per hour On a rest day and special day Computation of hourly wage rate: Hourly rate = 130% of Regular Hourly Rate = P50.5 x 1.3 = P65.65 per hour Computation of overtime rate: Overtime rate = Hourly rate + 30% of Hourly rate = P65.65 + (30% of P65.65) = P65.65 + P19.695 = P85.345 per hour On a rest day which falls on a special day Computation of hourly wage rate: Hourly rate = 150% of Regular hourly rate =P50.5 x 1.5 =P75.75 per hour Computation of overtime rate: Overtime rate = Hourly rate + 30% of Hourly rate = P75.75 + (30% of P75.75) = P75.75 + 22.725 = P98.475 On a regular holiday Computation of hourly wage rate: Hourly rate = 200% of Regular hourly rate =P50.5 x 2 =P101 per hour Computation of overtime rate: Overtime rate = Hourly rate + 30% of Hourly rate =P 101 + (30% of P101) =P101 + 30.3 =P131.3 per hour On a rest day which falls on regular holiday Computation of hourly wage rate: Hourly rate = 260% of Regular hourly rate =P50.5 x 2.6 =P131.3 per hour Computation of overtime rate: Overtime rate = Hourly rate + 30% of Hourly rate =P 131.3 + (30% of P131.3) =P131.3 + 39.39 =P170.69 per hour Here are the Basic Benefits for Employees covered by the Philippine Labor Code: 1. Social Security Systems (SSS) Contributions Republic Act No. 8282, otherwise known as the Social Security Act of 1997, refers to the social security system in the Philippines that is initiated, developed and promoted by its Government. The social security system is aimed at providing protection for the SSS member against socially recognized hazard conditions, such as sickness, disability, maternity, old age and death, or other such contingencies not stated but resulted in loss of income or results to a financial burden. The employee and his/her employer(s) are to contribute for the social security benefits of the said employee in accordance to a given schedule by the Philippine Social Security System. Monthly employee contribution depends on the employee's actual monthly salary. (See: Circular No. 33-P) 2. Contribution to National Health Insurance Program (NHIP) The employee and his/her employer(s) are to contribute for the medical insurance of the said employee in accordance to the Republic Act 7835 on Medicare Program which is administered by the Philippine Health Insurance Corporation (Philhealth). Monthly employee contribution depends on the employee's actual monthly salary. The contribution schedule is provided by Philhealth. (See: Philhealth Premium Contribution Schedule) 3. Contribution to Home Development and Mutual Fund (HDMF) The employer(s) is required to contribute per month not less than P100.00 to the employee's Home Development and Mutual Fund. In accordance to the periodic remittance schedule provided by HDMF, the employer(s) will remit this contribution, in addition to that of the employee's, which is to be deducted from his/her payroll. 4. The 13th Month Pay As mandated by the Presidential Decree No. 851, the employee shall receive a bonus salary equivalent to one (1) month, regardless of the nature of his/her employment, not later than December 24 of every year. 5. Service Incentive Leave Book III, Chapter III of the Labor Code of the Philippines covers the employee's benefit for Service Incentive Leaves. According to Article 95, an employee who has rendered at least one year of service is entitled to a yearly five days service incentive leave with pay. (See: Article 95, Conditions of Employment) 6. Meal and Rest Periods Under Article 83, the employee is provided a one-hour employee benefit for regular meals, when working on an eight (8 hour) stretch. Employees are also provided adequate rest periods in the morning and afternoon which shall be counted as hours worked. (See: Article 83, Conditions of Employment). All these provisions apply in addition to every new employee benefits furnished that are in excess of what is stipulated by the Philippine Labor Code. Other regular Philippine employees benefits furnished by the employer(s) but are outside of the mandated employee benefit includes, but not limited to: 1. 2. 3. 4. 5. Housing and housing plans Expense Account Company sponsored vehicle Paid Holiday and Vacation Educational assistance or plans to the employee and/or his direct dependents. 1. Minimum wage = P426 per day 2. 13th month pay (after 1 month of service) = 1/12 of the total basic salary earned by an employee within a calendar year 3. Overtime pay= 25% premium on hourly rate 4. Night shift differential if work between 10:00 PM to 6:00 AM = 10% premium on hourly rate 5. Special Non-Working day = 30% premium if worked 6. Regular holiday pay= 100% premium if worked, paid if unworked 7. Service Incentive Leave = 5 days after 1 year of service 8. Maternity Leave = daily maternity benefit equivalent to one hundred percent (100%) of her average salary credit for sixty (60) days or seventy-eight (78) days 9. Paternity leave = 7 days leave with pay (married only) 10. Parental leave for solo parents= 7 days leave with pay 11. Social Security System contribution (based on salary) 12. Pag-ibig contribution (based on salary) 13. Philhealth contribution (based on salary) Premium Pay Premium Pay refers to the additional compensation required by law for work performed within eight (8) hours on non-working days, such as rest days and special days. Special Days (e.g. Special (Non-Working) Holiday) Special Days During special days, the principle of "no work, no pay" applies and on such other special days as may be proclaimed by the President or by the Congress. Workers who were not required or permitted to work on those days are not by law entitled to any compensation. This, however, is without prejudice to any voluntary practice or provision in the Collective Bargaining Agreement (CBA) providing for payment of wages and other benefits for days declared as special days even if unworked. Under Executive Order No. 292 as amended by Republic Act No. 9849 unless otherwise modified by law,order or proclamation, the following are the special days in a year under that shall be observed in the country: Ninoy Aquino Day All Saints Day Last Day of the year Monday Nearest Aug. 21 November 1 December 31 Holiday Pay Holiday Pay refers to the payment of the regular daily wage for any unworked regular holiday. Regular Holidays Every employee covered by the holiday pay rule is entitled to his daily wage for any unworked regular holiday. This means that the employee is entitled to at least 100% of his wage even if he did not report for work, provided he is present or is on leave of absence with pay on the work day immediately preceding the holiday. Under Executive Order No. 292, as amended by RA 9849: unless otherwise modified by law, order or proclamation, the following are the regular holidays in a year: New Year's Day January 1 Maundy Thursday Good Friday Araw ng Kagitingan Labor Day Independence Day National Heroes Day Eid ul Fi'tr Eid ul Adha Bonifacio Day Christmas Day Rizal Day Movable date Movable date Monday nearest April 9 Monday nearest May 1 Monday nearest June 12 last Monday of August Movable date Movable date Monday nearest November 30 December 25 Monday nearest December 30 Overtime Pay Overtime Pay refers to the additional compensation for work performed beyond eight (8) hours a day. Night Shift Differential Night Shift Differential refers to the additional compensation of ten percent (10%) of an employee's regular wage for each hour of work performed between 10:00PM and 6:00AM. 13th Month Pay All employers are required to pay their rank and file employees regardless of the nature of their employment and irrespective of the method by which their wages are paid provided they worked for at least one (1) month during a calendar year. 13th Month Pay should be given to the employees not later than December 24 of every year. Computation of Wages Computation of wages is governed by the following rules: Computing Overtime: On Ordinary Days Plus 25% of the hourly rate multiplied by the number of hours. On a rest day, special day or regular holiday Plus 30% of the hourly rate on said days multiplied by the number of hours. Computing pay for work done on: A special day (a total of 130% x basic pay) A special day, which is also a scheduled rest day (a total of 150% x basic pay) A regular holiday (a total of 200% x basic pay) A regular holiday, which is also a scheduled rest day (a total of 260% x basic pay) Computing Night Shift Premium Where Night Shift is a Regular Work: On Ordinary day (110% x basic hourly rate) On a rest day, special day, regular holiday (110% of regular hourly rate for a rest day, special day, regular holiday) Computing Overtime on Night Shift: On ordinary day (110% x overtime hourly rate) On rest day, special day or regular holiday (110% x overtime hourly rate for rest days, special days, regular holidays) Computing 13th Month Pay: Total basic salary earned for the year exclusive of allowances, overtime, holiday, premium and night shift differential pay divided by 12 months = 13th month pay. Service Charges Employees of employers collecting service charges are entitled to an equal share in the 85% of the total of such charges, except managerial employees. The remaining 15% of the charges may be retained by the management to answer for losses and breakages and for distribution to managerial employees, at the discretion of the management in the latter case. Service charges are collected by most hotels and some restaurants, night clubs, cocktail lounges, among others. Service Incentive Leave Every employee who has rendered at least one (1) year of service is entitled to a yearly service incentive leave of five (5) days with pay. This benefit does not apply to the following: * government employees * house helpers and persons in the personal service of another * managerial employees * field personnel and those whose time and performance is unsupervised by the employer * those already enjoying this benefit * those enjoying vacation leave with pay of at least five (5) days * those employed in establishments regularly employing less than ten (10) employees Meaning of "one year of service" The phrase "one year of service" of the employee means service within 12 months, whether continuous or broken, reckoned from the date the employee started working. The period includes authorized absences unworked weekly rest days, and paid regular holidays. Where by individual or collective agreement, practice or policy, the period of working days is less than 12 months, said period shall be considered as one year for the purpose of determining entitlement to the service incentive leave. Availment/Commutation to Cash The service incentive leave may be used for sick and vacation leave purposes. The unused service incentive leave is commutable to its monetary equivalent at the end of the year. In computing, the basis shall be the salary rate at the date of commutation. The availment and commutation of this benefit may be on a pro rata basis. Paternity Leave (RA 8187) Paternity Leave is granted to all married male employees in the private sector, regardless of employment status, (e. g. probationary, regular, contractual, project-based) the purpose of which is to allow the husband to lend support to his wife during her period of recovery and/or in the nursing of her newborn child. The paternity leave shall be for seven (7) calendar days, with full pay, consisting of basic salary and mandatory allowances fixed by the Regional Wage Board, if any, provided that his pay shall not be less than the mandated minimum wage. Availment of the paternity leave shall be after the delivery, without prejudice to an employer's policy of allowing the employee to avail of the benefit before or during the delivery, provided that the total number of days shall not be more than seven (7) days for each covered delivery. Maternity Leave (RA 8282) Every pregnant woman in the private sector, whether married or unmarried, is entitled to maternity leave of sixty (60) days in case of normal delivery, or miscarriage, or seventyeight (78) days in case of caesarian section delivery, with benefits equivalent to 100% of the average daily salary credit of the employee as defined under the Social Security Law. Parental Leave for Solo Parents (RA 8972) Parental leave for solo parents is granted to any solo parent or individual who is left alone with the responsibility of parenthood to enable him/her to perform parental duties and responsibilities where physical presence is required. The parental leave in addition to leave privileges under existing laws, shall be for seven (7) work days every year, with full pay, consisting of basic salary and mandatory allowances fixed by the Regional Wage Board, if any, provided that his/her pay shall not be less than the mandated minimum wage. Emergency and contingency leave provided under a company policy or a collective bargaining agreement shall not be credited as compliance with the parental leave. Leave for Victims of Violence Against Women and Their Children (VAWC) (RA 9762) VAWC leave is granted to private sector women employees who are victims as defined in the law. The leave benefit shall cover the days that the women employee has to attend to medical and legal concerns. In addition to other paid leaves under existing labor laws, company policy, and/or collective bargaining agreement, the qualified victim employee shall be entitled to a leave of up to ten (10) days with full pay, consisting of basic salary and mandatory allowances fixed by the Regional Wage Board, if any. Special Leave for Women (RA 9710) A women employee, who has rendered continuous aggregate eployment service of at least 6 months for the last 12 months, is entitled to a special leave benefit of 2 months with full pay based on her gross monthly compensation following surgery caused by gynecological disorders. Separation Pay Separation pay is given to employees in instances covered by Articles 283 and 284 of the Labor Code. An employee's entitlement to separation pay depends on the reason or ground for the termination of his services. An employee may be terminated for just cause (i.e. gross and habitual neglect of duty, fraud or commission of a crime) and other similar causes as enumerated under Article 282 of the Labor Code and generally, may not be entitled to separation pay. On the other hand, where the termination is for authorized causes, separation pay is due. Retirement Pay Retirment pay is given to employees if they have reached the age of sixty (60) years or more but not beyond sixty-five (65) years old and have served the establishment for at least five (5) years. This retirement benefit is separate and distinct from that granted by the Social Security System. Date Last Reviewed: 2009-12-21 12:00:18