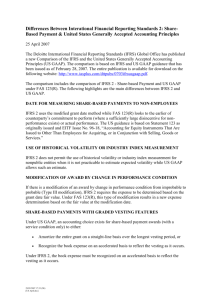

ACCT 409 SYLLABUS - University of South Carolina

advertisement

ACCT 730 SYLLABUS International Accounting Spring 2011 Instructor: Class Time: Office Hours: E-Mail: Telephone: Dana Garner, Ph.D., CPA Friday, 9:00-12:00 Tuesday & Thursday 1:30 – 3:30 (these are hours I will be in my office at CofC and would be a good time to call or email, I can also answer questions in person immediately following our class time) garnerd@cofc.edu 843-953-3990 Required Materials - Print or web-access to Mirza, Orrell, & Holt, IFRS: Practical Implementation Guide and Workbook, 2nd or 3rd edition (the 3rd edition is not scheduled for release until mid-Feb.) - Access to the ISAB standards. (you can register for a free version at www.iasb.org) Prerequisites Thorough understanding of US GAAP Course Description: The primary purpose of the course is to develop knowledge of International Financial Reporting Standards including the standards’ history, new standard adoption, the recording of financial transactions, and financial statement presentation. In addition, the US GAAP vs. IFRS convergence process will be discussed. Course Goals: Goal 1: Broadened Perspective Students will demonstrate an appreciation for the history of international accounting standards including the political and investor push for one world-wide set for quality accounting standards and the current US and international accounting standards convergence process. Goal 2: Development of Specific Skills Students will develop specialized skill set(s) that prepare them for careers in the accounting profession, including the ability to record and report financial information using the International Financial Reporting Standards. Goal 3: Professional Development Students will be required to obtain information from professional sources, including but not limited to professional standards and large firm international websites. Goal 4: Effective Communications Students will write professional documents that are technically correct and concise and will make effective presentations that are engaging and persuasive. Students will also communicate their ideas informally through extensive and meaningful participation in seminar-style class discussions throughout the term. Honor Code / Cheating It is the responsibility of every student at the University of South Carolina Columbia to adhere steadfastly to truthfulness and to avoid dishonesty, fraud, or deceit of any type in connection with any academic program. Any student who violates this Honor Code or who knowingly assists another to violate this Honor Code shall be subject to discipline. Students should be aware that unauthorized collaboration--working together without permission-- is a form of cheating. Unless the instructor specifies that students can work together on an assignment, quiz and/or test, no collaboration during the completion of the assignment is permitted. Other forms of cheating include possessing or using an unauthorized study aid (which could include accessing information stored on a cell phone), copying from others’ exams, fabricating data, and giving unauthorized assistance. As a faculty member and a Certified Public Accountant, I feel it is my job to assist you in becoming a productive member of the business world. The primary way corporations have reported false financial information is through lying and cheating on the part of management and auditors. You will not be a productive member of the business world if you decide that you will “get ahead” through lying and cheating and I therefore will not allow you to practice these behaviors in my class. I feel very strongly about this policy and will turn in all suspected lying, cheating, attempted cheating, and plagiarism to the appropriate college officials. In short, I feel very passionate about this subject and I expect you to as well. The Honor Code will be strictly enforced in this course. All assignments submitted to the instructor shall be considered graded work unless otherwise noted. Assessment of Your Progress in this Course (i.e. grading) Grading Scale A B+ B C+ 90.0%+ 87.0 - 89.9% 80.0 - 86.9% 77.0 - 79.9% C D+ D F 70.0 - 76.9% 67.0 – 69.9% 60.0 – 66.9% Below 60.0% Point Distribution Class Participation IFRS vs. US GAAP comparison Exam 1 Exam 2 Total Points Points 30 70 100 100 300 Note: I do not automatically roundup grades. Graded Assessments Class Participation You are expected to be an active participant in this course. This means that you must attend class, ask thoughtful and well-informed questions, and add to classroom discussions. In order to be well informed you must read assigned material before you come to class. Reading assignments will be made at least a week in advance and will be announced in class and/or posted on Blackboard. To encourage you to participate 10% of your grade will be related to participation. You can earn up to 3 participation points a class period. Here is how you will earn these points: 0 – The student is absent 1 – The student attends class and says nothing relevant to the discussions 2-3 – The student participates in class (the difference between 2 and 3 is the level of participation) Students will have 3 points subtracted from their participation point total for EACH time a cell phone (or other electronic device) disrupts class. This includes texting and all noises or vibrations the phone can make. If you have a serious situation that requires a cell phone to be on during class time (for example a family member is in surgery), please talk to me BEFORE class and we will determine the best course of action for the class period. Here how participation grades will be calculated: EarnedParticipationG rade CellPhoneDeduction x30 PossiblePa rticipationPo int s 3 Should you miss a class, it is your responsibility to get any missed assignments or class material from a classmate. I will not re-teach a lecture regardless of how wonderful you think your excuse is to miss a class. IFRS vs. US GAAP comparison After the first exam you will apply what we learn in class through 7 weekly responses worth 10 points each. Responses are expected to be TYPED, understandable, and written in proper grammar (something you would be willing to give your employer). You will pick a company reporting under IFRS and compare that company to one reporting under US GAAP (You may NOT pick DHL vs. UPS as we will be looking at these financial statements in class). For each area covered in the class immediately preceding the due date you will be expected to answer the following questions: What are the IFRS accounting requirements for the accounts associated with the areas we have covered (including references to the specific standard)? [if appropriate include the demonstration journal entries] o If appropriate, what are the reporting options available under IFRS? o Under IFRS Can you change which option you choose at a later date? Are the accounts on the companies’ financial statements comparable? (i.e. do they follow the same accounting policies?) o If the accounting policies are different is it a result of a difference between IFRS and US GAAP or differing accounting choices? Please, explain. o If the accounting policies are different is there a way to compare the financial balances on the financial statements? If not, based on the accounting policies do you have an educated hypothesis as to which account (IFRS company vs. US GAAP company) is likely to have a higher balance and why (or describe why they should be about the same). Inspect all footnotes for both companies related to the areas covered. What are the differences between the two companies? In your opinion is this a result of different accounting standards or something else? (i.e. one may have more capital leases than another vs. the standards actually requiring more disclosures.) Is this area part of the Memo of Understanding? If so, has it already been addressed? Are there any IFRS or US GAAP exposure drafts that address this area? Assignments are due at the beginning of class on the assigned day. A 5-point reduction will be applied to every 24-hour period late (including weekends). This means the high grade you can earn is a 5 if you turn in your assignment at 9:15 instead of 9:00 and a zero if you turn in the homework more than 24 hours late. In extreme situations you may email the assignment to me. The assignments are to be done by each individual (NO INTERACTION WITH ANY OTHER STUDENTS). If you have a question (even about mundane things like formatting) please come to me and do not talk to anyone else. Copying others’ work or assisting others is considered a violation of academic integrity and will result in zero points for all students involved. Exams I will administer 2 100 point exams. The exams may consist of multiple choice, short answer, and essay questions. The exam is to be done by each individual (NO INTERACTION WITH ANY OTHER STUDENTS). Copying others’ work or assisting others is considered a violation of academic integrity and will result in zero points for all students involved. I will also pursue the most severe consequences allowable by the University of South Carolina. You will sit at least 1 seat apart from all students during each exam. Makeup exam will be arranged for the following reasons provided that I am made aware of the reason for said absence BEFORE the exam: - Absences due to athletic participation or other extracurricular activities in which students are official representatives of the College (appropriate documentation is required to support your - claim). Absences due to illness requiring emergency medical attention for student or death in a student’s immediate family (appropriate documentation from the student affairs office is required to support your claim). Please see the footnote associated with the in-class quizzes to determine how to retain documentation from the student affairs office. Other policies Grade Appeals/Corrections If an error was made in grading an assignment or exam, or an error was made in posting a grade, you must notify me in writing within one week following the date that the assignment/exam is handed back and/or reviewed in class. After that time, all grades become final. Incompletes Incomplete grades will be given only in the event of extraordinary circumstances. This grade designation will not serve as a substitute for a "F" course grade. Course Communication Instructor announcements, such as date or homework assignment changes, may be made in class, through email, and / or on Blackboard. You may contact me through email, phone, or in person. I will typically respond to an email or phone call within 24 hours except for communication sent on Friday afternoon through Sunday night as I usually DO NOT check email on weekends, nor do I check voicemail during this time. Getting Help If there is something you do not understand, you are encouraged to seek help from me. Before seeking help from me, however, you should read the relevant text material, and independently develop specific questions. I will not repeat lectures of classes that have been missed, but I will answer specific questions that you may have related to homework or class discussions for which you were present. Classroom Modifications and Accommodations If there is a student in this class who has a documented disability and has been approved to receive accommodations, please feel free to discuss this modification with me. Estimated Due Dates (subject to change) 2/11 – Exam 1 2/25 – IFRS vs. US GAAP comparison 3/04 – IFRS vs. US GAAP comparison 3/18 – IFRS vs. US GAAP comparison 3/25 – IFRS vs. US GAAP comparison 4/01 – IFRS vs. US GAAP comparison 4/08 – IFRS vs. US GAAP comparison 4/15 – IFRS vs. US GAAP comparison 4/22 – Exam 2 Course Topics Introduction & FS presentation (~4 weeks) IFRS (~10 weeks) - History of the IASB - Inventories o IASC - Accounting Policies, Changes in Accounting o Use around the world Estimates and Errors o Previous required reconciliation - Events After the Balance Sheet Date - IASB standard making process - Construction Contracts - IASB Framework - Income Taxes - Convergence Process - Segment Reporting o Norwalk Agreement - Property, Plant, and Equipment o 2006 Memorandum of Understanding - Leases o 2008 Memorandum of Understanding - Revenue o SEC’s role - Employee Benefits o US Congress’ role - Borrowing Costs - Publically Available Resources - Related-Party Disclosures - Financial Statement Presentation - Accounting and Reporting by Retirement o Balance Sheet Benefit Plans o Income Statement - Investments in Associates o Statement of Changes in Equity - Financial Reporting in Hyperinflationary o Cash Flow Statement Economies o Comprehensive Income - Financial Instruments: Presentation o Disclosures - Financial Instruments: Recognition and Measurement - Earnings Per Share - Impairment of Assets - Provisions, Contingent Liability, and Contingent Assets - Intangible Assets - Investment Property - First-time Adoption of International Financial Reporting Standards - Share-Based Payments - Noncurrent Assets Held for Sale and Discontinued Operations