Information sheet: Health statutory agencies

advertisement

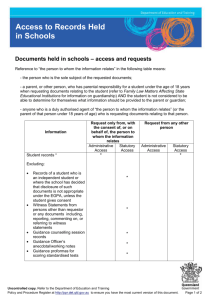

Information sheet Health statutory agencies – key compliance requirements This document has been prepared to accompany the ‘Health statutory agencies – compliance activity calendar’. Legal and administrative framework for statutory agency operation Each Health portfolio statutory agency is governed by its own enabling legislation, as well as other legislative requirements that are common to Queensland government bodies. Requirements vary depending on the organisational form of the agency (i.e. statutory body, statutory authority, committee/advisory council). A table summarising the organisational form of health statutory agencies is provided at Attachment 2. This information sheet helps to identify the legal and administrative framework within which health statutory agencies operate (see diagram below), describing key requirements that statutory agencies must comply with. It also includes links to useful documents to assist health statutory agencies to identify and meet their legislated and broader compliance requirements. The table at Attachment 1 identifies key legislative and other requirements that statutory agencies must comply with and may assist agencies in the development of a compliance register. It is not a comprehensive list of obligations and is therefore illustrative only. It should not be relied on as a source document in its own right – original documentation should be consulted. A separate document has been prepared for Hospital and Health Services (HHS) and HHS should contact the Office of Health Statutory Agencies (OHSA) via email statutoryagencies@health.qld.gov.au to obtain a current copy. Attachments Attachment 1—Health statutory agencies’ key compliance requirements template Attachment 2—Types of government bodies Contact for further information Contact Telephone Office of Health Statutory Agencies 3234 1705 Email statutoryagencies@health.qld.gov.au Revision history Date Version no. Description of change/revision 19/08/2013 v.1.0 Endorsed first version 15/04/2014 v.2.0 General updates to reflect changes to content and insertion of revised web links to legislation (as highlighted) Information sheet: health statutory agencies - key compliance requirements -2- Attachment 1 – Health statutory agencies’ key compliance requirements template Mandatory requirements Reference Date/Timeframe Accountability1 Supporting documents Enabling legislation – [insert name of Act e.g. Health Quality and Complaints Commission Act 2006] [insert details of the requirement] [insert relevant section of the Act] e.g. Include in the commission’s annual report: s172 HQCC information required by the Minister; and details Act of any direction given to the commission by the Minister, etc. [insert details of how often the activity must be done e.g. Annually /Quarterly/March] [insert details of who is accountable for compliance with the requirement] [insert link to enabling legislation and any relevant documents] Annually (included in Annual Report) Chief Executive Officer Health Quality and Complaints Commission Act 2006 (HQCC Act): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/H/HealthQCCA06.pdf ) Annually – published by 1 July Statutory body [insert e.g. link to a direction/document] Planning Strategic Plan developed compliant with the Department of the Premier and Cabinet (DPC) ‘Agency Planning Requirements’. s9 FPMS (statutory bodies that are published in the Service Delivery Statements i.e. QIMR, HCQQ must consult with both DPC and Treasury on their draft strategic plan – a consultation draft must be submitted to DPC by 31 March) Financial and Performance Management Standard 2009 (FPMS): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/F/FinAccPManSt09.pdf) Note: The Financial Accountability Act 2009 and this Standard establish the high level financial management and accountability obligations for all statutory bodies. Agency Planning Requirements – for the 2014 planning period: (http://www.premiers.qld.gov.au/publications/categories/plans/planningrequirements.aspx) Strategic Plans – Minimum Requirements Checklist (OHSA fact sheet): (http://www.health.qld.gov.au/ohsa/docs/sp-reqsv2.pdf) Hospital Foundation Strategic Plan Template: (http://www.health.qld.gov.au/ohsa/docs/hf-strategic-plan-template.doc) Strategic Planning for Government Bodies Webcast 2013 (OHSA): (http://www.health.qld.gov.au/ohsa/html/sp-webcast.asp) Please note, strategic plans may also have to take into account the final version of the Government's Queensland Plan (http://queenslandplan.qld.gov.au/), should this be available prior to 1 July 2014. At this stage, OHSA does not have any firm advice in relation to this matter but will provide additional advice and guidance should this be required. Operational Plan developed compliant with DPC’s Agency Planning Requirements. s9 FPMS Annually (monitored regularly; evaluated / Statutory body Agency Planning Requirements – for the 2014 planning period: (http://www.premiers.qld.gov.au/publications/categories/plans/planningrequirements.aspx) 1 This column identifies which statutory agency/ies the requirement relates to. When creating your own document this column could be used to identify the officer / staff member accountable for compliance with this requirement, e.g. Chief Executive Officer / Chief Finance Officer / all staff. Information sheet: health statutory agencies – key compliance requirements -3- Mandatory requirements Reference Date/Timeframe Accountability1 Supporting documents Operational Plan – Minimum Requirements Checklist (OHSA fact sheet): (http://www.health.qld.gov.au/ohsa/docs/op-plan-reqsv2.pdf) reviewed at least six monthly) Annual financial statements prepared, certified ss61-62 FAA, Annually (included Statutory body and tabled in Parliament in accordance with the s43, s45 in annual report) prescribed requirements (i.e. have regard to the FPMS Financial Reporting Requirements; submitted to the Auditor-General on the date agreed to allow the financial statements to be certified by not later than 2 months from the end of the financial year). Consider the Auditor-General’s report on audited financial statements, and any matters arising from the Auditor-General’s report. s46 FPMS Annually Statutory body Annual report prepared and given to the Minister for tabling. For a statutory body, the report must be compliant with the FPMS and DPC’s Annual Report Requirements. For other agencies, annual reports must be prepared in accordance with their enabling legislation. s61, s63 FAA, ss49-53 FPMS, enabling Act Annually Statutory body (statutory body – Statutory authority tabled in Parliament RAC by 30 September; other – as specified in enabling Act) Financial Accountability Act 2009 (FAA): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/F/FinAccountA09.pdf) Queensland Treasury Financial Reporting Requirements (FRRs) for Queensland Government Agencies (including Accounting Policy Guidelines): (http://www.treasury.qld.gov.au/office/knowledge/docs/fin-reporting-req/index.shtml) Annual Report Requirements for Queensland Government agencies: (http://www.premiers.qld.gov.au/publications/categories/guides/annual-reportguidelines.aspx) Annual Reports – Online Publication Compliance Checklist (OHSA fact sheet): (http://www.health.qld.gov.au/ohsa/docs/annualreport-publicationchecklist-v2.pdf) Financial Management Establish the following for efficiently, effectively and economically managing the financial resources of the statutory body – (a) a revenue management system; (b) an expense management system; (c) an asset management system; (d) a cash management system; (e) a liability management system; (f) a contingency management system; (g) a financial information management system; (h) a risk management system. s15 FPMS Statutory body In establishing the systems, the statutory body must have regard to the Financial Accountability Handbook. Financial Performance Management Standard 2009: (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/F/FinAccPManSt09.pdf ) Financial Accountability Handbook: (http://www.treasury.qld.gov.au/office/knowledge/docs/financial-accountabilityhandbook/) Queensland Treasury Financial Reporting Requirements (FRRs) for Queensland Government Agencies (including Accounting Policy Guidelines): (http://www.treasury.qld.gov.au/office/knowledge/docs/fin-reporting-req/index.shtml) Queensland Treasury – A Guide to Risk Management: (http://www.treasury.qld.gov.au/office/knowledge/docs/risk-management-guide/guide-torisk-management.pdf) Department of Health Risk Management Policy and Standards Policy: http://www.health.qld.gov.au/qhpolicy/docs/pol/qh-pol-070.pdf Standard: http://www.health.qld.gov.au/qhpolicy/docs/imp/qh-imp-070-1.pdf Information for Statutory Bodies (these new documents replace the Statutory Body Guide, two of which are designed to assist members of statutory bodies meet their statutory obligations (http://www.treasury.qld.gov.au/office/knowledge/docs/informationfor-statutory-bodies/index.shtml) Financial and Performance Management Standard 2009 Requirements (OHSA Fact Sheet): (http://www.health.qld.gov.au/ohsa/docs/fpms-requirements-v2.pdf) Information sheet: health statutory agencies – key compliance requirements -4- Mandatory requirements Reference Date/Timeframe Accountability1 Regularly review systems for managing resources to ensure the systems remain appropriate for managing the financial resources of the statutory body. s15 FPMS Regularly Statutory body Prepare and maintain a Financial Management Practice Manual (FMPM) that complies with related legislation, regulation and policies for use by staff in the performance of their financial management roles. s16 FPMS Maintain Statutory body Supporting documents FMPM Guidance Template for Hospital Foundations: (http://www.health.qld.gov.au/ohsa/html/hf-fmpm-guide.asp) Note: The FMPM is the internal instructional manual for the body to ensure compliance with the mandated requirements and is the initial point of reference for employees in relation to the body’s financial policy. Each person involved in the financial management of a statutory body is required to comply with the FMPM. The accounting practices presented in an FMPM must comply with the latest accounting standards and interpretations issued by the Australian Accounting Standards Board (AASB): (http://www.aasb.gov.au/Pronouncements/Current-standards.aspx) Developed to assist Hospital Foundations in the development of their own FMPM, the Guidance Template is modelled on the financial management methods of a range of public sector entities. The template provides questions, prompts and directions to guide the development of a financially sound and robust FMPM. Requirements in relation to establishing a revenue management and user charging system to ensure all revenue is promptly managed and customers are charged an appropriate amount for goods and services provided by the statutory body. s17, s18 FPMS Expenses managed with an expense management system which provides for promptly identifying, approving, managing and recording expenses and the timely paying of expenses. s19 FPMS Statutory body Financial Accountability Handbook: (http://www.treasury.qld.gov.au/office/knowledge/docs/financial-accountabilityhandbook/index.shtml) The handbook has been designed to assist accountable officers and statutory bodies discharge their obligations under the FAA, the FPMS, and the Financial Accountability Regulation 2009. Statutory body Queensland Procurement Policy (QPP) July 2013: (http://www.hpw.qld.gov.au/supplydisposal/governmentprocurement/ProcurementPolicy Guidance/StateProcurementPolicy/Pages/Default.aspx) Note: The State Procurement Policy has been superseded by the QPP, which provides the framework for all Queensland Government procurement. All statutory bodies are required to comply with the QPP and Queensland’s trade agreement obligations. Refer to the ‘Whole of Government Policy’ section on page 15. To the extent they apply to a statutory body, the statutory body must comply with the following documents in developing the expense management system, including: the ‘State Procurement Policy’, the ‘Queensland Ministerial Handbook’ and ‘General Guidelines for Personal Expenses and the Use of Credit Cards by Public Service Employees’ issued by the Office of the Public Service Commissioner. Procurement/Purchasing Requirements (OHSA fact sheet): (http://www.health.qld.gov.au/ohsa/docs/procurement-info-sheet-v2.pdf) Queensland Ministerial Handbook: (http://www.premiers.qld.gov.au/publications/categories/policies-andcodes/handbooks/ministerial-handbook.aspx) The statutory body’s expense management s20 FPMS system keeps a record of special payments over $5,000. Statutory body Keep written records and notifications where applicable to loss of the statutory body’s Statutory body ss21-22 FPMS Information sheet: health statutory agencies – key compliance requirements -5- Mandatory requirements Reference Date/Timeframe Accountability1 Supporting documents Statutory body Queensland Treasury Statutory Body Guide - Guide Sheet 4: Evaluating and reviewing significant physical assets: (https://www.yumpu.com/en/document/view/16291438/guide-sheet-4-evaluating-andreviewing-significant-physical-assets) property as a result of an offence or misconduct or other reason as specified in sections 21 & 22 of the FPMS. Assets managed in accordance with an asset s23 FPMS management system that ensures evaluations (similar to business cases) are prepared before acquiring, maintaining or improving a significant physical asset, with a completion review undertaken to ensure that objectives contained in the evaluations were met. Non-Current Asset Policies for the Queensland Public Sector (NCAPS): (http://www.treasury.qld.gov.au/office/knowledge/docs/non-current-assetpolicies/index.shtml) An asset management system must ensure that assets are regularly maintained and must comply with or have regard to: Non-current Asset Policies for the Queensland Public Sector Property Tenure Government Land Policy Queensland’s Project Assurance Framework Queensland’s Value for Money Framework. Manage the body’s cash in accordance with a cash management system which provides for control and recording of cash transactions. Transaction Policy: (http://www.dsdip.qld.gov.au/resources/glam-transaction-policy.pdf) Queensland’s Project Assurance Framework: (http://www.treasury.qld.gov.au/office/knowledge/docs/project-assurance-frameworkguidelines/index.shtml) Queensland’s Value for Money Framework: (http://www.treasury.qld.gov.au/projectsqueensland/policy-framework/public-private-partnerships/) s24 FPMS Statutory body Financial Accountability Handbook: (http://www.treasury.qld.gov.au/office/knowledge/docs/financial-accountabilityhandbook/index.shtml) Manage liabilities in accordance with a liability s25 FPMS management system, which promptly and accurately records liabilities, e.g. for operational costs and capital expenditure, and complies with ‘Leasing in the Queensland Public Sector – Policy Guidelines’. Statutory body Leasing in Queensland Public Sector Policy Guidelines: (http://www.treasury.qld.gov.au/office/knowledge/docs/leasing-in-qld/index.shtml) Note: These are mandatory guidelines that apply to the lease of all assets, but exclude tenancy leases of real property and leases of passenger or commercial motor vehicles obtained from Q-Fleet by a tied client. Manage contingent assets and contingent s26 FPMS liabilities in accordance with a contingency management system, which promptly identifies, records and reports on contingencies. Statutory body Note: A contingent asset or liability crystallises as the result of a future event that is outside the control of the agency. Comply with the mandatory principles stated in s27 FPMS the Information Standards and ensure that its financial information management system aligns with the targets stated in the QGEA and complies with the Public Records Act 2002. Statutory body Financial Accountability Handbook: (http://www.treasury.qld.gov.au/office/knowledge/docs/financial-accountabilityhandbook/index.shtml) Information sheet: health statutory agencies – key compliance requirements Current Information Standards (refer also pages 16-17): (http://www.qgcio.qld.gov.au/products/qgea-documents) Queensland Government Enterprise Architecture (QGEA) 2.0 (refer also pages 16-17 below): (http://www.qgcio.qld.gov.au/products/about-the-qgea) -6- Mandatory requirements Reference Date/Timeframe Accountability1 Supporting documents Public Records Act 2002: (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/P/PublicRecA02.pdf) Provides for the management of public records in Queensland. Manage strategic and operational risks in accordance with a risk management system. s28 FPMS Establish an internal audit function if directed by ss29-30 the Minister or if the body considers it FPMS appropriate. Systems for ensuring the internal audit function operates efficiently, effectively and economically must be developed and implemented. The internal audit function must function under an internal audit charter. Statutory body Queensland Treasury Audit Committee Guidelines – Improving Accountability and Performance: (http://www.treasury.qld.gov.au/office/knowledge/docs/improvingperformance/) Statutory body Financial Accountability Handbook - Volume 2: Governance (2.6 Head of internal audit; 2.9 Internal audit): (http://www.treasury.qld.gov.au/office/knowledge/docs/financial-accountabilityhandbook/volume-2-governance.shtml) The internal audit function prepares a strategic s31 FPMS audit plan that provides an overall strategy for the internal audit function for a period of at least 1 year. The plan must be approved by the statutory body. The head of internal audit must consult with an authorised auditor during preparation of audit plans. Annually Statutory body (with an internal audit function) The internal audit function prepares an audit plan for each year that sets out the audits intended to be carried out by the internal audit function during the year. The plan must be approved by the statutory body. The head of internal audit must consult with an authorised auditor during preparation of audit plans. s31 FPMS Annually Statutory body (with an internal audit function) The internal audit function gives final audit reports to the statutory body (to the audit committee if one is established). The statutory body must consider the contents of all reports and take the actions considered necessary. ss32-33 FPMS As required Statutory body A statutory body may establish an Audit s35 FPMS Committee. If they do, they must have regard to the Queensland Treasury document ‘Audit committee guidelines – improving accountability Statutory body Information sheet: health statutory agencies – key compliance requirements Queensland Treasury Audit Committee Guidelines – Improving Accountability and Performance: (http://www.treasury.qld.gov.au/office/knowledge/docs/improvingperformance/index.shtml) -7- Accountability1 Supporting documents Develop and implement a contract performance ss36-41 guarantee system. Sections 36-41 of the FPMS FPMS detail the obligations and responsibilities attaching to contract performance guarantees. Statutory body Note: Contract performance guarantees are securities provided by a contractor, or on a contractor’s behalf, to ensure a contractor completes all obligations under a contract negotiated between an agency and a contractor. Statutory bodies are to comply with Part 5 of the SBFAA. Statutory bodies must be stated in a regulation to have borrowing powers under the Act. Statutory body Statutory Bodies Financial Arrangements Act 1982 (SBFAA): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/S/StatutryBodA82.pdf) Mandatory requirements Reference Date/Timeframe and performance’, develop Terms of Reference, include members of the governing body, etc. Part 5 SBFAA, Schedule 2 SBFAR Statutory Bodies Financial Arrangements Regulation 2007 (SBFAR): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/S/StatutryBodR07.pdf) Note: The primary purpose of the Act and regulation is to establish the borrowing and investment powers of statutory bodies. Provisions also address the role of the Treasurer in providing guarantees – under the SBFAA, the Treasurer may guarantee the performance of obligations of a statutory body under a financial arrangement entered into by the body (sections 16 and 76). The Treasurer can charge a fee for this guarantee. The Treasurer can delegate functions under this Act to another Minister. Note: where a statutory body has not been assigned borrowing powers under the SBFAR, the Treasurer’s approval must be obtained to borrow an amount (refer Part 7A of the SBFAA). There are also requirements under the State Borrowing Program that statutory bodies must satisfy: (http://www.treasury.qld.gov.au/office/knowledg e/docs/overdraft/index.shtml). A statutory body may invest under this part depending on whether a regulation allocates a statutory body one of the three categories of investment powers. Where investments are not permitted under Part 6 of the Act, a statutory body may seek approval from the Treasurer under Part 7A of the Act. Requests are considered on a case-by-case basis. Hospital Foundations and the Council of the QIMR are included in Schedule 2 of the SBFAR as statutory bodies that may borrow under part 5 of the SBFAA. Part 6 SBFAA, Schedule 4 SPFAR Statutory body Queensland Treasury Investment Policy Guidelines for Statutory Bodies: (http://www.treasury.qld.gov.au/office/knowledge/docs/investment-policyguidelines/index.shtml) Note: The guidelines provide a general outline of the impact of the SBFAA on the operations of statutory bodies and aim to assist statutory bodies in understanding their obligations under the Act and provide information to assist in developing better-practice policy frameworks for the investment of funds. Hospital and Health Services are allocated category 2 investment power in Schedule 4 of the SBFAR. Health statutory bodies allocated category 3 investment power in Schedule 4 of the SBFAR are: Hospital Foundations and Council of the QIMR. s7 FPMS Statutory body FPMS: (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/F/FinAccPManSt09.pdf ) Governance A Governance Framework appropriate for the agency is established. Governance includes establishing a performance management system, a risk management system and an internal control system. Information sheet: health statutory agencies – key compliance requirements Governance Institute of Australia Website: (http://www.governanceinstitute.com.au/knowledge-resources/) Note: Provides a range of resources on best practice in board and organisational governance, and risk management. -8- Mandatory requirements Reference Date/Timeframe Accountability1 Supporting documents Cost-effective internal control structure established, including, for example, an organisation structure and delegations supportive of the objectives and operations of the body (the internal control structure must be included in the FMPM of the body). s8 FPMS Recommended – annual check and test2 Statutory body Financial Accountability Handbook: (http://www.treasury.qld.gov.au/office/knowledge/docs/financial-accountabilityhandbook/index.shtml) Financial Management Tools (provide guidance only, i.e. not mandatory): (http://www.treasury.qld.gov.au/office/knowledge/docs/financial-managementtools/index.shtml) Note: Queensland Treasury and Trade conducted a high-level review of the Financial Accountability Handbook and Financial Management Tools in October 2013. The majority of the changes to the Handbook are updates to related resources and minor wording changes. The most significant changes to the Tools is the addition of information designed to assist in evaluating and reviewing significant assets. A summary of changes is available on the websites. Information for Statutory Bodies – Overview of applicable legislation, policies and guidance documents: Appendix 1 (see page 9): (http://www.treasury.qld.gov.au/office/knowledge/docs/information-for-statutorybodies/statutory-bodies-information-overview.pdf) Compliance Checklists: (http://www.treasury.qld.gov.au/office/knowledge/docs/information-for-statutorybodies/statutory-bodies-information-overview.pdf) Australian Accounting Standards Board – Accounting Standards: (http://www.aasb.gov.au/Pronouncements/Current-standards.aspx) The performance of the body is managed compliant with the DPC document ‘A guide to the Queensland Government performance management framework’. s11 FPMS Statutory body Systems are in place for obtaining information to s12 FPMS enable the statutory body to decide whether it is: (a) achieving the objectives stated in its strategic plan efficiently, effectively and economically; and (b) delivering the services stated in its operational plan to the standard stated in the plan. Statutory Body A guide to the Queensland Government performance management framework : (http://www.premiers.qld.gov.au/publications/categories/guides/perf-manageframework.aspx) Queensland Audit Office – Better Practice Guides: Performance Reviews: (https://www.qao.qld.gov.au/files/file/publications/qao_bpg_performance_reviews.pdf) Performance Reporting to Boards: A Guide to Good Practice (Chartered Institute of Management Accountants): (http://www.cimaglobal.com/Documents/ImportedDocuments/perfrpttoboards_techguide s_2003.pdf) Thirteen Ways to Improve Your Monthly Board Reports (ExcelUser): (http://www.exceluser.com/tools/boardrpts.htm) Note: Under s77(2) ‘Chief finance officer’ of the FAA each departmental CFO must produce to the accountable officer, for each financial year, a statement about whether the financial internal controls are operating efficiently, effectively and economically. This statutory requirement does not apply to statutory bodies, however, bodies should have a process in place to check and test financial internal controls. 2 Information sheet: health statutory agencies – key compliance requirements -9- Accountability1 Mandatory requirements Reference Date/Timeframe Performance systems allow reporting about performance to be provided. s13 FPMS Report provided to Statutory body the statutory body at least every 3 months; and to the Minister annually or when requested Performance management system must allow s14 FPMS the body to assess: (a) the appropriateness of its objectives, and the services that it delivers to achieve its objectives (b) whether the performance information is suitable to assess the extent to which the objectives have been achieved (c) options to improve the efficiency, effectiveness and economy of the operations of the agency. Statutory body Part 7 of the AIA outlines the operation of Part 7, AIA conferral; performance; delegation of statutory functions and powers; making of appointments; acting appointments; etc. E.g. section 27A ‘Delegation of functions or powers’ outlines how delegation of functions and powers works. All agencies Supporting documents NHS Sample Board Papers: (http://www.rdehospital.nhs.uk/trust/board/boardpapers.html) Acts Interpretation Act 1954 (AIA): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/A/ActsInterpA54.pdf) Note: The AIA prescribes the meanings of common terms used in Acts where those Acts do not in themselves provide a definition, or where the definitions provided in the Acts require further clarification (i.e. the AIA only applies to the extent of any inconsistency), and provides courts with clear directions to resolve a range of potential inconsistencies. Public accountability The PIDA applies to the chief executive officer of a public sector entity, including obligations in regard to, for example, establishing procedures to deal with public interest disclosures (PIDs), keeping records of PIDs, and ensuring protections are in place for disclosers. Chapter 3, PIDA All agencies (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/P/PubIntDisA10.pdf) Note: The Queensland Ombudsman administers the PIDA. Under section 60, the Ombudsman has issued a Standard about the way in which agencies must deal with PIDs, including a requirement to provide information to the Ombudsman regarding PIDs received. The Standard is binding on all entities within the jurisdiction of the PIDA. Section 28 provides for the establishment of reasonable procedures by the chief executive of a public sector entity. Public Interest Disclosure Standard No. 1: (http://www.ombudsman.qld.gov.au/Portals/0/docs/Publications/WWTW/Public%20Inter est%20Disclosure%20Standard%20No%201_V1.pdf) Section 29 provides that the chief executive officer of a public sector entity must keep a proper record of disclosures. The Auditor-General of Queensland is required to audit each year the financial accounts of all statutory bodies (unless exempted) and to provide independent reports to the Queensland Parliament. The statutory body must grant the Public Interest Disclosure Act 2010 (PIDA): For further information (including PID facts and guides): (http://www.ombudsman.qld.gov.au/PublicationsandReports/PublicInterestDisclosures/P IDResources/tabid/443/Default.aspx). ss46-47 AGA As and when requested Auditor-General Act 2009 (AGA): Statutory body (unless exempted) (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/A/AttorneyGenA99.pdf) Note: Establishes the position of the Queensland Auditor-General and the Queensland Audit Office (QAO). The Act also confers on the Auditor-General and the QAO the functions and powers necessary to carry out independent audits of all Queensland Information sheet: health statutory agencies – key compliance requirements - 10 - Mandatory requirements Reference Date/Timeframe Accountability1 audit team access to all records, and stated information as and when requested by sections 46 & 47 of the AGA. In addition, each entity is responsible for liaising directly with the Audit Manager and providing solutions to the audit issues raised. The PSEA outlines the ethical obligations of employees within the Queensland Public Sector. The PSEA provides four (4) ethics principles for the public sector: (a) Integrity and impartiality (b) Promoting the public good (c) Commitment to the system of government and (d) Accountability and transparency. Supporting documents public sector agencies. Queensland Audit Office: (https://www.qao.qld.gov.au/home) Part 3, PSEA All agencies Queensland Government Ethics Website: (http://www.ethics.qld.gov.au/) Public Sector Ethics (OHSA fact sheet): (http://www.health.qld.gov.au/ohsa/docs/ethicssheet.pdf) The PSEA also incorporates a range of “ethical values” associated with each of the ethics principles. These principles and values form the basis of the codes of conduct required to be developed by each statutory body. The Code of Conduct for the Queensland Public ss11-12M(2) Service applies to all public service agencies. PSEA Employees of the agency must comply with the Code and any standard of practice in performing their official functions. Public Sector Ethics Act 1994 (PSEA): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/P/PublicSecEthA94.pdf) Declares the ethical principles that are fundamental to good public administration and covers requirements for codes of conduct for public officials. The PSEA ethics principles and values apply to all public service agencies and public sector entities, including statutory bodies and public officials. Annually (statement included in annual report) Prescribed public service agencies (HHSs, HQCC, MHRT) Code of Conduct for the Queensland Public Service: (http://www.psc.qld.gov.au/includes/assets/qps-code-conduct.pdf) Annually (statement included in annual report) Public sector entities (e.g. Hospital Foundations) Public Sector Ethics (OHSA fact sheet): (http://www.health.qld.gov.au/ohsa/docs/ethics-sheet.pdf) Public Sector Ethics (OHSA fact sheet): (http://www.health.qld.gov.au/ohsa/docs/ethics-sheet.pdf) The chief executive officer has certain responsibilities under the Act, including: must ensure employees have reasonable access to a copy of the Code and any standards of practice; must publish and keep available for inspection by any person copies of the Code and any standards of practice; must ensure employees are given access to appropriate education and training about public sector ethics; must ensure the administrative procedures and management practices of the agency have proper regard to the Act, the Code and any standards of practice; and must ensure the annual report includes a statement as per s12M. The chief executive officer of a public sector ss13-23 entity must ensure a code of conduct is PSEA prepared for the entity and approved by the Minister for Health. Employees of an entity must comply with the code of conduct in performing Information sheet: health statutory agencies – key compliance requirements - 11 - Mandatory requirements Reference Date/Timeframe Accountability1 Supporting documents s38 CMA As necessary All agencies Crime and Misconduct Act 2001 (CMA): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/C/CrimeandMisA01.pdf) their official functions. The chief executive officer also: must ensure employees have reasonable access to a copy of the Code and any standards of practice; must publish and keep available for inspection by any person copies of the ethics principles and the entity’s approved code of conduct; must ensure employees are given access to appropriate education and training about public sector ethics; must ensure the administrative procedures and management practices of the entity have proper regard to the Act and the entity’s code of conduct; and must ensure the annual report includes an implementation statement as per s23. If a public official (CEO of a unit of public administration) suspects that a complaint, information or matter involves, or may involve, official misconduct, they must notify the Crime and Misconduct Commission of the complaint. Crime and Misconduct Commission Queensland: (http://www.cmc.qld.gov.au/). The CEO of a unit of public administration has a s43-44 CMA responsibility to deal with a complaint about, or information or matter involving, official misconduct that is referred to it by the commission. As necessary All agencies (captured in the meaning of a unit of public administration) Section 44 of the CMA (see link above) outlines how complaints must be dealt with. Deal with applications for information as per Part 3 of the RTIA. As necessary All agencies Right to Information Act 2009 (RTIA): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/R/RightInfoA09.pdf) The Act gives the public a right of access to information held by government unless, on balance, providing access would be contrary to the public interest. Part 3, RTIA Further information is also available via (www.qld.gov.au/right-to-information/) Policy documents are made available for inspection and purchase by the public. s20 RTIA All agencies Note: An agency must make copies of each of its policy documents available for inspection and purchase by the public. However, nothing in this section prevents an agency from deleting exempt information or contrary to public interest information from a copy of a policy document. Publish a publication scheme, which is a scheme that sets out the classes of information that the agency makes available and how the information can be accessed, including any charges. This may include a de-identified disclosure log of documents that have been s21 RTIA All agencies Ministerial Guidelines and Links to Departmental Publication Schemes (http://www.rti.qld.gov.au/right-to-information-act/publication-schemes) Information sheet: health statutory agencies – key compliance requirements - 12 - Mandatory requirements Reference Date/Timeframe Accountability1 Supporting documents All agencies (except HHSs – National Privacy Principals (NPPs) apply to HHSs) Information Privacy Act 2009 (IPA): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/I/InfoPrivA09.pdf) Note: The Act provides for the fair collection and handling in the public sector environment of personal information, and gives the public a right to apply to access and amend their own personal information. released in response to Right to Information applications. Comply with the Information Privacy Principles in relation to the collection, storage, use and disclosure of an individual’s personal information. s27 IPA, Schedule 4 IPA Office of the Information Commissioner (Queensland): (http://www.oic.qld.gov.au/information-for/government) Recordkeeping – General, Digital, Cloud Computing (OHSA fact sheet): (http://www.health.qld.gov.au/ohsa/docs/recordk-sheet.pdf) A health statutory agency may only transfer an individual’s personal information to an entity outside of Australia in certain circumstances specified in section 33 of the IPA. s33, IPA All agencies Make and keep full and accurate records of its activities. s7 PRA All agencies (captured in meaning of public authorities) Public Records Act 2002 (PRA): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/P/PublicRecA02.pdf) Note: The PRA provides for the management of public records in Queensland. Recordkeeping – General, Digital, Cloud Computing (OHSA fact sheet): (http://www.health.qld.gov.au/ohsa/docs/recordk-sheet.pdf) Queensland State Archives: (http://www.archives.qld.gov.au/Pages/default.aspx) Retention and Disposal Schedules (e.g. Health Sector (Clinical Records), Health Quality and Complaints Commission): (http://www.archives.qld.gov.au/Recordkeeping/RetentionDisposal/Pages/RDSorg.aspx) General Retention and Disposal Schedule (GRDS) for Administrative Records: (http://www.archives.qld.gov.au/Recordkeeping/RetentionDisposal/Pages/GRDS.aspx) General legislative requirements An employer is legally liable for compensation for injury sustained by a worker employed by the employer if the injury is sustained by the worker in their employment. Worker’s Compensation and Rehabilitation Act 2003 (WCRA): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/W/WorkersCompA03.pdf ) An Act to establish a workers’ compensation scheme for Queensland, and for other purposes. s46 WCRA All agencies Every employer must, for each worker s48 WCRA employed by the employer, insure and remain insured for compensation and damages relating to injury sustained by the worker. All agencies If an employer meets criteria prescribed under the WCRR, they must appoint a Rehabilitation Agencies captured Worker’s Compensation and Rehabilitation Act 2003 (WCRA): in the WCRR (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/W/WorkersCompA03.pdf) An Ss226-227 Policy and WCRA, s99D, procedures Information sheet: health statutory agencies – key compliance requirements - 13 - Mandatory requirements Reference and Return to Work Coordinator and have 100 WCRR workplace rehabilitation policy and procedures. Note: employers meet the criteria of the WCRR if: (a) for an employer who employs workers at a workplace in a high risk industry, the wages of the employer for the proceeding financial year were more than $1.63M; or (b) the wages of the employer in Queensland for the preceding financial year were more than $4.9M. The Chief Executive, as an ‘officer’ as defined in s27 WHSA the WHSA will have certain work health and safety obligations under this Act, including due diligence, which is defined as taking reasonable steps: (a) to acquire and keep up-to-date knowledge of work health and safety matters; and (b) to gain an understanding of the nature of the operations of the business or undertaking of the person conducting the business or undertaking and generally of the hazards and risks associated with those operations; and (c) to ensure that the person conducting the business or undertaking has available for use, and uses, appropriate resources and processes to eliminate or minimise risks to health and safety from work carried out as part of the conduct of the business or undertaking; and (d) to ensure that the person conducting the business or undertaking has appropriate processes for receiving and considering information regarding incidents, hazards and risks and responding in a timely way to that information; and (e) to ensure that the person conducting the business or undertaking has, and implements, processes for complying with any duty or obligation of the person conducting the business or undertaking under this Act; and (f) to verify the provision and use of the resources and processes mentioned in paragraphs (c) to (e). Date/Timeframe Accountability1 reviewed at least criteria (HHSs, every 3 years and Council of the provide evidence QIMR, HQCC) of the review to QCOMP Supporting documents Act to establish a workers’ compensation scheme for Queensland, and for other purposes. Workers’ Compensation and Rehabilitation Regulation 2003 (WCRR): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/W/WorkersCompR03.pdf) Q-COMP (the Workers’ Compensation Regulatory Authority): (http://www.qcomp.com.au/) All agencies Information sheet: health statutory agencies – key compliance requirements Work Health and Safety Act 2011 (WHSA): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/W/WorkHSA11.pdf) Note: The WHS Act provides a framework to protect the health, safety and welfare of all workers at work and of all other people who might be affected by the work. Nationally uniform laws ensure all workers in Australia have the same standard of health and safety protection, regardless of the work they do or where they work. Work Health and Safety Regulation 2011 (WHSR): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/W/WorkHSR11.pdf) Work Health and Safety (Codes of Practice) Notice 2011: (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/W/WorkHSCPN11.pdf) Workplace Health and Safety Queensland (Department of Justice and AttorneyGeneral): (http://www.deir.qld.gov.au/workplace/index.htm) - 14 - Mandatory requirements Reference Date/Timeframe Accountability1 Supporting documents All agencies Fire and Rescue Service Act 1990 (FRSA): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/F/FireARescSeA90.pdf) Note: The Act establishes the Queensland Fire and Rescue Service and provides for the prevention of and response to fires and certain other incidents endangering persons, property or the environment and related purposes. s28 refers to duties of workers & s28 duties of other persons at the workplace. The occupier of a building is obliged to: maintain Part 9 means of escape from the building, prescribed Division 2 fire safety installations, and a fire and FRSA, BFSR evacuation plan; and provide instruction to persons in the building concerning the action to be taken by them in the event of a fire threatening the building; etc. Fire and Rescue Service Regulation 2011 (FRSR): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/F/FireRescueR11.pdf) The Building Fire Safety Regulation includes provisions relating to keeping evacuation routes free from obstacles; occupancy limits for buildings; meaning of specific terms (e.g. evacuation route, common area); etc. The obligation of an employer includes – s30, Division (a) ensuring that all electrical equipment used 3 ESA in the conduct of the person’s business or undertaking is electrically safe; and (b) if the person’s business or undertaking includes the performance of electrical work, ensuring the electrical safety of all persons and property likely to be affected by the electrical work; and (c) if the person’s business or undertaking includes the performance of work, whether or not electrical work, involving contact with, or being near to, exposed parts, ensuring persons performing the work are electrically safe. Building Fire Safety Regulation 2008 (BFSR): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/B/BuildgFireSR08.pdf) Queensland Fire and Rescue Service: (https://www.fire.qld.gov.au/default.asp) All agencies Electrical Safety Act 2002 (ESA): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/E/ElectricalSA02.pdf) (An Act about electrical safety, and for other purposes.) Electrical Safety Regulation 2013: (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/E/ElectricalSR13.pdf ) note: commenced on 1 January 2014 and replaces the 2002 Regulation. Electrical Safety (Codes of Practice) Notice 2013: (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/E/ElectricalSN13.pdf) Queensland Government Electrical Safety Office: (http://www.justice.qld.gov.au/fairand-safe-work/electrical-safety) Regulations, ministerial notices and codes of practice may prescribe the way to discharge a person’s electrical safety obligations. The BA requires that buildings be constructed in BA accordance with the Building Code of Australia and, where Queensland-specific provisions are necessary, the Queensland Development Code. The Act also contains specific compliance requirements, for example, in relation to fire safety for residential care buildings built, approved or applied for before 1 June 2007 (Chapter 7A), and swimming pool safety (Chapter 8). All agencies Information sheet: health statutory agencies – key compliance requirements Building Act 1975 (BA): (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/B/BuildA75.pdf) Note: The Building Act governs all building work in Queensland and empowers the regulation of certain aspects of buildings and structures. Building Regulation 2006: (https://www.legislation.qld.gov.au/LEGISLTN/CURRENT/B/BuildgR06.pdf) Queensland Development Code: (http://www.hpw.qld.gov.au/construction/BuildingPlumbing/Building/BuildingLawsCodes/ QueenslandDevelopmentCode/Pages/default.aspx) - 15 - Mandatory requirements Reference Date/Timeframe Accountability1 Supporting documents Australian Building Codes Board – About the national Construction Code: (http://www.abcb.gov.au/about-the-national-construction-code) Other Legislation Health statutory agencies may have additional responsibilities and obligations placed upon them by a number of pieces of other State legislation (https://www.legislation.qld.gov.au/OQPChome.htm) and Commonwealth legislation (http://www.comlaw.gov.au/), for example: Affirmative Action (Equal Employment Opportunity for Women) Act 1986 (Cth) Anti-Discrimination Act 1991 Commission for Children and Young People and Child Guardian Act 2000 Copyright Act 1968 (Cth) Coroners Act 2003 Criminal Code Act 1899 Disability Discrimination Act 1992 (Cth) Disability Services Act 1986 (Cth) Disaster Management Act 2003 Environmental Protection Act 1994 Environmental Protection Regulation 2008 Environmental Protection (Waste Management) Regulation 2000 Human Rights and Equal Opportunity Commission Act 1986 (Cth) Income Tax Assessment Act 1936 (Cth) Industrial Relations Act 1999 Industrial Relations (Tribunal) Rules 2011 Judicial Review Act 1991 Ombudsman Act 2001 Police Powers and Responsibilities Act 2000 Privacy Act 1988 (Cth) Sex Discrimination Act 1984 (Cth) State Penalties Enforcement Act 1999 State Penalties Enforcement Regulation 2000 Statutory Authorities (Superannuation Arrangements) Act 1994 Superannuation Guarantee (Administration) Act 1992 (Cth) Waste Reduction and Recycling Act 2011 Waste Reduction and Recycling Regulation 2011 Water Supply (Safety and Reliability) Act 2008 Whole of Government Policy Comply with the QPP. QPP Statutory body All agency employees are required to be aware of, and comply with, this policy. Accountable officers are responsible for ensuring the QPP is followed within their agencies; and managers and supervisors are responsible for ensuring that employees are aware of, and comply with, it. Queensland Procurement Policy (QPP) July 2013: (http://www.hpw.qld.gov.au/supplydisposal/governmentprocurement/ProcurementPolicy Guidance/StateProcurementPolicy/Pages/Default.aspx) Note: The QPP is the government’s overarching policy for the procurement of goods and services, including construction. Its purpose is to deliver excellence in procurement outcomes for Queenslanders. Cabinet has mandated this Policy for application to budget sector agencies, statutory bodies and Special Purpose Vehicles. These entities are collectively referred to as ‘agencies’ within this Policy. Procurement/Purchasing Requirements (OHSA fact sheet): (http://www.health.qld.gov.au/ohsa/docs/procurement-info-sheet-v2.pdf) Financial and Performance Management Standard 2009 Requirements (OHSA fact sheet): (http://www.health.qld.gov.au/ohsa/docs/fpms-requirements-v2.pdf) Implementation of the mandatory principles of QGEA the Information Standards is mandated as a key whole-of-Government ICT planning requirement. Specific Acts and regulations are referenced within each Information Standard. n/a (reporting focuses on core departments) IS31 & IS40 – all agencies IS18 – statutory body IS26– agencies with public facing internet sites within gov.au and Information sheet: health statutory agencies – key compliance requirements Queensland Government Enterprise Architecture (QGEA): (http://www.qgcio.qld.gov.au/products/about-the-qgea) Note: QGEA is the collection of ICT policies and associated documents that guide agency ICT initiatives and investments to improve the compatibility and costeffectiveness of ICT across government. The framework unites ICT strategy, ICT policy, Information Standards and enterprise architecture across the Queensland Government. - 16 - Mandatory requirements Reference Date/Timeframe For more information please see the QGEA guideline on the authority and applicability of the QGEA. Accountability1 Supporting documents edu.au domains e.g. MHRT Guideline to the Authority and Applicability of the QGEA: (http://www.qgcio.qld.gov.au/products/about-the-qgea/547-qgea/products/qgeadocuments/business/2353-qgea-guideline-to-the-authority-and-applicability-of-the-qgea) Note: in order to determine the applicability of QGEA policies to an individual agency, it needs to be determined whether or not an agency is captured or exempted under the particular legislation underpinning QGEA policies. For example, Information Standard 18 – Information Security supports the FPMS 2009 and as such applies to all accountable officers and statutory bodies as defined in the FAA. Current Information Standards: (http://www.qgcio.qld.gov.au/products/qgeadocuments) Publication of Gifts and Benefits Register Executives and persons paid remuneration equivalent to a senior executive service level or above, including statutory office holders, to provide, on an annual basis, a Declaration of Interests to the relevant Chief Executive or in the case of a statutory head, to the appropriate Minister and/or Parliamentary Committee and the Integrity Commissioner. The declaration must include information required under the directive, including revisions to existing Declaration of Interests. PSC Directive Quarterly (within No. 22/09 10 calendar days of the end of the quarter) Public service agencies (HHSs, HQCC, MHRT) Public Service Commission Directive No. 22/09: (http://www.psc.qld.gov.au/library/document/directive/2009/2009-22-gifts-benefits.pdf) PSC Policy Annually ‘Declaration of Interests – Senior Executive Service and Equivalent Employees including Statutory Office Holders’ All agencies PSC Policy ‘Declaration of Interests – Senior Executive Service and Equivalent Employees including Statutory Office Holders’: (http://www.psc.qld.gov.au/publications/subject-specific-publications/assets/sesdeclaration-of-interests_NEW.pdf) Crime and Misconduct Commission (CMC) information on receiving gifts and benefits: (http://www.cmc.qld.gov.au/topics/misconduct/misconduct-prevention/major-riskareas/gifts-and-benefits/gifts-and-benefits) Declaration of Interests Forms and FAQs: (http://www.psc.qld.gov.au/publications/subject-specific-publications/ceo-sesresources.aspx) Queensland Integrity Commissioner Website: (http://www.integrity.qld.gov.au/page/about-us/index.shtml) The policy requires full disclosure of any interests that may have a bearing, or be perceived to have a bearing, on the individual’s ability to properly and impartially discharge the duties of their office. Contribute to the development of Queensland Health's State Budget Papers - Service Delivery Statements and Regional Budget Statements. Annually HHSs, HQCC, MHRT, QMHC, QIMR (BP3 only) Queensland Health Budget Papers are coordinated by the State and Commonwealth Funding Unit (SCFU) within System Policy and Performance Division. [insert who is accountable for compliance with the direction e.g. Chief Executive [insert link to direction] Contact SCFU via email: State_Budget_Process@health.qld.gov.au Ministerial Directions to [insert agency name] [insert details of what the direction requires] [insert – note: an [insert agency is usually direction title/reference] required to report on any Ministerial directions in the Information sheet: health statutory agencies – key compliance requirements - 17 - Mandatory requirements Reference Date/Timeframe Accountability1 agency’s annual report] Officer] Supporting documents [insert agency name] Policy [insert details of what the policy mandates] [insert policy [insert] name e.g. HR Policy] [insert the title/s of [insert link to policy] who is accountable for compliance with the policy e.g. all staff] Information sheet: health statutory agencies – key compliance requirements - 18 - Attachment 2: Types of government bodies Type Committee/advisory council (advisory/consultative) Description A Ministerial committee/advisory council is advisory and consultative in nature, created to give advice on specific areas of interest. Health bodies Radiation Advisory Council (Radiation Safety Act 1999) It is not a separate legal entity; it is legally part of a department or statutory body and subject to departmental accountability requirements. It is not able to be a trading body and the Financial Accountability Act 2009 (FA Act) and Statutory Bodies Financial Arrangements Act 1982 (SBFA Act) will apply in the same manner as to its parent entity (e.g. Department). Statutory authority (provides independent oversight of certain functions) A statutory authority is a separate legal entity created under enabling legislation to provide independent oversight of certain functions. Although it is a separate legal entity, for financial accountability purposes, it is treated as part of its administering agency. Typically, the administering agency will be a department, although in rare cases it may be a statutory body. Statutory body (provides flexible and independent oversight and control funds) A statutory body is a separate legal entity created under enabling legislation to provide flexibility and independence, and to control its own funds. It is able to act as a trading body. The FA Act and SBFA Act apply. Mental Health Review Tribunal (Mental Health Act 2000 (MHA)) Mental Health Court Registry (MHA) Professional Conduct Review Panels of Assessors (Health Practitioners (Disciplinary Proceedings) Act 1999) Hospital and Health Services (Hospital and Health Boards Act 2011) Hospital Foundations (Hospitals Foundations Act 1982) Office of the Health Quality and Complaints Commission (Health Quality and Complaints Commission Act 2006) Council of the Queensland Institute of Medical Research (Queensland Institute of Medical Research Act 1945) Queensland Mental Health Commission (Queensland Mental Health Commission Act 2013) Information sheet: health statutory agencies – key compliance requirements - 19 -