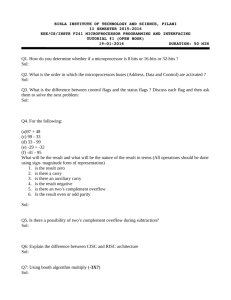

C.law & other laws practical questions

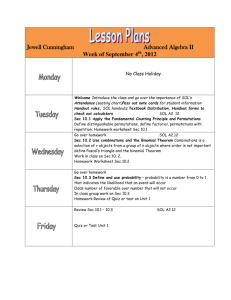

advertisement