IN THE MATTER OF THE INSURANCE ACT, R

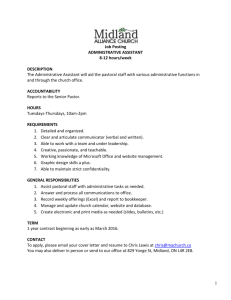

advertisement

IN THE MATTER OF THE INSURANCE ACT, R.S.O. 1990 c. I.8, s. 275 AS AMENDED AND IN THE MATTER OF THE ARBITRATION ACT, S.O. 1991, c. 17, AS AMENDED AND IN THE MATTER OF AN ARBITRATION BETWEEN: WEST WAWANOSH MUTUAL INSURANCE COMPANY Applicant and FEDERATION INSURANCE COMPANY, LLOYD’S OF LONDON INSURANCE COMPANY and ALLSTATE INSURANCE COMPANY Respondents AWARD COUNSEL Ms. Catherine R. Bruni, Counsel for the Applicant Ms. Ruth Henneberry, Counsel for Federation Insurance Company Edward J. Chadderton, Esq., Counsel for Lloyd’s of London Insurance Company Stuart S. Aird, Esq., Counsel for Allstate Insurance Company This Arbitration arises out of a motor vehicle accident which occurred on June 6, 2001 on Highway 169 between the Town of Bala and the Town of Gravehurst. Chris Wiegand had parked his vehicle on the west side of the road in order to check a connection between his pick-up and trailer. -2Dan Voisin had been proceeding southbound on Highway 169. Ahead of him and to his right, was the Wiegand vehicle parked on the west side of Highway 169. There was an intersecting road to the north of where the Wiegand vehicle was stopped. Malcolm McPherson was proceeding in a westerly direction on the side road to the left of Mr. Voisin. Mr. McPherson pulled out ahead of Mr. Voisin. Mr. Voisin cut to his right to avoid hitting the McPherson vehicle and collided with the stopped trailer of Mr. Voisin. He did not realize that Chris Wiegand was between the trailer and the pick-up truck which had been pulling the trailer. The Agreed Statement of Facts, sets out that Mr. Wiegand sued Mr. Voisin and Mr. McPherson in tort. Mr. Wiegand also sued his insurance broker, Mike Johnston & Johnston & Associates Insurance Brokers Ltd. since there was an issue as to the coverage on the Wiegand vehicle at the time of the accident. Mr. Wiegand also sued West Wawanosh for a Declaration as to coverage and for outstanding accident benefits claims. Mr. Wiegand suffered significant injuries. The preliminary issue to be determined in this Arbitration is whether or not West Wawanosh provided a policy of insurance to Christopher Wiegand, which policy contained Statutory Accident Benefits coverage at the time of the subject accident of June 6, 2001. EVIDENCE OF MICHAEL JOHNSTON -3Counsel for West Wawanosh Mutual Insurance Company, hereinafter referred to as “West Wawanosh” called Michael Johnston as the only witness to give evidence on behalf of West Wawanosh in this Arbitration. Michael Johnston stated that he had been an insurance broker since 1971. Starting in 1989 he was employed by Johnston & Assoc. Insurance Brokers Ltd. He was still employed there in 2000 and 2001. Mr. Johnston stated that the brokerage wrote home, auto, boat and business insurance. There were five brokers at the brokerage. Mr. Johnston stated that he received a call from Chris Wiegand, who called to obtain a quote for insurance on a vehicle and his business. This was a “cold” call as he had not spoken with Mr. Wiegand previously. Mr. Johnston took the first call. He was told by Mr. Wiegand that his business was hauling garbage from cottages. Mr. Wiegand was inquiring as to liability and Accident Benefits coverage on various vehicles. He did not seek physical damage coverage for the vehicles. There were five vehicles in all. Mr. Johnston could not recall if he gave quotes in respect of all five vehicles. At Tab 22 of the Joint Document Brief, marked as Exhibit 1, Mr. Johnston had his notes as to his initial call from Chris Wiegand. Mr. Johnston obtained some background information as to the nature of the business. He noted that there were a couple of barges and boats. The business had been ongoing for two years and had three employees. There was a discussion about cargo insurance. He noted that this was a seasonal business operating from May to November. -4He noted that there had been no business insurance on the business since 1999. Mr. Johnston did not give a quote during the initial call. He said that the practice was to call back with quotes. Mr. Johnston was unable to identify the exact date of the initial phone call. Mr. Johnston stated there were no discussions about putting the insurance on the vehicles and taking the insurance off at various times of year. Mr. Johnston stated that he telephoned back to Mr. Wiegand with quotes. He could not recall all the discussions that took place during that telephone call. He stated that he was instructed to proceed to put the coverages on. Mr. Johnston stated that two vehicles were insured. He obtained the serial numbers of a Ford and a Dodge. He was told that both vehicles were owned by Chris Wiegand. As part of the process, Mr. Johnston filled out an Application for Automobile Insurance. That Application was at Tab 2 of the Joint Document Brief. Mr. Johnston identified his handwriting on the document. He also signed the document. He said that it was filled out on May 2, 2000. At that point, he did not have particulars as to prior insurance on the two vehicles. It was agreed that Mr. Wiegand would get that and forward it to Mr. Johnston. The Application in the name of Chris Wiegand was an Owner’s Form which described vehicles owned by Chris Wiegand. Two drivers were noted on the Application as Chris Wiegand and his father, Jim. They were both noted since they lived together, as it was necessary to list all drivers of the described automobiles in the household or business. -5Chris Wiegand was asked about traffic tickets and he stated that he had had two speeding tickets. There was to be no coverage for damage or loss to the two vehicles. The estimated premium was $1,917.00 yearly. There was to be a deposit of two months premium, $319.50. Monthly payments were estimated at $159.75. Mr. Johnston said that he went over everything with Mr. Wiegand. He had no recollection of reviewing ownership of the two vehicles. He stated that Mr. Wiegand signed the Application and gave him the down payment cheque and completed the authorization re monthly payments to be withdrawn from a bank account. Mr. Wiegand provided a cheque of Island Haul A Way covering the deposit of $319.50. Mr. Johnston stated that he gave Chris Wiegand a copy of the Application for Insurance and a temporary liability slip to be kept in the vehicle. The temporary slip covered one month between May 2, 2000 and June 2, 2000. Mr. Johnston had no recall as to any discussions with Chris Wiegand as to removing the vehicles from the road on a seasonal basis. Mr. Johnston then sent the Application to West Wawanosh. It was noted that he was still seeking information as to prior insurance. Mr. Johnston ultimately received information from Mr. Wiegand that he had previously been insured with Allstate. He ultimately learned that there had been three speeding convictions instead of two convictions. premium. That resulted in a higher -6West Wawanosh sent a statement of account to Chris Wiegand dated May 11, 2000. The total premium was noted on the account and the monthly payments were noted to be $191.76 for June 1, 2000 and monthly payments of $191.79 thereafter. The letter was addressed to Christopher Wiegand at P.O. Box 1288, Gravenhurst, Ontario, P1P 1V4. A Certificate of Automobile Insurance with the total premium noted and the applicable coverages for the two vehicles was prepared by West Wawanosh, and a copy was sent to Chris Wiegand. Mr. Johnston said that he reviewed it and ensured the vehicle numbers were right. A copy of the Certificate and the account was contained in the files of Johnston & Assoc. Mr. Johnston said that he never heard from Chris Wiegand once the account and Certificate were sent out. Mr. Johnston said that when Chris Wiegand called to advise him about prior coverage through Allstate, Mr. Johnston could not recall discussions as to the vehicles being taken off the road at some point. Mr. Johnston said that he had another discussion with Mr. Wiegand in September of 2000 when a pontoon boat was added to the coverage. Mr. Johnston could not recall discussions then with Mr. Wiegand as to use of his various vehicles. Mr. Johnston said that his next contact with Mr. Wiegand about the auto policy was in November, 2000. Mr. Wiegand called to advise he wished the road coverage taken off both vehicles as they were parked for the season. Mr. Johnston stated, in his evidence, that this was not discussed with him before. -7Mr. Johnston advised Mr. Wiegand that when the coverage was taken off, the policy would be over. He advised Mr. Wiegand that if he purchased minimum fire and theft insurance, the policy would be kept in force and there would not be a need for a new Application when the coverage was “back on”. It was the evidence of Mr. Johnston that he had discussions with Mr. Wiegand that Mr. Wiegand would have to advise him when he was back and wished the coverage back on. He stated that all that was up to Mr. Wiegand. Mr. Johnston did not take notes as to when the coverage would be put back on. He said to do that would cause a problem. It was not his practice to ever take a date for the reinstatement of coverage. It was the evidence of Mr. Johnston that Chris Wiegand did not tell him when he would be back in business and need the coverage back on. It was the evidence of Mr. Johnston that he would have told Mr. Wiegand that Wiegand needed to call his office and request that the coverage be put back on. He did discuss the premiums with Mr. Wiegand. Because of the down payment, enough might have been paid such that additional payments would not be necessary. Mr. Johnston said that he understood that the coverage would be suspended because Wiegand’s business was done for the season. He understood that the vehicles were used only for business purposes. These instructions as to removing coverage were taken over the phone. He did not require notice in writing requesting such coverage changes. -8Mr. Johnston stated that he advised West Wawanosh in writing to delete all coverage other than specified perils for the two trucks. His form letter to West Wawanosh was at Tab 12 of the Joint Document Brief. The notice to West Wawanosh was dated November 22, 2000. It was the evidence of Mr. Johnston that Chris Wiegand called him that day or perhaps the day prior. It was the evidence of Mr. Johnston that the business of Chris Wiegand did not operate in the winter. Notwithstanding that, there was no change in the business coverage as that had to run for twelve months. On the document at Tab 12 i.e. the notice to West Wawanosh re the change in coverage, Mr. Johnston noted “Chris to advise when back on road”. It was the evidence of Mr. Johnston that he made that entry on the same day. It was the earlier evidence of Mr. Johnston that he assumed in every case that the insured person would call when coverage was to be put back on. One then wondered why such a note was put on the last mentioned document. A new Certificate of Automobile Insurance was prepared showing the effective dates of coverage as November 22, 2000 to May 2, 2001. That document showed the change in coverage. A copy of that certificate was sent to Chris Wiegand addressed to him at P.O. Box 1288, Gravenhurst, Ontario, P1P 1V4. A new Statement of Account was also sent to Chris Wiegand showing a reduction in the total premium and an overpayment. That document was dated November 27, 2000. -9By letter dated November 29, 2000, a cheque covering a refund of $199.05 was also sent to Christopher Wiegand at the same address. Mr. Johnston said that he received no additional contact from Chris Wiegand in November, 2000. By statement of account dated March 9, 2001, reference was made to an annual premium of only $40.00 plus taxes and service charge resulting in monthly payments of $3.57 on April 1, 2001 and $3.53 per month starting May 1, 2001. A copy of that statement of account was sent to Christopher Wiegand at the same address. A new Certificate of Automobile Insurance was also sent to Christopher Wiegand noting the restricted coverage on the two vehicles. That certificate covered the policy period between May 2, 2001 and May 2, 2002. It was the evidence of Mr. Johnston that he reviewed the new Certificate of Automobile Insurance and the statement of account before the documents were sent out. Accordingly, based on the evidence of Michael Johnston, in May, 2000, Christopher Wiegand would have received a Certificate of Automobile Insurance, two pink liability slips and a statement of account showing the monthly premiums. Once liability coverage and Accident Benefits coverage was to be taken off the two vehicles, after a request that that be done by Chris Wiegand in November, 2000, Chris Wiegand was a sent a new Certificate of Automobile Insurance, a statement of account, a refund cheque and new liability slips in November, 2000. It was the evidence of Michael Johnston that in June, 2001 he received a telephone call from Chris Wiegand. Chris was in hospital and was injured. Mr. Johnston - 10 got the Wiegand file and stated that there was a problem. He stated that he told Chris Wiegand that he had not called him to tell him to put coverage back on the two vehicles. Mr. Johnston stated that the response of Chris Wiegand was that he was upset and crying. Mr. Johnston stated that Chris Wiegand said that he realized that he had not called and that he had forgotten to do so. Chris Wiegand asked Mr. Johnston about coverage for his injuries. Mr. Johnston told him that he would have coverage as he was an innocent party and coverage would be available under the policy on the vehicle that struck him. Mr. Johnston also told Chris Wiegand to check his father’s policy for possible coverage. Mr. Johnston stated that he wrote notes after receiving the telephone call and those were contained at Tab 19 of the Joint Document Brief. Mr. Johnston stated that he wrote the notes after the telephone call. The notes were dated June 8, 2001. The notes stated what Mr. Johnston repeated in his Examination In Chief, that Chris Wiegand had asked him to backdate coverage and Mr. Johnston said that he couldn’t do that. According to the evidence of Mr. Johnston, Chris Wiegand did not say that Mr. Johnston was supposed to reinstate coverage at a particular point. Mr. Johnston put the coverages back on effective June 8, 2001. Mr. Johnston stated that he advised the owner of his agency of a potential problem. He said that people could come back and sue them. He did not think that that would happen in this case since Chris Wiegand had not called to reinstate coverage. Mr. Johnston recalled that he had spoken with Jim Wiegand in February, 2001 as to home insurance. Wiegand and his coverages. He said he had not had discussions then about Chris - 11 Counsel for Federation Insurance Company crossed examined Mr. Johnston. Mr. Johnston admitted that he was aware of the nature of the business carried on by Island Haul A Way. Mr. Johnston had arranged for business insurance through Optimum Frontier. Mr. Johnston had a general sense of what the business was about. Mr. Johnston stated that the West Wawanosh policy provided liability insurance on a 1988 Ford vehicle and 1988 Dodge vehicle. He understood that those vehicles were used for business purposes only. Initially, his information was that both vehicles were owned by Chris Wiegand. He later learned that the Dodge was owned by Jim Wiegand. Mr. Johnston noted that the original Application for Insurance was signed by Chris Wiegand and that the initial cheque covering the premium was provided on a cheque of Island Haul A Way. Mr. Johnston was examined and questioned about the statement of account initially sent out. A deposit of $319.50 was obtained from Island Haul A Way and monthly payments were then withdrawn from the company account. There was no explanation letter other than the statement of account sent to Christopher Wiegand. The Joint Document Brief contained all correspondence between the brokerage and West Wawanosh and Chris Wiegand. Mr. Johnston was cross examined as to the call received from Chris Wiegand in November, 2000. He stated that Christopher Wiegand spoke only to him about the two vehicles having coverage removed. The reason was that the business was - 12 being shut down for the season. The motor vehicles were not to be operated. He understood that the business would restart in the spring. He stated that he told Chris Wiegand that he could put the liability coverage back on. He stated that he told him there would also likely be a refund because of the deposit made and premiums paid to November, 2000. No confirming letters were exchanged by Mr. Wiegand and Mr. Johnston as to those discussions. Mr. Johnston admitted that no letter as to the coverage being removed was sent to Mr. Wiegand and there was no letter to Mr. Wiegand advising him not to forget to call in the spring to put coverage back on. Mr. Johnston was examined as to the note sent to West Wawanosh as to the removal of coverage and the addition of specified peril coverage. Mr. Johnston prepared the note to West Wawanosh. He was questioned as to writing the note that Chris was to advise when the vehicles were back on the road. He did not tell West Wawanosh about that note. All information concerning Mr. Wiegand sent to Wawanosh was sent by Mr. Johnston. There was an Agreed Statement of Facts. In that Agreed Statement of Facts, there was reference to West Wawanosh doing a motor vehicle record search on Chris and James Wiegand in March, 2001. Mr. Johnston was questioned as to why that would be done if the policy contained only comprehensive coverage. Mr. Johnston had no explanation as to why that would be done. He confirmed however that he had not sent information to West Wawanosh that liability coverage would be put back on the vehicle at some point once the liability coverage was removed. - 13 Mr. Johnston stated that he spoke with James Wiegand in February, 2002. He stated that James Wiegand did not allege that Mr. Johnston was told to put the coverage back on in May, 2001. Mr. Johnston had no notes as to his conversation with James Wiegand in February, 2002. Mr. Johnston stated, under cross examination, that he did not have a tickler system such that he would diary ahead when coverage would be put back on in a situation in which coverage had been removed on a seasonal basis. He stated that that was the responsibility of the customer and was not his reasonability. He stated that he had no standard form letter that would be sent out reminding customers about the need to advise him as to reinstatement of coverage. Mr. Johnston was examined as to the Certificate of Automobile Insurance dated November 11, 2000, which showed only comprehensive coverage and no liability coverage on the two vehicles. He stated that West Wawanosh did not use a Suspension of Coverage Form. He stated that the Certificate was prepared by West Wawanosh and was sent to Chris Wiegand. The policy number remained the same as the old policy number. Mr. Johnston stated that in the spring of 2001 he received the Certificate of Automobile Insurance coverage and the statement of account on the West Wawanosh letterhead and form and reviewed the same. Mr. Johnston was briefly re-examined by counsel for West Wawanosh. He stated that the premiums noted on the statement of account dated March 9, 2001 would have been removed from the account of Island Haul A Way. On June 1, 2001, a premium of $3.53 would have been removed. - 14 Mr. Johnston also stated that the address to which the various documents were sent to Christopher Wiegand was the address that Christopher Wiegand had provided to him. EVIDENCE OF CHRIS WIEGAND Chris Wiegand was called to give evidence by counsel for Federation Insurance Company. Chris Wiegand stated that he was operating a 1988 Ford F-150 pick-up at the time of his accident of June 6, 2001. Chris stated that at the time, the vehicle was insured by West Wawanosh Mutual Insurance Company. He said that the vehicle was first insured by West Wawanosh in May 2000. He stated that he arranged the insurance through an insurance broker, Michael Johnston. He recalled that the insurance policy also covered a Dodge Ram pick-up truck. Chris stated that he also obtained business liability insurance on Island Haul A Way. He said that the business dealt with refuse removal in the Muskoka area. He said that it was a seasonal business operating between May and mid-November each year. He said that 1999 was the first year of business. Chris stated that in the winter, he was a snowboard instructor and was out of the Province of Ontario. The two insured vehicles were used for the business of Island Haul A Way. - 15 It was the evidence of Chris Wiegand that he told Mike Johnston that his business was seasonal. He stated that he told Mike Johnston that he would leave the Province as trucks would be parked when the business was out of season. It was agreed that Mike Johnston would obtain a quote for the insurance in early May 2000. Mike Johnston called him with a quote and Chris then travelled to the office of Mike Johnston. It was the evidence of Chris Wiegand that he signed the Application for Insurance, as prepared by Mike Johnston, on May 3, 2000. Chris knew that he was insured with West Wawanosh and that there was liability coverage and accident benefits coverage on the two vehicles. He knew that property damage and comprehensive coverage were not in effect. Chris stated that he contacted Mike Johnston on November 22, 2000 and advised him that he was leaving the Province and closing the business for the winter and that liability coverage should be removed from the two vehicles. His only contact with Mike Johnston in November 2000 was by telephone. It was the evidence of Chris Wiegand that he told Mike Johnston that liability coverage was to be reinstated on the two vehicles on the renewal date of the policy, i.e. May 2, 2001. Chris Wiegand stated that Mike Johnston did not say that there was any problem or that he should call back in the spring. He stated that Mike Johnston did not tell him that he had to do anything more. It was the evidence of Chris Wiegand that when he left the Province, all of the mail addressed to him and his company was directed to his bookkeeper. - 16 Chris stated that he understood that premiums for the policy were removed from the Island Haul A Way account. He stated that he signed an authorization which permitted the removal of premiums from that account. Chris Wiegand repeated that he told Mike Johnston to reinstate liability coverage on the renewal date of the policy. Chris Wiegand stated that when he initially spoke with Mike Johnston, he advised him about the nature of the business and the routine of the business. Chris stated that when he met Mike Johnston on May 3, 2000, he did not know whether Mike Johnston took notes. Chris stated that he had no further discussions with Mike Johnston between November of 2000 and June of 2001. It was the recollection of Chris that the monthly premiums approximated $190.00 monthly commencing in May 2000. When Chris had the coverage removed in November 2000, he did not know the amount of the refund that he was to receive but knew that there would be a savings of some money. He could not recall discussions as to the amount of the premium to be charged once liability coverage was removed. Chris could not recall any discussions as to the premium to be charged for the term commencing May 2001. He was not concerned about the premium increasing. Chris advised that his accountant/bookkeeper was Larry Babineau. Mr. Babineau had been the bookkeeper for some time prior to the motor vehicle accident which occurred in June 2001. - 17 It was the evidence of Chris Wiegand that Larry Babineau would receive all of the mail and do all of the necessary bookkeeping when Chris was away in the off-season. Chris Wiegand stated that if anyone knew what the premium was at any point in time, that would likely have been Larry Babineau. Chris stated that if there was a matter of concern re the amount being taken out of the company account, Babineau would have contacted him. He received no calls from Babineau about the matter. It was the clear evidence of Chris Wiegand that he expected that West Wawanosh would reinstate liability coverage in May 2001. He said there was no question about that in his mind and he expected that he would have full coverage. Chris Wiegand was questioned about the Certificate of Automobile Insurance for the period commencing May 2, 2001 to May 2, 2002. He said that when he first got the Certificate, a pink slip was attached. He understood that to be a Certificate of Liability Insurance. Chris stated that he received a box of mail from Mr. Babineau in May 2001. During the months preceding that, he did not see any of the mail that would have come in. Chris stated that when he looked at the Certificate of Automobile Insurance, that he did not look at the premium being charged. He saw a pink slip and felt that that meant that he had insurance. He felt that way since he had told Michael Johnston to reinstate insurance coverage on May 2, 2001. - 18 Chris Wiegand was questioned as to the documentation received from West Wawanosh when the liability coverage was removed in November 2000. He stated that he did not see those documents. He simply knew that liability coverage had been removed. Chris Wiegand was shown the Certificate of Automobile Insurance at Tab 17 of the Joint Document Brief. That Certificate dealt with the renewal of comprehensive coverage and did not provide liability coverage. Chris questioned why there would be a renewal without liability coverage without calling him. Chris stated that he first saw the document at Tab 17, the Certificate of Automobile Insurance, in May 2001 when he picked up his mail. Chris was unable to say with certainty if he reviewed it before he drove the vehicles insured. Chris was asked whether he detached the pink slip attached and he stated that he did not. Chris repeated that he had not read over the document and simply knew that the pink slip provided insurance. After the instructions that he gave Michael Johnston, he did not question anything. Chris Wiegand stated that he was not asked to sign anything when coverage was removed or put back on. Chris stated that he would not have driven the vehicle if he knew that he had no liability coverage. He said that he had no reason to think that he was not covered. He knew the implications of driving without coverage. Chris Wiegand was cross-examined by counsel for West Wawanosh. - 19 Chris stated that he had traveled to the Banff area for the winter, for the three winters prior to the winter of 2000. He stated that his snowboarding work would commence in November or December each year depending on the weather. He would then work until mid-April approximately. He stated that he had returned home on April 24, 2000. The 1988 Ford F-150 had been purchased by his father before then. Chris could not recall the number of telephone conversations that he had with Michael Johnston. He said that he first had a meeting with Michael Johnston in April or May of 2000. He said that he advised Michael Johnston then about the nature of his business and the business schedule. He stated that he told Michael Johnston that he was gone all winter and did not need liability insurance when he was away. When Chris Wiegand was cross-examined as to the timing of coverage on the two vehicles, he said that he did not discuss the timing of cutting off coverage with Michael Johnston. He said that he did not know the date when he would finish work in the fall of 2000. He stated that he told Michael Johnston that he would call at the end of the season. However, he also stated that he told Michael Johnston that coverage for liability would be reinstated on renewal of the policy on May 2, 2001. Chris Wiegand was cross-examined as to why he would not tell Michael Johnston to lift coverage on December 15, 2000. He said he would not do that, because what would happen if he had finished in October 2000? He stated that he wanted the liability insurance to remain in effect while he was still working. However, he claimed that he knew that he would restart the business on or about May 2, 2001. - 20 He maintained that he would not keep his snow boarding business open after April 15 in any year. Chris Wiegand stated that he signed the Application for Automobile Insurance on May 3, 2000. He identified his signature on the document. He had no recollection of reviewing the document or reading it line by line and likely just signed it. When questioned as to late payment of fines or the receipt of speeding tickets, he could not recall the details of the same. When Chris Wiegand was shown the copy of the pink slip which was given to him on an interim basis covering the period May 2, 2000 to June 2, 2000, he stated that Michael Johnston gave that to him on May 3, 2000. He had no recollection as to whether he put it in his vehicle. Chris Wiegand was shown the Certificate of Automobile Insurance for the period May 2, 2000 to May 2, 2001. He said that he saw the document. When shown the pink slip at Tab 5 of the Joint Document Brief, he stated that he had no recollection as to what he did with that pink slip. Chris identified the cheques at Tab 6 of the Joint Document Brief, i.e. cheques of Island Haul A Way for the deposit and the Payment Authorization. Chris Wiegand was shown the statement of account dated May 11, 2000. That document was at Tab 8 of the Joint Document Brief. He had no recollection of seeing the document. He stated that the amounts shown approximated what he thought the premiums would be. Chris had no recollections about discussions with Michael Johnston re coverage on a pontoon boat in September 2000 or as to prior insurance with Allstate. - 21 Chris Wiegand stated that in November 2000, he contacted Michael Johnston to inform him that he was leaving for the season as discussed earlier. He told Michael Johnston that he wanted no liability coverage for the winter. He agreed that theft coverage would be put on. He stated that Michael Johnston said that that was a good idea since the vehicles were sitting in the parking lot all winter. Chris realized that the premiums would go down in November 2000. He stated that in November 2000, he headed to Utah as he had changed his plans. He stated that the ski hills in Utah closed on April 15, 2001 and he expected that he would be finished there about that time. Chris stated that he picked May 2, 2001 for the implementation of liability coverage because that was the renewal date. He stated that when he told Michael Johnston when liability coverage would be reinstated, that Michael Johnston said “ok”. He said that he left in November 2000 and that he understood the renewal date would be May 2, 2001. He thought that liability coverage would be reinstated then. He stated that he had given those instructions to Michael Johnston twice. He stated that he did not see any forms about changing coverage in November 2000 since he was away. Those would have gone to his bookkeeper. When questioned as to his receipt of a refund in the sum of $199.05 in November 2000, he stated that the cheque would have gone to his bookkeeper for deposit. - 22 Chris Wiegand admitted, under cross-examination, that he received the Certificate of Automobile Insurance for the period commencing May 2, 2001. He said that he likely saw it in May 2001. He said that it likely came to his attention when he received the box of mail and documents from his bookkeeper once he had returned from Utah. He stated that he saw it before the accident occurred in June 2001. Chris Wiegand was questioned as to whether the Certificate of Automobile Insurance came to him at the same time as the account dealing with premiums due commencing in April and May 2001. He did not know that. Chris Wiegand repeated that the only important matter was that a pink slip was attached to the Certificate. He stated that he did not look at the cost of insurance. He did not detach the pink slip or put it in his vehicle. He stated that he did not read the fine print on the pink slip. He did not notice that the pink slip did not have a description of the insured vehicle. Chris admitted that, when he was away starting in November 2000, he had access to banking records from his bookkeeper if he wanted them. He stated that all of the records and mail would go to a post office box and that his father would take all of the documents to the bookkeeper. The bookkeeper had a key to the post office box as well. The bookkeeper would open everything that came in. Chris stated that he had contact with the bookkeeper in March and April of 2001 but that he did not discuss insurance with him. The statement from West Wawanosh showed small premiums of $3.53 monthly commencing May 1, 2001 and $3.57 monthly for April 1, 2001. Chris stated that he did not check as to the withdrawals being made. - 23 Chris was questioned as to his various addresses. showed his address as 15 Blackfriars Pl., Cambridge. The police report He stated that that was his mother’s address. He stated that he moved a lot. Prior to the motor vehicle accident, he resided at his father’s cottage. Six months before that, he was in Utah. The summer before, he was at his father’s cottage. Six months prior to that, he was in Utah. He stated that his mother’s address was his home base and that his personal mail would go there. Ultimately, it was the evidence of Chris Wiegand that he told Michael Johnston to reinstate insurance on two separate occasions. That was at the time of his first meeting in May of 2000 and when he removed the coverage in November 2000. EVIDENCE OF JAMES WIEGAND James Wiegand was called to give evidence by counsel for Federation Insurance Company. James Wiegand is the father of Chris Wiegand. He was listed as a driver of the vehicles described in the Application for Automobile Insurance. However, he did not know if he was so listed. He stated that he owned the Dodge Ram pick-up described on the policy. It was the evidence of James Wiegand that in late April or May 2000, his son Chris met with Michael Johnston to arrange insurance. James Wiegand played no part in insuring the trucks. He was not directly involved with Michael Johnston in that regard. - 24 James Wiegand stated that he did have discussions with Michael Johnston about his own needs, i.e. insuring his own car and cottage. He could not recall if he had discussions about insuring his boats. James Wiegand knew that liability coverage had been arranged on the Ford F-150 and Dodge Ram pick-up through West Wawanosh commencing May 2, 2000. James Wiegand knew that his son Chris told Michael Johnston that the business was shut down in November 2000 and that liability coverage was to be removed from the two vehicles. James Wiegand understood that those discussions took place but he was not aware of the direct instructions given by Chris to Michael Johnston. In addition, James Wiegand did not get the documents as to insurance on the two vehicles. All of the paper work concerning the insurance went to his son Chris Wiegand. James stated that it was the routine of Chris to go to Utah in the winter and to then return back to Ontario at the end of the ski season to restart his business. He said that that usually took place in April. He did not believe that Chris actually restarted the business before May, but he could not recall exactly. James Wiegand stated that he was in the office of Michael Johnston in February or March of 2001. He stated that Michael Johnston asked him when Chris would be back and that he told him that Chris would be back at the end of April. That was his only discussion with Michael Johnston about the return of Chris to Ontario. James stated that it was his understanding that coverage would be put back on the two vehicles at the beginning of May 2001. It was his understanding that Chris would not have to do anything else in order to get the coverage back on. - 25 James Wiegand was cross-examined by counsel for West Wawanosh. He stated that he saw the pink slips for the vehicles with his name on it. He also stated that he saw his name on the Certificate of Automobile Insurance. He stated that when the Certificate of Automobile Insurance and pink slips were sent out, they were also addressed to him. Based on Tabs 3, 4, 5, 13, 14, 16 and 17, that was not so. James stated that when his son Chris was in Utah, he would pick up the mail addressed to Chris at a post office box. He stated that he had the key to the box and no one else had access to it. He stated that the bookkeeper had no key to the box. He stated he would deliver the envelopes received to the bookkeeper. He stated that envelopes received from West Wawanosh were delivered to the bookkeeper. He thought that he may have opened one but he was uncertain about that. He paid no premiums directly. James Wiegand stated that he had no knowledge of the banking situation of his son or his company. He was questioned as to whether he saw Certificates of Automobile Insurance including the original Certificate dated May 2000, the Certificate dated in November 2000 and the Certificate dealing with the renewal covering the period commencing May 2001. James Wiegand stated that he saw a couple of those Certificates. He did not know which ones he had seen. He could not recall if he saw the Statement of Account dated March 9, 2001, at Tab 16 of the Joint Document Brief. - 26 James stated that he knew that the liability coverage would not be back on the two vehicles until Chris returned to Ontario. He did not contemplate telling Chris to contact Michael Johnston about that. Chris Wiegand confirmed that he was the registered owner of the Dodge Ram. He left it to his son Chris to deal with the insurance. Chris would use the truck and so he would pay the insurance due on it. James never asked Chris for proof that insurance had been placed on the vehicles. James stated that it was his understanding that Chris gave instructions to Michael Johnston to reinstate coverage on his return to Ontario in the spring of 2001. He was unsure of the exact date when coverage would be put back on. He thought that Chris had told Michael Johnston to put the liability coverage back on when Chris returned to Ontario. James stated that he knew that Chris would be back during the last week of April or first week of May 2001. He did not know the specific date. James stated that in the winter of 1999 – 2000, Chris went to Utah. He had a vehicle for use in Utah which was owned by Chris or James. James thought that the vehicle had been insured by Allstate. Under re-examination by counsel for Federation Insurance Company, James Wiegand stated that it was his understanding that Chris had arranged with Michael Johnston for the liability coverage to be put back on on his return to Ontario. James was left with the impression from discussions with Chris that those arrangements had been made and that the insurance would be back on. - 27 SUBMISSIONS OF COUNSEL INSURANCE COMPANY FOR WEST WAWANOSH MUTUAL Counsel for West Wawanosh made submissions as to the issue of credibility of Chris Wiegand and Michael Johnston. It was argued that the evidence of Michael Johnston and Chris Wiegand differed as to discussions about terminating coverage on the two vehicles covered by the West Wawanosh policy. It was pointed out that one could not point to any pattern since the first contact between Chris Wiegand and Michael Johnston was in May 2000. Chris Wiegand may have had a pattern in mind as to when he would close his business in the fall of 2000 and when he would reopen it in the spring 2001. That would not be known or understood by Michael Johnston. It was the evidence of Chris Wiegand that when he had his first meeting with Michael Johnston in May 2000 that he was confident that he would have been back home and ready to start up his business again on May 1 or May 2, 2001. Yet, it was his evidence that he was uncertain as to the closing date of the business in the fall of 2000. Counsel for West Wawanosh wondered why Chris Wiegand was so certain as to his return date when he was not certain as to the date when he would be leaving Ontario in the fall of 2000. It was argued on behalf of West Wawanosh that it was the evidence of James Wiegand that Chris had returned back to Ontario at the end of the ski season in order to restart his business and that that usually took place in April of each spring. In contrast to that evidence of James Wiegand was the evidence of Chris Wiegand that he knew that he would restart the business on or about May 2, 2001. - 28 Counsel for West Wawanosh repeated the evidence of Michael Johnston that Johnston understood that Chris would call when he wished the motor vehicles back on the road and wished coverage to be put back into effect. Mr. Johnston stated that he would not take that obligation on himself and that it was not a reasonable practice for a broker to have to do that. It was argued on behalf of West Wawanosh that the annual premium for coverage on the two vehicles effective May 2000 was approximately $2,000.00 per year. When Chris contacted Michael Johnston in November 2000, Chris advised Johnston to remove the liability coverage on the two vehicles. It was the evidence of Chris Wiegand that he again told Michael Johnston to put that coverage back on effective May 2, 2001. Michael Johnston denied being told that. It was argued on behalf of West Wawanosh that the answer of Michael Johnston was consistent with his alleged practice as noted in his evidence and the notes which he made. It was also argued on behalf of West Wawanosh that the policy change documents in November 2000, including a Certificate of Automobile Insurance, a refund cheque and statement of account as to the same, and a covering letter enclosing a cheque for the refund were all sent out to Chris Wiegand. It was the evidence of Chris Wiegand that he did not see those documents. His evidence was that he simply knew that liability coverage had been removed. It was also argued on behalf of West Wawanosh that they had a system in place such that they would pull every file two months in advance. That was particularly so if a payment plan was in effect, as in the subject case. West Wawanosh pointed to Tabs 16 and 17 of the Joint Document Brief. A statement of account was sent out to - 29 Chris Wiegand on March 9, 2001, approximately two months before the policy on the two vehicles would have been renewed. In a statement of account dated March 9, 2001, reference is made to an effective date of the policy commencing May 2, 2001. The annual premium is shown at only $40.00 with monthly payments of $3.57 dated April 1, 2001 and $3.53 monthly thereafter. At Tab 17, is a Certificate of Automobile Insurance, also sent to Chris Wiegand showing the same annual premium of $40.00 plus taxes. It was argued on behalf of West Wawanosh that Chris Wiegand would have read over the Certificate of Automobile Insurance and the statement of account for coverage commencing in May 2001. It was argued that the amount of premium was very clear. It would be difficult to understand how an insured person could receive such an Account and Certificate and not notice the low annual premium. It was the evidence of Chris Wiegand that he picked up mail from his bookkeeper when he returned to Ontario in late April or early May 2001. He said that he looked at the Certificate and pink slip at Tab 17 of the Joint Document Brief but that he did not look at the premium being charged. His evidence was that he saw a pink slip and that that meant that he had insurance. Wiegand confirmed that he saw the document at Tab 17, i.e. the pink slip and Certificate of Insurance in May 2001 when he picked up his mail. However, he was unable to say with certainty if he reviewed it before he drove the insured vehicles. He did state that he did not detach the pink slip and place it in his vehicle. It was admitted by Chris Wiegand that if he had read the Certificate and Account, he would have known there was no coverage. - 30 It was argued on behalf of West Wawanosh that the documents were not confusing as to the amount of the premium being charged for the period commencing in May 2001. It was argued on behalf of West Wawanosh that the evidence of Chris Wiegand that when he saw the pink slip, he assumed that he had liability coverage, should not be accepted. He did not detach the pink slip and put it in his vehicle. It was argued that his evidence was questionable as to seeing the pink slip if he did not feel it was important enough to detach it and place it in his vehicle? It was argued on behalf of West Wawanosh that having seen the Certificate of Insurance and pink slip, why would Chris Wiegand not have called Michael Johnston to ensure that coverage was back on the vehicle. It was also argued on behalf of West Wawanosh that withdrawals of only $3.53 monthly were being made from the company account of Chris Wiegand. Small withdrawals were made on April 1, May 1 and June 1, 2001. Chris Wiegand had access to his banking records. It was argued that it was his issue if he didn’t consider it important enough to look at his banking records. It was argued that the evidence of Chris Wiegand should not be believed that insurance was a priority for him. His actions would not back up any such suggestion. It was argued on behalf of West Wawanosh that the statement of account dated March 9, 2001 showing premiums of less than $4.00 monthly and the contents of the Certificate of Automobile Insurance showing an annual premium of only $40.00 make it clear that the coverages are clearly set out and are there to be seen. - 31 It was argued on behalf of West Wawanosh that there was also the evidence of Michael Johnston when he was first contacted by Chris Wiegand in June 2001 following the accident. Michael Johnston said that he got the Wiegand file and immediately stated that there was a problem. His evidence was that he told Chris Wiegand that he had not called him to tell him to put coverage back on the two vehicles. The evidence of Johnston was that Chris Wiegand said that he realized that he had not called and that he had forgotten to do so. It was the evidence of Michael Johnston that Chris Wiegand asked him to backdate coverage and that Johnston stated that he could not do that. It was the clear evidence of Michael Johnston that Chris Wiegand admitted that he had forgotten to call to reinstate coverage. It was argued that Chris Wiegand was not a credible witness. It was argued on behalf of West Wawanosh that he was a “smart aleck” in the manner in which he answered questions in his evidence. The evidence of Chris Wiegand was contradicted by the evidence of his father. It was the evidence of Chris that only the bookkeeper had access to the post office box but that was not the evidence of his father. It was the evidence of James Wiegand that he cleared the box and took documents to the bookkeeper. West Wawanosh argued that evidence as to the licence suspension of Chris Wiegand and as to an unpaid fine was how he handled affairs. It was suggested that he did not keep track of his obligations. For example, the address on his licence had not always been changed. Pink slips were not put in his vehicles. It was argued that his behaviour was consistent with his forgetting to call Michael Johnston to reinstate coverage in the spring of 2001. - 32 West Wawanosh argued that the evidence of James Wiegand was that he understood that coverage would be back on when Chris returned to Ontario. Yet, James Wiegand did not know the date when coverage was to be put back on and he did not get confirmation as to anything. West Wawanosh made reference to the case of Patterson v. Gallant (1994) 3 S.C.R. 1080 (S.C.C.). The case dealt with the issue as to an insurer mailing out an offer to renew coverage and including a new pink card. The finding in the Supreme Court of Canada was that a pink card or slip by itself does not bind the insurer in the absence of an underlying insurance policy. West Wawanosh argued that the provision of a pink slip in this case did not mean that there was a valid liability policy and coverage. It was argued on behalf of West Wawanosh that the facts in the case of Howey v. Ayre (2001) N.J. No. 246 (NFLD. C.A.), were similar to the facts in the subject case. In the Howey case, coverage for public liability and property damage and accident benefits was deleted at some point. It was alleged on behalf of the policyholder that he was not aware of the change because he did not read the document. West Wawanosh argued that the case stands for the proposition that when an insured receives a Certificate of Insurance and a refund and a new policy document, in effect, he has an obligation to read the same. West Wawanosh also referred to the case of Budd v. The Personal Insurance Company of Canada, 62 O.R. (3d) 715. It was argued on behalf of West Wawanosh that there is a difference between considering an interpretation of the Priority Dispute Rules and dealing with possible negligence and action against the broker. It was argued that there can be inconsistent results when considering those two issues. - 33 SUBMISSIONS OF COUNSEL FOR FEDERATION INSURANCE COMPANY Counsel for Federation Insurance Company also addressed the credibility issue relating to the evidence of Michael Johnston and Chris Wiegand. Counsel argued that both Michael Johnston and Chris Wiegand believed that they were correct in their recollection of the discussions between the two of them concerning the policy on the two vehicles. It was argued that Michael Johnston had few notes as to the discussions with Chris Wiegand in November 2000 when Chris Wiegand instructed Michael Johnston to remove liability and accident benefits coverage from the two vehicles. It was argued that Michael Johnston had no notes or few notes concerning the matter. There was the Acknowledgement of Policy Change dated November 22, 2000. Michael Johnston by that Notice advised West Wawanosh to delete all coverages and to add specified peril coverage to the two vehicles. Michael Johnston advised that that was the only notice to West Wawanosh and that nothing further with respect to reinstatement of coverage was sent to West Wawanosh until after the accident in question. The question was raised on behalf of Federation Insurance Company as to why the motor vehicle record search was done by West Wawanosh in March 2001 when there was no liability coverage in effect then. It was argued on behalf of Federation Insurance Company that it would have been better if Michael Johnston had better notes. It was argued that it would have been good business practice to make more notes. There should have been more notes as to the seasonable nature of the business of Chris Wiegand and more notes as to the - 34 removal of coverage or as to the reinstatement of the same. It was argued that Michael Johnston knew the nature of the business and that it was a seasonal business. His initial notes noted that the vehicles were used for business purposes and that the business operated between May and November each year. The notes at Tab 22 of the Joint Document Brief contained a note as to “May/Nov.” Since Michael Johnston also put a business policy into effect, he had to know the nature of the business. It was argued on behalf of Federation that when Chris Wiegand called in November 2000 to have liability coverage removed from the two vehicles that that should have brought about some “trigger” that coverage would have to be put back on in the spring. It was argued that Michael Johnston knew that the vehicles were used for business purposes and that Chris Wiegand would be returning following the winter break. It was argued that when the renewal documents came in and were sent out in March 2001, Michael Johnston gave evidence that he reviewed the new Certificate of Automobile Insurance and the Statement of Account before the documents were sent out as to coverage for the period between May 2, 2001 and May 2, 2002. Counsel for Federation questioned why Michael Johnston would not then have called Chris Wiegand and sent a note to Chris Wiegand since Michael Johnston should have known that Chris would be returning to Ontario in the spring of 2001 and that the liability coverage ought then to be put back on the two vehicles. - 35 It was argued that Michael Johnston could have simply put a “sticky” on the file as to there being no liability coverage so that there would be some follow up in respect of the same. It was argued that if there was an oversight, the professional involved was Michael Johnston. One would have thought that the broker would have noted the matter ahead and done something. Chris Wiegand relied on Michael Johnston for insurance coverage and would also have been relying on Michael Johnston for proper follow-up. Insofar as the new pink slip and Certificate of Automobile Insurance for the period commencing May 2, 2001, the pink slip made no reference to the insured vehicles. It was argued on behalf of Federation that Michael Johnston would be in a better position to spot such changes on the pink slip, to know that there was only comprehensive coverage and not liability coverage, than would be the case for Chris Wiegand. Counsel for Federation addressed the issue as to when Chris Wiegand came back to Ontario in the spring of 2001. He came back in the last week of April or early May. The issue was not when he returned home but when he expected his insurance liability coverage would be put back on his two vehicles. It was argued that in the mind of Chris Wiegand, the reinstatement of liability coverage would be automatic. Chris Wiegand, according to his evidence, thought that the liability insurance would be automatically put back on as at May 2, 2001. Counsel for Federation addressed the issue as to the premium payments which were being taken automatically out of the business account of Chris Wiegand. It was argued that Chris Wiegand left it to his bookkeeper to check the chequing account. It was - 36 argued that the low payments coming out would have been more of a trigger if they were taken from his own personal chequing account. It was argued that not noticing the actual amount of the premium payments was typical since we were talking about two months only, i.e. April and May of 2001. Chris Wiegand had given unfettered authorization for automatic deductions to be made and the insurer would deduct what it would deduct. It was argued that the average insured person would not notice the changes on the pink slip for the period commencing May 2, 2001. It was argued that there was no reason why Chris Wiegand would not put the liability coverage back on. He had income of approximately $108,000.00 per year. There was no reason for him to scrimp on insurance costs. It was argued that the fact that there were no vehicles referred to or described on the pink slip, would not lead most people to believe that there was no liability coverage. It was argued that the evidence of Chris Wiegand was consistent. It was argued on behalf of Federation that the onus was on West Wawanosh to prove its case. There is an issue as to how reasonable a person’s belief has to be. Although it is argued that a pink slip is not proof that insurance is in effect, the fact that there was a pink slip goes to support a reasonable belief that the insured person has that insurance coverage. Counsel for Federation made reference to the case of Bissoon v. Pilot Insurance Co. (1996) O.I.C.D. 237. This was a Decision of Arbitrator L. Blackman. At page 11 of the Arbitration Decision, Arbitrator Blackman made reference to the book, Insurance Law in - 37 Canada, by Brown and Menezes. Brown and Menezes sited a case of Gilvesy v. Mayorscak Insurance Agency Ltd.. That case is reported at (1978) 21 O.R. (2d) 836. That was a situation in which an insured person called the broker and advised that he was travelling to New York and that liability coverage was to be taken off the vehicle. The broker had a note of January 28 as to the removal of coverage but the insured actually flew out on January 31. The accident was on the 29th of January. The question was who had to bear responsibility. The insured thought that he still had coverage. There had been a failure to communicate between the parties. By reason of Gilvesy, there is reference to the following proposition: “Rather, it is one of policy: Who, as between two innocent parties, should bear the consequences of a failure to communicate information or of negligence or fraud. When both the third party and the principal are innocent, the burden falls on the principal. This is based on the assumption that the principal is obtaining a benefit from the existence of the agency relationship and must therefore accept certain associated risks”. Counsel for Federation also made reference to the case of Certas v. CGU/Aviva, an Arbitration Decision of Lee Samis dated December 5, 2005. Counsel for Federation argued that in the Certas case, the insured took off coverage. One month later, an 11 year old was hit by a car while on a bicycle. The 11 year old was a dependant of his father. The father was a named insured under a policy of insurance issued by Certas. The policy was issued for the term of August 1, 2002 to August 1, 2003. About a month before the accident, on August 22, 2002, the father communicated with his insurance company and requested that all “road coverages” on the insured vehicle be deleted and that only comprehensive coverage should be continued in force. - 38 The critical issue in the case was the paperwork used by Certas to attempt to accommodate the change. Certas did not use a “Suspension of Coverage” Form 16 and simply issued a new Certificate of Automobile Insurance. Arbitrator Samis examined the Certificate of Automobile Insurance sent out by Certas after the change in coverage was requested. Arbitrator Samis then discussed the form of endorsement which the Superintendent of Insurance approved. This was OPCF 16, Suspension of Coverage Form. Arbitrator Samis determined that the regulator has specified a particular “form to be used when a person intends to suspend the coverage except for Comprehensive Coverage.” Arbitrator Samis determined that the insurer had to use the approved form to change the coverage. Arbitrator Samis also determined that if the appropriate form had been used, Statutory Accident Benefits Coverage would have continued in effect. Arbitrator Samis concluded that accident benefits coverage was still in effect. Accordingly, it was argued on behalf of Federation Insurance Company that West Wawanosh failed to use the appropriate form to change coverage and so one should conclude that accident benefits coverage was available under the West Wawanosh policy. SUBMISSIONS OF COUNSEL FOR INSURANCE COMPANY IN REPLY WEST WAWANOSH MUTUAL Counsel for West Wawanosh submitted that it was not being alleged by West Wawanosh that Chris Wiegand was trying to drive with no insurance coverage. - 39 Simply, it is the position of West Wawanosh that he forgot to call Michael Johnston to reinstate coverage when he returned to Ontario in the spring of 2001. It was argued on behalf of West Wawanosh that it was unreasonable to suggest that Michael Johnston should have realized coverage should be reinstated when he reviewed the renewal documents in the spring of 2001. Counsel for West Wawanosh argued that numerous of the cases referred to were different than the subject case since, in the subject case, a new Certificate of Insurance had been sent to Chris Wiegand and a new pink slip had been sent to him whereas that did not occur in the other cases. It was also argued on behalf of West Wawanosh that this is not a case in which a broker got instructions to delete coverage and there was an issue as to the effective date of the same. In this case, Michael Johnston had never received instructions to put coverage back on. Counsel for West Wawanosh addressed the Samis Decision in Certas v. CGU/Aviva. It was argued that in that case, there were changes in coverage during the first year that the policy was in effect. It was not a renewal situation. It was argued that the documents in the Certas case were confusing. In the subject case, as the Certificate of Automobile Insurance at Tab 13 of the Joint Document Brief shows, the Certificate specifically talks about the deletion of coverage on both vehicles. The document is clear as well that the only coverage still in effect was for Specified Perils. CONCLUSIONS Having heard the evidence and having heard submissions of counsel as to what ought to be considered on this Arbitration, I have reached the conclusion that on the - 40 date of the subject accident, June 6, 2001, the West Wawanosh policy issued to Christopher Wiegand did not provide Statutory Accident Benefits coverage. Both counsel addressed the issue of credibility of the witnesses Michael Johnston and Chris Wiegand. At the end of the day, it is really the evidence of those two witnesses that I must consider when determining the outstanding issue between West Wawanosh and Federation. The evidence of James Wiegand was not really of any help to me whatsoever. James Wiegand is the father of Chris Wiegand. He knew that Chris had met with Michael Johnston to arrange insurance, but James Wiegand was really not directly involved with that. He knew that a policy had been put on the two vehicles commencing May 2, 2000. He knew that his son’s business was being shut down in November 2000 and that liability coverage was to be removed. But really, any of his evidence dealing with the issue of the instructions given by Chris Wiegand to Michael Johnston was not very clear. James Wiegand never reviewed the documents relating to insurance coverage at any time. It is interesting to note that James Wiegand talked about Chris returning to Ontario at the end of April. It is alleged by Chris Wiegand that coverage was to go back on the two vehicles as at May 2, 2001. Although it was the evidence of James Wiegand that it was his “understanding” that Chris would not have to do anything else in order to get coverage back on the two vehicles, I really cannot accept that “understanding” as evidence. - 41 It was also troubling that James Wiegand stated that he received copies of Certificates of Automobile Insurance and pink slips and that those were also addressed to him. All of the documents in the Joint Document Brief show those documents all addressed to Christopher Wiegand and not to James Wiegand. At the end of the day, the evidence of James Wiegand was that he was unsure of the exact date when coverage would be put back on for the two vehicles. Insofar as credibility is concerned, I find that the evidence of Michael Johnston was more credible than that of Chris Wiegand. Michael Johnston gave his evidence in a very businessman-like fashion. He was able to produce his initial notes as to his initial call from Chris Wiegand. Those were at Tab 22 of the Joint Document Brief. It was obvious that Michael Johnston had some background information as to the company operated by Chris Wiegand. He did know that it was a seasonal business operating from May to November and his notes at Tab 22 of the Joint Document Brief showed that. Importantly, the notes at Tab 22 made no reference to any discussions about putting the insurance on the vehicles and taking the insurance off at various times of year. When I consider the evidence of Chris Wiegand, I also note that on the Application for Automobile Insurance, he showed himself as the owner of the two vehicles, when it turned out that one of them was owned by his father. Coupled with that was his own admissions as to his review of the various Certificates of Automobile Insurance, pink slips, and statements of account. It is very clear from his evidence that he was certainly not careful in reviewing those documents. There was some issue as to - 42 whether he even removed the pink slip from the Certificate to put the same in his vehicle. Furthermore, when he was away out of Ontario from November to April or May in each year, all of his mail and bookkeeping documents went to a bookkeeper. Accordingly, he never really reviewed documents received within that timeframe. In addition, initially, Chris Wiegand gave incorrect information to Michael Johnston as to the number of traffic tickets he had. Once the record from Allstate was produced, his insurance premiums were increased. It was the evidence of Michael Johnston that he had no recollection as to any discussions with Chris Wiegand as to removing the vehicles from the road on a seasonal basis, at his initial meeting with Chris Wiegand in May 2000. There is no issue between Michael Johnston and Chris Wiegand about Wiegand advising Johnston in November 2000 that liability coverage was to be taken off the two vehicles as they were parked for the season. It was the evidence of Mr. Johnston that in his discussions with Chris Wiegand in November 2000, that he told Chris Wiegand that he would have to advise him when he was back in Ontario and wished the coverage back on. He clearly stated that that was all up to Mr. Wiegand. Mr. Johnston did not take notes as to when coverage would be put back on. That was not his practice. It was the clear evidence of Mr. Johnston that Chris Wiegand did not tell him when he would be back in business and need the coverage back on. It is the clear evidence of Mr. Johnston that he would have told Mr. Wiegand that Wiegand needed to call his office and request that the coverage be put back on. - 43 The Joint Document Brief contains copies of numerous documents. The initial Application for Automobile Insurance at Tab 2 shows that Chris Wiegand was not very careful in advising Mr. Johnston as to who the owner of the two vehicles was. He was wrong about the number of traffic tickets that he had. There were numerous documents provided to Chris Wiegand by West Wawanosh, most of which were initially reviewed by Michael Johnston. There was the initial pink slip providing coverage for the period between May 2 and June 2, 2000. There was an initial Certificate of Automobile Insurance showing all of the coverage on the two vehicles for the period between May 2, 2000 and May 2, 2001. The Certificate shows liability coverage since a premium is shown under that heading. There was also Accident Benefits coverage for which a premium is shown. There is Uninsured Automobile coverage for which a premium is shown. There is direct compensation coverage for which a premium is shown and there is Family Protection for which a premium is shown. That Certificate was sent to Christopher Wiegand. A new pink slip was provided showing two vehicles insured with a description of the two vehicles, covering the period May 2, 2000 to May 2, 2001. We were also provided with a void cheque of Island Haul A Way. There was an initial cheque covering a premium of $319.50. There was an original Statement of Account addressed to Chris Wiegand showing monthly payments of approximately $191.79 monthly. Those were taken automatically out of the Island Haul A Way account. Surely, Christopher Wiegand would have known the approximate amount of the debits to his account. - 44 After the call in November 2000, a new Certificate of Automobile Insurance was sent to Christopher Wiegand. That is the document at Tab 13 of the Joint Document Brief. I described the various coverages in the prior Certificate of Automobile Insurance. We now had credits shown under “liability”, “accident benefits”, “uninsured automobile”, under “direct compensation”, and under “Family Protection”. The only positive premium shown was under “specified perils”. That Certificate showed a credit of approximately $939.12. That Certificate was sent to Christopher Wiegand. A new Statement of Account was sent by West Wawanosh to Christopher Wiegand showing a negative premium reflecting the credit due. Furthermore, by letter dated November 29, 2000, at Tab 15 of the Joint Document Brief, there is reference to a refund cheque because of an overpayment, in the sum of $199.05. There is simply no issue or argument on behalf of Christopher Wiegand that coverages were removed in November 2000. Christopher Wiegand has never taken issue with that. Once the coverages were removed, the monthly payments were greatly reduced. At Tab 16 of the Joint Document Brief, there is a Statement of Account showing monthly premiums of $3.53 per month starting May 1, 2000. Surely, Christopher Wiegand would have or should have noticed that he was now being charged $3.53 a month compared to $191.79 per month. The new Certificate of Automobile Insurance at Tab 17 of the Joint Document Brief showed coverage only for “specified perils”, with a total premium of $40.00 plus tax. - 45 It was the evidence of Christopher Wiegand that his bookkeeper dealt with things while he was away. Surely, the bookkeeper would have known that the premiums had been greatly reduced. If the bookkeeper was not aware of that, or if there was some problem at that stage, one would have thought that the bookkeeper might have been called as a witness at the Hearing. We heard no evidence from him. In March of 2001, the new Statement of Account was sent to Christopher Wiegand showing the premium of $3.53 monthly. A new pink slip and Certificate of Automobile Insurance was sent to him at the same time. It was the evidence of Chris Wiegand that he told Michael Johnston that liability coverage was to be reinstated on the two vehicles on the renewal date of the policy, i.e. May 2, 2001. He claims that he told Michael Johnston that in November 2000. That is when he had the liability coverage removed from his two vehicles. In reaching my conclusions, I must choose between the evidence of Michael Johnston and Chris Wiegand. Did Chris Wiegand advise Michael Johnston that liability coverage was to be reinstated on the two vehicles on the renewal date of the policy, i.e. May 2, 2001? I do not accept that evidence of Chris Wiegand as I prefer the evidence of Michael Johnston in that regard. It was the clear evidence of Chris Wiegand that he expected that West Wawanosh would reinstate liability coverage in May 2001. He said that there was no question about that in his mind and that he expected that he would have full coverage. There was troubling evidence of Chris Wiegand that he looked at the Certificate of Automobile Insurance prior to the subject accident. He said that he saw a - 46 pink slip and felt that that meant that he had insurance. He did not read those documents, it appears. That evidence was not that surprising since Chris Wiegand admitted that he never did see the documents when coverage was changed in November 2000. We also have a situation in which Chris Wiegand would not advise Michael Johnston ahead of time as to when coverage would be removed in the fall of 2000 as he was uncertain when he would stop working in the fall of each year. Accordingly, that is why he telephoned Michael Johnston in November 2000 and told him when to remove coverage. There was no specific date on which Chris Wiegand would return to Ontario each spring. His evidence was that he returned home on April 24, 2000. I found that his evidence was strange in that he would pick a reinstatement date ahead of time in November 2000, of May 2, 2001. May 2, 2001 was a Wednesday. Would it make sense that he would have picked a renewal date in mid-week in the first week of May, at a point when he had no idea as to the exact date of his return? Why would he do that when he could simply by telephone advise Michael Johnston when to put coverage back on? Accordingly, based on the evidence of the two witnesses, Michael Johnston and Chris Wiegand, I prefer the evidence of Michael Johnston and I accept his evidence over that of Chris Wiegand. Another troubling aspect of the evidence was the evidence of Michael Johnston that following the accident, Chris Wiegand telephoned him, Chris Wiegand admitted to Michael Johnston that he realized that he had not called and had forgotten to - 47 do so. It was also the evidence of Michael Johnston that Chris Wiegand asked him to backdate coverage and that Michael Johnston stated that he could not do that. In his evidence, Chris Wiegand did not deal with that evidence of Michael Johnston. He did not deal with Michael Johnston’s evidence that Chris Wiegand had admitted that he had not called and had forgotten to do so. He did not deal with the evidence of Michael Johnston that he had asked Michael to backdate coverage. Insofar as the various Certificates of Automobile Insurance, I find that they are very clear on their face. I agree with the findings in the case of Howey v. Ayre, that when an insured receives insurance documents, an insured has an obligation to read the same. It was argued on behalf of Federation Insurance Company that there was an obligation on the part of Michael Johnston to take positive steps as to the date of reinstating liability coverage, when Michael Johnston knew that he was dealing with a seasonal business. However, only Chris Wiegand would know when he was leaving Ontario and when he was returning to Ontario. The issue in this case was not whether liability coverage was removed from the two vehicles in the fall of 2000, the issue was whether or not Chris Wiegand had instructed Michael Johnston to put the coverage back on at some point. I find that that was not the case. The facts in this case are unique to this case and are slightly different than those in the case of Certas v. CGU. I find that any failure of West Wawanosh to use a Suspension of Coverage form does not mean that accident benefits coverage was in effect in this case, at the time of the subject accident. - 48 Although the documents in the Certas case are perhaps unclear, the documents in this case were not unclear. In the subject case, there was no issue that the liability coverage and accident benefits coverage were properly removed in November 2000. Accordingly, the result in the Certas v. CGU case does not apply to the subject case. Accordingly, as set out above, I find that the West Wawanosh policy did not contain accident benefits coverage at the time of the subject accident. We will shortly arrange for a telephone conference call at which time the parties can argue the issue of Costs. DATED this 19th day of December, 2007. Stephen M. Malach, Q.C., Arbitrator