Supreme Court of Appeal of South Africa

advertisement

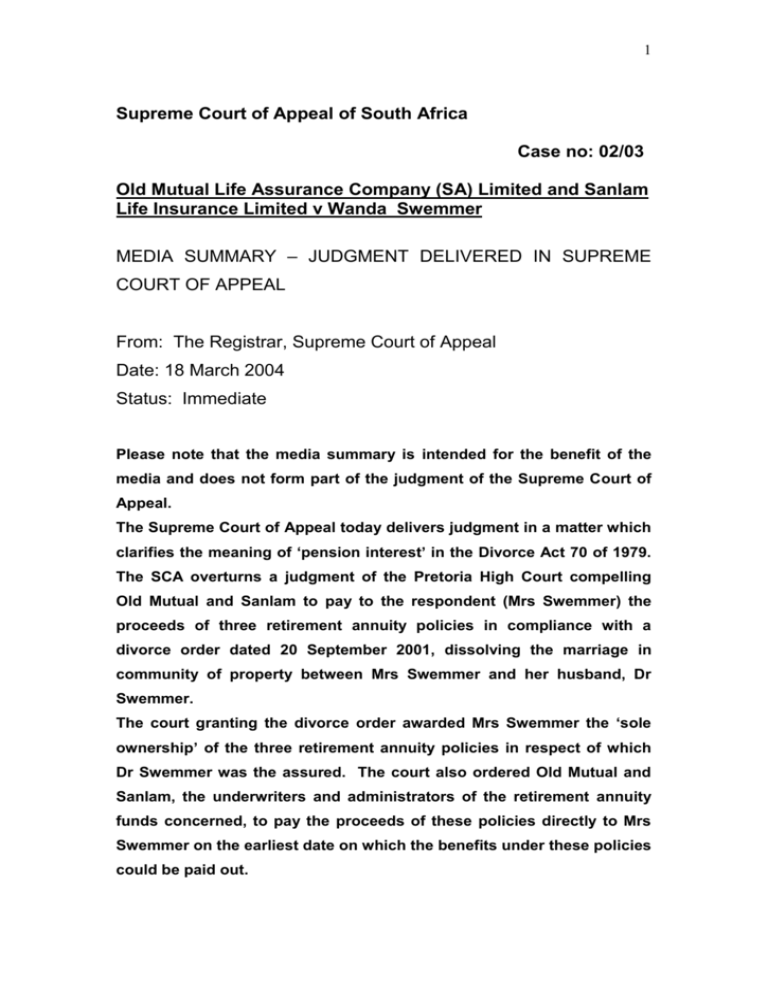

1 Supreme Court of Appeal of South Africa Case no: 02/03 Old Mutual Life Assurance Company (SA) Limited and Sanlam Life Insurance Limited v Wanda Swemmer MEDIA SUMMARY – JUDGMENT DELIVERED IN SUPREME COURT OF APPEAL From: The Registrar, Supreme Court of Appeal Date: 18 March 2004 Status: Immediate Please note that the media summary is intended for the benefit of the media and does not form part of the judgment of the Supreme Court of Appeal. The Supreme Court of Appeal today delivers judgment in a matter which clarifies the meaning of ‘pension interest’ in the Divorce Act 70 of 1979. The SCA overturns a judgment of the Pretoria High Court compelling Old Mutual and Sanlam to pay to the respondent (Mrs Swemmer) the proceeds of three retirement annuity policies in compliance with a divorce order dated 20 September 2001, dissolving the marriage in community of property between Mrs Swemmer and her husband, Dr Swemmer. The court granting the divorce order awarded Mrs Swemmer the ‘sole ownership’ of the three retirement annuity policies in respect of which Dr Swemmer was the assured. The court also ordered Old Mutual and Sanlam, the underwriters and administrators of the retirement annuity funds concerned, to pay the proceeds of these policies directly to Mrs Swemmer on the earliest date on which the benefits under these policies could be paid out. 2 Mrs Swemmer obtained an order against Old Mutual and Sanlam compelling them to pay her the proceeds of the three retirement annuity policies in compliance with the divorce order. The High Court (Pretoria) held that Mrs Swemmer had effectively replaced Dr Swemmer as the member of the retirement annuity funds concerned and thus had the right to ‘call up’ the policies on the earliest date provided for in the rules of these funds, viz the date on which Dr Swemmer attained the age of 55 years (2 December 2001). On appeal, the Supreme Court of Appeal concluded that this was not correct. In terms of sections 7(7) and 7(8) of the Divorce Act, as amended in 1989, the court granting a decree of divorce only has the power to order that a specified part of the ‘pension interest’ of the member spouse must be paid by the pension fund (including a retirement annuity fund) concerned to the non-member spouse when the pension benefits accrue in respect of the member spouse. ‘Pension interest’ is narrowly defined in the Divorce Act and simply establishes a method of ascertaining the ‘value’ of the interest of the member of the pension or retirement annuity fund concerned as accumulated up to the date of the divorce. There is no provision in the relevant sections of the Divorce Act for the pension or retirement annuity fund in question to be ordered to pay to the non-member spouse interest or capital growth on the portion of the ‘pension interest’ allocated to that spouse from the date of divorce to the date of eventual payment. Even if the court orders that 100% of the ‘pension interest’ of the member spouse in a specified fund or funds be awarded to the other spouse, the latter does not become the ‘owner’ of the policy or of the unaccrued pension benefits, does not replace the member spouse as a member of the fund, and cannot therefore exercise any right of the member spouse to anticipate (or postpone) the agreed maturity date of the policy. Exactly the same applies where the order made by the court relates to less that 100% of the pension interest of the member spouse. The relevant parts of the divorce order were thus in conflict with the provisions of sections 7(7) and 7(8) of the Divorce Act and could not be enforced against the retirement annuity funds in question, let alone 3 against the underwriters and administrators of these funds. The appeal by Old Mutual and Sanlam was accordingly upheld. This summary forms no part of the court’s judgment. *** ---ends---