July 2013 - Spirits.eu

advertisement

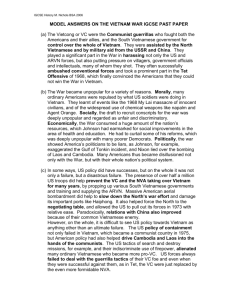

VIETNAM POSITION SUMMARY 05 July 2013 CP.CE-072-2013 EU WINE AND SPIRITS TRADE PRIORITIES FOR EU-VIETNAM FTA Cf. CP.CE-057-2012 KEY MESSAGES ● ● ● ● ● ● ● ● IMPORT TARIFFS: Full tariff elimination for imported wine and spirits. RULES OF ORIGIN: Adoption of rules of origin that take into account the logistical organization of the industry (regional hubs). EXCISE TAX SAFEGUARD: Secure the tariff elimination by making sure it would not be jeopardized by subsequent excise tax increase. NON-TARIFF BARRIERS: Removal of regulatory measures inconsistent with Vietnam WTO commitments. GEOGRAPHICAL INDICATIONS (GIS) AND IPR: Recognition and protection for EU GI spirits and wine and efficient enforcement of IPR protection. TRACEABILITY INFORMATION: Legal protection of traceability information voluntarily put on the products by the producers. ALCOHOLIC DRINKS DEFINITIONS: Adoption of wine and spirit definitions compatible with EU and internationally recognised standards. CUSTOMS VALUATION: Adoption of practices in line with the WTO agreement on customs valuation. Vietnam is a priority market for the European wine and spirits industry. A middle-income country with a large – and growing – drinking population, Vietnam remains a market with a strong potential that has not been completely fulfilled. The Vietnamese spirit market is estimated at more than 2 million nine-litre cases and the wine market at around 1.3 million nine-litre cases. Imported spirits consumption has increased 3.5 times between 2002 and 2012, whereas total spirit consumption has experienced a 10-fold increase1 over the same period. Therefore, further significant growth in consumption of imported wine and spirits is expected over the coming years, as more and more Vietnamese consumers can afford premium imported drinks as a result of both tariff reduction and the rise of a strong upper and middle-income class2. 1 2 Source: IWSR figures, May 2012. See annex 2 for more information on the Vietnamese market spiritsEUROPE B-rue Belliard, 12 | 1040 Brussels Tel. : +32 (2) 7792423 | info@spirits.eu 1 I. FULL ELIMINATION OF IMPORT TARIFFS The elimination of import tariffs is the key priority for the wines and spirits industry. CEEV and spiritsEUROPE seek the full elimination of tariffs on European wine and spirits upon the entry-intoforce of the agreement. As part of its WTO accession, Vietnam agreed to reduce its tariffs on spirits to 45% in 2013 (from 48% in 2012). This 2013 rate should be the starting point for the negotiations. Vietnamese Import Tariffs on Beverage Alcohol Beverage Beer Wine Spirits 2013 Tariff Rate 35% 50% (still/sparkling) 55% (other) 45% Source: CEPS This priority is all the more essential since Vietnam is engaged in a FTA negotiation with leading wine and spirits exporters, namely the United States and Australia, via the TransPacific Partnership (TPP) negotiations. Currently holding a significant market share, the EU wine and spirits sector needs to secure tariff liberalisation sooner than our international competitors to comfort and improve their position on the market. Moreover, tariff liberalisation would be in the Vietnamese government’s self-interest: according to industry estimates, a large share of imported alcohol enters the Vietnamese market without full payment of duties and taxes, resulting in significant revenue losses for the government. High import tariffs and excise taxes create major incentives for smuggling imported spirits. A vivid example of the benefits of tariff liberalisation would be China’s tariff reduction on spirits from 65% to 10% between 2000 and 2007. Combined with relatively low excise tax rates, it has led to a massive growth in legal spirits imports (from US$30 million to roughly US$500 million), and greatly increased government overall revenue collections (from US$ 30 million to US$265 million, including import tariffs, special consumption taxes, and VAT). II. RULES OF ORIGIN The wine and spirits sectors considers it of the utmost importance to secure rules of origin (ROO) that allow for the use of regional hubs – a cornerstone of some industry members’ supply chain model that provides for economies of scale – while retaining the eligibility for the preferential tariff rate agreed in the FTA. The previous language used in EU FTAs does not permit any processing or manipulation of exports in third countries before arrival in the importing country, other than loading and offloading of a vessel. This has notably been an issue in the EU-Korea FTA - the first FTA in the Asian region where hubs are mostly used - and keeps on being negotiated after the implementation of the Agreement. Appropriate ROO is key to the growth of European exports in the region since the hub model is a necessity to keep pace with modern supply chain models. Asian hubs, such as Singapore, enable the industry to consolidate shipments of non-country specific bottles, and apply country-specific back labels and tax stamps (where required). This model significantly decreases order fulfilment time for customers, provides for significant cost savings, and adds flexibility. This issue has been raised with the European Commission and it has been confirmed to us that the standard “direct transport clause” of future FTAs had been amended so as to allow a splitting of spiritsEUROPE B-rue Belliard, 12 | 1040 Brussels Tel. : +32 (2) 7792423 | info@spirits.eu 2 CEEV B-avenue des Arts 43 | 1040 Brussels, Tel. : +32 (2) 7792423 | ceev@ceev.be consignment as well as a third party invoicing in the FTA. We would very much appreciate clarification as to the wording and application in practice. This issue being very technical, making sure that we get the rules of origin right requires time and extensive consultation. III. EXCISE TAX SAFEGUARD We would like to stress that current excise taxation is based on a Special Consumption Tax, consisting in an ad valorem excise tax of 50% for all spirits of 20% abv or greater3. Although this is part of the WTO accession package of the country – it had agreed to lower the threshold from 40% abv to 20% abv, therefore allowing for the coverage most of Vietnamese spirits – the ad valorem system in itself penalizes high-value products. This bias has worsened since last year, when the excise tax rate was 45%. The industry would favour a specific tax system based on alcohol content that permits for the elimination of the discrimination against high-value imported products enshrined in the ad valorem scheme. Moreover, this increase in excise tax rate could be linked to the 2013 decrease in tariffs, therefore suggesting a risk to see the potential benefits of an FTA tariff liberalisation nullified by an increase in excise tax. Therefore, we would appreciate if the Commission could tackle the relationship between tariff liberalisation and domestic taxation in the framework of the FTA negotiations. We understand that the standard FTA language incorporates GATT Article III: National Treatment on Internal Taxation and Regulation and its interpretative notes into the scope of the FTA. To this extent, we would greatly appreciate it if the Commission could consider securing under those provisions a specific commitment or acknowledgement by Vietnam that the national treatment extends to matters of indirect taxation, similar to the approach adopted in the EU-Colombia FTA. IV. NON-TARIFF BARRIERS The increase in European wine and spirits exports could be undermined by the persistence or creation of non-tariff barriers by the Vietnamese government that contradict the WTO commitments of the country. We are especially wary of the new licensing scheme put in place by the Vietnamese authorities in 2013 (Decree 94/2012/ND-CP). By preventing operators from holding at the same time distributor, wholesaler and retailer licenses; restricting the importation to distribution licence holders and imposing a quota on the number of licenses available, the new system could threaten the operations of foreign companies in Vietnam. On top of appearing non-WTO compliant, these measures contradict the commitment of Vietnam to open up its market in the framework of the upcoming FTA. While acknowledging that the mere respect of WTO obligation is not a trade negotiations goal, we believe that the FTA talks constitute a powerful leverage to address WTO violations – as it has previously been the case for the EU-Colombia FTA – and we would greatly appreciate if the Commission used the opportunity of the FTA to solve the licensing issue before the conclusion of the agreement. 3 See Annex 2 for more information on the Special Consumption Tax spiritsEUROPE B-rue Belliard, 12 | 1040 Brussels Tel. : +32 (2) 7792423 | info@spirits.eu 3 CEEV B-avenue des Arts 43 | 1040 Brussels, Tel. : +32 (2) 7792423 | ceev@ceev.be V. GEOGRAPHICAL INDICATIONS AND IPR PROTECTION Protection of European geographical indications (GIs) could be enhanced: while Vietnam has taken some positive steps, such as recognition of some EU GIs, we believe there is room for improvement. We strongly support protection of a short list of key EU spirits GIs, similar to the successful outcome reached in the EU-Korea negotiation. Moreover, in the framework of the TransPacific Partnership negotiations - where other countries might want to negotiate lesser protection of GIs - it is important to make sure the issue is raised with the Vietnamese authorities. The wine and spirits sectors believe that current Vietnamese enforcement of IPR laws is inefficient, with long proceedings leading to unreliable and unpredictable protection. The Vietnamese Government itself acknowledges the unacceptably high prevalence of contraband and counterfeit goods. Significant volumes of goods are smuggled, a share of it being counterfeited, and counterfeit products are also being produced in Vietnam, for domestic consumption and export. The volume of counterfeit spirits is naturally difficult to quantify but it has been estimated that up to 20% of the spirits currently available in the market place are counterfeit. VI. TRACEABILITY European producers, abiding by EU law and following Codex Alimentarius guidelines, place a lot code on individual packages to be able to trace their products backward and forward in the supply chain. This allows to conduct an effective and targeted product recall if need be. Lot codes are mandatory for the circulation of foodstuff in the EU and tampering with them is forbidden. In Asia, traceability information are not being protected from tampering or blurring by any kind of legislation and smugglers routinely destroy lot codes to ensure their sales cannot be traced back to them. This breach in the traceability is detrimental to consumers in these countries, and is highly detrimental to producers since any safety issue would trigger a vast call back of products, or worsecase scenario could lead to a complete shutdown of a market. Traceability is key to building confidence towards our products in a region prone to food scandals and goods smuggling, and it should be considered as a tool against a protectionist reflex and a long-term insurance to keep market open. EU spirits producers seek legal prohibitions on the removal of traceability information (i.e. “decoding”) to help discourage informal activities, and ensure the authenticity of our brands and protection of our consumers. We would greatly appreciate it if the European Commission could open a dialogue on this issue aiming at the protection of EU producers’ lot codes by Vietnamese legislation. We would not support the introduction of a new-country specific coding requirement which would duplicate requirement we already conform to: forbidding to tamper with EU lot codes is the cost effective way to protect consumers. The EU could share with Vietnam the depth of expertise it has in this field especially since Member States implementation of traceability requirement offers a wide range of enforcement examples. VII. ALCOHOLIC DRINKS DEFINITIONS There is no legal definition for most spirits in Vietnam. This lack of definition can be problematic from a commercial standpoint when local products make use of names without satisfying European/international standards. It is especially detrimental to the industry when it leads the country to favour compliance with analytical criteria, i.e. criteria based on the product/product spiritsEUROPE B-rue Belliard, 12 | 1040 Brussels Tel. : +32 (2) 7792423 | info@spirits.eu 4 CEEV B-avenue des Arts 43 | 1040 Brussels, Tel. : +32 (2) 7792423 | ceev@ceev.be components and not on the production method. For example, in March 2010 a Scotch Whisky was found to exceed the maximum permitted level of aldehydes when tested for compliance with an inappropriate standard (‘flavoured spirits’). It was followed by negative press reports about levels of aldehydes in imported spirits affecting not only Scotch Whisky but all ‘brown’ spirits. In April 2010, Vietnam notified a new standard to the WTO4 that would have prevented the sale of virtually all EU brown spirits (whiskies, brandies, wine spirits etc) on the Vietnamese market. Although this particular TBT has been resolved and the aldehyde limit for spirits removed, this episode is a clear example of the need to adopt appropriate alcoholic drink definitions. The industry would favour the adoption by Vietnam of definitions based on raw materials and methods of production, an approach consistent with the one adopted by most of the world’s major spirits producing and exporting countries. Should Vietnam insist on keeping analytical parameters, it is essential to closely monitor Vietnamese legislation to make sure it does not exclude any genuine EU products. The industry would support a dialogue between the EU and Vietnam in the context of the FTA to bridge the gap between their regulatory systems on alcoholic beverages and favour compatibility. VIII. CUSTOM VALUATION The use of reference prices for imported goods results in de facto minimum import values. This is in violation of the WTO Agreement on Customs Valuation and triggers higher customs duty amounts. By way of example, Vietnam maintains a ’check price’ database for imported beverage alcohol brands and this has raised issues for industry over the years. Accordingly, the Industries support the inclusion of language that incorporates the WTO Agreement on Customs Valuation as an integral part of the agreement, subject to the dispute settlement provisions of the FTA. 4 (ref G/TBT/N/VNM/10). This “National technical regulation on food safety for Alcoholic beverages”, issued by the Ministry of Health, established “analytical parameters” for alcoholic drinks, i.e. setting arbitrary upper limits on naturally occurring chemical components in spirits, such as the above-mentioned aldehydes. spiritsEUROPE B-rue Belliard, 12 | 1040 Brussels Tel. : +32 (2) 7792423 | info@spirits.eu 5 CEEV B-avenue des Arts 43 | 1040 Brussels, Tel. : +32 (2) 7792423 | ceev@ceev.be ANNEX 1 – Additional information on the Vietnamese market In 20115, the Vietnamese market for all alcoholic beverages continued to develop. Beer led growth, due largely to the availability of inexpensive locally-made products, followed by wine: The total consumption of beer in 2012 was said to exceed 31 million HL. The estimated wine consumption in 2012 should be around 1.3 million nine-litre cases, of which only 140,000 cases are locally produced. The wine market continued its dynamic development due to the expansion of wine boutiques, retail outlets and the growing number of tourists. The Vietnamese spirit market is estimated to reach more than 2 million nine-litre cases, led by the growing consumption of whisk(e)y - still dominant in the north, Cognac - still dominant in the south and vodka (locally produced for its vast majority). The Vietnamese alcohol market aches from the considerable amount of non-recorded production of alcohol (350-400 million litres/year) that the Vietnamese government is trying to get control over: it delivered 127 alcohol production licenses for a total capacity of 130 million litres/year. It is estimated that there will be an additional 10 million consumers by 2015, while tourism is the country is growing (+8.5% between 2011 and 2012). Source: Eurostat NB: This graphs highlights EU direct exports to Vietnam. Because Eurostat data record only direct shipments from the EU to Vietnam, they significantly underestimate the volume of EU spirits exports. Thus, they overlook the vast volumes transiting through third countries, notably the regional hub of Singapore, which explains the enormous amount of EU spirits exports to Singapore (ca € 854 million in 2011) relative to the small size of its domestic market. 5 Source : ISWR spiritsEUROPE B-rue Belliard, 12 | 1040 Brussels Tel. : +32 (2) 7792423 | info@spirits.eu 6 CEEV B-avenue des Arts 43 | 1040 Brussels, Tel. : +32 (2) 7792423 | ceev@ceev.be ANNEX 2 – Vietnamese Excise Taxes on Beverage Alcohol Beverage Beer Wine Spirits <20° abv Spirits >20° abv 2012 Excise Tax Rate 45% 25% 25% 45% 2013 Excise Tax Rate 50% 25% 25% 50% Technical background: a) Until early 1996 Special Consumption Tax (SCT) applied to domestic products only, but since then it has been levied on imports, on the basis of the duty paid value (dpv). As regards local products, SCT may be levied at various stages during their production or processing. Any such tax paid is credited in the calculation of SCT in respect of subsequent sales; the authorities' intention is that SCT should be paid once only in respect of each item of goods. The 'taxable value' of local products is their production cost plus profit margin (i.e. ex factory price before application of SCT). Where the exact unit production costs are not known, the 'taxable value' (and hence the SCT) is deduced from the ex-factory price by the following formula: ex-factory price = taxable value 1 plus tax rate* (*i.e. 1.45 or 1.25 depending on strength of product) b) Prior to January 2010, the SCT differentiated between products at or over/under 40% vol. Now the differential is between those at or over/under 20% vol. Alcohol is alcohol and therefore should be taxed on the same basis. spiritsEUROPE position of principle for all markets is that specific is the best system. In any event, the Vietnamese ad valorem tax regime would appear to be out of line with that approach to alcohol excise taxation. c) Until now, the whole Vietnamese tax regime was ad valorem based and the Ministry of Finance considered that for a matter of coherence and simplicity, it would be counterproductive to introduce a specific taxation for one specific type of production. This position evolved: the National Assembly has adopted in November 2010 the Environmental Protection Tax Law (EPTL) that has come into force on January the 1st 2012 and that applies an "amount of environmental protection tax payable equal the quantity of unit of dutiable goods multiply absolute rate specified on a unit of goods”. spiritsEUROPE B-rue Belliard, 12 | 1040 Brussels Tel. : +32 (2) 7792423 | info@spirits.eu 7 CEEV B-avenue des Arts 43 | 1040 Brussels, Tel. : +32 (2) 7792423 | ceev@ceev.be ANNEX 3 – Additional background information on other trade irritants The enhanced bilateral dialogue resulting from the FTA negotiations could be used to remove the WTO non-compliant measures set up by the Vietnamese government. Keeping those measures in place would contradict the commitment of Vietnam to open up its market in the framework of upcoming FTA. New decree on Liquor production and trading - Decree 94/2012/ND-CP On 12 November 2012, Vietnam adopted its Decree 94/2012/ND-CP regulating Liquor production and trading. This Decree replaces Decree 40/2008/ND-CP and entered into force on 1 January 2013. This Decree had been under revision for the past year. It was notified to the WTO TBT Committee and EU wine and spirits exporters were grateful for the opportunity to provide comments to the draft. Two key concerns had emerged from these discussions. First, as initially drafted the Decree would have required that market-specific labels be applied prior to export (i.e., at the production site), rather than prior to introduction into the national customs territory (i.e., in a customs warehouse in Vietnam) as it is now currently the case. Such a change would have bene extremely costly to EU exporters. EU wine and spirits exporters were grateful that this requirement has been eliminated in the final version of the text but remains vigilant as other attempts are not unlikely. Second, the Decree provides for a new licensing regime. We believe that this regime will create barriers to the distribution/sale of imported alcohol products into Vietnam. The law itself took effect as of 1 January 2013. Decree 94 allows traders to possess only one type of license (distribution, wholesale or retail). By doing so this establishes a limit on the range of services that foreign operators can provide; no such restrictions apply to local producers for the type of activity they can undertake for the products they produce. Secondly, import rights will be given only to distribution license holders. In conjunction with an obligation to have only one license, importers will be effectively prohibited from engaging in any other activities other than distribution (e.g. wholesale activities, such as selling to supermarkets, stores, bars, restaurants etc). In theory, the multi-national entity may need to create a second company (same owner) to be a wholesaler for this purpose. Finally Decree 94/2012 establishes a quantitative limit on the number of distribution, wholesale and retail licenses, based on population. Restricting the number of licenses will create a secondary market for the licenses themselves and limit distribution options, particularly in under-populated, rural areas. Although, under the proposed system, companies that currently hold a license would have priority when renewing them, the quota system would have a serious negative impact on any new operators willing to enter the market (as the number of licenses might not be sufficient). These provisions seem inconsistent with the obligations of Vietnam under their WTO commitments in the General Agreement on Trade in Services (GATS). Moreover, the measures in question would modify the conditions of competition in Vietnam to the detriment of imported products, contradicting, therefore, a National Treatment obligation under the General Agreement on Trade in Goods 1994, Article III. We would encourage the Commission to address these issues with Vietnamese authorities through available multilateral and bilateral channels. spiritsEUROPE B-rue Belliard, 12 | 1040 Brussels Tel. : +32 (2) 7792423 | info@spirits.eu 8 CEEV B-avenue des Arts 43 | 1040 Brussels, Tel. : +32 (2) 7792423 | ceev@ceev.be Discriminatory Ban on Advertising Vietnam prohibits the advertising and promotion of wines and spirits exceeding 15% vol in virtually all media. We would welcome the elimination of all discrimination in order to ensure market access on equal terms for all products, knowing that products above 15% abv are predominantly imported while most local products (beer) are bottled at 15% a.b.v. or less. It is also understood that Ho Chi Minh City (HCMC) does not allow the advertising on television of any imported alcoholic beverages exceeding 4.5% abv, but it does allow advertisement of local products not exceeding 15% abv. Discriminatory Ban on products over 30% vol in certain outlets in Ho Chi Minh City (HCMC) In late 2002, the People’s Committee of HCMC promulgated decisions No 105 and 106 restricting the sale of alcoholic beverages over 30% vol. Dance halls and karaoke bars in the city are prohibited from selling alcoholic beverages above 30% abv, a measure especially detrimental to imported spirits. Other issues of relevance The industry has lately witnessed a number of measures which could signal a protectionist trend: the publication of a list of goods “not encouraged to import” (MOIT Decision 1380/QD-BCT). spiritsEUROPE B-rue Belliard, 12 | 1040 Brussels Tel. : +32 (2) 7792423 | info@spirits.eu 9 CEEV B-avenue des Arts 43 | 1040 Brussels, Tel. : +32 (2) 7792423 | ceev@ceev.be

![vietnam[1].](http://s2.studylib.net/store/data/005329784_1-42b2e9fc4f7c73463c31fd4de82c4fa3-300x300.png)