Payments via Imprest account procedure

advertisement

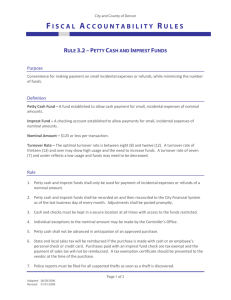

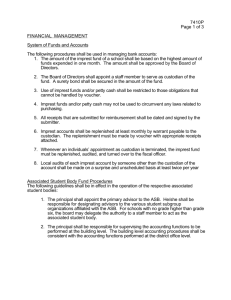

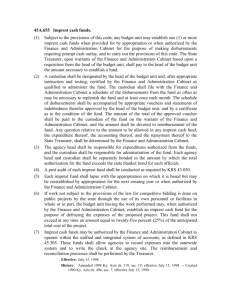

Procedure Payments via imprest account Introduction Imprest accounts are used to provide offices/units with easy access to cash/cheques for urgent purposes or where no bank account is available for the payment. The Oracle Accounting system (FIMS) or Purchase Card MUST be used to issue payments for goods/services received. For tax purposes Norfolk County Council has to be able to maintain expenses and benefit records in a structured way and be able to demonstrate to the tax inspector (should they choose to visit) that expenses are wholly, necessary and exclusively incurred for business purposes. Therefore staff should not be reimbursed via the Imprest system. Expenses such as travel and subsistence should be paid via the payroll because of the complications with tax. This is because expense claims include both a signed declaration by the claimant and authorisation by a more senior officer. They are also filed appropriately. No one person should be responsible for running the Imprest System unless there is only one member of Business Support staff. The daily transactions and the monthly reconciliation should be undertaken by different members of staff. In all cases the monthly reconciliation should be signed by the staff member reconciling the account and the Responsible Budget Officer, or a delegated person who is independent of the daily transaction process, to say that they agree everything balances and the expenditure is correct and appropriate. Access to the Petty Cash keys should be restricted to staff authorised to operate the petty cash system and should be locked away, preferably in another part of the building, or removed from the building when the Business Support staff leave the premises. All authorisation documentations (Expenditure Proposal Form (EPF) or Proforma Invoice) should be signed by the Responsible Budget Officer or a member of staff with Delegated Authority. See Appendix B – Procedure for Completing an Expenditure Proposal Form. The Responsible Budget Officer may delegate authority to other members of staff. A delegated signatory list (CS(FIN)003) should be completed with the amount permitted to be delegated and signed by the RBO and member of staff. This list should be checked and updated regularly, especially when changes in staff occur. No expenditure will be reimbursed unless there is an authorised EPF and valid receipt. A VAT receipt should be obtained where appropriate. If reimbursement is required for a split VAT receipt this should be shown on the system. See Appendix C – Claiming VAT on Petty Cash Expenditure. Payments permitted to be made via Imprest system are shown on Appendix A – Procedure for Use of Imprest Account. For payments over £100, the use of the Imprest account is permitted after contacting Children’s Services Finance team for authorisation, and all other payment methods have been reviewed, ie FIMS, journal or purchasing card. An exception to this is the Leaving Care Grant which can be paid out without contacting Finance team. Emergency Payments These may be made via the Imprest accounts rather than FIMS system provided that authority has been given by Children’s Services Finance Team. If agreement is given the EPF should be annotated with EMERGENCY PLACEMENT/PAYMENT. Version: 01 Doc Ref: 0825 Page 1 of 11 Procedure Payments via imprest account If reminder invoices are received for urgent payment then FIMS should be checked to ensure payment has not already been made and invoice annotated to this effect with the signature of the staff member doing the check.. The cash tin should be counted regularly (at least once per week) or when handed over to another member of Business Support staff and checked for agreement with the recorded Imprest account details at that point in time. A cash handover sheet should be generated and completed, printed and signed by staff member. This record of checks should be kept within the Imprest folder. Reimbursements should be processed within the first two weeks of the month so that the account does not go overdrawn. Independent spot checks of the Imprest System should be carried out and recorded on a quarterly basis. All paperwork should then be sent to the Children’s Services Finance Team for checking. During the spot check the Imprest level should be reviewed and checked to see if it is 3 times the average monthly spend. If changes are required then the Children’s Services Finance Team should be contacted to arrange the increase or decrease. Any concerns over the validity or appropriateness of payments via the Imprest System should be reported to the Children’s Services Finance Team. Documents CS(FIN)001 Expenditure Proposal Form (EPF) CS(FIN)002 Recurring Payment Log CS(FIN)006 Cash Transaction Record Sheet CS(FIN)004 & CS(FIN) 005 Cash Count Sheet Proforma Invoice (recurring payments) Petty Cash Voucher Signatory Lists Signatory Lists Each office should hold up-to-date signatory lists within their EPF folder as follows: Bank Account signatories (copy) Purchase to Payments Authorised Officer List (copy) CS(FIN)003 Delegated Authority List (original) Payments Payments are made by cash or cheques at the discretion of the person operating the imprest account. Under no circumstances are loans to be made or cheques cashed from petty cash. Version: 01 Doc Ref: 0825 Page 2 of 11 Procedure Payments via imprest account All requests for payment MUST be accompanied by a properly authorised EPF, indicating method of payment and budget to be used. The budget must be within the authority of the signatory (eg staff cannot authorise more monies than their delegated amount and operational staff cannot sign to Support budgets). (See Appendix B for procedure for Completing an EPF.) Payment shall only be made upon submission of the appropriate receipt. Proper VAT receipts should be obtained where appropriate to enable the tax element to be reclaimed by the County Council. A Petty Cash voucher should be completed for every cash expenditure. The completed voucher should include: The name of the person receiving reimbursement A description of the goods/services with itemised amounts and must show the VAT element if the purchase meets the criteria to claim VAT (See Appendix C) The total amount (in figures and words) Signature of the person receiving the money and the date received (this should be the same as the person receiving the reimbursement) Each voucher should be numbered consecutively If there is only one member of Business Support staff signing the cheque, the writing of cheque should be undertaken by 2 members of staff when the EPF is processed. One should complete cheque details from information on EPF and the second should check the details are correct and then sign. Any payment over £100 is not to be encouraged. Cheques, with very rare exceptions, should not be written for over £200. All expenditure payments over £100 are to be authorised by Children’s Services Finance Staff for payment via the Imprest Account. At NO time should blank cheques be signed and held in the cash tin. Partially completed and returned cheques should be crossed through and marked either ‘VOID’ or ‘CANCELLED’ and should be folded and stapled to the original stub in the cheque book. When unpresented cheques are more than 6 months old the original transaction should be reversed, thereby returning the monies to the bank account. A copy of this transaction to be printed and used as a voucher. The Imprest system must be updated at the time the payment is made for every expenditure of money from the cash tin and for every cheque written. All expenditure must have a valid receipt and this receipt should be crossed through once the payment has been made so that it cannot be submitted a second time. Stamps should be purchased from the cash tin and counted as part of the cash tin for reconciliation purposes. When a stamp is issued this should be logged in the stamp book or local spreadsheet. At the end of each month a copy of the log in the book or spreadsheet should be used as a voucher and the total amount entered into the Imprest system. A consecutively numbered voucher MUST accompany all expenditure, apart from cheques which are replacing lost/cancelled cheques. Version: 01 Doc Ref: 0825 Page 3 of 11 Procedure Payments via imprest account Cash Advance At times it is necessary for staff to hold cash advances when they are unsure of the actual amount of the expenditure. This may be for general usage for service users or, for example, when a worker needs to purchase items or transport a service user and is not aware of actual costs, ie petrol/food for the journey etc. An EPF must be drawn up and authorised by the Responsible Budget Officer. If any Cash Advances are held the following process MUST be in operation. The person named on the EPF will be responsible for the Cash Advance. The Business Support person responsible for the Imprest Account will pay out the initial Cash Advance on receipt of an authorised EPF. The amount will be recorded on the EPF and signed for by the receiver. The EPF will be held in the Imprest cash tin until receipts and any change is received. The cash advance amount will be counted as cash in hand until the money has been spent and receipts returned. The EPF must be kept in the tin for daily cashing up purposes. The named responsible person will need to ensure VAT receipts are obtained. A Petty Cash Voucher will be completed for the actual spend and signed and attached to the EPF when receipts and any change is returned from the original advance amount. Any receipts received should be crossed through to ensure monies are not claimed again. If there is any change, the amount on the front of the EPF must be crossed through and the EPF annotated ‘ACTUAL AMOUNT’ plus the new figure. Business Support staff will initial the EPF against the change. Please note an EPF cannot be increased this way – an additional authorised EPF for the difference is required. The expenditure amount will then be entered on to the Imprest system. If the cash advance is returned unspent the voucher and EPF must be crossed through and no entry on the Imprest system is necessary. Documentation to be filed alongside other vouchers. The majority of cash advances should not be held for any longer than a two week period and should be returned if unspent within this time. Change and VAT receipts should also be returned within this timescale. Any receipts received should be crossed through to avoid monies being claimed again. Exceptions to this are Youth Work Projects which may span several months and Residential Unit and Smaller Offices Cash Floats which are permanent advances. If Cash Advances are being held for a long period of time then the Business Support staff should chase the operational staff for submission or return. Safety of the funds is the responsibility of the named worker and should any money be lost, this must be discussed with Children’s Services Finance team who will advise the Version: 01 Doc Ref: 0825 Page 4 of 11 Procedure Payments via imprest account next course of action. Amounts over £50 need to be referred to Audit for their decision on the best way forward. Please remember you cannot replace lost funds without this discussion and an additional signed EPF. Cash Floats - Offices At times it is necessary to hold Cash Floats which are run from the main Imprest account. This may be for general usage for service users or when another office needs a relatively small amount of monies and it is not felt necessary to open another Bank Account. An EPF must be drawn up and authorised by the Responsible Budget Officer. This will be held in the cash tin and counted as cash in hand for daily cashing up purposes. If any Cash Floats are held the following process MUST be in operation. Version: 01 A named person will be responsible for the Float. The Business Support person responsible for the Imprest Account will pay out the initial Float on receipt of an authorised EPF. This amount will be recorded on the Cash Transaction Record Sheet and signed by the payee and the receiver. The EPF will be held in the main Imprest cash tin. The Float amount will be counted as cash in hand within the Imprest account at all times as per a Cash Advance. The Float will remain at the same holding figure each month and only topped up by the amount of the vouchers received. If the Float needs to be increased this can only be done by completion of a new EPF which replaces the original EPF in the cash tin. Any amounts disbursed from the Float MUST have an accompanying valid receipt and EPF, and the named responsible person will need to ensure receipts are obtained by other staff accessing the Float, and for submission of these when a ‘top up’ request is made. All receipts must be crossed through so that monies cannot be claimed again. At the point of request for ‘top up’, Petty Cash Vouchers, VAT receipts and Cash Transaction Record Sheet will be submitted for individual spends. If a worker regularly does not hand in receipts their line manager and the most senior member of support staff on site must address this. ‘Top ups’ will be made as and when required but as a minimum at the end of each month. A new Cash Transaction Record Sheet will be raised and this must be signed by the payee and the receiver. When a ‘top up’ of the Float occurs, payments made must be added to the Imprest system as ‘spends’. The unspent Float and the receipts should always Doc Ref: 0825 Page 5 of 11 Procedure Payments via imprest account equal the Float holding figure. The Float will still be counted as cash in hand in the Imprest account The named responsible worker will be accountable for balancing the Float on a regular basis (at least once a week). This must be signed correct on the Cash Transaction Record Sheet and they are responsible for the Float at all times. All receipts, petty cash vouchers, Cash Transactions Record Sheet(s) and the cash tin will be submitted to the Imprest account holder at the end of each month to be verified and included in the main Imprest reconciliation by Business Support Services. Receipts must be crossed through when entered on to Imprest system. Safety of the funds is the responsibility of the named worker and should any money be lost, this must be discussed with Children’s Services Finance team who will advise the next course of action. Amounts over £50 need to be referred to Audit for their decision on the best way forward. Please remember you cannot replace lost funds without this discussion and an additional signed EPF. Cash Floats – Residential Units At times it is necessary to hold Cash Floats when staff are unable to gain access to the Imprest account. This will be for small daily spends of the unit or weekend and evening shifts when Business Support Staff are not available to pay money out. If any Cash Floats are held the following process MUST be in operation. Version: 01 The Shift Leader will be responsible for the Float at all times. The Business Support person responsible for the Imprest account will pay out the initial Float to the Shift Leader for the residential Float tin, on receipt of an authorised EPF. This will be recorded on the Cash Transaction Record Sheet and signed by the payee and the Shift Leader. The EPF will be held in the main Imprest cash tin. The Float amount will be counted as cash in hand within the Imprest Account at all times. The Float will remain as the same holding figure each month and only topped up by the amount spent. As the Float is to be ongoing, the EPF needs only to be completed once, unless a different local practice has been agreed. If the original Float amount needs to be increased this must be in agreement with the Unit Manager and via an authorised EPF which replaces the original EPF in the cash tin. Any amounts disbursed from the Float MUST have an accompanying VAT receipt, and the Shift Leader will need to ensure that all staff obtain receipts. The Shift Leader will be responsible for making payments to shift staff, for the recording of spends onto the cash transation record and for submission of these when a ‘top up’ request is made. If a VAT receipt is not available then the Petty Cash voucher will need to be counter-signed by Shift Leader to confirm Doc Ref: 0825 Page 6 of 11 Procedure Payments via imprest account expenditure took place. Shift staff cannot reimburse themselves from the Float tin. ‘Top ups’ will be made as and when required. A new Cash Transaction Record Sheet will be raised and this must be signed by the payee and the receiver. This will be ‘topped up’ in line with agreed process by the Manager of each individual unit. When a ‘top up’ of the Float occurs, the cash transaction record sheet(s), receipts and petty cash vouchers will be removed from the tin and expenditure entered on to the Imprest system. The unspent Float and the receipts should always equal the holding figure. The original Float amount will still be counted as cash in hand in the Imprest Account The Shift Leader will be accountable for balancing the Float on (at least) a daily basis. This must be signed correct on the cash transaction record sheet. When the cash tin is handed over to a new Shift Leader both the outgoing and incoming Shift Leader will balance the tin and sign the cash transaction record sheet as correct. The cash tin must be kept locked away at all times and safety of the funds is the responsibility of the current Shift Leader. All receipts, petty cash vouchers, cash transactions record sheet(s) and the cash tin will be submitted at the end of each month to be verified and included in the main Imprest reconciliation by Business Support staff. Receipts MUST be crossed through when entered on to Imprest system. Safety of the funds is the responsibility of the Shift Leader and should any money be lost, this must be discussed with Children’s Services Finance team who will advise the next course of action. Amounts over £50 need to be referred to Audit for their decision on the best way forward. Please remember you cannot replace lost funds without this discussion and an additional signed EPF. Payments Awaiting Collection At times it is necessary for payments to be collected from a member of staff, other than the person responsible for the main Imprest account. If cash is held away from the main Imprest account the following procedure must be in operation. Version: 01 On receipt of an authorized EPF, the payment will be ‘made up’ by the person responsible for the Imprest account and placed in an envelope, with the recipient’s name clearly marked. A completed petty cash voucher will be attached to the envelope for the recipient to sign. The EPF will be kept in the cash tin until the receipt signed by the recipient is returned. If the initial recipient is a Worker who will pay the cash to someone else, then a second completed petty cash voucher will be signed by the worker as they will Doc Ref: 0825 Page 7 of 11 Procedure Payments via imprest account now be responsible for the safety of the funds until point of collection or delivery. The voucher should be attached to the EPF in the tin. If the monies are handed over to another person, but not final recipient, another petty cash voucher needs to be completed and signed by the new person to show the changeover of responsible person. The original voucher should be crossed through and the new one attached to the EPF in the tin. Once the monies are collected or delivered the petty cash voucher signed by the final recipient should be returned to the person responsible for the Imprest account, who will cross through the voucher attached to the EPF and attach the new signed voucher to the EPF. In the event of the money not being collected by the end of the working day the cash MUST be returned to the holder of the Imprest account to be locked away. (This does not have to be opened and added back to the tin unless the recipient will not be collecting within the next couple of days). Reconciliation and Reimbursement When the Bank Statement is received the Bank and Petty Cash reconciliation should be undertaken within the first two weeks of the month and reimbursement to bank account obtained as soon as possible. (See Work Instruction for Imprest system type for procedure.) AT NO TIME SHOULD THE BANK ACCOUNT BE ALLOWED TO GO OVERDRAWN. Outdated and Cancelled Cheques Occasionally cheques are cancelled or not presented for payment and after a period of six months become outdated. These cheques should be credited back to the cost centre they were spent against. If at some futute date cheques are eventually presented then a new entry needs to be made in the system. Backing Up Accounts Regular back-ups should be made to minimise the loss of data should the accounts become corrupt or unusable. A memory stick has been issued to each Imprest Account for this purpose. Version: 01 Doc Ref: 0825 Page 8 of 11 Procedure Payments via imprest account Insurance Levels Norfolk County Council levels for hold cash are as follows: Employee’s house In transit or in a bank night safe In the custody of an employee In a Locked Safe In a locked receptacle in schools In a locked receptacle – other than schools £500 £13,500 £13,500 £13,500 £250 £600 If these levels are not adhered to then any loss will not be covered by Norfolk County Council and will be the responsibility of the individual or establishment. For further information please click on link below. http://intranet.norfolk.gov.uk/financeforall/default.htm Version: 01 Doc Ref: 0825 Page 9 of 11 Procedure Payments via imprest account APPENDIX A PROCEDURE FOR USE OF IMPREST ACCOUNT Imprest Accounts CAN be used for the following expenditure Float/Cash Advance for expenditure incurred by staff on behalf of clients Payments to clients without bank accounts One-off Section 17 payment One-off irregular payment, eg emergency payments for accommodation In an emergency – First payment of expenditure that will subsequently be paid regularly on FIMS NB: All items above £100 require prior approval to use Imprest Account from a Children’s Services Finance Officer _______________________________________________________________ ____ Imprest Accounts MUST NOT be used for any of the following expenditure (FIMS/Oracle to be used instead) Expenditure incurred by Staff on behalf of clients Staff Subsistence Staff Travel and Mileage claims Staff or Client Air Travel Regular/Recurring Section 17 payments Regular Rents and Deposits Weekly payments to clients with bank accounts Invoices Room Hire and refreshments Household purchases, eg washing machine, vacuum cleaners, carpets Childminding, Nursery or Playscheme costs Holiday costs and payments towards presents All In-House Foster Carer payments Direct Debits Version: 01 Doc Ref: 0825 Page 10 of 11 Procedure Payments via imprest account PLEASE NOTE: When ever possible Accounts Payable (FIMS) or NCC Purchase Card should be used. Staff cannot be reimbursed for ANY personal expenditure via Imprest – they must reclaim on their mileage claim. Leaving Care Grant Due to the nature of the grant there is no requirement for prior approval to use Imprest Account from a Children’s Services Finance Officer. The maximum that can be withdrawn in Cash for the Leaving Care Grant in one day is £500 and in one Transaction £250. Version: 01 Doc Ref: 0825 Page 11 of 11