Guidelines to filling up the Softex Form

Guide lines to filling up the SOFTEX Form

1) Definitions of term used in guidelines:- a) ‘RBI No’ means RBI Softex Form which is put on the Certified Softex Form given by RBI. These number are valid only for particular Calendar Year. b) ‘Invoice’ means Export Invoice raised against Export Service Provided to Client. c) ‘Statement of Invoice (SOI)’ means Summary statement of Invoices enclosed with the SOFTEX Form for one client and one country. d) ‘IEC No.’ means Importer Exported Code provided by DGFT. e) ‘Bulk Statement’ means summary statement of Softex Form submitted in bulk (say fifty or more). f) ‘LOP No.’ means Letter of Permission No. given by STPI to STP unit /Exporter. g) ‘STP Unit’ means Exporter registered under STP scheme with STPI.

2) While submission Datacom /Internet connectivity bill (Service utilized for the offshore activity) as details specified in SOFTEX Form point no 08. Along with Backup information. (refer Fig 20 sample of

Backup Form).

3) Bulk Statement (Summary statement of all the SOFTEX Form submitted) in xls format for details please refer to Fig 4 for the sample of the Bulk statement.

4) Export Invoice should contain PO Ref no./WO Ref no./project id/project name and brief work description as per Agreement/PO/WO. (refer Fig 1)

5) One Softex Form need to be submitted against one LOP.

6) On the top of the Softex Form calendar year of the export Invoice should be specified.(refer Fig 2 and

Fig 3)

7) RBI Softex Form No. should not be filled if they are not provided by the STPI/SEZ/RBI.(refer Fig 2 and fig

4 the space is kept blank.)

8) At SF point no 1 The Name and Address of Organisation where the export activity has been done. Eg refer Fig 2 and Fig 5 the Address mentioned at SOFTEX Form Col No. 1 Export service is provided to the client details mentioned in Col No. 5.

9) At SF point no 2 The Name and Address of the STPI jurisdiction where SF is submitted for the certification (refer Fig 2 and Fig 6)

10) At SF point no 3, 10 digit IEC No should be specified (refer Fig 2). For details refer Notification No.

FEMA 23/2000-RB dated 3rd May 2000 .

11) At SOFTEX Form point no 4 against Category of Exporter correct option should be ticked out. Kindly refer Fig 2 and Fig 8.

12) Client/Buyer Name , Address and Country provided in SOFTEX Form point no 5 should be specified and same to be appeared in Invoice / SOI / Agreement / Gist of Contract along with Exporter relation with the Client. Kindly refer Fig 1 Sample case of Invoice Client Address is specified in SOFTEX Form Sample

(refer Fig 2 and Fig 9).

Kindly note that SOFTEX form having different buyer’s name or addresses will not be permitted.

However, multiple invoices with same buyer’s name and address may be clubbed in single SOFTEX form.

13) Invoice details at SF point no 06 and SOI (Statement of Invoice) details should be specified and match with the Actual invoice no / date. If one invoice is enclosed with SOFTEX Form then it should be specify the actual No and date of the invoice For more than one invoices are enclosed then attach

SOI(Statement of Invoice) and mentioned at SF point no 6 “Enclosed Statement of Invoice for the period<Starting Date> and <End Date>.” (refer Fig 1, Fig 2 and Fig 10)

14) At SOFTEX Form point no 7 correct option should be ticked out. a) Point no 7(a) is for related agreement copy is submitted to the STPI or not and b) 7(b) is regarding Payment realization mode on Royalty basis or not.

15) At SOFTEX Form point no 8 tick out or specify the Datacom Service Provider Name and Address which service is utilized for export activity.(refer Fig 2)

16) At SOFTEX Form point no 9 tick out or specify only one Type of Service provided to the Client specified at SF point no 5.( refer Fig 2 and Fig 13)

17) At SOFTEX Form point no 10 declare the total Export Value of Amount should be same as reflected in enclosed invoice/Statement of Invoices for offshore activity only.( refer Fig 2 and Fig 14)

18) At SOFTEX Form point no 11 details regarding Authorized dealer details (Name, Address and 14 digit code) should be mentioned in front of according to the realization mode. Authorized dealer should be

India base.(refer Fig 2 and Fig 15)

19) At SOFTEX Form Section B is related to the Royalty payment details if SF point no 7(b) is marked yes then this section should be filed along with Royalty Agreement otherwise Specify N.A (Not Applicable) as per your subject application.

20) At Section C date of realization should be within one year from the date of export. (refer Fig 2 and Fig

17)

21) At Section C Exporter Sign along with their Name and Designation of the Signatory Authority, Round

Stamp of Exporter and name of place & date when exporter has signed the SOFTEX Form should be specified. (refer Fig 2 and Fig 18)

22) Enclosure with the Softex Form. a) Statement of Invoice (SOI). It’s an summary statement of the Invoice enclosed with the SOFTEX

Form.( refer Fig 19 for the sample of the SOI). b) Contract Copy / Gist of Contract if not submitted to the STPI. c) Royalty Agreement if Applicable.

Please note:

1.

SOFTEX Form are sensitive document and utmost care should be taken while filling up and should be submitted with requisite enclosure. Every field of the SOFTEX Form is mandatory, if any field is not applicable then mention N.A in that field.

2.

Comments like ‘As per attachment’ or ‘As per Annexure’ on SOFTEX forms must be avoided.

3.

Import-Export certificate, if export made for the first time.

4.

Overwriting/ photocopy of signature/ ambiguous terms on invoice should be avoided.

5.

Do not file SOFTEX for negative invoice value or “0” zero export

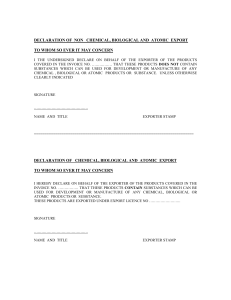

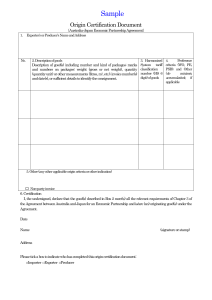

Annexure I

CHECKLIST FOR SOFTEX SUBMISSION

SUBMIT SOFTEX FORMS WITHIN 30 DAYS FROM THE DATE OF INVOICE

Unit Name: Category of exporter: STP/Non STP

Tick the appropriate choice ‘NA’ means Not Applicable

16

8

9

10

11

12

13

4

5

6

7

S. No CHECKLIST FOR EXPORT CERTIFICATE

1 Covering letter on Company Letter Head as per format

2

3

SOFTEX Form in Triplicate properly filled, signed and sealed

Invoices in Triplicate signed and sealed

Agreement /Purchase Order/Work Order/Job Order , if not submitted

Summary as per Annexure I, if SOFTEX /no. of invoices are more than

Back Up Form as per Annexure II

Datacom Service Provider Certificate as per Annexure III three

Internet Bill covering invoice period/dates

Copy of Authorized Signatory for signing of SOFTEX forms

APR and MPR are submitted till last F.Y.

No Dues Pending with STPI

LOP is Valid

Non-STP unit has paid service charges by cheque/DD as per revised charges

WHEN SOFTEX FORMS BEING SUBMITTED FOR FIRST THE TIME:

15 Certificate of commercial production, duly certified by Chartered Accountant, as a

Proof of commencement of commercial production.

Import & Export Code issued by DGFT (Copy required)

Yes No NA

Authorized Signatory with seal

Fig 1 : Sample of Invoice Format

XYZ Private limited, Building no 4, Bandra-Kurla Road, Bandra ,

Mumbai -400309

Export Invoice

Client Name and Address

XYZ Inc,

Plano , TX-56093, USA

Name of the supplier and

Address

XYZ Pvt Ltd

1 st Floor, International InfoTech

Park, Vashi railway station,

Vashi , Navi Mumbai -410709

Funds to be transferred to the following

Correspondent Bank: ICICI , New York, USA

Acct No 004 991234 chips UID 312345

For Onward Credit to:

XYZ Pvt Ltd Account no 012-3456789-123

ICICI, Sec-17 , Vashi, India, Swift Code ICICI ADCB

Authorised Dealer Code: 1234567-1234567

Invoice no

Invoice Date

Client Country

United States of America

Service period

Items

Import Export Code No

0123456789

01.05.11 to 30.05.11

Contract No SOW No 01

Contract Date 15.04.2008 hr Total( in USD)

1.

2.

Technical Engineer

Sr Technical Engineer

Rate/hr (in USD) No of employee

12

20

12

4

160

143

233,040.00

11,440.00

Total 244,480.00

Vat(12.3 %) 30,071.04

Total ( in USD) 274,551.04

Total Amount Payable: USD Dollars Two Hundred Seventy Four Thousand and Five Hundred and Fifty One

Payment Details

For XYZ Pvt Ltd

XYZ/2011-12/35

02.06.11

Authorized Signatory

Fig 2 Sample SOFTEX Form

Year: 2 0 1 1

SOFTWARE EXPORT DECLARATION (SOFTEX) FORM

(For declaration of Software Exports through data-communication links and receipt of Royalty on the Software

Packages/Products exported)

FORM NO: A C

1.

Name and address of the Exporter

Original

XYZ Private limited, 1 st Floor, International InfoTech Park,

Vashi railway station, Vashi , Navi Mumbai -410709

2.

STPI Center within whose jurisdiction the unit is situated

3.

Import-Export Code Number

STPI Vashi, Navi Mumbai, India

4.

Category of Exporter (EOU/DTA Unit)

5.

Buyer's name and address including country and

6.

7.

their relationship with exporting unit (if any)

Name of the country:-

Date and Number of Invoice

a) b)

Whether export contract/purchase order already registered with STPI. (If 'No' ,please attach copy of the contract/purchase order)

Does contract stipulate Payment of royalty

0 1 2 3 4

STP/EHTP/EPZ/SEZ/100% EOU

XYZ Inc, Plano , TX-56093, USA

5 6 7 8 9

(Parent Company)

USA

Enclosed Statement of Invoice for the period 01.Jun 11 to 31

Jun 11.

Yes

No

Yes No

SECTION – A

(For exports through data communication link)

8.

Name of authorised datacom service provider

STPI/VSNL/DOT/Internet/Others service provider

VSNL

International Infotec Park, Vashi, Navi Mumbai

9.

Type of software exported (Please mark ' ' on the appropriate box on the left side)

(a) Computer Software

Data Entry jobs and Conversion Software Data Processing

Software Development

Software Product, Packages

Others (Please specify)

(b) Other Software

Video/TV Software

Others (Please specify)

9

9

9

9

9

9

RBI Code

0

0

0

0

1

1

6

7

8

9

0

1

10.

Analysis of Export Value Currency Amount a) Full export value Of which :- i.

Net value of exports without transmission charges USD 296,636.00 ii.

Transmission charges Included in invoice N.A b) Transmission charges (if payable Separately by th overseas client) c) d) e)

Deduct: Agency commission, At the rate of …….%

Any other deduction as Permitted by RBI (please specify)

Amount to be realised [(a+b) - (c+d)] USD

N.A

N.A

N.A

296,636.00

11.

How export value will be realized (mode of realisation) (Please mark ' ' on the appropriate box)

a) Under L/C a) Name and address of N.A

Authorised Dealer b) Authorised Dealer Code No

b) Bank Guarantee a) Name and address of

Authorised Dealer

N.A

N.A

c) Any other arrangement e.g. advance payment, etc. including transfer/remittance to bank account maintained overseas b) Authorised Dealer Code No a) Name and address of

Authorised Dealer b) Authorised Dealer Code No

N.A

ABC Bank Ltd,

Sec-17 , Vashi, India

1234567-1234567

(Please specify)

SECTION – B

(For receipt of Royalty on Software Packages/Products exported)

12.

Details of Software Package(s)/Product(s) exported a) Date of export b) GR/SDF/PP/SOFTEX Form No. on Which exports were declared c) Royalty agreement details

%age and amount of royalty

Period of royalty agreement (Enclose copy of Royalty agreement, if not already registered)

13.

How royalty value will be realised (as defined in Royalty agreement)

14.

Calculation of royalty amount (Enclose copy of communication from the foreign customer)

15.

Name and address of designated Authorised Dealer in India through whom payment has Been received/to be received.

SECTION – C

N.A

N.A

N.A

N.A

N.A

N.A

N.A

A.D.Code No N.A

16.

Declaration by exporter

I/We hereby declare that I/we am/are the seller of the software in respect of which this declaration is made and that the particulars given above are true and that the value to be received from the buyer represents the export value contracted and declared above. I/we also declare that the software has been developed and exported by using authorised and legitimate datacom links.

I/We undertake that I/we will deliver to the bank named above the foreign exchange representing the full value of the software exported as above on or before …………… (i.e. within six months from the date of invoice / date of last invoice raised during a month), in the manner specified in the Regulations made under the Foreign Exchange

Management Act,1999.

Stamp (Signature of the Exporter)

Enclosure:

(1)

(2)

(3)

Copy of Export Contract [17(a)]

Copy of Royalty Agreement [12(c)]

Copy of communication from foreign customer [14]

Space for use of the competent authority (i.e. STPI/EPZ/SEZ) on behalf of Ministry of Communications & Information

Technology

Certified that the software described above was actually transmitted and the export/royalty value declared by the exporter has been found to be in order and accepted by us.

Place: ______________________________

Date: _______________________________

Name:_______________________________

Designation:_________________________

Stamp

( Signature of the Designated Official of

STPI/EPZ/SEZ on behalf of Ministry of

Communications Information Technology )

Place: ______Navi Mumbai

Date:________15 Jul 11

Name:___Sh Amit Verma__

Designation:____Director

Year: 2 0 1 1

SOFTWARE EXPORT DECLARATION (SOFTEX) FORM

(For declaration of Software Exports through data-communication links and receipt of Royalty on the Software

Packages/Products exported)

FORM NO: A C

1.

Name and address of the Exporter

Duplicate

XYZ Private limited, 1 st Floor, International InfoTech Park,

Vashi railway station, Vashi , Navi Mumbai -410709

2.

STPI Center within whose jurisdiction the unit is situated

3.

Import-Export Code Number

STPI Vashi, Navi Mumbai, India

4.

Category of Exporter (EOU/DTA Unit)

5.

Buyer's name and address including country and

6.

7.

their relationship with exporting unit (if any)

Name of the country:-

Date and Number of Invoice

b) c)

Whether export contract/purchase order already registered with STPI. (If 'No' ,please attach copy of the contract/purchase order)

Does contract stipulate Payment of royalty

0 1 2 3 4

STP/EHTP/EPZ/SEZ/100% EOU

XYZ Inc, Plano , TX-56093, USA

5 6 7 8 9

(Parent Company)

USA

Enclosed Statement of Invoice for the period 01.Jun 11 to 31

Jun 11.

Yes

No

Yes No

SECTION - A

(For exports through data communication link)

8.

Name of authorised datacom service provider

STPI/VSNL/DOT/Internet/Others service provider

VSNL

International Infotec Park, Vashi, Navi Mumbai

9.

Type of software exported (Please mark ' ' on the appropriate box on the left side)

(a) Computer Software

Data Entry jobs and Conversion Software Data Processing

Software Development

Software Product, Packages

Others (Please specify)

(b) Other Software

Video/TV Software

Others (Please specify)

9

9

9

9

9

9

RBI Code

0

0

0

0

1

1

6

7

8

9

0

1

10.

Analysis of Export Value Currency Amount f) Full export value Of which :- i.

Net value of exports without transmission charges USD 296,636.00 ii.

Transmission charges Included in invoice N.A g) Transmission charges (if payable Separately by th overseas client) h) i) j)

Deduct: Agency commission, At the rate of …….%

Any other deduction as Permitted by RBI (please specify)

Amount to be realised [(a+b) - (c+d)] USD

N.A

N.A

N.A

296,636.00

11.

How export value will be realized (mode of realisation) (Please mark ' ' on the appropriate box)

a) Under L/C c) Name and address of N.A

Authorised Dealer d) Authorised Dealer Code No

b) Bank Guarantee c) Name and address of

Authorised Dealer

N.A

N.A

c) Any other arrangement e.g. advance payment, etc. including transfer/remittance to bank account maintained overseas d) Authorised Dealer Code No c) Name and address of

Authorised Dealer d) Authorised Dealer Code No

N.A

ICICI Bank Ltd,

Sec-17 , Vashi, India

1234567-1234567

(Please specify)

SECTION – B

(For receipt of Royalty on Software Packages/Products exported)

12.

Details of Software Package(s)/Product(s) exported d) Date of export e) GR/SDF/PP/SOFTEX Form No. on Which exports were declared f) Royalty agreement details

%age and amount of royalty

Period of royalty agreement (Enclose copy of Royalty agreement, if not already registered)

13.

How royalty value will be realised (as defined in Royalty agreement)

14.

Calculation of royalty amount (Enclose copy of communication from the foreign customer)

15.

Name and address of designated Authorised Dealer in India through whom payment has Been received/to be received.

SECTION – C

N.A

N.A

N.A

N.A

N.A

N.A

N.A

A.D.Code No N.A

16.

Declaration by exporter

I/We hereby declare that I/we am/are the seller of the software in respect of which this declaration is made and that the particulars given above are true and that the value to be received from the buyer represents the export value contracted and declared above. I/we also declare that the software has been developed and exported by using authorised and legitimate datacom links.

I/We undertake that I/we will deliver to the bank named above the foreign exchange representing the full value of the software exported as above on or before …………… (i.e. within six months from the date of invoice / date of last invoice raised during a month), in the manner specified in the Regulations made under the Foreign Exchange

Management Act,1999.

Place: ______Navi Mumbai

Date:________15 Jul 11

Name:___Sh Amit Verma__

Designation:____Director

Stamp

(Signature of the Exporter)

Enclosure:

(1)

(2)

(3)

Copy of Export Contract [17(a)]

Copy of Royalty Agreement [12(c)]

Copy of communication from foreign customer [14]

Space for use of the competent authority (i.e. STPI/EPZ/SEZ) on behalf of Ministry of Communications & Information

Technology

Certified that the software described above was actually transmitted and the export/royalty value declared by the exporter has been found to be in order and accepted by us.

Place: ______________________________

Date: _______________________________

Name:_______________________________

Designation:_________________________

Stamp

( Signature of the Designated Official of STPI/EPZ/SEZ on behalf of Ministry of Communications

Information Technology )

For Authorised Dealer's use only

Duplicate to be forwarded after realisation along with R Supplementary Return

Certificate by authorised dealer

AD's Uniform Code No……………………………………

The SOFTEX Form included in the ENC statement sent to the Reserve Bank with the 'R' Return

(NOSTRO/VOSTRO)……………………… for the period ending……………………(Currency Name) sent on We certify and confirm that we have received the total amount of ……………. (Currency) ……………………….. (Amount) as under

being the proceeds of exports declared on this form.

Date of

Receipt

Currency

2

Credit to Nostro Account In

________ (country)

In our

In the name name of **

Held with

Held with

Us **

3 4 5

Debit to Non- Resident

Rupee Account of Bank in _________ (Country)

In our

In the name name of **

Held with

Held with us **

Period of R-Return with which the realization has been reported to RBI

6 7 1

(** Write the name of the concerned branch of Authorised Dealer)

Any other manner of receipt (Specify) …………………………………………………………………………………

Place: ______________________________

Date: _______________________________

Name:_______________________________

Designation:_________________________

(Signature of Authorised Official)

Stamp

Year: 2 0 1 1

SOFTWARE EXPORT DECLARATION (SOFTEX) FORM

(For declaration of Software Exports through data-communication links and receipt of Royalty on the Software

Packages/Products exported)

FORM NO: A C

1.

Name and address of the Exporter

Triplicate

XYZ Private limited, 1 st Floor, International InfoTech Park,

Vashi railway station, Vashi , Navi Mumbai -410709

2.

STPI Center within whose jurisdiction the unit is situated

3.

Import-Export Code Number

STPI Vashi, Navi Mumbai, India

4.

Category of Exporter (EOU/DTA Unit)

5.

Buyer's name and address including country and

6.

7.

their relationship with exporting unit (if any)

Name of the country:-

Date and Number of Invoice

c) d)

Whether export contract/purchase order already registered with STPI. (If 'No' ,please attach copy of the contract/purchase order)

Does contract stipulate Payment of Royalty

0 1 2 3 4

STP/EHTP/EPZ/SEZ/100% EOU

XYZ Inc, Plano , TX-56093, USA

5 6 7 8 9

(Parent Company)

USA

Enclosed Statement of Invoice for the period 01.Jun 11 to 31

Jun 11.

Yes

No

Yes No

SECTION - A

(For exports through data communication link)

8.

Name of authorised datacom service provider

STPI/VSNL/DOT/Internet/Others service provider

VSNL

International Infotec Park, Vashi, Navi Mumbai

9.

Type of software exported (Please mark ' ' on the appropriate box on the left side)

(a) Computer Software

Data Entry jobs and Conversion Software Data Processing

Software Development

Software Product, Packages

Others (Please specify)

(b) Other Software

Video/TV Software

Others (Please specify)

9

9

9

9

9

9

RBI Code

0

0

0

0

1

1

6

7

8

9

0

1

10.

Analysis of Export Value Currency Amount k) Full export value Of which :- i.

Net value of exports without transmission charges USD 296,636.00 ii.

Transmission charges Included in invoice N.A l) Transmission charges (if payable Separately by th overseas client) m) n) o)

Deduct: Agency commission, At the rate of …….%

Any other deduction as Permitted by RBI (please specify)

Amount to be realised [(a+b) - (c+d)] USD

N.A

N.A

N.A

296,636.00

11.

How export value will be realized (mode of realisation) (Please mark ' ' on the appropriate box)

a) Under L/C e) Name and address of N.A

Authorised Dealer f) Authorised Dealer Code No

b) Bank Guarantee e) Name and address of

Authorised Dealer

N.A

N.A

c) Any other arrangement e.g. advance payment, etc. including transfer/remittance to bank account maintained overseas f) Authorised Dealer Code No e) Name and address of

Authorised Dealer f) Authorised Dealer Code No

N.A

ICICI Bank Ltd,

Sec-17 , Vashi, India

1234567-1234567

(Please specify)

SECTION – B

(For receipt of Royalty on Software Packages/Products exported)

12.

Details of Software Package(s)/Product(s) exported g) Date of export h) GR/SDF/PP/SOFTEX Form No. on Which exports were declared i) Royalty agreement details

%age and amount of royalty

Period of royalty agreement (Enclose copy of Royalty agreement, if not already registered)

13.

How royalty value will be realised (as defined in Royalty agreement)

14.

Calculation of royalty amount (Enclose copy of communication from the foreign customer)

15.

Name and address of designated Authorised Dealer in India through whom payment has Been received/to be received.

SECTION – C

N.A

N.A

N.A

N.A

N.A

N.A

N.A

A.D.Code No N.A

16.

Declaration by exporter

I/We hereby declare that I/we am/are the seller of the software in respect of which this declaration is made and that the particulars given above are true and that the value to be received from the buyer represents the export value contracted and declared above. I/we also declare that the software has been developed and exported by using authorised and legitimate datacom links.

I/We undertake that I/we will deliver to the bank named above the foreign exchange representing the full value of the software exported as above on or before …………… (i.e. within six months from the date of invoice / date of last invoice raised during a month), in the manner specified in the Regulations made under the Foreign Exchange

Management Act,1999.

Place: ______Navi Mumbai

Date:________15 Jul 11

Name:___Sh Amit Verma__

Designation:____Director

Stamp (Signature of the Exporter)

Enclosure:

(4)

(5)

(6)

Copy of Export Contract [17(a)]

Copy of Royalty Agreement [12(c)]

Copy of communication from foreign customer [14]

Space for use of the competent authority (i.e. STPI/EPZ/SEZ) on behalf of Ministry of Communications & Information

Technology

Certified that the software described above was actually transmitted and the export/royalty value declared by the exporter has been found to be in order and accepted by us.

Place: ______________________________

Date: _______________________________

Name:_______________________________

Designation:_________________________

Stamp

( Signature of the Designated Official of

STPI/EPZ/SEZ on behalf of Ministry of

Communications Information Technology )

Fig 3 Sample of Statement of Invoice

STATEMENT OF INVOICES

FOR THE PERIOD FROM DATED 01 Jun 11 TO DATED 30 Jun 11.

Client Name and Country

Client Address

XYZ Inc, USA

XYZ Inc, Plano , TX-56093, USA

Contract/SOW/PO/WO No or Date: SOW No 01 dated 15.04.2008

REASON IF BILLING PERIOD AND INVOICE

DATE DIFFERENCE IS MORE THAN 30 DAYS: N.A

SR.

NO.

Billing

Period

INVOICE NO.

INVOICE

DATED

INVOIC

E

CURRE

NCY

INVOICE AMOUNT

AGAINST OFFSHORE

SERVICES

Conversi on Rate

INOVICE AMOUNT IN

(INR)

1.

2.

3.

May 11

May 11

XYZ/2011-12/35

XYZ/2011-12/45

02-Jun-11

15-Jun-11

May 11 XYZ/2011-12/49 16-Jun-11

USD

USD

USD

274,551.04

6,740.00

15,045.00

47.5

47.5

47.5

1,30,41,174.40

3,20,150.00

7,14,637.50

4.

May 11 XYZ/2011-12/55 30-Jun-11

Total

USD

USD

300.00

296,636.00

47.5 14,250.00

1,40,90,211.90

(Figures In Words Rs. _One Hundred And Forty Lakh Ninty Thousand Two Hundred And Eleven._____ )

Authorized Signatory

STAMP

NOTE :-

1.

Please prepare the Statement of Invoices in your Company Letter head.

2.

Following Persons can be Authorized to Sign the Statement of Invoices and Softex Forms. a.

Director of the Company (any one) b.

Company Secretary.

Any person authorized

Fig 20 Sample of Backup Form

Back Up Form

LOP( Letter of Permission) No.

( if STP Unit). LOP No STP/MUM/VIII(A)/1562/2009(02)/5672 dated 19 Feb 2009

Extension of LOP if any ( if STP Unit) N.A

Validity ( if STP Unit)

Address of Exporter

Area of Exporting unit ( in Sq ft)

18 Feb 2014

XYZ Private limited, 1 st Floor, International InfoTech Park, Vashi railway station, Vashi , Navi Mumbai -410709

12,545 sq ft

Name and Address of Datacom Service Provider

Type of Connectivity:

Period of Connectivity

Bandwidth utilized:

Total data Transfer:

VSNL, International Infotec Park, Vashi, Navi Mumbai

Lease Line

01 May 11 to 31 May 11

4MBPS

2500MB

No of Resources utilized: 1300 manpower (approximately)

Custom Bonding License no. and Validity (If

STP ) :- ABCDEFG dated 17 Mar 2011 validity upto 16 Mar 2013

Authorized Signatory

STAMP

Date:

Fig 20 Sample of Bulk Statement