Question Bank for Accountancy Class XII 2014-15

advertisement

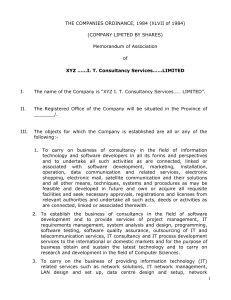

1 mark questions for Board exams Accountancy Class XII Partnership Accounts 1. Define partnership. Section 4 of the Indian Partnership Act, 1932 defines partnership as “The relation between persons who have agreed to share profits of a business carried on by all or any one of them acting for all”. 2. Is there any limit of number of partners in a firm? Yes, there must be at least two persons to form a partnership firm. According to Partnership Act, the maximum no. of partners in a firm is 10 in case of banking business and 20 in case of any other business. 3. Can a partner be exempted from sharing the losses in a firm. If yes, under what circumstances? Yes, if partnership deed provides so. 4. What is partnership deed? A partnership deed may be defined as a document in writing containing the important terms of partnership as agreed between the partners. 5. Why should a firm have a partnership deed? A partnership deed is necessary because a carefully prepared partnership deed can eliminate many problems and disputes that may arise in the future operations of the partnership. It specifies the terms and conditions of the agreement for smooth functioning. 6. State two elements/features of the partnership deed. (i) There must be atleast two persons to form a partnership. (ii) There must be an agreement (oral or written) entered into by all persons concerned to form a partnership. 7. State the provisions of Partnership Act, 1932 in the absence of partnership deed regarding : (i) Int. on partners drawings. (ii) Int. on advances other than capital. (iii) Int. on capital. (iv) Payment of salary to partner (v) Profit sharing ratio. Ans. (i) No int. will be charged on partner’s drawings. (ii) Int. will be given @ 6% if a partner advances loans to firm. (iii) No int. will be provided on capital. (iv) No salary will be given to partners. (v) Profits and losses will be shared equally among the partners. 8. State the provisions of the Indian partnership act regarding the payment of remuneration to a partner for the services rendered. A partner will be paid remuneration for the services rendered, when it is mentioned in the partnership deed. Otherwise no partner is entitled to get any salary. 9. Distinguish between fixed and fluctuating capital accounts. Basis Fixed capital Fluctuating capital Balance of accounts In case of fixed capital In case of fluctuating accounts, the balance of capital accounts the capital accounts normally balance in capital remains unchanged except accounts change from capital is introduced or year to year where capital is withdrawn permanently Number of accounts In case of fixed capital In case of fluctuating accounts each partner has capital account each two accounts: capital partner has only one account and current account account i.e. capital account. 10. When is that the capital account of a partner does not show a Debit Balance in spite of regular and consistent losses year after year? When the capital accounts are fixed, the capital account of a partner will never show debit balance since all transaction between firm and partner are recorded in current account. 11. What are the circumstances under which the balance of the fixed capital accounts may change? (i) Addition to Capital, (ii) Withdrawal of Capital. 12. List two items that may appear on the credit side of a partners’ fixed capital account. (i) Opening balance of capital, (ii) Amount of capital introduced by the partner under an agreement. 13. Where would you record int. on drawings when capital accounts are fixed? Current account of a partner will be debited. 14. Do all forms of business organisations prepare Profit and Loss appropriation account? Only partnership firms prepare a profit and loss appropriation account. 15. Why is Profit and Loss Appropriation a/c prepared by a partnership firm? In a partnership firm, profit and loss appropriation a/c is prepared to appropriate/distribute the profit or loss for the year among the partners. The profits are to be distributed as per the partnership deed. In the absence of partnership deed, profits are distributed equally as per the provisions of the partnership act, 1932. 16. A partnership deed provides for the payment of int. in capital but there was a loss instead of profits during the year. At what rate will the int. on capital be allowed? No int. on capital will be allowed. 17. What share of profit would a ‘Sleeping Partner’, who has contributed 75% of the total capital, get in the absence of a deed? In the absence of a partnership deed sleeping partner will get equal share of profit. 18. If a fixed amount is withdrawn on 15th day of every month of a calendar year, for what period will the int. on total amount withdrawn be calculated? Six months 19. How will you calculate int. on drawings when partners withdraw different amounts at different time intervals? Int. on drawings = Total of Products * rate/100 * 1/12 20. Give the average period in months for charging int. on drawings for the amount withdrawn in the beginning of each quarter. 7 ½ months. 21. Ram and Mohan are partners in a firm without any partnership deed. Their capitals are Ram Rs. 8,00,000 and Mohan Rs. 6,00,000. Ram is an active partner and looks after the business. Ram wants that the profit should be shared in proportion of capitals. State with reason whether his claim is valid or not. His claim is not valid because in the absence of a partnership deed, profits and losses should be shared equally. 22. What is meant by unlimited liability of partners? It means personal assets of partner may also be used for payment of debts. 23. Why is it necessary to have a partnership deed? (i) It helps in solving partner’s mutual conflicts. (ii) It helps in smooth functioning of business. 24. Where should you record interest on drawings when capital accounts are fixed? Debit side of capital account. 25. What is limited liability of a partner? It means personal assets of partner are not used for payment of debts. Liability is limited to the extent of his share in profit. 26. A,B and C decided that int. on capital will be provided to each partner @ 5% p.a. But after one year, C wants that no int. on capital is to be provided to a partner. State how C can do this? There should be consent among all the partners. 27. What do you mean by reconstitution of partnership firm? Whenever there is a change in the partnership agreement, but the firm continues, it is called reconstitution of the partnership firm. 28. List any two situations which may result in the reconstitution of a partnership firm. (i) Change in profit sharing ratio among the existing partners. (ii) At the time of admission of the partners. (iii) At the time of retirement or death of a partner. 29. What do you mean by change in profit sharing ratio? A change in profit sharing ratio basically implies the purchase of share of profit of one partner from another partner. And he pays for it in the form of proportionate goodwill. 30. Why is sacrificing ratio calculated? To determine the amount of compensation to be paid by the gaining partner to the sacrificing partner 31. Give two circumstances in which sacrificing ratio may be applied. (i) Change in profit sharing ratio of existing partners. (ii) Admission of a new partner in the firm. 32. Pawan and Jayshree are partners, Bindu is admitted for 1/4th share. What is the ratio in which Pawan and Jayshree will sacrifice their shares in favour of Bindu. Since Pawan and Jayshree are equal partners, so they will sacrifice in equal proportion i.e. 1/8th share each in favour of Bindu. 33. Why is gaining ratio calculated? Gaining ratio is required to be calculated because the remaining partners will pay the retiring partners’ share of goodwill in their gaining ratio. 34. Give any one difference between sacrificing ratio and gaining ratio. Basis Sacrificing ratio Gaining ratio Meaning It is the ratio in which It is the ratio in which old partners surrender a remaining partners part of their share in acquire the share of favour of new partner. retiring partner. Method Old ratio – New ratio New ratio – Old ratio 35. Explain the accounting treatment of goodwill, when there is a change in profit sharing ratio among existing partners. Firstly calculate the sacrificing/gaining share of partners then following entrey is passed with proportionate amount of goodwill: Gaining Partners’ Capital a/c Dr. To Sacrificing Partners’ Capital a/c (Proportionate share of goodwill adjusted between existing partners) 36. Who is sacrificing and gaining partner? Sacrificing partner, whose share in profit decreased and Gaining partner, whose share in profit increased due to change in profit sharing ratio. 37. How is new partner admitted to a firm? A person can be admitted as a new partner only with the consent of all the existing partners 38. State any one purpose for admitting a new partner. (i) When more capital is needed for expansion of business. (ii) When a competent person is required for efficient running of business. 39. State two main rights that a newly admitted partner acquires in the firm. The new partner along with other partners gets the following rights: (i) Right to share profits of the firm (ii) Right to share in the assets of the firm. 40. Why are reserves and surplus distributed at the time of reconstitution of the firm? Reserves and surplus are distributed at the time of reconstitution of the firm because they are accumulated profits which are earned by the existing partners. 41. How do you calculate new profit ratio of a partner? New share = Old share – Sacrificing share. 42. What is revaluation account? Revaluation account is a nominal account which shows profit or loss arising because of revaluation of assets and liabilities. 43. What is the nature of revaluation account? Revaluation account is a nominal account. 44. Define goodwill. Goodwill is the value of reputation of the firm in respect of profits expected in future over and above the normal profits earned by other similar firms belonging to the same industry. 45. State the reason of contributing for goodwill by a new partner at the time of his admission. To compensate the old partners for their sacrifice of share of profit. 46. Why is goodwill considered as an intangible asset and not as a fictitious asset? Goodwill cannot be seen and touched. It is invisible. All assets can be sold separately but goodwill cannot be sold separately. 47. Name methods of valuation of goodwill. (i) Average profit method, (ii) Super profit method, and (iii) Capitalisation method. 48. What are Super profits? Super profit is the excess of actual profit over the normal profit. 49. Give the meaning of hidden goodwill. Hidden goodwill is the excess of desired total capital of the firm over the actual combined capital of all partners. Hidden goodwill requires calculation of desired total capital on the basis of new partners’ capital for a given share. The difference between total capital and actual capital is hidden goodwill. 50. How does the factor ‘Location’ affects the business? ‘location’ increases the turnover and profit of the firm which affects the goodwill. 51. How does ‘Efficiency of management ‘ affects the goodwill of a firm? A well managed company enjoys high productivity and cost efficiency that leads to higher profits and more goodwill. 52. How does the nature of business affects the value of goodwill of a firm? The firm that produces high value added products or has stable demand will be able to earn more profit and more goodwill. 53. How does the market situation affects the value of the goodwill of a firm? The monopoly condition or limited competition enable the concern to earn high profits which leads to higher value of goodwill. 54. Show accounting treatment by giving a journal entry if new partner does not bring his share of goodwill in cash. New partners’ capital a/c Dr. To sacrificing partners’ capital a/c 55. How does the quality of product affects the goodwill of a firm? Increase in turnover and profit affect the goodwill of the firm. 56. What is meant by retirement of a partner? Retirement of a partner means, leaving the firm by a partner. A partner has a right to retire from a firm by giving suitable notice to other partners. 57. Give the meaning of gaining ratio. When a partner retires or dies, his profit is taken over by the continuing partners. The ratio in which the continuing partners have acquired the share of outgoing partner is called gaining ratio. 58. How is new profit sharing ratio calculated on retirement of a partner? New share = Old share + Acquired share 59. Why is gaining ratio calculated? Gaining ratio is calculated to ascertain the amount of goodwill payable to retiring partner by the remaining partners. 60. How is goodwill treated at the retirement of a partner? Remaining partners’ capital a/c To Retiring partners’ capital a/c Dr. 61. What share of goodwill a partner is entitled at the time of his retirement? A partner is entitled to his own share of goodwill at the time of his retirement. 62. How do you deal with existing goodwill at the retirement of a partner? Existing goodwill will be written off by debiting all partners’ capital account in their old ratio and crediting the goodwill account. 63. Why are assets and liabilities revalued on death of a partner? On the death of a partner, the representative of deceased partner must be given his share of profit/loss arising out of change in the value of assets and liabilities. That is why assets and liabilities are revalued on the death of a partner 64. What is the difference between retirement and death of a partner? From accounting point of view there is no difference in retirement or death of a partner, except the following: (i) Retirement of a partner is usually planned, but death of a partner may occur on any day. (ii) Retiring partners’ share in the firm is received himself by the partner but deceased partners’ share in the firm is received by his representative. 65. Mention the amounts payable to deceased partner. (i) His amount of capital, (ii) his share in goodwill, (iii) his share in accumulated profits and (iv) his share in profits and profit on revaluation. 66. How are profits estimated for the deceased partners’ share in profits? (i) On the basis of time, (ii) on the basis of sales 67. C wants to retire from the firm. There is general reserve of Rs. 50,000. C wants that it should be divided among all partners. Whereas A and B want that general reserve should remain intact to meet the future contingencies. Whose contention is correct? C’s contention is correct. 68. State the need for treatment of goodwill on retirement of a partner. Since the retiring partner will not be sharing profits, goodwill is given to compensate him for the same. 69. Explain treatment of general reserve in case of retirement of a partner. General reserve is distributed among all the partners in their old ratio. 70. Name different modes of dissolution of a firm. (i) By mutual agreement. (ii) By compulsory Dissolution. (ii) Dissolution by Court. (iv) Dissolution on happening of an event 71. Give any one difference between reconstitution of a firm and dissolution of a firm. A firm continues business after reconstitution of a firm but not in case of dissolution. 72. In case of dissolution, what journal entry would be passed if a partner agrees to discharge the firm’s liability? Realisation a/c Dr. To Partners’ Capital a/c 73. Show Journal entry, if 60% of debtors of full value of Rs. 70,000 realised on dissolution. Cash/Bank a/c Dr. 42,000 To Realisation a/c 42,000 74. Name some specific liabilities which are transferable to realisation a/c but payment of these is not made on dissolution of a firm. (i) Joint life policy reserve a/c (ii) Depreciation fund a/c (iii) Investment fluctuation fund a/c 75. Give journal entry for the treatment of sale of unrecorded assets. Cash a/c Dr. To Realisation a/c 76. Give journal entry for treatment of unrecorded liability. Realisation a/c Dr. To Cash a/c 77. Give journal entry for the treatment of assets taken by a partner when firm is dissolved. Partners’ Capital a/c Dr. To Realisation a/c 78. If creditors of the firm Rs. 50,000, X’s Capital Rs. 20,000, Y’s Capital Rs. 30,000, Loan from bank Rs. 50,000. Find out total assets of the firm. Total assets = Rs. 1,50,000 (Assets = Liabilities + Capital) 79. State the causes when a court may pass order for the dissolution of the firm. (i) A partner becomes a person of unsound mind. (ii) A partner is found guilty of misconduct. 80. Define meaning of firm’s debt and Private debt. Firm’s debt means the debt owed by the firm to outsiders as loan taken by the firm from bank. Private debt means the debt owed by the partner from the other person personally. 81. Give journal entry for accounting treatment in case of dissolution for transferring Debtors along with provision for doubtful debts. (i) Realisation a/c Dr. To Debtors a/c (ii) Provision for Doubtful Debts a/c Dr. To Realisation a/c 82. Give any two objects of preparing the realisation a/c at the time of dissolution of the firm. (i) To settle/close the assets and liabilities accounts. (ii) To find out net profit or net loss on realisation of sundry assets and after settlement of sundry liabilities. 83. On dissolution of firm, where is cash in hand transferred? On the debit side of cash account. COMPANY ACCOUNTS : SHARES AND DEBENTURES 84. What is a share? Capital of a company is divided into units with a nominal value. Each of these small units is called a share. 85. What are preliminary expenses? Preliminary expenses are those expenses which are incurred for incorporation of a company. 86. What are preference shares? Preference shares are those shares which carry following two rights in preference to equity shares : (i) As regards dividend, they have preferential right at a fixed rate; (ii) As regards capital, in the event of winding up, they have preferential right to be repaid the capital. 87. What is meant by equity shares? Equity shares are those shares which carry all the risks and rewards of the business. They do not have the right to dividend like the preference shares but they have voting right which preference shares don’t have. 88. What is meant by authorised or registered capital of the company? Authorised capital means the maximum amount of share capital which a company can raise in its lifetime. It is stated in the Memorandum of association. 89. What is reserve capital? Reserve capital is that part of uncalled capital which the company, by passing a special resolution, may reserve to be called upon only on winding up of the company. 90. What is the name given to that ‘part of capital’ of a company which is called upon only on winding up? Reserve capital. 91. What is meant by Called-up capital? Called-up capital is that part of subscribed capital which is called by the company, from the shareholders to whom shares are allotted. 92. What is meant by Paid-up capital? It is that part of Called-up capital which has been received by the company. 93. What is meant by issue of shares at a discount? Shares issued by a company below its nominal (face) value, is shares issued at a discount. Eg, Rs. 10 equity share is issued at Rs. 9. 94. What is meant by issue of shares at a premium? When a company issues a share above its face value, it is said that the company has issued shares at a premium, eg, a Rs. 10 share is issued at a price of Rs. 12. 95. What is meant by securities premium? The excess of issue price over the nominal (face) value of a Share/Debenture is securities premium. 96. What is meant by pro rata allotment of shares? Pro rata allotment of shares means allotment of shares in a fixed proportion. Pro rata allotment takes place only when the public issue of shares is oversubscribed. 97. State the steps other than rejecting applications that a company can take in case of over-subscription. (i) To make pro rata allotment to the applicants; or (ii) Accepting some applications in full; and; Allotting the remaining on pro rata basis 98. What is meant by Employees Stock Option Scheme? Employees Stock Option Scheme means a scheme under which the company grants an option (a right but not an obligation) to an employee to apply for shares of the company at a pre-determined price. 99. What is meant by buy back of shares? Buy back of shares implies the act of purchasing its own shares by a company. 100. What is meant by oversubscription of shares? Shares are said to be over-subscribed when the number of shares applied for is more than the number of shares offered for subscription. 101. Give any two alternatives available to a company for the allotment of shares in case of over-subscription. (i) Rejecting excess applications, and (ii) pro rata allotment. 102. What is meant by under-subscription of shares? Shares are said to be under-subscribed when the number of shares applied for is less than the number of shares offered for subscription. 103. What is meant by Sweat Equity Shares? Sweat Equity Shares mean equity shares issued by a company to its employees or directors at a discount or for consideration other than cash, such as for providing know-how or making available rights in the nature of Intellectual property or value addition. 104. What is meant by Rights Issue of Shares? Rights Issue is an issue of shares in which existing shareholders have a right to be offered new shares prior to the general public and an option to subscribe for the same. 105. What is meant by Preferential Allotment of Shares? Preferential Allotment of Shares is one that is made at a pre-determined price to the pre-identified people, such as promoters, venture capitalists, financial institutions, buyers of companies’ products or its suppliers, who wish to take a strategic stake in the company. 106. Give the meaning of Calls-in-Advance. Calls-in-Advance refers to the amount paid by shareholders in excess of the amount due from them. 107. Give the meaning of Calls-in-Arrears. Calls-in-Arrears is that part of capital which has been called-up by the company but not yet paid by the shareholder. 108. At what rate can interest be charged by a company on Calls-in-Arrears according to Table A? 5% p.a. 109. At what rate, interest on Calls-in-Advance may be paid by a company according to Table A? 6% p.a. 110. Can Securities Premium be used as working capital? Give reason in support of your answer. Securities Premium cannot be used as working capital. It can be used only for those purposes which are specified under section 77A and 78 of the Companies Act, 1956. 111. Identify the purpose of utilizing the Securities Premium that would maximise the return of shareholders. The amount of Securities Premium is used to issue fully paid Bonus Shares to the shareholders that would maximise their return. 112. What is meant by Issue of Shares for consideration other than cash? When the company purchases some assets (including services) or purchases a running business, instead of making the payment to the vendor in cash, it issues its shares. Such issue of shares is termed as issue of shares for consideration other than cash. 113. What is meant by Public Issue of Shares? Public Issue of Shares means an invitation by a company to public to subscribe the shares offered through a prospectus. 114. Can a company issue shares @ 6% discount in its Initial Public Offer (IPO)? Give reason. A company cannot issue shares at 6% discount in its Initial Public Offer (IPO) because as per section 79 of the Companies Act, 1956, the shares to be issued at a discount must be of a class already issued. 115. Can a new company issue its shares at a discount? If Not, why? A new company cannot issue its shares at a discount as per section 79 of the Companies Act, 1956. A company may issue shares at a discount if at least one year has elapsed since the date on which the company was entitled to commence business. 116. Can a company issue shares having nominal (face) value of Rs. 10 at Rs. 8? The company cannot issue the shares at Rs. 8 because sec 79 of the companies act, 1956 restrains issue of shares at a discount of more than 10%. 117. State when can shares be issued at a discount of more than 10%/ A company can issue shares at a discount of more than 10% with prior permission from the Company Law Board. 118. What is meant by forfeiture of shares? If a shareholder fails to pay any call made on him, the company may cancel his shares. This cancellation of shares for non-payment of amount due on shares is called forfeiture of shares. 119. On what conditions can forfeited shares be reissued? Shares forfeited become the property of the company and the Directors have the authority to reissue them at Par, at Premium, or at Discount. 120. What is meant by Capital Reserve? Capital reserve is created out of the profits of capital nature which are not available for distribution as dividend. 121. Explain Private Placement of Shares. Private Placement of Shares implies issue and allotment of shares to a select group of persons privately, and not to public in general through public issue. In order to place the shares privately, a company must pass a special resolution to this effect. 122. What is Minimum Subscription? Minimum Subscription ( Sec. 69 of The Companies Act, 1956) means the amount which, in the opinion of the Directors, must be raised by issue of shares in order to provide for the following: (i) Purchasing necessary assets for the company. (ii) Paying preliminary expenses and commission on sale of shares. (iii) (iv) (v) Paying loan, if arranged, for the above two purposes. Working capital, and Any other purpose. As per the guidelines of SEBI, a company must receive a minimum of 90% subscription against the entire issue before making any allotment of shares or debentures to the public. 123. State the purposes for which Securities Premium can be utilised? When shares are issued at a price higher than the nominal value, it is called issue of shares at premium. Excess of issue price over the nominal value is the amount of premium. It is a capital profit for the company and the amount so received is credited to a separate account called Securities Premium Reserve account. According to Sec 77A and 78 of the Companies Act, 1956, securities premium can be applied for the following purposes: (i) Issuing fully paid bonus shares to the shareholders, (ii) Writing off preliminary expenses of the company, (iii) Writing off expenses or the commission paid or discount allowed on any issue of shares or debentures of the company, (iv) Providing for the premium payable on the redemption of redeemable preference shares or of debentures, or (v) I purchasing its own shares ( buy back) [Section 77A] 124. What are the conditions for the issue of shares at a discount? Section 79 of the companies act, 1956 prescribes the following conditions for the issue of shares at a discount: (i) The shares are of a class already issued. (ii) At least one year must have elapsed since the company became entitled to commence business. (iii) Issue of shares at a discount is authorised by a resolution passed by the company in its general meeting and sanctioned by the central govt. (iv) The resolution specifies the maximum rate of discount at which the shares are to be issued. The rate must not exceed 10% unless sanctioned by the central govt. (v) The shares are issued within 2 months of the date on which the issue is sanctioned by the central govt. or within such extended time as the central govt. may allow. 125. What is the maximum amount of discount which may be allowed on reissue of shares? Maximum amount of discount which may be allowed on reissue of shares: Case Maximum discount 1. When the shares were originally The amount credited to forfeited issued at par or at premium shares account 2. When the shares were originally The amount credited to forfeited issued at discount. shares account + the amount of original discount. 126. What is meant by a Debenture? Debenture is an instrument issued by a company ender its common seal acknowledging a debt. It has the terms of repayment of principal and interest. 127. What does an Irredeemable Debenture means? Irredeemable Debentures or Perpetual Debentures are those debentures which are not repayable during the lifetime of the company. 128. What is meant by Unsecured Debentures? Unsecured Debentures are those debentures that are secured by neither a fixed charge nor a floating charge. 129. State the meaning of Non-Convertible Debentures. Non-Convertible Debentures are those which are not convertible into shares. 130. What is meant by Convertible Debentures? Convertible Debentures are those debentures which are convertible into Equity shares or Other Securities either at the option of debentureholders or at the option of the company, as the case may be, after a specified period. 131. Define Secured Debentures? Secured Debentures are those debentures which are secured by either a fixed charge or a floating charge. 132. Distinguish between fixed charge and floating charge. Fixed charge is a mortgage on specific assets. Floating charge, on the other hand, is a charge on present and future assets of the company. 133. What are Registered Debentures? Registered debentures are those debentures which are payable to the persons whose names appear in the Register of Debentureholders. 134. What does a Bearer Debenture means? Bearer Debentures are those debentures which are payable to the bearer or holder thereof. These debentures are transferable by mere delivery. 135. Why would an investor prefer to invest partly in Shares and partly in Debentures of a company? An investor would prefer to invest partly in shares and partly in debentures of a company due to the following reasons: (i) He would be an owner by investing in shares and would get dividend. (ii) He would be a lender to the company and would get regular interest. 136. What is meant by issue of debentures as purchase consideration? When the company purchases some assets (including services), and, instead of making payment to the vendor in cash, issues its fully paid debentures, it is known as issue of debentures for consideration other than cash or purchase consideration. 137. What is the nature of interest on debentures? Interest on debentures is a charge against profits. It is, therefore, provided even if the company does not have profit or has inadequate profits. 138. What is meant by issue of debentures as collateral security? When a company issues debentures to the lender as a security over and above the prime security, it means Issue of Debentures as Collateral Security. 139. Pass the necessary journal entry when 10,000 debentures of Rs. 100 each are issued as collateral security against a bank loan of Rs. 8,00,000. Debenture Suspense a/c Dr. 10,00,000 To Debenture a/c (being the issue of 10,000 debentures of Rs. 100 each As collateral security against bank loan) 140. (i) (ii) 10,00,000 Mention two sources of finance for redemption of debentures. Redemption from the fresh issue of shares or debentures, Redemption out of accumulated profits. 141. Explain SEBI guidelines regarding redemption out of profits. Section 117C (1) of the Companies Act, 1956 does not spell out as to what is adequate amount. For this purpose SEBI issued guidelines that it is obligatory for all companies issuing debentures to create a Debenture Redemption Reserve upto at least 50% of the amount of debentures issued before commencement of redemption of debentures. 142. Can debentures be redeemed out of capital only? No, debentures cannot be redeemed out of capital only. Government of India and SEBI has indirectly placed restrictions on the redemption of debentures. Now it is compulsory to create Debenture Redemption Reserve equal to at least 50% of the amount of the Debentures issued. 143. What is meant by own debentures? Own debentures are the debentures which are purchased by the issuing company either for immediate cancellation or keeping them as investment. 144. What are the exception for creating Debentures Redemption Reserve? a. An infrastructure company; b) if debentures are issued for less than 18 months maturity period. 145. How would you determine the time of redemption? Debentures are normally redeemed at the expiry of their time period. but quite often the company reserves the right in the Articles of Association to redeem them before the expiry of their time period. 146. To which account profit of redemption of debentures is transferred? Capital Reserve a/c. 147. What is the treatment given to debenture redemption reserve after all the debentures are redeemed? The balance standing to the credit of Debenture Redemption Reserve fund a/c is transferred to General Reserve a/c 148. Why does a company purchase its own debentures from the open market? A company may purchase its own debentures from the open market either: (i) For immediate cancellation or (ii) As an investment (to be cancelled when required).