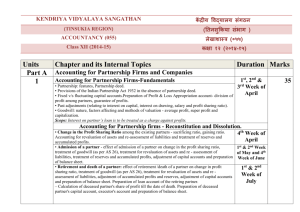

Remedial Material

advertisement

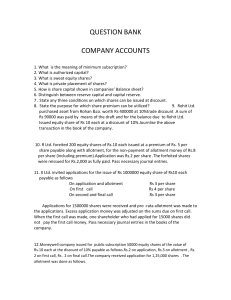

REMEDIAL MATERIAL FOR SLOW LEARNER Q 1Ruby ltd.issued 30000 equity share of Rs 10 each at a premium of Rs 3 per share Payable as Rs. 3 on app. Rs. 6 on allotment including premium’s. 2on first call And Rs, 2 on second call. Application received 40000 share.4000 application rejected and balance were subscribed on pro-rata basis.Mr A holder of 600 share, failed to pay allotment and subsequent failure to pay first call, his share were forfeited..Mr B holder of 400 share failed to pay two calls. His share were forfeited. Later on. 800 share(including A all share), were re – issued To Mr.C, as fully paid at Rs 11 per share. Pass necessary entries. ANS Capital reserves 3360, Amount not received on allotment 3240, 2. Babba Company purchased a machine from Gabba ltd for Rs.400000 at 10% trade Discount. Half amount paid by bank and the remaining amount by share of RS.10 each At 10% discount. Record above transaction. ANS a) Dr. Machine a/c & Cr.Baba by 360000 b) Dr.Baba a/c & Cr.Bank 180000 c) Dr.Baba a/c and discount on share a/c by 18000, 20000 And Cr.equity share capital by 200000 3. Pass necessary entries I Convert 100, 12% deb.of Rs.100 each into 10% Preference share of Rs.100 each at 25% Premium. II Redeemed Rs.100000, 12% deb. At a premium of 10% by draw a lots. ANS a) Dr.12% Deb a/c by 10000 and Cr.10% Pref share & share premium By 8000 and 2000 b) Dr.12% Deb and Premium on red. Of deb by 100000 and 10000 & Cr.Bank by 110000 .4 Poonam company Ltd. Issued 10000 equity share at Rs.100 each on 10% Premium. Amount called as Rs.20 on application, RS.40 on allotment (including premium), and Balance on call, Application was received for 20500 shares. Director rejects 500 shares and allots other Application on pro-rata basis. All money received except call on 50 shares which was later on forfeited .After due notice forfeited share re-issued at Rs 90.Pass necessary entries. 6 ANS Amount Recd on application 410000 Amount Recd on allotment 200000 Amount Recd on call 497500 Amount in capital reserve 2000 5. A. Ltd. Invited application from public for issue of 2,00,000 equity shares of Rs.10 each, payable on application Rs. 3, on allotment Rs.5 and Rs. 2 on first & final call. Company received applications for 3, 00,000 shares and decided to allot the share on pro- rata basis. Excess of application amounts to be utilized towards allotment and calls. B, who was allotted 2,000 shares failed to pay allotment and his shares were forfeited after Working : ANS a. Excess application amount (3,00,000 -2,00,000)x 3=3,00,000 b. Calls in arrear: on allotment 7,000 & 1st call 4,000 Forfeiture amount 3,000x3=9,000 6 Ankit Ltd. Company purchased a machine worth Rs. 1,05,000 from M/s India Traders. Payment was made by issue of equity share of Rs. 10 fully paid at issue price of Rs. 10.50 each. Pass journal entries in the books’ of the company. ANS No. of shares to be issued = 1,05,000/10.50=10,000 Share premium 10,000 x .50 =5,000 a. Machinery a/c - Dr. 1,05,000 To M/s India Trader a/c 1,05,000 b. M/s India trader a/c -Dr. 1,05,000 To Sh. Cap. a/c 1,00,000 To Sh. Prem. a/c 5,000 7 M/s M. Ltd. Purchased Machinery for Rs. 3,30,000 from M/s N.Ltd. Payment was made by issue of 9% debenture of Rs. 100. Pass journal entries for purchase of machinery and issue of debenture whena. Debentures are issued at par b. Debentures are issued at premium of 10% c. ANS No. of debenture when issued at par 3,300 No. of debenture when issued at premium 3,000 Machinery a/c -Dr.3,30,000 To M/s N. Ltd. 3,30,000 N. Ltd. –Dr. 3,30,000 To 9% Debenture a/c 3,30,000 b. N. Ltd. –Dr. 3,30,000 To 9% Debenture a/c 3,00,000 To Debenture premium a/c 30,000 8. Pass journal entries for issue of debentures in the books of M/s Gupta Ltd.:a. Issued 10,000, 12% debentures of Rs. 100 each at discount of 6% repayable at premium of 6%. b. Issued 15,000 10% debentures of Rs. 100 at premium of 20% Repayable at par. . Pass journal entries in the books of the company. ANS a. Bank a/c - Dr 9,40,000 Loss on issue of deb. –Dr 1,20,000 To 12% Deb. a/c 10,00,000 To Prem. on red. of deb. a/c 60,000 b. Bank a/c - Dr 18,00,000 To 12% Deb. a/c 15,00,000 .9 Lakshmi Ltd., issued a prospectus inviting applications for 30,000 shares of Rs.10 each payable as under. On application Rs.3 On allotment Rs.2 On first call Rs.2 On final call Rs.3 Applications were received for 40,000 shares, and pro-rata allotment was made on application for 34,000 shares. Excess money paid on application was utilized towards allotment money. Mr. Rao whom 500 shares were allotted failed to pay the allotment money and on his subsequent failure to pay the first call money, his shares were forfeited ANS 1. Bank A/c -Dr. 1,20,000 To Share Application A/c 1,20,000 2. Share application A/c -Dr. 90,000 To Sh. Cap. A/c 90,000 . 3. Share Application a/c 18,000 To Bank a/c 18,000 4. Sh. Allot. A/c -Dr. 60,000 To Sh.Cap. A/c 60,000 5. Bank A/C - Dr. 47,000 S.Appl.a/c Dr 12,000 Calls in arrear A/c - Dr. 1,000 To Sh. Allot A/c 60,000 6. Sh. 1st Call A/c -Dr. 60,000 To Sh. Cap. A/C 60,000 7. Bank A/C - Dr. 59,000 Calls in arrear A/C - Dr . 1,000 To Sh 1st call A/C 60,000 8. Sh. Cap. A/c -Dr. 3,500 To Sh. Forfeiture A/c 1,701 To S. Allot. A/c 799 To S. first call a/c 1,000 9. Sh. Final Call A/c -Dr. 88,500 To Sh. Cap. A/ 88,500 10. Bank A/C - Dr. 88,500 To Sh 1st call A/C 88,500 10. Swapna Ltd., issued 2,00,000 equity shares of Rs.10 each at a discount of 10%. On these shares, payments are to be made as follows. Rs.3 on application, Rs.2 on allotment and Rs.5 on first and final call. Balu who is allotted 6,000 shares has not paid the first and final call. Hence his shares have been forfeited and shave been reissued at a discount of 5%. Pass necessary journal entries for forfeiture and re-issue only in company books ANS 1. S. Cap. a/c Dr. 60,000 (6000X10) To Share forfeited a/ To Discount of issue of shares a/c To S. First and final call A/c 2. Bank a/c Dr. 57,000 Disc.on issue of shares a/c 3,000 To S.Cap. a/c 3. Share forfeited a/c Dr 27,000 To Capital Reserve a/c 24,000 6,000 30,000 60,000 27,000 . 11 DIFFERENCE BETWEEN SHARE & DEBENTURE DEBENTURE SHARE A debenture holder is creditor of co. A debenture holder gets interest. A shareholder is joint owner of co. . A shareholder gets dividend. A debenture holder gets interest the co. gets profit or loss A shareholder gets profit when co. gets profit. Only. The rate of interest is fixed for all the time The rate of dividend change every year Debenture holder had no voting Right Shareholder have voting right. Debenture may be converted into Share. All debentures are secured in India. Share are never convertible. Shareholders do not have any Security On winding up the debenture Paid before shareholder 12 On winding up the shareholder paid after Debenture A ltd X ltd convert 200 12% debenture of rs. 100 each issued at 10% discount into convert 1000 12% debentureof Rs. 100 each issued at 5% discount into equity shareof Rs. 10 each at par before maturity period. ANS (1) BANK A/C DR. 95000 DISCOUNT A/C DR. 5000 TO 12% DEBENTURE 100000 (2) 12% DEBENTURE A/C DR. 95000 TO EQUITY SHARE. 95000 13 (BEING 9500 SHARE ISSUED TO DEBENTURE HODER) Ltd. forfeited 300 shares of Rs. 10 each fully called up held by Ramesh for non-payment of allotment money of Rs. 3 per share and final call money of Rs. 4 per share. Out of these 250 shares were reissued to Rishi for a total payment of Rs.2, 000. Pass necessary journal entries. Journal Date Particular Shares capital A/c (300 x Rs. 10) To share forfeited A/c (300 x 3) To share allotment A/c (300 x 3) To share final call A/c (300 x 4) ( Being forfeiture of 300 share for nonpayment of allotment and final call money) Bank A/c Share forfeited A/c To share capital A/c ( being re issue of 250 forfeited shares for Rs 8 per share fully paid) Share forfeited A/c To capital reserve A/c (Being profit on re issue of 250 shares transferred to capital reserve) L. F. Debit Rs. 3,000 Credit Rs. 900 900 1,200 2,000 500 2,500 250 250 Note: Total amount forfeited on 300 shares @ Rs. 3 per share = Rs. 900 Amount forfeited on 250 shares re issued @ Rs 3 per share = Rs 750 Less: Discount allowed on reissue of forfeited shares = 500 Profit on reissue of forfeited shares transfer to capital reserve = 250 14. How will you show share capital in the balance sheet? Ans: SCHEDULE VI PART I FORM OF BALANCE SHEET (Disclosure of Share capital only) Liabilities (1) Share Capital Authorized Capital Issued Capital Subscribed Capital *** Less: Calls Unpaid *** Add: Forfeited Shares *** (2) Reserves and Surplus Amount *** *** *** A. Capital Reserve B. capital redemption reserve C. Securities Premium D. Other reserve Less: Debit balance in P&L A/C(if any) E. Surplus F. Sinking fund Example: A company was formed with an authorized capital of Rs.20,00,000 divided into 20,000 shares of Rs.100 each. It issued to the public 15,000 shares, payable as Rs.30 on application, Rs.30 on allotment and the balance on first and final call. Applications were received for Rs.12,000 shares. The amount of allotment was duly received except from Mahesh, who held 1,000 shares did not pay allotment. The company did not make call. How will you show share capital in the Balance Sheet? Solution: BALANCE SHEET OF A COMPANY (As On…………..) Liabilities Share Capital Authorized : 20,000 shares of Rs.100 each Issued : 15,000 shares of Rs.100 each Subscribed: 12,000 shares of Rs.100, each Rs. 60 per shares call up 7,20,000 Less: 30,000 Total Amount Assets Current Assets Cash at Bank Amount Total 6,90,000 6,90,000 20,00,000 15,00,000 6,90,000 6,90,000 15. Bharath Tyres Ltd. Invited application for 1,00,000 shares of Rs. 10 each issued at a premium of Rs. 4 per share. The amount was payable as under : On Application Rs. 6 ( including premium Rs. 2) On Allotment Rs. 6 ( including premium Rs. 2) Balance on first and final call. Application for 1,50,000 shares were received. Allotment was made to all applicants on pro-rata basis. Subodh, to whom 200 shares were allotted, failed to pay allotment money. Vikram, to whom 100 shares were allotted, failed to pay the call money. Their shares were forfeited and afterwards reissued @ Rs. 8 per share fully paid up. Pass necessary Journal entries. Solution : Journal Date Particulars L.F. Debit I Bank A/c 9,00,000 Share Application A/c (Being application received for 1,50,000 shares of Rs. 6 including premium Rs. 6) II Share Application A/c 9,00,000 To Share Capital A/c To Securities Premium A/c To Share Allotment A/c (Being adjustment of share application money) III Share Allotment A/c 6,00,000 To Share Capital A/c To Securities Premium A/c (Being allotment money due on 1,00,000 shares) IV Bank A/c 2,99,400 To Share Allotment A/c (Being allotment money received on Credit 9,00,000 4,00,000 2,00,000 3,00,000 4,00,000 2,00,000 2,99,400 99,800) V Share First and Final call A/c To Share Capital A/c (Being the first and final call money due on 1,00,000 shares) VI Bank A/c To Share First and Final call A/c (Being first and final call money received on 99,700 share of Rs. 2 per share) VII Share Capital A/c Securities Premium A/c To Share Forfeiture A/c To Share Allotment A/c To Share First and Final Call A/c (Being 200 share forfeited for nonpayment of allotment and first call) VIII Share Capital A/c To Share Forfeited A/c To Share First and Final Call A/c (Being 100 share forfeited for the nonpayment of call money) IX Bank A/c Share Forfeited A/c To Share Capital A/c (Being the re-issue of 300 shares @ Rs. 8 per share, fully paid) X Forfeited Share A/c To Capita Reserve A/c (Being the transfer of profit on re-issue of shares to capital reserve A/c) 2,00,000 2,00,000 1,99,400 1,99,400 2,000 400 1,400 600 400 1,000 800 200 2,400 600 3,000 1,600 1,600 16. K ltd has been registered with an authorized capital of Rs. 2,00,000 divided into 2,000 shares of Rs. 100 each of which 1,000 shares were offered for public subscription at a premium of Rs. 5 per share payable as under : Rs. On Application 10 On Allotment 25 ( including premium) On First Call 40 On Final Call 30 Application were received for 1,800 shares of which applications for 300 shares were rejected outright, the rest of the applications were allotted 1,000 shares on pro-rata basis. Excess application money was transferred to allotment. All the money were duly received except from Sunder, holder of 100 shares, who failed to pay allotment and first call money. His shares were later on forfeited, and reissued to Shyam at Rs. 60 per share, Rs. 70 paid up final call has not been made. Pass necessary journal entries in the books of K ltd. Solution : Journal Date Particulars I Bank A/c To Share Application A/c (Being application money on 1,800 shares @ Rs. 10 each received) II Share Application A/c To Share Capital A/c To Bank A/c To Share Allotment A/c (Being share application money transferred to share capital A/c on 1,000 shares @ 10 each on the pro- L.F. Debit 18,000 Credit 18,000 18,000 10,000 3,000 5,000 rata basis) III Share Allotment A/c To Share Capital A/c To Securities Premium A/c (Being share allotment made due with premium) IV Bank A/c To Share Allotment A/c (Being share allotment money received with exception of Rs. 2,000) V Share First Call A/c To Share Capital A/c (Being share first call money made due) VI Bank A/c Calls-in-Arrears A/c To Share First Call A/c (Being share first call money received) VII Share Capital A/c (70 × 100) Securities Premium A/c (5 × 100) To Share Forfeited A/c To Share Call-in-Arrears (Being 100 share forfeited for the non-payment of allotment and share first call) VIII Bank A/c Share Forfeited A/c To Share Capital A/c (Being reissue of forfeited shares @ Rs. 60 per share, Rs. 70 Paid up) IX Share Forfeited A/c To Capital Reserve A/c (Being transfer of share forfeited A/c to capital reserve A/c) 25,000 20,000 5,000 18,000 18,000 40,000 40,000 36,000 4,000 40,000 7,000 500 1,500 6,000 6,000 1,000 7,000 500 500 Working Note : (i) Calculation of amount received on allotment : Total amount due on allotment (1,000 × 25) 25,000 Less: Allotment money received in advance (5,000) Less: Amount of allotment not received from Sunder (2,000) Amount received on allotment 18,000 (ii) Shares Applied by Sunder = 1,500/1,000 × 100 = 150 (iii) Money paid by Sunder on application (150 × 10) 1,500 Money utilized as application money (100 × 10) 1,000 Surplus money transferred to allotment 500 (iv) Allotment money due from Sunder (100 × 25) 2,500 Less : Allotment money received in advance from Sunder 500 Amount of allotment not received form Sunder 2,000 (iv) While forfeiting shares, Share Capital Account will be debited @ Rs. 70 per share because the final call has been made. 17 .X Ltd. Issued 2,00,000 10% debentures of Rs 100 each at par to be redeemed at par after 12 years. Debentures are callable after four years at an exercise price of Rs 104. After six years company invoked the call option and holders of 10.000 debentures responded to the call option. Record necessary entries at the time of issue of debentures and at the time of cancellation of debentures. Journal Date Particular On issue of debentures Bank A/c To 10% Debentures application A/c (money received on application) 10% Debenture application A/c To 10% debenture A/c ( debenture application money transferred to 10% debentures account on allotment) At the time of cancellation of debentures 10% debentures A/c Loss on redemption A/c To Bank A/c (debenture redeemed under transferred call option at Rs. 104) Profit & Loss A/c To Loss on Redemption A/c (Loss on redemption of debentures transferred to profit and Loss A/c) l. Debit f Rs Credit Rs 2,00,00,000 2,00,00,000 2,00,00,000 2,00,00,000 10,00,000 40,000 10,40,000 40,000 40,000 18 X Ltd., issued 2, 00,000 10% Debentures of Rs.100 each at par to be redeemed at par after12 years. Debentures are callable after four years at an exercise price of Rs.104. After six years company invoked the call option and holders of 10,000debentures responded to the call option. Record necessary entries at the time of issue of debentures and at the time of cancellation of debentures. Solution: Date Particular l. Debit f Rs Credit Rs On issue of debentures Bank A/c To 10% Debentures application A/c (money received on application) 10% Debenture application A/c To 10% debenture A/c ( debenture application money transferred to 10% debentures account on allotment) At the time of cancellation of debentures 10% debentures A/c Loss on redemption A/c To Bank A/c (debenture redeemed under transferred call option at Rs. 104) Profit & Loss A/c To Loss on Redemption A/c (Loss on redemption of debentures transferred to profit and Loss A/c) 2,00,00,000 2,00,00,000 2,00,00,000 2,00,00,000 10,00,000 40,000 10,40,000 40,000 40,000 19 . Pass journal entries in the books of a limited company in connection with the issue and redemption of debentures with reference to the following transactions: 1. 10% Debentures of Rs 5, 00,000 issued at par and redeemable at par. 2. 10% Debentures of Rs 5, 00,000 issued at a premium of 5% but redeemable at par. 3. 10% Debentures of Rs 5, 00,000 issued at a discount of 5 per cent but redeemable at par. 4. 10% Debentures of Rs 5, 00,000 issued at par but redeemable at a premium of 5 percent. 5. 10% Debentures of Rs 5, 00,000 issued a discount of 5% and redeemable at 5 per cent premium. Date Particular 1. (a) On issue (i) Bank A/c To 10% Debentures Application & allotment A/c l.f Debit Rs Credit Rs 5,00,000 5,00,000 (Amount received on issue) (ii)10% Debentures Application & allotment A/c To 10% debentures A/c 5,00,000 5,00,000 (Allotment of debentures) (b) On redemption (i) 10% Debentures A/c To debentures holders A/c 5,00,000 5,00,000 (amount due to debenture holders on redemption) (ii) Debentures A/c To bank A/c 5,00,000 5,00,000 (Final payment made to debenture holders) 2. (a) On issue (i) Bank A/c To 10% Debentures Application A/c 5,25,000 5,25,000 (amount received on issue) (ii)10 % Debenture Application & allotment A/c To 10% debenture A/c To Debe3nture holders A/c 5,25,000 5,00,000 25,000 (allotment on debentures and premium in issue brought into account) (b) On redemption (i) 10% Debentures A/c To debentures holders A/c 5,00,000 5,00,000 (amount due to debenture holders on redemption) (ii) Debenture holders A/c To Bank A/c (final payment made to debentures holders) 5,25,000 5,25,000 3. (a) On issue (i) Bank A/c To 10% debentures Application & allotment A/c 4,75,000 4,75,000 (Amount received on issue) (ii) 10% Debentures application & Allotment A/c Discount on issue of debentures A/c To 10% Debenture A/c 4,75,000 25,000 5,00,000 (allotment of debentures and discount on issue brought into account ) (b) On redemption (i) 10% Debentures A/c To debenture holders A/c 5,00,000 5,00,000 (amount due to debentures holders on redemption ) (ii) debenture holders A/c To bank A/c 5,00,000 5,00,000 (final payment made to debenture holders) 4. (a) On issue (i) Bank A/c To 10% debentures Application & allotment A/c 5,00,000 5,00,000 (Amount received on issue) (ii) 10% debentures Application & allotment A/c Loss on issue of debentures A/c To 10% debentures A/c To premium of redemption of debentures A/c 5,00,000 25,000 5,00,000 25,000 (allotment of debentures and premium on redemption brought into account) (b)On redemption (i) 10% debentures A/c premium on redemption of debenture A/c To debenture holders A/c 5,00,000 25,000 5,25,000 (amount due to debenture holders on redemption including premium ) (ii) Debenture holders A/c To bank A/c 5,25,000 5,25,000 (final payment made to debentures) 5. (a) On issue (i) Bank A/c To 10%bentures application & allotment A/c 4,75,000 4,75,000 (amount received in issue) (ii) 10% debentures Application & allotment A/c Loss on issue of debentures A/c To 10 debenture A/c To premium or redemption of debenture A/c 4,75,000 50,000 5,00,000 25,000 (allotment of debentures and discount on issue and premium on redemption brought into account as loss on issue) (b) On redemption (i) 10% debentures A/c Premium on redemption of debenture A/c To debenture holders A/c 5,00,000 25,000 5,25,000 (amount due to debenture holders on redemption including premium) (ii) Debentureholders A/c To bank A/c 5,25,000 5,25,000 (final payment made to debenture holders) *************************************************************