AGM Report14-15 (English)

advertisement

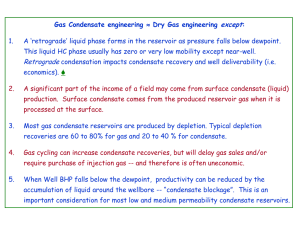

Report of the Board of Directors on the audited balanced sheet, income statement, auditor’s report and other activities of Sylhet Gas Fields Limited for the fiscal year 2014-15 Bismillahir Rahmanir Rahim Distinguished Shareholders, Assalamu-Alaikum, On behalf of Board of Directors and on my own behalf I welcome you all to the 33rd Annual General Meeting of Sylhet Gas Fields Limited. The company has been playing pioneering role in the last nearly five decades in the discovery, extraction, production and diversified use of natural gas. I recall with delight that the usage of natural gas as primary energy started in the then East Pakistan now Bangladesh with the discovery of natural gas at Haripur gas field in the year 1955 and with the commencement of gas production and supply from Chhatak gas field on commercial basis in the year 1960. The nature & area of company activities has widened over the period. At present, a total of 13 gas wells are now on-stream from the four gas fields of the company. A significant amount of liquefiable hydrocarbon is produced with the gas as co-product from Haripur, Kailashtilla and Beanibazar gas fields. The company has been contributing significantly to the savings of foreign currency by splitting nearly 3750 bbls/day of gascondensate into marketable diesel, petrol & kerosene. The gas-condensate is obtained from Bibiyana gas field of Chevron Bangladesh. This foreign currency would have otherwise been spent in the import of petroleum products. The natural gas liquids (NGL), being produced in the molecular sieve & turboexpander plant of Kailashtilla gas field, is used as feed-stock to produce liquefied petroleum gas (LPG). It is noted that the molecular sieve & turbo-expander plant is the first of its kind in the country. The year 2014-2015 has been another milestone in the continued economic progress of the company. Since inception, as a profitable organization, the company has been contributing greatly to keep the wheel of economy vibrant & dynamic by depositing significant amount of revenue in the national exchequer every year. The company has been awarded by National Board of Revenue as the top-most VAT-payer in the production sector in the last consecutive four years. We are delighted at the continued & successive achievement of Sylhet Gas Fields Limited, the oldest gas producing company in the country. I, now, present a brief report on the activities of the company and the Audited Balance Sheet & Income Statement, Auditor’s reports for the financial year 2014-2015: 1.0 Operational activities: The company has 4 (four) producing gas fields namely-Sylhet (Haripur), Kailashtilla, Rashidpur and Beanibazar under its umbrella. A total of 13 gas wells (2 wells at Sylhet, 4 wells at Kailashtilla, 5 wells at Rashidpur and 1 well at Beanibazar) are currently on stream which produced an average of 150.00 mmscf gas daily in the year. The produced gas is supplied to Jalalabad Gas T & D System Ltd., Bakhrabad Gas Distribution Company Ltd., Pashchimanchol Gas Company Ltd. and Karnaphuli Gas Distribution Company Ltd. franchised area. During the year under report gas production from the newly drilled wells Rashidpur-8 & Kailashtilla-7 started from August 2014 and September 2015 respectively. A substantial amount of condensate (heavy + light) & Natural Gas Liquids (NGL) is extracted from the gas stream during the course of gas processing. The condensate is split into petrol, diesel and kerosene. Besides, the gas-condensate available from Bibiyana field of Chevron Bangladesh is piped to the Rashidpur Condensate Fractionation Plant (RCFP) and is split into petrol, diesel and kerosene. 1.1 Brief description on gas and condensate processing plants of the company: The wells so far drilled, the wells on-stream at present, the type, installed capacity, and present processing capacity of the gas/condensate processing plants now in operation at different fields of SGFL is depicted below: 1 Nos. of Well Year of Discovery Field Total Wells Currently on-stream Quantity (mmcf) Existing Process Plants Production Type of Nos. of Capacity Process Plants Plants (MMSCFD) Silicagel 1 30 Silicagel 1 30 MSTE 1 90 Silicagel 3 160 Glycol 1 60 Silicagel 1 60 Sylhet (Haripur) 1955 4 2 8.2 Kailashtilla 1961 7 5 74 Rashidpur 1960 8 5 59 Beanibazar Chhatak 1981 1959 Total: Installation 2009 Installation 2012 2 1 22 1 13 9.5 150.7 - 8 430 - - - 1 2500 bbls/day - - - 1 1250 bbls/day Rashidpur condensate fractionation plant 2.0 Production Statistics: 2.1 Natural Gas: During the year, the company has produced a total of 54088.550 mmcf of natural gas from its 13 wells of Sylhet (Haripur), Kailashtilla, Rashidpur and Beanibazar fields at an average rate of 150 mmcf per day. Field wise production data in the year and the year before is given below: 2014-2015 Field Sylhet (Haripur) Kailashtilla Rashidpur Beanibazar Total Producing Well well nos.-2 (7 & 8 ) well nos.-5 (1,2,3,4 & 6) well nos.-5 (1,3,4, 7 & 8) well no.-1 (2) No. of wells-13 2013-2014 Total Production (mmcf) 350.898 26461.330 21106.127 3470.195 54088.550 Producing Well well nos.-2 (7 & 8 ) well nos.-6 (1,2,3,4,5 & 6) well nos.-4 (1,3,4 & 7) well nos.-2 (1 & 2) No. of wells-14 Total Production (mmcf) 3193.738 29290.644 17059.854 3730.391 53274.627 The gas production in the year has increased by 813.923 mmcf. The gas production has increased due to the commencement of production from the newly drilled well no. Rashidpur-8. Mention is made that the gas production remained suspended throughout the year from wells no. Kailashtilla5 & Beanibazar-1. On the other hand, owing to excessive water & sand production, well no. Kailashtilla-1 has produced gas only for one month. SGFL and other gas producing companies’ gas production as percentage of total gas production in the country in the year 2014-2015 is mentioned below: Name of the company SGFL BGFCL BAPEX Sub-total IOC Grand total 2.2 Production (mmcf) 54088.550 297669.160 39774.064 391531.774 500639.516 892171.290 Percentage (%) 6 34 4 44 56 100 Condensate and Natural Gas Liquids (NGL): The company has produced 33697.159 kilolitres of heavy condensate (which is not fractionated) & 2188.566 kilolitres of light condensate (which is not directly sold) i.e. a total of 35885.725 kilolitres of saleable heavy and light condensate from its Sylhet (Haripur), Kailashtilla, Rashidpur, and Beanibazar fields in the year 2014-2015. It is seen from the field-wise condensate production statistics that owing to the total suspension of gas production from two heavy hydrocarbon rich wells – Kailshtilla-5 & Beanibazar-1 and partial production of another heavy hydrocarbon rich well no. Kailastilla-1, the total condensate production has decreased although gas production has slightly increased in the year. Besides, an amount of 27623 kilolitres of Natural Gas Liquids (NGL) produced from Kailashtilla MSTE plant has been piped to RPGCL’s NGL fractionation plant at Kailashtilla which is 72 kilolitres i.e. 0.26 % lesser than the previous year. Kailashtilla MSTE plant is capable of extracting 29,000 2 kilolitres NGL from the present gas production rate of around 60 mmscfd. NGL is used as feedstock for the production of LPG. RPGCL doesn’t receive NGL regularly in full quantity causing the necessity of burning the NGL in the flare. It creates adverse impact on the environment. Field wise production data of condensate & NGL is as follows: (Kilolitre) Gas Field Sylhet (Haripur) Kailashtilla Rashidpur Beanibazar Total Condensate (Heavy+Light) 2014-2015 Light Condensate 1732.974 455.592 2188.566 Heavy Condensate 319.845 23811.177 1416.047 8150.09 33697.159 2013-2014 Light Condensate 1932.094 794.699 2726.793 Heavy Condensate 373.653 27297.977 1257.049 8506.846 37435.525 NGL 27623 27623 35885.725 NGL 27695 - 40162.318 SGFL and other gas producing companies’ condensate & NGL production as percentage of total condensate/NGL production in the country in the year 2014-2015 is summarized below: Company SGFL BGFCL BAPEX Sub-Total IOC Total 2.3 Condensate Percentage Quantity (%) 35885.725 8 28468.473 6 3668.386 1 68022.584 15 393563.541 85 461586.125 100 NGL Quantity Percentage (%) 27623 27623 27623 100 100 100 Petrol, Diesel, Kerosene and Octane: The condensate available from Bibiyana field of Chevron Bangladesh is fractionated into petrol, diesel and kerosene in the Rashidpur Condensate Fractionation Plant (RCFP). The company has produced about 90796.903 kilolitres of petrol (including the light condensate of Sylhet & Kailashtilla fields), 35712.053 kilolitres of diesel and 29331.810 kilolitres of kerosene by processing condensate employing its fractionation plants at RCFP, Sylhet (Haripur) field, and Kailashtilla field. Field wise petrol, diesel, kerosene and octane production is as follows: (Kilolitre) Field RCFP Sylhet (Haripur) Kailashtilla Total Petrol 78481.067 2014-2015 Diesel 28011.223 Kerosene 28587.184 Octane - Petrol 71025.727 2013-2014 Diesel Kerosene 30793.620 29369.028 Octane 6878.449 2473.643 - 744.626 - 2715.905 - 792.793 - 9842.193 90796.903 7700.830 35712.053 29331.810 0.00 9799.930 83541.562 7757.177 38550.797 30161.821 6878.449 In the year petrol production has increased by 7255.341 kilolitres whereas diesel and kerosene production has decreased by 2838.744 kilolitres and 830.011 kilolitres respectively as compared to the previous year. The diesel and kerosene production has decreased as the oil marketing companies have not lifted the petroleum products in the intended quantities keeping pace with the production capacity. The process of converting a portion of petrol into octane remained suspended due to the embargo imposed by the Environment & Forest Ministry on the import and use of previously procured LD-K02 brand octane booster. The process of importing octane booster as per changed and gazetted specification issued on 31-01-2013 by the Environment & Forest Ministry could not be completed through tendering process resulting in the total suspension of octane production from RCFP. SGFL and other gas producing companies’ petrol, diesel & kerosene production as percentage of total production in the country in the year 2014-2015 is summarized below: 3 (Kilolitre) Company SGFL BGFCL BAPEX Sub-total IOC Grand Total 2.4 Petrol Quantity Percentage (%) 90796.903 88 12068.644 12 102865.547 100 102865.547 100 Diesel Quantity Percentage (%) 35712.053 47 39528.223 53 75240.276 100 75240.276 100 Kerosene Quantity Percentage (%) 29331.810 100 29331.810 100 29331.810 100 Characteristics of SGFL Natural Gas: Compared to the other gas fields of the country, the natural gas being produced from Kailashtilla and Beanibazar fields of SGFL contain significantly higher amount of liquid hydrocarbons (condensate). Beanibazar wells and Kailashtilla wells yield 2.385 kilolitres and 1.272-1.590 kilolitres of condensate respectively from each million cubic feet of produced gas. Besides, Molecular Sieve Turbo Expander (MSTE) plant, being in operation at Kailashtilla field yields an additional amount of around 1.272 kilolitres of Natural Gas Liquids (NGL) from each million cubic feet of gas during the course of processing in the cryogenic section of the plant. The NGL, not available in any other gas fields in Bangladesh, is of great economic value and is used as feed-stock for manufacturing Liquefied Petroleum Gas (LPG). 3.0 Sales Statistics: 3.1 Natural Gas: In the year, a total of 54015.393 mmcf of gas was sold to Jalalabad Gas T & D System Ltd., Bakhrabad Gas Distribution Company Ltd., Karnaphuli Gas Distribution Company Ltd. and Pashchimanchal Gas Company Ltd. as per gas consumption break-down given by GTCL. The amount includes the quantity of gas consumed (28.393 mmcf) gas as fuel for power generation and domestic usages. The gas sold in the previous year was 53175.000 mmcf. It may also be mentioned that, in the year 2014-2015, 73.157 mmcf of gas was used as fuel for process heaters and compressors of gas process plants. 3.2 Petroleum Co-Products: In the year 2014-2015, a total of 56998.017 kilolitres of condensate (Heavy & Light) of Rashidpur, Kailashtilla, Beanibazar and Haripur of SGFL, 1332 kilolitres of condensate from Fenchuganj field of BAPEX and 235002.807 kilolitres of condensate from Bibiyana, Moulvibazar & Jalalabad field of Chevron Bangladesh was sold. On the other hand, a total of 90877 kilolitres of petrol, 34998 kilolitres of diesel, 27423 kilolitres of kerosene and 27623 kilolitres of NGL was sold. An amount of 129514.5 kilolitres of condensate was sold to the ten condensate fractionation plants built and being operated by private organizations in the country. The amount is 7341 kilolitres (15.46%) more than the year before. The ten privately-owned condensate fractionation plants are contracted to SGFL for purchase of condensate. 4.0 Financial Activities: Respected Shareholders, Now I present a brief description of financial activities of the company for the year 2014-2015: In the financial year 2014-2015, the actual revenue expenditure stood at TK. 59.85 crore against the allocated revenue budget of Tk. 83.52 crore. The revenue expenditure reduced by Tk. 23.67 crore (28.34%) compared to budget estimate. In the year, the expenditure on salary and allowances reduced by Tk. 5.1 crore, expenses on repair & maintenance of plant/machinery reduced by Tk. 10.08 crore and savings of another Tk. 8.40 crore in a number of sub-heads owing to expenditure reduction and strict financial discipline maintained by the management resulted in the reduction of total revenue expenditure by Tk. 23.67 crore. 4 As per government directive debt to equity ratio of any gas production organization shall be kept limited to the ratio of 60:40. In the case of SGFL, debt to equity ratio stood at 9.65:90.35 at the year end which was 6.30:93.70 in the previous fiscal year. Besides, in the year 2014-2015 the rate of return on net average fixed asset stood at 79.14% which was 94.81% in the previous fiscal year. The above indicators manifest the sound financial base of the company. 4.1 Sales Income: The sales statistics of gas, condensate, petrol, diesel, kerosene, octane and NGL during the year is as below: (Gas: mmcf) (Petroleum co-products: kilolitres) Products Gas Condensate Petrol Diesel Kerosene Octane NGL Amount sold 54015.393 35658.54 90877.65 34997.62 27423.80 27623.00 Total income 2014-2015 Revenue income (Tk.in crore) 415.58 Percentage of income 1251.55 75.07 1667.13 100 24.93 Amount sold 53203.361 39636.39 83283.13 40471.00 30213.40 7301.26 27695.00 2013-2014 Revenue income (Tk.in crore) 396.08 Percentage of income 20.35 1549.87 79.65 1945.95 100 In the year 2013-2014 the total amount of sales income was Tk. 1945.95 crore. Due to the decrease in the amount of kerosene & diesel sales and as a result of downward revision of prices of all categories of petroleum products effective from 1 November, 2014, the sales proceeds decreased by Tk. 278.82 crore (14.33%) as compared to the previous year. In the year 2014-2015 the budgeted sales proceeds was TK. 1997.54 crore whereas actual sales proceeds stood at Tk. 1667.13 crore. The total amount of sales income reduced by Tk. 330.41 crore (16.54%) compared to the targeted budget amount. As the oil marketing companies did not lift the petroleum products from RCFP in intended quantities keeping pace with the production capacity, sales proceeds decreased by Tk. 337.89 crore i.e. 21.26% compared to the targeted amount. 4.2 Operational Expenses: In the year 2014-2015 budget estimate for the operational expense was Tk. 927.15 crore whereas operational expenses stood at Tk. 676.49 crore which is 27.04% less than the budget estimate. In the year 2014-2015, the expenses reduced by Tk. 5.91 crore on salary and allowances, by Tk.10.08 crore on plant maintenance & repair, by Tk.1.17 crore on corporation overhead, by Tk.8.40 crore in various sub-heads owing to expenditure reduction by the management, by Tk.5.82 crore on depreciation head as asset was not attached with the fixed asset according to budget, by Tk. 6.16 crore on depletion head. Besides, sales expenses on transportation of petroleum products reduced by Tk. 2.50 crore. On the other hand condensate purchase for RCFP reduced by Tk. 212.60 crore. The actual operational expense in the previous year was Tk. 817.82 crore. But in the year 20142015 the actual operational expenses stood at Tk. 676.49 crore, which is Tk. 141.33 crore i.e. 17.28% lesser than the previous year. As a result of the decrease of condensate price effective from November 1, 2014, the expenses on condensate purchase for RCFP decreased by Tk.148.14 crore. Moreover, the expenses reduced by Tk. 5.49 crore on corporation overhead. On the other hand, expenses increased by Tk. 1.94 crore on salary and allowances, by Tk. 1.66 crore on sales expenses, by Tk. 3.84 crore as depreciation, by Tk. 0.33 crore on plant maintenance & repair, by Tk. 0.18 crore on depletion, by Tk. 2.24 crore on the stock adjustment of petroleum products (excepting RCFP) and Tk. 2.11 crore on stationeries, traveling, training, insurance, fuel, transportation cost, expenses for security etc. sub-heads. 5 4.3 Profit: Sales proceeds on gas, co-products & fractionated products and the other income are tabled below: Products Gas Co-products and fractionated products Interest and other income Total 2014-2015 Amount Percentage (Tk. in crore) (%) 415.58 22.27 2013-2014 Amount Percentage (%) (Tk.in crore) 396.08 18.42 1251.55 67.08 1549.87 72.04 198.61 1865.74 10.65 100.00 205.33 2151.28 9.54 100.00 After the deduction of revenue expenditure of Tk. 1251.31 crore made as payment of supplementary duty, VAT, interest on loan and WPPF, the pre-tax profit in the year stood at Tk. 614.43 crore which is Tk. 117.75 crore or 16.08% less than the previous fiscal year. 5.0 Payment to the Government Exchequer: During the year, the company has paid Tk. 848.29 crore to the National Board of Revenue which is 50.88% of total sales income of the company. It is mentioned that the total amount paid to the National Board of Revenue in the year 2013-2014 was Tk.1086.31 crore. Head-wise payment in the fiscal year 2014-2015 is as under: Head Supplementary Duty and VAT Income Tax Dividend DSL (Debt Service Liability) Total 6.0 2014-2015 Amount paid Percentage (%) (Tk. in crore) 522.14 61.55 2013-2014 Amount paid Percentage (%) (Tk. in crore) 684.72 63.04 186.07 140.08 - 21.93 16.52 - 232.50 168.20 0.89 21.40 15.48 0.08 848.29 100.00 1086.31 100.00 Accounts Receivables and Accounts Payables: At the year ended on 30 June 2015, the accounts receivables on the sales of gas and petroleum products stood at Tk. 575.72 crore which is equivalent to 5.50 months' average receivables. Earlier, POCL, JOCL & MPL used to pay the supply bill of petroleum products to SGFL. It has been decided that Bangladesh Petroleum Corporation (BPC) by itself, instead of oil companies would pay the supply bill of petroleum products to SGFL from January, 2015. But BPC did not pay the supply bill fully within the stipulated 30 June, 2015. Hence, the accounts receivable has increased. The accounts receivables in the previous year were Tk. 395.73 crore, which was equivalent to 2.70 months' average receivables. At the year ended on 30 June 2015, the accounts receivables from the gas distribution companies stood at Tk. 133.51 crore which is equivalent to 3.70 months' average receivables. In the previous year this amount was Tk.118.27 crore which was equivalent to 2.75 months' average receivables. On the other hand, accounts payables of the company for payment of SD and VAT to the Government exchequer stood at Tk. 93.16 crore which is equivalent to 2.94 months’ average payables. 7.0 Capital Structure 7.1 Authorized Capital: The present authorized capital of the company is Tk. 500.00 (five hundred) crore divided into 5 (five) crore ordinary shares of Tk.100.00 (one hundred) each. 6 7.2 Paid-Up Capital: The paid-up capital of the company on the last day of the financial year under report stood at Tk. 88.43 crore. 7.3 Dividend In the year 2014-2015 the dividend on Sylhet Gas Fields Limited was fixed at Tk. 140.08 crore by the Govt./Petrobangla which is 158.40% of the SGFL's paid-up capital. The dividend fixed has already been paid as advance. 8.0 Ongoing Development Projects: Sylhet Gas Fields Limited has been implementing various development projects for enhancing its revenue income alongside meeting the ever-increasing energy demand of the country. 8.1 Augmentation of Gas Production under Fast Track Program-SGFL part: A gas well, Rashidpur-8, was drilled under SGFL part of the project by GOB fund under ADP. As per the drilling contract with M/s. Gazprom EP International Investment B.V., Russia, the drilling contractor spudded-in the well on 04-06-2014 and completed the drilling in all respect on 07-08-2014. The well was drilled up to the total depth of 2990m. The well was completed at the upper gas sand (1475-1497 m MD). An 8-kilometer long 4-inch diameter gas gathering pipe line has been laid. Upon completion of hook-up between the wellhead and the gas gathering pipe line, the well has been flowing at the rate of 13 mmcf/d of gas from 27-08-214 and added to the national gas grid. As per 2nd RDPP, implementation period of the project is July 2010-March 2016. SGFL part of the project involves a total expenditure of Tk. 165.25 crore including a foreign currency component of Tk. 123.60 crore. 8.2 Drilling of one appraisal (oil)/development (gas) well-Kailashtilla-7 at Kailashtilla Field: Based on the recently conducted 3-Dimensional seismic survey at Kailashtilla field, the project has been undertaken to drill one appraisal (oil)/development (gas) well-Kailashtilla-7 at Kailashtilla structure. RDPP of the project was approved by the administrative Ministry on 08-09-2014. As per RDPP, the project-being financed by Gas Development Fund-is scheduled for completion between September, 2012 and December, 2015 with a project outlay of Tk. 218.1879 crore including a foreign currency component of Tk. 58.9894 crore. The national exploration company, Bapex, spudded-in the well on 17-10-2014 and completed the drilling operations on 08-03-2015. The well testing was completed on 26-03-2015. The well is now producing at a rate of around 7/8 mmscfd of gas from 05-09-2015. 8.3 Installation of a 4000-bbl/day capacity Condensate Fractionation Plant at Rashidpur: The project has been undertaken with the aim of evacuating the enhanced condensate to be available at Bibiyana field of Chevron Bangladesh and fractionating the condensate into marketable products i.e. petrol, diesel & kerosene. As per RDPP, approved on 12-08-2014, the project is scheduled for completion between July 2012 and December 2016 with a total project outlay of Tk. 463.50 crore including a foreign currency component of Tk. 328.80 crore. Under the project, the land acquisition, engagement of foreign consultant and obtaining of environmental clearance certificate has been completed. A contract has been signed on 31-072014 between SGFL & Bangladesh Diesel Plant (BDP) Limited (under the management of Bangladesh Army) for land development, land filling and construction of guard wall. Around 60% work on land development/land filling is already complete and construction of guard wall has begun. Another contract has been signed between SGFL and Bangladesh Machine Tools Factory (BMTF) Limited (under the management of Bangladesh Army) on 14-06-2015 for construction of boundary wall, box culvert, approach road, deep tube well with pump house, master drain & road7 side drain etc. The jobsite has already been handed over to BMTF Limited. The progress of BMTF's work is being monitored closely. A contract agreement between SGFL and EPC contractor has been signed on 27-04-2015. Finalization of design & drawing of the project is progressing. The other development work such as construction of petroleum product pipeline, fuel gas line, and civil facilities is now underway. The projected daily yield of the plant is 445.20 kilolires of petrol, 56.24 kilolires of diesel and 133.560 kilolires of kerosene. 8.4 Installation of a 3000-bbl/day Catalytic Reforming Unit to convert petrol into octane at Rashidpur: The project has been undertaken to convert petrol into octane employing catalytic reforming process (CRU). Petrol would be available from Rashidpur Condensate Fractionation Plant. RDPP of the project has been approved on 12-08-2014. The project implementation period is targeted from March 2012 to June 2017 and the project will be financed from company’s own resource. The total outlay of the project is Tk. 354.13 crore including a foreign currency component of Tk. 276.38 crore. Under the project, the land acquisition, engagement of foreign consultant and obtaining of environmental clearance certificate has been completed. Land development, land filling & construction of guard wall is progressing. An international tender has been floated on 24-07-2015 to engage EPC contractor including licensor. The tender will be opened on 11-11-2015. The project, if implemented successfully, is expected to yield 430.890 kilolires of octane and 25.85 metric ton of Liquefied Petroleum Gas (LPG) per day out of 3000 bbls motor spirit feedstock. 8.5 Construction of two storage tanks at Rashidpur Condensate Fractionation Plant (RCFP) premises: In order to ensure continuous full swing operation of the existing Rashidpur Condensate Fractionation Plant (RCFP) by increasing storage capacity of diesel oil and kerosene oil at RCFP compound, one diesel tank with a total capacity of 60,000 barrels and one kerosene tank with a capacity of 20,000 barrels is being constructed with finance from company’s own resource. As per revised DPP the project is scheduled for completion between September 2012 and December 2015 with a budgeted expenditure of Tk. 21.31 crore in local currency. In the mean time, the acquisition of land, obtaining of environmental clearance, signing of contract with EPC contractor, land development and construction of boundary wall & retaining have been completed. The design & drawings of civil and mechanical construction by the engaged EPC contractor to build the storage tanks have been approved. The construction of tank foundation work is completed entirely while tank fabrication is completed up to 75%. Besides, 85% of boundary wall work has been completed. The construction of tanks has been scheduled for completion in all respect by December 2015. 8.6 Drilling of appraisal /development well - Kailashtilla-9: The project has been undertaken based on the result of recently conducted 3-Dimensional seismic survey. The project is being financed from Gas Development Fund (GDF). As per approved DPP, the project is scheduled for completion between November, 2013 and December, 2015. The total project expenditure is Tk. 140.07 crore including a foreign currency component of Tk. 60.99 crore. It is noted that the project implementation work has been kept suspended up till the completion of ongoing review of 3-D results as per SGFL’s board decision on 29-04-2015. But procurement of materials already in the pipeline, land acquisition and construction of warehouse under the project is continuing but 'go slow' policy is being followed in this regard. Process of engaging foreign consultant and obtaining environmental clearance in favour of the project is going on. 8.7 Drilling of appraisal /development well Sylhet-9: The project has been undertaken based on the result of recently conducted 3-Dimensional seismic survey. The project is being financed from Gas Development Fund (GDF). As per approved DPP, the project is scheduled for completion between December, 2013 and June, 2016. The total project expenditure is Tk. 160.27 crore including a foreign currency component of Tk. 55.80 crore. 8 It is noted that the project implementation work has been kept suspended till the completion of ongoing review of 3-D results as per SGFL’s board decision on 29-04-2015. But procurement of materials already in the pipeline, land acquisition and construction of warehouse under the project is continuing but 'go slow' policy is being followed in this regard. Process of engaging foreign consultant is going on. Environmental clearance in favor of the project has already been obtained. 8.8 Drilling of Rashidpur-10 & 12 (exploratory) well: The project has been undertaken based on the result and recommendation of recently conducted 3-Dimensional seismic survey. The project is being financed from Gas Development Fund (GDF). As per approved DPP, the project is scheduled for completion between July, 2014 and June, 2017. The total project expenditure is Tk. 409.81 crore including a foreign currency component of Tk. 123.03 crore. Under the project, a total of 6.50 acre land has been leased on fixed demand long term basis from the Forest Department. Land acquisition is already completed. The request for hill cutting, razing and dressing under the project is in the final approval stage. The said approval will follow obtainment of environmental clearance in favor of the project. A draft contract has been initialed between SGFL and the selected consulting firm in connection with the engagement of foreign consultants. The initialed draft report has been forwarded to NBR for vetting. As per govt. decision, an addendum to the drilling contract has been signed between SGFL and Gazprom EP International Investments B.V. on 01-09-2015 for drilling of Rashidpur- 10 & 12 under “The Speedy Supply of Power & Energy (Special Provision) Act -2010. As per approved RDPP, the total project cost stands at Tk. 556.2745 crore. These two wells are expected to produce around 30 mmscf of gas per day. 8.9 Drilling of Rashidpur-9 (appraisal/development) well: The project has been undertaken based on the result of recently conducted 3-Dimensional seismic survey. The project is being financed from Gas Development Fund (GDF). As per DPP approved on 25-03-2015, the project cost is Tk. 198.07 crore including a foreign currency component of Tk. 57.08 crore and is scheduled for completion between February, 2014 and June, 2017. Under the project, a total of 15.03 acre land has been leased on fixed demand long term basis from the Forest Department. Land acquisition is already completed. The request for hill cutting, razing and dressing under the project is in the final approval stage. The said approval is required for obtainment of environmental clearance in favor of the project. A draft contract has been initialed between SGFL and the selected consulting firm in connection with the engagement of foreign consultants. The initialed draft report has been forwarded to NBR for vetting. The well would be drill by GAZPROM. As per approved RDPP, the total project cost is Tk. 292.2539 crore. The well is expected to produce around 10 mmscf of gas per day. 9.0 Future planning: The following activities have been planned for increasing the revenue earning of the company alongside meeting the ever-growing energy demand of the country. 9.1 Short-Term Planning (2016-2018): Completion of the drilling of Rashidpur-9, Rashidpur-10 & Rashidpur-12 and Kailashtill-9 & Sylhet-9. Drilling of new wells at Chhatak gasfield based on the available data. The program depends on govt./Petrobangla’s nod. Conduction of 3-D seismic survey over Beanibazar structure employing BAPEX/international firm. Review of 3-D seismic survey report of Sylhet (Haripur) submitted by BAPEX. Work-over, remedial action/repair on the presently suspended wells. 9 9.2 Medium-Term Planning (2019-2020): Commencement of drilling of new well(s) at Beanibazar field based on the planned 3-D seismic survey report. Running of wireline logging in the well – Surma -1/1A (Sylhet-8). Workover of the well based on the logging result. Drilling of another new well at Sylhet (Haripur) field based on the result of Sylhet-9. Drilling of another two new wells at Rashidpur field based on the results of drilling of wells which are currently underway. Drilling of new wells at Chhatak structure upon completion of 3-D seismic survey. Drilling of new wells in the gas block no. 12, 13 & 14, if remaining area (outside the ring fenced area of IOC) of the said blocks are given to SGFL. Taking initiative to install a 60-mmcfd capacity gas process plant at Haripur gasfield. 9.3 Long-Term Planning (2021-2025): Drilling of new wells at Chhatak structure upon completion of 3-D seismic survey. Drilling of another two new wells at Rashidpur field based on the results of drilling of wells which are currently underway. If allocated to SGFL, conduction of 2-D seismic survey at Atgram structure and drilling of new wells based on the result of seismic survey. 10.0 Environment Conservation & Security: Due emphasis is always given to environment protection alongside the development activities of the company. 10.1 Environment Conservation: Environmental Management Plan (EMP) study on the existing process plants at different fields/installations has been conducted by BETS Consulting Services. Environmental clearance in favor of the existing process plants has been obtained from the Department of Environment (DoE). Environmental regulations are properly observed in operating the process plants in all the installations. Water produced from the wells are collected and separated from the condensate in API separators and water is drained regularly in environment friendly manner. Weeds are either killed or trimmed regularly in and around the wells, process plant, office and residential area. Wastes generated at residential area and clinical waste are collected & burnt in a pit in environment-friendly manner. Saline water and sludge are discharged from the process plants during the course of gas and condensate production. Setting up of an effluent treatment plant at each field/location is underway to treat the water and sludge being generated during process operations before discharging. BUET is providing technical assistance for setting up of effluent treatment plant (ETP). In the preliminary stage, BUET has submitted a report on the sludge of condensate and saline water upon making a visit to SGFL’s fields. On the basis of the report and the design & geometric drawing provided by BUET consultant, SGFL will soon undertake to set-up an ETP at Beanibazar Gas Plant. The setting up of ETP at the other fields/installations would be undertaken later on in phases. 10.2 Safe Work environment/Safety: Appropriate safety rules are maintained in producing gas, condensate, petrol/octane, kerosene, diesel from the process plants of different fields. Personal Protective Equipment (PPE) is worn by the employees during maintenance and operation jobs in the process plants, power houses and other vulnerable points/areas. The procedure/instructions for using PPE are displayed at locations adjacent to each field/installation with a view to increasing awareness among the officers, employees and visitors. The efficacy of all Jockey Pumps, Fire Fighting Pumps, Fire Extinguisher, Water and Foam Deluge System, Fire Hydrants, Fire Monitor, Hot Insulation, Threaded Joint, Pipe 10 fittings are regularly checked / investigated. Besides periodic maintenance and cleaning of various equipment, Generators’ shed, compressors’ shed are done as per schedule. Fire fighting and fire prevention equipment are deployed in all important and vulnerable points / installations for preventing and combating fire and fire-related incidents in the incipient stages. Fire Hydrant Points and Firewater Ring Mains are always kept serviceable to face any emergency situation; moreover, fire extinguisher cylinders are kept in place for use in all important and vulnerable points. In order to install adequate number of fire extinguisher cylinders in all fields/installations different types of new fire extinguisher/cylinders are regularly purchased. Refillable fire extinguisher cylinders are refilled and kept serviceable. In addition, company’s two standalone fire tenders are kept ready round-the-clock to face any emergency situation. Besides, fire fighting workshops and fire drills in each field in every year is arranged with the assistance/guidance of Fire Service & Civil Defence station, Sylhet to impart training on earthquake, landslides, fire & fire-related incident, first aid and rescue operations etc. In continuation of that the following training course titled-Fire Fighting, Rescue, First-Aid and Earthquake was arranged in different field/installations: Field/Installation Sylhet (Haripur) Kailashtilla + MSTE Rashidpur + RCFP Beanibazar Duration of the Course 23-24 December 2014 23-24 December 2014 6-7 May 2015 12-13 May 2015 Total: No. of Participants 25 30 28 17 100 Mention is made that no reportable fire & fire-related incidents occurred in year and the over all production operations was unhindered. 11.0 Healthcare Service: Sylhet Gas Fields Ltd. is mainly a gas producing/processing and petroleum co-products processing company. As the health risk always exist among those working in the process plants for production, operation and maintenance, the facilities of medical center are there to each of the fields and headquarters to ensure proper medication. Officers and employees including dependents are given medical assistance under company’s medical rules by the medical retainer. A comparison of expenditure on treatment & medication in the year 2014-2015 with that of the previous year is depicted below: (Tk. in crore) Installation/ Field Headquarters Sylhet (Haripur) Kailashtilla Kailashtilla MSTE Plant Rashidpur RCFP Beanibazar Total 12.0 2014-2015 Number of Budgetary Officer/Employees Allocation 234 37 83 52 1.39 105 48 43 602 1.39 Expenditure made 0.68 0.11 0.16 0.10 0.11 0.05 0.04 1.26 Number of Officer/Employees 245 37 78 54 105 50 45 614 2013-2014 Budgetary Allocation 1.40 1.40 Expenditure made 0.65 0.11 0.15 0.10 0.10 0.04 0.04 1.19 Security and Protection: Field/installations including company headquarters are the Key Point Installation (KPI) graded establishments. Security rules applicable to KPI are strictly adhered to. Company-appointed security personnel and members of the ansar are on round-the-clock duty to maintain surface security at the company headquarters and field installations. Besides, assistance from the police administration is sought when the law and order situation warrants. Meetings of the security committee are regularly held and actions are taken with all seriousness as per their suggestions/advice, if any. Required number of street lights/flood lights are in place for the convenience of night shift duty personnel. Closed Circuit Television (CCTV) has been installed at the company Headquarters and Rashidpur Condensate Fractionation Plant as part of strengthening security measures. Initiatives have been taken to install similar system at other installations. 11 13.0 Manpower: In the latest revised organogram, the company has a provision of total manpower strength of 940 comprising 427 officers and 513 employees. As at June 2015, a total of 602 personnel including 280 officers and 332 employees were in the employment of the company. It is noted that, in the year 2014-2015, a total of eight officers and four staff went on retirement while 1 officer & 1 staff member have died. The written and oral tests for recruiting 1st & 2nd class Officers remained suspended as per Ministry's advice and Petrobangla's suggestions in the face of agitation and demand of locals. To overcome the stalemate of manpower recruitment, Petrobangla's suggestions/opinion/direction has been sought in the month of May 2015 after a lapse of nearly 3 years. The company's Board of Directors is also aware of the situation/latest status of manpower recruitment process. The core demand of the locals is that all the 58 contractor's labour now working in the Company since long time as "no work no pay basis" shall be given regular employment in the Company and all the present vacant post in the category of 3rd & 4th class employee shall be filled-up by the local applicant. But there is no opportunity of meeting their demand as company's recruitment policy. In the aftermath, an acute crisis of manpower exists in the Company. 14.0 Human Resource Development: Officers and employees engaged in various categories of job are imparted foreign and local training with a view to broaden their skill & professionalism. A total of Tk. 3.50 crore was provisioned in the budget in the year 2014-2015 on training head. Of the budgeted amount, a total of Tk. 21,57,902.00 and Tk. 2,92,67,023.00 were spent in arranging local training and foreign training respectively. 14.1 Local Training: A total of 216 personnel including 143 officers and 73 staff participated in different (43 courses) local training courses/seminars. 14.2 Foreign Training: A total of 50 officers went abroad for participating in different training courses under company’s own fund. In addition, 9 officers from Ministry/Petrobangla went abroad with company officer for attending the training courses. The training received/seminar attended is listed below: Sl No. 1. 2. 3. 4. 5. Topics of the Training Courses Human Resource Management for Oil, Gas and Mineral Exploration Industries Using IT. Project Management Using IT. Number of Participants 10 Accounting and Auditing for Gas, Oil and Mining Companies. Human Resource Management for Oil, Gas and Mineral Exploration industries Using IT. Pipeline Risk Assessment and Management. 10 10 10 10 Institution Duration Asian Institute of Technology (AIT) Bangkok, Thailand 20-31 October, 2014 Asian Institute of Technology (AIT) Bangkok, Thailand Asian Institute of Technology (AIT) Bangkok, Thailand Asian Institute of Technology (AIT) Bangkok, Thailand 20-31 October, 2014 Asian Institute of Technology (AIT) Bangkok, Thailand 8-19 December, 2014 20 April-01 May, 2014 18-29 May, 2014 Total Participants: 50 15.0 Management-Employees Relation: The differences/disputes arisen were settled amicably and through bilateral discussions and therefore the overall work environment in the company was quite satisfactory during the year. 12 16.0 Welfare Activities: 16.1 Stipend: Under the company’s education scheme in the year 2014 a total of 29 students were given lump sum grant while 46 students were given monthly stipend among the children of company’s officers/employees who passed the Primary School Certificate (PSC) /equivalent examination. 37 students were given monthly stipend while 24 students were given lump sum award among the JSC passed/equivalent. 35 students were given monthly stipend while 14 students were awarded lump sum grant from among the SSC/equivalent examination passed. 16 students were given monthly stipend while 12 students were awarded lump sum grant from among the HSC or equivalent examination passed. One degree (Honors)/Engineering student received lump sum award. In the year, a total of Tk. 12,05,400.00 was spent for the stipend awarded to the children of the staff & officers. 16.2 Corporate Social Responsibility (CSR): Under the company’s CSR policy, Tk. 17.44 lakh was given as lump-sum stipend to the poor and financially disadvantaged but meritorious students in the four Upazilas situated adjacent to the company’s field/installations. The selection was made from next to the government scholarship recipients who passed in different examinations. The stipend was awarded with the objective of nurturing merit among the students. Besides, with the aim of enhancing social awareness, Tk. 12,000.00 to each of Jaintapur, Golapganj, Beanibazar & Bahubal upazila (total of Tk. 48,000.00) was given to arrange seminar/symposium and rally on the occasion of Great Independence & National Day-2015. In addition, a total of Tk. 1.0 (one) lakh i.e. Tk. 25,000.00 to each of the four upazilas was given to the valiant freedom fighters as honorarium on the occasion of the Great Victory Day-2014. The break-up is as under: Sl. No. 1. 2. 3. 16.3 Description of the Item Lump-sum stipend given to the students of 4 Upazila adjacent to the Company Installation/Field Arrangement of seminar/symposium and rally on the occasion of Great Independence & National Day-2015 in the 4 Upazila For the reception and giving honorarium to the valiant freedom fighters on the occasion of Great Victory Day-2014 in the 4 Upazila Total: Amount Disbursed (Taka) 17,44,000.00 48,000.00 1,00,000.00 18,92,000.00 Grant: Under social developments activities, the monthly and lump-sum grant given in the year is as below: Sl No. 1. 2. 3. 4. 5. 6. 7. Grant Name of the Institution Chiknagool Adorso Uchho Biddaloy, Jointapur, Sylhet Haripur Bohumukhi Uchho Biddaloy, Jointapur, Sylhet Ronokeli balika Uchho Biddaloy & college, Golapgonj, Sylhet Buddhi Protibondhi Biddaloy, Shirajgonj Bongomata Sheikh Fazilatunnesa Mujib Ideal College, Tarhash, Shirajgonj Modhyaparha Granite Mine School, Modhyoparha Mining Company Limited, Modhyoparha, Dinajpur Biyam Adarsha Uchcha Bidyaloy, Bahubal, Habiganj 13 Lump-sum (Tk.) Monthly (Tk.) Expenditure in the Fiscal Year - 15,000.00 1,80,000.00 - 20,000.00 2,40,000.00 - 18,000.00 2,16,000.00 3,00,000.00 - 3,00,000.00 5,00,000.00 - 5,00,000.00 5,00,000.00 - 5,00,000.00 2,00,000.00 - 2,00,000.00 8. 9. 10. 11. 12. 13. Fatehpur Adarsha Uchcha Bidyaloy, Bahubal, Habiganj Korgram Govt. Primary School, Jaintapur, Sylhet. Captain Rashid Football Tournament, Jointapur, Sylhet Building construction of Lalabazar Range Reserve Force of Police, Sylhet Bangladesh Scouts, Sylhet Area, Sylhet Bangladesh Scouts, Dhaka 1,00,000.00 - 1,00,000.00 50,000.00 - 50,000.00 15,000.00 - 15,000.00 1,00,000.00 - 1,00,000.00 5,00,000.00 2,00,000.00 - 5,00,000.00 2,00,000.00 31,01,000.00 Total Of the budgeted amount of Tk. 1.00 (one) crore on CSR and grand head, a total of Tk. 49.93 crore (18.92+31.01) was spent in the year. 16.4 Socio-cultural activities As in the past, annual sports and cultural functions were arranged as part of recreational activities for the officers and employees of the company. Besides, annual Milad Mahfil and Ifter Mahfil were arranged with due religious fervor and dignity. The great Shahid Dibash and International Mother Language Day, the great Independence Day, the Victory Day were celebrated with due festivity and in a befitting manner. 17.0 Challenge and possible means of overcome Rashidpur Condensate Fractionation Plant (RCFP) & other fractionation units at Kailshtilla & Haripur cannot often be run in full swing for not lifting the products (petrol, diesel & kerosene) in the intended quantities in line with the production capacities. SGFL’s existing gas margin is Tk. 0.225/cubic meter whereas BGFCL’s, BAPEX’s & IOC’s margins are Tk. 0.833, Tk. 0.93 & Tk. 6.863 per cubic meter respectively. SGFL cannot meet even onethird of its total operational expense with such a low gas margin. A proposal for increasing the gas margin for SGFL has been sent to Petrobangla upon due approval from SGFL’s board. The company’s request for increasing gas margin warrants early consideration. A total of 26 wells (1 in Chhatak, 8 in Haripur, 8 in Rashidpur, 7 in Kailashtilla & 2 in Beanibazar field) have so far been drilled since the incipience of the company. Four wells at Haripur field became unsuccessful at time of drilling in 1950s & 1960s. In the four fields (excepting Chhatak) 8 wells (Haripur-3 & 6, Kailashtilla-1 & 5, Beanibazar-1, Rashidpur-2, 5 & 6) out of 21 is now out of stream owing to natural decline of reservoir pressure and excessive water production accompanied by sand. A committee, recently formed by Petrobangla, has given recommendation & suggestion as to the means of bringing production from the off-stream wells. Besides, the gas reserve of SGFL’s fields is depleting slowly but surely resulting in the decline of overall gas production & supply. At present, SGFL is producing around 148 mmscf of gas daily from its 13 on-stream wells whereas the company was capable of producing around 220 mmscf of gas daily back in the year 2002. Increasing gas production capacity of the company is now a requirement of the time in the backdrop of ever-increasing gas demand in the country. NGL (Natural Gas Liquids) of MSTE plant at Kailashtilla is supplied to RPGCL’s NGL fractionation plant at Kailashtilla. The NGL is fractionated in to petrol & LPG by RPGCL. The produced LPG is piped to LPG bottling plant of LP Gas Limited and petrol is marketed to BPC’s oil marketing companies by means of tank lorries. As the overall petrol demand in the country does not commensurate with the total production capacity, ullage problem often occurs in the storage tanks of RPGCL. On that pretext, RPGCL does not receive NGL in full quantity resulting in the burning of non-received portion of such a valuable NGL to the flare. This attributes to the cause of environmental pollution on one hand and negatively impacts the revenue earning of SGFL on the other hand. In view of that, SGFL proposes to handover the old 65 MT capacity NGL fractionation plant (now lying idle at Kailashtilla premises) of RPGCL to SGFL. In such case, SGFL can utilize this facility upon relocation and reinstallation at MSTE plant premises. If SGFL’s request is considered, burning of non-received portion of NGL can be avoided and SGFL can produce petrol & LPG. Environmental pollution can thus be averted to a great extent. 14 Respected Shareholders The overall success of an organization largely depends on the pragmatic policy & appropriate work strategy of management, expertise of the personnel & proper evaluation and favorable work environment. The merit of the work force, the dedication and honesty/integrity are considered as the driving force of an organization. I am greatly delighted that Sylhet Gas Fields Ltd., the oldest gas producing company in the country, would be able to contribute more in the national economy through the utilization of its resources and opportunities/potentialities. On behalf of the Board of Directors, I sincerely pass my thanks to all the officers and employees working at different tier for the continued success and satisfactory work environment prevailing in the company. Alongside, I wish to record my sincere gratitude and thanks to the Energy and Mineral Resources Division, Planning Commission, Ministry of Finance, Petrobangla, ERD, ADB, other development associates and local administrations, our valued customers and everyone involved in conducting company’s affairs. Expressing unflinching support and full trust on the company management I render my heart-felt thanks to the distinguished shareholders for their kind presence in the Annual General Meeting of the company. I wish to firmly believe that, a new horizon of hope would open with the successful implementation of the development programs/endeavor undertaken by the company with the objectives of its further progress. A bright and prosperous future await the company and the country, it is hoped. Now, let me have the privilege of presenting the Board of Directors' Report of Sylhet Gas Fields Limited for the financial year 2014-2015 before the distinguished shareholders for their kind consideration, adoption and approval. Thanks to all. Allah Hafez. On behalf of the Board of Directors (Istiaque Ahmad) Chairman 15