1. About pet food

advertisement

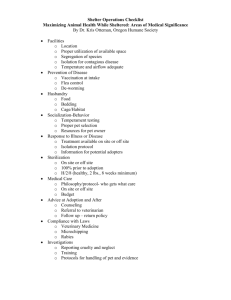

Agricultural Economics Research Institute PET FOOD PRODUCTION IN HUNGARY – ONE OF THE DRIVING SECTORS OF THE FOOD ECONOMY Budapest October 2009 TABLE OF CONTENTS Executive Summary ............................................................................................................... 3 1. About pet food .................................................................................................................... 5 2. The Hungarian pet food market ......................................................................................... 9 3. The global and regional pet food market ......................................................................... 13 4. Pet food production in Hungary ....................................................................................... 17 5. The economic importance of pet food production in Hungary ........................................ 23 5.1. Sales revenues, profitability ..................................................................................... 23 5.2. Foreign trade ............................................................................................................. 24 5.3. Employment ............................................................................................................. 28 5.4. Raw material utilisation ............................................................................................ 30 Sources ................................................................................................................................. 33 Annexes ................................................................................................................................ 34 2 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. Executive Summary Modern pet food production developed in parallel with the increasing need to feed pets in an easier, quicker, cleaner and more satisfactory manner. Now it is a global industry involving sectors from grain production and the meat industry, through engineering and construction up to consulting services and it employs several hundred thousand people. Beyond satisfying the demand of its consumers, the sector is also important because it uses by-products of agriculture and the food industry, the disposal of which – as wastes – would otherwise involve considerable costs. Their utilisation as raw materials for pet food reduces the costs of some of the food produced for human consumption. Population growth, the increase of consumer incomes, the strengthening of the middle classes in the emerging economies, the aging of society and the increasing proportion of childless and single person households in the developed countries constitute the main driving forces of the demand for pet food. Besides these, mention should be made of the social and health benefits of pet ownership which have an influence on the market as well. In Hungary, the demand for pet food is constantly growing. At present, the annual domestic consumption is estimated to be around 160 thousand tons, of which 130 thousand tons are produced domestically. The total volume of domestic sales has increased by 25 % during the last five years, reaching HUF 30 billion in 2008. According to the estimates of industry experts, nearly 35 % of the daily needs of dogs and cats are satisfied by feeding pet foods in Hungary. Consequently, there is a huge potential for growth even though – due to the decrease of the domestic purchasing power especially during the financial and economic crisis – a slower market expansion may be expected in the next few years compared to other countries of Central and Eastern Europe. Pet food production in Hungary has a history of nearly two decades. Beyond domestic producers, the first foreign owned companies emerged between 1991 and 1993. Opening their own plants, these companies based their production principally on domestic raw materials. Hungary soon became the largest pet food producer in the Central and Eastern European region and the production capacities of today exceed the domestic market demand several times. The member companies of the Hungarian Pet food Association produced altogether 408,000 tons of pet food in 2008. This exceeds the production amount of the previous year by nearly 4 % and that of 2004 by 15 %. Between 2003 and 2008, the value of investments in the sector has grown three-fold. Due to capacity expansion, the number of workers directly employed by the sector has increased by more than 50 %, reaching over 1,400 in 2008. Today, pet foods produced in Hungary are available in almost all European countries and Japan, Australia and Kazahstan are also regularly included in the list of importers. The high added value and the competitive prices allow these products to be transported great distances, too. Dog and cat food (CN 230910) currently represents about 75-80 % of the total of feedstuff (CN 2309) exports of Hungary. Following the Millennium, dog and cat food became an important item within the Hungarian exports of agricultural and food industry 3 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. products. In two consecutive years, in 2004 and 2005, 6.3 % of the total export revenues of the food economy were derived from the exports of these products, of which the combined export volume amounted to 294 thousand tons, with a value of EUR 262 million in 2008. The extent of export orientation and labour-efficiency of the pet food industry is well characterised by the fact that the proportion of the export sales revenues calculated on the basis of the APEH data and of the average staff number was the highest – after edible oil and starch production – among all food industry branches in the pet food branch in 2008, amounting to HUF 31 million per employee. From the HUF 62.4 billion sales revenues of the organisations classified as pet food producers in 2008 (NACE 1572), HUF 17.7 billion derived from domestic sales and 44.7 billion from exports. In 2008, the branch ranked sixth among the food industry branches on the basis of its export volume, and it occupied fifth place in the average of the years 2004-2008. The high share of export sales in the total sales revenues is prominent in pet food production, being 72 % both in 2008 and in the five years’ average, which may account for the success of the sector. 4 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. 1. About pet food Pet foods are unprocessed, partially or entirely processed materials or products used for feeding pets, that is, animals kept for pleasure and not for food production or other economic purposes. Pet foods belong to the category of feed mixtures. Provisions of Act CXIX of 2001 and of the Decree on its execution 43/2003 of the Ministry of Agriculture and Rural Development regulate the production, marketing and use of pet foods as feed mixtures. Decree 44/2003 of the Ministry of Agriculture and Rural Development, as amended from time to time, on the compulsory requirements of the Codex Pabularis Hungaricus specifies in details the requirements relating to pet foods and the materials that may be used in their production. Categorisation of pet food Pet foods may be divided into categories according to different criteria. Foods for carnivorous pets (e.g. dogs and cats), foods for satisfying the needs of omnivorous pets, including also animal-derived components and foods suitable for feeding herbivorous pets (e.g. cage birds or rodents) including exclusively phytogenic components can be differentiated. Pet foods can be further broken down to the groups of raw and processed products. Raw pet foods are phytogenic and/or meat and poultry products suitable but not intended for human consumption that are untreated except for cooling, freezing, quickfreezing, drying or another equivalent preservation procedure, to be sold exclusively in consumer packaging in licensed pet food shops. The difference between raw and processed pet foods is that the latter are prepared through a process stabilising their consistency. Pet foods are usually formulated in line with the needs of different species, of the different age groups (puppies, adults etc.), and with the specific needs arising from the different health conditions (healthy, with young, lactating, weak immune system etc.) and from the life style (indoor or outdoor keeping, animals kept for sport purposes etc.) of the individuals. The characteristics of the pet foods are determined by the nutritive power, quality and taste of the basic materials (meat, fish, vegetables, cereals and oil seeds etc.), the different combinations of the ingredients and alimentary substances, their proportions and by the heat treatment technology. Based on the composition of alimentary substances of pet foods, complete and complementary foods and treats can be differentiated. Complete pet foods contain the daily requirements of nutritional substances of the animals in sufficient quantity and correct proportions. Complementary foods satisfy the animals’ daily nutritional needs only partially and therefore may only be fed in combination with other foods. Treats are tasty morsels which can be helpful in training and educating the animals or in providing other functional benefits (e.g. anti-plaque etc.). These do not even partly cover the daily nutrition needs; therefore they can only be fed in small quantities together with complete or complementary pet foods. As regards their consistency, the pet foods can be divided into three groups: dry, wet (canned) and semi-moist products (Figure 1). The low moisture containing dry pet foods include extruded feeds (e.g. shaped feed grains), the different flaked cereals and some of the treats. The wet foods prepared from high moisture containing raw materials include canned foods and single-serving pouches (e.g. meat cubes or meat-balls in gravy or in 5 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. jelly), marketed also in chilled or deep-frozen form. The semi-moist pet foods are usually soft chewable drops or biscuits – including most reward treats – mostly sold in bags. Figure 1 Pet food categories PET FOOD FOODS FOR CARNIVOROUS PETS PROCESSED PET FOODS RAW COMPLETE PET FOODS WET FOODS FOR OMNIVOROUS PETS DRY RAW COMPLEMENTARY PET FOODS WET DRY TREATS WET SEMIMOIST PRODUCTS DRY Source: AKI The production technology of dry pet foods is relatively simple, while that of the wet foods is more complicated. However, be it dry or wet foods, from the two product groups produced in largest volumes, i.e. dog and cat food – formulation of the former is simpler; the production of foods which satisfy the palate of cats requires more competences and expertise, as well as more research and development. Production of pet food Pet keeping as a hobby has undergone remarkable changes during recent decades. The faster pace of life and the striving for comfort and for satisfaction of the pets’ needs to the highest possible standard have changed the habits and the norms of their owners. In parallel with the increased need to feed pets in an easier, quicker, cleaner and more satisfactory manner, modern pet food production1 developed in the middle of the 20th century and is now a global industry involving sectors from the meat industry, through machine engineering and construction up to consulting services and employing several hundred thousand people (Figure 2). In fact the first commercial pet food in the world – a biscuit for dogs – was launched much earlier, in the 1860s in England. 1 6 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. Figure 2 Industry sectors and services related to pet food production CEREAL PROCESSORS MEET PROCESSORS MILLING INDUSTRY RETAIL TRADE MACHINERY DISTRIBUTION ADVERTISING PET FOOD BUILDING TRANSPORT STEEL INDUSTRY PROFESSIONALS SERVICES PRINTING STORAGE PACKAGING INDUSTRIES Source: AKI Beyond the satisfaction of the buyers’ requirements, one of the most important effects of pet food production consists in recycling. The industry utilises several byproducts generated in the agriculture and food industry, the disposal of which – as waste or dangerous waste – would otherwise imply considerable costs. Thanks to their utilisation as pet food, the costs of food produced for human consumption may be reduced. There are very strict regulations concerning pet food production in the European Union (EU). Raw materials must comply with the food production and hygiene standards and with the veterinary requirements specified in the Council Regulation 1774/2002/EC 2. Pet food has to be traceable and can be produced exclusively by licensed factories. In Hungary, the safety level of the feed production demanded by the authorities is high in international comparison; this is one of the reasons – beyond abundant supply of raw materials and the once cheap labour force – why three of the world’s leading pet food producers – Mars, Nestlé and Provimi – have established production facilities here3. The most important phytogenic materials used for pet food production in Hungary are cereals and their derivatives, some leguminous crops, different protein extracts, root vegetables, oil seeds and vegetable oils. Animal products include frozen veterinary controlled slaughter products (complying with the requirements of suitability for human consumption) and meat meal purchased from producers of animal protein feeds. Pet foods are high added value products. During the last decade, the processed products of the Hungarian food economy have generally suffered market losses; an ever increasing proportion of the exports consist of raw materials (e.g. cereals, raw cow milk etc.). In this context it is especially gratifying that the domestic pet food industry is able not only to satisfy the domestic market but also to sell the majority of its products in foreign markets. 2 The most important rules and requirements related to the production of dog and cat food is specified in the guidelines of the European Pet food Industry Federation (FEDIAF); the Hungarian Pet food Association collaborated in their development. 3 At present, only these three companies are members of the Hungarian Pet food Association, but Vitakraft Aqua-Food also has production capacities in Hungary. 7 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. 8 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. 2. The Hungarian pet food market According to estimates of the European Pet food Industry Federation (FEDIAF), 60 % of the pets in Hungary are dogs and cats, 20 % are birds and the remaining 20 % consists of small rodents, reptiles, amphibians and fishes. Dogs have the largest body size and the highest food requirement; according to the data of the Central Agricultural Office (MgSzH), 1,232 million dogs were vaccinated in 20084. (The highest number of vaccinated dogs is to be found in Budapest, amounting to 269,000 in 2008). The domestic cat population is estimated to exceed that of dogs by 20-25%. The proportion of households keeping dogs and/or cats is about 40 % in Hungary, against the estimated European average of 20-30 %. The demand for pet food is growing; annual domestic consumption is estimated to be 160 thousand tons at present, of which 130 thousand tons is produced domestically5. The total volume of domestic sales has increased by 25 % during the last five years, reaching HUF 30 billion in 2008 (Figure 3). Currently, the wet products segment has taken the market lead from the dry products, these latter representing round 40 % of sales. Beyond wet pet food, the market segment of the pet treats is also quickly expanding, even though their share still does not attain 10 %. It is worth noting that the share of dog foods within the total sales has already been around 60 % for several years. Dog owners have a preference for the cheap dry foods, while two thirds of cat proprietors prefer to buy the more expensive canned products for their pets. Figure 3 Pet food sales in Hungary (2004-2008) 35 30 bln HUF 25 20 15 10 5 0 2004 2005 2006 2007 2008 Source: Hungarian Pet food Association 4 The number of stray dogs is estimated to be about 200,000. However, Euromonitor International estimates the Hungarian dog population at about 1.8 million. 5 Beyond the quantity sold on the domestic market, nearly 300 thousand tons are exported by the Hungarian pet food industry. 9 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. Hypermarkets and discount stores are the leading pet food retailers in Hungary. With their own (private) label products, mostly launched around the Millenium, they have contributed greatly to the quick growth in the popularity of pet foods. As the pet superstores also made headway, a growing assortment and improving quality were seen in the retail own label products. Here, too, a premium quality products segment has been introduced, reducing the differences between branded and own (private) label products. The premium quality own label products available in most of the domestic hypermarkets have been adapted to the branded products not only in their higher vitamin, mineral and nutrient content but also as regards their unit sizes and attractive packaging. Today, the share of own label products exceeds 50 % within the total of dog and cat food sales. The share of pet shops in the sale of pet foods is increasing year-on-year; these try to make headway among hypermarkets, discount stores and pet superstores not only through their large product selection but also by providing related consultancy services. Their importance is growing due to the fact that some pet food producers keep strictly to the specialised sales channels, therefore their products are distributed through pet shops, veterinary clinics and pharmacies. The share of total sales through pet shops may be estimated at 25 % (Figure 4). Figure 4 Market share of the pet food sales channels in Hungary 5% 12% 25% 58% Hyper- & supermarkets Pet shops Other Online sales Source: AKI The turnover of the small, local shops run by independent retailers has slightly declined during recent years, principally due to the growth of on-line pet food sales which provide an even more comfortable method of purchase. With the development of the pet culture the demand in Hungary for economy, premium and super-premium products has became more balanced. However in the pet food market not only these preferences may be significant, fashion trends and changes in the popularity of species and/or breeds can also cause changes. While previously the products 10 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. positioned in the premium and super-premium categories had a greater role in feeding cats, currently – as the breeds of smaller dogs have become more popular – the share of quality products has increased also among dog foods (feeding of smaller dogs is relatively cheaper). This, of course, may partially be attributed to the fact that Hungary is one of the largest pet food producing countries in Europe therefore the unit prices of branded products are the lowest within the Central-East-European region. A paradoxical feature of the Hungarian market is that while the demand for quality products is increasing, the level of brand loyalty is low, mainly due to the high price sensitivity of buyers and also to the frequent sales promotions. In spite of the large number of pets, local production and low consumer prices, the calorie coverage level6 slowly increases and nears the estimated lowest Western European rate of 40 %. According to the estimates of industry experts, around 30 % of the dogs and 40 % of the cats in Hungary are fed with pet food. (Demand for these products is remarkable principally in bigger cities and in their immediate hinterlands. In rural areas, pets still having functional roles are traditionally fed table scraps.) Consequently, there is a remarkable potential for growth, even though – due to the decrease of the domestic purchasing power especially during the the financial and economic crisis – a slower market expansion can be expected in the next few years compared to other countries of Eastern Europe. The calorie coverage level is an indicator showing the proportion of the pets’ needs covered by ready-made pet foods in a given country. 6 11 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. 12 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. 3. The global and regional pet food market The increase of the population and of the incomes of consumers, as well as the strengthening of the middle class in the emerging countries, the aging of the population and the increased proportion of childless households in the developed countries constitute the main driving forces of the demand for pet food. In the opinion of the industry’s professionals, the financial and economic crisis has had only a slight impact on the sector. According to estimates of Euromonitor International, the global market turnover of pet food and accessories (care products etc.) within the period 1998-2007 increased by 5 % per annum on average, amounting to EUR 53 billion in 2007. Analysts expect an additional annual increase of about 3 % on the short term (the market’s turnover may exceed EUR 84 billion in three years’ time – in 2012 – calculated at 2007 prices). Total sales of dog and cat food, representing 71 % of the total turnover value of pet food and accessories, exceeded 45.1 billion dollars (USD) in 2007, with a jump of 43 % within the period 2002-20077. The sales value of the other pet foods did not attain even one tenth of this value. According to the statistics of Euromonitor International, the hyper- and supermarkets had a market share of 37.7 %, while pet shops had 21.7 % and pet superstores had 13.5 % of global sales in 2007. In the course of one decade, the market share of the hyper- and supermarkets decreased by around 5 percentage points, while that of the pet superstores – the most dynamically developing channel of distribution – increased nearly by 24 percentage points. In the Eastern European region, the picture is quite different: the hyper- and supermarkets realised 40.4 % of total sales, the share of pet amounted to 32.4 % and that of pet superstores to 6.8 % in 2007. Here the participation of all three distribution channels increased: that of the hyper- and supermarkets by 12.7 percentage points, while the pet superstores increased their share by 6.7 percentage points and the pet shops by 4.4 percentage points against their share of ten years ago. The losers of their expansion are the other food and non-food shops and veterinary offices. Though the number of pet food producers is high all over the world, only a small group of them have a significant role in global production. The two leading groups of companies, Mars (previously Masterfoods) and Nestlé had an aggregate share of over 50 % of total sales of dog and cat food, while the share of the ten largest pet food producers exceeded 70 % in 2007 (Table 1). A relatively high proportion of pet foods are part of international trade: the foreign trade turnover of dog and cat food amounted to USD 8.43 billion, 16 % of the total sales in 2008. The exports are quite concentrated: France is the leader among exporters with export incomes of 1.6 billion dollars, followed by the United States, having export revenues of USD 1.18 billion. These two countries, together with Germany, the Netherlands and Thailand were responsible for nearly 58 % of the global export turnover in 2008. Hungary, with its exports amounting to USD 303 million and with its share of 3.6 % occupied eighth place, while it was the fifth largest exporter among EU Member States. The largest net importer of pet foods is Japan. The combined balance of Japan’s dog and cat food trade showed a deficit of USD 785 million in 2008. The United Kingdom 7 The share of dog foods was 69%, that of cat foods 31% within the 2007 turnover. 13 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. followed in second place with a negative balance of USD 449 million and Belgium was third, with its deficit of USD 434 million. Seven of the ten largest net importers of dog and cat food were EU-15 Member States; their aggregate trade balance showed a deficit of USD 1.65 billion. Beyond Hungary, only Poland is a net exporter from among the Visegrad Group countries8: it realised a positive balance of USD 62 million in 2008. At the same time, imports of dog and cat food exceeded exports by USD 37 million in Slovakia and by USD 66 million in the Czech Republic. Table 1 The ten largest pet food producing companies in the world (2007) Company Mars Inc. Nestlé SA Colgate-Palmolive Co. Procter&Gamble Co. Del Monte Foods Co. Agrolimen SA Uni-Charm Corp. Nutriara Alimentos Ltda. Total Alimentos SA Nisshin Seifun Group 2007 retail sales (US$ billion) 11,80 10,90 3,00 2,99 1,70 0,61 0,31 0,27 0,23 0,20 Year-on-year growth in sales between 2006-2007 (%) 9,8 5,0 8,3 3,4 1,5 4,3 4,1 39,1 19,0 1,9 Source: Pet food Industry The growth of pet food sales in the period 2004-2008 was fastest in the countries of North America, Latin America and Western Europe. According to the forecasts of Euromonitor International however, the highest growth rates are expected in Eastern Europe (above all in Russia, in Romania and in Bulgaria) during the next few years (Table 2). Poland is another important growing market in the East European region; an annual increase of 6-7 % is expected in the short term. In Poland the dog population exceeds seven million, while the number of cats approaches six million. From among the “new” Member States of the European Union, the Czech Republic and Romania are still considered to be large markets; in the former there are about three million dogs and 1.8 million cats living in the households, while the dog population may be estimated at five million and that of cats at four million in the latter. (Far to the east from us cats enjoy considerably higher popularity, as their traditional feeding is remarkably cheaper: more than 16 million are living in Russia and 7.5 million cats are kept in Ukraine, while the dog population amounts merely to about one third in both countries). 8 The Czech Republic, Poland, Hungary and Slovakia. 14 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. Table 2 The ten fastest growing pet food markets in the world (2013) 2013 retail sales (US$ million) 2 625,8 386,9 315,3 55,7 26,3 407,5 283,5 325,7 49,8 645,5 Country Russia Thailand Romania India Indonesia China Ukraine South-Korea Bulgaria Argentina Yearly growth of sales 2008 to 2013 (%) 13,3 11,8 11,6 11,4 9,5 9,0 8,9 8,9 8,5 8,4 Source: Euromonitor International It is expected that the United States will remain the largest pet food market in the world, where sales will exceed USD 18.8 billion in 2013. Brazil is significantly behind in second place with an annual turnover approaching USD 4.3 billion, while Japan is in third place with its annual sales below USD 4.1 billion. By 2013, Russia may become the world’s sixth largest pet food market. In Germany, where the market is practically mature and saturated, a slight decrease in sales may be expected in the future (Table 3). Table 3 The ten largest pet food markets in the world (2013) Country USA Brazil Japan United Kingdom France Russia Italy Germany Mexico Canada 2013 reatil sales (US$ million) 18 827,1 4 274,9 4 089,1 3 718,6 3 054,8 2 625,8 2 512,1 2 379,5 1 462,5 1 407,8 Source: Euromonitor International 15 Yearly growth of sales 2008 to 2013 (%) 2,7 6,1 2,6 1,7 1,3 13,3 4,9 -0,8 2,1 2,2 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. 16 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. 4. Pet food production in Hungary Pet food production in Hungary has a history of nearly two decades. Beyond domestic producers, the first companies with foreign ownership appeared between 1991 and 1993. Opening their own factories, these companies based their production principally on domestic raw materials. Soon Hungary became the largest pet food producer of the Central East European region and the production capacities of today exceed the domestic market demand several times. The member companies of the Hungarian Pet food Association produced altogether 408,000 tons of pet food in 20089. This exceeds the production amount of the previous year by nearly 4 % and that of 2004 by 15 % (Figure 5). The last available aggregated national production data of the Central Statistical Office relate to 2007, when the domestic pet food production exceeded 416,000 tons. The share of the then nine members of the Association amounted to 95 %. Figure 5 Pet food production of the members of the Hungarian Pet food Association (20042008) 450 400 thousand tons 350 300 250 200 150 100 50 0 2004 2005 2006 2007 2008 Source: Hungarian Pet food Association It is unique in the Central East European region that two of the world’s largest pet food producers, Mars and Nestlé, have both implemented regional production, management and distribution centre in the same country. At present, Provimi PET-Hungária Kft is the market leader in pet food production in Hungary. The combined share of Mars and Nestlé on the domestic market of pet foods has decreased below 50 %. From the remaining 9 According to data of the Ministry of Agriculture and Rural Development, the total quantity of pet foods produced in Hungary amounted to 407 thousand tons in 2008. 17 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. important enterprises, Vitakraft Aqua-Food and the by now non-Association members, Tendre (formerly Bábolna Takarmányipari Kft) and Pamax produce pet food in Hungary, while Hill’s Pet Nutrition, Alpha-Pet Food and Royal Canin are only present in pet food distribution. Mars Global revenues in 2007: USD 11 billion. Mars Incorporated has an important role in the Hungarian food and confectionary industry, as well as in the production and export of pet food for small hobby animals. The Hungarian division of Masterfoods is constituted of Mars Magyarország Értékesítési Bt., based in Budapest, and in Effem Hungary Kft of Csongrád. Recognising the growing local and regional demand for pet food products, the company established its production base in Csongrád-Bokros in 1993, where its output has since been dynamically increased. The factory of Csongrád-Bokros had an initial production capacity of some thousand tons, later increased to ten thousand tons, and is now Hungary’s largest exporter of processed agricultural products, the most significant dry food producer in Europe and the largest employer in the Hungarian South Plain region. Products produced in Csongrád-Bokros are sold in 42 countries and the total value of production-related investments until now exceeds HUF 22 billion. The enterprise buys in excess of HUF 10 billion of domestic raw materials from 500 Hungarian suppliers for its output. As one of the largest employers of the region, it employs 800 people and provides subsistence for 4,000 through its suppliers. The gross revenues of the two domestic enterprises of Mars exceeded HUF 50 billion in 2008. The net revenues of Effem Hungary Kft, the Hungarian pet food producing company of Mars, amounted to HUF 32 billion in 2007. Of the revenues of Mars Magyarország, 55 % derive from the sale of pet foods, about 35 % from confectionary and the remaining 10 % from the sale of other food products. Nestlé Hungária Kft Global revenues in 2007: USD 10.9 billion. The Hungarian members of the Nestlé Group produce and market foodstuffs (coffee, cocoa, kitchen products, baby food, confectionary, ice cream etc.), mineral and spring waters, medicines, corn flakes and pet foods. Nestlé, the world’s leading food industrial company, has been active in pet food production since 1985. The buying of the Ralston Purina company in 2001 constituted an important event in the world’s pet food market. Nestlé has started its operation in Hungary in 1993, by introducing the Friskies brand. In 1998, the Nestlé Group bought Jupiter Állateledelgyártó Kft together with the licence of the Darling brand and with the factory in Bük. At that time, the factory produced only canned food. Thereafter, in 1999, a new pet food factory was established in Bük with HUF 6 billion investment, which – as the first in Hungary – was already able to produce both dry and wet pet food. During the years, the factory became the Central East European centre of pet food production. Through the development of the factory the settlement of Bük may thank a food industrial production facility for granting important supply possibilities for domestic agricultural producers. 18 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. PET-Hungária Kft (Provimi) Global sales revenues in 2008: EUR 2.1 billion. The Dutch Provimi deals with the production and trade of feed preparations and of pet foods in several countries of Europe (Table 4) and beyond. Until now, Provimi SA has acquired a stake in 21 companies all over the world. The EUR 225 million pet food sales had a 13 % share of the total revenue of Provimi in 2008. The sales of fodders intended for farm animals represented an 87 % share of total revenues. In the field of pet food production, Provimi has until now acquired a majority ownership in five companies (Table 4). Provimi Pet Food produced a total of 389 thousand tons of pet food in 2008. Table 4 Pet food production capacities of Provimi SA within the EU Dry pet food Czech Italy Spain Hungary Poland Slovakia Total Capacities (tons) 45,000 25,000 75,000 76,000 8,000 20,000 249,000 Capacities (tons) 40,000 15,000 50,000 120,000 Wet pet food Czech Poland Holland Hungary Total 225,000 Source: Provimi SA Table 5 Provimi SA’s pet food production activities Company Rocofa BV Nama Ben Pet Hungaria Provimi Pet food France Country Holland Slovakia Poland Hungary France Year of acquisition 2003 2004 2005 2005 2006 Source: Provimi SA PET-Hungária Kft, a company owned by Provimi Group, has joined the two largest global pet food producing companies (Mars and Nestlé) with respect to the size of its East European pet food production capacities. Provimi PET-Hungária is a member of the group of companies constituted by the enterprises managed by Provimi Investments SA (hereinafter referred to together as Provimi Group). Agrokomplex Central Soya Zrt. is another Hungarian member of Provimi Group, operating principally in the field of production and trade of feed preparations. PET-Hungária has two production facilities: canned dog and cat food were produced in Sopronhorpács and dry dog and cat food in Dombóvár. About 90 % of the production is marketed in Hungary (covering the entire territory of the country), while the remaining 10 % is mainly sold in the Central East European countries. PET-Hungária realised net revenues amounting to HUF 8.1 billion in 2004, increasing its net revenues to HUF 14 billion by 2008. Since 2005, Provimi Holding has 19 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. been the owner of the company. Beyond the Hungarian market, the products of the company are sold in more than ten countries, in commercial chains (Austria, Croatia, Serbia, Montenegro, Bosnia and Herzegovina, Slovenia, Bulgaria, Turkey, Italy, Ireland and Ukraine). Provimi Group invested EUR 2.9 million in 2006, EUR 4 million in 2007 and EUR 14.4 million in 2008 into the Hungarian pet food production. In 2008, Provimi invested more than HUF 4 billion into the development of its factories in Kaposszekcső and Sopronhorpács. In 2008, 76 thousand tons of dry pet food was produced in Sopronhorpács and 120 thousand tons of canned food in Kaposszekcső. Thus, the company has become the largest producer of branded pet food in Central Europe. Colgate-Palmolive Global revenues in 2008: USD 2.1 billion. Hill's Pet Nutrition is a member of the Colgate-Palmolive group of companies. In 2008, the pet food production division had a share of 14 % – amounting to USD 2.1 billion – of Colgate-Palmolive’s total net revenues. Hill's Pet Nutrition operates in Hungary only in the field of pet food marketing. Newcopharm Hungária Kft distributes the products of Hill's Pet Nutrition in Hungary; its domestic sales revenues exceeded HUF 1 billion in 2008. Procter & Gamble Global revenues of the division in 2007: USD 2.99 billion. The pet food division of Procter & Gamble group realised sales revenues amounting to USD 2.99 billion in 2007. Alpha-Pet Food Kft is the exclusive distributor of its Eukanuba and IAMS brands in Hungary. Beyond IAMS and Eukanuba, the other important brands of AlphaPet Food include Chicopee dog food, Dream Dog, Dream Cat, Bono and Juwe dog and cat food, Naturdiet organic canned foods and PowerVit for small pets. Their own brand products include: Dogex, Alpha Falat, Prémium Dog, Alfi Dog, Dog United SC and Alpha Mix dry dog foods in three flavours; Premium Cat and Alfi Cat dry cat foods in three flavours; Dogex, Prémium Dog, Prémium Cat, Alfi Dog, Alfi Cat, Foltos and Cirmos canned products which has been introduced as new products on the Hungarian pet food market. Beyond distributing pet food, Alpha-Pet Food operates also in the field of production and marketing of veterinary preparations (Alpha-Vet Állatgyógyászati Kft). The company’s net domestic sales revenues amounted to HUF 8.3 billion in 2008. Vitakraft Aquafood Kft Vitakraft Aqua-Food Kft is the specialist of food for small mammals, fishes and birds, and is a significant wholesaler on the Hungarian pet food and care products market. Their wide selection of products is to be found in stores and pet shops. Their products, developed by their own, are partly produced in Hungary and partly imported from 14 countries, are sold under the brand name Bobi for dogs, Miau for cats, Pepe for rodents, Molly for birds and Aqua-Food and Rio for fishes. In 2008, net domestic sales revenues exceeded HUF 1 billion. 20 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. Bábolna Takarmányipari Kft (Tendre) Branded products of Tendre include: Porcijó Standrad, Porcijó Komplex, Porcijó Floki, Porcijó Kölyök, Porcijó Aktív, Porcijó Cirmix, Porcijó canned products, Porcijó dog and cat salami, Porcijó Komfort cat litter, Vahur, Alex, Ston, Alít, Lotti. Its own brand products are: Union Dog, Union Crok, and, in addition, Dolli Dog, Dolli Duo, Dolli Cat, Dolli Maxi, Roni, Fickó, Extra Cat and Extra Dog which are produced for Alpha-Pet Food. The pet food business has a share of 7 % in Tendre Kft’s total turnover. There are three production factories within Tendre’s plant of Zalacséb. Pet food production started in 1996 in Zalacséb, through the installation of a wet extruder of New Zealand production. Exclusively dry pet food is produced in the pet food factory of Tendre. The factory’s capacity amounts to about 9,500 tons a year, if operating in three shifts. Tendre distributes also canned products imported from Italy. Earlier, Tendre purchased the dog and cat salami products from the Békéscsaba, later from the Győr plant of Bábolna Zrt. At present, these products are produced by Barni Állateledel Kft for Tendre. The company distributes nearly 100 sorts of products, among them the dry dog food in 10 kg packaging for the small shop network. Its annual revenues from pet food sales amount to approximately HUF 1.4 billion. Agro-Trust Kft Agro-Trust Kft of Bábolna owns one of the most modern production facilities in Hungary, having an annual capacity of 15 thousand tons. The company was established in 2007 with an investment of HUF 500 million. REX dog and cat salami, REX Plus dog and cat salami and DALMI dog salami are the brands distributed by the company. Other producers From among the smaller producers, Bono SK should be mentioned which brand name is identical with the company’s. Pamax Kft operates in Csévharaszt and also has a production facility in Romania. Its brands include Bodri, Hektor, Turbo Dog and Hamm. Mancs salami is the best known brand of Bekker és Bekker Kft of Monor. In Pécs, Barni Állateledel Kft produces dog and cat salami products with brand names Dolli, Roni and Porcijó. Recently two enterprises within the sector have been closed. Feed-Full Zrt. has closed its production units and its commercial activities are unimportant. Biovet Kft of Kaposvár had a considerable market weight. It owned the Champion Dog and Champion Cat brands, which disappeared from the market when the company closed. 21 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. 22 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. 5. The economic importance of pet food production in Hungary 5.1. Sales revenues, profitability Statistics provide only few starting-points for evaluating the importance of pet food production within the Hungarian food industry; data sources are quite poor at this depth. In practice one can depend only upon the Central Statistical Office’s (KSH) industrial statistics data and upon the Hungarian Tax and Financial Control Administration’s (APEH) data aggregated by special branches. As both the statistics of the KSH and the data of the APEH are grouped according to the official classification of economic activities and not on the basis of the actual activity, some distortion is to be expected; this is unavoidable and to an extent which does not influence the overall picture. Due to methodological reasons, there are also some differences between the two databases. The pet food production recorded under TEÁOR (Hungarian NACE) code 1572 followed a different path than that of the food industry during the last decade. According to the KSH data, the production volume of 2008 of the national economy’s branch “Production of food, drinks and tobacco” amounted to just 88.7 % of the value in 1998, while the same indicator was 275.2 % in the case of pet food production. Despite development, sales revenues in 2008 of the branch recorded in the APEH database (HUF 62.4 billion) were sufficient for 16th place among the 34 food industrial branches (Figure 6). The sales revenues of the sixth ranked branch “Farm animal feed production” (i.e. fodder production) coded 1571 in the TEÁOR amounted to HUF 152 billion, while the “Meat processing” sector realised the highest sales revenues (HUF 252 billion) among all special branches. Sales revenues per capita (average statistical number) in the pet food sector fluctuated between 38 and 43 million HUF during these years. Figure 6 Sales revenues of the fodder and pet food production branches (2003-2008) 160 140 120 bln HUF 100 80 60 40 20 0 2004 2005 2006 Fodder production 2007 2008 Pet food production Source: APEH 23 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. From the HUF 62.4 billion total sales revenues of the enterprises classified as pet food producers in 2008, HUF 17.7 billion derived from domestic sales and 44.7 billion from exports. In 2008, the branch ranked 6th among the food industrial branches on the basis of its export volume, and it occupied the 5th place in the average of the years 20042008. The high share of export sales in the total sales revenues is prominent in pet food production, being 72 % both in 2008 and in the five years’ average, which may account for the success of the sector. The same indicator is no higher than 50 %, neither in 2008 nor in the five years’ average, in any other branch; the mean share of export sales in the entire food industry being just 20 %. Based on the APEH database, the profitability of the operation can also be estimated. Earnings before taxes in the pet food sector amounted to HUF 3.8 billion in the average of five years, the third highest among the sector’s branches. The trend is decreasing; the pre-tax earnings exceeded HUF 5 billion between 2003 and 2005, amounted to HUF 3.5 billion in 2006 and 2007, but to just HUF 774 million in 2008 in the entire branch. These latter data may be explained by the sharpening competition and by the extremely high price level of the raw materials in 2007/2008. From the other derived indicators the return on sales before taxes was 8 % in the average of the years 2004-2008, the fifth highest among the branches, but this also declined to 1.2 % by 2008. As regards pre-tax profit per employee, the pet food production branch occupied 3rd place in the average of five years. Its per employee profits of HUF 3.1 billion were exceeded only by the branches of refined edible oil and starch production. 5.2. Foreign trade Pet foods, together with prepared fodders, belong to the product category CN 23 – “Food industrial by-products and prepared feeds” of the combined (foreign trade) nomenclature, and within this, to the category CN 2309 – “Preparations and feeds for feeding animals”. Thanks to the investments implemented from foreign capital following the change of regime, the exports of feed preparations (CN 2309) have spectacularly increased as from the end of the previous decade (Figure 7). Exports increased during the five years between 1999 and 2004 to 328 thousand tons, i.e. by nearly three and a half times, and then, in 2008, they surpassed 491 thousand tons which is more than five times higher than the export volume of a decade earlier. The value of exports presented similar dynamic development: while the export sales revenues of the product group did not reach EUR 53 million in 1999, they approached already EUR 360 million in 2008. 24 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. Figure 7 Foreign trade of preparations and feeds for feeding animals (CN 2309) (1999-2008) 500 450 thousend tons 400 350 300 250 200 150 100 50 0 1999 2000 2001 2002 2003 Exports 2004 2005 2006 2007 2008 Imports Source: KSH foreign trade statistics As the imports have grown at a considerably lower pace, the foreign trade of the feed preparations contributed a remarkable surplus to the foreign trade balance of the Hungarian food economy and national economy. The extent of this contribution is well demonstrated by the fact that the foreign trade balance of the CN 23 product group (including, among others, meal of soybean and of other oil seeds, furthermore, fish meals and feed premixes) could become equalised, implying that export revenues of the feed preparations covered basically the imports of raw materials for the feed industry. This is a remarkable achievement, taking into account the dependence of the Hungarian livestock sector on imported protein feeds. Annex 2 includes the relevant detailed data. 25 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. Figure 8 Export structure of preparations and feeds for feeding animals (CN 2309) (2004-2008) 400 350 mln EUR 300 250 200 150 100 50 0 2004 2005 2006 2007 Dog food and cat food 2008 Other Source: KSH foreign trade statistics Unequivocally, the exports of pet foods, and principally of dog and cat food having recently 75-80 % share therein (CN 230910), had a major role in the growth of the CN 2309 product group’s exports (Figure 8). Following the Millenium, these products became an important item within the Hungarian exports of agricultural and food industrial products (Figure 9). In two consecutive years, in 2004 and 2005, 6.3 % of the total export revenues of the food economy derived from exports of dog and cat food and the exported volume amounted to 294 thousand tons, with a value of EUR 262 million in 2008. Figure 9 Value and share of dog and cat food exports (CN 230910) of the food economy export revenues (2003-2008) 350 7,0 300 223 197 200 210 6,0 5,0 209 4,0 170 150 3,0 100 2,0 50 1,0 0 0,0 2003 2004 Value of exports 2005 2006 2007 2008 Share of food economy exports revenues Source: KSH foreign trade statistics 26 percent mln EUR 250 262 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. The degree of export-orientation and labour-efficiency of the branch is well characterised by the fact that the proportion of the export sales revenues calculated on the basis of the APEH data and of the average staff number was the highest – after edible oil and starch production – among all food industrial branches in the pet food branch in 2008, amounting to HUF 31 million per employee. The distribution of the dog and cat food exports by partner countries is less concentrated; the exports are not restricted to some major markets. The total share of the countries ranked in the first three places – Germany, the United Kingdom and Romania – amounted to just 30 % in 2008, while the turnover of the first five partner countries covered 46 % (Figure 10). The pet foods produced in Hungary are present in almost all European countries, but also Japan, Australia and Kazahstan are regularly included among the importers. The high added value and the competitive prices allow the products to be transported great distances, too. Figure 10 Distribution of the dog and cat food (CN 230910) export revenues by partner countries (2008) Germany Other United Kingdom Romania Russia Poland Italy Croatia Czech Republic Ukraine France Source: KSH foreign trade statistics As regards the target countries of the Hungarian dog and cat food exports, we cannot be satisfied. From among the countries included in the data of the International Trade Centre (Figure 11), the growth of the Hungarian exports exceeded the expansion of the partner country’s total imports only in Austria, Switzerland, Serbia, Turkey and Ukraine. In the remaining countries, increasing the exports would be desirable. It is also true that the large importing countries (Germany and France) have already had a remarkable share on the Hungarian exports until now; therefore additional market expansion has less potential. 27 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. Figure 11 Export market diversification of the Hungarian dog and cat food exports (CN 230910) Annual grotwh of partner countries' imports from the world between 2004-2008, % 50 Ukraine 40 Russian Federation Serbia Lithuania Bulgaria Scale: 2% of world imports 30 Romania Latvia 20 Czech Republic Croatia Turkey Slovakia Greece France Italy Netherlands 10 Portugal Austria Switzerland Germany Slovenia 0 0 2 4 6 8 10 12 Share of partner countries in Hungary's exports, 2008, % Hungary export growth to partner < Partner import growth from the world Hungary export growth to partner > Partner import growth from the world Reference bubble Bubble size is proportionnal to the share in world imports of partner countries for the selected product Source: International Trade Center calculations based on COMTRADE statistics 5.3. Employment The number of pet food producers has tripled during the last ten years; the KSH registered more than fifty companies operating in the field of pet food production in 2007 (Figure 12). Among them only three operated on a large scale. Nearly half of the producers employed less than four persons; almost 30 % of them were registered as medium size enterprises. It is to be noted that while only seven small and medium size enterprises were registered as pet food producers in 1998, already 40 such enterprises included pet food production in their activities in 2007. 28 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. Figure 12 Number of pet food producers in Hungary (1998-2007) 70 60 50 40 30 20 10 0 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Source: KSH Although the number of pet food production plants decreased between 2005 and 2007, the number of people employed within the sector increased, thanks to the continuous investments and to the expanding production capacities (Figure 13). Figure 13 Number of persons employed in the production of fodders and pet foods (2003-2008) 4 500 4 000 3 500 3 000 2 500 2 000 1 500 1 000 500 0 2003 2004 2005 2006 Fodder production 2007 2008 Petfood production Source: APEH The workforce increased principally at the three biggest pet food producers, where 94 % of the branch’s employees were employed in 2008. While the number of employees in fodder production decreased by 26 % between 2003 and 2008, the number of those employed in the pet food production increased by more than 50 %. In all, 15 counties are involved in pet food production, but the companies of the branch employ most people in Pest, Tolna, Csongrád, Vas, Komárom-Esztergom and Jász-Nagykun-Szolnok counties. 29 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. 5.4. Raw material utilisation Pet food producers principally use materials from the agriculture and food industry. These include meats, poultry, fish, feed corn and other agricultural products, as well as byproducts generated during production of food for human consumption (Figure 14). Figure 14 Links between feed production, animal husbandry and food production and consumption Food Industry by-products of the food industry Consumer Food Expired self life or damaged products Food wastes Livestock Farming Dead animals SRM Feed Pet food Waste Feed by-products Other waste Source: MgSzH In agriculture and forestry, nearly 30 million tons of plant residues, by-products, loppings and scraps are generated yearly. This is topped by some 5 million tons of waste from the food industry which add up to 35 million tons of reusable biomass a year in Hungary. Besides tese, recycling of the approximately 280 thousand tons of slaughtering and meat industry by-products is only resolved to a very limited extent (Figure 15). 30 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. Figure 15 Utilisation of the by-products of livestock farming and processing in the pet food production Farm animals Died on Farms/ Diseased animals Abbatoir Died in transit/ Diseased animals Passed Inspections Fit for Human Consuption Surpluses & Materials not Intended for Human Consuption TSE – animals/ SRM High risk Rendering Plants Human Food Processing plant Melting Plant Animal Protein Processing Plant Supervised Disposal Human Food Pet food Source: FEDIAF According to the data of the Hungarian Pet food Association, between 2005 and 2008 the value of the raw materials utilised by the Hungarian pet food producers amounted to HUF 30-32 billion, with raw materials of domestic origin having a share of 47-54 % and the share of the imported materials being 46-53 % (Figure 16). The value of the imported raw materials amounted to HUF 14-16 billion, 86 % thereof deriving from the EU Member States in 2008, while the proportion was 98 % in 2005. That means the rate of raw materials imported from third countries has increased. 31 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. Figure 16 Origin of the raw materials used for pet food production by the member companies of the Hungarian Pet food Association (2005-2008) 100 90 80 percent 70 60 50 40 30 20 10 0 2005 2006 2007 Domestic row materials 2008 Imported raw materials Source: Hungarian Pet food Association 32 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. Sources 1) Erős-Hajdu Sz. [2008]: Polctükör – Állateledelek kiegészítőként vagy jutalomból. Trade Magazin, 10. szám. www.trademagazin.hu/index.php?oldal=2&mod=cikkek&cikk=2143 2) Hegóczki J. – Pándi F. – Vereczkey G. [2009]:’ Élelmiszer-ipari hulladékok statisztikája’, Statisztikai Szemle, vol. 87, no. 3, pp. 287-301. 3) Nyárs Levente [2009]: ’Az állati eredetű hulladékok ártalmatlanításának helyzete és kilátásai Magyarországon’, Hulladéksors, vol. 10, no. 5, pp. 30-34. 4) Pet food And Pet Care Products in Hungary [2009]: www.euromonitor.com/Pet_Food_And_Pet_Care_Products_in_Hungary 5) Phillips-Donaldson, D. [2008]: Global growths continues. Compiled by Debbie Phillips-Donaldson. Pet Food Industry, May, 2008. www.pet foodindustry.com/0805PETgrowth.aspx?terms=Pet food+Hungary 6) Phillips-Donaldson, D. F2009G: Rising pet food powers. Based on reports and presentations from Euromonitor, www.euromonitor.com, Updated: May 28, 2009. www.pet foodindustry.com/PrintPage.aspx?id=24828 7) Popp J. (szerk.) – Potori N. (szerk.) – Stauder M. – Wagner H. – [2005]: A takarmánytermelés és -felhasználás elemzése, különös tekintettel az abraktakarmánykeverékek gyártására. Agrárgazdasági Tanulmányok, 2005/5. Budapest: Agrárgazdasági Kutató Intézet. 8) Taylor, Jessica [2009]: ’Top 10 Global Pet food Leaders’, Pet food Industry, January 2009 http://www.pet foodindustrydigital.com/pet foodindustry/200901/?pg=24#pg24 33 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. Annexes 34 Error! Use the Home tab to apply címsor 1 to the text that you want to appear here. Annex 1 The top brands of international pet food producer companies in Hungary Name of Company Mars Subsidiary company: Peetfood Mars Nestlé SA World headquarters McLean, Virginia, USA Franklin, Tennesse, USA Vevey, Switzerland Subsidiary company: Nestlé Purina PetCare Colgate-Palmolive Subsidiary company: Hill’s Pet Nutrition Provimi SA Home subsidiary company: PET-Hungária Ltd. St. Louis, Missouri, USA New York, USA Topeka, Kansas, USA Top brands Pedigree, Chappi, Sheba, Whiskas, Kitekat, Trill Friskies, Darling, Purina Proplan, Dog Chow, Cat Chow, Gourmet, Purina One, Purina Félix Hill’s Science Diet, Hill’s Prescription Diet Rotterdam, Holland Basa, Dax, Propesko, Reno Budapest, Hungary 35 Error! Use the Home tab to apply Címsor 1 to the text that you want to appear here. Annex 2 Foreign trade of the most important feed product categories in ‘000 EUR Year Food industry by-products and wastes; prepared feeds (CN 23) Exports Imports 1995 34 601 144 641 1996 56 938 173 953 1997 49 323 208 497 1998 56 484 223 836 1999 74 027 182 645 2000 119 365 239 639 2001 153 662 289 710 2002 175 487 292 942 2003 233 699 267 302 2004 266 661 277 743 2005 300 478 241 456 2006 295 292 274 238 2007 319 006 354 344 2008 418 725 428 042 Source: KSH foreign trade statistics Of which: Feed preparations, pet foods (CN 2309) Exports 15 750 31 177 32 564 39 233 52 951 96 635 132 462 157 551 213 636 239 147 273 516 263 193 288 198 359 893 Imports 19 000 16 753 21 979 30 838 33 099 37 783 46 184 55 874 59 803 63 333 80 199 91 767 113 332 127 102 Of which: Dog- and cat food in pack (CN 230910) Exports 8 929 8 188 14 503 22 464 32 436 60 469 89 030 116 237 170 341 196 673 210 466 208 769 223 324 262 302 Imports 8 641 7 711 8 972 11 512 13 618 17 656 17 887 17 166 20 779 21 744 31 731 36 940 44 524 59 274 Foreign trade of the most important feed product categories in tons Food industrial by-products and waste; prepared feeds (CN 23) Exports Imports 1995 218 358 681 505 1996 291 408 663 226 1997 191 423 675 592 1998 271 042 902 091 1999 361 326 857 909 2000 416 813 952 801 2001 383 753 1 044 614 2002 392 143 1 076 224 2003 441 460 1 041 206 2004 505 665 908 448 2005 613 305 838 506 2006 638 971 924 830 2007 579 334 1 139 732 2008 810 105 1 096 783 Source: KSH foreign trade statistics Year Of which: feed preparations, pet foods (CN 2309) Exports 28 021 52 418 48 651 60 272 94 486 182 097 212 308 226 041 283 508 328 382 385 760 370 917 373 043 491 067 36 Imports 31 258 29 149 34 935 44 604 48 454 53 744 62 064 67 000 76 297 74 555 98 721 112 130 142 064 158 745 Of which: Dog- and cat food in pack (CN 230910) Exports 15 719 13 600 27 232 37 377 50 259 83 838 119 487 142 308 189 866 237 291 266 257 247 895 267 395 294 177 Imports 13 658 15 273 18 202 20 996 24 196 28 410 28 561 23 408 29 032 28 553 42 621 47 202 53 120 69 718