Assessment is nothing but audit of the books of account of the dealer

advertisement

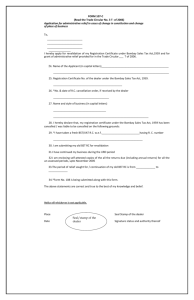

MEANING OF ASSESSMENT: According to the Merriam-Webster online dictionary the word assessment comes from the root word assess which is defined as: 1. to determine the rate or amount of (as a tax) 2. to impose (as a tax) according to an established rate: subject to a tax, charge, or levy 3. to make an official valuation of (property) for the purposes of taxation 4. to determine the importance, size, or value of (assess a problem) 5. to charge (a player or team) with a foul or penalty. 6. Assessment in education is best described as an action “to determine the importance, size, or value of.” The word, “ASSESSMENT” has been defined and explained by the Supreme Court of India and other Courts as follows: The word “assessment” has been used in Cl. IV in its widest connotation and includes the procedure for declaration and imposition of tax liable and the machinery for enforcement thereof including a proceeding for imposition of penalty. (C.A Abraham vs, Income Tax Officer, Kottyam, AIR 1961 SC 609.) The word “assessment” can bear a very comprehensive meaning, it can comprehend the whole procedure for ascertaining and imposing liability upon the tax payer. (Kalavati Devi Harlaka v. C. I. T, W.B., AIR 1968 SC 162). The term “assessment” is generally used in this country for the actual procedure adopted in fixing the liability to pay a tax on account of particular goods or property or whatever may be the object of the tax in a particular case and determining its amount. (Constitution of India). (A. C. of C. E., v. National Tobacco Co. of India Ltd. AIR 1972 SC 2563.) “Assessment” is the process of determining the total income of the assessee and the sum payable by the assessee as income tax, surcharge, super tax etc,(AIR 1977 SC 459.). Subject to appeal and revision, the assessment proceedings are complete, with the passing of an assessment order by the assessing officer. The order is popularly, known as Assessment Order. Assessment order is source of subsequent orders of appeal, revision, and order of High Court and Supreme Court. Therefore, it is required to a well reasoned, speaking order. Passed by following the standards laid down by the judiciary and observing the rules of natural justice. Not only this, the assessing officer has to strike the balance of various factors while passing the assessment order. As The Honourable Supreme Court, in the case of State of Kerala v. Kurian Abraham Pvt.LTD [2008] 13 VST 1 (SC), has observed; “Tax administration is a complex subject, It consists of several aspects. The Government needs to strike a balance in the imposition of tax between collection of revenue on one hand business-friendly approach, on the other hand. Today, Government have realized that in matters of tax collection difficulties faced by the business have got to be taken into account. Exemptions, undoubtedly, is a matter of policy. Interpretation of an entry is undoubtedly a quasi-judicial function under the tax laws. Imposition of taxes consists of liability, quantification of liability and collection of taxes. Policy decisions have to be taken by the Government. However, the Government has to work through its senior officers in the matter of tax administration.” On binding nature of the circulars it has been held that; “The circular is statutory in nature. Therefore it is binding on the department though not on the courts and the assessees, ---------------------------------------------------------------- till day, it has not been withdrawn. In the circumstances it is not open to the officers administrating the law working under the Board of Revenue to say that the said circular is not binding on them. If such a contention was to be accepted, it would lead to chaos and indiscipline in the administration of tax laws.” Above observations of the honourable apex court is one example, there are innumerable factors the assessing officer has to consider and take into account while finalizing the assessment of a dealer. So, the officers must be vigilant from the stage of receipt of the periodical returns, because, as held In Ghanshyamdas v. Regional Assistant Commissioner of Sales Tax [1963] 14 S.T.C. 976 (S.C.) ; “a statutory obligation to make a return within a prescribed time does not proprio vigore initiate the assessment proceedings before the Commissioner, but the proceedings would commence after the return was submitted and would continue till a final order of assessment was made in regard to the said return.” The process of assessment begins with the process of filing returns and ends with final proceedings of regular assessment, reassessment, appeal, revision, or order of High Court or Supreme Court as the case may be. The process of assessment includes, collection of data and documentary proofs relating to the transactions of sale and purchases, including sale and purchase bills, delivery memos, proofs of transportation, details of reduction or enhancement of sale or purchase price, by way of adjustment through debit and credit notes, of discounts offered and received, goods returned and goods rejected, price variations, tax rate differences and such other factors, with amendments of provisions of law and alteration of rate of tax of scheduled entries as well as various concessions, add and withdrawal of various concessions etc, which effects the original sale/purchase price determined and charged in the invoices/bills, claims of refunds and payment of tax. Submission of statutory documents in support of various claims of deductions claimed from turnover of sale or purchase or claims of reduction in rate of tax, made during the tax period or during the assessment year, accounting and finally preparing the returns and filing it with the appropriate authority. with the proofs of payments made towards tax, penalty, and interest into the Government treasury. In legal terms, all the documents forming part of the assessment whether kept on record or not, notices issued and served, replies and representations made and received and any other documents called for or submitted during the process of assessments or in any other further proceedings of assessment, whether kept on assessment file or returned to the assessee after verification, are “DOCUMENTS ON RECORD OF ASSESSMENT ORDER”. These documents on records of assessments are base for the orders of assessment, reassessment, appeal, revision etc. The assessing authority is required to verify the documents on record and assess the correct amount of tax paid and payable and confirm and allow various claims of deductions, reductions and exemptions made and claimed in the self assessment made by the assessee. The assessing officer has to pass quality order of assessment, as per the requirement of the provisions of the law. If, the officer agrees with the self assessment made by the assessee, than the order becomes formal, however, it is duty and responsibility of the officer to confirm that the self asssessment made by the assessee is correct and tax paid by the assesee is correct and does not suffer any infirmity, because every order is subject to audit, appeal, and revision. The officer is answerable for under and over assessment equally. As discussed above, considering all the documents on record, the assessing officer has to pass a reasoned speaking order, in order to sustain his order at all levels of the assessment proceedings, including the High Court and the Supreme Court. Every order should contain reasons because; “Failure to give reasons amount to denial of justice”. The need for recording of reasons is greater in a case where the order is passed at the original stage. At the stage of appeal or revision, however, if the appellate or revising authority, do not agree with the reasons contained in the order under challenge, onus is on these authorities to pass a well reasoned order or disapprove the order and send it back to the original order making authority with appropriate direction for passing well reasoned speaking order. The assessment order is a quasi judicial order which is subject to further proceedings of appeal and revision, up to the stage of the Honourable High Court and Supreme Court. therefore, it requires due care and caution. Reasons for accepting or not accepting the claims of the assessee should contain in the assessment order itself. The assessment order shall speak itself. The reasons for a conclusion cannot be substituted either by way of document or affidavit. In other words, the judicial order shall speak for itself and it should reflect the application of mind by the concerned officer. Where, the assessing officer has not discussed anything and he has simply accepted the return of income. The order does not reflect the application of mind. It does not contain any reason whatsoever. Therefore, the order passed by the assessing officer does not confirm the standard prescribed by the Apex Court. “In S.N. Mukharji vs, Union of India AIR 1990 SC 1984, a Constitution Bench of the Supreme Court discussed the development of law on this subject in India, Australia, Canada, England and the United States of America and after making reference to a large number of judicial precedents, their Lordships culled out the following propositions (page 1995): The decisions of this court referred to above indicate that with regard to the requirement to record reasons the approach of this court is more in line with that of the American Courts. An important consideration which has weighed with the court for holding that an administrative authority exercising quasijudicial functions must record the reasons for its decision, is that such a decision is subject to the appellate jurisdiction of this court under article 136 of the Constitution as well as the supervisory jurisdiction of the High Courts under article 227. the Constitution and that the reasons, if recorded, would enable this court or the High Courts to effectively exercise the appellate or supervisory power. But this is not the sole consideration. The other considerations which have also weighed with the court in taking this view are that the requirement of recording reasons would; (i) guarantee consideration by the authority; (ii) introduce clarity in the decisions; and (iii) minimize chances of arbitrariness in decision making. In this regard a distinction has been drawn between ordinary courts of law and tribunals and authorities exercising judicial functions on the ground that a judge is trained to look at things objectively uninfluenced by considerations of policy or expediency whereas an executive officer generally looks at things from the stand point of policy and expediency. Reasons, when recorded by an administrative authority in an order passed by it while exercising quasijudicial functions, would no doubt facilitate the exercise of its jurisdiction by the appellate or supervisory authority. But the other considerations, referred to above, which have also weighed with this court in holding that an administrative authority must record reasons for its decision, are of no less significance. These considerations show that the recording of reasons by an administrative authority services a salutary purpose, namely, it excludes chances of arbitrariness and ensures a degree of fairness in the process of decision-making. The said purpose would apply equally to all decisions and its application cannot be confined to decisions which are subject to appeal, revision or judicial review. In our opinion, therefore, the requirement that reasons be recorded should govern the decisions of an administrative authority exercising quasi-judicial functions irrespective of the fact whether the decision is subject to appeal, revision or judicial review. It may, however, be added that it is not required that the reasons should be as elaborate as in the decision of a court of law. The extent and nature of the reasons would depend on particular facts and circumstances. What is necessary is that the reasons are clear and explicit so as to indicate that the authority has given due consideration to the points in controversy. The need for recording of reasons is greater in a case where the order is passed at the original stage. The appellate or revisional authority, if it affirms such an order, need not give separate reasons if the appellate or revisional authority agrees with the reasons contained in the order under challenge.” In Testeels Ltd v. N.M. Desai (1970) 37 FJR 7; AIR 1970 Guj 1, a Full Bench of the Gujarat High Court has made an extremely lucid enunciation of law on the subject. Some of the observations made in the decision are extracted below: “The necessity of giving reasons flows as a necessary corollary from the rule of law which constitutes one of the basic principles of the Indian Constitutional set-up. The administrative authorities having a duty to act judicially cannot therefore decide on considerations of policy or expediency. They must decide the matter solely on the facts of the particular case, solely on the material before them and apart from any extraneous considerations by applying pre-existing legal norms to factual situations. Now the necessity of giving reasons is an important safeguard to ensure observance of the duty to act judicially. It introduces clarity, checks the introduction of extraneous or irrelevant considerations and excludes or, at any rate, minimizes arbitrariness in the decision-making process. Another reason which compels making of such an order is based on the power of judicial review which is possessed by the High Court under article 226 and the Supreme court under article 32 of the Constitution. These courts have the power under the said provisions to quash by certiorari a quasi-judicial order made by an administrative officer and this power of review can be effectively exercised only if the order is a speaking order. In the absence of any reasons in support of the order, the said courts cannot examine the correctness of the order under review. The High Court and the Supreme Court would be powerless to interfere so as to keep the administrative officer within the limits of the law. The result would be that the power of judicial review would be stultified and no redress being available to the citizen, there would be insidious encouragement to arbitrariness and caprice. If this requirement is insisted upon, then, they will be subject to judicial scrutiny and correction.” Above observations and laid down principles of law, have to be implemented while passing orders PROVISIONAL ASSESSMENT Section 32, Return scrutiny and provisional assessment. 32.(1); Returns or revised returns furnished by the dealer in accordance with section 29 shall be subject to scrutiny by the Commissioner. (2) (a) if any dealer has furnished return or revised return according to which;(i) net amount of tax payable, in accordance with section 13 is nil. (ii) the amount of tax credit is carried forward for subsequent return or (iii) the amount of refund is claimed therein or (iv) the dealer has claimed in the return or the revised return higher amount of tax credit than the admissible amount of tax credit. then, the Commissioner may, as soon as possible, provisionally assess such dealer for the period of such return or as the case may be, revised return. For the purpose of aforesaid provisional assessment, the Commissioner shall serve on such dealer in the prescribed manner a notice requiring him to explain in writing, on or before the date specified in the aforesaid notice, the basis on which the dealer has furnished such returns or the revised returns. The Commissioner may, after considering such explanation provisionally assess the amount of tax due from such dealer and issue an order in the prescribed form. (b) If the dealer who has been served the notice under clause (a) fails to comply with requirement of clause (a) the Commissioner shall determine the amount of tax payable in the manner as may be prescribed and serve on such dealer an order of the provisional assessment. (3) Where a registered dealer has not furnished the return in respect of any tax period within the prescribed time, the Commissioner shall, notwithstanding anything contained in section 34, proceed to assess the dealer provisionally for the period for such default., proceed to assess the dealer provisionally for the period for such default. (4) Where the Commissioner has reason to believe that the dealer has evaded the tax or has claimed more amount of tax credit than the admissible amount of tax credit, he may after taking into account all relevant materials gathered by him and after giving the dealer a notice in the prescribed form, provisionally assess to the best of his judgment the amount of tax payable by the dealer. (5) The provisions of this Act shall mutatis mutandis apply to the provisional assessment as if provisional assessment were an audit assessment made under this Act. (6) Nothing contained in this section shall prevent the Commissioner from making assessment under section 33 and 34. [Provisions of Provisional Assessment under the repealed G.S.T Act, 1969. where under Section 41 B, they were as under: 41B Provisional Assessment: (1). Where the Commissioner has reason to believe that the dealer has evaded the tax. He may, after taking into account all relevant materials gathered by him and after giving the dealer a reasonable opportunity of being heard, provisionally assess the amount of tax payable by the dealer. (2).The provisions of this Act shall mutatis mutandis apply to the provisional assessment made under this Act. These provisions were interpreted and analyed by the Honourable Gujarat High Court in the case of Batliboi & Co. Ltd. Vs. Sales Tax Officer ( Guj ), 119 S.T.C.583. in following words; “the provisional assessment can be made by the Commissioner or his delegate as assessing authority only if he “has reasons to believe that a dealer has evaded the tax”..................................... On the facts and legal position disclosed by the dealer, there did not exist any grounds and circumstances for the assessing officer to reasonably form an opinion that the dealer had evaded the tax.” In the case of Asian Paints India Ltd. V. D.C. S.T. (Guj ).148 STC 532.( Guj ); The Gujarat High Court has held that; the provisional assessment order passed under section 41B of the State Act has got to be taken into account while passing regular order under section 41(3) of the Act and it can either be upheld or set aside or modified but cannot be ignored or suppressed.] Observations made by the Honourable Gujarat High Court are applicable to the provisional assessments made under Section 32 of the Gujarat Value Added Tax Act 2003. Provisional Assessment Requires; 1. A Notice in prescribed form, ( Notice in form 301), (Rule 29) 2.Service of notice in form 301. Date fixed for compliance with the notice shall not be earlier than fifteen days from the date of service of notice. Provided date earlier than the date may be fixed if the dealer or his agent agrees thereto in writing. Sub-Sections (2) and (4); 3. Explanation of the dealer in writing. 4. Assessment order in Form 304. ( Rule 29 (2 ). Accounts to be audited in certain cases. Section 63: (1) If in respect of any particular year, total turnover of a dealer exceeds such amount, not being less than one crore as may be prescribed then such dealer shall get his accounts verified and audited by a authority within nine months from the end of that year and obtain within that period a report of such audit in the prescribed form duly signed and verified by such prescribed authority along such particulars as may be prescribed. A true copy of such report shall be furnished by such dealer to the Commissioner within such period as may be prescribed. Explanation : For the purpose of this section , “specified authority “ means.(i). a Chartered Accountant within the meaning of the Chartered Accounts Act, 1949 and includes persons who by virtue of the provisions of section (2) of section 226 of the Companies Act, 1956, is entitled to be appointed to act as an auditor of Companies. (ii). a cost Accountant within the meaning of the Cost and Works Accountants Act, 1959. (iii). a legal practitioner or Sales Tax Practitioner whose name is entered in the list maintained by the Commissioner in accordance with the provisions of Section 81. (2) If any dealer liable to get his accounts audited under sub-section (1) fails to furnish a true copy of such report within the prescribed time, the Commissioner shall, after giving the dealer a reasonable opportunity of being heard, impose on him, in addition to any tax payable, a sum by way of penalty not exceeding rupees ten thousand, as he may determine. Section 64: Preservation of Records. 64. The dealer shall preserve his books of accounts and the records relevant for the purpose of this Act till the period of six years from the end of the accounting year to which the books of account and the record relate: [Provided that where the dealer is a party to an appeal or revision under this Act, he shall preserve the books of account and the records pertaining to the subject matter of such appeal or revision until the appeal or revision is finally disposed of.] SELF ASSESSMENT. Section 33 : Self assessment. 33. (1) Every registered dealer shall, by such dates and to such authority as may be prescribed, furnish annual return by way of self assessment in the prescribe form, containing such particulars and accompanied by supporting documents, as may be prescribed. (2) The amount of tax credit, exemptions and other claims by the dealer in the annual return for which no supporting tax invoice, declarations, certificates, or evidence required under this Act or the Central Act is furnished, shall be self - assessed by the dealer by disallowing such tax credits, exemptions and other claims and by levying the appropriate rate of tax as if the sales or purchases were taxable. (3) Where,(a) a dealer has furnished all the returns, revised returns, if any, and annual returns by the date prescribed therefore and paid the amount of tax due according to such returns. and (b) the Commissioner is satisfied that the returns or, as the case may be revised returns and annual returns furnished by such dealer are correct and complete, and (c) a notice for audit assessment under sub-section (2) of section 34 has not been served on such dealer within such period as may be prescribed, such dealer shall be deemed to have been assessed for that year: Provided that the Commissioner of his own motion within a period of three years from the end of the year in respect of which or part of which the tax is assessable, may call for and examine the record of such dealer who has been deemed to have been assessed and after serving notice and giving the dealer an opportunity of being heard, pass such order thereon in accordance with the provisions of section 34, as the Commissioner may thinks just and proper. Annual return by way of self assessment. Dealer is required to submit annual return by way self assessment in the prescribed form containing prescribed particulars and documents, On receipt of self assessment in Form 205 and Annual Audit Report, department can carry out Audit Assessment as provided under Section 34 of the Gujarat Value Added Tax Act 2003. The provisions are as under: Rule 30 : Particulars and supporting documents under section 33. (1) Every registered dealer, other than a dealer who has been granted permission to pay lump sum tax under section 14, 14A, read with clause (bb) of sub-rule (8) of rule 28, 14B, 14C, or 14D shall furnish: (a) Form 201 alongwith the Forms 201A, 201B and 201C appended to Form 201. (b) the forms on the strength on which he has availed exemption from or concessions of tax under any provisions of the Act or the Central Act along with the annual return in form 205. (c) Form 212 and Form 213 in case of a dealer dealing in the commodities mentioned in Schedule III to the Act. (2) Notice required to be given under clause (c) of sub-section (3) of section 33 shall be in Form 302 and such notice shall be served on such dealer not later than two year from the date of closure of the year in respect of which the tax is assessable. At the end of the accounting year the assessee is required to carry out self assessment and file annual return in forms FORM: 205: Annual Return. and FORM 205A: Additional information. The provisions are as under: AUDIT ASSESSMENT SECTION 34. Audit assessment. 34. (1) Subject to the provisions of sup-section (2), the amount of tax due from a registered dealer shall be assessed in the manner hereinafter provided, separately for each year, during which he is liable to pay tax, (2) (a) Where, (i) The commissioner is not satisfied with the bonafides of any claim of tax credit, exemption, refund , deduction, concession, rebate, or genuineness of any declaration or evidence furnished by a dealer in support thereof with the self assessment, or (ii) The commissioner has reason to believe that detailed scrutiny of the case is necessary, the Commissioner may, notwithstanding the fact that the dealer may have been assessed under Section 33, serve on such dealer in the prescribed manner a notice requiring him to appear on a date and place specified therein, which may be his place of business or a place specified in the notice, either to attend and produce or cause to be produced the books of account and all evidence on which the dealer relies in support of his returns to produce such evidence as specified in the notice. (b) in respect of such class of dealers as the State Government may, by rules specify. (3) The dealer shall provide all co-operation and reasonable assistance to the Commissioner as may be required in case the proceedings under this section are required to be conducted at his place of business. (4) If proceedings under this section are to be conducted at the place of business of the dealer and it is found that the is not functioning from such premises or no such premises exists, the Commissioner shall assess to the best of his judgment the amount of tax due from him. (5) If the Commissioner is unlawfully prevented from conducting the proceedings under this section, he may assess to the best of his judgment the amount of tax due from the dealer and may further direct that the dealer shall pay by way of penalty, addition to the amount of tax so assessed, a sum equal to the tax amount. (6) If any dealer; (a) has not furnished returns in respect of any period by the prescribed date; (b) has furnished incomplete or incorrect returns for any period; (c) has failed to comply with the terms on notice issued under sub-section (2) (d) has failed to maintain books of account in accordance with the provisions of this Act or rules made there under or has not regularly employed any method of accounting; the Commissioner shall assess to the best of his judgment the amount of tax due from him. (7) If the Commissioner is satisfied that the dealer, in order to evade or avoid payment of tax,(a) has failed to furnish, without reasonable cause, returns in respect of any period or the selfassessment by the prescribed date; (b) has furnished incomplete or incorrect returns for any period; (c) has availed tax credit for which he is not eligible. (d) has employed such method of accounting which does not enable the Commissioner to assess the tax due from him; or (e) has knowingly furnished falls or incorrect self assessment, he shall, after giving the dealer an opportunity of being heard, direct that the dealer shall pay, by way of penalty, a sum not exceeding to one and a half times of the amount of tax assessed on account of the said reasons in the audit assessment. (8) If the Commissioner, upon information which has come into his possession, is satisfied that any dealer who has been liable to pay tax under this Act in respect of any period, has failed to get registered, the Commissioner shall proceed to assess to the best of his judgment the amount of tax due from the dealer in respect of such period and all subsequent periods. In making such assessment, he shall give the dealer an opportunity of being heard. The Commissioner may, if he is satisfied that the default was without reasonable cause, direct that the dealer shall pay, by way of penalty, in addition to the amount of tax so assessed, a sum equal to the amount tax assessed or a sum of rupees five thousand, whichever is more. (9) No assessment under sub-section (2), (5), or (7) shall be made after the expiry or four years from the end of the year in respect of which or part of which the tax is assessable. ( Provisions under the repealed sales tax Act1969. i.e, G.S.T ACT. Section 42; .after expiry of three years from the end of the year in which the last monthly, quarterly or as the case may be annual return is filed). (10) No assessment under sub-section (8) shall be made after the expiry of eight years from the end of the year in which or part of which the tax is assessable. Provided that where any assessment is required to be made in pursuance of an order of any court or authority, such fresh assessment shall be made at any time within two years from the date of such order; Provided further that in computing the period of limitation for the purpose of this section, any period during which assessment proceedings are stayed by an order or injunction of any court or authority shall be excluded. (11) Any assessment made or penalty imposed under this section shall be without prejudice to prosecution for any offence under this Act. (12) Where in case of a dealer, the amount of tax assessed for any period under this section or reassessed for any period under section 35 exceeds the amount of tax already paid under sub-section (1), (2) or (3) of section 30 by the dealer in respect of such period by more than twenty five percent. of the amount of tax so paid, there shall be levied on such dealer a penalty not exceeding one and one -half times the difference between the tax paid under section 30 and the amount so assessed or reassessed. Rule 31 of the Gujarat Value Added Tax Rules; Audit assessment under section 34. The notice to be given under sub-section (2) of Section 34 shall be in Form 302 and the date fixed for compliance with the notice shall not be earlier than fifteen days from the date of service thereof ; (2) Order of assessment in form 304. (3) The Commissioner may make the detailed scrutiny in the following cases for audit assessment under clause (b) of sub-section (2) of Section 34, namely:_ a) Annul total turnover exceeds 10 Crors. b) Tax payable exceeds 25 Lacs. c) Total turnover or taxable turnover or tax payable compared to the previous year falls to the extent of 10% d) Seizure of books of account under section 67(4) e) Claim of input tax credit exceeds 10% f) Amount of input tax credit carried forward exceeds 20% g) Holders of exemption/deferment certificates and dealers situated in SEZ. h) Cases selected by random sampling. Best Judgment Assessment in certain circumstances: Section 32 (4); Where the Commissioner has reason to believe that the dealer has evaded the tax or has claimed more amount of tax credit than the admissible amount of tax credit, he may, after taking into account all relevant materials gathered by him and after giving the dealer a notice in the prescribed form, provisionally assess to the best of his judgment the amount of tax payable by the dealer. Section; 34(4) : the dealer is not functioning from the business place shown as place of his business or not functioning from the premises or no such premises exists.( Commissioner SHALL asses to the best of his judgment ) Section 34 (5): the Commissioner is unlawfully prevented from conducting assessment proceedings ( Commissioner MAY assess to the best of his judgment, may further direct that the dealer shall pay, by way of penalty in addition to the amount of tax so assessed a sum equal to the tax amount.) Section 34(6): If any dealer; (a.) Has not furnished returns,…….. (b.) Has furnished incomplete and incorrect returns (c.) Has failed to comply with the terms of notice issued under sub-section (2) (d.) Has failed to maintain books of account…( shall assess to the best of his judgment ) Section 34 (7) : if the commissioner is satisfied that the dealer, in order to evade or avoid payment of tax,Employed the methods enumerated under sub- sections (a) to (e) of Section 34. Penalty. a sum of equal to one and half times of the amount of tax assessed on account of the said reasons in the audit assessment. Section 34 (8): dealer failed to get registration. (the Commissioner shall assess to the best of his judgment ). In addition to the amount assessed penalty equal to the amount assessed or sum of rupees five thousand whichever is more should be levied. BEST OF HIS JUDGMENT ? Audit assessment under Section 34 provides for the “Best of his Judgment, Assessment” in certain circumstances so, what is “The Best Judgment”? How it is being made or being understood and interpreted in legal terms. The concept of best Judgment can be gathered from the following observations: Describing the nature and character of a best judgment assessment, Lord Russell of Killowen in delivering the judgment of the Privy Council in Income Tax Commissioner v. Badridas Ramlal Shop, Akola , observed as under: “The officer is to make an assessment to the best of his judgment against a person who is in default as regards supplying information. He must not act dishonestly, or vindictively or capriciously, because he must exercise judgment in the matter. He must make what the honestly believes to be a fair estimate of the proper figure of assessment, and for this purpose he must be able to take into consideration local knowledge and repute in regard to the assessee’s circumstances, and his own knowledge of previous returns by an assessment of the assessee, and all other matters which he thinks will assist him in arriving at a fair and proper estimate; and though there must necessarily be guess-work in the matter, it must be honest guess-work.” In state of Kerala v. Vellukutty,17 STC 465,(SC), it was held; “Judgment is a faculty to decide the matter with wisdom truly and legally. Judgment does not depend the arbitrary caprice of judge but on settled and invariably principle of justice. Though there is an element of guess work in a “best judgment assessment, it shall not be a wild one but shall have a reasonable nexus to the available material and the circumstances of each case. (similar view was taken by the honourable Supreme Court in Commissioner of Sales Tax v. H.M.Esufali H.M.Abdulali, 32 STC 77 (SC). Above observations are more than sufficient to have knowledge of the subject, in order to put it into action. ASSESSMENT ON THE BASIS OF FAIR MARKET PRICE:. Section 34A: Notwithstanding anything contained in this Act, if the Commissioner is of the opinion that any transaction by any dealer during any tax period or a set of transactions by the dealer has been accounted in a manner so as to pay tax less than the tax otherwise payable on such sale or the tax otherwise payable on such sale or purchase, than the Commissioner shall calculate the tax liability as per fair market price of such transaction or transactions. Explanation: for the purpose of this section, “fair market price” means the value at which goods of like kind are, sold or would be sold in the open market in the state. Though, the explanation provided under the Section is sufficient to understand and determine the “fair market price”. general definition of “Market Price” given below is to be considered while determining the value of the goods, assets or services. “Market Price” is the current price at which an asset or service can be bought or sold. Economic theory contends that the market price converges at a point where the forces of supply and demand meet. Shocks to either the supply side and/or demand side can cause the market price for a good or service to be re-evaluated.” A prudent man always looks around himself and gets what he want. Fair market prices are not a matter of investigation, they are around you wherever you are, this is age of globalization and global economy is a finger tip away, so, day to day prices of goods and services are not far away from your finger tips. TURNOVER ESCAPING ASSESSMENT: Section 35: (1) Where after a dealer has been assessed under section 32,33 or 34 for any year or part thereof, the Commissioner has reason to believe that the whole or any part of the taxable turnover of the dealer in respect of any period has, - (a.) Escaped assessment or (b.) Been under assessed or (c.) Been assessed at a rate lower than the rate at which it is assessable of (d.) Wrongly been allowed any deduction there from or (e.) Wrongly been allowed any tax credit therein. (2) No order shall be made under sub-section (1) after the expiry of FIVE years from the end of the year in respect of which or part of which the tax is assessable. The notice required to be given under sub-section (1) of section 35 shall be in Form 303 and the date fixed for compliance with the notice shall not be earlier than fifteen days from the date of service thereof. (Rule 32). Assessment orders under all above sections are required to be passed in prescribed form No: 304. Taxation authorities are quasi-judicial authorities, orders made by them are quasi-judicial orders. The orders are required to be made by following settled principles of law, Rules of natural justice, standards and norms determined and followed by the judiciary as well as by the quasi-judicial authorities, such as 1.Principles of Natural Justice, 2. Speaking Orders, 3. Well reasoned order. and 4.Orders free from Bias and prejudice etc. “The principles of natural justice, especially the audi alteram partem rule, require that an interested individual have an opportunity to be heard and to make his or her arguments but this does not necessarily mean that a hearing must be held unless the Act and the Regulations require it”. So, under the provisions of assessment of the Gujarat Value Added Tax Act 2003, (extracted above) it has been emphasized that the dealer or person interested, should be given opportunity of hearing. This means the law requires and makes it obligatory on the assessing or decision making authority to follow the rules of natural justice. It is requirement of the law therefore, failure to follow the law may lead to miscarriage of the justice. And render the order of the assessment or any other based on it, illegal and void. QUASI-JUDICIAL ORDERS: A judicial process is well settled and as pointed out by Shah J., in Jaswant Sugar Mills’s case, AIR 1963 SC 677, a quasi-judicial decision involves the following three elements: (1) It is in substance a determination upon investigation of a question by the application of objective standards to facts found in the light of pre-existing legal rules: (2) It declares rights or imposes upon parties obligations affecting their civil rights; and (3) the investigation is subject to certain procedural attributes contemplating an opportunity of presenting its case to a party, ascertainment of facts by means of material if a dispute be on question of facts, and if the dispute be on question of law, on the presentation, of legal argument, and a decision resulting in the disposal of the matter on findings based upon those questions of law and fact. In the case of State Of Gujarat vs Avani Underwear Co.[1993]91 STC148. (on 15 January, 1993 ), the honourable Gujarat High Court held that: Apart from this specific provision, it is clear that the Sales Tax Commissioner was exercising quasijudicial power under section 55 of the Act. It is well-settled law that where an authority makes an order in exercise of a quasi-judicial function, it must record its reasons in support of the order it makes. Every quasijudicial order must be supported by reasons. (reference may be made to a decision in the case of Woolcombers of India v.Woolcomber Workers Union AIR 1973 SC 2758, Siemens Engineering and Manufacturing Co, India Limited v. Union of India AIR 1976 SC 1785, and Mukharjee vs. Union of India AIR 1990 SC 1984). 11. Reasons are required to be stated even with regard to administrative orders which affect the rights of the parties : Further, admittedly rejection of an application under section 55(2) would affect the right of the applicant to get remission of sales tax payable by him for a particular period during which he has suffered loss because of riot or natural calamity. Even with regard to administrative orders which affect the rights of the parties, the principles of natural justice also require that the authority should record reasons before deciding the rights of the parties unless the orders passed by certain specified authorities are excluded from the ambit of principles of natural justice or such exclusion can be implied from the nature of the subject-matter, the scheme and the provisions of the enactment. In the case of Mukharjee vs. Union of India AIR 1990 SC 1984, the Supreme Court dealt with this aspect in detail while dealing with sections 162, 164 of the Army Act, 1950 and the Rules made there under. After considering the various decisions, the court observed that an important consideration which has weighed with the court for holding that an administrative authority exercising quasi-judicial functions must record the reasons for its decision, is that such a decision is subject to the appellate jurisdiction of the Supreme Court under article 136 of the Constitution as well as the supervisory jurisdiction of the High Courts under article 227 of the Constitution and that the reasons, if recorded, would enable the court to effectively exercise the appellate or supervisory power. The court further observed that the other considerations which have also weighed with the court in taking this view are that the requirement of recording reasons would (i) guarantee consideration by the authority; (ii) introduce clarity in the decisions; and (iii) minimize chances of arbitrariness in decision-making. The court has further observed that the requirement that reasons to be recorded should govern the decisions of an administrative authority exercising quasi-judicial functions irrespective of the fact whether the decision is subject to appeal, revision or judicial review on the ground that it would exclude the chances of arbitrariness and ensure a degree of fairness in the process of decision-making. The court has further observed as under : “38. The object underlying the rules of natural justice ‘is to prevent miscarriage of justice’ and secure ‘fair play in action’. As pointed out earlier the requirement about recording of reasons for its decision by an administrative authority exercising quasi-judicial functions achieves this object by excluding chances of arbitrariness and ensuring a degree of fairness in the process of decision-making. Keeping in view the expanding horizon of the principles of natural justice, we are of the opinion, that the requirement to record reason can be regarded as one of the principles of natural justice which govern exercise of power by administrative authorities. The rules of natural justice are not embodied rules. The extent of their application depends upon the particular statutory framework whereunder jurisdiction has been conferred on the administrative authority. With regard to the exercise of a particular power by an administrative authority including exercise of judicial or quasi-judicial functions the Legislature, while conferring the said power, may feel that it would not be in the larger public interest that the reasons for the order passed by the administrative authority be recorded in the order and be communicated to the aggrieved party and it may dispense with such a requirement. It may do so by making an express provision to that effect as those contained in the Administrative Procedure Act, 1946 of U.S.A. and the Administrative Decisions (Judicial Review) Act, 1977 of Australia whereby the orders passed by certain specified authorities are excluded from the ambit of the enactment. Such an exclusion can also arise by necessary implication from the nature of the subject-matter, the scheme and the provisions of the enactment. The public interest underlying such a provision would outweigh the salutary purpose served by the requirement to record the reasons. The said requirement cannot, therefore, be insisted upon in such a case. 39. For the reasons aforesaid, it must be concluded that except in cases where the requirement has been dispensed with expressly or by necessary implication, an administrative authority exercising judicial or quasi-judicial functions is required to record the reasons for its decision.” 41. Reason is the heartbeat of every conclusion. It introduces clarity in an order and without the same, it becomes lifeless. Reasons substitute subjectivity by objectivity. Absence of reasons renders the order indefensible/unsustainable particularly when the order is subject to further challenge before a higher forum. 42. Thus, it is evident that the recording of reasons is a principle of natural justice and every judicial order must be supported by reasons recorded in writing. It ensures transparency and fairness in decision making. The person who is adversely affected may know, as to why his application has been rejected.” In the matter of State of Rajasthan vs. Sohanlal , (2004) 5 SCC 573, it was observed thus:“3. .... The hallmark of a judgment/order and exercise of judicial power by a judicial forum is to disclose the reasons for its decision and giving of reasons has been always insisted upon as one of the fundamentals of sound administration justice-delivery system, to make known that there had been proper and due application of mind to the issue before the Court and also as an essential requisite of principles of natural justice. ............ The giving of reasons for a decision is an essential attribute of judicial and judicious disposal of a matter before courts, and which is the only indication to know about the manner and quality of exercise undertaken, as also the fact that the court concerned had really applied its mind.” In the case of Testeels Ltd. vs N.M. Desai And Anr. AIR 1970 Guj 1, (1969) GLR 622 GJ, the honourable Gujarat High Court, observed as under: 3. There are two strong and cogent reasons why we must insist that every quasi-judicial order must disclose reasons in support of it. The necessity of giving reasons flows as a necessary corollary from the rule of law, which constitutes one of the basic principles of our constitutional set up. Our Constitution posts a welfare State in which every citizen must have justice - social, economic and political and in order to achieve the ideal of welfare State, the State has to perform several functions involving acts of interferences with the free and unrestricted exercise of private rights. The State, is called upon to regulate and control the social and economic life of the citizen in order to establish socio-economic justice and remove the existing imbalance in the socio-economic structure. The State has, therefore, necessarily to entrust diverse functions to administrative authorities, which involve making of orders and decisions and performance of acts affecting the rights of individual members of the public. In exericse of some of these functions, the administrative authorities are required to act judicially. Now what is involved in a judicial process is well settled and as pointed out by Shah J., in Jaswant Sugar Mills’s case, AIR 1963 SC 677 (supra), a quasijudicial decision involves the following three elements: (1) It is in substance a determination upon investigation of a question by the application of objective standards to facts found in the light of pre-existing legal rules: (2) It declares rights or imposes upon parties obligations affecting their civil rights; and (3) the investigation is subject to certain procedural attributes contemplating an opportunity of presenting its case to a party, ascertainment of facts by means of material if a dispute be on question of facts, and if the dispute be on question of law, on the presentation, of legal argument, and a decision resulting in the disposal of the matter on findings based upon those questions of law and fact. The administrative authorities having a duty to act judicially cannot therefore decide on considerations of policy or expediency. They must decide the matter “solely on the facts of the particular case solely on the material before them and apart from any extraneous considerations” by applying “pre-existing legal norms to factual situations”. The duty to act judicially excludes arbitrary exercise of power and it is, therefore, essential to the rule of law that the duty to act judicially is strictly observed by the administrative authorities upon whom it is laid. If any departure from the observance of the duty to act judicially could pass unnoticed, it would open the door to arbitrariness and make a serious inroad on the rule of law. To quote the words of the Supreme Court in S.G. Jaisighani vs,Union of India AIR, 1967 SC 1427: “. . . . .. the absence of arbitrary power is the first essential of the rule of law upon which our whole constitutional system is based. In a system governed by rule of law, discretion, when conferred upon executive authorities, must be confined within clearly defined limits. The rule of law from this point of view means that decisions should be made by the application of known principles and rules and, in general, such decisions should be predictable and the citizen should know where he is. If a decision is taken without any principle or without any rule it is unpredictable and such a decision is the antithesis of a decision taken in accordance with the rule of law.” Now the necessity of giving reasons is one of the most important safeguards to ensure observance of the duty to act judicially. If the administrative officers can make orders without giving reasons, such power in the hands of unscrupulous or dishonest officers may turn out to be a potent weapon for abuse of power. But if reasons are required to be given for an order, it will be an effective restraint on such abuse as the order, if it discloses extraneous or irrelevant considerations or is arbitrary, will be subject to judicial scrutiny and correction. As observed by Subba Rao J., as he then was, in Madhya Pradesh Industries Ltd. vs. Union of India AIR, 1966 SC 671, “A speaking order will at its best be a reasonable and at its worst at least a plausible one”. The condition to give reasons introduces clarity, checks the introduction of extraneous or, at any rate, minimise arbitrariness in the decision making process it gives satisfaction to the party against whom the order is made and guarantees consideration of all relevant factors and discharge of his functions by the officer in accordance with the requirement of law. We may in this connection usefully quote the following passage from “American Administrative Law” by Bernard Schwartz at page 163: “The value of reasoned decisions as a check upon the arbitrary use of administrative power seems clear.... The right to know the reasons for a decision which adversely affects one’s person or property is a basic right of every litigant (and that whether the forum be judicial or administrative). But the requirement that reasons be given does more than merely vindicate the right of the individual to know why a decision injurious to him has been rendered. For the obligation to give a reasoned decision is a substantial check upon the misuse of power. The giving of reasons serves both to convince those subject to decisions that they are not arbitrary and to ensure that they are not, in fact, arbitrary. The need publicly to articulate the reasoning process upon which a decision is based, more than anything else, requires the Magistrate (judicial or administrative) to work out in his own mind all the factors which are present in a case. A decision supported by specific findings and reasons is much less likely to rest on caprice or careless consideration. As Judges Jerome Frank well put it in language as applicable to decision-making by administrators as by trial judges, the requirement of reasons has the primary purpose of evoking care on the part of the decider. . . . .” If the administrative officers having a duty to act judicially are required to set forth in writing the mental processes of reasoning which have led them to the decision, it would to a large extent help to ensure performance of the duty to act judicially and exclude arbitrariness and caprice in the discharge of their functions. The public should not be deprived of this only safeguard. 4. Another reason of equal cogency which weighs with us in spelling out the necessity for giving reasons is based on the power of judicial review which is possessed by the High Court under Article 226 and the Supreme Court under Article 32. The High Court under Article 226 and the Supreme Court under Article 32 have the power to quash by certiorari a quasi-judicial order made by an administrative officer and this power of review exercisable by issue of certiorari can be effectively exercised only if the order is a speaking order and reasons are given in support of it. If no reasons are given, it would not be possible for the High court or the Supreme Court exercising its power of judicial review to examine whether the administrative officer has made any error of law in making the order. It would be the easiest thing for an administrative officer to avoid judicial scrutiny and correction by omitting to give reasons in support of his order. The High Court and the Supreme Court would be powerless to interfere so as to keep the administrative officer within the limits of the law. The result would be that the power of judicial review would be stultified and no redress being available to the citizen, there would be insidious encouragement to arbitrariness and caprice. The power of judicial review is a necessary concomitant of the rule of law and if judicial review is to be made an effective instrument for maintenance of the rule of law, it is necessary that administrative officers discharging quasi-judicial functions must be required to give reasons in support of their orders so that they can be subject to judicial scrutiny and correction. 5. This has always been regarded as a most important reasons in the United States for insisting that quasi-judicial decisions must show reasons on their face. To quote from Schwartz’s “American Administrative Law” at page 166: “In the United States, perhaps the most prominent reasons advanced for the requirements of reasoned decisions is the role of such decisions in facilitating review by the courts. If the bases of administrative decisions are not articulated, it is most difficult for a reviewing court to determine whether the decision is a proper one. ‘We must know what a decision means before the duty becomes ours to say whether it is right or wrong’, reads an oft-cited statement of Gardozo J., . . . . . . for judicial control to be of practical value, the administrative tribunal or agency, ‘in making its order, should not make it an unspeaking or unintelligible order, but should in some way, state upon the face of the order the element which had led to the decision’. The words quoted are from a noted judgment of Lord Cairns, L.C., in which he laid down the distinction between ‘speaking’ and ‘unspeaking’ orders, which has become of basic importance in present-day English Administrative law. When Lord Cairns speaks of an ‘unspeaking or unintelligible order’, he obviously means an order which gives no reasons. If the administrator does not give reasons, he, in effect, disarms the exercise of the High Court’s supervisory jurisdiction. In such a case, the Court cannot examine further than the face of the challenged decision, which, in Lord Sumner’s famous phrase, ‘speaks’ only with ‘inscrutable face of a sphinx’.” It is therefore necessary for giving full meaning and content to the power of judicial review conferred on the High Court and the Supreme Court by the Constitution that every administrative officer exercising quasi-judicial functions must make a speaking order, that it, give reasons in support of the order. If the order speaks only with the “inscrutable face of a sphinx” it would be impossible for the High Court and the Supreme Court to effectively exercise their power of judicial review by means of certiorari. 6. This view is not only supportable on principle but it is also in consonance with the trend of juristic thought in the United States where there is considerable development in the field of administrative law in recent times. In the United States, as will be evident from the two passages from Schwartz’s “Amercian Administrative Law” quoted above, the American Courts have always insisted that administrative decisions should be speaking ones, that is, they must contain at least the findings upon which they are based and the reasons which have prevailed with them in introducing this requirement are the same two reasons which have found favour with us. It is also interesting to find that the administrative law in France has moved in the same directions. For a long time Conseil d’Etat consistently refused to require that the adminsitration should give reasons for its decisions in the absence of a statutory provision imposing that requirement. But in a decision rendered by it in 1950 Conseil d’Etat opened, in the words of one commentator, “a first breach in the established jurisprudence under which in the absence of a legal text requiring it the decisions of the administrative authorities need not be reasoned ones” and annulled an administrative decision in which no reasons were given. The Commissaire du gouvernment there advocated a bold departue from the prior case law and stated that the Conseil should require reasoned decision in every case in which the administrator was exercising quasi-judicial functions, even though the Legislature did not expressly impose such requirement. Otherwise, he asked, how could the Conseil really determine the validity of a challenged decision? In its decision adopting the approach of the Commissaire, the Conseil d’Etat stated that the obligation to give reasons was imposed “in order to enable the reviewing court to determine whether the directions and prohibitions contained in the law have been followed.” This is the same reason which has motivated the American Courts in requiring that administrative decisions must contain findings that show their basis and it is the same reason which has appealed to us for taking the view that in India too, as in the United States and France, administrative officers exercising quasi-judicial functions must make speaking orders. 7. The position in England is of course different and therefore strongest reliance was placed upon it on behalf of the State in England, though in the Liquor Licence Cases decided in the latter half of the nineteenth century the view was taken that the Licensing Justices who were empowered to refuse liquor licences on four specified grounds must specify the grounds for refusal in the order made by them and if they failed to do so, anorder of mandamus would issue to compel them to hear and determine the applications according to law, it appears that, as a general rule, no duty to give reasons in support of a quasi-judicial order is recognised by the Courts. The decisions in the Liquor Licence Cases are regarded as somewhat anomalous and the considered view has always been that a quasi-judicial authority is not subject to any duty to give reaosns for its decision. The decision in Robinson v. Minister of Town and Country Planning, (1947) KB 702 clearly seems to suggest that even if the Minister exercises quasi-judicial functions, there is no obligation on him to give reasons for his decision. This view is also implicit in the decision of the Court of Appeal in Rex v. Northumberland Compensation Appeal Tribunal (1952) 1 K.B., 338. In that case, the Court held that a quasi-judicial decision of an administrative tribunal could be quashed by certiorari for error of law where it “spoke” its error on its face. But where the decision was not contained in such a “speaking order”, the court would not intervene. There is implicit in this decision the recognition of the possibility that a quasi-judicial authority may not make a speaking order. This being the position, the Donoughmore Committee on Ministers’ powers in its report made in 1932 formulated the principle that a party is entitled to know the reasons for the decision, be it judicial or quasi-judicial and recommended acceptance of this principle as a principle of natural justice. Pursuant to this recommendation the British Parliament when it came to enact the Tribunals and Inquiries Act, 1958 introduced Section 12 in that Act which now expressly requires that in certain circumstances, the administrative tribunals specified in the First Schedule as also the Ministers holding a statutory inquiry must give reasons for the decision. Thus what the Courts failed to achieve by the process of judicial construction had to be set right by Parliamentary legislation. But what the Parliament did serves to emphasize the necessity of giving reasons in support of a quasi-judicial decision. 8. So much on principle. But quite apart from principle, there is in our view clear authority for the proposition that every quasi-judicial decision must be supported by reasons. The germ of this principle is to be found in the decision of the Supreme Court in Express Newspaper (Private) Ltd., v. Union of India, AIR 1958 SC 578. In that case the validity of the Working Journalists (Conditions of Service) and Miscellaneous Provisions Act, 1955 was challenged inter alia on the ground that the impugned Act did not provide for the giving of reasons for its decision by the Wage Board and thus rendere the petitioner’s right to approach the Supreme Court for the enforcement of their fundamental rights nugatory. Dealing with this contention. N. H. Bhagwati J., speaking on behalf of the Supreme Court said: “It is no doubt true that if there was any provision to be found in the impugned Act which prevented the Wage Board from giving reasons for its decision, it might be construed to mean that the order which was thus made by the wage board could not be a speaking order and no writ of certiorari could ever be available to the petitioners in that behalf. It is also true that in that event this Court would be powerless to redress the grievances of the petitioners by issuing a writ in the nature of certiorari and the fundamental right which a citizen has of approaching this Court under Art. 32 of the Constitution would be rendered nugatory.” The Supreme Court, however, took the view that there was no provision in the main Act which prevented the Wage Board from giving reasons for its decision and the challenge was negatived on that ground. But these observations undoubtedly support, the second reason which we have given for taking the view that reasons must be given in support of every quasi-judicial decision. 9. There is also another decision of the Supreme Court on the point and that is the decision in Govindrao vs, State of Madhya Pradesh AIR, 1965 SC 1222. The appellants in that case claiming to be the descendants of former Ruling Chiefs in some districts of Madhya Pradesh applied under the Central Provinces and Berar Revocation of Land Revenue Exemption Act, 1948, for grant of money or pension as suitable maintenance for themselves. They held estates in two districts on favourable terms as Jahgirdars, Maufidars and Ubaridars and enjoyed exemption from payment of land revenue amounting in the aggregate to Rs. 27,828.5-0 per year. On the passing of the Act the exemption was lost and they claimed to be entitled to grant of money or pension under the provisions of the Act. They applied to the Deputy Commissioner who forwarded their applications to the State Government. These were rejected without any reasons being given therefor. The appellants filed a petition in the High Court of Madhya Pradesh under Article 226 for a writ of certiorari to quash the order of the State Government. On the petition being dismissed, the appellants preferred an appeal to the Supreme Court. One of the grounds of challenge before the Supreme Court was that the order of the State Government was invalid since the appellants had not been heard by the State Government before making the order and the order was not supported by any reasons. The Supreme Court upheld this ground of challenge observing: “The next question is whether Government was in making the order of April 26, 1955? That order gives no reasons at all. The Act lays down upon the Government a duty which obviously must be performed in a judicial manner. The appellants do not seem to have been heard at all. The Act bars a suit and there is all the more reason that Government must deal with such cases in a quasi-judicial manner giving an opportunity to the claimants to state their case in the light of the report of the Deputy Commissioner. The appellants were also entitled to know the reason why their claim for the grant of money or a pension was rejected by Government and how they were considered as not falling within the class of persons who it was clearly intended by the Act to be compensation in this manner. Even in those cases where the order of the Government is based upon confidential material this Court has insisted that reason should appear when Government performs curial or quasi-judicial functions (M/s, Hari Nagar Sugar Mills Ltd,vs,Shyam Sunder Jhunihumwala (1962) 2 SCR 339 = (AIR 1961 SC 1669). The High Court did not go into any other question at all because it rejected the petition at the threshold on its interpretation of S. 5(3). That interpretation has been found by us to the erroneous and the order of the High Court must be set aside. As the order of Government does not fulfill the elementary requirements of a quasi-judicial process we do not consider it necessary to order a remit to the High Court. The order of the State Government must be set aside. . . . . . . .” The Supreme Court held that the necessity to give reasons was an elementary requirement of quasijudicial process and since the order of the Government did not fulfil this elementary requirement, it was liable to be set aside. This decision to our mind is a direct authority for the proposition that every qusijudicial decision must be supported by reasons and no further authority is necessary in support of the proposition. SPEAKING ORDER. “Cryptic and Non Speaking Assessment Order” Speaking order is another aspect of fairness doctrine. In India, in the absence of any specific statutory requirement, there is no general requirement for the administrative agencies to give reasons for their decision. However, if the relevant statute so requires, the court consider it mandatory and has held that the reason should not be merely rubber-stamp reasons but a brief, brief clear statement providing the link between the material on record and the conclusion reached. Where the statute does not provide for speaking order, the court has insisted that in case of violation of fundamental rights, speaking order will be a constitutional requirement. In the rest of the area also speaking order may be requirement under natural justice. Case Laws: (1);Gurdial Singh Fijji vs. State of Punjab (1979)2 SCC 368. (2).Union of India vs. Mohanlal Capoor (1973)2 SCC836. (3); S.N. Mukharji v.Union of India (1990) 4 SCC 594. Important Judgments: Ashok Lay Land v. State of Tamilnadu (2004)134 STC 473 (SC); In this case the Supreme Court has held that Section 6A of the Central Act, as amended, provides for a conclusive proof, except on a limited ground. According to the Supreme Court, the order of the authority under Section 6-A is conclusive for all practical purposes and the re-opening of the assessment is permissible only on limited grounds, such as fraud, collusion, misrepresentation, or suppression of material facts or giving or furnishing of false particulars, since in such cases, the order would be vitiated in law. The Supreme Court has further explained that when the order passed in terms of sub-section (2) of Section 6-A is found to be illegal or void ab-initio or otherwise voidable, the assessing officer derives jurisdiction to direct reopening of the proceedings. It is further ruled by the Supreme Court in the said decision that mere change in the opinion of the assessing officer or to have a relook at the matter would not confer any jurisdiction upon him to get the proceedings reopened. Asian Paints India Ltd. V. D.C. S.T. (Guj ).148 STC 532.( Guj ); In this case, The Gujarat High Court has held that; the provisional assessment order passed under section 41B of the State Act has got to be taken into account while passing regular order under section 41(3) of the Act and it can either be upheld or set aside or modified but cannot be ignored or suppressed. Assessing Officer cannot act on the basis of belief held by somebody else. M/s, Natraj Rubber vs. STO, 113 STC 575, (Gujarat). In the case of M/s, Natraj Rubber vs. STO, 113 STC 575, (Gujarat ). The honourable Gujarat High Court has held that “the holding of reason, in our opinion by the assessing officer was nothing more than a pretence which the back ground of the case suggests has been foisted on him by the repeated efforts for the audit department not accepting position of law that assessing officer is bound by decision under section 62, and where it had no gumption to even alleged that determination under section 62, was erroneous. Abhay Kumar Dilipkumar ( 2007) 6 VST 60 (M.P). HELD: that the revisional authority while deciding the revision did not discuss any legal provision or case law or the facts and the stand taken by the petitioner. It is the duty of revisionary authority to take note of facts involved in the case, then the concerned legal provisions and then take note of the submission of the petitioner and then decide the case after taking into consideration the case law governing the controversy. The reasons for accepting or rejecting the conclusion has to be mentioned in the order so as to make the order in accordance with law for being challenged in higher courts, if the occasion arose. The order in question was cryptic and short of reasoning, much less cogent and judicial reasoning. It did not take in to consideration or decide any of the submissions urged by the petitioner though arising out of the case. The court could not uphold the such order, nor decide the issue in a writ in the absence of any finding rendered by the authority on the objection taken by the petitioner against the order.’ Case law referred to : K.G. Industries vs. S.T.O (1999)113 STC49( M.P). Hanuman Prasad vs, State of Assam. [2007]7 VST 566 (Guahati) “The power and jurisdiction conferred under section 20(1) of the Act is required to be exercised with due application of mind. The power cannot be exercised mechanically or at the behest of some other authority other than on his own application of mind. Exercise of such a power must be independent of any extraneous consideration and de hors any dictation or direction of any other authority”. Steel Authority of India Ltd. Vs, STO (2008) 16 VST 181 (SC).9. A bare reading of the order shows complete non-application of mind. As rightly pointed out by learned counsel for the appellant, this is not the way a statutory appeal is to be disposed of. Various important questions of law were raised. Unfortunately, even they were not dealt by the first appellate authority. 10. Reason is the heartbeat of every conclusion. It introduces clarity in an order and without the same it becomes lifeless. (See Raj Kishore Jha v. State of Bihar 2003 (11) SCC 519) 11. Even in respect of administrative orders Lord Denning, M.R. in Breen v. Amalgamated Engg. Union (1971) 1 All ER 1148, observed: “The giving of reasons is one of the fundamentals of good administration.” In Alexander Machinery (Dudley) Ltd. v. Crabtree 1974 ICR 120 (NIRC) it was observed: “Failure to give reasons amounts to denial of justice.” “Reasons are live links between the mind of the decision-taker to the controversy in question and the decision or conclusion arrived at.” Reasons substitute subjectivity by objectivity. The emphasis on recording reasons is that if the decision reveals the “inscrutable face of the sphinx”, it can, by its silence, render it virtually impossible for the courts to perform their appellate function or exercise the power of judicial review in adjudging the validity of the decision. Right to reason is an indispensable part of a sound judicial system; reasons at least sufficient to indicate an application of mind to the matter before court. Another rationale is that the affected party can know why the decision has gone against him. One of the salutary requirements of natural justice is spelling out reasons for the order made; in other words, a speaking-out. The “inscrutable face of the sphinx” is ordinarily incongruous with a judicial or quasi-judicial performance. Reason is the heart-beat of every conclusion: it introduces clarity in an order and without the same it becomes lifeless. ( Rajkishore Jha v.State of Bihar[2003] 11 SCC 519 ) Right to reason is an indispensable part of sound judicial system; reasons at least sufficient to indicate application of mind to the matter before the court, Tribunal or authority. The affected party has to know why the decision has gone against him. One of the salutary requirement of natural justice is spelling out reasons for the order made. Even in respect of administrative orders Lord Denning, M.R. in Been v. Amalgameted Engineers.Union [1971] 1 All ER 1148, observed: “The giving of reasons is one of the fundamentals of good administration” In Alexander Machinery (Dudley) Ltd. V. Crabetree [1974]ICR 120 (NIRC) it was observed : “Failure to give reasons amount to denial of justice”. “Reasons are live links between the mind of the decision-taker to the controversy in question and the decision or conclusion arrived at”. “Reasons substitute subjectivity. The emphasis on recording reasons is that if the decision reveals the “inscrutable face of the sphinx”, it can by its silence, render it virtually impossible for the courts to perform their appellate function or exercise the power of judicial review in adjudicating the validity of the decision. Right to reason is an indispensable part of a sound judicial system; reasons at least sufficient to indicate an application of mind to the matter before court. Another rationale is that the affected party can know why the decision has gone against him. One of the salutary requirement of natural justice is spelling out reasons for the order; in other words, a speaking – out. The inscrutable face of the sphinx is ordinarily incongruous with a judicial or quasi-judicial performance. BABU SEBASTIAN V. ASTO 141 STC 434 ( KER ). In this case, following principles laid down by the honourable Apex court have been followed; “that the assessing authorities exercise quasi-judicial functions and they have a duty cast on them to act in a judicial and independent manner. If their judgment is controlled by the directions given by the Collector it cannot be said to be their independent judgment in any sense of the word.” [ Orient Paper Mills Limited v Union of India AIR 1970 SC.]. “that an order passed by the officer who was merely voicing the opinion of the superior without any conviction of his own, was hardly a satisfactory way of dealing with the matter. It was clear that he did not exercise his own judgment in the matter and faithfully followed the instructions by the superiors. The whole procedure was violative of the principles of natural justice.” [ Mahadayal Premchandra v, CTO (1958) 9 STC 428, AIR 1958 SC 667. M/S,TARA DYERS vs. STATE OF TAMILNADU, [2008] 16 VST 556 ( Mad). The Madras High Court at para 5 of the Judgment has held as under: But at the same time, it is also the duty on the part of the assessing officer to give reasons for rejecting the objections raised by the assessee pointing out the judgments rendered by this court. It is the further duty of the assessing officer to give reasons as to why the judgment relied on by the assessee are not applicable to their case. This aspect of the matter has been given a go bye by the assessing officers and none of the objections raised by the assessee have been considered by them. But on the contrary, the assessing officers reached the conclusion based on their own reasoning, which is impermissible in law. Hence all the assessment orders are hereby set aside.” To conclude. It can be said and understood that: “Being judicial or quasi-judicial authority one should not be “Biased or Prejudiced” because, “Judge or Quasi-judicial authorities, like all walks of life, are not infallible. In the matter of interpretation of statutory provisions or while assessing evidence in a particular case or deciding questions of law or facts, mistakes may be committed bona fide which are corrected at the appellate stage. This explains the philosophy behind the hierarchy of courts. While mistakes committed bona fide are subject to correction in the next higher tier of the judicial hierarchy an essential requirement of judicial adjudication is that the judge is impartial and neutral and is in a position to apply his mind objectively to the facts of the case put up before him. If he is pre-disposed or suffers from prejudices or has biased mind he disqualify himself from acting as a judge. ( Sridhar Lime Products v.DC,CT 147 STC 89 ( AP ).