Streaming and refundability of imputation credits

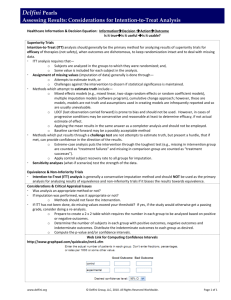

advertisement