Municipal Act, RSO 1990, c. M.45

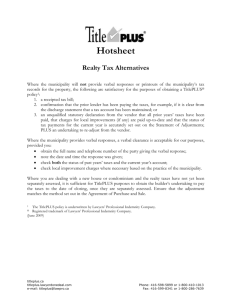

advertisement