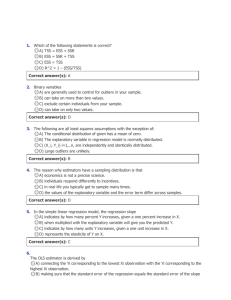

Topic 1: Introduction to Econometrics

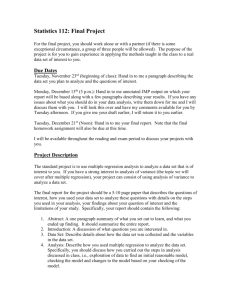

advertisement