Handout #6a - Pen Pacific

Handout #6a

The Wall Street Journal (April 3, 2013)

Is Innovation Killing the Soap Business?

By PAUL ZIOBRO and SERENA NG

The laundry-soap business has a problem—it is shrinking—thanks to premeasured pod detergents from Procter & Gamble Co. and others that keep consumers from overdosing. For years, consumer-product makers could count on extra sales from shoppers who poured in too much detergent with every load. The phenomenon became more pronounced when manufacturers rolled out increasingly concentrated detergent. premeasured = pod = count on = overdosing =

“more pronounced” = concentrated = roll out =

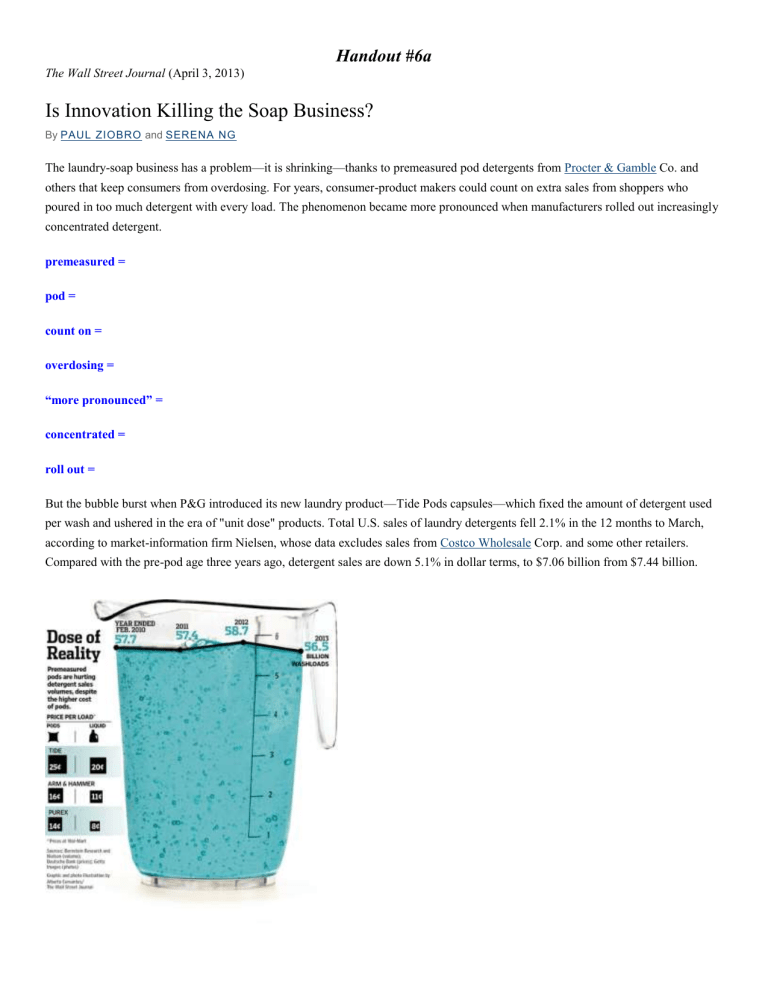

But the bubble burst when P&G introduced its new laundry product—Tide Pods capsules—which fixed the amount of detergent used per wash and ushered in the era of "unit dose" products. Total U.S. sales of laundry detergents fell 2.1% in the 12 months to March, according to market-information firm Nielsen, whose data excludes sales from Costco Wholesale Corp. and some other retailers.

Compared with the pre-pod age three years ago, detergent sales are down 5.1% in dollar terms, to $7.06 billion from $7.44 billion.

“the bubble burst” = capsule = usher in =

The sales downturn has set off an unusually frank debate in the industry over when innovation goes too far, and it has led to fingerpointing about who might be at fault. James Craigie, the outspoken chief executive of Church & Dwight Co., which sells low-price detergents under the Arm & Hammer and Xtra brands, has an answer: P&G. "Pod is killing the laundry detergent category," Mr.

Craigie said at an industry conference in February. finger-pointing =

2 outspoken =

New products ought to expand the revenue pie for manufacturers and retailers, not shrink it, he said. That is what innovation always did in the past, he said. The last round of more-concentrated liquid, in 2008, drove laundry detergent sales up 5%, he said. At the same conference, Clorox Co. noted that concentrated bleach helped lift overall bleach sales, a fact that Mr. Craigie reiterated. But since Tide

Pods launched in early 2012 and others (including Church & Dwight) followed, the sales trend has been down, he said.

(Tide detergent on display. The economics of the shift to pods work in favor of Procter & Gamble, which sells more than $4.5 billion in laundry detergent in North

America annually.)

"Now, what kind of a new product is good when it's hurting the total category?" he said.

P&G executives see things differently. Tide Pods represent "the ultimate perfect dose" of laundry detergent, said P&G Chief

Executive Robert McDonald , a former Tide brand manager himself, speaking in an interview. "We are laser focused on making sure consumers get the right dose, and that may have consequences for our competitors." laser focused =

Companies that make packaged foods and household goods have long profited from consumers' tendency to use more than the recommended amounts of their products, said Burt Flickinger III, managing director of Strategic Resource Group and an ex-P&G executive. "Consumers associate larger sizes with more savings and more value, and they tend to over-pour or over-use the products because they don't feel guilty about using more," he said. packaged foods =

“associate lager sizes with more savings and more value” =

3

But the economics of the shift to pods work in favor of P&G, which sells more than $4.5 billion in laundry detergent in North America annually. P&G says it has about 75% of the unit-dose market and is drawing customers from rivals. Consumers pay about 25 cents a load for Tide Pods at Wal-Mart , versus 20 cents per wash load for bottled Tide and as little as 7 cents for competitors' low-price detergents, according to Deutsche Bank Markets Research. More consumers are also using high-efficiency washing machines, which clean with relatively little detergent.

The result, according to P&G, which expects sales of Tide Pods to hit $500 million in the fiscal year ending in June, is that sales of unit dose and higher-priced detergents are growing while the low-end market is losing share. While that is good for P&G, the trend is weighing on the industry as a whole. At United Supermarkets, a Texas-based chain of about 50 supermarkets, laundry detergent sales are flat over the past year, and profits in that category are actually down a bit, said business manager Stephanie Black.

Part of the reason is that the chain is selling more unit-dose laundry detergent, like Tide Pods, which have a profit margin up to 5% lower than liquid laundry for retailers. Unit sales of liquid and powdered detergent, meanwhile, are down around 15%. Ms. Black said profit margins on unit-dose detergents are constrained because the wholesale price is already high, so the retailer is wary of putting too much of a markup on it. "We don't lose on them, but we don't make as much of a profit," Ms. Black said. constrained = limited

Diane Patten, a 37-year-old attorney in Jacksonville, Ore., said she uses Tide Pods for laundry during ski vacations with her husband and two boys. "They are so convenient…I pack a few in a little container and throw them in a bag" when the family travels, she said.

At home, Ms. Patten uses Tide bottled detergent because it is cheaper. "I usually follow the cap measurement unless there is a really filthy load," she said. convenient = filthy =

Consumer products companies have been making their soaps more concentrated for years to save on packaging materials and transportation costs, as well as to make room for more jugs on store shelves. Consumers often responded by reaching for larger bottles and cartons—sizes that felt more familiar— and pouring more than the recommended amount into their washing machines. Church &

Dwight is now making its Arm & Hammer bottled liquid detergent more concentrated in the hopes that rivals will follow and industry sales will grow. reaching for =

Adam Lowry, co-founder of Method Products Inc., which makes highly concentrated detergents that are dispensed like hand soap via a few small pumps, said consumer-goods giants have little incentive to help consumers cut back on overdosing, since it helps send

shoppers back to the stores faster to buy more detergent. A major contributor to the overdosing problem, he said, is the oversize laundry jug, which he likens to sport-utility vehicles. The caps tend to be much bigger than the dose for the heaviest loads, he said.

4 dispense = incentive = oversize =

As bottles and packages become smaller, Mr. Lowry believes, consumers will be less apt to over-pour. But that is something that detergent-makers won't want to give up. "If you decided to go to a format that eliminated all the consumers overdosing," Mr. Lowry said, "you have a shareholder issue on your hands." less apt =

“shareholder issue” =