SWOT Analysis TIME WARNER

advertisement

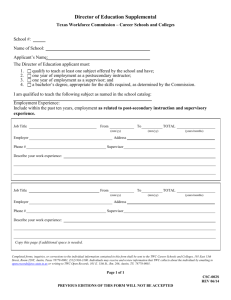

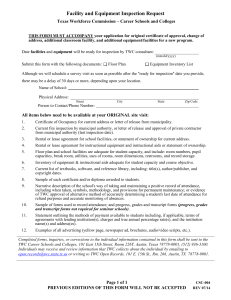

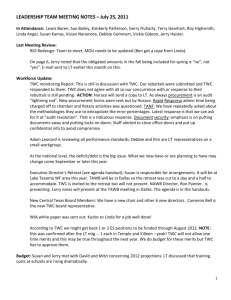

THE E2B Time Warner Cable Marketing Plan Professor: Dr. Andrea Scott Angela Copeland Dustin Stollberg Tim Fischer Yue Yuan April 5, 2005 MBAM 615.12 1 Table of Content Contents 1. EXECUTIVE SUMMARY………………………………… ………..3 2. Situation Analysis ..................................................................... 4 2.1. Market Summary ................................................................. 4 2.1.1. Market Demographics ................................................... 4 2.1.2. Market Geograhics ....................................................... 4 2.1.3. Market Psychograhics ................................................... 4 2.1.4. Market Behaviors .......................................................... 5 2.1.5. Market Needs ................................................................ 5 2.1.6. Market Trends ............................................................... 6 2.1.7. Market Growth ............................................................... 7 2.2. SWOT Analysis ................................................................... 8 2.3. Competitive Analysis ........................................................... 9 2.4. Product Offering ................................................................ 12 2.5. Macroenvironment Analysis ................................................ 14 3. Marketing Strategy ................................................................. 15 3.1. Marketing Objectives ......................................................... 15 3.2. Financial Objectives ............................................................ 16 3.3. Target Markets .................................................................. 16 3.4. Positioning ......................................................................... 18 3.5. Marketing Mix .................................................................... 19 3.5.1. Product ............................................................................ 19 3.5.2. Price ............................................................................. 19 3.5.3. Promotion ..................................................................... 19 3.5.4. Channels of Distribution ............................................... 20 3.6. Marketing Research ............................................................ 21 4. Sales and Expenses Forecast ................................................ 22 5. Implementation ....................................................................... 23 Appendix .................................................................................... 24 Appendix A. Research Questionaire .......................................... 24 Appendix B. Los Angeles City, California Statistics and Demographics…………………………………………………..25 2 1.0. Executive Summary Time Warner Cable faces many challenges to expanding their customer base in Cable, VoIP (internet-based telephone), VOD, and Broadband internet. This Marketing Plan strives to identify these challenges and offer a marketing mix and strategy to minimize customer churn (loss) and maximize revenue and new subscriptions. Through targeted research we have identified the main opportunity for addressing these challenges in the realm of increasing focus and promotion on VOD (Video on Demand). While there seems to be opportunity to increase Hispanic subscriber base, due to disproportionate smaller numbers of subscribers compared to the population demographic and their increasing purchasing power and disposable income, we believe the larger opportunity lies in VOD. VOD has the power to boost revenue and customer growth due to its high buy rate and loyalty of customers who try it. Increasing promotions and VOD certificate giveaways will lead to increased revenue and customer loyalty, thus reducing churn. Additionally, by adding VOD offerings in Spanish, TWC will additionally be able to capture and keep a larger portion of the Hispanic market. By implementing the strategies outlined in this marketing plan, TWC will be able to dramatically increase its VOD buy-rates. This in turn will lead to an increase in overall revenue, and a decrease in churn. VOD is a very powerful tool, and with customers aware of its capabilities, they will perceive more value from their cable service. This is the most important step in retaining customers, and gaining new customers. 3 2.0. Situation Analysis: Time Warner Cable, Los Angeles 2.1. Market Summary Time Warner Cable’s (TWC) target market is broken into small areas throughout Los Angeles. Potential customers are technologically savvy consumers. These customers are early adopters, who look for quick, easy, and reliable technology that will meet their needs. TWC is limited in the physical areas in which it can expand, so emphasis will need to be placed on retaining and increasing the value of existing customers as well as the recruitment of competitors’ customers through targeted marketing. Two areas of focus that will assist in this are bundling and on-demand programming. 2.1.1. Market Demographics o TWC Customers are generally middle to upper class o Average household income is $53,546 / year o Racial makeup: 41% white, 28% Hispanic, 16% Asian, and 5% African American o English is the primary language 59% of the time with 20% Spanish, 11% Asian, and 7% Indo-European (Source: TWC Pepperdine Presentation) 2.1.2. Market Geographics o 352,000 Time Warner customers in the Los Angeles area o Located in Orange County, Garden Grove, Torrance, South Pasadena, and Chatsworth (Source: TWC Pepperdine Presentation) 2.1.3. Market Psychographics o Most customers are early adopters of technology o They keep up on the latest trends in TV, computers, and phone communications o 43% of TWC customers rent their homes o Average home value: $253,578 (Source: TWC Pepperdine Presentation) 4 2.1.4. Market Behaviors o On average, the TWC customer demographic is more educated than typical consumers o TWC customers are looking for fast, reliable service in the form of video television, high speed internet, and digital phone o High speed (and often higher priced) versions of technologies can be a symbol of status (as customers view them as a superior product) o High usage rate in comparison to other similar technologies o Bundling of TWC products will lead to increased customer loyalty (Source: TWC Pepperdine Presentation) 2.1.5. Market Needs Time Warner Cable meets many important daily needs and wants of its customers in both their business and personal lives. Time Warner customers want high quality television that provides a selection of channels, on-demand programming, clear reception, and the option of high definition television Need / want high speed internet and digital telephone to perform daily activities for themselves, their families, and their workplaces. Customers are busy; they desire the convenience of reliable, high-speed technology Whether the customer works from home, or is a stay at home parent, the customer relies on Time Warner to provide the best high speed experience possible. 5 2.1.6. Market Trends Time Warner is operating within a limited and volatile market. TWC’s market is fixed geographically and does not face the threat of entering cable providers. However, they face uncertain competition from satellite, phone and other emerging high speed providers. These industries (video, high-speed internet and phone) have become increasingly unstable with consolidation and the introduction of new and alternative technology channels (Netflix, Blockbuster Online, VOD, PPV). Consolidation and partnering is the current trend o Verizon and Yahoo are working together to provide a bundled offering (Source: LA Times, Jan. 18th, 2005) o Time Warner Cable has been in talks with Sprint (Source: Technewsworld.com, Dec. 29th, 2004) while also eyeing Adelphia for acquisition (Source: MSNBC, Sept. 9th, 2004) o Verizon is testing its own Video/Television offering to be transmitted through fiber optic phone lines in limited test areas nationally (Source: WSJ, Jan. 31st, 2005) and will be rolling out in Huntington Beach (Source: TWC Pepperdine Presentation) o All these mergers and acquisitions are with the same goal of increasing market share and reducing customer churn by expanding bundling and offerings to include: phone, broadband, wireless, and video/television content 6 Time Warner’s target market is expanding from high and moderate income early adopters to include an increasingly broad demographic o Being driven by the decreasing price of digital technologies and increasing acceptance on the consumer end o Increasing purchasing power of the Hispanic population (Source: 2000 US Census Bureau, Census.gov) o Implications: Increasing accessibility of TWC technology to average consumers will lead to an increased potential customer base within their fixed geographic area 2.1.7. Market Growth Due to government regulations, the LA Time Warner Cable market is considered relatively static at this time, but does have potential for growth within its existing boundaries. Currently, Time Warner dominates 54% of the video content market within its designated area. Controlling “churn” (the annual number of customer cancellations) will be key to increasing market share. Growth in digital phone market looks limited due to increasing consumer reliance on mobile phones and decreasing usage of land lines (Source: MediaMark Research) 7 2.2. SWOT Analysis Strengths Weakness Product Offering Bundling Option One Bill for Customer Brand Recognition VOD and DVR Available to All Customers Good financial Health Compared to Competition No Service Contracts No Extra HD Equipment Required Equipment Does Not Have to be Purchased Advertising Lack of Awareness of DVR and VOD Benefits to Customers Inability to Market to Customers Using Mass Media Perception of Service to Customers Satellite Has Ability to Use Mass Media for Advertising Opportunities Threats Consumer Awareness of VOD and DVR Benefits Awareness of Bundling Awareness of Internet Phone Service Availability of HD Channels Increased buying power of Hispanic Market Consumer Confidence through Excellent Customer Service Internet Marketing VOD Buy-rates Satellite Perception by Potential Customers Competitor Pricing Consolidation and Partnerships of Competition Cell Phone Use / Decreased Need for Landline Entrance of Telecom into Television/Video Content Market Increased Free Wi-Fi Adoption Through Municipal Funding The SWOT analysis reveals that TWC is in a geographically stable, but competitive market. While TWC does not face competition from other cable companies, competition in all three areas of services is increasing due to partnering with Satellite companies and the imminent introduction of fiber optic Video/Television Content from Phone and DSL providers. It will be vital to TWC’s continued success and growth in Los Angeles to focus on the objectives of increasing market share, share of customer, and reducing churn. 8 2.3. Competitive Analysis Time Warner Los Angeles competes with a variety of competitors comprising two main categories: Video / Television Content Providers and Broadband / Phone Providers. Video / Television Content Time Warner competes with Dish Network and DirectTV Time Warner has a 54% market share of the 352k homes passed through their share of the Los Angeles network DirectTV and Dish Network hold 22% of the entire Los Angeles market, which we assume to hold approximately similar within TWC’s market The remaining non-cable or satellite subscriber market can be divided into no service, approximately 15%, and cable theft, approximately 10% Satellite subscriptions growth has been high but has began to taper off both nationally and within the LA market over the last two years (Dish Network grew 402% in the last five years). This could be due to possible increasing consumer dissatisfaction with satellite services relating to rain fade, required annual contracts and expensive equipment (Source: TWC.com) Time Warner has begun to gain some of that ground back in the LA market over the last two years with a net annual subscription increase of approximately 3,000 subscribers o This resurgence in TWC’s subscription growth is strongly contested and the competition is fierce o Satellite television has responded by investing substantial funds in a mass media campaign to win back and increase their subscriber base o TWC LA is unable to match these funds and due to the segmentation of their service areas, is unable to utilize traditional mass media o They are responding with a focus on their Direct Sales Force (door to door) and Direct Mail (Source: TWC Pepperdine Presentation) 9 Phone and Broadband TWC LA competes with SBC and Verizon SBC controls approximately 2/3rds of the LA phone market while Verizon’s controls close to 1/3rd TWC currently has a significant technical advantage in Broadband over these competitors with higher bandwidth and download speeds o This will change with the inevitable introduction of fiber optic phone and DSL lines (starting with Verizon in Huntington Beach) o The introduction of these higher speed lines also pose a threat to TWC’s bundling advantage as Verizon and other broadband competitors are targeting entrance into the Video/Television Content market Another major challenge for TWC will be growing the phone portion of their portfolio o Consumer understanding of digital phone is at best limited and will require considerable marketing investment or word of mouth promotion to increase its acceptance o Further hindrances to growth in this sector, to all competitors, come from the trend of increasing reliance on mobile phones as a primary communication tool and the introduction of internet-based phone services (ex. Vonage). Brand Positioning The main distinguishing feature between Cable and Satellite services is the emergence of the On-Demand feature offered by Cable o In the long run, the growing use of this feature will be a strong asset for cable in overcoming consumer perceptions of the technical superiority of Satellite 10 o Currently, TWC is positioned with a higher income demographic on average than satellite providers o This trend fits with TWC’s current marketing strategy aimed towards pushing technological superiority and pricing competitiveness o Dish Network and DirectTV have focused on separating themselves as the cheaper alternative to cable The current trend and push now is toward bundling o Offering all three (television content, phone and broadband), gives TWC the opportunity to not only capture a much more significant portion of each customer’s discretionary spending but also promises to reduce customer turnover o Furthermore, TWC is looking to increase their offering with the entrance into the wireless market through a partnership with Sprint (Technewsworld.com, Dec. 29th, 2005) o DirectTV and Dish Networks have recognized this and have begun to form partnerships and alliances nationally with SBC and EarthLink to increase their offering and retention percentages Competition is fierce between the three companies o Price cuts by Dish Network and DirecTV have forced Time Warner to follow suit to remain competitive o TWC is generally more expensive but separates itself with a lack of contract service and additional HD equipment o Additionally, customer perception of Satellite services is generally of more high tech and better customer service, two assumptions which the Coop of TWC and competing cable providers is trying and slowly beginning to change 11 2.4. Product Offering Figure 1 – TWC Product Offering (Source: TWC Pepperdine Presentation) Time Warner Cable has a large product offering (see Figure 1) that takes into account their consumers’ wants and needs. Any entertainment needs that the customer might have, TWC can provide for them. TWC offers all basic and digital cable programming. HD programming is available. Through the recent addition of VOD (video on demand) services, the potential is now there for customers to forego the trip to Blockbuster and watch new release movies any time they want. VOD gives consumers the ability to watch non-edited content at their own pace/ (allowing for fast-forward, rewind, and pause) o This is a huge improvement compared to the old PPV (pay-per-view) lineup, where you had to wait for movies to start and watch them in a single sitting Another benefit of VOD is the free content that customers can access free of charge. Included in this are certain SVOD channels such as HBO, Starz, and MAX, which allow the subscriber to the linear channel to access the premium SVOD content. 12 Figure 2 – TWC Bundling Offerings (Source: TWC Pepperdine Presentation) TWC has done an excellent job of capturing their customers’ needs with TWC’s product offering (see Figure 2 above) o TWC offers cable internet, which is faster than dial-up and DSL o The internet telephone service that they offer allows the customer unlimited minutes for a flat monthly fee o All TV, Phone, and Internet needs are covered by Time Warner, which is a great way of trying to get the customer to get all of these products from the same company Everything is combined onto one bill, which makes the billing process very convenient for the customer, which in turn creates another great selling point to purchase TWC’s bundle of products The addition of cellular services would be a great addition to their lineup, since the use of telephone land-lines has been on a steady decline (homes with no land-line increased 3.5% last year; Source ITFacts.biz) over the last few years and the use of cellular telephones has skyrocketed (25% increase over last 2 years; Source: MediaMark Research) o This can either be achieved through partnering with one of the cellular companies, or through the acquisition a cellular company 13 o By doing this, TWC will be able to cover all bases of their customers in house entertainment and telecommunication needs. 2.5. Macroeconomic Analysis Time Warner’s customers are geographically fragmented Hispanic and Asian customers account for 44% of TWC customers and are showing attractive opportunities for fast growth o Evidence shows that Hispanic and Asian American customers’ buying power rose significantly over the last decade o The two demographic segments have a large proportion of young people with rising household incomes (Standard & Poor’s Industry Surveys) o Compared with the overall population, these two segments have the potential to spend a relatively larger portion of their disposable income on cable and entertainment services Economic prospects: o Fear that continuously high oil prices and weak job recovery will negatively impact customer spending o However, sustained growth in median household Effective Buying Income in Los Angeles (from $31,737 in 1999 to $33,398 in 2003: 2003 City of Los Angeles Economic & Demographic Information) indicates a positive outlook for Los Angeles providers. With the September 2004 approval of bankruptcy for Adelphia, who owns the largest cable TV and broadband Internet market in Los Angeles, the market is likely to be restructured with their acquisition o Adelphia’s market share is likely to be acquired by one or more of the existing Los Angeles providers 14 Calls for decentralization in the cable television industry and potential future regulations lead to uncertainty in the industry Furious competition among cable companies is likely to lead to a pricing war 3.0. Marketing Strategy Time Warner Cable must meet specific objectives, strategies, product positioning, and a marketing mix TWC must increase the usage in both their VOD and high speed products TWC will position themselves as the industry leader because they offer superior service, reliability, and easy to use video on demand TWC’s focus on these objectives will help them to increase their overall share of the Los Angeles market 3.1. Marketing Objectives Time Warner Cable has multiple objectives to meet through their marketing. The main objectives that will be met through this situational analysis are the following: 1. Increase the sales rate of VOD (video on demand) by 25%. 2. Increase net profit of VOD revenue by 50% 3. Generate awareness of the VOD product within target market by 25% within one year of implementation. 4. Increase high speed internet subscriptions among existing Time Warner Cable customers by 15%. 5. Reduced churn through increased VOD use and high speed internet subscriptions. 15 3.2. Financial Objectives Time Warner Cable has multiple financial objectives. The main objectives that will be met through this situational analysis are the following: 1. Increase Sales revenue by 15% to $358.69MM by utilizing increased VOD buy rates and High Speed Bundling 2. Increase revenue per day to an average of $.98MM (358.69/365) 3. Limit marketing expenditures to a 2% increase of $7.14 M. 3.3. Target Markets Time Warner Cable targets subscribers geographically within its 8 service territories and communities in Los Angeles, covering the areas of Canyon County, Orange Country, City of San Fernando, Santa Clarita, South Bay, Torrance, South Pasadena, and West San Fernando Valley. The targeted markets are separated into three segments: Professional Youngsters (Source: Marketing Plan Pro), Upper-Medium Income Household, and Baby Boomers. The primary marketing opportunity is to deepen the product penetration in these well defined market segments. See Figure 3 below. Professional Youngsters Individuals or couples between the ages of 20 and 34 26.36% of the population in Los Angeles is between 20 and 34. (Source: 2000 US Census) Having stable jobs, earn around $50,000 annually. Not having the burden of children and having comparatively a big amount of discretionary money. College educated, tech-savvy, and like to try and benefit from the latest technology products. (Source: Marketing Plan Pro) 16 Upper-medium Income Household Persons in the age range of 35 to 54 27.42% of the population in Los Angeles is between 35 and 54. (Source: 2000 US Census) Married and having a combined annual income of greater than $80,000 Having at least one child under 18. Busy at work and their recreations are primarily at home. More likely to be dependent on convenient high-speed package services. Having the need to take charge of the programs that the children watch. Baby Boomers Persons in the age range of 55 to 64 7.03% of the population in Los Angeles is between 55 and 64. (Source: 2000 US Census) Mostly retired, own a house, and have much leisure time to spend at home. They like to have access to a wide range of TV programs. 17 Target Markets 7.03%, 12% 27.42%, 45% 26.36%, 43% Professional Youngsters Upper-medium Income Household Baby Boomers Figure 3 – Target Markets, (Source: 2000 US Census data from U.S. Census Bureau. See Appendix I) 3.4. Positioning Time Warner Cable has the most robust features and product offering. TWC offers the highest internet speeds, quality service, and reliability. TWC needs to focus on differentiating their cable internet and Video on Demand (VOD) from their satellite competitors. The convenience of ordering movies in real time (with the ability to stop, fast-forward, etc.) from the comfort of one’s own couch has the potential to revolutionize the market for home movie rentals. By increasing awareness of the benefits of VOD, TWC will position themselves as the leader in the home movie rental market, leading to increased revenue and lower churn. 18 3.5. Marketing Mix o 3.5.1.Product Overall, the TWC products enable the customer to fulfill their multimedia wants, including, VOD, Cable TV, and Telephone. In order to gain the most for the existing market that TWC has available in Los Angeles, the VOD offering, and the general cable package is what we will push to the potential customers. VOD is a very powerful tool, and the buy rates have not shown what VOD is capable of achieving for TWC. o TWC has been a leader in the installation of VOD for all of its markets, so they now need to increase the customer awareness of this product. o 3.5.2. Price In order to gain the most new customers, we will continue with special rates to entice customers to sign up for a bundle of TWC services (see figures 1,2) Also, new customers will be given deals on the full package that TWC offers of Cable TV, Phone, and High-speed internet o 3.5.3. Promotion In order for TWC to reach its full potential within the Los Angeles market, we decided to put some of our marketing effort to the gain of professional youngsters, baby boomers, and the upper-medium level household. 19 TWC has done well with its subscriber rates for the Asian, Caucasian, and African-American markets, with a possible expansion into the qualified Hispanic market. In order to reach these markets we will launch special promotions: In Store Events: o Team up with Best Buy or other electronics retailers, give out free VOD coupons for TV purchase Sampling: o Free VOD movie passes o Free VOD pass every month with bundle signup o Buy five VOD movies, get one free Events: o Set up monthly VOD & Internet information sessions for customers to attend Discounts: o Incentive Programs o Give price breaks to young professionals o 3.5.4. Channels of Distribution TWC has an extensive call center setup, which allows customers to sign up for new services fairly quickly This is the most convenient way to sign up for the service, therefore no change is needed TWC does not offer services through any retail outlets 20 3.6. Marketing Research Upon subscription and installation, Time Warner Cable may conduct personal interview to ask customers to answer questions about their needs, buying plans, and ideal prices. In this way, TWC is able to collect information about its customers and audiences and to improve its marketing mix accordingly. Surveys should be mailed to the appropriate zip codes in order to gain information on potential customers (Appendix.1). Another source of marketing research is based on the feedback mechanism. The company may use methods of telephone interviewing or on-line questionnaire to track the customers’ level of satisfaction. The company can also attach a short mail questionnaire to collect information on the reasons why people unsubscribe the service. Customer satisfaction level needs to be measured quarterly. The last source of market research is comparative analysis. As Time Warner Cable is the high-tech service provider, it is important to conduct regular comparative analysis to analyze the market trends. The company needs to consistently scan the market and collect information about the competitors to look for any changes in technology and service offerings. 21 4.0. Sales & Expense Forecast Estimated 5-year Sales Projections are described below in Figures 4 and 5. Estimated 5 year Sales Projections 2005 % Chg. Sales Revenue (million) - Marketing Costs Sales Revenue - Marketing Expense $ $ $ 358.70 7.10 351.50 15% 2% 15.26% % Total 2006 % Chg. 412.5 15% 2% 7.3 2% 405.2 15.26% % Total 2007 % Chg. 474.4 15.00% 2% 7.4 2.00% 466.9 15.23% % Total 2008 % Chg. % Total $ 545.50 2% $ 7.60 $ 537.90 15% 2% 15% 2009 % Chg. 1% % Total 627.3 15.00% 7.7 2.00% 619.6 15.18% Figure 4: Estimated 5-year Sales Projections, based on a modest growth rate of 15%. We find that although this is a conservative estimate, if Time Warner uses the suggestions from this Sales $1,400 $1,200 $1,000 $800 $600 $400 $200 $0 Marketing Expenses 2004 2005 2006 Sales-Marketing Expenses 2007 2008 2009 Figure 5: Estimated 5-year Sales Projections, based on Figure 4 data 22 1% 5.0. Implementation: Below is the implementation plan recommended including date of implementation, activity, target market, and steps involved. Date Summer 2005 Summer 2005 Summer 2005 Summer 2005 Summer 2005 Summer 2005 Summer 2005 Summer 2005 to Summer 2006 Summer 2005 to Summer 2006 Summer 2006 forward Activity Distribute free VOD coupons Include free VOD coupons in Bills Offer Discount Coupons for VOD Include package deal ads in bills Expand VOD promotion on TWC channel Promote Children’s VOD movies for children on summer vacation Addition of Spanish VOD channels Target Market Steps All customers Get Studios to buy into this promotion All customers Get studios to buy into this promotion All customers Get studios to buy into this promotion All customers Develop ads; Distribute ads to TWC customers All customers Develop promotion; schedule promotion Families within Obtain lists of families within target market target market Send out periodic reminder fliers with information to use VOD All customers Call customers to survey them on their understanding of VOD and any additional information that would encourage them to increase their use Utilize feedback gained from customer surveys to implement further marketing activities Customers in the target market who have used VOD in the past year All customers Hispanic customers Coordinate with Spanish studios to diversify VOD offering Develop ads; Distribute ads to TWC customers Obtain calling list of VOD users; schedule call center calling; implement calls Analyze customer feedback gained above; Develop strategy based on feedback to increase VOD usage 23 Appendix A: Time Warner Cable Survey 1. What is your household income? 2. How long have you lived at your current address? 3. Do you currently subscribe to any cable TV services? 4. What services do you subscribe to? (Cable TV, High-Speed Internet, Phone) 5. Are you interested in adding any cable services? 6. Do you have an HD TV? 7. How long have you been subscribing to your current cable service? 8. Do you rent movies from Video Rental Stores? 9. How many movies a month? 10. Have you used the VOD service? 11. What has been your experience with the VOD service? 24 Appendix B: Los Angeles City, California Statistics and Demographics (US Census 2000) Los Angeles Population: Number 3694820 Percent 100.00% Sex and Age Male Female 1841805 1853015 49.85% 50.15% 285976 297837 255604 251632 299906 674098 584036 428974 143965 115663 187111 125829 44189 7.74% 8.06% 6.92% 6.81% 8.12% 18.24% 15.81% 11.61% 3.9% 3.13% 5.06% 3.41% 1.2% Under 5 years 5 to 9 years 10 to 14 years 15 to 19 years 20 to 24 years 25 to 34 years 35 to 44 years 45 to 54 years 55 to 59 years 60 to 64 years 65 to 74 years 75 to 84 years 85 years and over Median age (years) 18 years Male Female 21 years 62 years 65 years Male Female and over and over and over and over 31.6 2713509 1339269 1374240 2545346 423568 357129 148051 209078 73.44% 36.25% 37.19% 68.89% 11.46% 9.67% 4.01% 5.66% 25