Sepetmber 1– Sepetmber 15

N69 (298) 15.09.2014

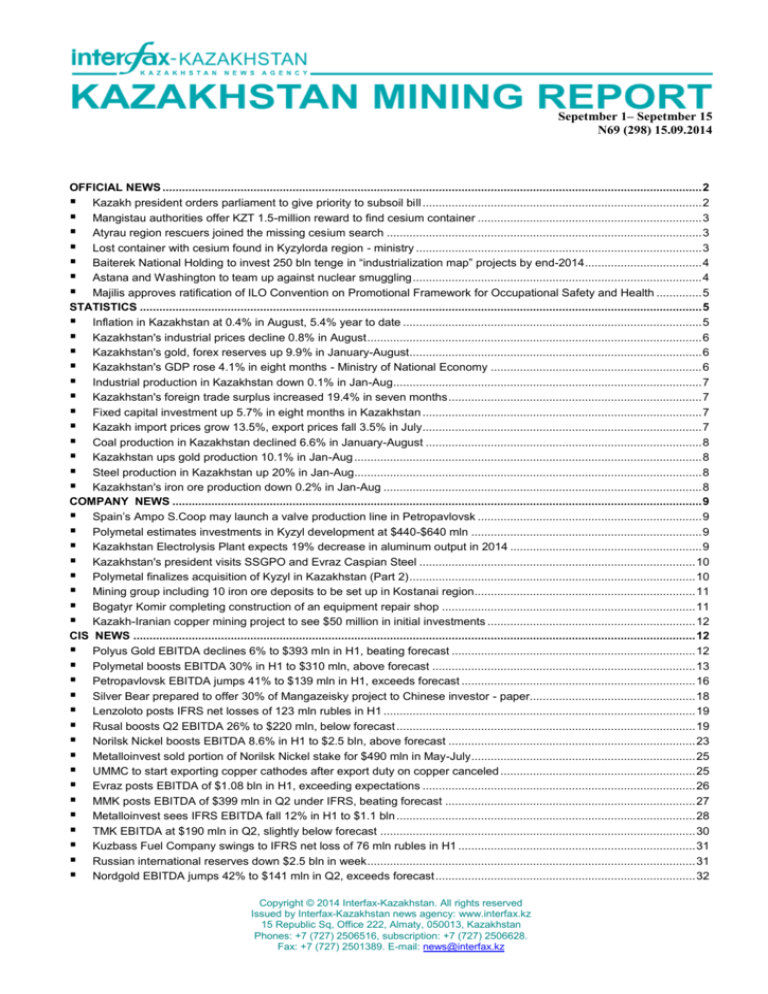

OFFICIAL NEWS ...................................................................................................................................................................... 2

Kazakh president orders parliament to give priority to subsoil bill ...................................................................................... 2

Mangistau authorities offer KZT 1.5-million reward to find cesium container ..................................................................... 3

Atyrau region rescuers joined the missing cesium search ................................................................................................. 3

Lost container with cesium found in Kyzylorda region - ministry ........................................................................................ 3

Baiterek National Holding to invest 250 bln tenge in “industrialization map” projects by end-2014 .................................... 4

Astana and Washington to team up against nuclear smuggling ......................................................................................... 4

Majilis approves ratification of ILO Convention on Promotional Framework for Occupational Safety and Health .............. 5

STATISTICS ............................................................................................................................................................................. 5

Inflation in Kazakhstan at 0.4% in August, 5.4% year to date ............................................................................................ 5

Kazakhstan's industrial prices decline 0.8% in August ....................................................................................................... 6

Kazakhstan's gold, forex reserves up 9.9% in January-August.......................................................................................... 6

Kazakhstan's GDP rose 4.1% in eight months - Ministry of National Economy ................................................................. 6

Industrial production in Kazakhstan down 0.1% in Jan-Aug............................................................................................... 7

Kazakhstan's foreign trade surplus increased 19.4% in seven months .............................................................................. 7

Fixed capital investment up 5.7% in eight months in Kazakhstan ...................................................................................... 7

Kazakh import prices grow 13.5%, export prices fall 3.5% in July...................................................................................... 7

Coal production in Kazakhstan declined 6.6% in January-August ..................................................................................... 8

Kazakhstan ups gold production 10.1% in Jan-Aug ........................................................................................................... 8

Steel production in Kazakhstan up 20% in Jan-Aug........................................................................................................... 8

Kazakhstan's iron ore production down 0.2% in Jan-Aug .................................................................................................. 8

COMPANY NEWS ................................................................................................................................................................... 9

Spain’s Ampo S.Coop may launch a valve production line in Petropavlovsk ..................................................................... 9

Polymetal estimates investments in Kyzyl development at $440-$640 mln ....................................................................... 9

Kazakhstan Electrolysis Plant expects 19% decrease in aluminum output in 2014 ........................................................... 9

Kazakhstan's president visits SSGPO and Evraz Caspian Steel ..................................................................................... 10

Polymetal finalizes acquisition of Kyzyl in Kazakhstan (Part 2) ........................................................................................ 10

Mining group including 10 iron ore deposits to be set up in Kostanai region.................................................................... 11

Bogatyr Komir completing construction of an equipment repair shop .............................................................................. 11

Kazakh-Iranian copper mining project to see $50 million in initial investments ................................................................ 12

CIS NEWS ............................................................................................................................................................................. 12

Polyus Gold EBITDA declines 6% to $393 mln in H1, beating forecast ........................................................................... 12

Polymetal boosts EBITDA 30% in H1 to $310 mln, above forecast ................................................................................. 13

Petropavlovsk EBITDA jumps 41% to $139 mln in H1, exceeds forecast ........................................................................ 16

Silver Bear prepared to offer 30% of Mangazeisky project to Chinese investor - paper................................................... 18

Lenzoloto posts IFRS net losses of 123 mln rubles in H1 ................................................................................................ 19

Rusal boosts Q2 EBITDA 26% to $220 mln, below forecast ............................................................................................ 19

Norilsk Nickel boosts EBITDA 8.6% in H1 to $2.5 bln, above forecast ............................................................................ 23

Metalloinvest sold portion of Norilsk Nickel stake for $490 mln in May-July..................................................................... 25

UMMC to start exporting copper cathodes after export duty on copper canceled ............................................................ 25

Evraz posts EBITDA of $1.08 bln in H1, exceeding expectations .................................................................................... 26

MMK posts EBITDA of $399 mln in Q2 under IFRS, beating forecast ............................................................................. 27

Metalloinvest sees IFRS EBITDA fall 12% in H1 to $1.1 bln ............................................................................................ 28

TMK EBITDA at $190 mln in Q2, slightly below forecast ................................................................................................. 30

Kuzbass Fuel Company swings to IFRS net loss of 76 mln rubles in H1 ......................................................................... 31

Russian international reserves down $2.5 bln in week ..................................................................................................... 31

Nordgold EBITDA jumps 42% to $141 mln in Q2, exceeds forecast ................................................................................ 32

Copyright © 2014 Interfax-Kazakhstan. All rights reserved

Issued by Interfax-Kazakhstan news agency: www.interfax.kz

15 Republic Sq, Office 222, Almaty, 050013, Kazakhstan

Phones: +7 (727) 2506516, subscription: +7 (727) 2506628.

Fax: +7 (727) 2501389. E-mail: news@interfax.kz

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

Centerra considers Kyrgyzstan's claims about KGC dividend payments unfounded ....................................................... 33

Chelyabinsk Zinc Plant swings to net profit of 925 mln rubles in H1 ............................................................................... 34

Rostec, Shenhua agree $10 bln in coal mining, power projects ....................................................................................... 35

Russian international reserves down $0.3 bln in week ..................................................................................................... 35

Russia boosts gold production, concentrate exports 24% in 7M ...................................................................................... 35

Russia cuts aluminum exports 20%, copper up 5%, nickel - 0.6% in 7M ......................................................................... 35

Russia boosts ferrous metal exports 1.15% in 7M ........................................................................................................... 36

Ukraine cuts steel output 11% in 8M ................................................................................................................................ 37

Nesis ups stake in Polymetal to 19.86% .......................................................................................................................... 37

GV Gold, Kopy Goldfields targeting 40,000-60,000 oz gold per year at Krasny field ....................................................... 38

Manas Resources receives environmental approval to develop Shambesai field ............................................................ 39

Gold mining enterprise robbed in Kyrgyzstan................................................................................................................... 39

China to invest $30 mln in Tajik cathode plant ................................................................................................................. 39

Severstal shareholders approve 2.14 ruble/share dividend for H1 ................................................................................... 40

Latvia selling Liepajas metalurgs to Ukrainian KVV Group for 107 mln euro ................................................................... 40

Mechel aiming to raise $2 bln-$3 bln in 2-3 yrs with asset sales – paper......................................................................... 40

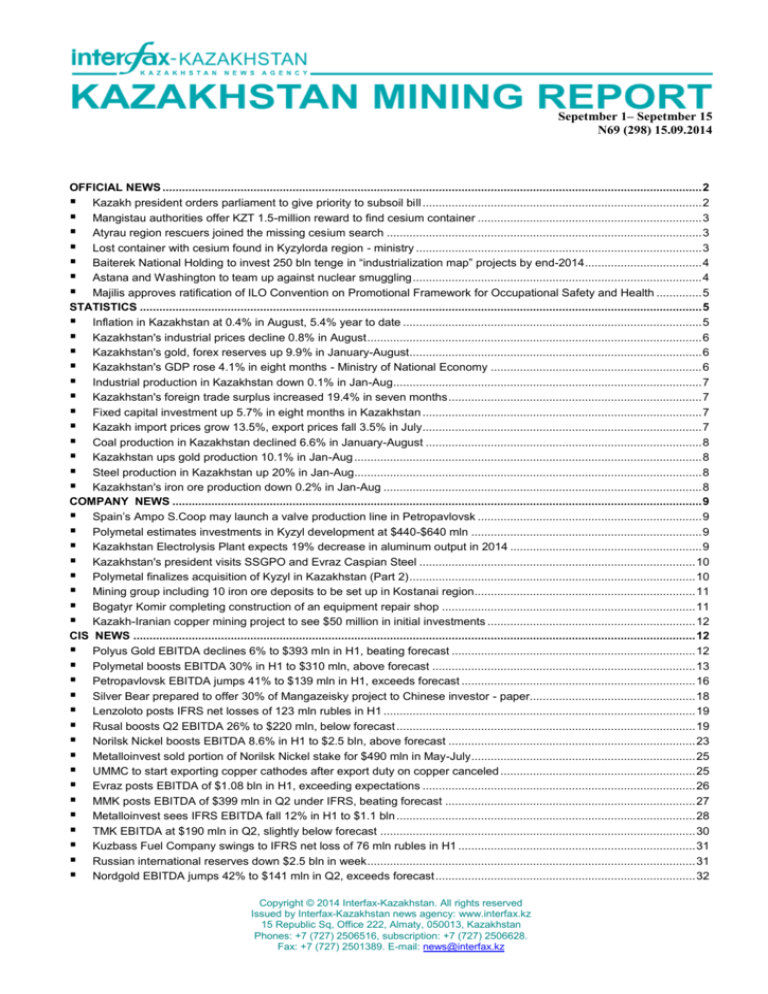

IMPORTANT MACROECONOMIC INDICATORS OF KAZAKHSTAN

Inflation

Rate

Gold and currency reserve

August

2014

Year-todate

of refinancing

(Sept 1, 2014)

0.4%

5.4%

5.5% per annum

National Bank - $27.743 bl

National Fund - $77.236 bl

FOREX rates

Country

rating

KZT 181.95/$1 (Sept 15)

S&P – BBB+

Moody’s – Ваа2

Fitch – BBВ+

OFFICIAL NEWS

Kazakh president orders parliament to give priority to subsoil bill

ASTANA. Sept 2 (Interfax-Kazakhstan) – Kazakh President Nursultan Nazarbayev instructs the parliament to

give priority to the subsoil bill.

"First, you need to adopt amendments to the law on mineral resource management as these amendments are

aimed to ease the license issue procedure, reduce administrative barriers and make the decision-making

process more transparent", the president said when addressing the fourth session of the fifth parliament of

Kazakhstan in Astana on Tuesday.

In February 2014, the government proposed 189 amendments to the subsoil legislation.

According to the amendments, the expertise requirements for license contracts will be reduced to 60%; the

terms and conditions of the model contract optimized; the companies extracting solid mineral resources-excluding uranium--will now not have to get approval for changes in the production volumes.

The amendments also propose a new mechanism for awarding license contracts based on the “first come, first

served” principle. In this case, the subsoil use fee will increase annually.

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 2

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

The bill also provides free access to geological information and excludes the feasibility study requirement from

the mandatory project documentation.

Mangistau authorities offer KZT 1.5-million reward to find cesium container

ALMATY. Sept 4 (Interfax-Kazakhstan) – One and half million tenge reward is offered for missing container

with radioactive cesium-137, said the Mangistau region Governor office.

70 National Guard servicemen "have combed the area from Shetpe to Oporny village in Beineu district, a

distance of 300 km," said the regional administration.

The police go door to door explaining hazards to local residents and looking for new information in the case.

Vehicles are being searched and all scrap metal outlets are subject to inspection.

A 50-60 kg container with cesium-137 fell out of the Kamaz truck on the way from Uralsk to Mangutsau region.

The radioactive cargo was intended for scientific use. All emergency services in the area, including the police

and military units are engaged in the search campaign. A toxic hazard warning has been issued to local

residents.

Atyrau region rescuers joined the missing cesium search

AKTAU. Sept 4 (Interfax-Kazakhstan) – Nearly 250 people armed with metal detectors are looking for the

missing container with cesium-137, deputy head of the regional emergency department Kazhimuhan Kospayev

said at a Thursday press conference in Aktau.

According to him, the container might fall out of KAMAZ in the desert, 275 km from Aktau. "Roads there are in a

very poor condition covered with a thick layer of road dust and sand," he said.

"Just in case, we have engaged Atyrau region search teams as well," he added.

Director of BN-350 Reactor Decommission at MAEC Kazatomprom Yuri Shirokobokov said at a press

conference that Kazpromgeofizika was transporting cesium and the Kamaz truck had three containers fastened

to the sides of the truck body.

He specified that the container has a double capsule with the active core having 6 mm to 6.5 mm in diameter. In

other words, cesium weight in the capsule is measured in grams.

"If the capsule is cracked open, the radiation willl exceed norm 8,000 times. But opening it without special tools

it's not easy task," added Shirokobokov.

One and half million tenge reward was offered for the missing container with radioactive cesium-137. All

emergency services in the area, including the police and military units are engaged in the search campaign. A

50-60 kg container with cesium-137 presumably fell out of the Kamaz truck on the way from Uralsk to

Mangutsau region on August 28.

Lost container with cesium found in Kyzylorda region - ministry

ASTANA. Sept 8 (Interfax) - A container carrying cesium-137, which was lost in Kazakhstan's Mangistau region,

has been found in the Kyzylorda region, the republic's Interior Ministry said on Saturday.

In the early hours of September 6, police received a call from a resident of the city of Kyzylorda who said that a

Kamaz vehicle was carrying the lost radioactive isotope of cesium, the spokesperson said.

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 3

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

"As soon as the report came in, the personnel in the Kyzylorda and nearby regions were immediately instructed

to stop the vehicle. As a result of their concerted efforts, police officers stopped the Kamaz vehicle with a driver

and passenger and the lost capsule in the trunk, on the turn into the town of Baigekum, Shieli District, Kyzylorda

region, at 2 a.m. this morning," the Interior Ministry said.

The driver and the passenger of the vehicle have been brought to the Shieli District Police Department and are

now being questioned.

It was reported that a container carrying cesium-137, which was 30 centimeters high, had 20 centimeters in

diameter and weighed about 50-60 kilograms, fell out of the Kamaz vehicle on August 28 on the Sai-OtesShetpe road in the Mangistau region.

The search for the dangerous object involved all regional emergency agencies, including the police, the

emergency situations ministry and the army. The authorities of the Mangistau region promised a 1.5-million

tenge award (the current exchange rate: 182 tenge/$1) to anyone who finds the container with the cesium.

Baiterek National Holding to invest 250 bln tenge in “industrialization map” projects by end2014

ASTANA. Sept 8 (Interfax-Kazakshtan) – National Management Holding Baiterek will finance “industrialization

map” projects to the total amount of 250 billion tenge by the end of this year, Baiterek says in a press release.

Current FOREX rate is 182/$1.

“By the end of 2015, Baiterek will finance projects to the total amount of about 250 billion tenge, including an

expansion project at the carmaker Saryarka Avtoprom, a project for construction of a high-carbon ferrochrome

shop at the Aktobe ferroalloy plant, a zinc export project at Kazzinc and others,” the press release says.

In the seven months of the current year, the Development Bank of Kazakhstan supported 16 projects by lending

a total of 341.5 billion tenge and made a decision to finance another six projects with 44.5 billion tenge worth of

loans.

The Investment Fund of Kazakhstan is mulling over 16 rehabilitation projects in 2014-2015. The Fund expects a

return-on-investment of 3.1 billion tenge in 2015, according to the press release.

In January-July 2014, the enterprises that were supported by the National Agency for Technical Development

produced 5.45 billion tenge worth of goods. The Agency also provided 128 million tenge in innovation grants.

National Management Holding Baiterek was organized in May 2013 to manage the stakes in the national

institutes of development, the national companies and other legal entities. Baiterek either owns such stakes or

manages them on behalf of the other stakeholders.

Baiterek manages the Development Bank of Kazakhstan (DBK), Investment Fund of Kazakhstan, DAMU

Entrepreneurship Development Fund, Kazyna Capital Management, Baiterek Development JSC, Center for

Management of Public Private Partnership Projects LLP, the National Agency for Technical Development,

Zhilstroisberbank of Kazakhstan (Housing Construction Savings Bank), Mortgage Company of Kazakhstan,

Mortgage Loan Guarantee Fund of Kazakhstan and KazExportGrant JSC.

Astana and Washington to team up against nuclear smuggling

ASTANA. Sept 10 (Interfax-Kazakhstan) – Kazakhstan and the United States have reached agreement to step

up effort in the fight against nuclear and radiological material smuggling.

“A multiagency delegation of U.S. officials met with their Republic of Kazakhstan counterparts in Astana on

September 8-9 to advance U.S.-Kazakhstani mutual efforts to counter nuclear smuggling,” the US Embassy in

Kazakhstan says in a press release.

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 4

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

The meeting provided an opportunity to deepen our ongoing bilateral partnership in this area under the U.S.Kazakhstan Communiquй on Intentions to Improve Kazakhstan’s Capabilities to Combat Nuclear Smuggling,

which the two countries signed in 2006, according to the press release.

During the meeting in Astana, the sides agreed to cooperate more closely in support of Kazakhstan’s effort to

develop a training curriculum on illicit trafficking at the Nuclear Security Training Center, an initiative that

President Nazarbayev announced at the 2012 Nuclear Security Summit in Seoul.

“Specifically, U.S. and Kazakhstani officials discussed how to use ongoing and proposed training opportunities at

the Center to strengthen national competencies in the areas of nuclear forensics, radiation detection, and law

enforcement investigations. In addition, our governments reviewed overall progress in implementing the 2006

Communiquй across a broad range of cooperative activities to work with Kazakhstan to prevent, detect, and

respond to nuclear and radiological material trafficking incidents,” the press release says.

Majilis approves ratification of ILO Convention on Promotional Framework for Occupational

Safety and Health

ASTANA. Sept 10 (Interfax-Kazakhstan) – Kazakhstan's Majilis, Lower Chamber of Parliament on Wednesday

approved ratification of the Convention on the Promotional Framework for Occupational Safety and Health (No.

187).

According to the Minister of Health and Social Development Tamara Duysenova, ILO Convention was ratified by

25 member countries including Russia and Moldova.

According to statistics, the number of employees working in hazardous conditions in Kazakhstan, at the

beginning of 2014 amounted to 376,000 or one fifth of the total employment. High noise level poses danger to

40% of employees (153,800), while high gas content and dust in the working area affects more than 35%

(132,900).

"Currently, the Kazakh government is working on the transition from the compensation OSH management

system to a modern professional risk management to implement a preventive approach to workers' health risks

and cut costs associated with hazardous working conditions. Therefore, it is suggested to ratify ILO Convention

187," said Duysenova.

Convention No 187 was adopted at the General Conference of the International Labor Organization (ILO) on

June 15, 2006 in Geneva.

Convention No. 187 calls for ratifying member States to take action to progressively achieve a safe and healthy

working environment and commit themselves to continuous improvement of occupational safety and health by

means of a national policy, a national system and a national program aimed at the prevention of occupational

injuries, diseases and deaths, through tripartism and social dialogue.

STATISTICS

Inflation in Kazakhstan at 0.4% in August, 5.4% year to date

ALMATY. Sept 2 (Interfax-Kazakhstan) – In August the inflation level in Kazakhstan stood at 0.4%, the Kazakh

State Agency for Statistics said.

In August 2014, the prices for food products decreased by 0.1%, for non-food items rose by 1.1% and for

services by 0.4%.

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 5

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

The annual inflation rate through the eight months ended August 31, 2014 is at 5.4%, with prices for food stuffs

climbing by 5.3%, non-food products by 6.2% and services by 4.7%.

Kazakhstan's industrial prices decline 0.8% in August

ASTANA. Sept 2 (Interfax-Kazakhstan) - The prices for industrial products and services decreased 0.8% in

August 2014 compared to July 2014 and rose 15.4% compared to August 2013, the State Agency for Statistics

reported.

In August 2014 the prices for industrial products decreased 0.8% from a month earlier or an increase of 16%

compared to August 2013; industrial service prices remained flat compared to the previous month or grew by

7.9% compared to August 2013.

Last month the prices in the mining sector went down by 1.8% while the prices in the manufacturing grew by

1.8%.

In the reporting month the prices for metal ores decreased by 3.1%, crude oil and natural gas by 1.9% while the

precious and non-ferrous metals rose by 4.7% in price, paper and paper products by 4.2%, coke and petroleum

products by 2.4% and tobacco products by 2.3%.

Kazakhstan's gold, forex reserves up 9.9% in January-August

ALMATY. Sept 8 (Interfax-Kazakhstan) - Kazakhstan's gold and foreign currency reserves, including the Kazakh

National Bank's gross reserves and funds accumulated in Kazakhstan's National Fund, rose to $104.979 billion

as of the end of August 2014, up 1.2%in the month and 9.9% in January-August, the National Bank said in a

statement.

Assets of the National Fund grew 0.62% in July to $77.236 billion (up 9.1% in 8 months).

In August 2014, gross international reserves of the National Bank rose 2.76% to $27.743 billion (up 12.25% in 8

months) and the bank's net international reserves grew 2.85% to $27.106 billion, up 12.15% from the beginning

of the year.

Currency reserves fell 1.12% in August to $20.224 billion (up 5.53% in 78M), while gold assets rose 14.91% to

$7.519 billion (up 35.45% in 8M).

Kazakhstan's GDP rose 4.1% in eight months - Ministry of National Economy

ASTANA. Sept 10 (Interfax-Kazakhstan) – Kazakhstan's GDP in January-August 2014 increased by 4.1%.

"GDP growth according to the estimates made 4.1% in eight months," said the Minister of National Economy

Erbolat Dossaev at a Wednesday briefing in Astana.

"The index of physical volume of industrial production was 0.1% down, agriculture growth was 2.5%,

construction (4.7% up), trade (9.4% up), transport (7% up) and communications (9.3% up), " Dosayev said.

The investment in fixed assets increased by 5.7%.

"Inflation over the past month was 0.4% and in annual terms amounted to 5.4% in eigth months," said the

Minister.

The Kazakh government expects real GDP growth in 2014 at 6%.

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 6

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

Industrial production in Kazakhstan down 0.1% in Jan-Aug

ALMATY. Sept 12 (Interfax-Kazakhstan) – In January-August 2014 the industrial output in Kazakhstan edged

down 0.1% year-on-year, the State Statistics Agency said.

In the reporting period the mining industry shrank by 0.1%, processing industry declined by 0.4%, power,

electricity, gas and steam supplies increased by 1.7%, and water supplies reduced by 4.2%.

According to the statistics, industrial output grew in nine regions of the country in January-August 2014. A

decrease in industrial production was reported in the Aktobe, Atyrau, Kyzylorda, Pavlodar regions and in Astana

and Almaty.

The industrial production in Kazakhstan decreased 0.4% in January-June 2014 and rose 2.3% in 2013.

Kazakhstan's foreign trade surplus increased 19.4% in seven months

ALMATY. Sept 12 (Interfax-Kazakhstan) – In January-July 2014, the foreign trade surplus of Kazakhstan totaled

$25.2 billion, or an increase of 19.4% compared with the same period of 2013, the State Agency for Statistics

reported.

In the reporting period, the country's foreign trade turnover decreased by 7.7% year-on-year to $71 billion,

including exports of $48.1 billion (down 3.6%) and imports of $22.9 billion (down 15.3%).

In the reporting period, export operations with the Customs Union amounted to $2.915 billion (down 21%),

imports to $7.825 billion (down 22.9%).

The main buyers of Kazakhstan-made products were Italy (22.8% of all exports), China (13.3%), and the

Netherlands (11.4%). The main exporters to Kazakhstan were Russia (32.7% of all Kazakhstan’s imports in the

reporting period), China (17.7%), Germany (5.8%).

Fixed capital investment up 5.7% in eight months in Kazakhstan

ALMATY. Sept 12 (Interfax-Kazakhstan) – In January-August 2014, fixed capital investment in Kazakhstan

amounted to 3.699 trillion tenge (182.5 tenge/$1), or an increase of 5.7% compared with the same period of

2013, the State Agency for Statistics said.

In January-August 2014, the most attractive industries for investment were mining (31% of all fixed capital

investment), transport and warehousing (18.8%) and real estate (11.3%), according to statistics.

In the reporting period, investment mostly came from the companies’ equity capital (57.7% of total investment),

public money (20.1%), loans from banks (9.2%, including loans from foreign banks - 4.6%) and borrowed funds

(13%, including non-residents' borrowed funds - 7.8%).

Kazakh import prices grow 13.5%, export prices fall 3.5% in July

ALMATY. Aug 13 (Interfax-Kazakhstan) - In July 2014 the prices for imported goods in Kazakhstan rose 13.5%

and export prices declined 3.5% compared to July 2013, the State Agency for Statistics said in a statement.

According to the statistics, the prices for commodity imports rose by 1%, commodity exports fell by 6.6% in price.

Imported semi-finished products grew in price by 3.7%, exported items by 3%. The prices for imported finished

products increased by 16.9% and for exported items rose by 17.3%.

Compared to June 2014, the July export prices and import prices went down 0.5% and 2.3%.

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 7

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

July 2014 saw a decline in export prices for nonferrous and ferrous metal ore (7.7%), copper (2.3%) and

liquefied propane (1.9%). On the other hand, there was an increase in export prices for lead (10.9%), natural

gas (7%), aluminum (4.4%), ferroalloys (4.3%), coal (3.5%), zinc (2.6%), gas condensate (2.3%) and oil (0.2%).

In the reporting month exported flour fell (9.8%), while cotton and barley increased 11.7% and 2.3%.

The import prices went down for vegetable oil (8.6%), vegetables (6.6%), dairy products (1.3%), tea (0.7%) and

fish (0.4%). Rice rose in price (9.9%), meat products (3.7%), coffee (2.2%), poultry (2.1%) and sugar (0.8%).

Coal production in Kazakhstan declined 6.6% in January-August

ALMATY. Sept 12 (Interfax-Kazakhstan) – In January-August 2014 Kazakhstan produced 68.072 million tonnes

of coal, 6.6% down from the same period last year, the statistics committee of the ministry of national economy

said.

Kazakhstan has mainly coal mines in Karaganda, Pavlodar and East Kazakhstan regions.

Kazakhstan ups gold production 10.1% in Jan-Aug

ALMATY. Sept 15 (Interfax-Kazakhstan) - In January-August 2014 Kazakhstan produced 30,432 kg of refined

gold or an increase of 10.1% year-on-year, said the Statistics Department of the Ministry of Economy.

In the same period, the republic produced 588,171 kg of refined silver or a decrease of 8.9% compared with

January-August 2013.

In January-August 2014, the output of unmanufactured zinc came to 216,156 tonnes or up 2.1% year-on-year,

and unmanufactured refined copper production amounted to 184,716 tonnes or down 26.9%.

Steel production in Kazakhstan up 20% in Jan-Aug

ALMATY. Sept 15 (Interfax-Kazakhstan) – Kazakhstan produced 2.616 million tonnes of crude steel in JanuaryAugust 2014 or an increase of 20% compared with the same period last year, reported the State Agency for

Statistics.

In the reporting period, the output of flat steel products grew 17.6% to 1.684 million tonnes, production of

galvanized steel rose 9.9% to 364,516 tonnes and production of tin-plate and tin-plated sheet declined 14.2% to

58,977 tonnes.

In January-August 2014, the republic produced 1.122 million tonnes of ferroalloys or a rise of 5.7% year-on-year.

Kazakhstan's iron ore production down 0.2% in Jan-Aug

ALMATY. Sept 15 (Interfax-Kazakhstan) – Kazakhstan extracted 33.891 million tonnes of iron ore in JanuaryAugusts 2014 or a decrease of 0.2% compared to the same period last year, said the Statistics Department of

the Ministry of Economy.

In the reporting period Kazakhstan produced 25.863 million tonnes of copper ore or a decrease of 6.7% year-onyear, 3.586 million tonnes of copper and zinc ore or up 0.8%, and 4.560 million tonnes of lead and zinc ore or

down 6.4%.

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 8

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

According to statistics, the output of copper in concentrate amounted to 308,100 tonnes or up 4.7%, and zinc in

concentrate to 228,900 tonnes or down 2.6%.

COMPANY NEWS

Spain’s Ampo S.Coop may launch a valve production line in Petropavlovsk

ASTANA. Aug 29 (Interfax-Kazakhstan) – Ampo S.Coop, incorporated in Spain, is mulling over a valve

production project on the site of MunayMash Plant in Petropavlovsk, according to a press release of the North

Kazakhstan Region administration.

The project was discussed at a meeting between Regional Governor Yerik Sultanov and Ampo S.Coop

President Jon Aguirre, the regional administration says in a press release.

The company is considering a possibility of launching a valve shop on the site of ManayMash JSC that will

produce valves for the oil, gas and water pipelines and other infrastructure.

“First, we need to develop a business plan. It will take us six weeks. In addition, we may have to train the local

specialists and we are ready to send them to Spain for training. We hope that the new production line will be put

into operation in January 2015,” Aguirre is quoted as saying.

Ampo S.Coop manufactures fittings and components for pipeline construction.

MunayMash JSC produces subsurface oil pumps.

Polymetal estimates investments in Kyzyl development at $440-$640 mln

MOSCOW. Sept 2 (Interfax) - Russian gold and silver producer OJSC Polymetal estimates investments in the

Kyzyl project in Kazakhstan at $440-$640 million, the company said in a presentation.

A total of $40 million may be spent in 2015, including on design and a feasibility study, $200-$250 million in

2016, $150-$250 million in 2017 and $50-$100 million in 2018, materials say.

Polymetal noted that these figures were preliminary. Spending in 2015 may be re-estimated in Q4 2014, as well

as in 2016-2018 following a possible deal (expected in Q4 2014) and a renewed feasibility study (Q4 2015).

Kazakhstan Electrolysis Plant expects 19% decrease in aluminum output in 2014

PAVLODAR. Sept 2 (Interfax-Kazakhstan) – JSC Kazakhstan Electrolysis Plant, part of Eurasian Resources

Group (ERG), plans to produce 203,000 tonnes of aluminum by year-end or 47,000 tonnes less (down 18.8%)

year-on-year, the press office of the enterprise told Interfax-Kazakhstan.

The decrease in output is caused by an overhaul of electrolysis units at the plant, which is planned, according to

the press office.

Kazakhstan Electrolysis Plant in Pavlodar region is the only domestic producer of primary aluminum and has

been annually producing 250,000 tonnes of aluminum annually since 2010.

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 9

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

The plant exports over 90% of its products. Its major consumers are plants in Russia, Ukraine, Belarus and

Uzbekistan.

In December 2013, ERG closed a deal to buy ENRC. ENRC specialized in the production of bauxites, copper,

coal, aluminum, ferro-alloys, pellets; its owned assets included Kazchrome, Zhairem Mining and Processing

Integrated Works, Sokolov-Sarbai Mining and Processing Integrated Works, Aluminum of Kazakhstan,

Kazakhstan Electrolysis Plant, Eurasian Energy Corporation, Shubarkol Komir and ENRC Logistics.

Kazakhstan's president visits SSGPO and Evraz Caspian Steel

ASTANA. Sept 3 (Interfax-Kazakhstan) – Kazakhstan President Nursultan Nazarbayev named the SokolovSarbai Mining and Processing Production Association (SSGPO), a leader of the national industrial production,

when visiting the company during his working visit to the region.

The president praised SSGPO as it was celebrating its 60th anniversary for implementing a wide-scale

modernization, launching major investment projects and creating new jobs.

Later the same day, during his trip to Kostanai region, he visited Evraz Caspian Steel rolling mill producing light

sections and rebars. The mill has an annual capacity of 450,000 mt of light sections.

SSGPO is the largest iron ore mining and processing enterprise in Kazakhstan. Operations include the

Sokolovsky, Sarbaisky, Kacharsky and Korzhinkolskiy iron ore open pits; the Sokolovsky underground mine;

dolomite and limestone open pits; and crushing, concentrating and pelletising facilities. The Rudny heat and

energy plant supplies these operations with reliable, low-cost power.

Polymetal finalizes acquisition of Kyzyl in Kazakhstan (Part 2)

MOSCOW. Sept 4 (Interfax) - Russian gold and silver producer OJSC Polymetal finalized on Thursday the

acquisition of Altynalmas Gold Ltd (AAG), the holding company for the Kyzyl gold project in Kazakhstan,

Polymetal said in a statement.

The initial cost of the acquisition was $318.5 million in cash funds and another $300 million in shares from an

additional issue. As a result, the seller - Sumeru Gold, which is owned by Timur Kulibayev, the son-in-law of the

President of Kazakhstan - received 7.45% of Polymetal's increased equity.

According to Interfax's calculations, the stake of Polymetal's largest shareholder, Peter Kellner's PPF Group, fell

to 18.97% from 20.5% as a result of the additional issue. The stake of Alexander Nesis' ICT Group fell to 17.11%

from 18.49%, while Alexander Mamut's went to 9.21% from 9.95%.

"The initial consideration for this acquisition comprised $318.5 million in cash and $300 million payable through

the issue to Sumeru Gold B.V. of 31,347,078 new ordinary shares of the Company (the "Consideration Shares"),

representing approximately 7.45% of the Company's enlarged issued share capital. The number of shares

issued was determined by dividing $300 million by the unweighted mean average closing price of Polymetal

shares on the Main Market of the London Stock Exchange in the twelve calendar months ending three trading

days before Completion which comprised $9.57027 per share. Deferred additional cash consideration up to an

agreed cap, contingent on certain conditions being met and dependent on the relative dynamics of the gold price

and the price of Polymetal's shares, may be payable over up to the next seven years. Sumeru Gold B.V. is

entitled to a put option giving it a right to require Polymetal to acquire or procure acquirers for the Consideration

Shares by notice to Polymetal during the one month period immediately following the first anniversary of

Completion at a price per Consideration Share equal to $9.57027," the statement says.

The Kyzyl gold project comprises the Bakyrchik and Bolshevik gold deposits and is located in north-eastern

Kazakhstan.

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 10

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

The acquisition will increase Polymetal's gold equivalent reserves by approximately 50% to 19.7 million ounces

with a single large high-grade property containing 6.7 Moz gold at 7.5 g/t (JORC), and a life of mine of 20 years

based on reserves at Bakyrchik. Resources will increase 23%, or 20.6 million ounces.

Polymetal hopes by the end of 2015 to finish appraising the project's reserves and drafting a feasibility study.

Construction might begin early 2016 and production, according to preliminary estimates, in 2018.

Based on Polymetal's preliminary estimate, production at Kyzyl could total 100,000-150,000 ounces of gold in as

soon as 2018 with overall production totaling 1.45-1.5 million ounces. In addition, Production at Kyzyl in 2019

could reach 325,000-375,000 ounces with overall production of 1.55-1.6 million ounces.

Investments are estimated at $440-$640 million. A total of $40 million may be spent in 2015, including on design

and a feasibility study, $200-$250 million in 2016, $150-$250 million in 2017 and $50-$100 million in 2018,

materials say.

Polymetal International plc is Russia's largest silver producer and one of the country's largest gold miners. The

London- and Moscow-listed Polymetal's free float is 50.16%. Major shareholders include PPF Group (20.5%),

Alexander Nesis's ICT Group (18.49%) and Alexander Mamut (9.5%). Management and employees own 0.91%

of the shares. The company has operations in Magadan and Sverdlovsk regions, Khabarovsk Territory,

Chukotka and Kazakhstan.

Mining group including 10 iron ore deposits to be set up in Kostanai region

KOSTANAI. Sept 5 (Interfax-Kazakhstan) – Sokolovka LLP together with Civic-Oriented Entrepreneurial

Corporation Tobol plans to set up a mining group including 10 iron ore deposits in Kostanai region.

The total amount of investment into exploration will top 11 billion tenge (182 tenge/$1), Tobol told InterfaxKazakhstan.

Sokolovka LLP will be an investor and partner for Tobol. The company plans to implement the project using its

own funding and borrowings. The two entities will set up a JV with specified stakes, according to Tobol.

A decision was made to unite 10 deposits into one group because their reserves are not significant and such an

agglomeration would bolster their investment attractiveness and reduce exploration expenditure. The deposits

are situated in Kostanai, Mendykara, Taran, Karabalyk, Kamysty, Zhitikara districts, according to Tobol.

Approximately contracts will be registered during the first half of 2015. After receiving contracts exploration is to

be conducted as long as 6 years and should define the overall iron ore reserves, according to Tobol.

Sokolovka LLP is registered in Kostanai region and specializes in the collection (procurement), storage,

processing and sale of scrap metal and non-ferrous metal wast, production and processing of iron ore,

limestone, dolomite, as well as production and sale of pellets, concentrate, crushed stone and limestone.

Civic-Oriented Entrepreneurial Corporation Tobol was set up in 2007 in Kostanai region and researches 33

minerals located in the region.

Bogatyr Komir completing construction of an equipment repair shop

PAVLODAR. Sept 9 (Interfax-Kazakhstan) – Bogatyr Komir LLP in Ekibastuz is completing the construction of an

equipment repair shop, the company told Interfax-Kazakhstan.

Ekibastuz is a town in the Pavlodar Region, north Kazakhstan.

The cost of the project is over one billion tenge (182/$1).

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 11

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

The new shop will be used to repair the company’s trucks, which transport coal, and the equipment and

machinery from the Bogatyr and North open-cast mines.

This year, the company has already completed a number of capital expenditure projects totaling 567.4 million in

value.

Bogatyr Komir is owned by JSC Samruk-Energo, which is part of Kazakhstan’s National Wealth Fund SamrukKazyna, and Russia’s RUSAL.

The company produces coal using an open-cut method at two deposits – Bogatyr and Severny, the total coal

reserves of which are estimated at around 3 billion tonnes. The production capacity of the Bogatyr deposit is 32

million tonnes of coal a year and the North deposit 10 million tonnes.

Kazakh-Iranian copper mining project to see $50 million in initial investments

PAVLODAR. Sept 12 (Interfax-Kazakhstan) – Iran's Kavand Nahan Zamin have signed an agreement with

Kazakhstan's Cooper-kz LLP on joint exploration and production of cooper at the Borly deposit in Karaganda

region, Ministry of Investment and Development told Interfax-Kazakhstan.

The document was signed within the framework of the Kazakh-Iranian Business Forum held in Astana on

September 9.

"The initial investment is estimated at $50 million," said the spokesman.

"An exploration stage will last until 2016 to be followed by copper production," according to the Ministry's press

office.

The ministry, however, declined to elaborate on other details of the deal such as share interests in the project

and financing.

Iran and Kazakhstan at a business forum held in Astana during the first state visit of Iranian President Hassan

Rouhani to Kazakhstan, signed a number of bilateral documents, including agreements in the fields of geology,

metallurgy, agriculture, transport, logistics, tourism and manufacturing of building materials to the total of $500

million

CIS NEWS

Polyus Gold EBITDA declines 6% to $393 mln in H1, beating forecast

MOSCOW. Aug 22 (Interfax) - Polyus Gold International Ltd (PGIL), the controlling shareholder in Polyus Gold,

reduced earnings before interest, taxes, depreciation and amortization (EBITDA) 6% to $393 million in the first

half of 2014, the company said in its IFRS earnings statement.

Analysts told Interfax in a consensus forecast that EBITDA would decline 6.5% to $390 million.

Revenue in the six months edged down 2% year-on-year to $1.007 billion.

Net profit totaled $253 million compared with a net loss of $167 million in H1 2013.

Capex in H1 was $287 million, which was 59% less than in H1 2013. The company said that capex fell because

costs at the Natalka field also fell.

All-in sustaining costs came to $905 per ounce, down 18% from H1 2013, when they were $1,103. Total cash

costs declined 13% to $662 per ounce. These two figures fell thanks to a program to optimize spending and

because of the ruble's depreciation.

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 12

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

The company's net debt was $370 million as of end-June 2014 versus $349 million a year ago. The net debt to

EBITDA ratio remained at 0.4x.

Main financial results, mln rubles:

H1 2014

H1 2013 Change

Sales revenue 1 007

1 024

-2%

Profit

253

(167)

-

Operating profit 278

(156)

-

Earnings per share, cents

8

(5)

Capex

700

-59%

Gold production, '000 ounces

746

718

4%

Gold sales, '000 ounces

751

654

15%

Average sales price, $ per ounce

1 296

1 513

-14%

EBITDA

417

-6%

41%

2 pp

287

393

EBITDA margin 39%

-

Polyus Gold boosted production 4% in H1 to 745,600 ounces. The company confirmed its 2014 production

forecast at 1.58-1.65 million ounces of gold.

In other company news, Anastasia Galochkina has joined the Polyus Gold board of directors.

Galochkina was nominated for the board of directors of the gold miner from Wandle Holdings Limited, which is

affiliated with the fund established by Suleyman Kerimov, the Suleyman Kerimov Foundation.

The place on the Polyus Gold board of directors became vacant on August 18 due to the departure of the

company's non-executive director, Anna Kolonchina.

Galochkina is the managing director of Nafta Moscow. In 2004-2011 she worked at the Swedish investment

company, Vostok Nafta Investment Ltd, and in 2006-2008 she was on the board of directors for Kontakt East

Holding AB. Before joining Vostok Nafta, Galochkina worked at the Moscow office of Ernst&Young.

Polymetal boosts EBITDA 30% in H1 to $310 mln, above forecast

MOSCOW. Aug 27 (Interfax) - OJSC Polymetal, Russia's largest silver producer and a leading gold producer,

boosted adjusted earnings before taxes, depreciation, and amortization (EBITDA) 30% year-on-year in JanuaryJune 2014 to $310 million, the company said.

Analysts from nine investment banks said in an Interfax consensus survey that EBITDA would total $271 million.

In January-June 2014 Polymetal had net profit of $100 million versus loss of $255 million a year before. Adjusted

net profit was $101 million.

Polymetal's board of directors decided to pay out dividends from 30% of adjusted net profit in H1 at $0.08 per

share. Dividends for H1 2013 were $0.01 per share, meaning this year's interim dividends could be 700% more.

Polymetal IFRS financial highlights for H1 2014:

H1 2014

H1 2013 %

Revenue, $ mln 727

721

+1%

Total cash cost, $/GE oz

627

787

-20%

All-in cash cost, $/GE oz

938

1,210

-22%

Adjusted EBITDA, $ mln

310

239

+30%

Adjusted EBITDA margin

43%

33%

+10 p.p.

Average realized gold price, $/oz

1297

1441

-10%

Average LBMA gold price, $/ oz

1290

1524

-15%

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 13

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

Average realized silver price, $/oz

19,1

24,3

-21%

Average LBMA silver price, $/oz

20,1

26,6

-25%

Net profit, $ mln

100

(255)

-

Adjusted net profit, $ mln

101

17

-

Return on equity

11%

2%

+9 p.p.

Basic EPS, $/share

0,26

(0,66) -

Underlying EPS, $/share

0,26

0,04

-

Dividend declared for the period, $/share

0,08

0,01

-

Net debt, $ mln 1,038

1,045*

-1%

Net debt/Adjusted EBITDA

1,55

1,75*

-11%

Net operating cash flow, $ mln

141

59

+139%

Capital expenditure, $ mln

105

171

-38%

Free cash flow, $ mln

29

(125)

-

* As of December 31, 2013

In comparison with the same period of last year, the average realized price for gold and silver fell by 10% and

21%, respectively. "The price decline was offset by 12% growth in the volume of gold equivalent sold," Polymetal

said in statement on its website.

"Adjusted EBITDA margin was 43% compared to 33% in H1 2013," it said.

"Group Total Cash Cost was $627 per gold equivalent ounce (GE oz), down 13% compared to H2 2013 (half-onhalf) and down 20% year-on-year due to a robust operational performance, resulting in higher average grades

processed and increased throughput across the portfolio, coupled with significant Russian ruble and Kazakh

tenge depreciation against the US dollar," the statement said.

"All-in cash costs amounted to $938/GE oz and decreased 22% year-on-year, driven mostly by a reduction in

total cash costs during the period, combined with increased production levels and associated reduction in per

ounce sustaining capital and exploration expenditure at operating mines," Polymetal said.

"Net debt at June 30, 2014 decreased by $7 million to $1.038 billion (December 31, 2013: $1.045 billion), while

the Company paid dividends of $31 million during the period. Free cash flow was $29 million and is expected to

be significantly stronger in the second half of the year due to the planned de-stockpiling at Mayskoye and the

seasonal reduction of the timing gap between production and sales," Polymetal said.

Polymetal's unused credit lines currently amount to $1.115 billion.

Sales

South Korea accounted for 10% of the metal sales of Polymetal in the first half of 2014.

Shipments to South Korea totalled $74 million in the first half, 48 times more than in the same period of 2013,

Polymetal reported.

Meanwhile, shipments to China and Europe, which accounted for respectively 8% and 12% of Polymetal's metal

sales in the first half of 2013, virtually stopped.

Russian gold miners usually sell most of their metal to Russian banks. Polymetal's domestic sales grew to 71%

from 63% of the total. The second largest share of sales was in Kazakhstan, where the company has the

Varvarinskoye deposit and a major regular customer in Kazzinc.

Breakdown of Polymetal metal sales by region, mln USD:

Region

H1 2014

H1 2013 H1 2014/H1 2013

Russia

518.8

451.6

71%*

63%

99.3

87.7

Kazakhstan

Copyright © 2014 by Interfax-Kazakhstan news agency

Total in 2013

14.9% 1060.9

62%

13.3% 170.2

Page 14

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

South Korea

Japan

China

Europe

14%

12%

73.9

1.5

10%

0%

30.7

38.770

4%

5%

2.9

54.335

0%

8%

0.2

86.9

-99.8% 152

0%

12%

9%

Total metal sales

100%

725.8

10%

4720.4%

90.5

5%

-20.9% 65.2

4%

-94.6% 165.4

10%

720.8

100%

0.7%

1704.1

100%

* Here and elsewhere, share of Polymetal metal sales in corresponding period

"The change in the structure of sales by region is due to the shipment conditions that were offered. We are

continually analyzing the market and regularly conduct negotiations with potential buyers. As a result, the

geography of shipments can change," a Polymetal spokesman told Interfax.

The drop in shipments to China is also due to the fact that Polymetal has stopped selling concentrate from the

Albazino deposit in Khabarovsk Territory to China. This year all the concentrate is being processed at the

Amursk POX facility. In 2013, offtake sales to China from Albazino totaled 79,000 ounces in concentrate.

Last year Polymetal also sold concentrate from its Dukat gold and silver mine in Magadan Region and gold from

the Varvarinskoye deposit under offtake contracts to Japan, South Korea, Kazakhstan and China. The company

said that in 2014 it intends to diversify sales from Dukat at the expense of offtake buyers from Japan,

Kazakhstan and South Korea.

There should be an increase in shipments to China in the second half of 2014. Polymetal has already signed

agreements with three offtake buyers from China for the delivery of gold concentrate from the Maiskoye deposit

in Chukotka. In 2013, Polymetal shipped 30,000 tonnes of concentrate from Maiskoye to China, which is

equivalent to 48,000 ounces of gold.

Capex

Polymetal reduced capex to $115 million in the first half of 2014, 36% less than in the same period last year, the

company said.

The startup of the Mayskoye facility in April 2013 marked the completion of Polymetal's major investment

projects and beginning with the second half of 2013, the bulk of capex has gone to support business operations

and geological exploration, the company said.

Polymetal confirmed the 2014 capex target totaling $250 million, including capitalized stripping costs.

Polymetal capex in H1 2014 ($ mln):

H1 2014

H1 2013 Change

Mayskoye (Chukotka)

9

30

-69%

Dukat (Magadan region)

13

15

-12%

Amursk/Albazino ( Khabarovsk territory)

9

23

-61%

Omolon (Magadan region)

5

10

-53%

Varvara ( Kazakhstan )

5

11

-57%

Khakanja ( Khabarovsk territory)

3

7

-60%

Voro ( Sverdlovsk region)

3

5

-39%

Geological exploration

35

19

+82%

Corporate and other

6

9

-32%

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 15

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

Capitalized stripping costs

25

49

-49%

Capitalized interest

2

3

-31%

Total

181

-36%

115

Capex excluding stripping costs totaled $90 million in the first half of 2014, down from $132 million in the same

period last year.

Capex declined for all existing enterprises in the period year-on-year and mainly reflects the cost of renewing the

fleet of mining equipment and maintenance of processing capacity.

Investment in standalone exploration projects totaled $35 million in the first half, up from $19 million in the first

half last year. The exploration effort is focused on the Maminskoye deposit in Sverdlovsk region, on the Svetloye

and Kutyn deposits in Khabarovsk territory and at PGM deposits.

Capex for stripping activities applies to those enterprises whose stripping ratio during the reporting period

exceeded the average, for the most part, Varvara, Voro and Khakanja.

Dividends

Polymetal will pay its shareholders dividends for the first half of the year on September 26, the company said.

Polymetal's board of directors decided to pay dividends upwards of $31 million, or 30% of adjusted net profit for

H1 2014.

Dividends will be paid at $0.08 per share, up eightfold from the $0.01 per share paid for H1 2013.

The register of shareholders to receive dividends closes on September 5, 2014. The last day to select a currency

(dollars or pounds sterling) is September 8.

Polymetal's charter capital consists of 389,472,865 shares.

TCC forecast

Polymetal has lowered its forecast for total cash costs (TCC) in 2014 to $650-$700 per ounce of gold equivalent,

the company said in materials.

That is 7% lower than the 2014 TCC forecast that Polymetal announced in March, $700-$750 per oz.

It also lowered the forecast for all-in cash costs, by roughly 2.5% to $950-$1,000 per oz of gold equivalent from

$975-$1,025 per oz.

Polymetal said the decrease in costs was the result of ruble weakening, in which most of its expenses are

denominated, and anticipated superior operating results.

The forecasts might be revised downward further if the ruble weakening persists until the end of the year,

Polymetal said.

The ruble has depreciated 2.8% against the dollar in the year so far. The average exchange rate declined 12.8%

compared with the same period last year. Most of the weakening occurred in February-May 2014.

Polymetal's TCC was $627 per oz in H1 2014, 13% less than in H2 2013 and 20% less than in H1 2013. All-in

cash costs were 22% lower year-on-year at $938 per oz.

Polymetal's shares are traded on the London Stock Exchange (LSE) and the Moscow Exchange, and free float

exceeds 50%. Major shareholders include PPF Group (20.5%), Alexander Nesis's ICT Group (18.49%) and

Alexander Mamut (9.95%). The company has operations in Magadan and Sverdlovsk regions, Khabarovsk

Territory, Chukotka and Kazakhstan.

Petropavlovsk EBITDA jumps 41% to $139 mln in H1, exceeds forecast

MOSCOW. Aug 28 (Interfax) - Petropavlovsk, a Russian gold mining company, increased its earnings before

interest, tax, depreciation and amortization (EBITDA) by 41% year-on-year to $139.2 million in the first half of

2014, the company reported.

Analysts at six investment banks polled by Interfax had expected the company to post EBITDA of $106 million.

Revenue declined 10% to $453 million, mostly connected with a drop in sales price of 12%, which was partially

compensated by a 5% increase in sales in real terms.

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 16

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

The company reduced its net loss to $95.3 million from $742.2 million.

In light of the losses, Petropavlovsk's board of directors is recommending that the company not pay first-half

dividends.

Petropavlovsk operating and financial highlights in H1 2014:

H1 2014

H1 2013 Change

Gold production, '000 oz

306,4

294,7

4%

Gold sales, '000 oz

310,7

297,1

5%

Average sales price, $/oz

1386

1579

(12%)

Cash cost at hard-rock mines, $/oz

847

1136

(25%)

Total cash costs, $/oz

853

1157

(26%)

Revenue, $ mln 453

505,1

(10%)

EBITDA, $ mln 139,2

98,7

41%

Net loss/profit, $ mln

8,3

(615,4) -

Basic (loss) earnings per share, $

(95,3)

(742,2) (87%)

Net income (loss) incurred by shareholders, $ mln

(54)

(666,1) (92%)

Net income (loss) per share, $

(0,28)

(3,39) (92%)

Net cash flow from operations, $ mln

80,8

82,7

(2%)

Petropavlovsk's net debt as of July 1, 2014, was $924 million. Compared with the end of the first quarter ($911

million) the company increased net debt 1.4%. Compared with the end of 2013 ($948 million), debt is down

2.5%.

JORC resources, reserves

Petropavlovsk plc has boosted its JORC mineral resource base by 1 million oz gold, the company said.

Proven + probable reserves increased by 0.5 million oz gold. The increase entirely covers withdrawals from

reserves in H1 2014.

Petropavlovsk also converted into JORC a portion of the resource and reserves classified earlier under the

Russian Classification System: 3.1 million oz of non-refractory resources and 0.82 million oz of non-refractory

reserves.

Total ore reserves amounted to 9.34 million oz, including 4.47 million oz of proven + probably reserves.

Total mineral resources (Measured, Indicated and Inferred) were 26.41 million oz.

Petropavlovsk ore reserves as of June 30, 2014 (JORC):

Category

Tonnage (mln t)

Grade (g/t Au)

Gold (mln oz)

Non-refractory ore reserves

115.687 1.20

4.47

- Proven

6.491

1.50

0.31

- Probable

109.197

1.18

4.16

Refractory ore reserves

147.594 1.03

- Proven

19.676

1.23

0.78

- Probable

127.918

1.00

4.09

Total ore reserves

263.282 1.10

- Proven

26.167

1.30

1.09

- Probable

237.115

1.08

8.25

4.87

9.34

Petropavlovsk gold resources as of June 30, 2014 (JORC):

Category

Tonnage (mln t)

Grade (g/t Au)

Copyright © 2014 by Interfax-Kazakhstan news agency

Gold (mln oz)

Page 17

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

Non-refractory mineral resources

14.30

- Measured+Indicated

239.131 1.08

- Measured

35.475

1.15

1.31

- Indicated

203.656

1.07

7.00

- Inferred

193.935

0.96

5.98

Refractory mineral resources

8.32

12.11

- Measured+Indicated

226.770 0.91

- Measured

25.058

1.13

0.91

- Indicated

201.712

0.88

5.71

- Inferred

250.097

0.68

5.49

Total mineral resources

6.62

26.41

- Measured+Indicated

465.901 1.00

- Measured

60.533

1.14

2.22

- Indicated

405.368

0.98

12.72

- Inferred

444.031

0.80

11.47

14.94

Petropavlovsk expects to increase resources further through additional conversion of Russian Classification

System resources to JORC and from new non-refractory ore sections. For example, the company has received

very promising results at Berezoviy area's Uspenskiy stream, about 10 km northwest of the Malomir plant, where

it found 5-meter-long interval of mineralization with a grade of about 22 g/t which has yet to be reflected in total

resources.

Petropavlovsk commercially develops gold deposits - the Pokrovsky mine, Pioneer, Malomir and Albyn - in the

Amur region. Petropavlovsk raised gold production 4% last year to 741,000 oz.

The company's biggest shareholders include Van Eck Associates Corporation, which owned 10% as of April 28;

Schroders plc with 5.09%; and Peter Hambro with 3.43%.

Silver Bear prepared to offer 30% of Mangazeisky project to Chinese investor - paper

MOSCOW. Aug 26 (Interfax) - Silver Bear, a company that develops silver projects in Russia, is prepared to

team up with Chinese investors, national daily Kommersant reported on Tuesday, citing a list of proposals for the

development of Russian-Chinese cooperation prepared by business association Delovaya Rossiya at the

request of the Economic Development Ministry.

Silver Bear is willing to offer co-investors, including investors from China, a 30% stake in the Mangazeisky silver

project in Yakutia, the paper reported company board director Alexei Sotskov as saying.

He said silver is purchased by state repository Gokhran and banks, so it is not that important whether the coinvestor is an industrial or financial player. But a co-investor is "one of the financing options, in addition to loans,

not instead of them; the company will implement the project in any case," Sotskov said.

The matter has not yet progressed to the stage of specific negotiations with investors, the paper said. Interest in

investment from China began to surge in the spring, after the cooling of Russia's relations with the West.

Silver Bear has raised CAD11 million (about $10 million) since the beginning of 2014 in a private placement for

the development of the Mangazeisky project. As a result, Inflection Management Corporation, the beneficiary of

which is TekhnoNikol president and cofounder Sergei Kolesnikov, has acquired almost 26% of Silver Bear.

Alexei Mordashov's investment fund Aterra Investments has increased its stake to more than 25%.

The Mangazeisky project is Silver Bear's core asset. The total cost of its development is estimated at $83.5

million plus or minus 30%, a report on the preliminary economic assessment of the project states. This includes

an estimated $32.35 million for the first stage of the project (before the start of production).

Silver Bear could produce an average of 1.748 million ounces of silver annually at Mangazeisky over the

projected mine life of 19 years, including 2.687 million ounces per year in the first five years. Open-pit mining is

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 18

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

possible for ten years. The internal rate of return is expected to be 63%, at a pessimistic silver price forecast of

$20 per ounce.

Silver Bear's other major shareholders are the bank Forbes & Manhattan with about 9% and Mikhail Fridman's

Alfa Group with less than 5%.

Silver Bear posted a net loss of CAD2.9 million (about $2.7 million) in the first half of 2014. Most expenditures

(about $1 million) went into exploration.

Lenzoloto posts IFRS net losses of 123 mln rubles in H1

IRKUTSK. Aug 27 (Interfax) - OJSC Lenzoloto, which is owned by Polyus Gold, post net losses to International

Financial Reporting Standards (IFRS) amounting to 123 million rubles in H1 2014 against 281 million rubles in

net profit in H1 2013, the company said in a report to IFRS.

Sales revenue fell 24.8% to 1.759 billion rubles.

Lenzoloto financial highlights for H1 (mln rubles)

H1 2014

H1 2013

Sales revenue 1 759

2 340

Revenue from gold sales

1 592

2 194

Operating profit (loss)

(124)

263

Pretax profit (loss)

(106)

358

Gross profit

660

242

Net profit (loss) (123)

281

Lenzoloto closed 2013 with net profit of 1.455 billion rubles to IFRS, down 49.8% from 2012. Sales revenue fell

by 21% to 9.223 billion rubles.

OJSC Lenzoloto produces alluvial gold in the Irkutsk region via a subsidiary, CJSC Gold Mining Company

Lenzoloto. Lenzoloto is principally involved in the management of its ore mining subsidiaries and it also provides

real estate and other property rental services.

The company owns 44 licenses to produce alluvial gold, with total B+C1+C2 balance sheet reserves of over 14

tonnes. Gold Mining Company Lenzoloto owns 45 licenses.

Rusal boosts Q2 EBITDA 26% to $220 mln, below forecast

MOSCOW. Aug 27 (Interfax) - Russian aluminum company UC Rusal boosted adjusted earnings before taxes,

depreciation, and amortization (EBITDA) to International Financial Reporting Standards (IFRS) 26.4% year-onyear in the second quarter of 2014 to $220 million, the company said in a statement.

Analysts surveyed by Interfax had forecast that EBITDA would increase 29% to $225 million. Goldman Sachs

had the closes forecast ($222 million).

Results

Rusal had EBITDA of $393 million in H1, down 6.3% from the same period of last year.

Revenue in Q2 was up 6.5% compared with the same period of last year at $2.261 billion due to an increase in

aluminum sales of 4.6%, an increase in the average price of aluminum on the London Metal Exchange (LME) of

5.3% and because of a 5.4% growth in premiums on the price on LME, the statement says.

Revenue in the first half of 2014 decreased by 15.7% to $4.384 billion as compared to $5.203 billion in the first

half of 2013 due to a 12.6% decrease in physical aluminum sales and continued pressure of the LME price down

to an average of $1,753 per tonne, a 8.7% decrease compared to the same period of 2013, partially offset by

historically high premiums over LME aluminum price of $347 per tonne for the first half of 2014, the company

said.

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 19

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

"Management views further improvement of margins and profits in the second half of 2014 at current aluminum

price levels. 2014 capex is expected to be approximately $500-$600 million. Rusal's EBITDA in the second half

of the year is expected in excess of $600 million at current aluminum price levels," the statement says.

"Aluminum segment cost per tonne decreased by 9.8% to $1,752 per tonne in the first half of 2014, in

comparison with $1,942 per tonne in the first half of 2013 following the successful completion of capacity

curtailments program at the least efficient smelters. External factors such as the depreciation of the Russian

Ruble to the US dollar by 12.8% to 34.98 rubles in the first half of 2014 from 31.02 rubles in the respective

period of 2013, has also had a significant positive effect on the overall level of costs," Rusal said.

The company recognized profit and recurring net profit of $116 million and $129 million, respectively, for the

second quarter of 2014, demonstrating positive results for the first time since the first quarter of 2013, the

company said. Recurring Net Loss decreased by 74% to $40 million for the first six months of 2014, as

compared to $154 million for the same period in 2013 as negative effect of the foreign exchange differences was

more than compensated by the increase in the company's share in results of associates due to significantly

improved performance of Norilsk Nickel.

Adjusted net loss increased to $395 million for the first half of 2014, as compared to $236 million for the same

period of 2013, primarily due to a foreign exchange loss in the reporting period as compared to a foreign

exchange gain in the same period of the prior year as a result of the significant depreciation of the

Russian Ruble against the US dollar, the company said.

The company said adjusted net profit excludes its stake in Norilsk Nickel, the result of changes in the fair cost of

derivatives, changes to the interest rate on restructured debt and the effect of depreciated non-current assets.

Net debt as of end-June was $10.594 billion, up 2.4% from March 31 ($10.34 million).

Commenting on the first half results, Rusal CEO Oleg Deripaska said: "During the first half of 2014, there was a

major improvement in Rusal's financial results in the second quarter compared to the first quarter, which was a

result of a recovery in the aluminum price, a rise in average realized premiums, and tight cost controls."

"In the second half of the year, we expect the LME spot aluminum price to remain around current levels and we

see a potential upside for physical premiums. The positive dynamics in the aluminum sector is supported by the

mounting ex-China deficit, solid demand fundamentals driven by the ongoing shift from steel to aluminum in the

automotive sector and a lack of new primary aluminum projects putting pressure on the supply side of the

equation," he said.

Main financials for Q2, H1 2014 (mln USD):

Revenue

Q2 2014

H1 2014

Change compared with Q2 2013 Change compared with Q1 2014

Change compared with H1 2013

2 261

-10,3% 6,5%

4 384

-15,7%

Adjusted EBITDA

220

26,4% 27,1% 393

-6,4%

Adjusted EBITDA margin

9,7%

2,8 pp 1,6 pp 9%

0,9 pp

Net profit (loss) 116

--

-209

47,6%

Adjusted profit (loss)

-149

-20%

-39,4% -395

67,4%

Recurring net profit (loss)

129

-

-

-40

-74%

Sales of primary aluminum and alloys

893

-11%

4,6%

1 747

-10%

Aluminum segment cost per tonne, $

1 764

-7,7% 1,3%

1 752

-9,8%

Total cost of sales decreased by 17.8% to $3.656 billion for the six months ending June 30, as compared to

$4.446 billion for the corresponding period of 2013. The decrease was primarily driven by the 12.6% (or 251

thousand tonnes) reduction in the aggregate volumes of aluminum sold, the company said.

Cost of alumina decreased in the reporting period (as compared to the first six months of 2013) by 26.1%,

primarily as a result of a decrease in both alumina purchase volumes and average alumina purchase price.

Cost of bauxite decreased by 3.5% in the first six months of 2014 as compared to the same period of prior year,

due to 8.6% decrease in purchase volume partially compensated with the slight increase in the purchase prices,

the statement says.

Copyright © 2014 by Interfax-Kazakhstan news agency

Page 20

INTERFAX-KAZAKHSTAN

KAZAKHSTAN MINING REPORT

N69 (298) 15.09.2014

"Decrease in costs of raw materials (other than alumina and bauxite) and other costs by 11.8% for the first six

months of 2014 as compared to the first six months of 2013 was primarily driven by the lower volume of primary

aluminum and alloys sold," Rusal said.

"Energy cost decreased by 24.6% in the first half of 2014 compared to the same period of 2013, primarily due to

the continuing depreciation of the Russian Ruble against the US dollar as well as decrease in weighted-average

electricity tariffs," the statement says.

Aluminum output

Rusal reduced aluminum production 9.3% year-on-year in Q2 2014 to 900,000 tonnes, the company said.

Aluminum output in H1 2014 fell 10.8% year-on-year to 1.783 million tonnes.

Overall output fell due to a drop in production at some smelters located in European Russia and the Urals,

notably Bogoslovsk, Urals, Volkhov, Volgograd and Nadvoitsy; the first phase of the Novokuznetsk smelter in

Siberia; and the Alscon smelter in Nigeria.

Alumina production declined 1.3% year-on-year in Q2 2014 to 1.8 million tonnes and edged down 0.5% in H1

2014 to 3.618 million tonnes.

Bauxite production for the quarter ended March 31, 2014 was 3 million tonnes, up 2.1% year-on-year, but down

0.5% in H1 2014 to 5.9 million tonnes.

Production of foil and packaging rose 4% in H1 2014 year-on-year to 45,400 tonnes.

The share of value-added products in Rusal's output rose to 46.9% in Q2 2014.

Rusal targets production of 1.8 million tonnes of aluminum in H2 2014.

Rusal operating highlights in Q2 2014 and H1 2014 ('000 tonnes):

Q2 2014

H1 2014/H1 2013

Q2 2014/Q2 2013

Q2 2014/Q1 2014

Aluminum

900

-9.3%

2%

1 783

-11%

Alumina

1 804

-1.3%

-0.5% 3 618

-0.5%

Bauxite

3 303

2.1%

14.6% 5 885

-0.5%

H1

2014

Global production and consumption

Rusal's 2014 market outlook remains broadly unchanged with a slight improvement in the H2 2014 due to

seasonally stronger demand. Global consumption of primary aluminum is forecast to reach 55 million tonnes in

2014, an increase of 6.5% compared to the previous forecast of 6%, Rusal said in the press release. China

remains the largest growing market with an expected 13% growth rate (previously 10%), followed by North

America with 5% growth, Asia excluding China with 4% growth and Europe with 3% growth.

During H1 2014, global primary aluminum consumption reached 27 million tonnes, representing a 6% increase

compared to H1 2013. The fastest growing markets during the period were China (13%), Japan and South Korea

(10%) and Central and South America (5%). North America experienced a 4.3% increase in growth whereas

consumption grew moderately in Europe by 3% year-on-year.

Global industrial production, a key driver of commodity demand, rose by 4% year-on-year in H1 2014, increasing

due to strong growth in North America and China and a fast recovery throughout Europe. Rusal forecasts that

the aluminum market ex-China experienced a market deficit of 0.6 million tonnes due to stronger than

anticipated aluminum consumption and production curtailments during H1 2014.These factors have supported

the recovery of the aluminum price to $2,000 per tonne (on the LME) at the beginning of July, and it has